ISEQ® All-Share

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TCPID Update February 2020

Update from the Trinity Centre for People with Intellectual Disabilities School of Education, Trinity College Dublin February 2020 Trinity College Dublin, The University of Dublin Update from the Trinity Centre for People with Intellectual Disabilities, School of Education, Trinity College Dublin February 2020 Dear Partners, Thank you all as always for your continued support for the Trinity Centre for People with Intellectual Disabilities. We now have more than 30 TCPID Business Partners and Business Patrons which is an incredible achievement and something that we are very grateful to you all for. Thanks to your very generous support, we are able to secure the future of the TCPID and create many exciting opportunities for our students and graduates. We launched our TCPID online mentor training programme at the end of last year. We hope that you have found it useful so far and we would greatly welcome any feedback that you may have at any stage. We are very much looking forward to continuing working with you all in 2020. Here are just a few of our highlights over the past few months here in the TCPID. With warmest thanks as always for your support, TCPID Pathways Coordinator Email: [email protected] Tel: 01 8963885 Please follow all our latest news on our website at www.tcd.ie/tcpid as well as on Facebook @InclusionTCD, Twitter @IDTCD Instagram inclusiontcd as well as on LinkedIn www.linkedin.com/school/inclusiontcd Trinity College Dublin, The University of Dublin ASIAP Graduation Dr. Mary-Ann O’Donovan, Course Coordinator and Assistant Professor in Intellectual Disability and Inclusion: Friday January 31st 2020 was a very proud day for all of us in the TCPID as it was graduation day for our Level 5 Certificate in Arts, Science and Inclusive Applied Practice. -

Download the Report

ANNUAL REPORT 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 This third annual report of the Irish Takeover Panel is made to Mary Harney, T.D., Minister for Enterprise, Trade and Employment as required by section 19 of the Irish Takeover Panel Act, 1997 Irish Takeover Panel (Registration No. 265647), 8 Upper Mount Street, Dublin 2 Telephone: (01) 6789020 Facsimile: (01) 6789289 Contents Page Members of the Panel, Directors and Director General 3 Introduction 5 Chairperson’s Statement 7 Director General’s Report 9 Directors’ Report 13 Statement of Directors’ Responsibilities 15 Auditors’ Report 16 Financial Statements 18 Appendix 1 Administrative Appendix 24 Appendix 2 Takeovers supervised by Irish Takeover 31 Panel, July 1, 1999 to June 30, 2000 Appendix 3 List of Relevant Companies as 32 at June 30, 2000 Euro denominated memoranda Financial Statements 33 2 Members of the Panel Irish Association of Investment Managers Irish Clearing House Limited Nominated by the Irish Bankers Federation Irish Stock Exchange Limited Law Society of Ireland Brian Walsh Nominated by the Consultative Committee of Accountancy Bodies Ireland Directors of the Panel Chairperson Daniel O’Keeffe, S.C. } } Appointed by the Governor of the Central } Bank of Ireland Deputy Chairperson William M. McCann, FCA } Leonard Abrahamson Appointed by the Irish Stock Exchange (Alternate: Brendan O’Connor) Ann Fitzgerald Appointed by the Irish Association of Investment Managers Daniel J. Kitchen Appointed by the Consultative Committee of Accountancy Bodies Ireland Brian J. O’Connor Appointed by the Law Society of Ireland (Alternate: Laurence Shields) Roisin Brennan Appointed by the Irish Bankers Federation (Alternate: John Butler) Director General (and Secretary of the Panel) Miceal Ryan 3 4 Introduction The Irish Takeover Panel (“the Panel”) is the statutory body responsible for monitoring and supervising takeovers and other relevant transactions in Ireland. -

Financial Reporting Decisions MISSION

2020 Financial Reporting Supervision Unit Financial Reporting Decisions MISSION To contribute to Ireland having a strong regulatory environment in which to do business by supervising and promoting high quality financial reporting, auditing and effective regulation of the accounting profession in the public interest DISCLAIMER Whilst every effort has been made to ensure the accuracy of the information contained in this document, IAASA accepts no responsibility or liability howsoever arising from any errors, inaccuracies, or omissions occurring. IAASA reserves the right to take action, or refrain from taking action, which may or may not be in accordance with this document IAASA: Financial Reporting Decisions 2 Contents Page 1. Background & introduction .................................................................................................... 4 2. Bank of Ireland Group plc ...................................................................................................... 5 3. Crown Global Secondaries IV plc .......................................................................................... 8 4. Irish Residential Properties REIT plc................................................................................... 10 5. Kerry Group plc ................................................................................................................... 13 6. Kenmare Resources plc ...................................................................................................... 16 7. Smurfit Kappa Group plc .................................................................................................... -

