The Rise of Intellectual Capital As an Essential Business Asset

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Media Kit 2020

SYDNEY MEDIA KIT 2020 www.wheretraveller.com Photo: © Hugh Stewart/Destination NSW. The tourism market in VISITORS* SPEND In2019 $34billion 41.5 million visited PER YEAR Sydney the greater Sydney region IN SYDNEY *International and domestic INTERNATIONAL The Gateway to Australia % VISITOR OVERNIGHT VISITORS NUMBERS TO AUSTRALIA SPEND Most international visitors 40 INCREASED TRIPS REPRESENT arrive in Sydney first when LEISURE TRAVEL % % they come to Australia. 11 BETWEEN 39 2018-19 OF THEIR DOLLARS IN SYDNEY 3.1 NIGHTS 37.9the million average visitors to 1 = China 2 = USA the greaterduration Sydney of stay region TOURIST 3 = New Zealand SPENDING: 4 = United Kingdom Record growth of domestic and TOP 5 5 = South Korea international visitors year on year NATIONALITIES Photo: Destination NSW. Sources: Destination NSW and Tourism Research Australia wheretraveller.com Print: a trusted and versatile media solution We can create diverse media READERS ARE products to make your campaign % effective such as advertorials, inserts, magazine covers, editorial 70 listings and much more. MORE LIKELY TO RECALL YOUR • In-r oom placement in BRAND IN PRINT (source: Forbes) 5, 4.5 and 4 star hotels for guaranteed visibility to the lucrative visitor market WHERETRAVELLER MAGAZINE • We can create custom content READERSHIP: • Diverse and current coverage across bars, restaurants, 226,000 entertainment, shopping, PER MONTH sightseeing and more WhereTraveller products are supported by Les Clefs d’Or Australia, the International Concierge Society wheretraveller.com WhereTraveller Magazine: the complete guide WhereTraveller Magazine is a monthly guidebook-style magazine that readers can easily take with them when they explore each city’s top restaurants, shops, shows, attractions, exhibits and tours. -

Wesley College Foundation Annual Report and Journal

WeThse leyan WESLEY COLLEGE FOUNDATION ANNUAL REPORT AND JOURNAL 2018 WESLEY COLLEGE STUDENTS 2018 FRESHERS fr 2018 Thomas Alchin, India Allen, Jack Andrighetto, William Bridget Klemp, Anna Knes Knes, Angus Knott, John Avery, Aimee Ball, Talia Barnet-Hepples, Michael (Yianni) Kokolakis , Alice Kotowicz, Sophie Laycol, Bartimote, Angus Barton, Victoria Bennet, Natasha Cooper Lee, Todd Levine, Madeleine Lockhart, Bernard, Isabella Best, Thomas Binns, Hugh Angelina Lockley, Angus Macintyre, Nicholas Blanchfield, James Boric, Guy Bouchier, Georgia Marchione, Filippo Martini, Matteo Martini, Colin Boxley, Caitlin Brown, Eleanor Brown, Jeffrey Brown, McCalhill, Claire McRedmond, Tara Menzies, Tracey Matthew Buckland, Kelly Burns, Emma Carter, Milden, Eliza Millar, Katie Miller, Christian Neoh, Lucy Matthew (Andrew) Coetzee, Sarah Cohen, Julia Cole, O'Brien, Cecilie Okkels, Isabelle Oxley, Sam Parks, Ella Edwin Cruz-Garcia, Raquel Cuevas, Timothy D'Cruz, Pechan, Rosalie Pether, Joshua Pincus , Emma Pryse Alistair de Vroet, Emma Dewhurst, Toby Dickinson, Jones, Samuel Ridley, James Robertson, James Rowse, James Dominic (IFSA), Hugh Duffield, Darby Durack, Alistair Russell, Ethan Russell, Darcy Ryan, Issac Salas Hannah Edgell, Harry Edmondson, Calvin Engelen, , Thomas Sanders, Josef Schuler, Matilda Scott- Wil Ferguson, Madison Flavel, Leili Friedlander, Lucia Bowden, Grace Searle, Juliana Shenker , Elise Geddes, Katherine Gordon, Jaya Greene, Emma Sherrington, Julia Slancar, Cameron Smith, Georgina Gutheinz, Philippa Haberlin, Lizzy Hackl, Charles -

Airport OLS Penetrations by Existing and Planned Structures in the Sydney and Brisbane CBD

