Notice of Ceasing to Be a Substantial Holder

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notice of Ceasing to Be a Substantial Holder

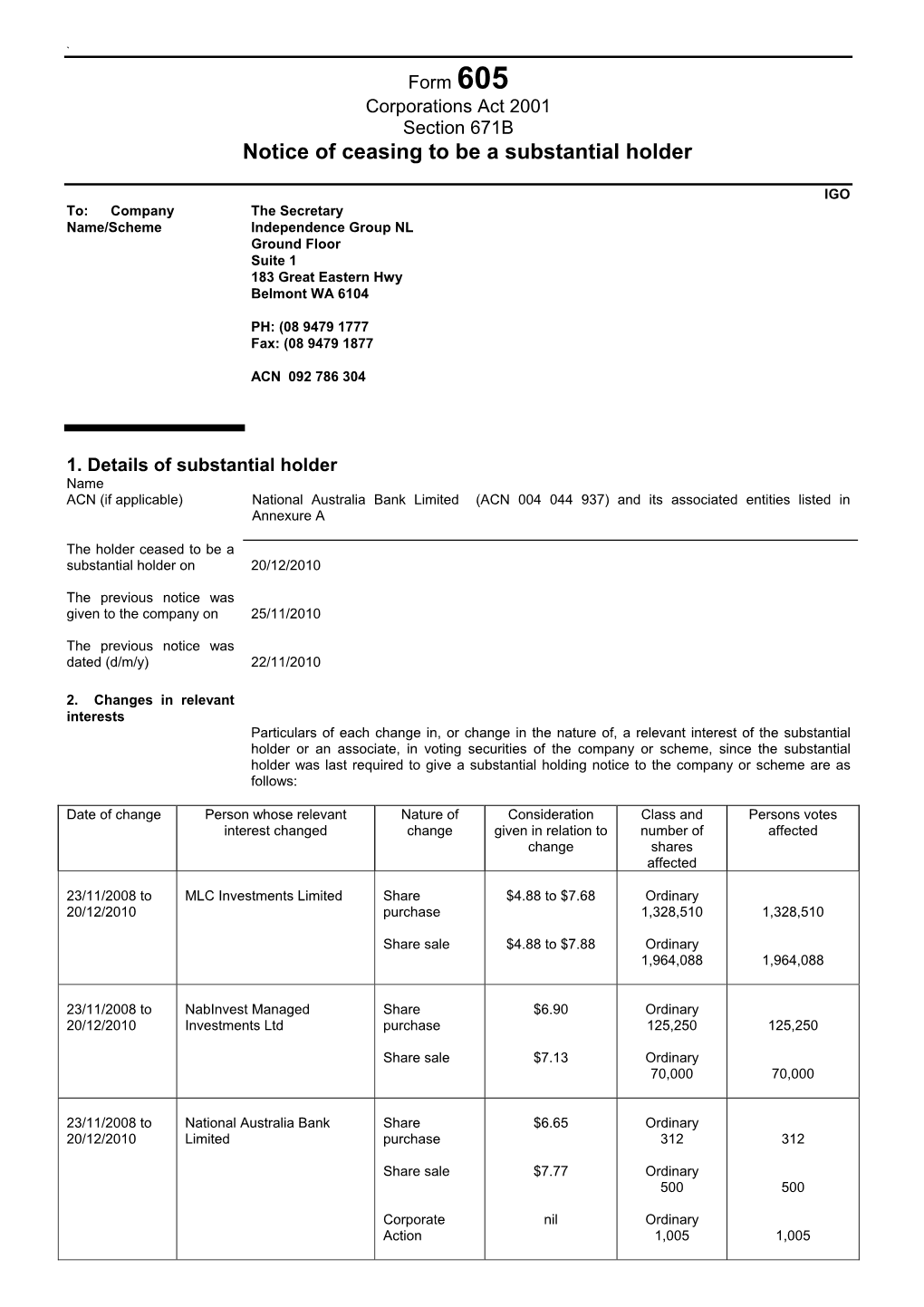

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IGO To: Company The Secretary Name/Scheme Independence Group NL Ground Floor Suite 1 183 Great Eastern Hwy Belmont WA 6104 PH: (08 9479 1777 Fax: (08 9479 1877 ACN 092 786 304 1. Details of substantial holder Name ACN (if applicable) National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in Annexure A The holder ceased to be a substantial holder on 19/11/2010 The previous notice was given to the company on 17/09/2008 The previous notice was dated (d/m/y) 15/09/2008 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 16/09/2008 to MLC Limited Share $4.20 to $6.08 Ordinary 19/11/2010 purchase 142,151 142,151 Share sale $3.63 to $7.08 Ordinary 143,078 143,078 16/09/2008 to MLC Investments Ltd Share $1.00 to $7.08 Ordinary 19/11/2010 purchase 1,255,338 1,255,338 Share sale $1.00 to $6.10 Ordinary 2,396,099 2,396,099 16/09/2008 to NabInvest Managed Share $1.56 to $6.09 Ordinary 19/11/2010 Investments Ltd purchase 329,240 329,240 Share sale $3.51 to $5.05 Ordinary 55,050 55,050 16/09/2008 -

For Personal Use Only

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder IPL To: Company The Secretary Name/Scheme Incitec Pivot Limited 70 Southbank Bvd Southbank VIC 3006 PH: (03) 8695 4400 Fax: (03) 8695 4419 ACN 004 080 264 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 07/10/2011 substantial holder on The previous notice was 11/10/2011 given to the company on The previous notice was 06/10/2011 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose relevant Nature of Consideration Class and Persons votes interest changed change given in relation to number of affected change shares affected 07/10/2011 National Australia Bank Securities No consideration Ordinary Limited Lending – directly referable 2,165,000 2,165,000 Decrease to the securities provided by NAB 07/10/2011 National Australia Bank Share sale $3.03 to $3.10 Ordinary Limited 30,179 30,179 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association For personal use only No change 4. -

For Personal Use Only Use Personal for to the Securities Provided by NAB

` Form 605 Corporations Act 2001 Section 671B Notice of ceasing to be a substantial holder MQG To: Company The Secretary Name/Scheme Macquarie Group Limited Level 7 1 Martin Place Sydney NSW 2000 Tel: (02) 8232 3333 Fax:(02) 8232 4330 ACN 122 169 279 1. Details of substantial holder Name National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in ACN (if applicable) Annexure A The holder ceased to be a 16/05/2013 substantial holder on The previous notice was 18/05/2013 given to the company on The previous notice was 15/05/2013 dated (d/m/y) 2. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate, in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of change Person whose Nature of change Consideration Class and Persons votes relevant interest given in relation to number of affected changed change shares affected 16/05/2013 MLC Investments Share purchase $45.38 Ordinary Limited 10,099 10,099 Share sale $47.05 Ordinary 3,840 3,840 16/05/2013 National Australia Securities Lending – No consideration Ordinary Bank Limited Increase directly referable 500,000 500,000 to the securities provided by NAB Securities Lending – No consideration Ordinary Decrease directly referable 22,200,000 22,200,000 For personal use only to the securities provided by NAB 16/05/2013 Antares Capital Share purchase $44.92 to $45.93 Ordinary Partners Limited 120,901 120,901 3.Changes in association The following persons who have become associates of, ceased to be associates of, or have changed the nature of their association with, the substantial holder in relation to voting interests in the company or scheme are as follows: Name and ACN (if applicable) Nature of association No change 4. -

Full Year Results

/--5 CriiVb^oObpriqp Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafu1B K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& Qefpcriivb^ovb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovÚk^iobmloq^kafpdfsbkql qeb>rpqo^if^kPb`rofqfbpBu`e^kdbIfjfqba%>PU&rkaboIfpqfkdOrib1+0>+ Results for Announcement to the Market Results for announcement to the market Report for the year ended 30 September 2008 30 September 2008 $m (1) Revenue from ordinary activities up 4.7% * to 16,257 Profit after tax from ordinary activities attributable to members of the Company down 0.9% * to 4,536 Net profit attributable to members of the Company down 0.9% * to 4,536 * On previous corresponding period (twelve months ended 30 September 2007). (1) Reported as the sum of the following items from the Group's consolidated income statement: Net interest income, Premium and related revenue, Fee income and Other income. On a cash earnings basis revenue increased by 5.8%. Franked Amount amount Dividends per share per share Final Dividend 97 cents 100% Interim dividend 97 cents 100% Record date for determining entitlements to the final dividend 13 November 2008 Highlights (2) Group cash earnings down 10.7% Cash earnings from ongoing operations of $3,916 million for the September 2008 year decreased by $470 million or 10.7% on the September 2007 year. Underlying profit increased by $996 million or 13.9%. This reflects good revenue growth stemming from the Group's market leading position in business banking in Australia, successful repricing initiatives in all regions and strong performance in nabCapital's Markets business. A disciplined approach to cost management has been maintained however, cash earnings have been reduced by a higher bad and doubtful debts charge mainly relating to Asset Backed Securities Collateralised Debt Obligations in nabCapital. -

