Exporting Squid and Cuttlefish to Europe 1. Product Description

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Influences of Squid Ink Added to Low Salt Fermented Squid on Its Changes in Lactic Acid Bacteria

Korean J. Food & Nutr. Vol. 26. No. 4, 678~684 (2013) THE KOREAN JOURNAL OF http://dx.doi.org/10.9799/ksfan.2013.26.4.678 한국식품영양학회지 FOOD AND NUTRITION Influences of Squid Ink Added to Low Salt Fermented Squid on Its Changes in Lactic Acid Bacteria †Sung-Cheon Oh Dept. of Food & Pharmacy, Daewon University College, Jecheon 390-702, Korea 저염 오징어 젓갈의 숙성 중 오징어 먹즙 첨가가 젖산균의 변화에 미치는 영향 †오 성 천 대원대학교 제약식품계열 국문요약 오징어 먹즙을 첨가하지 않은 저염 오징어 젓갈은 숙성 발효에 따라 숙성 초기에 젖산균 총수가 급속히 증가하고, Leuconostoc이 증가하여 숙성 적기에 최대량을 나타내고 이후 서서히 감소하였다. Lactobacillus는 숙성 적기 이후의 총 균수의 대부분을 차지할 만큼 균수가 많아지므로 숙성 적기 이후 품질에 관여하는 것으로 보인다. Streptococcus와 Pediococcus는 숙성 적기까지 완만하게 증가하다가 이후 급격히 감소하였다. Yeast는 숙성 중기 이후에 검출되고, 숙성 말기에 급격히 증가하므로 부패에 주로 관여하는 것으로 보인다. 오징어 먹즙을 첨가한 저염 오징어 젓갈의 숙성발효에 따른 젖산균의 변화를 보면 총 균수는 숙성 중반까지 증가하다가 중반 이후 약간 감소하였으나, 최대치에 도달하는 기간은 무 첨가군에 비하여 길었고, 젖산균 중 Leuconostoc, Streptococcus 및 Pediococcus는 숙성 후반까지 증가하였다가 후반에 감소하는 반면에, Lactobacillus는 숙성 후반까지 계속 증가하였다. Yeast는 숙성 초기에는 거의 증가하지 않다가 숙성 중반 이후 증가하였는데, 이러한 경향은 무 첨가군과 유사하였으나 젖산균의 수가 무 첨가군에 비하여 적었다. 오징어 먹즙을 첨가한 저염 오징어 젓갈에서 모든 균들의 수가 감소되어 오징어 먹즙이 균들의 성장 을 억제하는 것으로 확인되었다. Key words: lactic acid bacteria, low salt fermented squid, squid ink, yeast, ripening Introduction is a dominant strain in the ripening stage regardless of the salt concentration although higher salt concentration reduces the Fermented squid is a fermented seafood product which contains bacterial count in an extract (Mori et al. -

Thermal Behavior, Microstructure and Protein Quality of Squid Fillets Dried

Food Control 36 (2014) 102e110 Contents lists available at ScienceDirect Food Control journal homepage: www.elsevier.com/locate/foodcont Thermal behavior, microstructure and protein quality of squid fillets dried by far-infrared assisted heat pump drying Yun Deng a, Yuegang Wang a, Jin Yue a,*, Zhenmin Liu b, Yuanrong Zheng b, Bingjun Qian b, Yu Zhong a, Yanyun Zhao a,c,* a SJTU-Bor Luh Food Safety Center, Department of Food Science and Technology, Shanghai Jiao Tong University, 800 Dongchuan Road, Shanghai 200240, PR China b Dairy Research Institute, Bright Dairy & Food Co., Ltd., Bldg 2, No.1518, West Jiangchang Road, Shanghai 200436, PR China c Department of Food Science and Technology, 100 Wiegand Hall, Oregon State University, Corvallis, OR, USA article info abstract Article history: The effects of far-infrared assisted heat pump drying on the thermal behavior, microstructure and protein Received 6 May 2013 quality of squid fillets were studied. Heat pump drying (HPD) alone or in combination with far-infrared À Received in revised form radiation (FIR) at the power of 100, 500 and 800 W, 40 C and 2 m s 1 air velocity were compared. 3 August 2013 Nitrogen fractions, proteases activities, amino acid profile, microstructure, SDS-PAGE and protein quality Accepted 5 August 2013 of fresh and dried squid samples were examined. Results showed that glutamic acid, aspartic acid, lysine and isoleucine are the dominant amino acids in all samples. The total contents of essential amino acid Keywords: and non-essential amino acid, essential amino acid index, estimated protein efficiency ratio and bio- Heat pump drying fi > Far-infrared radiation logical value were not signi cantly different among all squid samples (P 0.05). -

