Annual Financial Report 2002

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Natwest Markets Plc

Information Memorandum 5 March 2020 NatWest Markets Plc (incorporated in Scotland with limited liability under the Companies Act 1948 to 1980, registered number SC090312) A$5,000,000,000 Debt Issuance Programme Arranger & Dealer National Australia Bank Limited Dealers Australia and New Zealand Banking Group Limited Commonwealth Bank of Australia Mizuho Securities Asia Limited NatWest Markets Plc The Toronto-Dominion Bank Westpac Banking Corporation Contents Important notices 1 1. Programme summary 4 2. Information about NatWest Markets Plc 9 3. UK Bank Resolution Regime 10 4. Selling restrictions 11 5. Summary of certain taxation matters 15 6. Other important matters 17 7. Conditions of the Notes 19 8. Form of Pricing Supplement 39 9. Glossary 44 Directory 47 42015475_33 Important notices This Information Memorandum The distribution and use of this Information Memorandum, including any Issue Materials, and the This Information Memorandum relates to a debt offer or sale of Notes may be restricted by law in certain issuance programme (“ Programme ”) established by jurisdictions and intending purchasers and other NatWest Markets Plc (the “Issuer ”), under which it may investors should inform themselves about them and issue Notes from time to time. It has been prepared by, observe any such restrictions. and is issued with the authority of, the Issuer. In particular: The Issuer is neither a bank nor an authorised deposit- taking institution which is authorised under the this Information Memorandum is not a prospectus Australian Banking Act and nor is it supervised by the or other disclosure document for the purposes of the Australian Prudential Regulation Authority. The Notes Corporations Act. -

Annual Report 1999 an International Financial Services Group

An international financial services group Annual Report 1999 National Australia Bank Limited ACN004044937 The National’s International Franchise Our Vision Contents To be the world’s leading financial services company. 1999 @ a Glance 2 Our Mission Financial Highlights 4 We tailor financial services to help Corporate Highlights 6 individuals, families, businesses and The Board of Directors 8 communities to achieve their goals. Group Leadership Team 10 Our Values Year in Review by the Chairman Service to our customers and the Managing Director 11 Quality in everything we do Business and Personal Professionalism and ethics in all our Financial Services 16 actions Products and Services 18 Competitiveness and a will to win Growth and development of our Global Wholesale Financial Services 20 people National Services Information Continuous productivity improvement Technology Enterprises 22 Growing profit for our stakeholders Community Relations 24 Key Business Units 26 Financial Information and Analysis Description of Business 30 Financial Review 36 Financial Calendar United Kingdom Asia Australia United States Report of the Directors 75 15 December 1999 Final dividend payable Financial Report Financial Statements 80 16 December 1999 Annual General Meeting Notes to the 27 January 2000 1999–2000 Q1 Results Financial Statements 84 Directors’ Declaration 165 4 May 2000 1999–2000 Q2 Results Auditors’ Report 165 July 2000 Interim 1999–2000 dividend paid Form 20-F Cross Reference Index 166 27 July 2000 1999–2000 Q3 Results Shareholder Information -

Orora Investor Briefing November 2013 Contents

Orora Investor Briefing November 2013 Contents • The demerger of Orora Limited • About Orora Limited • Strategic Direction of Orora • Orora Leadership • Board & Management Teams • Summary Orora Ltd 2 The demerger of Orora Limited The steps to the demerger 3 Demerger to be completed this calendar year Event Date Announced intention to demerge 1 August 2013 Scheme Booklet lodged with ASX 1 November 2013 Scheme and General Meeting (SGM) 9 December 2013 Demerger effective date (last date Amcor shares will trade cum-entitlement) 17 December 2013 Orora shares commence trading (deferred settlement basis) 18 December 2013 Scheme record date 24 December 2013 Demerger implemented 31 December 2013 Orora shares commence trading (normal settlement basis) 3 January 2014 Process is “on track” Orora Ltd 4 About Orora Limited The newest global packaging brand 5 Orora is set up for success • Strong, well-positioned core business • Focused portfolio & good industry structures • Stable, defensive earnings streams • Experienced Board & Executive Team with track record of performance • Cost reduction opportunities a key factor in expected near term earnings growth • Strong financial profile/metrics • Strong balance sheet • Well-capitalised businesses • Near-term earnings growth in company’s direct control • Strong cash flows • Proposed dividend payout 60 – 70% - dividends to be franked to the extent practicable • Disciplined approach to future growth • Capital management optionality Orora Ltd 6 The Orora Limited Group – A focused company Orora Australasia 26 -

