Directors' Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Wise EC Issued

District wise Environmental Clearances Issued for various Development Projects Agra Sl No. Name of Applicant Project Title Category Date 1 Rancy Construction (P) Ltd.S-19. Ist Floor, Complex "The Banzara Mall" at Plot No. 21/263, at Jeoni Mandi, Agra. Building Construction/Area 24-09-2008 Panchsheel Park, New Delhi-110017 Development 2 G.M. (Project) M/s SINCERE DEVELOPERS (P) LTD., SINCERE DEVELOPERS (P) LTD (Hotel Project) Shilp Gram, Tajganj Road, AGRA Building Construction/Area 18-12-2008 Block - 53/4, UPee Tower IIIrd Floor, Sanjav Place, Development AGRA 3 Mr. S.N. Raja, Project Coordinator, M/s GANGETIC Large Scale Shopping, Entertainment and Hotel Unit at G-1, Taj Nagari Phase-II, Basai, Building Construction/Area 19-03-2009 Developers Pvt. Ltd. C-11, Panchsheel Enclve, IIIrd Agra Development Floor, New Delhi 4 M/s Ansal Properties and Infrastructure Ltd 115, E.C. For Integrated Township, Agra Building Construction/Area 07-10-2009 Ansal Bhawan, 16, K.G. Marg, New Delhi-110001 Development 5 Chief Engineer, U.P.P.W.D., Agra Zone, Agra. “Strengthening and widening road to 6 Lane from kheria Airport via Idgah Crosing, Taj Infrastructure 11-09-2008 Mahal in Agra City.” 6 Mr. R.K. Gaud, Technical Advisor, Construction & Solid Waste Management Scheme in Agra City. Infrastructure 02-09-2008 Design Services, U.P. Jal Nigam, 2 Lal Bahadur Shastri Marg, Lucknow-226001 7 Agra Development Authority, Authority Office ADA Height, Agra Phase II Fatehbad Road, AGRA Building Construction/Area 29-12-2008 Jaipur House AGRA. Development 8 M/s Nikhil Indus Infrastructure Ltd., Mr. -

Proquest Dissertations

Daoxuan's vision of Jetavana: Imagining a utopian monastery in early Tang Item Type text; Dissertation-Reproduction (electronic) Authors Tan, Ai-Choo Zhi-Hui Publisher The University of Arizona. Rights Copyright © is held by the author. Digital access to this material is made possible by the University Libraries, University of Arizona. Further transmission, reproduction or presentation (such as public display or performance) of protected items is prohibited except with permission of the author. Download date 25/09/2021 09:09:41 Link to Item http://hdl.handle.net/10150/280212 INFORMATION TO USERS This manuscript has been reproduced from the microfilm master. UMI films the text directly from the original or copy submitted. Thus, some thesis and dissertation copies are In typewriter face, while others may be from any type of connputer printer. The quality of this reproduction is dependent upon the quality of the copy submitted. Broken or indistinct print, colored or poor quality illustrations and photographs, print bleedthrough, substandard margins, and improper alignment can adversely affect reproduction. In the unlikely event that the author did not send UMI a complete manuscript and there are missing pages, these will be noted. Also, if unauthorized copyright material had to be removed, a note will indicate the deletion. Oversize materials (e.g., maps, drawings, charts) are reproduced by sectioning the original, beginning at the upper left-hand comer and continuing from left to right in equal sections with small overiaps. ProQuest Information and Learning 300 North Zeeb Road, Ann Arbor, Ml 48106-1346 USA 800-521-0600 DAOXUAN'S VISION OF JETAVANA: IMAGINING A UTOPIAN MONASTERY IN EARLY TANG by Zhihui Tan Copyright © Zhihui Tan 2002 A Dissertation Submitted to the Faculty of the DEPARTMENT OF EAST ASIAN STUDIES In Partial Fulfillment of the Requirements For the Degree of DOCTOR OF PHILOSOPHY In the Graduate College THE UNIVERSITY OF ARIZONA 2002 UMI Number: 3073263 Copyright 2002 by Tan, Zhihui Ai-Choo All rights reserved. -

