Morning Wrap

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TCPID Update February 2020

Update from the Trinity Centre for People with Intellectual Disabilities School of Education, Trinity College Dublin February 2020 Trinity College Dublin, The University of Dublin Update from the Trinity Centre for People with Intellectual Disabilities, School of Education, Trinity College Dublin February 2020 Dear Partners, Thank you all as always for your continued support for the Trinity Centre for People with Intellectual Disabilities. We now have more than 30 TCPID Business Partners and Business Patrons which is an incredible achievement and something that we are very grateful to you all for. Thanks to your very generous support, we are able to secure the future of the TCPID and create many exciting opportunities for our students and graduates. We launched our TCPID online mentor training programme at the end of last year. We hope that you have found it useful so far and we would greatly welcome any feedback that you may have at any stage. We are very much looking forward to continuing working with you all in 2020. Here are just a few of our highlights over the past few months here in the TCPID. With warmest thanks as always for your support, TCPID Pathways Coordinator Email: [email protected] Tel: 01 8963885 Please follow all our latest news on our website at www.tcd.ie/tcpid as well as on Facebook @InclusionTCD, Twitter @IDTCD Instagram inclusiontcd as well as on LinkedIn www.linkedin.com/school/inclusiontcd Trinity College Dublin, The University of Dublin ASIAP Graduation Dr. Mary-Ann O’Donovan, Course Coordinator and Assistant Professor in Intellectual Disability and Inclusion: Friday January 31st 2020 was a very proud day for all of us in the TCPID as it was graduation day for our Level 5 Certificate in Arts, Science and Inclusive Applied Practice. -

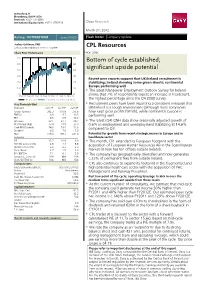

CPL Resources

www.davy.ie Bloomberg: DAVY<GO> Research: +353 1 6148997 Institutional Equity Sales: +353 1 6792816 Davy Research March 21, 2012 Rating: OUTPERFORM Issued 30/06/09 Flash Note: Company update Joshua Goldman, PhD [email protected] / +353 1 6148997 CPL Resources Share Price Performance Price: 298c 350 300 Bottom of cycle established; 300 260 significant upside potential 250 220 200 180 Recent peer reports suggest that UK/Ireland recruitment is 150 140 stabilizing; Ireland showing some green shoots; continental Europe performing well 100 100 • The latest Manpower Employment Outlook Survey for Ireland 50 60 Mar 09 Sep 09 Mar 10 Sep 10 Mar 11 Sep 11 Mar 12 shows that 7% of respondents expect an increase in headcount, CPL price (c) Rel to ISEQ overall index (rhs) the highest percentage since the Q4 2008 survey. Key financials (€m) • Recruitment peers have been reporting a consistent message that Year end Jun12E Jun13F Jun14F UK/Ireland is a tough environment (although most companies Group Turnover 292.3 310.9 335.8 have kept gross profits flattish), while continental Europe is EBITDA 8.9 9.7 10.5 performing well. PBT 8.9 9.5 10.4 EPS Basic 23.1 27.1 29.7 • The latest (Q4) QNH data show seasonally adjusted growth of EPS Diluted (Adj) 23.4 27.5 30.0 0.6% in employment and unemployment stabilizing at 14.6% Cash EPS (Diluted) 24.9 29.0 31.6 compared to Q3. Dividend 6.0 7.0 7.0 NBV 179.0 198.7 221.0 Potential for growth from recent strategic moves in Europe and in Valuation healthcare sector P/E 12.7 10.9 9.9 • This month, CPL extended its European footprint with the FCF Yld (pre div) (%) 2.8 7.4 8.8 Dividend Yield (%) 2.0 2.3 2.3 acquisition of European Human Resources AB in the Scandinavian Price / Book 1.7 1.5 1.3 market (it now has ten offices outside Ireland). -