Ruins Hold Special Place in Island's History

Business cards, flyers, invitations and more! Contact printshop.stripes.com 042-552-2510 (extension77315) 227-7315 VOLUME 13 NO. 33 AUGUST 8 − AUGUST 14, 2019 SUBMIT STORIES TO: [email protected] STRIPESOKINAWA.COM FACEBOOK.COM/STRIPESPACIFIC FREE INSIDE INFO KATSUREN CHANGES TO MILITARY MAIL MAY BE COMING PAGES 2-3 CASTLE Ruins hold special place in island’s history MARINES GET READY FOR OKINAWA, FUJI PAGE 3 ENJOY THE SIMPLICITY OF INARIZUSHI PAGE 5 PAGES 4 -5 IT’S EISA TIME! PAGE 8 gs rin a Kimodameshi b naw l to Oki hil shopping malls as seasonal attractions. Hor- BY TAKAHIRO TAKIGUCHI,c STRIPES OKINAWA ror movies and reports of haunted locations are televised, while popular kimodameshi uch like Halloween in October in (literally, to test your courage through scared the West, mid-summer is a sea- route) games are enjoyed in schools and local Mson to intersect with the dead in communities throughout summertime. Japan, as deceased ancestors are believed to Just like horror films and scary stories give visit and spend few days with us during tradi- you goosebumps, kimodameshi and haunted Special 8-page tional Obon period (August 13-15). houses make the Japanese cool with fear and Also similar to the U.S., temporary haunt- File photos pullout inside! ed houses are built in amusement parks or SEE KIMODAMESHI ON PAGE 6 2 STRIPES OKINAWA A STARS AND STRIPES COMMUNITY PUBLICATION AUGUST 8 − AUGUST 14, 2019 Military mail may be affected by US treaty withdrawal BY WYATT OLSON, to be counting on a meeting STARS AND STRIPES scheduled for September dur- Max D. -

Changes in Tissue Proteinase Activity of Indian Mackerel Upon Curing in Brine and Salt

CHANGES IN TISSUE PROTEINASE ACTIVITY OF INDIAN MACKEREL UPON CURING IN BRINE AND SALT by LEEMA JOSE, P. SEEMA NAIR and M.R RAGHUNATH Biochemistry and Nutrition Division, Central Institute of Fisheries Technology Matsyapuri PO, Kochi - 682 029, INDIA ABSTRACT Autolytic activity in the muscle of Indian mackerel (Rastrelliger kanagurta) cured in saturated brine and dry salt, was monitored at pH 3, 4, 9 and 10 along with weight loss, moisture, salt and a- amino nitrogen, at 3, 6, 12, 24 and 48h of curing. The fish lost 14 to 29% of the initial weight after 48h of curing, in brine and dry salt, respectively. Correspondingly the moisture decreased from 76 to 57% in brine cured and 52% in dry salted fish. Salt content in the muscle increased from 1% to 14.82 and 13.32% in the case of brine cured and dry salted mackerel respectively, with slower uptake of salt in the latter because of the lesser surface area in contact. Tissue proteinases were activated initially in all cases when salting commenced, with higher activation in the case of pH 3 and 4. But subsequently increasing salt concentrations.suppressed the autolytic activity. Autolytic proteinases in the mackerel muscle were suppressed between 37 to 78% of their original activity in case of the brine cured fish and between 36 to 74% in the dry salted fish, at the pH assayed. Concentration of a-amino nitrogen in the muscle increased initially in both types of curing at 3 h, but decreased later on. Autolytic activity assayed in the presence of salt containing buffers showed that at 10-20% salt level, (the concentrations prevailing in fish after 48h salting), 36-71% of the original tissue proteinase activity was still intact, which can affect cured product quality. -