1 Airport OLS Penetrations by Existing and Planned Structures in the Sydney and Brisbane CBD It is crucial that the safety implications arising from the recent incidents involving a Qantas airbus A380 following take-off at Singapore airport on the 4th of November, 2010 and a B747 departing the same airport two days later are fully appreciated by governments at all levels. Although the problems were serious enough, they could have been a lot worse and could well have occurred at Brisbane or Sydney airports. To further illustrate what happened to the A380, the following interim list of 18 items damaged by the exploding engine was released to the media on the 11/11/2010. 1.Massive fuel leak in the left mid fuel tank (there are 11 tanks, including in the horizontal stabiliser on the tail); 2.Massive fuel leak in the left inner fuel tank; 3. A hole on the flap fairing big enough to climb through; 4 The aft gallery in the fuel system failed, preventing many fuel transfer functions; 5 Problem jettisoning fuel; 6 Massive hole in the upper wingsurface; 7 Partial failure of leading edge slats; 8 Partial failure of speed brakes/groundspoilers; 9 Shrapnel damage to the flaps; 10 Total loss of all hydraulic fluid in one of the jet'stwo systems; 11 Manual extension of landing gear; 12 Loss of one generator and associatedsystems; 13 Loss of brake anti-skid system; 14 No.1 engine could not be shut down in theusual way after landing because of major damage to systems; 15 No.1 engine could not beshut down using the fire switch, which meant fire extinguishers would not work on thatengine; 16 ECAM (electronic centralised aircraft monitor) warnings about the major fuelimbalance (because of fuel leaks on left side) could not be fixed with cross-feeding; 17 Fuelwas trapped in the trim tank (in the tail) creating a balance problem for landing; 18 Left wingforward spar penetrated by debris With so much damage to the aircraft, it’s clear that all on board were extremely lucky. -

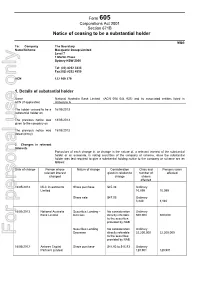

For Personal Use Only Use Personal for to the Securities Provided by NAB

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder MQG To: Company The Secretary Name/Scheme Macquarie Group Limited Level 7 1 Martin Place Sydney NSW 2000 Tel: (02) 8232 3333 Fax:(02) 8232 4330 ACN 122 169 279 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 16/05/2013 substantial holder on The previous notice was 18/05/2013 given to the company on The previous notice was 15/05/2013 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose Nature of change Consideration Class and Persons votes relevant interest given in relation to number of affected changed change shares affected 16/05/2013 MLC Investments Share purchase $45.38 Ordinary Limited 10,099 10,099 Share sale $47.05 Ordinary 3,840 3,840 16/05/2013 National Australia Securities Lending – No consideration Ordinary Bank Limited Increase directly referable 500,000 500,000 to the securities provided by NAB Securities Lending – No consideration Ordinary Decrease directly referable 22,200,000 22,200,000 For personal use only to the securities provided by NAB 16/05/2013 Antares Capital Share purchase $44.92 to $45.93 Ordinary Partners Limited 120,901 120,901 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association No change 4. -

Achieving A-Grade Office Space in the Parramatta Cbd Economic Review

ACHIEVING A-GRADE OFFICE SPACE IN THE PARRAMATTA CBD ECONOMIC REVIEW 13 SEPTEMBER 2019 FINAL PREPARED FOR CITY OF PARRAMATTA URBIS STAFF RESPONSIBLE FOR THIS REPORT WERE: Director Clinton Ostwald Associate Director Alex Stuart Research Analyst Anthony Wan Project Code P0009416 Report Number Final © Urbis Pty Ltd ABN 50 105 256 228 All Rights Reserved. No material may be reproduced without prior permission. You must read the important disclaimer appearing within the body of this report. urbis.com.au CONTENTS TABLE OF CONTENTS Executive Summary ............................................................................................................................................. i Introduction ........................................................................................................................................................ 1 1. Planning Context................................................................................................................................... 3 1.1. A Metropolis of Three Cities ................................................................................................................. 3 1.2. Current Parramatta City Centre Planning Controls .............................................................................. 5 1.3. Draft Auto Alley Planning Framework (2014) ....................................................................................... 9 1.4. Parramatta City Centre Planning Framework Study (2014) .............................................................. -

Urban Design in Central Sydney 1945–2002: Laissez-Faire and Discretionary Traditions in the Accidental City John Punter