Indian Tourist Sites – in the Footsteps of the Buddha

INDIAN TOURIST SITES – IN THE FOOTSTEPS OF THE BUDDHA Adarsh Batra* Abstract The Chinese pilgrims Fa Hien and Hsuan Chwang). Across the world and throughout the ages, religious people have made The practice of pilgrimages. The Buddha Buddhism flourished long in himself exhorted his followers to India, perhaps reaching a zenith in visit what are now known as the the seventh century AD. After this great places of pilgrimage: it began to decline because of the Lumbini, Bodhgaya, Sarnath, invading Muslim armies, and by the Rajgir, Nalanda and twelfth century the practice of the Kushinagar. The actions of the Dharma had become sparse in its Buddha in each of these places are homeland. Thus, the history of described within the canons of the the Buddhist places of pilgrimage scriptures of the various traditions of from the thirteenth to the mid- his teaching, such as the sections on nineteenth centuries is obscure Vinaya, and also in various and they were mostly forgotten. compendia describing his life. The However, it is remarkable that sites themselves have now been they all remained virtually undis- identified once more with the aid turbed by the conflicts and develop- of records left by three pilgrims of ments of society during that period. the past (The great Emperor Ashoka, Subject only to the decay of time *The author has a Ph.D. in Tourism from Kurukshetra University, Kurukshetra (K.U.K.), India. He has published extensively in Tourism and Travel Magazines. Currently he is a lecturer in MA- TRM program in the Graduate School of Business of Assumption University of Thailand. -

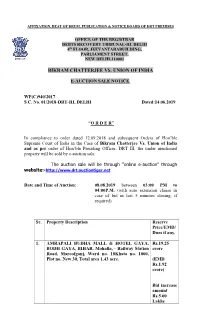

Bikram Chatterjee Vs. Union of India

AFFIXATION, BEAT OF DRUM, PUBLICATION & NOTICE BOARD OF DRT PREMISES OFFICE OF THE REGISTRAR DEBTS RECOVERY TRIBUNAL-III, DELHI 4th FLOOR, JEEVANTARABUILDING, PARLIAMENT STREET, NEW DELHI-110001 BIKRAM CHATTERJEE VS. UNION OF INDIA E-AUCTION SALE NOTICE. WP(C)940/2017 S.C. No. 01/2018-DRT-III, DELHI Dated:14.06.2019 “O R D E R” In compliance to order dated 12.09.2018 and subsequent Orders of Hon’ble Supreme Court of India in the Case of Bikram Chatterjee Vs. Union of India and as per order of Hon’ble Presiding Officer, DRT III, the under mentioned property will be sold by e-auction sale. The auction sale will be through “online e-auction” through website:-http://www.drt.auctiontiger.net Date and Time of Auction: 08.08.2019 between 03:00 PM to 04:00P.M. (with auto extension clause in case of bid in last 5 minutes closing, if required). Sr. Property Description Reserve Price/EMD/ Dues if any. 1. AMRAPALI BUDHA MALL & HOTEL GAYA, Rs.19.25 BODH GAYA, BIHAR, Mohalla, - Railway Station crore Road, Maroofganj, Ward no. 18Khata no. 1000, Plot no. New 30, Total area 1.43 acre. (EMD Rs.1.92 crore) Bid increase amount Rs.5.00 Lakhs 2. AMRAPALI JAIPUR PROPERTIES: Rs.18 Crore 1) Hitech City-II- 14 Plots Nos. EMD Rs.1.8 162(452.86 sq.yds),168(300 Sq.yds), Crore 258(407.78 sq.yds) ,6(402.78 sq.yds) , 10(565.97sq.yds.),11(606.25 sq.yds.), 12(646.53 Sq.yds.,13(686.81sq.yds.), Bid increase 14(1123.11sq.yds.,15(609.72 sq.yds.), amount 16(509.38 sq.yds.) ,17(455 sq.yds.), Rs.5.00 18(400.63 sq.yds.),19(424.31 sq.yds. -