Human Capital Management Industry Update Winter 2019

HUMAN CAPITAL MANAGEMENT STAFFING & RECRUITMENT – INDUSTRY UPDATE | Winter 2019 Houlihan Lokey Human Capital Management Houlihan Lokey is pleased to present its third Human Capital Management (HCM) Industry Update. Once again, we are happy to share industry insights, a public markets overview, a snapshot of relevant macroeconomic indicators, transaction announcements, and related detail. We believe this newsletter will provide you with the most important and relevant information you need to stay up to date with the HCM industry. We would also like to encourage you to meet with us at the SIA Executive Forum in Austin, Texas on February 25-28, 2019 where we would be happy to share recent market developments and further insights. If there is additional content that you would find useful for future updates, please do not hesitate to contact us with your suggestions. Regards, Thomas Bailey Jon Harrison Andrew Shell Managing Director Managing Director Vice President [email protected] [email protected] [email protected] 404.495.7056 +44 (0) 20 7747 7564 404.495.7002 Additional Human Capital Management Contacts Larry DeAngelo Pat O’Brien Alex Scott Bennett Tullos Mike Bertram Head of Business Services Associate Financial Analyst Financial Analyst Financial Analyst [email protected] [email protected] [email protected] [email protected] [email protected] 404.495.7019 404.495.7042 404.926.1609 404.926.1619 404.495.7040 Human Capital Management – Coverage by Subsector Staffing & VMS/MSP/RPO Talent Payroll/ HR Consulting/ Recruitment Management & PEO Benefits Admin Development -

Scheme Document. the Scheme Meeting Will Start at 12 Noon on That Date and the EGM at 12.15 P.M

174368 Proof 6 Tuesday, November 24, 2020 22:39 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this Scheme Document and what action you should take, you should consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser who, if you are taking advice in Ireland, is authorised or exempted under the European Union (Markets in Financial Instruments) Regulations 2017 (S.I. No. 375 of 2017) or the Investment Intermediaries Act 1995 (as amended) or, if you are taking such advice in the United Kingdom, is authorised pursuant to the Financial Services and Markets Act 2000 of the United Kingdom or, if you are taking advice elsewhere, is an appropriately authorised independent financial adviser. If you have sold or otherwise transferred all your Cpl Shares, please send this Scheme Document and the accompanying documents at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. The release, publication or distribution of this Scheme Document in or into jurisdictions other than Ireland and the United Kingdom may be restricted by law and therefore persons into whose possession this Scheme Document comes should inform themselves about and observe such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable Law, the companies involved in the Acquisition disclaim any responsibility or liability for the violation of any such restrictions by any person. -

Creating Impact – Achieving Results

30% Club Ireland CEO & Chairs Third Annual Conference Creating Impact – Achieving Results 25 January 2017 #30pcImpact National Gallery of Ireland Clare Street, Dublin 2 3.45pm Registration 4pm Seminar 6:15-7.30pm Reception & Networking @30percentclubIE www.30percentclub.org 30% Club Ireland Creating Impact Achieving Results 25 January 2017 2 Creating Impact Achieving Results 25 January 2017 Agenda 4.00pm Opening Remarks An Tánaiste and Minister for Justice and Equality, Frances Fitzgerald TD 4.15pm Welcome Marie O’Connor, Partner, PwC, Country Lead, 30% Club Ireland 4.25pm Painting the Picture: Research Update 2016 Facilitator: Conor O’Leary, Group Company Secretary, Greencore Anne-Marie Taylor, Management Consultant - Women in Management and Women on Boards: the Irish picture Darina Barrett, Partner, KPMG - The Think Future Study 2016 Dr Sorcha McKenna, Partner, McKinsey – Women Matter: Women in the Workplace 2016 4.45pm Sasha Wiggins introduces Lady Barbara Judge Sasha Wiggins, CEO, Barclays Bank Ireland introduces Lady Barbara Judge, Chair, Institute of Directors 5.00pm Taking Action Facilitator: Melíosa O’Caoimh, Senior Vice President, Northern Trust Anne Heraty, CEO, CPL Resources and President of Ibec Gareth Lambe, Head of Facebook Ireland Pat O’Doherty, CEO, ESB Brian O’Gorman, Managing Partner, Arthur Cox 5.25pm Leadership Commitment and Accountability - Perspective of the Chair Facilitator: Bríd Horan, Former Deputy CEO, ESB Rose Hynes, Chair, Shannon Group and Origin Enterprises Gary Kennedy, Chair, Greencore Gary McGann, Chair, Paddy Power Betfair 5.45pm Diplomacy, Diaspora and Diversity Anne Anderson, Ambassador of Ireland to the United States 6.00pm Future Plans & Closing Remarks Carol Andrews, Global Head of Client Service and Prime Custody (AIS), BNY Mellon Please note that this is an on the record event and views expressed are not necessarily representative of all 30% Club members. -