Progress in Planning 63 (2005) 11–160 www.elsevier.com/locate/pplann Urban design in central Sydney 1945–2002: Laissez-Faire and discretionary traditions in the accidental city John Punter School of City and Regional Planning, Cardiff University, Cardiff CF10 3WA, UK Abstract This paper explores the laissez faire and discretionary traditions adopted for development control in Central Sydney over the last half century. It focuses upon the design dimension of control, and the transition from a largely design agnostic system up until 1988, to the serious pursuit of design excellence by 2000. Six eras of design/development control are identified, consistent with particular market conditions of boom and bust, and with particular political regimes at State and City levels. The constant tensions between State Government and City Council, and the interventions of state advisory committees and development agencies, Tribunals and Courts are explored as the pursuit of design quality moved from being a perceived barrier to economic growth to a pre-requisite for global competitiveness in the pursuit of international investment and tourism. These tensions have given rise to the description of Central Sydney as ‘the Accidental City’. By contrast, the objective of current policy is to consistently achieve ‘the well-mannered and iconic’ in architecture and urban design. Beginning with the regulation of building height by the State in 1912, the Council’s development approval powers have been severely curtailed by State committees and development agencies, by two suspensions of the Council, and more recently (1989) by the establishment of a joint State- Council committee to assess major development applications. -

Full Year Results

/--5 CriiVb^oObpriqp Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafu1B K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& Qefpcriivb^ovb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovÚk^iobmloq^kafpdfsbkql qeb>rpqo^if^kPb`rofqfbpBu`e^kdbIfjfqba%>PU&rkaboIfpqfkdOrib1+0>+ Results for Announcement to the Market Results for announcement to the market Report for the year ended 30 September 2008 30 September 2008 $m (1) Revenue from ordinary activities up 4.7% * to 16,257 Profit after tax from ordinary activities attributable to members of the Company down 0.9% * to 4,536 Net profit attributable to members of the Company down 0.9% * to 4,536 * On previous corresponding period (twelve months ended 30 September 2007). (1) Reported as the sum of the following items from the Group's consolidated income statement: Net interest income, Premium and related revenue, Fee income and Other income. On a cash earnings basis revenue increased by 5.8%. Franked Amount amount Dividends per share per share Final Dividend 97 cents 100% Interim dividend 97 cents 100% Record date for determining entitlements to the final dividend 13 November 2008 Highlights (2) Group cash earnings down 10.7% Cash earnings from ongoing operations of $3,916 million for the September 2008 year decreased by $470 million or 10.7% on the September 2007 year. Underlying profit increased by $996 million or 13.9%. This reflects good revenue growth stemming from the Group's market leading position in business banking in Australia, successful repricing initiatives in all regions and strong performance in nabCapital's Markets business. A disciplined approach to cost management has been maintained however, cash earnings have been reduced by a higher bad and doubtful debts charge mainly relating to Asset Backed Securities Collateralised Debt Obligations in nabCapital. -

SYDNEY CBD OFFICE Market Overview

RESEARCH APRIL 2011 SYDNEY CBD OFFICE Market Overview HIGHLIGHTS • Many landlords took the opportunity to complete refurbishment programs on vacant buildings over 2010 in an effort to reposition the asset and boost market appeal. In contrast the majority of space coming online in 2011 and 2012 are new developments which have been underpinned by major tenant commitments and equity injections. Recent confidence about future take-up has also led to many developers/owners reigniting development pipelines in an effort to continue to grow their prime portfolios into the future. • Face rents in the CBD have stabilised, with some modest growth recorded in select assets over the past six months. Incentives have begun to contract, in particular for Premium assets and should retract sharply once tenant demand gains momentum and the excess vacant space is absorbed. Average prime gross effective rents are projected to grow by 10% per annum over the next three years, returning to their peak (mid 2008) levels by mid 2013. • Investor interest increased from late 2009 and continued throughout 2010 with $1.9 billion worth of transactions transpiring over the year to January 2011. The increased appetite from off-shore groups in 2009 and H1 2010 was followed by the return of the domestic players (including super funds, unlisted funds and private equity funds). This culminated in twelve major sales (above $10 mill) transacting since July 2010, with a total value of $1.05 billion. APRIL 2011 SYDNEY CBD OFFICE Market Overview Table 1 Sydney CBD Office Market Indicators as at January 2011 Grade Total Stock Vacancy Annual Net Annual Net Average Gross Average Average Core (m²) ^ Rate Absorption Additions Face Rent Incentive Market Yield (%) ^ (m²) ^ (m²) ^ ($/m²) (%) (%) Prime 2,368,687 7.7 73,034 98,025 650 - 950 (851 Avg) 26.5 6.50 - 7.50 (6.90 Avg) Secondary 2,475,853 8.8 32,359 18,540 450 - 560 (509 Avg) 29.0 7.75 - 8.75 (8.28 Avg) Total 4,844,540 8.2 105,392 116,565 Source: Knight Frank/PCA ^PCA OMR data as at January 2011 NB. -