Glanbia/Dawn Dairies and Golden Vale Dairies

DETERMINATION OF MERGER NOTIFICATION M/11/004 - Glanbia/Dawn Dairies and Golden Vale Dairies Section 21 of the Competition Act 2002 Proposed acquisition by Glanbia Foods Ireland Limited of the Limerick-based liquid milk business of Kerry Group plc Dated 1 April 2011 Introduction 1. On 19 January 2011, in accordance with section 18(3) of the Competition Act 2002 (the “Act”), the Competition Authority (the “Authority”) received a voluntary notification of a proposed acquisition by Glanbia Foods Ireland Limited (“Glanbia”) of the Limerick-based liquid milk business of Kerry Group plc (“Kerry”). The Kerry Limerick- based liquid milk business to be acquired (hereinafter the “Target Business”) comprises primarily the liquid milk business carried on by two wholly-owned subsidiaries of Kerry: Dawn Dairies Limited (“Dawn Dairies”) and Golden Vale Dairies Limited (“Golden Vale Dairies”) and certain other tangible and intangible assets described further below. 2. On 16 February 2011, the Authority served two Requirements for Further Information on Glanbia and Kerry pursuant to section 20(2) of the Act. This automatically suspended the procedure for the Authority’s Phase 1 assessment. 3. Upon receipt of the responses to the Requirements for Further Information, the “appropriate date” (as defined in section 19(6) of the Act) became 4 March 2011. 1 4. The notification contains an economic report prepared by Dr. Francis O’Toole on behalf of the parties (hereinafter, this report will be referred to as the “Economic Report”).2 The Economic Report provides the views of the parties on the markets that are likely to be affected by the proposed transaction. -

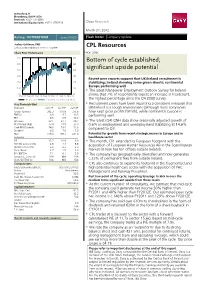

CPL Resources

www.davy.ie Bloomberg: DAVY<GO> Research: +353 1 6148997 Institutional Equity Sales: +353 1 6792816 Davy Research March 21, 2012 Rating: OUTPERFORM Issued 30/06/09 Flash Note: Company update Joshua Goldman, PhD [email protected] / +353 1 6148997 CPL Resources Share Price Performance Price: 298c 350 300 Bottom of cycle established; 300 260 significant upside potential 250 220 200 180 Recent peer reports suggest that UK/Ireland recruitment is 150 140 stabilizing; Ireland showing some green shoots; continental Europe performing well 100 100 • The latest Manpower Employment Outlook Survey for Ireland 50 60 Mar 09 Sep 09 Mar 10 Sep 10 Mar 11 Sep 11 Mar 12 shows that 7% of respondents expect an increase in headcount, CPL price (c) Rel to ISEQ overall index (rhs) the highest percentage since the Q4 2008 survey. Key financials (€m) • Recruitment peers have been reporting a consistent message that Year end Jun12E Jun13F Jun14F UK/Ireland is a tough environment (although most companies Group Turnover 292.3 310.9 335.8 have kept gross profits flattish), while continental Europe is EBITDA 8.9 9.7 10.5 performing well. PBT 8.9 9.5 10.4 EPS Basic 23.1 27.1 29.7 • The latest (Q4) QNH data show seasonally adjusted growth of EPS Diluted (Adj) 23.4 27.5 30.0 0.6% in employment and unemployment stabilizing at 14.6% Cash EPS (Diluted) 24.9 29.0 31.6 compared to Q3. Dividend 6.0 7.0 7.0 NBV 179.0 198.7 221.0 Potential for growth from recent strategic moves in Europe and in Valuation healthcare sector P/E 12.7 10.9 9.9 • This month, CPL extended its European footprint with the FCF Yld (pre div) (%) 2.8 7.4 8.8 Dividend Yield (%) 2.0 2.3 2.3 acquisition of European Human Resources AB in the Scandinavian Price / Book 1.7 1.5 1.3 market (it now has ten offices outside Ireland). -

