ISEQ® All-Share

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TCPID Update February 2020

Update from the Trinity Centre for People with Intellectual Disabilities School of Education, Trinity College Dublin February 2020 Trinity College Dublin, The University of Dublin Update from the Trinity Centre for People with Intellectual Disabilities, School of Education, Trinity College Dublin February 2020 Dear Partners, Thank you all as always for your continued support for the Trinity Centre for People with Intellectual Disabilities. We now have more than 30 TCPID Business Partners and Business Patrons which is an incredible achievement and something that we are very grateful to you all for. Thanks to your very generous support, we are able to secure the future of the TCPID and create many exciting opportunities for our students and graduates. We launched our TCPID online mentor training programme at the end of last year. We hope that you have found it useful so far and we would greatly welcome any feedback that you may have at any stage. We are very much looking forward to continuing working with you all in 2020. Here are just a few of our highlights over the past few months here in the TCPID. With warmest thanks as always for your support, TCPID Pathways Coordinator Email: [email protected] Tel: 01 8963885 Please follow all our latest news on our website at www.tcd.ie/tcpid as well as on Facebook @InclusionTCD, Twitter @IDTCD Instagram inclusiontcd as well as on LinkedIn www.linkedin.com/school/inclusiontcd Trinity College Dublin, The University of Dublin ASIAP Graduation Dr. Mary-Ann O’Donovan, Course Coordinator and Assistant Professor in Intellectual Disability and Inclusion: Friday January 31st 2020 was a very proud day for all of us in the TCPID as it was graduation day for our Level 5 Certificate in Arts, Science and Inclusive Applied Practice. -

Kenmare Resources Plc Moma Titanium Minerals Mine

Kenmare Resources plc Moma Titanium Minerals Mine 2013 Half Yearly Results Trading Update Disclaimer This Confidential Presentation (the “Presentation”) has been prepared and issued by Kenmare Resources plc (the “Company” or “Kenmare”). While this Presentation has been prepared in good faith, the Company and its respective officers, employees, agents and representatives expressly disclaim any and all liability for the contents of, or omissions from, this Presentation, and for any other written or oral communication transmitted or made available to the recipient or any of its officers, employees, agents or representatives. No representations or warranties are or will be expressed or are to be implied on the part of the Company, or any of its respective officers, employees, agents or representatives in or from this Presentation or any other written or oral communication from the Company, or any of its respective officers, employees, agents or representatives concerning the Company or any other factors relevant to any transaction involving the Company or as to the accuracy, completeness or fairness of this Presentation, the information or opinions on which it is based, or any other written or oral information made available in connection with the Company. This Presentation does not constitute or form part of, and should not be construed as, an offer, invitation or inducement to purchase or subscribe for any securities of the Company nor shall it or any part of it form the basis of, or be relied upon in connection with, any contract or investment decision relating to such securities, nor does it constitute a recommendation regarding the securities of the Company. -

2020-08-19 KMR H1 2020 Results and Interim Dividend Announcement

Kenmare Resources plc, 4th Floor, Styne House, Hatch Street Upper, Dublin 2, D02 DY27, Ireland T: +353 1 671 0411 E: [email protected] W: www.kenmareresources.com Kenmare Resources plc (“Kenmare” or “the Company” or “the Group”) 19 August 2020 Half-yearly results for the six months to 30 June 2020 and interim dividend Kenmare Resources plc (LSE:KMR, ISE:KMR), one of the leading global producers of titanium minerals and zircon, which operates the Moma Titanium Minerals Mine (the "Mine" or "Moma") in northern Mozambique, today announces its half year results for the six month period ended 30 June 2020 (“H1 2020”) and declares its interim dividend. The Company also provides updated full year (“FY”) 2020 guidance. Statement from Michael Carvill, Managing Director: “Our performance during the first half of 2020 demonstrated Kenmare’s resilience and agility, effectively managing many challenges posed by the COVID-19 pandemic to continue to produce and ship our products safely. Although production was weaker in H1 2020 than in the corresponding period last year, our business remained profitable and I am pleased to announce an interim dividend of USc2.31 per share. This represents 20% of profit after tax, in line with our dividend policy. Market conditions for titanium feedstocks continued to strengthen in H1 2020, driving a 28% increase in received ilmenite prices, to US$217 per tonne, compared to last year. We have agreements for the majority of our H2 2020 ilmenite production, although market conditions are expected to become more subdued in the second half of the year. We continue to actively manage COVID-19-related disruption to the relocation of Wet Concentrator Plant B. -

