Ctc Md&A Q4 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadian Tire Corporation Announces Agreement to Acquire Helly Hansen

Canadian Tire Corporation Announces Agreement to Acquire Helly Hansen • Adds a global brand and a leader in sportswear and workwear that professionals use and trust • Supports CTC’s vision of becoming the #1 Retail Brand in Canada • Strengthens CTC’s core outdoor and workwear businesses across multiple retail banners • Accelerates CTC’s ability to distribute current and future owned brands internationally • Immediately accretive to CTC with strong revenue and EBITDA growth trajectory TORONTO, May 10, 2018 – Canadian Tire Corporation, Limited (TSX:CTC, TSX:CTC.A) (CTC) announced today that it has entered into an agreement to purchase the company, controlled by the Ontario Teachers’ Pension Plan, which owns and operates the Helly Hansen brands and related businesses. Helly Hansen is a leading global brand in sportswear and workwear based in Oslo, Norway. Founded in 1877, Helly Hansen is known for its professional grade gear and for being a leader in designing innovative and high quality technical performance products developed for the harshest outdoor conditions. Within its core categories of sailing, skiing, mountain, urban, rainwear and workwear, Helly Hansen designs and delivers products used by professionals and outdoor enthusiasts around the world. With wholesale and retail distribution capabilities across more than 40 countries, Helly Hansen is a trusted and celebrated brand worldwide. Outdoor and workwear categories are core to CTC’s retail banners and, through Mark’s and FGL, the Company has had a long history with Helly Hansen as one of its largest customers. This acquisition strengthens CTC’s core businesses across multiple banners, increases its brand offerings in Canada and its ability to grow its brands internationally. -

Annual Information Form Canadian Tire Corporation, Limited Table of Contents

CANADIAN TIRE CORPORATION, LIMITED 2012 Annual Information Form February 21, 2013 ANNUAL INFORMATION FORM CANADIAN TIRE CORPORATION, LIMITED TABLE OF CONTENTS 1. Corporate Structure 1 2. Description of the Business 1 2.1 Retail Business 2 2.2 Financial Services Business 10 2.3 Seasonality of the Business 11 2.4 Intangible Properties 12 2.5 Economic Dependence 12 2.6 Lending 13 2.7 Financing of the Business 13 2.8 Risk Factors 13 2.9 Employees 15 2.10 Social and Environmental Policies 15 3. General Development of the Business 16 3.1 Retail Business Developments 16 3.2 Financial Services Business Developments 21 3.3 Other Business Developments 21 4. Capital Structure 23 4.1 Description of Capital Structure 23 4.2 Market for Securities 24 5. Dividends 25 6. Security Ratings 26 7. Transfer Agents and Registrars 27 8. Directors and Officers 27 9. Interests of Experts 32 10. Legal Proceedings and Regulatory Actions 32 11. Additional Information 33 ANNEX A – Audit Committee Mandate and Charter i Certain brands mentioned in this report are the trade-marks of Canadian Tire Corporation, Limited, Mark’s Work Wearhouse Ltd., FGL Sports Ltd. or used under license. Others are the property of their respective owners. CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION This Annual Information Form, and the documents incorporated by reference herein, contain forward-looking information that reflects management’s current expectations related to matters such as future financial performance and operating results of the Company. Forward-looking statements are provided for the purposes of providing information about management’s current expectations and plans and allowing investors and others to get a better understanding of our financial position, results of operation and operating environment. -

Q3-2018-IR-Factsheet FINAL.Pdf

INVESTOR FACT SHEET CANADIAN TIRE CORPORATION, LIMITED Canadian Tire Corporation (CTC) offers products and CTC has an 85.5% effective The vast majority of _______ services that prepare Canadians for the Jobs and Joys interest in CT REIT, an Canadians reside within of Life in Canada through a network of approximately unincorporated, closed- 15 minutes of a 1,700 retail outlets and gas bars and a range of end real estate investment Canadian Tire store. financial service products. trust, which is comprised of On July 3, 2018, CTC The Company’s retail business results are delivered over 325 properties totalling acquired Helly Hansen, through the Company’s retail banners, including: approximately 26 million a leading global brand in Canadian Tire, FGL (Sport Chek, Sports Experts, square feet of gross sportswear and workwear Atmosphere), Mark’s, Helly Hansen, PartSource and leasable area. based in Oslo, Norway. Gas+. Q3 COMPARABLE Q3 DILUTED EPS Q3 RETAIL ROIC1,2 SALES GROWTH 2.5% CANADIAN TIRE 2.2% $3.15 8.94% FGL 2.2% +21.7% MARK’S 6.1% OUR THREE-YEAR FINANCIAL ASPIRATIONS (2018 – 2020)4 3%+ 10%+ 10%+ CONSOLIDATED COMPARABLE CONSOLIDATED AVERAGE ANNUAL DILUTED RETAIL RETURN ON INVESTED CAPITAL4 SALES GROWTH4 EPS GROWTH4 2018 STRATEGIC FOCUS AREAS Brand & Customer Financial Product Talent Platforms Experience Discipline Portfolio WE PREPARE CANADIANS FOR THE JOBS AND JOYS OF LIFE IN CANADA 1 Figures are calculated on a rolling 12-month basis. 2 Refer to Section 8.3.1 of the Q3 2018 MD&A for additional information on the Company’s key operating performance measures. -