Task Force on Climate-Related Financial Disclosures Guidance on Scenario Analysis for Non-Financial Companies

Task Force on Climate-related Financial Disclosures Guidance on Scenario Analysis for Non-Financial Companies October 2020 The Task Force on Climate-related Financial Disclosures Executive Summary Climate change is spawning a host of long-term and short-term “ No matter how well we prepare ourselves, effects that affect businesses broadly and fundamentally. The World Economic Forum ranks climate risks among the top five when the imagined future becomes the very business risks, saying “climate change is striking harder and more real present, it never fails to surprise.” rapidly than many expected.” – Alan AtKisson, Believing Cassandra Companies will be affected by climate change across multiple dimensions (strategic, operational, reputational, and financial), along the entire value chain, across regions, and over long periods • Scenario analysis allows for the continual exploration of of time. But assessing and planning for these risks — and alternative strategies, even if current strategies seem to be opportunities — is challenging given the associated uncertainties. working. Scenario analysis can identify key drivers of change and pathways of development that a company can monitor to Scenario analysis helps companies in making strategic and risk understand which futures are emerging and allow for “midcourse management decisions under complex and uncertain conditions corrections.” This is a cornerstone of resilient strategies. such as climate change. It allows a company to understand the risks and uncertainties it may face under different hypothetical • Scenario analysis is used beyond climate issues. Scenario futures and how those conditions may affect its performance, analysis is applicable to a wide range of issues facing companies thus contributing to the development of greater strategy resilience under conditions of uncertainty (e.g., the COVID-19 pandemic). -

Lend Lease Annual Report 2014 Over 50 Years Creating the Best Places

2000 SYDNEY OLYMPIC VILLAGE 2006 TORINO WINTER OLYMPIC VILLAGE 2012 LONDON OLYMPIC ATHLETES VILLAGE 313@SOMERSET SHOPPING CENTRE 30 THE BOND, SYDNEY NATIONAL SEPTEMBER 11 MEMORIAL AND MUSEUM NEW YORK ACADEMY OF SCIENCE CANBERRA ADELAIDE WOMEN’S AND CHILDREN’S HOSPITAL ADELAIDE OVAL ALKIMOS ANZ HEADQUARTERS – MELBOURNE DOCKLANDS ANZAC BRIDGE AURORA PLACE AUSTRALIA SQUARE AUSTRALIAN WORLD EXPO PAVILION SHANGHAI BARANGAROO HEADLAND PARK BARANGAROO SOUTH BBC HEADQUARTERS BLUES POINT TOWER BLUEWATER SHOPPING CENTRE BON SECOURS ST FRANCIS MEDICAL PAVILION BRISBANE INTERNATIONAL AIRPORT BROADGATE LONDON CALTEX HOUSE CANELAND CENTRAL CASTLECRAG CRAIGIEBURN DARLING HARBOUR & COCKLE BAY DARLING HARBOUR LIVE DARLING PARK THE DARLING QUARTER DEPARTMENT OF DEFENSE MILITARY HOUSING PRIVATIZATION INITIATIVE DEUTSCHE BANK PLACE ELEPHANT & CASTLE ERINA FAIR ETIHAD STADIUM MELBOURNE GATEWAY BRIDGE GOLD COAST UNIVERSITY HOSPITAL GRAND CENTRAL STATION RESTORATION GREENWICH PENINSULA HER MAJESTY’S TREASURY BUILDING REDEVELOPMENT HUME HIGHWAY IRON COVE BRIDGE JACKSONS LANDING JEM SINGA- PORE KUALA LUMPUR PETRONAS TOWERS LAKESIDE JOONDALUP LANCASHIRE COUNTY COUNCIL SCHOOLS PFI INITIATE LLOYDS BUILDING LONDON M2 MOTORWAY M7 MOTORWAY MACARTHUR SQUARE MELBOURNE MARKETS MELBOURNE TENNIS CENTRE MLC CENTRE MID–CITY SHOPPING CENTRE MUSEUM FOR AFRICAN ART NEW YORK NATIONAL MUSEUM CANBERRA NORTH SHORE MEDICAL CENTRE ONE57 NEW YORK PARKWAY PARADE PARRAMATTA STADIUM PORT BOTANY EXPANSION QANTAS DOMESTIC TERMINAL QUEENSLAND CHILDREN’S HOSPITAL RNA SHOWGROUNDS ROYAL CHILDREN’S -