Annual Report 2002 1 Financial Highlights

Kerry Group Annual Report & Accounts 2002 2002 at a Glance Sales increased by 25% to c3.8 billion Like-for-like sales growth of 6% EBITDA increased by 18% to c390m Operating profit* increased by 17% to c305m Adjusted profit after tax* up 22% to c189m Adjusted earnings per share* increased by 15.8% to 101.8 cent Final dividend per share up 16.3% to 7.85 cent e273m acquisition programme Free cash flow c232m *before goodwill and exceptionals Our Mission Kerry Group will be a major international specialist food ingredients corporation, a leading international flavour technology company and a leading supplier of added-value brands and customer branded foods to the Irish and UK markets. We will be leaders in our selected markets – excelling in product quality, technical and marketing creativity and service to our customers – through the skills and wholehearted commitment of our employees. We are committed to the highest standards of business and ethical behaviour, to fulfilling our responsibilities to the communities which we serve and to the creation of long-term value for all stakeholders on a socially and environmentally sustainable basis. Contents 2 Financial Highlights 3 Results in Brief 4 Chairman’s Statement 6 Managing Director’s Review 16 Business Review 18 Ireland and Rest of Europe 26 Americas 32 Asia Pacific 34 Financial Review 36 Financial History 37 Directors and Other Information 38 Report of the Directors 47 Independent Auditors’ Report 48 Statement of Accounting Policies 50 Group Financial Statements Kerry Group plc Annual Report -

Human Capital Management Industry Update Winter 2019

HUMAN CAPITAL MANAGEMENT STAFFING & RECRUITMENT – INDUSTRY UPDATE | Winter 2019 Houlihan Lokey Human Capital Management Houlihan Lokey is pleased to present its third Human Capital Management (HCM) Industry Update. Once again, we are happy to share industry insights, a public markets overview, a snapshot of relevant macroeconomic indicators, transaction announcements, and related detail. We believe this newsletter will provide you with the most important and relevant information you need to stay up to date with the HCM industry. We would also like to encourage you to meet with us at the SIA Executive Forum in Austin, Texas on February 25-28, 2019 where we would be happy to share recent market developments and further insights. If there is additional content that you would find useful for future updates, please do not hesitate to contact us with your suggestions. Regards, Thomas Bailey Jon Harrison Andrew Shell Managing Director Managing Director Vice President [email protected] [email protected] [email protected] 404.495.7056 +44 (0) 20 7747 7564 404.495.7002 Additional Human Capital Management Contacts Larry DeAngelo Pat O’Brien Alex Scott Bennett Tullos Mike Bertram Head of Business Services Associate Financial Analyst Financial Analyst Financial Analyst [email protected] [email protected] [email protected] [email protected] [email protected] 404.495.7019 404.495.7042 404.926.1609 404.926.1619 404.495.7040 Human Capital Management – Coverage by Subsector Staffing & VMS/MSP/RPO Talent Payroll/ HR Consulting/ Recruitment Management & PEO Benefits Admin Development -

CDP Ireland Climate Change Report 2015

1 CDP Ireland climate change report 2015 Irish Companies Demonstrating Leadership on Climate Change ‘On behalf of 822 investors with assets of US$95 trillion’ Programme Sponsors Report Sponsor Ireland partner to CDP and report writer 2 3 Contents 04 Foreword by Paul Dickinson Executive Chairman CDP 06 CDP Ireland Network 2015 Review by Brian O’ Kennedy 08 Commentary from SEAI 09 Commentary from EPA 10 Irish Emissions Reporting 12 Ireland Overview 14 CDP Ireland Network initiative 16 The Investor Impact 17 The Climate A List 2015 19 Investor Perspective 20 Investor signatories and members 22 Appendix I: Ireland responding companies 23 Appendix II: Global responding companies with operation in Ireland 27 CDP 2015 climate change scoring partners Important Notice The contents of this report may be used by anyone providing acknowledgement is given to CDP Worldwide (CDP). This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. Clearstream Solutions, and CDP have prepared the data and analysis in this report based on responses to the CDP 2015 information request. No represen- tation or warranty (express or implied) is given by Clearstream Solutions or CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, Clearstream Solutions and CDP do not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

20F Statement 2020

As filed with the United States Securities and Exchange Commission on July 28, 2020 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended: March 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☐ SHELL COMPANY REPORT PURSUANT/ TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report:___________ For the transition period from _________ to _________ Commission file number: 000-29304 Ryanair Holdings plc (Exact name of registrant as specified in its charter) Ryanair Holdings plc (Translation of registrant’s name into English) Republic of Ireland (Jurisdiction of incorporation or organization) c/o Ryanair DAC Dublin Office Airside Business Park, Swords County Dublin, K67 NY94, Ireland (Address of principal executive offices) Please see “Item 4. Information on the Company” herein. (Name, telephone, e-mail and/or facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Trading Symbol(s) Name of each exchange on which registered American Depositary Shares, each representing RYAAY The NASDAQ Stock Market LLC five Ordinary Shares Ordinary Shares, par value 0.6 euro cent per share RYAAY The NASDAQ Stock Market LLC (not for trading but only in connection with the registration of the American Depositary Shares) Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report. -