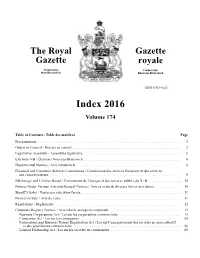

The Royal Gazette Index 2016

The Royal Gazette Gazette royale Fredericton Fredericton New Brunswick Nouveau-Brunswick ISSN 0703-8623 Index 2016 Volume 174 Table of Contents / Table des matières Page Proclamations . 2 Orders in Council / Décrets en conseil . 2 Legislative Assembly / Assemblée législative. 6 Elections NB / Élections Nouveau-Brunswick . 6 Departmental Notices / Avis ministériels. 6 Financial and Consumer Services Commission / Commission des services financiers et des services aux consommateurs . 9 NB Energy and Utilities Board / Commission de l’énergie et des services publics du N.-B. 10 Notices Under Various Acts and General Notices / Avis en vertu de diverses lois et avis divers . 10 Sheriff’s Sales / Ventes par exécution forcée. 11 Notices of Sale / Avis de vente . 11 Regulations / Règlements . 12 Corporate Registry Notices / Avis relatifs au registre corporatif . 13 Business Corporations Act / Loi sur les corporations commerciales . 13 Companies Act / Loi sur les compagnies . 54 Partnerships and Business Names Registration Act / Loi sur l’enregistrement des sociétés en nom collectif et des appellations commerciales . 56 Limited Partnership Act / Loi sur les sociétés en commandite . 89 2016 Index Proclamations Lagacé-Melanson, Micheline—OIC/DC 2016-243—p. 1295 (October 26 octobre) Acts / Lois Saulnier, Daniel—OIC/DC 2016-243—p. 1295 (October 26 octobre) Therrien, Michel—OIC/DC 2016-243—p. 1295 (October 26 octobre) Credit Unions Act, An Act to Amend the / Caisses populaires, Loi modifiant la Loi sur les—OIC/DC 2016-113—p. 837 (July 13 juillet) College of Physicians and Surgeons of New Brunswick / Collège des médecins Energy and Utilities Board Act / Commission de l’énergie et des services et chirurgiens du Nouveau-Brunswick publics, Loi sur la—OIC/DC 2016-48—p. -

CANADIAN TIRE CORPORATION, LIMITED 2015 Annual Information Form

CANADIAN TIRE CORPORATION, LIMITED 2015 Annual Information Form February 17, 2016 ANNUAL INFORMATION FORM CANADIAN TIRE CORPORATION, LIMITED TABLE OF CONTENTS 1. Corporate Structure 2 2. Description of the Business 3 2.1 Retail Segment 3 2.2 CT REIT Segment 12 2.3 Financial Services Segment 12 2.4 Real Estate Management 13 2.5 Seasonality of the Business 14 2.6 Intangible Properties 14 2.7 Economic Dependence 15 2.8 Lending 15 2.9 Financing of the Business 15 2.10 Risk Factors 15 2.11 Employees 17 2.12 Corporate Citizenship 17 3. General Development of the Business 19 3.1 Retail Business Developments 19 3.2 CT REIT Business Development 25 3.3 Financial Services Business Developments 25 3.4 Other Business Developments 26 4. Capital Structure 28 4.1 Description of Capital Structure 28 4.2 Market for Securities 29 5. Dividends 30 6. Security Ratings 31 7. Transfer Agents and Registrar 31 8. Directors and Officers 32 9. Interests of Experts 36 10. Legal Proceedings and Regulatory Actions 37 11. Additional Information 37 12. Forward Looking Information 37 Annex A - Audit Committee Mandate and Charter i Certain brands mentioned in this report are the trademarks of Canadian Tire Corporation, Limited, Mark’s Work Wearhouse Ltd., FGL Sports Ltd. or used under license. Others are the property of their respective owners. ANNUAL INFORMATION FORM CANADIAN TIRE CORPORATION, LIMITED In this document, the terms “Company” and “CTC” refer to Canadian Tire Corporation, Limited, its predecessor corporations and all entities controlled by it and their collective businesses unless the context otherwise requires. -