ASX Cards Database

REPORT1 long_name asx_ref create_date remove_date C34 02/03/73 B191 ORDENN (ANTHONY) & SONS LIMITED A13 08/04/70 "TRUTH" & "SPORTSMAN" LIMITED T11 07/08/59 "TRUTH" & "SPORTSMAN" LIMITED (SYDNEY) LIMITED P51 (THE) COMMONWEALTH INSTALMENT RECEIPT TR C453 05/07/96 (THE) ENVIRONMENTAL GROUP LIMITED E131 12/10/95 (THE) NATPROPS PROPERTY TRUST N97 21/03/85 (THE) NATPROPS PROPERTY TRUST N97 30/01/80 A & I DISCOUNTERS LIMITED A180 22/05/68 A-CAP DEVELOPMENT LIMITED A50 03/10/90 A-CAP DEVELOPMENT LIMITED A50 28/06/73 A-CAP DEVELOPMENT LIMITED A50 10/01/80 A-CAP DEVELOPMENT LIMITED A50 23/12/69 A-CAP DEVELOPMENT LIMITED A242 10/01/80 A-CAP DEVELOPMENT LIMITED A242 28/06/73 A.A.R. LIMITED A34 29/01/76 A.A.R. LIMITED A34 06/08/80 A.B.E HOLDINGS LIMITED A266 27/06/84 A.O.G. MINERALS LIMITED A83 16/07/87 A.R.I. LIMITED A80 17/07/80 A.R.I. LIMITED A80 14/07/88 A.U.R. NL A101 03/10/90 A.U.R. NL A101 13/12/84 A1 CONSOLIDATED GOLD N.L. A7 22/01/75 A1 CONSOLIDATED GOLD N.L. A7 19/06/69 A1 CONSOLIDATED GOLD N.L. A7 01/01/32 AAPC LIMITED A395 08/07/93 ABACUS PACIFIC NV A345 03/05/89 Wednesday, 19 September 2001 Page 1 of 331 long_name asx_ref create_date remove_date ABACUS PACIFIC NV A345 22/10/87 ABADOR GOLD NL A151 10/06/93 ABALDYN LIMITED A311 31/07/86 ABALEEN MINERALS NL A47 11/12/69 ABALEEN MINERALS NL A47 03/11/75 ABALEEN MINERALS NL A47 06/06/85 ABALEEN MINERALS NL A47 09/04/87 ABBOT HOLDINGS LIMITED A224 17/12/87 ABBOT HOLDINGS LIMITED A224 20/11/80 ABBOTT LG HOLDINGS LIMITED A224 20/11/80 ABEL LEMON HOLDINGS LIMITED A187 05/04/78 ABERCOM LIMITED A251 -

For Personal Use Only Use Personal For

5 May 2016 Euro Medium Term Note Programme - Offering Circular 5 May 2016 Attached is a copy of Lendlease’s Euro Medium Term Note Programme - Offering Circular. The Offering Circular was listed with the Singapore Exchange (SGX) late yesterday. The establishment of the Euro Medium Term Note Programme forms part of Lendlease’s routine capital markets activities, permitting the issuance of debt in a variety of capital markets and currencies. ENDS FOR FURTHER INFORMATION, PLEASE CONTACT: Investors: Media: Suzanne Evans Nadeena Whitby Tel: 02 9236 6464 Tel: 02 9236 6865 Mob: 0407 165 254 Mob: 0467 773 032 For personal use only Lendlease Corporation Limited ABN 32 000 226 228 and Lendlease Responsible Entity Limited ABN 72 122 883 185 AFS Licence 308983 As responsible entity for Lendlease Trust ABN 39 944 184 773 ARSN 128 052 595 Level 4, 30 The Bond Telephone +61 2 9236 6111 30 Hickson Road, Millers Point Facsimile +61 2 9252 2192 NSW 2000 Australia lendlease.com IMPORTANT NOTICE NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR ANY PERSON OR ADDRESS IN THE UNITED STATES IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached Offering Circular. You are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached Offering Circular. In accessing the attached Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access.