2020.11.05 Q3 FY12/20 Presentation1.93MB

Financial Results for the 3rd Quarter of Fiscal Year Ending December 31, 2020 November 2020 OUTSOURCING Inc. Securities Code: 2427/TSE 1st Section Copyright (C) 2020 OUTSOURCING Inc. All Rights Reserved. Contents ⚫ P. 2 Our Group’s Social Responsibility and Significance ⚫ P. 5 Consolidated Financial Results for 3Q FY12/20 (IFRS) ⚫ P. 19 The Revised Full-Year Consolidated Financial Forecasts (IFRS) and Dividend Forecast ⚫ P. 25 Status of Group Companies Whose Goodwill is Recorded on OS Account ⚫ P. 37 The Group’s Advantage in Discovering New Demands in Response to COVID-19 ⚫ P. 42 Acquisition Announcement Made on November 4, 2020 ⚫ P. 44 Reference Materials Copyright (C) 2020 OUTSOURCING Inc. All Rights Reserved. 1 Our Group’s Social Responsibility and Significance Copyright (C) 2020 OUTSOURCING Inc. All Rights Reserved. 2 Our Group’s Social Responsibility and Significance New Initiatives in Social Responsibility Due to large, worldwide changes caused by rapid globalization, significant changes have been starting to occur in what the society demands from HR service companies and their roles in society. By redefining our management philosophy, we as the Outsourcing Group will create a framework that will allow us to contribute widely to society through our business activities. Group Mission Management Philosophy Vision of a society to be achieved through our businesses Universal principles for realizing our group mission that underpin our group’s business activities Compliance Implementation Execution Execution Sustainability Policy Business Vision Upward spiral through the Code of Conduct power of employees Business Policy (individual) and the power of the company (unity) Copyright (C) 2020 OUTSOURCING Inc. -

Alan Duffy As Well As Being HSBC Ireland’S CEO, Alan Is Also in Charge of the Company’S Corporate Banking and Security Services Businesses in Ireland

The Business & Finance CEO 100 Index profiles Ireland’s business leaders and their career progression. The top 100 CEOs in Ireland work across the widest possible variety of industries, implementing long-term strategies, spearheading corporate culture and delivering strong results. COMMUNICORP GROUP Adrian Serle With Communicorp since January 2017, Adrian has spent over 20 years in media, predominantly UK radio. From 2000, he spent nine years with Emap where he operated local and national radio stations leading teams across TV, radio, magazines, digital and sales. In 2009 he joined Orion Media where he assumed roles as the Group Commercial Director and Group CEO. DELL EMC Aisling Keegan After beginning her career in New York, Aisling returned to Ireland 18 years ago to join technology giant Dell. In 2016, a year before Dell Technologies was formed in 2017, she was appointed chief integration officer for the UK and Ireland market, and more recently appointed vice president and general manager of the Dell EMC commercial business in Ireland. HSBC Alan Duffy As well as being HSBC Ireland’s CEO, Alan is also in charge of the company’s corporate banking and security services businesses in Ireland. He joined HSBC Ireland in 2006 and his experience of 25 years spans the US, Canadian, European and Nordic markets. He holds an MBA from the Smurfit Graduate School of Business. SHIRE Alan Walshe Alan Walshe heads up bio-pharmaceutical company Shire, which has been present in Ireland since 1994. After studying life sciences at university, he moved into commercial roles In the pharmaceutical industry and lead the foundation of a biopharma start-up before joining Shire. -