Canadian Tire Célèbre 90 Ans D’Existence Au Canada, Au Service Quotidien Des Canadiens

90 ANS DE VIE AU CANADA R APPORT ANNUEL 2011 DE C ANADIAN TIRE WorldReginfo - 90b30eea-5d6b-4b82-8e98-1375b5e93f59 Le réseau d’entreprises Canadian Tire célèbre 90 ans d’existence au Canada, au service quotidien des Canadiens. MC 01 > POINTS SAILLANTS DES RÉSULTATS FINANCIERS 19 > FGL SPORTS 02 > MESSAGE DE LA PRÉSIDENTE DU CONSEIL 21 > SERVICES FINANCIERS d’adMINISTRATION 22 > CROISSANCE ET PRODUCTIVITÉ 04 > MESSAGE DU PRÉSIDENT ET CHEF DE LA DIRECTION 24 > NOTRE ENGAGEMENT ENVERS LA COMMUNAUTÉ 06 > QUI NOUS SOMMES 25 > VIABILITÉ DE L’entrePRISE MD 09 > 90E ANNIVERSAIRE 26 > BON DÉPART DE CANADIAN TIRE 11 > SURVOL DE L’entrePRISE 28 > Notre réseau d’entrePRISES CANADIAN TIRE 12 > GROUPE DÉTAIL CANADIAN TIRE 30 > NOTRE ÉQUIPE DE DIRECTION MC 17 > Mark’s / L’ÉQUIPEUR 32 > ASPIRATIONS FINANCIÈRES WorldReginfo - 90b30eea-5d6b-4b82-8e98-1375b5e93f59 ANNUALREVIEW.CANADIANTIRE.CA POURQUOI INVESTIR Chez Canadian TireMD, nous avons NOUS POSSÉDONS UN NET AVANTAGE CONCURRENTIEL pris l’engagement d’accompagner > Plus de 1 700 emplacements pratiques les Canadiens dans leurs tâches et > Une importante part de marché dans tous nos principaux leurs loisirs quotidiens — et nous secteurs d’activités le faisons bien. > Le plus grand détaillant d’articles de sport au Canada Devant nos actionnaires, nous > Un vaste assortiment d’articles automobiles nous engageons à exécuter notre > Un assortiment diversifié, des marques maison dynamiques stratégie de croissance et à dégager et des articles exclusifs de la valeur à long terme. Pour > Des produits financiers qui complémentent nos entreprises résumer, nous pensons qu’investir de détail dans Canadian Tire se justifie par nos quatre grandes forces. -

Canadian Tire Corporation Canadian Tire Corporation

Canadian Tire CorporationCanadian Tire Canadian Tire Corporation 2016 Report to Shareholders 2016 Report Shareholders to 2016 Our Triangle represents the most iconic brand in the marketplace and for 95 years, we have been providing customers with everything they need for the Jobs and Joys of Life in Canada. For a full update of 2016 business highlights, community investments and video messages from the executive team, please visit our Year in Review website at yearinreview.canadiantirecorporation.ca Maureen J. Sabia, Chairman of the Board 1 / Stephen G. Wetmore, President and Chief Executive Officer 2 / Management’s Discussion and Analysis 3 / Consolidated Financial Statements 58 / Board of Directors 114 / Executive Leadership Team 114 Maureen J. Sabia Chairman of the Board The Board of Directors took a bold decision in July of 2016 to change the leadership of Canadian Tire and appointed Stephen Wetmore as President and CEO. My colleagues and I felt strongly that we had We have examined our relationship with the responsibility for the long-term success Management and we are seeking even of the Tire and we were unanimous in our better ways of making sure that the flow of belief that a transformational leader was information to the Board is as effective as Sadly, in May of 2017, the Board will say needed to lead the Company at this time of possible to facilitate better decision making goodbye to George Vallance, a valuable unprecedented change in the retail industry. in order to achieve our 2022 goal. In today’s member of our Board of Directors. George Moreover, we firmly believed that Stephen fast-changing world, it is not enough for decided to retire as an Associate Dealer in would take the Tire’s iconic brand to the us to be at the leading edge of good January 2017 and Don Murray, a highly next level, a strategic imperative for us. -