Scheme Document. the Scheme Meeting Will Start at 12 Noon on That Date and the EGM at 12.15 P.M

174368 Proof 6 Tuesday, November 24, 2020 22:39 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this Scheme Document and what action you should take, you should consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser who, if you are taking advice in Ireland, is authorised or exempted under the European Union (Markets in Financial Instruments) Regulations 2017 (S.I. No. 375 of 2017) or the Investment Intermediaries Act 1995 (as amended) or, if you are taking such advice in the United Kingdom, is authorised pursuant to the Financial Services and Markets Act 2000 of the United Kingdom or, if you are taking advice elsewhere, is an appropriately authorised independent financial adviser. If you have sold or otherwise transferred all your Cpl Shares, please send this Scheme Document and the accompanying documents at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. The release, publication or distribution of this Scheme Document in or into jurisdictions other than Ireland and the United Kingdom may be restricted by law and therefore persons into whose possession this Scheme Document comes should inform themselves about and observe such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable Law, the companies involved in the Acquisition disclaim any responsibility or liability for the violation of any such restrictions by any person. -

CSI BHR Report

IRISH BUSINESS & HUMAN RIGHTS: Benchmarking compliance with the UN Guiding Principles Centre for Social Innovation, Trinity Business School Benn Finlay Hogan ML Rhodes Susan P. Murphy Mary Lawlor 8 November 2019 Benchmarking Compliance with the UN Guiding Principles Table of Contents 1. Introduction......................................................................................................................... 1 2. Background........................................................................................................................ 3 3. Benchmarking Process....................................................................................................... 5 3.1 What are we benchmarking against?........................................................................... 5 3.2 Choosing the Corporate Human Rights Benchmark methodology.............................. 5 3.3 Benchmarking indicators in the CHRB methodology................................................... 7 3.4 Selecting a sample of Irish companies........................................................................ 9 3.5 Data collection........................................................................................................... 12 3.6 Quality assurance...................................................................................................... 13 3.7 Constraints and limitations......................................................................................... 13 4. Findings........................................................................................................................... -

Creating Impact – Achieving Results

30% Club Ireland CEO & Chairs Third Annual Conference Creating Impact – Achieving Results 25 January 2017 #30pcImpact National Gallery of Ireland Clare Street, Dublin 2 3.45pm Registration 4pm Seminar 6:15-7.30pm Reception & Networking @30percentclubIE www.30percentclub.org 30% Club Ireland Creating Impact Achieving Results 25 January 2017 2 Creating Impact Achieving Results 25 January 2017 Agenda 4.00pm Opening Remarks An Tánaiste and Minister for Justice and Equality, Frances Fitzgerald TD 4.15pm Welcome Marie O’Connor, Partner, PwC, Country Lead, 30% Club Ireland 4.25pm Painting the Picture: Research Update 2016 Facilitator: Conor O’Leary, Group Company Secretary, Greencore Anne-Marie Taylor, Management Consultant - Women in Management and Women on Boards: the Irish picture Darina Barrett, Partner, KPMG - The Think Future Study 2016 Dr Sorcha McKenna, Partner, McKinsey – Women Matter: Women in the Workplace 2016 4.45pm Sasha Wiggins introduces Lady Barbara Judge Sasha Wiggins, CEO, Barclays Bank Ireland introduces Lady Barbara Judge, Chair, Institute of Directors 5.00pm Taking Action Facilitator: Melíosa O’Caoimh, Senior Vice President, Northern Trust Anne Heraty, CEO, CPL Resources and President of Ibec Gareth Lambe, Head of Facebook Ireland Pat O’Doherty, CEO, ESB Brian O’Gorman, Managing Partner, Arthur Cox 5.25pm Leadership Commitment and Accountability - Perspective of the Chair Facilitator: Bríd Horan, Former Deputy CEO, ESB Rose Hynes, Chair, Shannon Group and Origin Enterprises Gary Kennedy, Chair, Greencore Gary McGann, Chair, Paddy Power Betfair 5.45pm Diplomacy, Diaspora and Diversity Anne Anderson, Ambassador of Ireland to the United States 6.00pm Future Plans & Closing Remarks Carol Andrews, Global Head of Client Service and Prime Custody (AIS), BNY Mellon Please note that this is an on the record event and views expressed are not necessarily representative of all 30% Club members.