CPL Technology Salary Guide 2014

teCHnoloGy Cpl’s Technology team were delighted to receive the NRF Best in Practice IT & Telecoms 2013 in recognition of our achievements and expertise in this sector. We have seen the IT market expand at pace over the last year and Ireland continues to be a country of choice for software professionals and the majority of software companies looking to hire IT talent. There has been a marked increase in the demand for web application engineers, JavaScript, PHP, Python and Ruby engineers. iOs and Android developers are also consistently in demand on both a permanent and contract basis. The area of Infrastructure Engineering and Technical Support continues to see strong demand for Linux Engineers, in particular DevOps Engineers. There has also been an increase in companies requiring skill sets such as Cyber Security, Virtualization and Storage Engineering and high-end IP/Data Network Engineering. Ireland’s strategic location has encouraged increasing levels of investment in cloud computing, ‘Big Data’ analytics and analytical centres. IT Project Managers are now expected to bring an array of skills on-board, including Data Analysis, Business Intelligence prowess, SDLC and/or Business Analysis skills. Overall salaries have remained strong; as an example we have seen a 10 – 15% increase in salaries at the mid-level. Due to increasing competition for the best candidates, salaries and daily rates are open to negotiation for candidates with the “in demand” skills. Data warehousing, business intelligence and DBA professionals are in strong demand and have their choice of opportunities on the market. In addition, the telecommunications sector has continued to expand despite the scarcity of highly skilled candidates, which has created further competition between larger organisations for the best talent. -

ISEQ® All-Share

Factsheet 1/3 ISEQ ISEQ® All-Share Objective The ISEQ All-Share tracks the performance of the stocks admitted to listing on Euronext Dublin and Euronext Growth Dublin. A velocity threshold is applied during the selection, except for companies who are incorporated in Northern Ireland. Constituents are reviewed twice a year and they are weighted based on their full market capitalisation. The index serves as an underlying for structured products, funds and exchange traded funds. Investability Stocks are screened to ensure liquidity to ensure that the index is investable. Transparency The index rules are available on our website. Euronext acts as Supervisor. All our rulebooks can be found on the following webpage: www.euronext.com/en/indices/index-rules. Statistics September-2019 Market Capitalization EUR Bil Performance (%) Fundamentals Full not mkt cap Q3 2019 2,24% P/E Incl. Neg LTM 20,99 Free float weighted YTD 13,95% P/E Incl. Neg FY1 18,02 2018 -22,14% P/E excl. Neg LTM 23,12 2017 7,99% P/E excl. Neg FY1 18,03 Components (full) EUR Bil 2016 -4,04% Price/Book 2,43 Average 2,32 Price/Sales 2,37 Median 0,55 Annualized (%) Price/Cash Flow 16,94 Largest 23,64 2 Year -4,74% Dividend Yield (%) 1,00 Smallest 0,00 3 Years 1,14% 5 Years 5,08% Risk Component Weights (%) Since Base Date 04-Jan-1988 5,94% Sharpe Ratio 1 Year (0,09) Largest 26,86 Volatility 30 Day 16,57 Smallest 0,002 Top ten 87,22 Performance of other versions ISEQG ERI5G ISEQ All Share GR (%) Q3 2019 2,61% YTD 16,08% 2018 -20,78% 2017 9,49% 2016 -2,68% This publication is for information purposes only and is not a recommendation to engage in investment activities. -

Cpl Resources Plc

global search local jobs cpl resources plc annual report for the year ended 30 June 2009 cpl resources plc annual report for the year ended 30 June 2009 Contents Directors and other information 2 Chairman’s statement 4 Chief executive’s review 5 Directors’ report 9 Statement of directors’ responsibilities 6 Independent auditor’s report 7 Group income statement 9 Group statement of changes in shareholders’ equity 20 Company statement of changes in shareholders’ equity 2 Group and Company balance sheet 22 Group and Company cash flow statements 24 Significant accounting policies 26 Notes forming part of the financial statements 34 cpl resources plc annual report for the year ended 30 June 2009 Directors and other information Directors John Hennessy (Non-Executive Chairman) Anne Heraty (Chief Executive) Paul Carroll Breffni Byrne (Non-Executive) Oliver Tattan (Non-Executive) Garret Roche Josephine Tierney (Finance Director) Secretary Wilton Secretarial Limited First Floor Fitzwilton House Wilton Place Dublin 2 Registered office 83 Merrion Square Dublin 2 Auditor KPMG Chartered Accountants Stokes Place St. Stephen’s Green Dublin 2 Solicitors William Fry Fitzwilton House Wilton Place Dublin 2 Principal bankers AIB plc 62 St Brigid’s Road Artane Dublin 5 Registrars and paying agents Computershare Services Limited Heron House Corrig Road Sandyford Industrial Estate Dublin 8 UK paying agents Computershare Services Limited 4th Floor, Caxton House Redcliff Way, Bristol BS99 7NH England 2 cpl resources plc annual report for the year ended 30 June 2009 Directors and other information (continued) Board of Directors John Hennessy (Non-Executive – Chairman) Oliver Tattan joined Cpl Resources plc in December Breffni Byrne * (Non-Executive) 2007. -