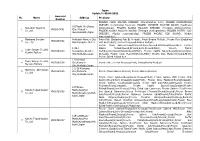

Japan Update to 05.04.2021 Approval No Name Address Products Number FROZEN CHUM SALMON DRESSED (Oncorhynchus Keta)

Japan Update to 05.04.2021 Approval No Name Address Products Number FROZEN CHUM SALMON DRESSED (Oncorhynchus keta). FROZEN DOLPHINFISH DRESSED (Coryphaena hippurus). FROZEN JAPANESE SARDINE ROUND (Sardinops 81,Misaki-Cho,Rausu- Kaneshin Tsuyama melanostictus). FROZEN ALASKA POLLACK DRESSED (Theragra chalcogramma). 1 VN01870001 Cho, Menashi- Co.,Ltd FROZEN ALASKA POLLACK ROUND (Theragra chalcogramma). FROZEN PACIFIC COD Gun,Hokkaido,Japan DRESSED. (Gadus macrocephalus). FROZEN PACIFIC COD ROUND. (Gadus macrocephalus) Maekawa Shouten Hokkaido Nemuro City Fresh Fish (Excluding Fish By-Product); Fresh Bivalve Mollusk.; Frozen Fish (Excluding 2 VN01860002 Co., Ltd Nishihamacho 10-177 Fish By-Product); Frozen Processed Bivalve Mollusk; Frozen Chum Salmon(Round,Dressed,Semi-Dressed,Fillet,Head,Bone,Skin); Frozen 1-35-1 Alaska Pollack(Round,Dressed,Semi-Dressed,Fillet); Frozen Pacific Taiyo Sangyo Co.,Ltd. 3 VN01840003 Showachuo,Kushiro- Cod(Round,Dressed,Semi-Dressed,Fillet); Frozen Pacific Saury(Round,Dressed,Semi- Kushiro Factory City,Hokkaido,Japan Dressed); Frozen Chub Mackerel(Round,Fillet); Frozen Blue Mackerel(Round,Fillet); Frozen Salted Pollack Roe 3-9 Komaba- Taiyo Sangyo Co.,Ltd. 4 VN01860004 Cho,Nemuro- Frozen Fish ; Frozen Processed Fish; (Excluding By-Product) Nemuro Factory City,Hokkaido,Japan 3-2-20 Kitahama- Marutoku Abe Suisan 5 VN01920005 Cho,Monbetu- Frozen Chum Salmon Dressed; Frozen Salmon Dressed Co.,Ltd City,Hokkaido,Japan Frozen Chum Salmon(Round,Semi-Dressed,Fillet); Frozen Salmon Milt; Frozen Pink Salmon(Round,Semi-Dressed,Dressed,Fillet); -