ASX Cards Database

REPORT1 long_name asx_ref create_date remove_date C34 02/03/73 B191 ORDENN (ANTHONY) & SONS LIMITED A13 08/04/70 "TRUTH" & "SPORTSMAN" LIMITED T11 07/08/59 "TRUTH" & "SPORTSMAN" LIMITED (SYDNEY) LIMITED P51 (THE) COMMONWEALTH INSTALMENT RECEIPT TR C453 05/07/96 (THE) ENVIRONMENTAL GROUP LIMITED E131 12/10/95 (THE) NATPROPS PROPERTY TRUST N97 21/03/85 (THE) NATPROPS PROPERTY TRUST N97 30/01/80 A & I DISCOUNTERS LIMITED A180 22/05/68 A-CAP DEVELOPMENT LIMITED A50 03/10/90 A-CAP DEVELOPMENT LIMITED A50 28/06/73 A-CAP DEVELOPMENT LIMITED A50 10/01/80 A-CAP DEVELOPMENT LIMITED A50 23/12/69 A-CAP DEVELOPMENT LIMITED A242 10/01/80 A-CAP DEVELOPMENT LIMITED A242 28/06/73 A.A.R. LIMITED A34 29/01/76 A.A.R. LIMITED A34 06/08/80 A.B.E HOLDINGS LIMITED A266 27/06/84 A.O.G. MINERALS LIMITED A83 16/07/87 A.R.I. LIMITED A80 17/07/80 A.R.I. LIMITED A80 14/07/88 A.U.R. NL A101 03/10/90 A.U.R. NL A101 13/12/84 A1 CONSOLIDATED GOLD N.L. A7 22/01/75 A1 CONSOLIDATED GOLD N.L. A7 19/06/69 A1 CONSOLIDATED GOLD N.L. A7 01/01/32 AAPC LIMITED A395 08/07/93 ABACUS PACIFIC NV A345 03/05/89 Wednesday, 19 September 2001 Page 1 of 331 long_name asx_ref create_date remove_date ABACUS PACIFIC NV A345 22/10/87 ABADOR GOLD NL A151 10/06/93 ABALDYN LIMITED A311 31/07/86 ABALEEN MINERALS NL A47 11/12/69 ABALEEN MINERALS NL A47 03/11/75 ABALEEN MINERALS NL A47 06/06/85 ABALEEN MINERALS NL A47 09/04/87 ABBOT HOLDINGS LIMITED A224 17/12/87 ABBOT HOLDINGS LIMITED A224 20/11/80 ABBOTT LG HOLDINGS LIMITED A224 20/11/80 ABEL LEMON HOLDINGS LIMITED A187 05/04/78 ABERCOM LIMITED A251 -

For Personal Use Only Use Personal For

5 May 2016 Euro Medium Term Note Programme - Offering Circular 5 May 2016 Attached is a copy of Lendlease’s Euro Medium Term Note Programme - Offering Circular. The Offering Circular was listed with the Singapore Exchange (SGX) late yesterday. The establishment of the Euro Medium Term Note Programme forms part of Lendlease’s routine capital markets activities, permitting the issuance of debt in a variety of capital markets and currencies. ENDS FOR FURTHER INFORMATION, PLEASE CONTACT: Investors: Media: Suzanne Evans Nadeena Whitby Tel: 02 9236 6464 Tel: 02 9236 6865 Mob: 0407 165 254 Mob: 0467 773 032 For personal use only Lendlease Corporation Limited ABN 32 000 226 228 and Lendlease Responsible Entity Limited ABN 72 122 883 185 AFS Licence 308983 As responsible entity for Lendlease Trust ABN 39 944 184 773 ARSN 128 052 595 Level 4, 30 The Bond Telephone +61 2 9236 6111 30 Hickson Road, Millers Point Facsimile +61 2 9252 2192 NSW 2000 Australia lendlease.com IMPORTANT NOTICE NOT FOR DISTRIBUTION TO ANY U.S. PERSON OR ANY PERSON OR ADDRESS IN THE UNITED STATES IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached Offering Circular. You are therefore advised to read this disclaimer carefully before reading, accessing or making any other use of the attached Offering Circular. In accessing the attached Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. -

