For Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Personal Use Only Use Personal for to the Securities Provided by NAB

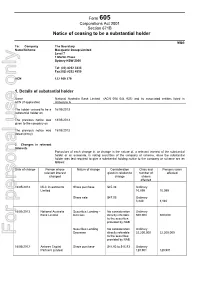

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder MQG To: Company The Secretary Name/Scheme Macquarie Group Limited Level 7 1 Martin Place Sydney NSW 2000 Tel: (02) 8232 3333 Fax:(02) 8232 4330 ACN 122 169 279 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 16/05/2013 substantial holder on The previous notice was 18/05/2013 given to the company on The previous notice was 15/05/2013 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose Nature of change Consideration Class and Persons votes relevant interest given in relation to number of affected changed change shares affected 16/05/2013 MLC Investments Share purchase $45.38 Ordinary Limited 10,099 10,099 Share sale $47.05 Ordinary 3,840 3,840 16/05/2013 National Australia Securities Lending – No consideration Ordinary Bank Limited Increase directly referable 500,000 500,000 to the securities provided by NAB Securities Lending – No consideration Ordinary Decrease directly referable 22,200,000 22,200,000 For personal use only to the securities provided by NAB 16/05/2013 Antares Capital Share purchase $44.92 to $45.93 Ordinary Partners Limited 120,901 120,901 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association No change 4. -

Full Year Results

/--5 CriiVb^oObpriqp Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafu1B K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& Qefpcriivb^ovb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovÚk^iobmloq^kafpdfsbkql qeb>rpqo^if^kPb`rofqfbpBu`e^kdbIfjfqba%>PU&rkaboIfpqfkdOrib1+0>+ Results for Announcement to the Market Results for announcement to the market Report for the year ended 30 September 2008 30 September 2008 $m (1) Revenue from ordinary activities up 4.7% * to 16,257 Profit after tax from ordinary activities attributable to members of the Company down 0.9% * to 4,536 Net profit attributable to members of the Company down 0.9% * to 4,536 * On previous corresponding period (twelve months ended 30 September 2007). (1) Reported as the sum of the following items from the Group's consolidated income statement: Net interest income, Premium and related revenue, Fee income and Other income. On a cash earnings basis revenue increased by 5.8%. Franked Amount amount Dividends per share per share Final Dividend 97 cents 100% Interim dividend 97 cents 100% Record date for determining entitlements to the final dividend 13 November 2008 Highlights (2) Group cash earnings down 10.7% Cash earnings from ongoing operations of $3,916 million for the September 2008 year decreased by $470 million or 10.7% on the September 2007 year. Underlying profit increased by $996 million or 13.9%. This reflects good revenue growth stemming from the Group's market leading position in business banking in Australia, successful repricing initiatives in all regions and strong performance in nabCapital's Markets business. A disciplined approach to cost management has been maintained however, cash earnings have been reduced by a higher bad and doubtful debts charge mainly relating to Asset Backed Securities Collateralised Debt Obligations in nabCapital. -