Management's Discussion and Analysis

Management’s Discussion and Analysis Canadian Tire Corporation, Limited First Quarter 2017 1.0 Preface 1.1 Definitions In this document, the terms “we”, “us”, “our”, “Company”, “Canadian Tire Corporation”, “CTC”, and “Corporation” refer to Canadian Tire Corporation, Limited, on a consolidated basis. This document also refers to the Corporation’s three reportable operating segments: the “Retail segment”, the “CT REIT segment”, and the “Financial Services segment”. The financial results for the Retail segment are delivered by the businesses operated by the Company under the Company’s retail banners, which include Canadian Tire®, PartSource®, Petroleum, Mark’s®, Sport Chek®, Sports Experts®, Atmosphere®, and Pro Hockey Life (“PHL”). In this document: “Canadian Tire” refers to the general merchandise retail and services businesses carried on under the Canadian Tire and PartSource names and trademarks, and the retail petroleum business carried on by Petroleum. “Canadian Tire stores” and “Canadian Tire gas bars” refer to stores and gas bars (which may include convenience stores, car washes, and propane stations) operated under the Canadian Tire and Gas+® names and trademarks. “CT REIT” refers to the business carried on by CT Real Estate Investment Trust and its subsidiaries, including CT REIT Limited Partnership (“CT REIT LP”). “Financial Services” refers to the business carried on by the Company’s Financial Services subsidiaries, namely Canadian Tire Bank (“CTB” or “the Bank”) and CTFS Bermuda Ltd. (“CTFS Bermuda”). “FGL Sports” refers to the retail business carried on by FGL Sports Ltd., and “FGL Sports® stores” which includes stores operated under the Sport Chek, Sports Experts, Atmosphere, PHL, National Sports, and Hockey Experts, names and trademarks. -

Canadian Tire Corporation

Canadian Tire Corporation Management’s Discussion and Analysis and Consolidated Financial Statements and Notes For the year ended December 30, 2017 Management's Discussion and Analysis Canadian Tire Corporation, Limited Fourth Quarter and Full Year 2017 Table of Contents 1.0 PREFACE 2 2.0 COMPANY AND INDUSTRY OVERVIEW 4 3.0 CORE CAPABILITIES 7 4.0 HISTORICAL PERFORMANCE HIGHLIGHTS 9 5.0 2017 FINANCIAL ASPIRATIONS AND STRATEGIC IMPERATIVES 12 6.0 2018 FINANCIAL ASPIRATIONS AND KEY INITIATIVES 15 7.0 FINANCIAL PERFORMANCE 18 7.1 Consolidated Financial Performance 18 7.2 Retail Segment Performance 21 7.3 CT REIT Segment Performance 27 7.4 Financial Services Segment Performance 29 8.0 BALANCE SHEET ANALYSIS, LIQUIDITY, AND CAPITAL RESOURCES 32 9.0 EQUITY 39 10.0 TAX MATTERS 40 11.0 ACCOUNTING POLICIES, ESTIMATES, AND NON-GAAP MEASURES 41 12.0 ENTERPRISE RISK MANAGEMENT 48 13.0 INTERNAL CONTROLS AND PROCEDURES 54 14.0 SOCIAL AND ENVIRONMENTAL RESPONSIBILITY 55 15.0 RELATED PARTIES 58 16.0 SUBSEQUENT EVENT 58 17.0 FORWARD-LOOKING STATEMENTS AND OTHER INVESTOR COMMUNICATION 58 2017 MANAGEMENT'S DISCUSSION AND ANALYSIS 1 MANAGEMENT'S DISCUSSION AND ANALYSIS 1.0 Preface 1.1 Definitions In this document, the terms “we”, “us”, “our”, “Company”, “Canadian Tire Corporation”, “CTC”, and “Corporation” refer to Canadian Tire Corporation, Limited, on a consolidated basis. This document also refers to the Corporation’s three reportable operating segments: the “Retail segment”, the “CT REIT segment”, and the “Financial Services segment”. The financial results for the Retail segment are delivered by the businesses operated by the Company under the Company’s retail banners, which include Canadian Tire, PartSource, Petroleum, Mark’s, Sport Chek, Sports Experts, Atmosphere, and Pro Hockey Life (“PHL”). -