For Personal Use Only Use Personal For

TRR[ CRIIVB>O OBPRIQP Fk`lomlo^qfkdqebobnrfobjbkqplc>mmbkafuV´ For personal use only Qefpcriivb^oobpriqp^kklrk`bjbkqfk`lomlo^qbpqebmobifjfk^ovcfk^iobmloqdfsbk qlqeb>rpqo^if^kPb`rofqfbpBu`e^kdb%>PU&rkaboIfpqfkdOribVU° K^qflk^i>rpqo^if^?^khIfjfqba>?K./--1-11604%qebÐ@ljm^kvÑ& For personal use only Full Year Results Results for Announcement to the Market 2009 Results for announcement to the market Report for the year ended 30 September 2009 30 September 2009 $m Revenue from ordinary activities (1) up 8.9% * to 17,705 Profit after tax from ordinary activities attributable to members of the Company (2) down 42.9% * to 2,589 Net profit attributable to members of the Company (2) down 42.9% * to 2,589 * On previous corresponding period (year ended 30 September 2008). (1) Reported as the sum of the following items from the Group’s consolidated income statement: Net interest income, Premium and life related revenue, Fee income and Total other income. On a cash earnings basis revenue increased by 9.7%. (2) Net profit attributable to members of the company was down 42.9% to $2,589 million, largely due to developments in several long standing and previously announced legal and tax proceedings, accounting volatility from fair value movements and expenses of the Efficiency, Quality and Service program. Franked Amount per amount per share share Dividends cents % Final dividend 73 100 Interim dividend 73 100 Record date for determining entitlements to the final dividend 19 November 2009 Highlights (3) Group cash earnings down 1.9% Cash earnings from ongoing operations of $3,841 million for the September 2009 year decreased by $75 million or 1.9% on the September 2008 year. -

Corporations Law Form

Form 603 Corporations Law Notice of initial substantial holder Section 671B RRA To:Company Name/Scheme The Secretary RR Australia Limited Level 1 47 Rickard Road BANKSTOWN NSW 32200 Fax: (02) 9101 9035 ACN/ARSN ACN 072 507 147 1. Details of substantial shareholder Name National Australia Bank Limited (ACN 004 044 937) being comprised of the bodies corporate ACN (if applicable) listed in Annexure A and which includes Elly Investments Pty Ltd ACN 098 198 004 (Elly Investments Pty Ltd acquired more than 20% of the voting power in Pengana Holdings Pty Limited (PHPL) on 30 April 2008. Pengana Capital Limited is a wholly owned subsidiary of PHPL) The holder became a substantial holder on 02/05/2008 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of Persons’ votes Voting power securities Ordinary 9,607,900 9,607,900 7.507% 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities Elly Investments Pty Ltd Having voting power in Ordinary Pengana Capital Limited that 9,607,900 is above 20% TOTAL 9,607,900 4. -

2007 Annual Financial Report INFORMATION ABOUT THIS PAGE: Image Placement and Crop Is First Draft Only

2007 Annual Financial Report Report Financial Annual 2007 2007 annual financial report INFORMATION ABOUT THIS PAGE: Image placement and crop is first draft only. National Australia Bank Limited ABN 12 004 044 937 This 2007 annual financial report is lodged with the Australian Securities and Investments Commission and Australian Securities Exchange. National Australia Bank Limited (NAB) is publicly listed in Australia and overseas and, as such, must meet regulatory requirements of all jurisdictions it operates in internationally. This report contains information prepared on the basis of the Corporations Act 2001 (Cth) and Australian equivalents to International Financial Reporting Standards. The Group deregistered from the United States Securities and Exchange Commission (SEC) effective September 20, 2007. Accordingly, all SEC related disclosures have been removed from this financial report for both the current and comparative financial years. NAB is no longer obliged to produce a concise version of this report, and this year introduced a non statutory shareholder review. The shareholder review comprises information from the annual financial report and the Company’s 2007 profit disclosures. To view the annual financial report online, visit www.nabgroup.com. Alternatively, to arrange for a copy to be sent to you free of charge, call Shareholder Services on 1300 367 647 from within Australia, or +61 3 9415 4299 from outside Australia. Nothing in this report is, or should be taken as, an offer of securities in NAB for issue or sale, or an invitation to apply for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. -

