NAB Full Financials

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Ceasing to Be a Substantial Holder

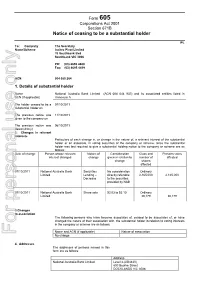

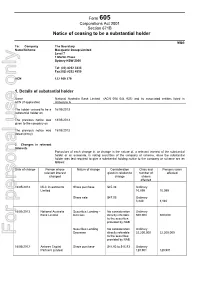

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IGO To: Company The Secretary Name/Scheme Independence Group NL Ground Floor Suite 1 183 Great Eastern Hwy Belmont WA 6104 PH: (08 9479 1777 Fax: (08 9479 1877 ACN 092 786 304 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a substantial holder on 19/11/2010 The previous notice was given to the company on 17/09/2008 The previous notice was dated (d/m/y) 15/09/2008 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 16/09/2008 to MLC Limited Share $4.20 to $6.08 Ordinary 19/11/2010 purchase 142,151 142,151 Share sale $3.63 to $7.08 Ordinary 143,078 143,078 16/09/2008 to MLC Investments Ltd Share $1.00 to $7.08 Ordinary 19/11/2010 purchase 1,255,338 1,255,338 Share sale $1.00 to $6.10 Ordinary 2,396,099 2,396,099 16/09/2008 to NabInvest Managed Share $1.56 to $6.09 Ordinary 19/11/2010 Investments Ltd purchase 329,240 329,240 Share sale $3.51 to $5.05 Ordinary 55,050 55,050 16/09/2008 -

Media Release

Australian High Commission, Kuala Lumpur MEDIA RELEASE 15 DECEMBER 2017 Deepening Australia’s engagement with the Muslim world – visit to Malaysia by Australia’s Special Envoy to the OIC, Mr Ahmed Fahour AO Australia’s Special Envoy to the Organisation of Islamic Cooperation (OIC), Mr Ahmed Fahour AO, visited Malaysia for a one-day official visit yesterday. Mr Fahour called on Deputy Minister in the Prime Minister’s Department, Dato’ Dr Asyraf Wajdi Dusuki, to discuss Australia’s engagement with the OIC, Islamic banking and finance, as well as key challenges facing the Muslim world. They also shared experiences on countering violent extremism. Mr Fahour was treated to a tour and prayers at Masjid Negara with the Grand Imam, Tan Sri Syaikh Ismail Muhammad. He also had lunch with local experts and commentators, to exchange views on trends in Islam in Australia and Malaysia. A highlight for Mr Fahour was a visit to the “Faith, Fashion, Fusion: Muslim Women’s Style in Australia” exhibition at the Islamic Arts Museum Malaysia, which is being displayed for the first time internationally with the support of the Australian Government and Lendlease Malaysia. Developed by the Museum of Applied Arts and Sciences in Sydney, “Faith, Fashion Fusion” explores the experiences and achievements of Australian Muslim women and how they express their faith through fashion. It also displays Australia’s growing modest fashion market and the work of a new generation of Muslim designers and entrepreneurs. Mr Fahour, who is also the Patron of the Islamic Museum of Australia said, “The exhibition showcases the diversity of Australia’s Muslim communities and the significant contribution they make to Australia’s contemporary, multicultural society.” Mr Fahour welcomed these efforts that help to build understanding and respect between the Islamic community and other faiths and cultures. -

For Personal Use Only

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IPL To: Company The Secretary Name/Scheme Incitec Pivot Limited 70 Southbank Bvd Southbank VIC 3006 PH: (03) 8695 4400 Fax: (03) 8695 4419 ACN 004 080 264 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 07/10/2011 substantial holder on The previous notice was 11/10/2011 given to the company on The previous notice was 06/10/2011 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 07/10/2011 National Australia Bank Securities No consideration Ordinary Limited Lending – directly referable 2,165,000 2,165,000 Decrease to the securities provided by NAB 07/10/2011 National Australia Bank Share sale $3.03 to $3.10 Ordinary Limited 30,179 30,179 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association For personal use only No change 4. -

