Session 1 Business Strategy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Placement Analysis - 2019 Batch

Placement Analysis - 2019 Batch Highest Package Offered Average Package Offered Lowest Package Offered 12.0 LPA 4.0 LPA 3.0 LPA Total No of Companies Invited : 502 Total no of Students Placed : 1328 Top Companies with packages above 5 Lacs (CTC) S.No Company Name 1 TCS 2 SHELL TECHNOLOGIES 3 AVIZVA 4 OPTUM 5 Zycus 6 XEBIA IT 7 TEK SYSTEMS 8 SAPIENT 9 MANN INDIA 10 HYUNDAI 11 YAMAHA MOTOR 12 RELIANCE 13 REAL DATA 14 CVENT 15 Think n Learn 16 Tolexo 17 Google 18 Dyson 19 United Lex 20 WIPRO WASE 21 HSBC 22 Accolite 23 Novanet 24 Foresight 25 Blue Star 26 RMS 27 Samsung 28 Amazon 29 Keyence 30 Veris Top Payers /Dream Companies Company Name CTC (LPA) INDIAN AIR FORCE 12 GOOGLE 12 HSBC 12 SIRION LABS 12 NATIONAL INSTRUMENTS 12 SHELL TECHNOLOGIES 10 THINK N LEARN 10 ACCOLITE 10 VMWARE 9.12 TCS (CODEVITA) 7.5 HYUNDAI 7.5 NOVANET 7 ZYCUS 6.5 XEBIA IT 6 MANN INDIA TECHNOLOGIES 6 RELIANCE 6 REAL DATA 6 FORESIGHT 6 BLUE STAR 6 SAMSUNG 6 AMAZON 6 KEYENCE 6 WIPRO WASE 5.57 OPTUM 5.4 SAPIENT 5.3 AVIZVA 5.25 DYSON 5.07 YAMAHA 5 CVENT 5 TOLEXO 5 UNITED LEX 5 PFIZER 5 LAMBORGINI 5 Top Recruiters Company Name Final Placed ACCENTURE 309 TCS 120 WIPRO TECHNOLOGIES 70 THINK N LEARN 40 ICONMA 39 NEC TECHNOLOGIES 29 AMAZON 52 FLIPKART 25 RELIANCE 23 MANN INDIA TECHNOLOGIES 21 SOPRA STERIA 20 HEXAWARE 16 HCL TECHNOLOGIES 23 SAMSUNG 28 ERICSSON 15 NTT DATA 33 Top IT Companies: S.No Company Name 1 NEC 2 TATA TECHNOLOGIES 3 WIPRO 4 ACCENTURE 5 HEXAWARE 6 OPTUM 7 NIIT 8 GRAPECITY 9 TCS 10 MPHASIS 11 SAPIENT 12 NEWGEN 13 ACCENTURE 14 Gemalto 15 Google 16 Genpact -

The Frenchman Steadying Wipro's Ship

MONDAY,5JULY2021 10 NEWDELHI LONG STORY LIVEMINT.COM THEREPORTAGFRENCHMANE|TALKINGPOINTS |IDEAS |INSIGHT |THE BOTTOMLINE STEADYING WIPRO’S SHIP Leading from Paris, the new Wipro CEOThierryDelaporte is bringing fresh energy to the IT company. Wipro’snew chief executiveofficer,ThierryDelaporte, clearly has his task cut out forhim. Wipro’sITservices revenuesare still in the $8 billion rangewhile its closest competitor HCL TechnologiesLtd crossed the $10billion mark in calendar year 2020. HT Ayushman Baruah visit the Bengaluru headquarters of the role in ensuringthat the deal is asuccess. mint SECOND WIND consultingfirmEY-India.“Theyrequirea [email protected] companythathewasleading.Tomorrow, “Theteamunderherissettlingdownwell,” SHORT differentriskappetite,investmentability, BENGALURU itwouldhavebeenayearsincehetookthe he said. STORY Chart1:Afterlagging behind itspeers commercialconstruct,andtheneedtolev- job, and he is yet to set foot in Bengaluru. Delaporte aims to take a“flexible and foryears, Wipro'sm-cap hassurged past erage an ecosystemofpartnerstocreate henFrenchmanThierry open approach” to Capco’s integration, HCLTechinrecentmonths. long-term value for customers,” he said. Delaporte took the LEADING FROM AFAR giventhescaleandnatureofthebusiness. WHO Marketcapitalization (intrillion) Whenaskedaboutwhatwasworkingfor CEO’s job at IndianIT oday, Delaporte has anascent yet Capcowilloperateasaseparateglobalunit, him,Delaporte highlighted afew factors Paris-based Thierry Delaporte, WiproIHCLTechnologies nfosys Tcredibleturnaroundstorytotell.Part -