Pp43-45 6.3-Oliver

THE FINANCIAL SERVICES FORUM Retail Banking BANK TO THE FUTURE The high street banks have alienated many of their customers in their search for efficiency, depersonalising the whole experience with offshore call centres and centralised lending decisions. Malcolm Oliver looks at how two relative newcomers to the UK retail banking scene are reviving the old concept of real bank managers and personal service. The future of retail banking is a self-evidently important The key to success is often not the development of theme, and indeed one that The Financial Services Forum the ideas themselves but having the confidence (and addresses each year in the slightly broader context of its perhaps the commercial and professional courage) to Future of Retail Financial Services conferences. stand out and not dismiss them, like most of the herd, But between the positive idea and the delivered reality as passé or inappropriate to the needs of twenty-first- can fall a huge shadow. If speakers really have cracked century customers. As Allan Leighton said recently, in the problem in a way that will deliver lasting customer his new book on leadership, “the biggest challenge to satisfaction and regulatory approval and sustainable senior management is being able to listen effectively to profitability, why on earth would they want to give their those below who know what will and will not work”. secrets away to commercial rivals? Just reflect on how many financial services companies The Forum largely avoids this problem by its in the last decade or so have put in place new strategies membership formula, which means that most presenters to relocate call centres overseas, or to close local will already have built informal relationships with most of branches, or to withdraw free ATMs, or to restrict opening the audience, and will therefore feel that they are talking hours – only to have to perform an embarrassing volte- amongst friends rather than competitors. -

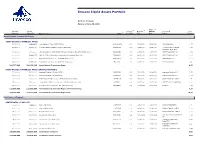

Invesco Liquid Assets Portfolio

Invesco Liquid Assets Portfolio Portfolio Holdings Data as of June 30, 2021 4 2 3 Final Principal Market 1 Coupon/ Maturity Maturity Associated % of Amount Value ($) Name of Issue CUSIP Yield (%) Date Date Issuer Portfolio Asset Backed Commercial Paper ASSET-BACKED COMMERCIAL PAPER 25,000,000 24,998,958 Ionic Capital III Trust (CEP-UBS AG) 46220WUG9 0.13 07/16/2021 07/16/2021 UBS GROUP AG 1.27 37,777,000 37,774,140 Lexington Parker Capital Company (Multi-CEP) 52953AUV5 0.15 07/29/2021 07/29/2021 Lexington Parker Capital 1.93 Company (Multi-CEP) 10,500,000 10,500,000 LMA Americas LLC (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QXR6 0.05 10/25/2021 10/25/2021 CREDIT AGRICOLE SA 0.54 40,000,000 39,992,272 LMA SA (CEP-Credit Agricole Corporate & Investment Bank S.A.) 53944QW30 0.24 09/03/2021 09/03/2021 CREDIT AGRICOLE SA 2.04 20,000,000 20,000,000 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JW26 0.14 09/02/2021 09/02/2021 BNP PARIBAS SA 1.02 55,000,000 54,964,250 Ridgefield Funding Co. LLC (CEP-BNP Paribas S.A.) 76582JY81 0.14 11/08/2021 11/08/2021 BNP PARIBAS SA 2.80 188,277,000 188,229,620 Asset-Backed Commercial Paper 9.60 ASSET-BACKED COMMERCIAL PAPER (INTEREST BEARING) 50,000,000 50,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VG1 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 2.55 25,000,000 25,000,000 Anglesea Funding LLC (Multi-CEP) 0347M5VL0 0.17 07/01/2021 08/04/2021 Anglesea Funding LLC 1.27 10,000,000 10,000,000 Bedford Row Funding Corp. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

