Notice of Ceasing to Be a Substantial Holder

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Personal Use Only

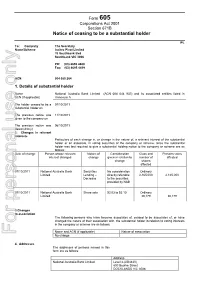

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IPL To: Company The Secretary Name/Scheme Incitec Pivot Limited 70 Southbank Bvd Southbank VIC 3006 PH: (03) 8695 4400 Fax: (03) 8695 4419 ACN 004 080 264 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 07/10/2011 substantial holder on The previous notice was 11/10/2011 given to the company on The previous notice was 06/10/2011 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 07/10/2011 National Australia Bank Securities No consideration Ordinary Limited Lending – directly referable 2,165,000 2,165,000 Decrease to the securities provided by NAB 07/10/2011 National Australia Bank Share sale $3.03 to $3.10 Ordinary Limited 30,179 30,179 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association For personal use only No change 4. -

For Personal Use Only Use Personal For

TRR[ CRIIVB>O OBPRIQP Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafuV´ For personal use only Qefpcriivb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovcfk^iobmloqdfsbk qlqeb>rpqo^if^kPb`rofqfbpBu`e^kdb%>PU&rkaboIfpqfkdOribVU° K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& For personal use only Full Year Results Results for Announcement to the Market 2009 Results for announcement to the market Report for the year ended 30 September 2009 30 September 2009 $m Revenue from ordinary activities (1) up 8.9% * to 17,705 Profit after tax from ordinary activities attributable to members of the Company (2) down 42.9% * to 2,589 Net profit attributable to members of the Company (2) down 42.9% * to 2,589 * On previous corresponding period (year ended 30 September 2008). (1) Reported as the sum of the following items from the Group’s consolidated income statement: Net interest income, Premium and life related revenue, Fee income and Total other income. On a cash earnings basis revenue increased by 9.7%. (2) Net profit attributable to members of the company was down 42.9% to $2,589 million, largely due to developments in several long standing and previously announced legal and tax proceedings, accounting volatility from fair value movements and expenses of the Efficiency, Quality and Service program. Franked Amount per amount per share share Dividends cents % Final dividend 73 100 Interim dividend 73 100 Record date for determining entitlements to the final dividend 19 November 2009 Highlights (3) Group cash earnings down 1.9% Cash earnings from ongoing operations of $3,841 million for the September 2009 year decreased by $75 million or 1.9% on the September 2008 year. -

Corporations Law Form

Form 603 Corporations Law Notice of initial substantial holder Section 671B RRA To:Company Name/Scheme The Secretary RR Australia Limited Level 1 47 Rickard Road BANKSTOWN NSW 32200 Fax: (02) 9101 9035 ACN/ARSN ACN 072 507 147 1. Details of substantial shareholder Name National Australia Bank Limited (ACN 004 044 937) being comprised of the bodies corporate ACN (if applicable) listed in Annexure A and which includes Elly Investments Pty Ltd ACN 098 198 004 (Elly Investments Pty Ltd acquired more than 20% of the voting power in Pengana Holdings Pty Limited (PHPL) on 30 April 2008. Pengana Capital Limited is a wholly owned subsidiary of PHPL) The holder became a substantial holder on 02/05/2008 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of Persons’ votes Voting power securities Ordinary 9,607,900 9,607,900 7.507% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Elly Investments Pty Ltd Having voting power in Ordinary Pengana Capital Limited that 9,607,900 is above 20% TOTAL 9,607,900 4. -

Notice of Ceasing to Be a Substantial Holder

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IGO To: Company The Secretary Name/Scheme Independence Group NL Ground Floor Suite 1 183 Great Eastern Hwy Belmont WA 6104 PH: (08 9479 1777 Fax: (08 9479 1877 ACN 092 786 304 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a substantial holder on 20/12/2010 The previous notice was given to the company on 25/11/2010 The previous notice was dated (d/m/y) 22/11/2010 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 23/11/2008 to MLC Investments Limited Share $4.88 to $7.68 Ordinary 20/12/2010 purchase 1,328,510 1,328,510 Share sale $4.88 to $7.88 Ordinary 1,964,088 1,964,088 23/11/2008 to NabInvest Managed Share $6.90 Ordinary 20/12/2010 Investments Ltd purchase 125,250 125,250 Share sale $7.13 Ordinary 70,000 70,000 23/11/2008 to National Australia Bank Share $6.65 Ordinary 20/12/2010 Limited purchase 312 312 Share sale $7.77 Ordinary 500 500 Corporate nil Ordinary Action 1,005 -