Wipro at a Glance

Wipro at a Glance Wipro Ltd. (NYSE:WIT) is a leading Information Technology, Consulting and Business Process Services company that delivers solutions to enable its clients DO BUSINESS BETTER.Wipro delivers winning business outcomes through its deep industry experi- ence and a 360 degree view of "Business through Technology." By combining digital strategy, customer centric design, advanced analytics and product engineering approach,Wipro helps its clients create successful and adaptive businesses. Be passionate Unyielding integrity in Treat each person with respect Be global and responsible about clients’ success everything we do Market Clients in Capitalization 175,000+ of over 6 Workforce Continents $ 17 Billion Highlights Wipro acquired Appirio, A Global Cloud Services Company Wipro’s business has grown over Wipro’s Managed File Transfer as a Service (MFTaaS) Platform Over the last Enables Advanced Digital Integration on Microsoft Azure & CAGR of Connected Digital Enterprises on Amazon Web Services. 15 years 24% 25times Greater Toronto Airports Authority Awards Futuristic IT and Business Transformation Contract to Wipro. Wipro and Asahi Beverages, the Australia New Zealand business of the Japanese beverage giant, were jointly recognized for the ‘Best BPO Sourcing’ partnership of 2016 by the ANZ Paragon Awards™ Financials 2015 - 2016 Awards Gross Revenue- US $ 7.7 Billion Wipro recognized as member of Dow Jones Sustainability Index Revenue of IT services segment- US $ 7.3 Billion (DJSI) for the seventh time in a row. Wipro is also a member of the DJSI Emerging Markets Index. Net Income- US $ 1.3 Billion A leading Australian Banking Group has chosen Wipro as a key transformation partner for Testing&Digital Assurance. -

Facts About Asia: India’S Thriving Technology Industry

Teaching Asia’s Giants: India Facts About Asia: India’s Thriving Technology Industry The Infy hallmark pyramid. It serves as the multimedia studio for Infosys’s headquarters in Bangalore. Source: Wikimedia Commons at https://tinyurl.com/y4orqfx4. Introduction North American readers of this journal, even if they are not especially tech savvy, are likely familiar with Silicon Valley, located in the San Francisco Bay area, and many of the companies like Apple and Google that make the region their home. Fewer are likely aware of India’s own “Silicon Valley” and the various Indian private compa- nies and startups that help to make the IT sector one of the more faster growing sectors of the economy and cre- ate the prospect of India becoming a world leader in technology companies. According to the 2020 Global Innovation Index, an annual study of the most innovative countries across a series of industries published by World Intellectual Property Organization (WIPO), Cornell University and IN- SEAD, a top international private business school, India ranks as the world’s top exporter of information tech- nology (IT) and eighth in the number of science and engineering graduates. The IT industry is a highly significant part of the Indian economy today with the sector contributing 7.7% of India’s total GDP by 2017, a most impressive increase from 1998 when IT accounted for only 1.2% of the nation’s GDP. IT revenues in 2019 totaled US $180 billion. As of 2020, India’s IT workforce accounts for 4.36 million employees and the United States accounts for two-thirds of India’s IT services exports. -

India Country Report on Smart Grids

Prepared by Writer(s) Name Nation Organization Type of Organization Email address Surname (e.g. University / Research institution / National Authority /Industry / etc.) Dr. J. B. V. India Department of Science National Authority [email protected] Reddy & Technology Dr. Sanjay India Department of Science National Authority [email protected] Bajpai & Technology Prof. N. P. India Indian Institute of University / Research [email protected] Padhy Technology Roorkee Institution Prof. India Indian Institute of University / Research sukumariitdelhi@gmail. Sukumar Technology Delhi Institution com Mishra Prof. S.C. India Indian Institute of University / Research [email protected] Srivastava Technology Kanpur Institution Dr. Subir Sen India Powergrid National Authority under subir@powergridindia. Corporation of India Ministry of Power com Ltd. Mr. Arun India NSGM-PMU, National Authority akmishra@ Kumar Powergrid under Ministry of Power powergridindia.com Mishra Corporation of India Ltd., Ms. Kumud India NSGM-PMU, National Authority kmd@powergridindia. Wadhwa Powergrid under Ministry of Power com Corporation of India Ltd., Mr. Soonee India Power System National Authority [email protected] S. K. Operation Corporation under Ministry of Power Ltd. (POSOCO) Prof. Bhim India Indian Institute of University / Research [email protected] Singh Technology Delhi Institution Dr. Ashu India Indian Institute of University / Research [email protected] Verma Technology Delhi Institution Mr. P. R. India Department of National Authority [email protected] Hariharan Scientific & Industrial Research Er. Maharshi India Indo-US Science & Established by India and US [email protected] Vadapalli Technology Forum Governments Mission Innovation IC#1 - Smart Grids III Contents 1. General Framework and Implementation.................................................................................. -