Group Corporate Affairs

Group Corporate Affairs 500 Bourke Street Melbourne Victoria 3000 AUSTRALIA www.nabgroup.com National Australia Bank Limited ABN 12 004 044 937 ASX Announcement Monday 17 November 2008 NAB Australian Region market update National Australia Bank Executive Director and CEO Australia, Ahmed Fahour, is conducting a series of market briefings following the release of the NAB full year results on Tuesday 21 October. The briefing materials are attached and are largely based on the information disclosed during the full year results announcement. “NAB’s Australian Region continues to deliver excellent results in a challenging market, demonstrating increased revenue growth and a tight focus on cost control,” Mr Fahour said. “This is an outstanding achievement when viewed in the context of the external environment over the course of the year. “Throughout this difficult time NAB has continued to invest in our business by developing new brands such as UBank, extending our microfinance initiatives, delivering new products such as the Clear home loan, and commencing new infrastructure initiatives such as our Next Generation platform. “NAB has remained strong through these challenging conditions, and continues to focus on providing excellent support and service to our customers,” Mr Fahour said. Australian Region Financial Performance The Australia Region delivered cash earnings growth (before IoRE) of 15.8% and underlying profit growth of 19.3% over the prior comparative period. Revenue growth of 10.1% was an excellent result achieved in a very challenging environment. The strong performance of cash earnings growth of 18.5% by the Australia Banking business reflects continued momentum in business lending and consumer deposit gathering. -

BCA 2012 Annual Review: One Country. Many Voices

ONE COUNTRY. MANY VOICES. ANNUAL REVIEW 2012 04 OUR MEMBERS 26 OUR ACHIEVEMENTS 08 PRESIDENT’S MESSAGE 28 ONE COUNTRY, MANY VOICES 11 CHIEF EXECUTIVE’S MESSAGE 30 PUBLICATIONS 14 ABOUT US 15 OUR VISION, GOAL AND VALUES 16 HOW WE WORK Cover: Yuyuya Nampitjinpa, 18 OUR STRUCTURE Women’s Ceremony, 2011 © 2012 Yuyuya Nampitjinpa licensed 24 OUR WORK PROGRAM by Aboriginal Artists Agency Limited ONE COUNTRY. MANY VOICES. The Business Council of Australia (BCA) has been talking with people and organisations from different parts of the community. The intention, on all sides, has been simple: to fi nd common ground on goals for achieving national wealth for Australia. Not the fi nancial wealth of a few, but enduring prosperity for all. This means rewarding jobs, a better health and aged care system, world’s best education and training, and quality infrastructure to meet our needs into the future. Choices and opportunities that don’t leave groups of Australians behind. The BCA’s vision is for Australia to be the best place in the world to live, learn, work and do business. Our members bring their collective experience in planning, innovating, leading and inspiring. Working with others to develop interconnected policy responses, we can transcend limited short-term thinking to envision a future we would wish for the generations to follow. It’s time to show that together we’re up for the tough conversations, the planning and the collaboration needed to secure our nation’s enduring prosperity. 3 Our members BCA membership details throughout this review are valid as at 1 October 2012. -

For Personal Use Only Use Personal for to the Securities Provided by NAB

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder MQG To: Company The Secretary Name/Scheme Macquarie Group Limited Level 7 1 Martin Place Sydney NSW 2000 Tel: (02) 8232 3333 Fax:(02) 8232 4330 ACN 122 169 279 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 16/05/2013 substantial holder on The previous notice was 18/05/2013 given to the company on The previous notice was 15/05/2013 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose Nature of change Consideration Class and Persons votes relevant interest given in relation to number of affected changed change shares affected 16/05/2013 MLC Investments Share purchase $45.38 Ordinary Limited 10,099 10,099 Share sale $47.05 Ordinary 3,840 3,840 16/05/2013 National Australia Securities Lending – No consideration Ordinary Bank Limited Increase directly referable 500,000 500,000 to the securities provided by NAB Securities Lending – No consideration Ordinary Decrease directly referable 22,200,000 22,200,000 For personal use only to the securities provided by NAB 16/05/2013 Antares Capital Share purchase $44.92 to $45.93 Ordinary Partners Limited 120,901 120,901 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association No change 4. -