ASX Cards Database

REPORT1 long_name asx_ref create_date remove_date C34 02/03/73 B191 ORDENN (ANTHONY) & SONS LIMITED A13 08/04/70 "TRUTH" & "SPORTSMAN" LIMITED T11 07/08/59 "TRUTH" & "SPORTSMAN" LIMITED (SYDNEY) LIMITED P51 (THE) COMMONWEALTH INSTALMENT RECEIPT TR C453 05/07/96 (THE) ENVIRONMENTAL GROUP LIMITED E131 12/10/95 (THE) NATPROPS PROPERTY TRUST N97 21/03/85 (THE) NATPROPS PROPERTY TRUST N97 30/01/80 A & I DISCOUNTERS LIMITED A180 22/05/68 A-CAP DEVELOPMENT LIMITED A50 03/10/90 A-CAP DEVELOPMENT LIMITED A50 28/06/73 A-CAP DEVELOPMENT LIMITED A50 10/01/80 A-CAP DEVELOPMENT LIMITED A50 23/12/69 A-CAP DEVELOPMENT LIMITED A242 10/01/80 A-CAP DEVELOPMENT LIMITED A242 28/06/73 A.A.R. LIMITED A34 29/01/76 A.A.R. LIMITED A34 06/08/80 A.B.E HOLDINGS LIMITED A266 27/06/84 A.O.G. MINERALS LIMITED A83 16/07/87 A.R.I. LIMITED A80 17/07/80 A.R.I. LIMITED A80 14/07/88 A.U.R. NL A101 03/10/90 A.U.R. NL A101 13/12/84 A1 CONSOLIDATED GOLD N.L. A7 22/01/75 A1 CONSOLIDATED GOLD N.L. A7 19/06/69 A1 CONSOLIDATED GOLD N.L. A7 01/01/32 AAPC LIMITED A395 08/07/93 ABACUS PACIFIC NV A345 03/05/89 Wednesday, 19 September 2001 Page 1 of 331 long_name asx_ref create_date remove_date ABACUS PACIFIC NV A345 22/10/87 ABADOR GOLD NL A151 10/06/93 ABALDYN LIMITED A311 31/07/86 ABALEEN MINERALS NL A47 11/12/69 ABALEEN MINERALS NL A47 03/11/75 ABALEEN MINERALS NL A47 06/06/85 ABALEEN MINERALS NL A47 09/04/87 ABBOT HOLDINGS LIMITED A224 17/12/87 ABBOT HOLDINGS LIMITED A224 20/11/80 ABBOTT LG HOLDINGS LIMITED A224 20/11/80 ABEL LEMON HOLDINGS LIMITED A187 05/04/78 ABERCOM LIMITED A251 -

2007 Annual Financial Report INFORMATION ABOUT THIS PAGE: Image Placement and Crop Is First Draft Only

2007 Annual Financial Report Report Financial Annual 2007 2007 annual financial report INFORMATION ABOUT THIS PAGE: Image placement and crop is first draft only. National Australia Bank Limited ABN 12 004 044 937 This 2007 annual financial report is lodged with the Australian Securities and Investments Commission and Australian Securities Exchange. National Australia Bank Limited (NAB) is publicly listed in Australia and overseas and, as such, must meet regulatory requirements of all jurisdictions it operates in internationally. This report contains information prepared on the basis of the Corporations Act 2001 (Cth) and Australian equivalents to International Financial Reporting Standards. The Group deregistered from the United States Securities and Exchange Commission (SEC) effective September 20, 2007. Accordingly, all SEC related disclosures have been removed from this financial report for both the current and comparative financial years. NAB is no longer obliged to produce a concise version of this report, and this year introduced a non statutory shareholder review. The shareholder review comprises information from the annual financial report and the Company’s 2007 profit disclosures. To view the annual financial report online, visit www.nabgroup.com. Alternatively, to arrange for a copy to be sent to you free of charge, call Shareholder Services on 1300 367 647 from within Australia, or +61 3 9415 4299 from outside Australia. Nothing in this report is, or should be taken as, an offer of securities in NAB for issue or sale, or an invitation to apply for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. -

Notice of Ceasing to Be a Substantial Holder

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IGO To: Company The Secretary Name/Scheme Independence Group NL Ground Floor Suite 1 183 Great Eastern Hwy Belmont WA 6104 PH: (08 9479 1777 Fax: (08 9479 1877 ACN 092 786 304 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a substantial holder on 20/12/2010 The previous notice was given to the company on 25/11/2010 The previous notice was dated (d/m/y) 22/11/2010 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 23/11/2008 to MLC Investments Limited Share $4.88 to $7.68 Ordinary 20/12/2010 purchase 1,328,510 1,328,510 Share sale $4.88 to $7.88 Ordinary 1,964,088 1,964,088 23/11/2008 to NabInvest Managed Share $6.90 Ordinary 20/12/2010 Investments Ltd purchase 125,250 125,250 Share sale $7.13 Ordinary 70,000 70,000 23/11/2008 to National Australia Bank Share $6.65 Ordinary 20/12/2010 Limited purchase 312 312 Share sale $7.77 Ordinary 500 500 Corporate nil Ordinary Action 1,005 -