Download the Report

ANNUAL REPORT 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 IRISH TAKEOVER PANEL Report for the year ended June 30, 2000 This third annual report of the Irish Takeover Panel is made to Mary Harney, T.D., Minister for Enterprise, Trade and Employment as required by section 19 of the Irish Takeover Panel Act, 1997 Irish Takeover Panel (Registration No. 265647), 8 Upper Mount Street, Dublin 2 Telephone: (01) 6789020 Facsimile: (01) 6789289 Contents Page Members of the Panel, Directors and Director General 3 Introduction 5 Chairperson’s Statement 7 Director General’s Report 9 Directors’ Report 13 Statement of Directors’ Responsibilities 15 Auditors’ Report 16 Financial Statements 18 Appendix 1 Administrative Appendix 24 Appendix 2 Takeovers supervised by Irish Takeover 31 Panel, July 1, 1999 to June 30, 2000 Appendix 3 List of Relevant Companies as 32 at June 30, 2000 Euro denominated memoranda Financial Statements 33 2 Members of the Panel Irish Association of Investment Managers Irish Clearing House Limited Nominated by the Irish Bankers Federation Irish Stock Exchange Limited Law Society of Ireland Brian Walsh Nominated by the Consultative Committee of Accountancy Bodies Ireland Directors of the Panel Chairperson Daniel O’Keeffe, S.C. } } Appointed by the Governor of the Central } Bank of Ireland Deputy Chairperson William M. McCann, FCA } Leonard Abrahamson Appointed by the Irish Stock Exchange (Alternate: Brendan O’Connor) Ann Fitzgerald Appointed by the Irish Association of Investment Managers Daniel J. Kitchen Appointed by the Consultative Committee of Accountancy Bodies Ireland Brian J. O’Connor Appointed by the Law Society of Ireland (Alternate: Laurence Shields) Roisin Brennan Appointed by the Irish Bankers Federation (Alternate: John Butler) Director General (and Secretary of the Panel) Miceal Ryan 3 4 Introduction The Irish Takeover Panel (“the Panel”) is the statutory body responsible for monitoring and supervising takeovers and other relevant transactions in Ireland. -

Financial Reporting Decisions MISSION

2020 Financial Reporting Supervision Unit Financial Reporting Decisions MISSION To contribute to Ireland having a strong regulatory environment in which to do business by supervising and promoting high quality financial reporting, auditing and effective regulation of the accounting profession in the public interest DISCLAIMER Whilst every effort has been made to ensure the accuracy of the information contained in this document, IAASA accepts no responsibility or liability howsoever arising from any errors, inaccuracies, or omissions occurring. IAASA reserves the right to take action, or refrain from taking action, which may or may not be in accordance with this document IAASA: Financial Reporting Decisions 2 Contents Page 1. Background & introduction .................................................................................................... 4 2. Bank of Ireland Group plc ...................................................................................................... 5 3. Crown Global Secondaries IV plc .......................................................................................... 8 4. Irish Residential Properties REIT plc................................................................................... 10 5. Kerry Group plc ................................................................................................................... 13 6. Kenmare Resources plc ...................................................................................................... 16 7. Smurfit Kappa Group plc .................................................................................................... -

Kenmare Resources CASE STUDY

Kenmare Resources CASE STUDY About SNAPSHOT Metals and Mining Kenmare Resources is an Irish incorporated mining company with its head office INDUSTRY located in Dublin. The company is a member of the FTSE All-Share Index and has a premium listing on the London Stock Exchange and a secondary listing on the Irish 1500 Stock Exchange. EMPLOYEES & CONTRACTORS The principal activity of the company is the operation of the Moma Titanium Minerals Mine, which is located on the north east coast of Mozambique. The Moma Mine Mozambique contains deposits of heavy minerals which include the titanium minerals ilmenite and PROJECT LOCATION rutile, as well as the zirconium silicate mineral, zircon. 2014 CUSTOMER SINCE Q&A PRODUCTS & SERVICES We spoke to Jose Sinanhal, System Administrator at Kenmare Resources, about their need for a workforce management solution to improve their compliance, reduce their INX InControl risk and increase their productivity. Training What were you using to previously manage your workforce in these areas? Data migration We were previously using another EHS solution which had a number of limitations and gaps in functionality such as action management and root case analysis. RELEVANT SOLUTIONS Safety What was sought in a new system? Risk We sought a new user-friendly system were all data and reporting would be maintained, managed and readily available when required. Compliance What have been some notable changes since implementing the system? Since implementing INX, the most notable positive changes have included: • Ease of and range of reporting • Redefining the ‘assign user’ security access, • Aligning the monthly stats with Kenmare Report systems • Focus on relevant and important incidents and events with the ability to better manage and report. -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 26 May 2020 08:37 BST Upcoming Events Select headline to navigate to article ARYZTA COVID-19 challenges to the fore, though liquidity Company Events robust 26-May ARYZTA; Q320 Results 27-May Hibernia REIT; FY Results FBD Holdings Business update on BI cover; test case to 28-May Non-Standard Finance; FY19 Results Norwegian Air Shuttle; Q120 Results go to commercial courts Irish Banks EBA paper on first insights into Covid-19 impact on EU banks Mondi Ferguson CFO joins Mondi Economic Events Ireland 28-May Retail Sales Apr20 United Kingdom United States Europe This document is intended for the sole use of Goodbody Stockbrokers and its affiliates Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers UC, trading as “Goodbody”, is regulated by the Central Bank of Ireland. In the UK, Goodbody is authorised and subject to limited regulation by the Financial Conduct Authority. Goodbody is a member of Euronext Dublin and the London Stock Exchange. Goodbody is a member of the FEXCO group of companies. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate, Goodbody Stockbrokers Goodbody Morning Wrap ARYZTA COVID-19 challenges to the fore, though liquidity robust ARYZTA provided a Q3 update (end April) this morning with organic revenues down 21.5%. Recommendation: Hold ARYZTA now expects that COVID-19 will have a material impact on FY20 performance Closing Price: €0.44 though it is not possible to fully assess the consequences that will result from the short and longer-term impact. -