Amcor Rigid Plastics June 2017 Agenda 02

Amcor Rigid Plastics June 2017 Agenda 02 1 Safety briefing 2 Amcor Rigid Plastics a Key Messages b Leadership Team c Business Overview d Latin America Update 3 Amcor Rigid Plastics North America f Key Messages g Business Overview 4 Summary Safety – Manchester Evacuation Route 03 Safe zone Safety instructions for fire emergency: Exit through cafeteria Walk away from the building Turn left, proceed to safe zone Lobby Area Staying safe Required safety behaviors for visitors 04 Listen to your guide and pay attention to signs. Obey all instructions (verbal or written) Take Action, Take Care! is Amcor’s safety philosophy and a cornerstone of staying safe in our site. If you see something you think is No jewelry unsafe during your visit, Take Action Consult your guide in case No mobile phones by telling your guide. Take Care of of concern yourself and others by staying with your guide at all times, not touching anything, and following a few basic rules: Pay attention to vehicles and stay in No cameras allowed on site pedestrian walkways Except by special permission Make eye contact with drivers before crossing pathways Don’t touch machinery Hold the handrails on stairs or equipment Agenda 05 1 Safety briefing 2 Amcor Rigid Plastics a Key Messages b Leadership Team c Business Overview d Latin America Update 3 Amcor Rigid Plastics North America f Key Messages g Business Overview 4 Summary Amcor Rigid Plastics Key Messages 06 Safety is always the top priority Outstanding leaders committed to outperformance and delivering value to stakeholders Strong position: footprint, markets, technology and customers In attractive segments With substantial growth potential Amcor Rigid Plastics Safety Highlights 07 Co-worker safety is always our top priority. -

Settlement Banks for FX and MM Transactions, Options and Derivatives

Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Australia AUD National Australia Bank Ltd., Me lbourne NATAAU33033 Acc. 1803012548500 Bulgaria BGN Unicredit Bulbank AD, Sofia UNCRBGSF IBAN BG42UNCR96601030696607 Canada CAD Royal Bank of Canada, Toronto ROYCCAT2 Acc. 095912454619 SYDBANK A/S China CNY Standard Chartered Bank Ltd., Hong Kong SCBLHKHH Acc. 44709448980 Czech R epublic CZK Unicredit Bank Czech Republic AS , Prague BACXCZPP IBAN: CZ242700000000008166802 8 Acc. 81668028 Denmark DKK Danmarks Nationa lbank, Copenhagen DKNBDKKK Acc. 1115 -4 IBAN DK0910050000011154 Euroland EUR Commerzbank A G, Frankfurt COBADEFF Acc. 4008724346 IBAN DE 83500400000872434600 Hong Kong HKD Stan dard Chartered, Hong Kong SCBLHKHH Acc. 44708122739 Hungary HUF OTP Bank PLC , Budapest OTPVHUHB IBAN: HU66117820078102030800000000 Iceland ISK NBI HF NBIIISRE IBAN: IS230100270912726805925439 India INR Standard Chartered Bank , New Delhi SCBLINBB Acc. 222 -0-523804 -8 Indonesia IDR Standard Chartered Bank, Jakarta SCBLIDJX Japan JPY Bank of Tokyo -Mitsubishi UFJ Ltd , Tokyo BOTKJPJT Acc. 653 -0440973 Kenya KES Kenya Commercial Bank, Nairobi KCBLKENX Mexico MXN BBVA Bancomer S.A., Mexico BCMRMXMMCOR Acc. 0095001475 Morocco MAD Banque Marocaine du Commerce Extérieur, Cass ablanca BMCEMAMC New Ze aland NZD ANZ National Bank Ltd , Wellin gton ANZBNZ22058 Acc. 266650 -00001 NZD NO.1 Nor way NOK DNB Nor Bank ASA , Oslo DNBANOKK IBAN: NO32 70010213124 Acc. 7001.02.13124 Valid from: 24.02.2021 Sydbank A/S, CVR No DK 12626509, Aabenraa www.sydbank.com Page: 1/2 Settlement Banks for FX and MM Transactions, Options and Derivatives Cou ntry: Currency: Correspondent Bank: SWIFT: Poland PLN Bank Millennium SA, Warsaw BIGBPLPW IBAN PL 02116022020000000039897935 Romania RO N UniCredit Tiriac Bank SA, Bucharest BACXROBU IBAN RO65B ACX0000000001413310 Saudi Arabia SAR Saudi British Bank, Riyadh SABBSARI Acc. -

Against the Hallmark Nickel Project (Philippines) Information About Destructive Mining Project in Mati, Davao, Philippines

Against the Hallmark Nickel Project (Philippines) Information about destructive mining project in Mati, Davao, Philippines October 28, 2009 Contents Macambol ........................................... 4 BHP Billiton ......................................... 4 Who is AMCOR? ....................................... 4 BHP Billiton and AMCOR Dispute ............................. 5 The Mining Act of 1995 ................................... 5 2 From anarchists in Philippines involved in resistance: Autonomous resistance against eco-destruction and social turmoil carried out by cap- ital needs to develop unbounded and analyzed upon creating a revolutionary plight in reclaiming direct control towards freedom — liberatory space and unconstrained desire and capacity beyond the bondages of imagination to put into action — without compromise. The struggle against domination, the enemy — state, capital and reli- gion acquiring and exploiting the earth landscape as extractable resources manifests the ever-growing contagious outbreak of various oppositional elements and social conventions concealed within the legal framework and morality of lobbying, servi- tude and pacifism until natural life is mechanically being reduced and controlled into the hands of conservation experts, scientists and sustainable management schemes as a means of reaction to such atrocious events. Ideological dogma, reformism and centralized administrative structures often becomes the product of deeds and aca- demic indoctrination consequently suppressing the burning rage of defiance -