NAB Full Financials

Annual Financial Report 2004 Annual Financial Report Annual Financial Report 2004 the Year the Facts www.nabgroup.com the Future Cover+spineFullFinance2004 2 1/12/04, 5:12:56 PM National Australia Bank Limited ABN 12 004 044 937 This annual financial report 2004 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. Nothing in this annual financial report 2004 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. inside_Cover_FullFinance2004 2 1/12/04, 5:15:24 PM Table of contents Presentation of information 2 Notes to the financial statements 103 Financial summary 3 1 Principal accounting policies 103 Selected financial data 4 2 Transition to Australian equivalents to International Business overview 9 Financial Reporting Standards 112 Introduction 9 3 Segment information 114 Strategy 9 4 Revenue from ordinary activities 117 Business operating model 9 5 Profit from ordinary activities before income tax expense 118 Changes to the business operating model 9 6 Income tax expense 121 Introduction to Financial Services 10 7 Dividends and distributions 122 Financial Services Australia 10 8 Earnings per share 123 Financial Services Europe 11 9 Cash and liquid assets 124 Financial Services New Zealand 12 10 Due from other financial institutions 124 Corporate & Institutional Banking 12 -

Annual Financial Report 2002

Annual Financial Report 2002 National Australia Bank Limited ABN 12 004 044 937 This Annual Financial Report 2002 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. It is also filed with the United States Securities and Exchange Commission as an annual report on Form 20-F. Nothing in this Annual Financial Report 2002 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. Table of contents Presentation of information 2 5 Profit from ordinary activities before income Financial highlights 3 tax expense 90 Selected financial data 4 6 Income tax expense 94 Business overview 7 7 Dividends and distributions 94 Introduction 7 8 Earnings per share 95 Strategy 7 9 Cash assets 96 Business operating model 7 10 Due from other financial institutions 96 Introduction to Financial Services 8 11 Due from customers on acceptances 96 Financial Services Australia 8 12 Trading securities 97 Financial Services Europe 9 13 Available for sale securities 97 Financial Services New Zealand 10 14 Investment securities 99 Wholesale Financial Services 10 15 Investments relating to life insurance business 103 Wealth Management 11 16 Loans and advances 103 Other 11 17 Provisions for doubtful debts 106 Competition 12 18 Asset quality disclosures 108 Regulation of the financial services system 13 19 Mortgage servicing -

Becoming a Substantial Holder Signed by Me and Dated 31/12/2013

Form 603 Corporations Act 2001 Notice of initial substantial holder Section 671B TGA To:Company Name/Scheme The Secretary Thorn Group Limited Level 1, 47 Rickard Road Bankstown NSW 2200 PH: (02) 9101 5000 Fax: (02) 9101 5035 ACN 072 507 147 1. Details of substantial shareholder National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Name Annexure A ACN (if applicable) The holder became a substantial holder on 24/12/2013 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of Persons’ votes Voting power securities Ordinary 7,703,363 7,703,363 5.174% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities MLC Investments Limited Power to control the voting Fully paid ordinary and /or disposal of securities shares pursuant to its position as the 979,204 responsible entity or trustee of various managed investment schemes and trusts MLC Wealth Management Limited Power to exercise voting Fully paid ordinary rights pursuant to position shares held as the Registrable 130,132 Superannuation Entity licensee for the superannuation products it issues. -

Nab 946,884 946,884

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder SFR To: The Secretary Company Name/Scheme Sandfire Resources NL Level 2 31 Ventnor Avenue West Perth WA 6005 Ph: (08) 6430 3800 Fax: (08) 6430 3849 ACN 105 154 185 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a 17/12/2013 substantial holder on The previous notice was 13/12/2013 given to the company on The previous notice was 10/12/2013 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of change Consideration Class and Persons votes interest changed given in relation to number of affected change shares affected 11/12/2013 to National Australia Securities Lending – No consideration Fully paid 17/12/2013 Bank Limited Increase directly referable ordinary to the securities shares provided by NAB 946,884 946,884 Securities Lending – No consideration Fully paid Decrease directly referable ordinary to the securities shares provided by NAB 1,020,614 1,020,614 3. Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association No change 4. -