Everest Group PEAK Matrix for Network Transformation and Managed Services 2020

® Everest Group PEAK Matrix™ for Network Transformation and Managed Service Providers 2020 Focus on Wipro December 2019 ® ™ Copyright © 2019 Everest Global, Inc. This document has been licensed for exclusive use and distribution by Wipro EGR-2019-29-E-3493 Introduction and scope Everest Group recently released its report titled “Network Transformation and Managed Services PEAK Matrix™ Assessment 2020: Transform your Network or Lie on the Legacy Deathbed.” This report analyzes the changing dynamics of the network services landscape and assesses service providers across several key dimensions. As a part of this report, Everest Group updated its classification of 13 service providers on the Everest Group PEAK Matrix™ for network services into Leaders, Major Contenders, and Aspirants. The PEAK Matrix is a framework that provides an objective, data-driven, and comparative assessment of network service providers based on their absolute market success and delivery capability. Based on the analysis, Wipro emerged as a Leader. This document focuses on Wipro’s network services experience and capabilities and includes: ⚫ Wipro’s position on the network transformation and managed services PEAK Matrix ⚫ Detailed network services profile of Wipro Buyers can use the PEAK Matrix to identify and evaluate different service providers. It helps them understand the service providers’ relative strengths and gaps. However, it is also important to note that while the PEAK Matrix is a useful starting point, the results from the assessment may not be directly prescriptive for each buyer. Buyers will have to consider their unique situation and requirements, and match them against service provider capability for an ideal fit. Source: Everest Group (2019) ® Copyright © 2019, Everest Global, Inc. -

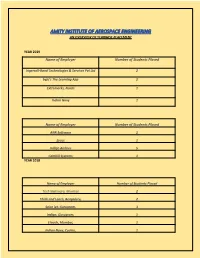

Amity Institute of Aerospace Engineering an Overview of Yearwise Placement

AMITY INSTITUTE OF AEROSPACE ENGINEERING AN OVERVIEW OF YEARWISE PLACEMENT YEAR 2019 Name of Employer Number of Students Placed Ingersoll-Rand Technologies & Services Pvt Ltd 2 byju's The Learning App 2 Extramarks, Noida 1 Indian Navy 1 Name of Employer Number of Students Placed ANR Software 1 Zycus 1 Indigo Airlines 5 Cambill Systems 1 YEAR 2018 Name of Employer Number of Students Placed Tech Mahindra, Mumbai 2 Think and Learn, Bengaluru, 2 Spice jet, Gurugram, 3 Indigo, Gurugram, 1 Etouch, Mumbai, 1 Indian Navy, Cochin, 1 Yes Bank, Delhi, 1 PCITS, Gurugram, 1 IIT, Kanpur, 1 Zeus Neumerix, Pune 1 YEAR 2017 YEAR 2016 Name of Employer Number of Students Placed Wipro, Bengaluru, 2 Rockwell Collins (India) 2 Enterprises Pvt Ltd, Hyderabad, Indigo, Gurugram 2 Decathlons, Bangalore, 1 Tech Mahindra, Mumbai 2 Think & Learn Pvt Ltd, 2 Bengaluru Space India, Navi Mumbai. 1 Shanghai Civil aviation 1 Academy Axes Cades, Noida. 1 Zener, Dubai. 1 DRDL, Hyderabad 1 BT Tech Lab, Gurugram. 1 Indian Navy, Cochin. 1 TCS, Hyderabad. 1 Byjus Tutorials, Delhi. 1 YEAR 2015 Wipro, Bangalore, 6 Indigo, Gurgaon,, 3 Honeywell, Gurugram, 4 Indian Airforce,New Delhi, 1 Smartican, New Delhi, 1 Cosmic Infra group, Delhi, 1 Decathelon,Delhi 1 Axis Bank, Mumbai,com 1 UTC Aerospace, Bangalore, 1 IIAE,Dehradun,.in 1 Indian Army, New Delhi, 1 Amazon, Bangalore 1 IIT, Kanpur, 1 Spice Jet Limited, Gurugram, 1 Haryana, Indigo, Gurugram 4 Wipro Ltd, Bangalore 7 Indian Navy, New Delhi 1 IBM Pvt. Ltd, Bangalore 1 IIIT, Mumbai 1 IIT, Kanpur 1 Lakshmi Precision Rohtak 1 Mahindra Automotive, Gurugram 1 YEAR 2014 Wipro Limited Bengaluru 2 Indian Navy, New Delhi 2 Space Technology and Education Pvt Ltd, 1 ARM Digital, Gurgaon 2 IISc, BANGALORE 1 IIT, Kanpur 1 DELL, Chandigarh 1 HAL Bangalore 1 ASP consultants, Bangalore, India, 1 Indian Coast Guard, Coast Guard Noida 1 Accenture, Hyderabad 1 Adfactors, New Delhi 1 YEAR 2013. -