The Rise of Intellectual Capital As an Essential Business Asset

A $81.6 BILLION IN FUNDS UNDER MANAGEMENT REPORT TO SHAREHOLDERS 2000 New look real estate services˜ integrated & global. The rise of intellectual capital as an essential business asset. Powerful plan. Powerful future. Lend Lease An Integrated Real Estate Group 6 Financial Highlights A quick view of the year’s results. THEATRE,LOWRY SALFORD 8 Chairman’s Report The importance of our core values to our future. http://www.lendlease.com 14 Chief Executive’s 38 eCommerce 40 Intellectual Capital Report A global market place with Knowledge, people, culture – new dynamics transforming The value that can be created Lend Lease is its people. our business. through the integrated real estate platform. feature stories... 44 Stuart Hornery Daring to be different creates 2 Integrated & Global a reputation for success. Benefits Everybody We can offer a portfolio of real 46 The Hornery Institute estate services that cross traditional business lines. The next chapter of the Lend Lease philosophy of caring and sharing. 48 Board of Directors Our Directors comment on the challenges of change. 50 Community Day Our employees tell of how we can personally make 13 Jill Ker Conway a difference. Our Story, Our Future. Introducing our Chairman Elect. 51 Corporate Governance Our governance must reflect that we are now a global company. 57 Concise Financial Report 2000 18 Areas of Operation Results, management REAL ESTATE INVESTMENT discussion and analysis & FUNDS MANAGEMENT and Directors’ Report. Directing global capital flows. BOVIS LEND LEASE “Guidance and services for businesses A strategic partner that delivers. PROPERTY DEVELOPMENT investing in or managing global Building communities. -

Corporations Law Form

Form 603 Corporations Act 2001 Notice of initial substantial holder Section 671B VOC To:Company Name/Scheme The Secretary Vocus Communications Limited Level 1 189 Miller Street North Sydney NSW 2060 Ph: (02) 8999 8999 Fax: (02) 9959 4348 ACN 084 115 499 1. Details of substantial National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in shareholder Annexure A Name & ACN (if applicable) The holder became a substantial holder on 09/01/2015 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of securities Persons’ votes Voting power Fully paid ordinary 5,295,653 5,295,653 5.025% shares 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities MLC Investments Limited Power to control the voting and /or disposal Fully paid ordinary of securities pursuant to its position as the shares responsible entity or trustee of various 852,094 managed investment schemes and trusts. NabInvest Managed Power to control the voting and /or disposal Fully paid ordinary Investments Limited of securities pursuant to its position as the shares responsible entity or trustee of certain 1,435,747 managed investment schemes or trusts (NAB ICS and SPF investments). -

NAB Full Financials

Annual Financial Report 2004 Annual Financial Report Annual Financial Report 2004 the Year the Facts www.nabgroup.com the Future Cover+spineFullFinance2004 2 1/12/04, 5:12:56 PM National Australia Bank Limited ABN 12 004 044 937 This annual financial report 2004 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. Nothing in this annual financial report 2004 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. inside_Cover_FullFinance2004 2 1/12/04, 5:15:24 PM Table of contents Presentation of information 2 Notes to the financial statements 103 Financial summary 3 1 Principal accounting policies 103 Selected financial data 4 2 Transition to Australian equivalents to International Business overview 9 Financial Reporting Standards 112 Introduction 9 3 Segment information 114 Strategy 9 4 Revenue from ordinary activities 117 Business operating model 9 5 Profit from ordinary activities before income tax expense 118 Changes to the business operating model 9 6 Income tax expense 121 Introduction to Financial Services 10 7 Dividends and distributions 122 Financial Services Australia 10 8 Earnings per share 123 Financial Services Europe 11 9 Cash and liquid assets 124 Financial Services New Zealand 12 10 Due from other financial institutions 124 Corporate & Institutional Banking 12 -

Corporations Law Form

Form 603 Corporations Law Notice of initial substantial holder Section 671B IGO To:Company Name/Scheme The Secretary Independence Group NIL Suite 9 72 Melville Parade SOUTH PERTH WA 6151 Fax: (08) 9367 3288 ACN/ARSN ACN 092 786 304 1. Details of substantial shareholder Name National Australia Bank Limited (ACN 004 044 937) and its associated companies listed in ACN (if applicable) Annexure A and which includes MLC Investments Limited ACN 002 641 661 MLC Limited ACN 000 000 402 The holder became a substantial holder on 15/09/2008 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of Persons’ votes Voting power securities Ordinary 6,823,578 6,823,578 6.06% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities MLC Investments Limited Power to control voting and/or Ordinary disposal of securities 6,769,838 MLC Limited Power to control voting and/or Ordinary disposal of securities 53,740 TOTAL 6,823,578 4. Details of present registered holders The persons registered as holders of the securities referred to in paragraph 3 above are as follows: Holder of relevant interest Registered holder of securities Person entitled to be registered Class and as holder number of securities MLC Limited National Nominees Limited Ordinary (ACN 004 278 899) 53,740 MLC Investments Limited RBC Global Services Australia Ordinary Nominees Pty Limited (MasterKey 21,633 Custom Superannuation Fund A/C) (ACN 097 125 123) National Nominees Limited Ordinary (ACN 004 278 899) 6,748,205 Total 6,823,578 5. -