Full Year Results

/--5 CriiVb^oObpriqp Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafu1B K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& Qefpcriivb^ovb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovÚk^iobmloq^kafpdfsbkql qeb>rpqo^if^kPb`rofqfbpBu`e^kdbIfjfqba%>PU&rkaboIfpqfkdOrib1+0>+ Results for Announcement to the Market Results for announcement to the market Report for the year ended 30 September 2008 30 September 2008 $m (1) Revenue from ordinary activities up 4.7% * to 16,257 Profit after tax from ordinary activities attributable to members of the Company down 0.9% * to 4,536 Net profit attributable to members of the Company down 0.9% * to 4,536 * On previous corresponding period (twelve months ended 30 September 2007). (1) Reported as the sum of the following items from the Group's consolidated income statement: Net interest income, Premium and related revenue, Fee income and Other income. On a cash earnings basis revenue increased by 5.8%. Franked Amount amount Dividends per share per share Final Dividend 97 cents 100% Interim dividend 97 cents 100% Record date for determining entitlements to the final dividend 13 November 2008 Highlights (2) Group cash earnings down 10.7% Cash earnings from ongoing operations of $3,916 million for the September 2008 year decreased by $470 million or 10.7% on the September 2007 year. Underlying profit increased by $996 million or 13.9%. This reflects good revenue growth stemming from the Group's market leading position in business banking in Australia, successful repricing initiatives in all regions and strong performance in nabCapital's Markets business. A disciplined approach to cost management has been maintained however, cash earnings have been reduced by a higher bad and doubtful debts charge mainly relating to Asset Backed Securities Collateralised Debt Obligations in nabCapital. -

'Rogue Bankers'

Australian Bankers‘ Problematic code 1 THE AUSTRALIAN BANKERS’ PROBLEMATIC CODE Part 3b: Report to Council of Small Business Organisations of Australia Dated 5 December 2010 Australian Bankers‘ Problematic code 2 EXECUTIVE SUMMARY The Fairness of Bank / Customer Relationships in Australia This report examines, and makes recommendations in respect of, the extent to which customers of Australian banks are assured of fair treatment and full disclosure of facts that are relevant to their transactions. Before 1981, the activities of Australian Banks, including the manner in which they dealt with their customers, were subject to detailed regulations imposed by the Federal Government. Following the 1981 Campbell Committee report, the extent of this regulation was significantly reduced. After the stock market crash in 1987, it was feared that deregulation had gone too far. An alternative approach was sought to ensure that bank customers received fair treatment, and the Government assigned responsibility for suitable recommendations to a committee chaired by Stephen Martin. In its 1991 report the Martin Committee concluded that the banks should be required to establish a formal system of self regulation based on a government approved Code of Banking Practice. It further cited the high cost of resolving disputes, in the courts, between banks and their customers; and stressed the importance of an effective, low cost, complaints resolution procedure. Australian Bankers‘ Problematic code 3 The first such Code of Practice was established in 1993 but not adopted until 1996. It was substantially revised in 2003, and further modified in 2004. Despite a review in 2005 and further reviews in 2008, the 2004 code is essentially still in force. -

Australia Post Business Case

QUT BlueShift Business Case Competition Business Case: Australia Post Contents Overview ................................................................................................................................................. 2 Digital disruption and the decline of traditional mail ..................................................................... 2 The politics of privatisation ............................................................................................................. 5 Moving forward .............................................................................................................................. 5 Brief for consulting firms ........................................................................................................................ 6 Scope ............................................................................................................................................... 6 Appendices .............................................................................................................................................. 7 Appendix A – Australia Post Annual Report 2014 ................................................................................... 7 Appendix B – More mail-outs: Federal election drives revenue growth over current year ........... 8 Appendix C – IBISWorld Industry Risk Rating Report: Postal Services in Australia ........................ 9 Appendix D – Australian and International Postal Services Overview Background Report ......... 10 BlueShift Business -

The Executive's Guide to Navigating Digital Disruption

The Executive’s Guide to Navigating Digital Disruption Wisdom from the iTnews ACS CXO challenge Foreword FROM THE ACS. hat a difference a little over a year ecosystem develops, momentum will grow and can make? ultimately benefit all Australians, both within business When the CXO Challenge kicked and our communities. W off in June 2014, the Australian The CXO Challenge has been an invaluable research dollar was at US94c. Fast forward piece, providing extraordinary insight into technology to August 2015 and our currency is at US74c - yet a leaders from across the ASX 200 and how they have mini-economic boom hasn’t eventuated. embraced digital disruption to enhance their business Most notably, Iron Ore was over $90 USD/tonne models and develop new revenue streams. twelve months ago and now is just over $50 USD/ Highlighting that value creation is an individual tonne. The cycle of capital investment in the resources journey, approaches vary throughout the Challenge sector is drawing to an end, moving to production. such as TabCorp bringing digital back in-house, Telstra’s This is a perfect storm for our technology leaders. focus on ecosystem development, how ANZ considers Necessity is the mother of invention, and Australia analytics and automation will deliver a digital edge has some challenges to overcome in terms of revenue in the provision of advice as a service and tracking generation and tax receipts in order to maintain our systems being deployed by Domino’s to empower their historically high standards of living. customers. Industries were already experiencing digital Some themes are constant however such disruption, however over the last six months the as seeking ways to deliver best of breed digital political and economic landscapes have caught up and user experiences so that customers self-manage, recognised the importance of this disruption. -