TRR[ CRII VB>O OBPRIQP

TRR[ CRIIVB>O OBPRIQP Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafuV´ Qefpcriivb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovcfk^iobmloqdfsbk qlqeb>rpqo^if^kPb`rofqfbpBu`e^kdb%>PU&rkaboIfpqfkdOribVU° K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& Full Year Results Results for Announcement to the Market 2009 Results for announcement to the market Report for the year ended 30 September 2009 30 September 2009 $m Revenue from ordinary activities (1) up 8.9% * to 17,705 Profit after tax from ordinary activities attributable to members of the Company (2) down 42.9% * to 2,589 Net profit attributable to members of the Company (2) down 42.9% * to 2,589 * On previous corresponding period (year ended 30 September 2008). (1) Reported as the sum of the following items from the Group’s consolidated income statement: Net interest income, Premium and life related revenue, Fee income and Total other income. On a cash earnings basis revenue increased by 9.7%. (2) Net profit attributable to members of the company was down 42.9% to $2,589 million, largely due to developments in several long standing and previously announced legal and tax proceedings, accounting volatility from fair value movements and expenses of the Efficiency, Quality and Service program. Franked Amount per amount per share share Dividends cents % Final dividend 73 100 Interim dividend 73 100 Record date for determining entitlements to the final dividend 19 November 2009 Highlights (3) Group cash earnings down 1.9% Cash earnings from ongoing operations of $3,841 million for the September 2009 year decreased by $75 million or 1.9% on the September 2008 year. -

Disclosure of Beginning to Have Substantial Holding

Disclosure of movement of 1% or more in substantial holding or change in nature of relevant interest or both Sections 23 and 24, Securities Markets Act 1988 Date of relevant event: 9 September 2011 To: New Zealand Stock Exchange And: Kathmandu Holdings Limited Date this disclosure made: 14 September 2011 Date last disclosure made: 31 August 2011 Substantial security holder(s) giving disclosure Name(s): National Australia Bank Limited (ACN 004 044 937) and its associated companies listed in Annexure A: Summary of substantial holding to which disclosure relates Class of securities Previous Notice Present Notice Person’s votes Voting power Person’s votes Voting power Ordinary 10,100,031 5.050% 19,782,034 9.891% Details of transactions and events giving rise to relevant event Details of the transactions or other events requiring disclosure under the instructions to this form: Person whose Nature of change Consideration Class and number Person’s relevant interest given in relation of securities votes affected changed to change affected NabInvest Managed Share purchase $1.60 Ordinary Investments Limited 183,000 183,000 29/08/2011 to National Australia Securities Lending No consideration Ordinary 09/09/2011 Bank Limited – Increase directly referable to the securities 1,025,000 provided by NAB (refer Appendix 1) Securities Lending No consideration Ordinary - Decrease directly referable to the securities 930,813 provided by NAB 29/08/2011 to Aviva Investors Transition to NAB Ordinary 09/09/2011 Australia Limited Group 9,404,816 SSH-Movement KMD -

Notice of Ceasing to Be a Substantial Holder

Form 605 Corporations Law Section 671B Notice of ceasing to be a substantial holder WDC To: Company Name/Scheme Westfield Group 100 William Street SYDNEY NSW 2000 Fax: (02) 9358 7077 ACN/ARSN ABN 66 001 671 496 1. Details of substantial holder Name National Australia Bank Limited Group (ACN 004 044 937) being ACN (if applicable) comprised of the bodies corporate listed in Annexure A and which includes: Flexiplan Australia Limited ACN 056 678 427 Godfrey Pembroke Financial services Limited ACN 003 059 541 National Asset Management Limited ACN 062 806 884 National Australia Trustees Limited ACN 007 350 405 MLC Limited ACN 000 000 402 MLC Investments Limited ACN 002 641 661 The holder ceased to be a 29/04/2005 substantial holder on The previous notice was given to the company on 21/07/2004 The previous notice was dated (d/m/y) 21/07/2004 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation number of affected to change shares affected 21/07/2004 to Flexiplan Australia Limited Share purchase $14.64 to $17.26 Ordinary 102,714 29/04/2005 102,714 21/07/2004 to Share sale $14.35 to $17.36 Ordinary 114,173 29/04/2005 114,173 2. -

NAB Full Financials

Annual Financial Report 2005 new thinking new actions National Australia Bank Limited ABN 12 004 044 937 This annual financial report 2005 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. Nothing in this annual financial report 2005 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. Table of contents Chairman’s message 2 2 Transition to Australian equivalents to International Managing Director's message 3 Financial Reporting Standards 126 Presentation of information 4 3 Segment information 133 Financial summary 5 4 Revenue from ordinary activities 136 Selected financial data 6 5 Profit from ordinary activities before income tax expense 137 Business overview 10 6 Income tax expense 141 Introduction 10 7 Dividends and distributions 142 Strategy and corporate principles 10 8 Earnings per share 143 Business operating model 10 9 Cash and liquid assets 143 Total Australia 10 10 Due from other financial institutions 143 Total United Kingdom 12 11 Due from customers on acceptances 144 Total New Zealand 13 12 Trading securities 144 Institutional Market & Services 13 13 Available for sale securities 145 Other 14 14 Investment securities 147 Competition 14 15 Investments relating to life insurance business 149 Regulation of the financial services system 14 16 Loans and advances 150