U.S.$75,000,000,000 Global Medium Term Note Programme

OFFERING CIRCULAR DATED 24th JANUARY, 2008. NATIONAL AUSTRALIA BNZ INTERNATIONAL CLYDESDALE BANK PLC BANK LIMITED FUNDING LIMITED, acting through its London Branch (ABN 12 004 044 937) (incorporated in New Zealand with (incorporated in Scotland with limited (incorporated with limited liability in the limited liability under registered number liability under registered number Commonwealth of Australia) 1635202 and registered as a branch in SC001111) England & Wales under numbers BR008377 and FC026206) U.S.$75,000,000,000 Global Medium Term Note Programme unconditionally and irrevocably guaranteed in the case of Notes issued by BNZ International Funding Limited, acting through its London Branch by BANK OF NEW ZEALAND (incorporated in New Zealand with limited liability under registered number 428849) Under this U.S.$75,000,000,000 Global Medium Term Note Programme (the Programme), National Australia Bank Limited (NAB), Clydesdale Bank PLC (Clydesdale) and BNZ International Funding Limited, acting through its London Branch (BNZ-IF) (each, an Issuer and together, the Issuers) may from time to time issue notes (the Notes, which include Senior Notes and Subordinated Notes (as such terms are defined below)) denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined below). This Offering Circular supersedes all previous prospectuses and offering circulars relating to the Programme. Any Notes issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes in issue prior to the date hereof. The payment of all amounts owing in respect of the Notes issued by BNZ-IF (Guaranteed Notes) will be unconditionally and irrevocably guaranteed by Bank of New Zealand (the Guarantor). -

Corporations Law Form

Form 603 Corporations Act 2001 Notice of initial substantial holder Section 671B TPI To:Company Name/Scheme The Secretary Transpacific Industries Group Limited Level 1 159 Coronation Drive Milton QLD 4064 Ph: (07) 3367 7800 Fax: (07) 3367 7878 ACN 101 155 220 1. Details of substantial National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in shareholder Annexure A Name & ACN (if applicable) The holder became a substantial holder on 08/01/2015 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of securities Persons’ votes Voting power Fully paid ordinary 75,948,976 75,948,976 4.808% shares 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities MLC Investments Limited Power to control the voting and /or disposal Fully paid ordinary of securities pursuant to its position as the shares responsible entity or trustee of various 55,930,820 managed investment schemes and trusts. MLC Wealth Management Power to control the voting and /or disposal Fully paid ordinary Limited of securities pursuant to its position as the shares responsible entity or trustee of various 1,015,514 managed investment schemes and trusts. -

Annual Financial Report 2002

Annual Financial Report 2002 National Australia Bank Limited ABN 12 004 044 937 This Annual Financial Report 2002 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. It is also filed with the United States Securities and Exchange Commission as an annual report on Form 20-F. Nothing in this Annual Financial Report 2002 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. Table of contents Presentation of information 2 5 Profit from ordinary activities before income Financial highlights 3 tax expense 90 Selected financial data 4 6 Income tax expense 94 Business overview 7 7 Dividends and distributions 94 Introduction 7 8 Earnings per share 95 Strategy 7 9 Cash assets 96 Business operating model 7 10 Due from other financial institutions 96 Introduction to Financial Services 8 11 Due from customers on acceptances 96 Financial Services Australia 8 12 Trading securities 97 Financial Services Europe 9 13 Available for sale securities 97 Financial Services New Zealand 10 14 Investment securities 99 Wholesale Financial Services 10 15 Investments relating to life insurance business 103 Wealth Management 11 16 Loans and advances 103 Other 11 17 Provisions for doubtful debts 106 Competition 12 18 Asset quality disclosures 108 Regulation of the financial services system 13 19 Mortgage servicing