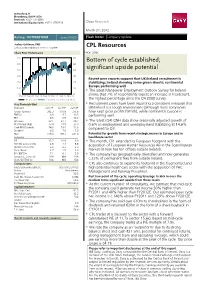

CPL Resources

www.davy.ie Bloomberg: DAVY<GO> Research: +353 1 6148997 Institutional Equity Sales: +353 1 6792816 Davy Research March 21, 2012 Rating: OUTPERFORM Issued 30/06/09 Flash Note: Company update Joshua Goldman, PhD [email protected] / +353 1 6148997 CPL Resources Share Price Performance Price: 298c 350 300 Bottom of cycle established; 300 260 significant upside potential 250 220 200 180 Recent peer reports suggest that UK/Ireland recruitment is 150 140 stabilizing; Ireland showing some green shoots; continental Europe performing well 100 100 • The latest Manpower Employment Outlook Survey for Ireland 50 60 Mar 09 Sep 09 Mar 10 Sep 10 Mar 11 Sep 11 Mar 12 shows that 7% of respondents expect an increase in headcount, CPL price (c) Rel to ISEQ overall index (rhs) the highest percentage since the Q4 2008 survey. Key financials (€m) • Recruitment peers have been reporting a consistent message that Year end Jun12E Jun13F Jun14F UK/Ireland is a tough environment (although most companies Group Turnover 292.3 310.9 335.8 have kept gross profits flattish), while continental Europe is EBITDA 8.9 9.7 10.5 performing well. PBT 8.9 9.5 10.4 EPS Basic 23.1 27.1 29.7 • The latest (Q4) QNH data show seasonally adjusted growth of EPS Diluted (Adj) 23.4 27.5 30.0 0.6% in employment and unemployment stabilizing at 14.6% Cash EPS (Diluted) 24.9 29.0 31.6 compared to Q3. Dividend 6.0 7.0 7.0 NBV 179.0 198.7 221.0 Potential for growth from recent strategic moves in Europe and in Valuation healthcare sector P/E 12.7 10.9 9.9 • This month, CPL extended its European footprint with the FCF Yld (pre div) (%) 2.8 7.4 8.8 Dividend Yield (%) 2.0 2.3 2.3 acquisition of European Human Resources AB in the Scandinavian Price / Book 1.7 1.5 1.3 market (it now has ten offices outside Ireland). -

Human Capital Management Industry Update Winter 2019

HUMAN CAPITAL MANAGEMENT STAFFING & RECRUITMENT – INDUSTRY UPDATE | Winter 2019 Houlihan Lokey Human Capital Management Houlihan Lokey is pleased to present its third Human Capital Management (HCM) Industry Update. Once again, we are happy to share industry insights, a public markets overview, a snapshot of relevant macroeconomic indicators, transaction announcements, and related detail. We believe this newsletter will provide you with the most important and relevant information you need to stay up to date with the HCM industry. We would also like to encourage you to meet with us at the SIA Executive Forum in Austin, Texas on February 25-28, 2019 where we would be happy to share recent market developments and further insights. If there is additional content that you would find useful for future updates, please do not hesitate to contact us with your suggestions. Regards, Thomas Bailey Jon Harrison Andrew Shell Managing Director Managing Director Vice President [email protected] [email protected] [email protected] 404.495.7056 +44 (0) 20 7747 7564 404.495.7002 Additional Human Capital Management Contacts Larry DeAngelo Pat O’Brien Alex Scott Bennett Tullos Mike Bertram Head of Business Services Associate Financial Analyst Financial Analyst Financial Analyst [email protected] [email protected] [email protected] [email protected] [email protected] 404.495.7019 404.495.7042 404.926.1609 404.926.1619 404.495.7040 Human Capital Management – Coverage by Subsector Staffing & VMS/MSP/RPO Talent Payroll/ HR Consulting/ Recruitment Management & PEO Benefits Admin Development -