Download a PDF Copy of the Guide to Jodo Shinshu Teachings And

Adapted from: Renken Tokuhon Study Group Text for Followers of Shinran Shonin By: Kyojo S. Ikuta Guide & Trudy Gahlinger to June 2008 Jodo Shinshu Teachings and Practices INTRODUCTION This Guide to Jodo Shinshu Teachings and Practices is a translation of the Renken Tokuhon Study Group Text for Followers of Shinran Shonin. TheGuide has been translated from the original version in Japanese and adapted for Jodo Shinshu Temples in North America. TheGuide has been developed as an introduction to Jodo Shinshu for the layperson. It is presented in 2 parts. Part One describes the life and teachings of the Buddha, and the history and evolution of Jodo Shinshu teachings. Part Two discusses Jodo Shinshu practices, including Jodo Shinshu religious days and services. The Calgary Buddhist Temple gratefully acknowledges the Renken Tokuhon Study Group for providing the original text, and our mother Temple in Kyoto - the Jodo Shinshu Hongwanji-ha - for supporting our efforts. It is our hope that this Guide will provide a basic foundation for understanding Jodo Shinshu, and a path for embracing the life of a nembutsu follower. Guide to Jodo Shinshu Teachings and Practices Table of Contents PART ONE: JODO SHINSHU TEACHINGS 1 THE LIFE OF THE BUDDHA . 2 1.1 Birth of the Buddha . 2 1.2 Renunciation . 2 1.3 Practice and Enlightenment . 2 1.4 First Sermon . 2 1.5 Propagation of the Teachings and the Sangha . 3 1.6 The Buddha’s Parinirvana . 3 1.7 The First Council . 4 2 SHAKYAMUNI’S TEACHINGS. 5 2.1 Dependent Origination (Pratitya-Samutpada) . 5 2.2 The Four Marks of Dharma. -

The Monetary Economy in Buddha Period (Based on the Comparative Analysis of Literary and Archaeological Sources)

IOSR Journal Of Humanities And Social Science (IOSR-JHSS) Volume 7, Issue 6 (Jan. - Feb. 2013), PP 15-18 e-ISSN: 2279-0837, p-ISSN: 2279-0845. www.Iosrjournals.Org The Monetary Economy in Buddha Period (Based On the Comparative Analysis of Literary and Archaeological Sources) 1Dr. Anuradha Singh, 2 Dr. Abhay Kumar 1Assistant Professor, Department of History, Faculty of Social Sciences, Banaras Hindu University, Varanasi-221005, U.P., India. 2Assistant Professor Department of History,School of Social Sciences, Guru Ghasidas Central University Bilaspur-495009, C.G., India. Archaeology reveals that the sixth BC era was the time of secondary civilization. Many cities as Shravasti, Saket, Ayodhya, Champa, Rajgriha, Kosambi and Varanasi described in Pali literature is indicative of materialistic prosperity and rich town culture. These northeastern towns of India are connected by highways to Takkasila in north, Pratishtha in south, Mrigukachha in west, Tamralipti in east and of central Kanyakubza, Ujjayini, Mathura, Sankashya and many others places. These cities were inhabited by northern black glittering earthen-pot culture. Peoples of this culture widely use iron make weapons and stricken coins. These materialistic and archaeological relics exhibit their economic strength. Artisans and businessmen were doing trading by forming union in cities. We came to know the eighteen categories of artisans. Contribution of stricken coins was very important in trading and buying-selling by these categories. By the circulation of stricken coins, trading was promoted significantly and trading becomes simplified. Various proofs of currency circulation is found in Pali scriptures and it also came to knowledge that the payments of salaries and buying was made by coins. -

DECLINE and FALL of BUDDHISM (A Tragedy in Ancient India) Author's Preface

1 | DECLINE AND FALL OF BUDDHISM (A tragedy in Ancient India) Author's Preface DECLINE AND FALL OF BUDDHISM (A tragedy in Ancient India) Dr. K. Jamanadas 2 | DECLINE AND FALL OF BUDDHISM (A tragedy in Ancient India) Author's Preface “In every country there are two catogories of peoples one ‘EXPLOITER’ who is winner hence rule that country and other one are ‘EXPLOITED’ or defeated oppressed commoners.If you want to know true history of any country then listen to oppressed commoners. In most of cases they just know only what exploiter wants to listen from them, but there always remains some philosophers, historians and leaders among them who know true history.They do not tell edited version of history like Exploiters because they have nothing to gain from those Editions.”…. SAMAYBUDDHA DECLINE AND FALL OF BUDDHISM (A tragedy in Ancient India) By Dr. K. Jamanadas e- Publish by SAMAYBUDDHA MISHAN, Delhi DECLINE AND FALL OF BUDDHISM A tragedy in Ancient India By Dr. K. Jamanadas Published by BLUEMOON BOOKS S 201, Essel Mansion, 2286 87, Arya Samaj Road, Karol Baug, New Delhi 110 005 Rs. 400/ 3 | DECLINE AND FALL OF BUDDHISM (A tragedy in Ancient India) Author's Preface Table of Contents 00 Author's Preface 01 Introduction: Various aspects of decline of Buddhism and its ultimate fall, are discussed in details, specially the Effects rather than Causes, from the "massical" view rather than "classical" view. 02 Techniques: of brahminic control of masses to impose Brahminism over the Buddhist masses. 03 Foreign Invasions: How decline of Buddhism caused the various foreign Invasions is explained right from Alexander to Md. -