Who Moderates the Social Media Giants? a Call to End Outsourcing

Who Moderates the Social Media Giants? A Call to End Outsourcing PAUL M. BARRETT Center for Business and Human Rights June 2020 Contents Executive Summary .................................................................................... 1 1. Introduction ............................................................................................ 3 Sidebar: The Coronavirus Pandemic and Content Moderation ............... 6 2. The Origins and Development of Content Moderation ............................. 7 Sidebar: Ad Hoc Policies: From COVID-19 to Holocaust Denial.............. 9 3. The Moderator’s Experience ................................................................. 12 4. Content Moderation and Volatile Countries ........................................... 19 Sidebar: Many Frauds, Not Enough Fact-Checkers .............................. 23 5. Recommendations ............................................................................... 24 Endnotes .................................................................................................. 27 Acknowledgments We extend special thanks to researchers and Stern Signature Project participants Abhinav Krishna, Tiffany Lin, and Su-Kyong Park. Thanks also to the following for their time and insights: Facebook: Monika Bickert, Ruchika Budhraja, Arun Chandra, Nick Clegg, Crystal Davis, Sarah Oh, Maxime Prades, Drew Pusateri, Guy Rosen, Miranda Sissons Google/YouTube: Markham Erickson, Mike Grosack, Alex Joseph, Radha Penekelapati, Alexandria Walden, Clement Wolf Twitter: Del Harvey, -

ISEQ® All-Share

Factsheet 1/3 ISEQ ISEQ® All-Share Objective The ISEQ All-Share tracks the performance of the stocks admitted to listing on Euronext Dublin and Euronext Growth Dublin. A velocity threshold is applied during the selection, except for companies who are incorporated in Northern Ireland. Constituents are reviewed twice a year and they are weighted based on their full market capitalisation. The index serves as an underlying for structured products, funds and exchange traded funds. Investability Stocks are screened to ensure liquidity to ensure that the index is investable. Transparency The index rules are available on our website. Euronext acts as Supervisor. All our rulebooks can be found on the following webpage: https://live.euronext.com/en/products-indices/index-rules. Statistics March-2020 Market Capitalization EUR Bil Performance (%) Fundamentals Full not mkt cap Q1 2020 -28,26% P/E Incl. Neg LTM 20,50 Free float weighted YTD -28,26% P/E Incl. Neg FY1 17,70 2019 31,09% P/E excl. Neg LTM 20,54 2018 -22,14% P/E excl. Neg FY1 17,70 Components (full) EUR Bil 2017 7,99% Price/Book 3,01 Average 2,23 Price/Sales 1,91 Median 0,30 Annualized (%) Price/Cash Flow 12,35 Largest 19,49 2 Year -11,59% Dividend Yield (%) 1,71 Smallest 0,002 3 Years -8,19% 5 Years -3,06% Risk Component Weights (%) Since Base Date 04-Jan-1988 5,22% Sharpe Ratio 1 Year (0,50) Largest 26,86 Volatility 30 Day 65,57 Smallest 0,002 Top ten 91,76 Performance of other versions ISEQG ERI5G ISEQ All Share GR (%) Q1 2020 -27,58% YTD -27,58% 2019 33,63% 2018 -20,78% 2017 9,49% This publication is for information purposes only and is not a recommendation to engage in investment activities.