National Australia Bank 800 Bourke Street Docklands Vic 3008 Tel: 61 3 8634 1587 Fax: 61 3 8634 3625

SUBMISSION 31 Executive Director & Chief Executive Officer Australia National Australia Bank 800 Bourke Street Docklands Vic 3008 Tel: 61 3 8634 1587 Fax: 61 3 8634 3625 18 July 2008 The Hon Craig Thomson MP Committee Chair Standing Committee on Economics PO Box 6021 House of Representatives Parliament House CANBERRA ACT 2600 [email protected] Dear Mr Thomson Inquiry into competition in the banking and non banking sectors National Australia Bank (NAB) welcomes the opportunity to respond to this Inquiry. National Australia Group is an international financial services organization that provides a comprehensive and integrated range of financial products and services. The Group is structured around regional retail banking and wealth management operations and an international capital markets and institutional banking business. The Group’s businesses include: the National Australia Bank (NAB), MLC, the Bank of New Zealand, Great Western Bank in the United States and nabCapital. NAB has also contributed to and supports the Australian Bankers’ Association (ABA) submission, which provides a comprehensive overview of Australia’s retail banking sector and the issues relevant to competition. NAB’s retail bank employs around 11,000 people in all States and Territories across Australia. We offer our 3.3 million customers a wide variety of banking options, including almost 800 stores, internet and telephone banking, ATMs and mobile bankers. We continue to develop new banking channels that use next generation technologies to help customers bank from the comfort of their home or office. We have grouped our comments around the Committee’s terms of reference, highlighting the issues we consider as relevant to competition in retail banking. -

ASX Cards Database

REPORT1 long_name asx_ref create_date remove_date C34 02/03/73 B191 ORDENN (ANTHONY) & SONS LIMITED A13 08/04/70 "TRUTH" & "SPORTSMAN" LIMITED T11 07/08/59 "TRUTH" & "SPORTSMAN" LIMITED (SYDNEY) LIMITED P51 (THE) COMMONWEALTH INSTALMENT RECEIPT TR C453 05/07/96 (THE) ENVIRONMENTAL GROUP LIMITED E131 12/10/95 (THE) NATPROPS PROPERTY TRUST N97 21/03/85 (THE) NATPROPS PROPERTY TRUST N97 30/01/80 A & I DISCOUNTERS LIMITED A180 22/05/68 A-CAP DEVELOPMENT LIMITED A50 03/10/90 A-CAP DEVELOPMENT LIMITED A50 28/06/73 A-CAP DEVELOPMENT LIMITED A50 10/01/80 A-CAP DEVELOPMENT LIMITED A50 23/12/69 A-CAP DEVELOPMENT LIMITED A242 10/01/80 A-CAP DEVELOPMENT LIMITED A242 28/06/73 A.A.R. LIMITED A34 29/01/76 A.A.R. LIMITED A34 06/08/80 A.B.E HOLDINGS LIMITED A266 27/06/84 A.O.G. MINERALS LIMITED A83 16/07/87 A.R.I. LIMITED A80 17/07/80 A.R.I. LIMITED A80 14/07/88 A.U.R. NL A101 03/10/90 A.U.R. NL A101 13/12/84 A1 CONSOLIDATED GOLD N.L. A7 22/01/75 A1 CONSOLIDATED GOLD N.L. A7 19/06/69 A1 CONSOLIDATED GOLD N.L. A7 01/01/32 AAPC LIMITED A395 08/07/93 ABACUS PACIFIC NV A345 03/05/89 Wednesday, 19 September 2001 Page 1 of 331 long_name asx_ref create_date remove_date ABACUS PACIFIC NV A345 22/10/87 ABADOR GOLD NL A151 10/06/93 ABALDYN LIMITED A311 31/07/86 ABALEEN MINERALS NL A47 11/12/69 ABALEEN MINERALS NL A47 03/11/75 ABALEEN MINERALS NL A47 06/06/85 ABALEEN MINERALS NL A47 09/04/87 ABBOT HOLDINGS LIMITED A224 17/12/87 ABBOT HOLDINGS LIMITED A224 20/11/80 ABBOTT LG HOLDINGS LIMITED A224 20/11/80 ABEL LEMON HOLDINGS LIMITED A187 05/04/78 ABERCOM LIMITED A251