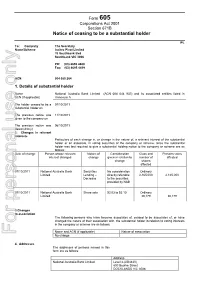

Notice of Ceasing to Be a Substantial Holder

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IGO To: Company The Secretary Name/Scheme Independence Group NL Ground Floor Suite 1 183 Great Eastern Hwy Belmont WA 6104 PH: (08 9479 1777 Fax: (08 9479 1877 ACN 092 786 304 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a substantial holder on 19/11/2010 The previous notice was given to the company on 17/09/2008 The previous notice was dated (d/m/y) 15/09/2008 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 16/09/2008 to MLC Limited Share $4.20 to $6.08 Ordinary 19/11/2010 purchase 142,151 142,151 Share sale $3.63 to $7.08 Ordinary 143,078 143,078 16/09/2008 to MLC Investments Ltd Share $1.00 to $7.08 Ordinary 19/11/2010 purchase 1,255,338 1,255,338 Share sale $1.00 to $6.10 Ordinary 2,396,099 2,396,099 16/09/2008 to NabInvest Managed Share $1.56 to $6.09 Ordinary 19/11/2010 Investments Ltd purchase 329,240 329,240 Share sale $3.51 to $5.05 Ordinary 55,050 55,050 16/09/2008 -

National Australia Bank Selects Payplus Cls from Fundtech; Fundtech Furthers Its Dominance in the Cls Market

Fundtech Contact: Media Contact: George Ravich Justine Schneider Fundtech Ltd. Ruder Finn, Inc. (201) 946-1100 (212) 583-2750 [email protected] [email protected] FOR IMMEDIATE RELEASE NATIONAL AUSTRALIA BANK SELECTS PAYPLUS CLS FROM FUNDTECH; FUNDTECH FURTHERS ITS DOMINANCE IN THE CLS MARKET JERSEY CITY, N.J.--(BUSINESS WIRE)--Oct. 5, 2000--Fundtech Ltd. (NASDAQ:FNDT), a leading provider of e-payments and Internet banking solutions, today announced that its PAYplus CLS(TM) software has been selected by the National Australia Bank Limited (ASX: NAB) to facilitate settlement of foreign exchange (FX) trades in the Continuous Linked Settlement (CLS) environment. The National Australia Bank is a major Australian financial institution with subsidiary operations in the United Kingdom, Ireland, New Zealand and the United States. It ranks among the top 50 banks in the world, with assets of over AUD 322 billion. "Fundtech's PAYplus CLS provides an integrated solution which is consistent with the National's straight through processing philosophy," said Mr. Bruce Rose, General Manager, Global Wholesale Support Services, National Australia Bank. "Fundtech's PAYplus CLS will support the management of the Group's foreign exchange operations in the new CLS system." Major global financial services companies such as Bank of America, Bank of New York, Deutsche Bank, Dresdner Bank, and Commerzbank have also Fundtech Corporation 30 Montgomery Street, Suite 501, Jersey City, NJ 07302, USA ■ Tel: +1-201-946-1100 ■ Fax: +1-210-946-1313 www.fundtech.com selected Fundtech's CLS solution. Fundtech is currently contracting with several other large global banks for its PAYplus CLS solution. -

For Personal Use Only

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IPL To: Company The Secretary Name/Scheme Incitec Pivot Limited 70 Southbank Bvd Southbank VIC 3006 PH: (03) 8695 4400 Fax: (03) 8695 4419 ACN 004 080 264 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 07/10/2011 substantial holder on The previous notice was 11/10/2011 given to the company on The previous notice was 06/10/2011 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 07/10/2011 National Australia Bank Securities No consideration Ordinary Limited Lending – directly referable 2,165,000 2,165,000 Decrease to the securities provided by NAB 07/10/2011 National Australia Bank Share sale $3.03 to $3.10 Ordinary Limited 30,179 30,179 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association For personal use only No change 4.