Everest Group PEAK Matrix® for Network Transformaton And

Everest Group PEAK Matrix® for Network Transformation and Managed Services Providers 2021 Focus on Wipro August 2021 Copyright © 2021 Everest Global, Inc. This document has been licensed to Wipro EGR-2021-29-E-4533 Everest Group PEAK Matrix® for Network Transformation and Managed Services Providers 2021 Background of the research The COVID-19 pandemic fueled the digital transformation initiatives of enterprises to ensure business continuity. With a work-from-home culture prevalent for the past 12-18 months, there has been a shift in network strategies of enterprises to provide seamless and secure connectivity to their workforce. Rapid cloud adoption along with other digital transformation initiatives have further accelerated the enterprise needs to adopt next-generation network technologies. The network services industry is further bound to undergo radical changes in enterprise needs and priorities, as next-generation network technologies such as private 5G network, SD-WAN, and IoT/edge networks come into play. Service providers need to realign their strategies with these shifts in the network services market to ensure that they can provide next-generation network services to enterprises. In this research, we present an assessment and detailed profiles of 12 network service providers featured on the network transformation and managed services PEAK Matrix®. The assessment is based on Everest Group’s annual RFI process for calendar year 2021, interactions with leading network services providers, client reference checks, and an ongoing analysis of the network services market. This report includes the profiles of the following 12 leading network service providers featured on the Network Transformation and Managed Services PEAK Matrix® : Leaders: Accenture, HCL Technologies, TCS, and Wipro Major Contenders: IBM, Infosys, Microland, Orange Business Services, Tech Mahindra, and Zensar Aspirants: Computacenter and Mphasis Scope of this report: Geography Service providers Services Global 12 Network transformation and managed services Proprietary & Confidential. -

Board Presentation

Analyst Meet 2017 R Srikrishna, CEO www.hexaware.com | © Hexaware Technologies. All rights reserved. 1 Safe Harbor Statement Certain statements on this presentation concerning our future growth prospects are forward-looking statements, which involve a number of risks, and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding fluctuations in earnings, our ability to manage growth, intense competition in IT services including those factors which may affect our cost advantage, wage increases, our ability to attract and retain highly skilled professionals, time and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, our ability to manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks, our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which Hexaware has made strategic investments, withdrawal of governmental fiscal incentives, political instability, legal restrictions on raising capital or acquiring companies outside India, and unauthorized use of our intellectual property and general economic conditions affecting our industry www.hexaware.com | © Hexaware Technologies. All rights reserved. 2 Our 3 Year Journey www.hexaware.com | © Hexaware Technologies. All rights reserved. 3 Fastest organically growing IT services company… Revenue Growth 155 Persistent 151 150 150 Hexaware Cognizant 144 145 142 142 Mindtree 138 141 138 136 134 HCL Tech 133 130 133 Tech M 128 127 124 Infosys 123 123 124 TCS 122 119 119 116 113 Wipro 112 113 112 111 110 109 108 108 105 106 103 103 102 101 100 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Acquisition-led growth www.hexaware.com | © Hexaware Technologies. -