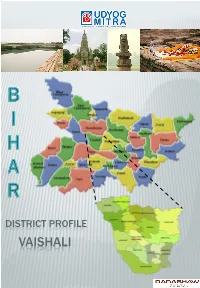

Vaishali Introduction

DISTRICT PROFILE VAISHALI INTRODUCTION Vaishali district is one of the thirty-eight districts of the state of Bihar. It formed in 1972, separated from Muzaffarpur district. The district is surrounded by Muzaffarpur district in the North, Samastipur district in the East and Ganga River in South and Gandak River in West. The Vaishali district is a part of Tirhut division and the district headquarters are at Hajipur town. Hajipur is separated from the State’s biggest city Patna by a River Ganga. It is the second fastest growing city in the state. HISTORICAL BACKGROUND Vaishali got its name from King Vishal, a predecessor to Lord Ram. Vaishali finds reference in the Indian epics Ramayana. Vaishali was the capital of the Lichchavi State, considered as the First Republic in the World. It is said that the Lord Buddha, delivered his last semon and announced his Mahaparinirvana during his visit to Vaishali. 100 years after the Lord Buddha attained Mahaparinirvana, second Buddhist Council was held at Vaishali. Jain Tirthankar Lord Mahavir was said to be born at Vaishali to King Siddhartha and Queen Trishala. Amrapali the famous courtesan, has invited Lord Buddha to her house and Lord has visited her place. With Lord Buddha’s visit, Amrapali was purged with all impurities, she gifted her mango grove to the Sangh and joined Buddhism. Ananda, the favorite disciple of Buddha, attained Nirvana in the midst of Ganga outside Vaishali. ADMINISTRATIVE Hajipur City is the district headquarters. Vaishali district spread across 3 talukas: Mahnar, Hajipur, Mahua Vaishali district has been divided into 16 Municipal Blocks: o Mahnar o Hajipur o Chehrakala o Vaishali o Mahua o Premraj o Bidupur o Jandaha o Patedhi-Belshar o Goraul o Patepur o Desri o Raghopur o Sahadi buzurg o Lalganj o Bahgwanpur Total Number of Panchayats in Vaishali district 291. -

Dbet Alpha PDF Version © 2017 All Rights Reserved

A BIOGRAPHY OF THE TRIPITAKA MASTER OF THE GREAT CFEN MONASTERY OF THE GREAT TANG DYNASTY dBET Alpha PDF Version © 2017 All Rights Reserved BDK English Tripitaka 77 A BIOGRAPHY OF THE TRIPITAKA MASTER OF THE GREAT CFEN MONASTERY OF THE GREAT TANG DYNASTY Translated from the Chinese of Sramana Huili and Shi Yancong (Taisho, Volume 50, Number 2053) by Li Rongxi Numata Center for Buddhist Translation and Research 1995 © 1995 by Bukkyo Dendo Kyokai and Numata Center for Buddhist Translation and Research All rights reserved. No part of this book may be reproduced, stored in a retrieval system, or transcribed in any form or by any means— electronic, mechanical, photocopying, recording, or otherwise— without the prior written permission of the publisher. First Printing, 1995 ISBN: 1-886439-00-1 Library of Congress Catalog Card Number: 94-073928 Published by Numata Center for Buddhist Translation and Research 2620 Warring Street Berkeley, California 94704 Printed in the United States of America A Message on the Publication of the English Tripitaka The Buddhist canon is said to contain eighty-four thousand different teachings. I believe that this is because the Buddha’s basic approach was to prescribe a different treatment for every spiritual ailment, much as a doctor prescribes a different medicine for every medical ailment. Thus his teachings were always appro priate for the particular suffering individual and for the time at which the teaching was given, and over the ages not one of his prescriptions has failed to relieve the suffering to which it was addressed. Ever since the Buddha’s Great Demise over twenty-five hundred years ago, his message of wisdom and compassion has spread throughout the world. -