2014 Annual Information Form from Canadian Tire Corporation, Limited

CANADIAN TIRE CORPORATION, LIMITED 2014 Annual Information Form February 26, 2015 ANNUAL INFORMATION FORM CANADIAN TIRE CORPORATION, LIMITED TABLE OF CONTENTS 1. Corporate Structure 2 2. Description of the Business 3 2.1 Retail Segment 3 2.2 CT REIT Segment 11 2.3 Financial Services Segment 12 2.4 Real Estate Management 13 2.5 Seasonality of the Business 13 2.6 Intangible Properties 14 2.7 Economic Dependence 14 2.8 Lending 14 2.9 Financing of the Business 15 2.10 Risk Factors 15 2.11 Employees 16 2.12 Corporate Citizenship 17 3. General Development of the Business 18 3.1 Retail Business Developments 18 3.2 CT REIT Business Development 23 3.3 Financial Services Business Developments 23 3.4 Other Business Developments 24 4. Capital Structure 26 4.1 Description of Capital Structure 26 4.2 Market for Securities 27 5. Dividends 28 6. Security Ratings 29 7. Transfer Agents and Registrar 30 8. Directors and Officers 30 9. Interests of Experts 34 10. Legal Proceedings and Regulatory Actions 35 11. Additional Information 35 ANNEX A i Certain brands mentioned in this report are the trademarks of Canadian Tire Corporation, Limited, Mark’s Work Wearhouse Ltd., FGL Sports Ltd. or used under license. Others are the property of their respective owners. CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION This Annual Information Form, and the documents incorporated by reference herein, contains forward-looking information that reflects management’s current expectations relating to matters such as future financial performance and operating results of Canadian Tire Corporation, Limited (“CTC”). -

PDF-Xchange 4.0 Examples

Canadian Tire Corporation Delivers Strong Topline Growth Across all Businesses in the First Quarter • Strong consolidated comparable sales, up 6.1% in the first quarter: th o Canadian Tire up 7.1%, marking 20 consecutive quarter of growth o Mark’s up 4.9%; SportChek up 3.4% • Continued strong Financial Services GAAR growth of 9.3%; revenue up 7.8%; and over two million active credit card accounts • Financial Services IBT was $112.4 million, up 15.8% • Diluted earnings per share (EPS) was $1.12, down 4.8% TORONTO, May 9, 2019 – Canadian Tire Corporation, Limited (TSX:CTC, TSX:CTC.A) today released first quarter results for the period ended March 30, 2019. “Ending our winter season with exceptional sales performance positions us well as we enter our second largest quarter of the year,” said Stephen Wetmore, President and CEO, Canadian Tire Corporation. “Our first quarter earnings are always focused on Financial Services, which delivered strong growth in IBT of 15.8%.” CONSOLIDATED OVERVIEW • Consolidated retail sales increased $91.2 million or 3.3% in the first quarter. Excluding Petroleum, consolidated retail sales were up 6.3% over the same period last year. • Consolidated revenue increased $79.5 million, or 2.8%. Excluding Petroleum, consolidated revenue increased $128 million, or 5.4% in the quarter. • Diluted EPS was $1.12 in the quarter, a decrease of $0.06 per share, or 4.8%. RETAIL OVERVIEW • The following financial results reflect Q1 2019 performance compared to Q1 2018. • Retail segment revenue increased 2.3%. Excluding Petroleum, retail segment revenue increased 5.2%. -

Canadian Tire Corporation

Canadian Tire Corporation 2018 Investor Presentation Forward Looking Information Caution regarding forward-looking statements: This document contains forward-looking statements that reflect Management’s current expectations relating to matters such as future financial performance and operating results of the Company. Forward-looking statements provide information about Management’s current expectations and plans, and allow investors and others to better understand the Company’s anticipated financial position, results of operations and operating environment. Readers are cautioned that such information may not be appropriate for other purposes. Certain statements other than statements of historical facts included in this document may constitute forward-looking statements, including, but not limited to, statements concerning Management’s current expectations relating to possible or assumed future prospects and results, the Company’s strategic goals and priorities, its actions and the results of those actions and the economic and business outlook for the Company. Often, but not always, forward-looking statements can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “intend”, “believe”, “estimate”, “plan”, “can”, “could”, “should”, “would”, “outlook”, “forecast”, “anticipate”, “aspire”, “foresee”, “continue”, “ongoing” or the negative of these terms or variations of them or similar terminology. Forward-looking statements are based on the reasonable assumptions, estimates, analyses, beliefs and opinions