Patent Portfolio of Major Indian IT Companies

Patent Portfolio of Major Indian IT Companies A Measure of Innovation 2010 This report provides an insight into the impor- tance of innovation by analyzing the Patent Port- folio of five major Indian Information Technol- ogy Companies - HCL Technologies, Infosys Tech- nologies, Mahindra Satyam, Tata Consultancy Services and Wipro. Patent Portfolio of Major Indian IT Companies A Measure of Innovation 2010 Contents Executive Summary 9 Introduction 10 Vertical Market for Indian IT Sector 10 Exhibit 1: Vertical Market for Indian IT Sector 2007 - 08 10 Scope of the study & Research Methodology 11 Databases and Tools 11 Organizations Considered for the Study 12 HCL Technologies Limited 12 Infosys Technologies Limited 13 Mahindra Satyam 14 Tata Consultancy Services Limited 15 Wipro Limited 15 Company Speak 17 Infosys 17 TCS 17 Wipro 17 HCL Technologies Limited 19 Exhibit 2: Geographical Distribution of Patent Filings - HCL 19 Exhibit 3: IPC category-wise Distribution - HCL 19 Exhibit 4: Granted Patents and Pending Applications - HCL 20 Exhibit 5: Timeline of Patent filings - HCL 20 Infosys Technologies Limited 22 Exhibit 6: Geographical Distribution of Patent Filings - Infosys 22 Exhibit 7: IPC category-wise Distribution - Infosys 22 Exhibit 8: Granted Patents and Patent Pending - Infosys 23 Exhibit 9: Timeline of Patent filings - Infosys 23 Mahindra Satyam 25 Exhibit 10: Geographical Distribution of Patent Filings - Mahindra Satyam 25 Exhibit 11: IPC category-wise Distribution - Mahindra Satyam 25 Exhibit 12: Granted Patents and Pending Applications -

Article Title

International In-house Counsel Journal Vol. 5, No. 19, Spring 2012, 1 The Ownership Structure and Corporate Governance in Major Private Sector Companies of India (2000 -2010) V.K.MALHOTRA Associate Professor, Department of Economics, C.C.S.University, India & MANOJ KUMAR AGARWAL Assistant Professor, Department of Commerce, Meerut College, Meerut, India Abstract The issue of ownership structure and its effect on corporate governance has invited interest and attention from researchers in the United States, Europe and the other parts of the world. The area remains under explored in the Indian context. This paper attempts to study the trend of changes in the ownership structure of the ten largest private sector companies (excluding public sector, banking and financial sector companies as these are regulated by a different set of philosophy, rules/norms) and its effects on the corporate governance in the studied companies over the period 2000 to 2010. The basic assumption behind studying the largest companies is that the top companies are first subjected to the changes in trend. For the purpose of analysis, the study uses the ownership format prescribed by the Securities and Exchange Board of India for submission by the companies to the stock exchange/s. The broad categories include- Promoters and Promoter group, Public Shareholding/Non-promoter Group comprising of Institutional Investors, and Non-Institutional Investors. Under these major categories the sub-category wise division of share-holding has also been analysed. To notice the corporate governance situation in the studied companies, a composite index comprising of Board-related, CAT-related (Complaints, Audit Fee, and Tax dues) and Finance-related aspects has been constructed. -

Aim Computer Consulting,LLC Livonia (734) 557-3815 Automotive

India Aim Computer Consulting,LLC HOV Services Livonia Livonia (734) 557-3815 (734) 632-1600 Website: www.hovservices.com Automotive Design Troy INCAT North American Engineering Center (248) 712-1191 Novi Website: http://www.automotive-design.com (248) 273-0404 Website: www.incat.com Climax Overseas Pvt. Ltd. Rochester Hills Infosys Technologies Limited (248) 232-7336 Southfield Website: http://www.climaxoverseas.com (248) 603-4325 Website: www.infosys.com Design Intent Engineering Inc. Farmington Hills Kongovi Electronics (248) 478-0134 Troy Website: www.designintenteng.com (248) 588-2876 Website: http://www.kongovi.in Eicher Engineering Solutions Farmington Hills KPIT Infosystems Inc. (248) 478-0134 Novi Website: http://www.designintenteng.com (916) 932-5821 Website: http://www.kpitcummins.com Geometric Engineering Inc. Troy Larsen & Toubro Infotech Ltd. (248) 606-6154 Southfield Website: www.geometicglobal.com (248) 948-7920 Website: www.lntinfotech.com HCL America Inc. Troy Mahindra Engineering (248) 458-0318 Troy Website: http://www.hcltech.com (248) 594-4001 x111 Website: http://www.mahindra.com Mahindra North American Technical Center Sigma Global Inc. Troy Plymouth (248) 629-1390 (248) 348-7666 Website: http://www.mahindra.com Website: www.sigmaglobal.net Mahindra North American Technical Centre Sundram Fasteners Ltd. Troy Troy (248) 629-1390 91-44-28478500 Website: www.sundram.com Merycon Corp. Ann Arbor Super Auto Forge (734) 327-9842 Novi Website: http://www.mim-india.com (248) 344-9988 Website: www.superautoforge.net Mutual Engineering Pvt. Ltd. West Bloomfield Synergetic Engineering of India (313) 282-3230 Rochester Hills Website: http://www.meplonline.com/index.html (248) 763-9428 Website: http://www.synergetic-global.com Neptune Engineering Inc.