The Lecture Notes of Chapter One of the Vimalakirti Sutra by Khenpo Sodargye’S Translation Team

http://khenposodargye.org/ The Lecture Notes of Chapter One of the Vimalakirti Sutra by Khenpo Sodargye’s translation team Lecture 1 .................................................................................................................................. - 3 - A Few Words before the Teaching ........................................................................................... - 3 - Which Version Are We Going to Use ....................................................................................... - 4 - What Benefits Will the Teaching Bring to You? ....................................................................... - 5 - Khenpo’s Expectations for Those Who Follow the Teaching .................................................. - 7 - Lecture 2 .................................................................................................................................. - 9 - What You Need to Do Before and After the Teaching ............................................................ - 9 - Who is Vimalakirti? ................................................................................................................ - 12 - Who is Kumarajiva? ............................................................................................................... - 15 - When & Where the Teaching Takes Place? .......................................................................... - 19 - Lecture 3 .............................................................................................................................. -

To Download Order

1 IN THE SUPREME COURT OF INDIA CIVIL ORIGINAL JURISDICTION I.A.NOS. 49238 OF 2020, 49239 OF 2020, I.A.NO.29350 OF 2020, I.A.NOS. 166987 OF 2019, I.A.NO. 29699 OF 2020, I.A.NOS.155624 OF 2019, I.A.NO.141062 OF 2019 AND I.A.NO.49139 OF 2020 IN WRIT PETITION [C] NO.940 OF 2017 BIKRAM CHATTERJI & ORS. … PETITIONERS VERSUS UNION OF INDIA & ORS. … RESPONDENTS O R D E R In Re I.A.No.49238 of 2020 seeking directions filed by NBCC (I) Ltd. 1. By way of I.A. No.49238 of 2020, NBCC has submitted that it has established the work on the following conditions: i. “NBCC will not be held responsible for any existing disputes involving and in relation to the Projects; ii. NBCC will not be held responsible for any disputes arising from the contracts entered into by Amrapali in relation to the Projects; iii. NBCC will not be held responsible for any past or present liabilities in relation to the Projects, including on account of dues of homebuyers, vendors, contractors, government authorities, etc.; iv. NBCC will not be liable in relation to any disputes, including before any Court or Arbitrator, existing or arising at a later date, with the existing vendors, contractors, co-developers, landowners, home- buyers, banks, financial institutions, other lenders 2 and creditors and any government authority.” 2. As NBCC is appointed as a Project Management Consultant to complete various projects, it was permitted to float the tenders and prepare DPRs. It is submitted that NBCC has completed two projects and floated tenders for other projects, barring three projects. -

Religious Movement – Jainism & Buddhism JAINISM

RELIGIOUS MOVEMENT Religious Movement – Jainism & Buddhism • The 6th Century B.C. was a period of great religious upheaval (uncertainty). • In India Mahavira, who founded Jainism and Gautam Buddha, who gave birth to Buddhism infused a new life into the old and shattered society. • They protested against ritualistic form of religion, brutality of caste and dominance of brahmanas. They advocated social equality, justice and freedom for both men and women. • They rejected the Vedas and vedic rituals, denounced sacrifices and propagated the doctrine of non-violence. • They were motivated by the philosophy of the Upanishads. Their ideas about Karma, Soul, Rebirth, Moksha and Ahimsa were inspired by Upanishads. Causes Of New Movements The condition of the then society favoured the rise and growth of Jainism and Buddhism. A few of these causes were: 1. The Vedic philosophy had lost its original purity and in 6th Cen B.C. Rituals had become more complex, ceremonies were painful and awfully expensive. 2. The caste system had become rigid and brutal (cruel/inhuman); there were strict restriction on food, drinks and marriage. Interchange of caste was impossible.Jainism and Buddism offered people of low caste an honoured place. 3. The supremacy of brahmanas created unrest. 4. All the religious treatises (texts/thesis/articles/papers/essays) were written in Sanskrit which was the language of elite class and not the masses. Both the religion have used common language of the people i.e. Pali and Prakrit. JAINISM Important Literature: • Aacharanga Sutra – Rules and regulations related with Jaina monks. • Bhagawati Sutra –Biography of Mahavira Swami • Kalpa Sutra –Biography of 23 Tirthankaras (Prophets or Gurus) • Nyayadhamma Katha – Teachings of Lord Mahavira Important Tirthankaras: Rishabhadeva / Adinatha – He was first Tirthankara and mentioned in Rigveda.In Dilwara Jain temple (Mt.