The Rise of Intellectual Capital As an Essential Business Asset

A $81.6 BILLION IN FUNDS UNDER MANAGEMENT REPORT TO SHAREHOLDERS 2000 New look real estate services˜ integrated & global. The rise of intellectual capital as an essential business asset. Powerful plan. Powerful future. Lend Lease An Integrated Real Estate Group 6 Financial Highlights A quick view of the year’s results. THEATRE,LOWRY SALFORD 8 Chairman’s Report The importance of our core values to our future. http://www.lendlease.com 14 Chief Executive’s 38 eCommerce 40 Intellectual Capital Report A global market place with Knowledge, people, culture – new dynamics transforming The value that can be created Lend Lease is its people. our business. through the integrated real estate platform. feature stories... 44 Stuart Hornery Daring to be different creates 2 Integrated & Global a reputation for success. Benefits Everybody We can offer a portfolio of real 46 The Hornery Institute estate services that cross traditional business lines. The next chapter of the Lend Lease philosophy of caring and sharing. 48 Board of Directors Our Directors comment on the challenges of change. 50 Community Day Our employees tell of how we can personally make 13 Jill Ker Conway a difference. Our Story, Our Future. Introducing our Chairman Elect. 51 Corporate Governance Our governance must reflect that we are now a global company. 57 Concise Financial Report 2000 18 Areas of Operation Results, management REAL ESTATE INVESTMENT discussion and analysis & FUNDS MANAGEMENT and Directors’ Report. Directing global capital flows. BOVIS LEND LEASE “Guidance and services for businesses A strategic partner that delivers. PROPERTY DEVELOPMENT investing in or managing global Building communities. -

Corporations Law Form

Form 603 Corporations Act 2001 Notice of initial substantial holder Section 671B VOC To:Company Name/Scheme The Secretary Vocus Communications Limited Level 1 189 Miller Street North Sydney NSW 2060 Ph: (02) 8999 8999 Fax: (02) 9959 4348 ACN 084 115 499 1. Details of substantial National Australia Bank Limited (ACN 004 044 937) and its associated entities listed in shareholder Annexure A Name & ACN (if applicable) The holder became a substantial holder on 09/01/2015 2. Details of voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate had a relevant interest in on the date the substantial holder became a substantial holder are as follows: Class of securities Number of securities Persons’ votes Voting power Fully paid ordinary 5,295,653 5,295,653 5.025% shares 3. Details of relevant interests The nature of the relevant interest the substantial holder or an associate had in the following voting securities on the date the substantial holder became a substantial holder are as follows: Holder of relevant interest Nature of relevant interest Class and number of securities MLC Investments Limited Power to control the voting and /or disposal Fully paid ordinary of securities pursuant to its position as the shares responsible entity or trustee of various 852,094 managed investment schemes and trusts. NabInvest Managed Power to control the voting and /or disposal Fully paid ordinary Investments Limited of securities pursuant to its position as the shares responsible entity or trustee of certain 1,435,747 managed investment schemes or trusts (NAB ICS and SPF investments). -

NAB Full Financials

Annual Financial Report 2004 Annual Financial Report Annual Financial Report 2004 the Year the Facts www.nabgroup.com the Future Cover+spineFullFinance2004 2 1/12/04, 5:12:56 PM National Australia Bank Limited ABN 12 004 044 937 This annual financial report 2004 is lodged with the Australian Securities and Investments Commission and Australian Stock Exchange Limited. Nothing in this annual financial report 2004 is, or should be taken as, an offer of securities in National Australia Bank Limited for issue or sale, or an invitation to apply for the issue or for the purchase of such securities. All figures in this document are in Australian dollars unless otherwise stated. inside_Cover_FullFinance2004 2 1/12/04, 5:15:24 PM Table of contents Presentation of information 2 Notes to the financial statements 103 Financial summary 3 1 Principal accounting policies 103 Selected financial data 4 2 Transition to Australian equivalents to International Business overview 9 Financial Reporting Standards 112 Introduction 9 3 Segment information 114 Strategy 9 4 Revenue from ordinary activities 117 Business operating model 9 5 Profit from ordinary activities before income tax expense 118 Changes to the business operating model 9 6 Income tax expense 121 Introduction to Financial Services 10 7 Dividends and distributions 122 Financial Services Australia 10 8 Earnings per share 123 Financial Services Europe 11 9 Cash and liquid assets 124 Financial Services New Zealand 12 10 Due from other financial institutions 124 Corporate & Institutional Banking 12