Morning Wrap

Morning Wrap Today ’s Newsflow Equity Research 19 Apr 2016 Upcoming Events Select headline to navigate to article Kerry Group Mixed set of results from customers Company Events 19-Apr Associated British Foods; Q2'16 results Origin Enterprises ABF sees declines in agri sales Danone; Q1'16 results 20-Apr Packaging Corp. of America; Q1'16 results Cairn Homes Cairn turns attention from buying to building Punch Taverns PLC; Q2'16 results UK Economic View Brexit “remain” campaign moves up a gear Economic Events Ireland United Kingdom United States 19-Apr Housing Starts Mar'16 Europe 19-Apr Current Account Feb'16 21-Apr Consumer Confidence Indicator Feb'16 Goodbody Capital Markets Equity Research +353 1 6419221 Equity Sales +353 1 6670222 Bloomberg GDSE<GO> Goodbody Stockbrokers (trading as Goodbody) is regulated by the Central Bank of Ireland. For the attention of US clients of Goodbody Securities Inc, this third-party research report has been produced by our affiliate Goodbody Stockbrokers. Please see the end of this report for analyst certifications and other important disclosures. Goodbody Morning Wrap Kerry Group Mixed set of results from customers Danone reported Q1 results this morning, with lfl Group sales growth of 3.5% (vs. 3.2% Recommendation: Buy forecast) and volume growth of 0.8% (vs. 1.3% forecast). This is a slight regression from Q3 Closing Price: €82.15 and Q4 when volumes grew by +0.8% and +1.3% respectively. The Waters and Medical Liam Igoe Nutrition division grew volumes strongly, at +6.4% and +5.2% respectively. However, the +353-1-641 9450 Fresh Dairy’s division was down 2.1% while Early Life Nutrition saw volume growth of 1.3%. -

Scheme Document. the Scheme Meeting Will Start at 12 Noon on That Date and the EGM at 12.15 P.M

174368 Proof 6 Tuesday, November 24, 2020 22:39 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this Scheme Document and what action you should take, you should consult your stockbroker, bank manager, solicitor, accountant or other independent financial adviser who, if you are taking advice in Ireland, is authorised or exempted under the European Union (Markets in Financial Instruments) Regulations 2017 (S.I. No. 375 of 2017) or the Investment Intermediaries Act 1995 (as amended) or, if you are taking such advice in the United Kingdom, is authorised pursuant to the Financial Services and Markets Act 2000 of the United Kingdom or, if you are taking advice elsewhere, is an appropriately authorised independent financial adviser. If you have sold or otherwise transferred all your Cpl Shares, please send this Scheme Document and the accompanying documents at once to the purchaser or transferee, or to the stockbroker, bank or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. The release, publication or distribution of this Scheme Document in or into jurisdictions other than Ireland and the United Kingdom may be restricted by law and therefore persons into whose possession this Scheme Document comes should inform themselves about and observe such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable Law, the companies involved in the Acquisition disclaim any responsibility or liability for the violation of any such restrictions by any person. -

Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start

eurex circular 2 41/05 Date: Frankfurt, November 30, 2005 Recipients: All Eurex members, CCP members and vendors Authorized by: Daniel Gisler Introduction of a Central Counterparty at Irish Stock Exchange Information for Production Start Related Eurex Circulars: 057/05, 230/05 Contact: Customer Support, tel. +49-69-211-1 17 00 E-mail: [email protected] Content may be most important for: Attachment: Ü Front Office / Trading Updated List of CCP-eligible Securities for ISE Ü Middle + Back Office Ü Auditing / Security Coordination With this circular we complement information on the introduction of a Central Counterparty for the Irish stock market scheduled for next Monday, December 5, 2005. The Central Counterparty (CCP) for securities traded in the Xetra order book at Irish Stock Exchange (ISE) originated from a common initiative of Irish Stock Exchange, Euroclear/CRESTCo Limited and Deutsche Börse AG. Eurex Clearing AG, which already renders CCP services for other markets, acts as CCP. The product range for production start on December 5, 2005 comprises Irish stocks and Exchange Traded Funds (ETFs) traded in the Xetra order book at Irish Stock Exchange. Please find attached to this circular an updated list of securities which will be CCP-eligible for ISE effective December 5, 2005. Should you have any questions or require further information, please feel free to contact the Customer Support Team at tel. +49-69-211-1 17 00. Eurex Clearing AG Customer Support Chairman of the Executive Board: Aktiengesellschaft mit Sitz D-60485 Frankfurt/Main Tel. +49-69-211-1 17 00 Supervisory Board: Rudolf Ferscha (CEO), in Frankfurt/Main www.eurexchange.com Fax +49-69-211-1 17 01 Dr.