Approved List of Japanese Fishery Fbos for Export to Vietnam Updated: 11/6/2021

Approved list of Japanese fishery FBOs for export to Vietnam Updated: 11/6/2021 Business Approval No Address Type of products Name number FROZEN CHUM SALMON DRESSED (Oncorhynchus keta) FROZEN DOLPHINFISH DRESSED (Coryphaena hippurus) FROZEN JAPANESE SARDINE ROUND (Sardinops melanostictus) FROZEN ALASKA POLLACK DRESSED (Theragra chalcogramma) 420, Misaki-cho, FROZEN ALASKA POLLACK ROUND Kaneshin Rausu-cho, (Theragra chalcogramma) 1. Tsuyama CO., VN01870001 Menashi-gun, FROZEN PACIFIC COD DRESSED LTD Hokkaido, Japan (Gadus macrocephalus) FROZEN PACIFIC COD ROUND (Gadus macrocephalus) FROZEN DOLPHIN FISH ROUND (Coryphaena hippurus) FROZEN ARABESQUE GREENLING ROUND (Pleurogrammus azonus) FROZEN PINK SALMON DRESSED (Oncorhynchus gorbuscha) - Fresh fish (excluding fish by-product) Maekawa Hokkaido Nemuro - Fresh bivalve mollusk. 2. Shouten Co., VN01860002 City Nishihamacho - Frozen fish (excluding fish by-product) Ltd 10-177 - Frozen processed bivalve mollusk Frozen Chum Salmon (round, dressed, semi- dressed,fillet,head,bone,skin) Frozen Alaska Pollack(round,dressed,semi- TAIYO 1-35-1 dressed,fillet) SANGYO CO., SHOWACHUO, Frozen Pacific Cod(round,dressed,semi- 3. LTD. VN01840003 KUSHIRO-CITY, dressed,fillet) KUSHIRO HOKKAIDO, Frozen Pacific Saury(round,dressed,semi- FACTORY JAPAN dressed) Frozen Chub Mackerel(round,fillet) Frozen Blue Mackerel(round,fillet) Frozen Salted Pollack Roe TAIYO 3-9 KOMABA- SANGYO CO., CHO, NEMURO- - Frozen fish 4. LTD. VN01860004 CITY, - Frozen processed fish NEMURO HOKKAIDO, (excluding by-product) FACTORY JAPAN -

Le Dynasty – Takeaway Menu

LE DYNASTY – TAKEAWAY MENU ENTRÉE FROM THE WOK CHẢ GIÒ - Fried Spring Rolls (4 rolls) $7.20 GÀ/BÒ/HEO SA TẾ – Chicken or Beef or Pork Sate $20 The classic, deep-fried Vietnamese spring roll homemade w/ pork Your choice of meat, braised w/ baby corn & onion in the chef’s mince & vermicelli. Served w/ Dipping Sauce peanut sate sauce BÒ NUỚNG - Barbeque Beef (2 skewers) $8.60 H Ạ T ĐI Ề U TH Ị T BÒ – Beef w/ Cashew Nut $22 Tender slices of beef on skewers well marinated, served w/ sate sauce. GÀ/BÒ/HEO RAU CẢI – Chicken or Beef or Pork w/ Vegetables $20 GÀ NUỚNG - Chicken Sate Skewers (2 Skewers) $9 Served w/ homemade peanut sate sauce GÀ/BÒ/HEO SẢ ỚT – LEMONGRASS CHILLI (Chicken or $20 Beef or Pork) CHIM CÚT CHIÊN ĐỘN – Roast Quail $9 Marinated in chef’s soy sauce & fried Served w/ a Lemon & Pepper GÀ/BÒ/HEO CAY – CHILLI (Chicken or Beef or Pork) $20 Sauce GÀ/BÒ/HEO GỪNG – GINGER (Chicken or Beef or Pork) $20 CÁNH GÀ ĐỘN THỊT – Stuffed Chicken Wing $8 Chicken wing stuffed w/ a mixture of minced pork & vermicelli, & GÀ/HEO TIÊU – PEPPER (Chicken or Pork) $20 fried golden brown. Served w/ Plum Sauce HẠT ĐIỀU THỊT GÀ – Chicken w/ Cashew Nut $22 BÒ LÚC LẮC – Cubed Beef $12 Marinated tender beef sautéed in chef’s Pepper Sauce GÀ PLUM SAUCE – Chicken w/ Plum Sauce $20 ĐẬU HŨ RANG MUỐI – Salted Tofu $12 GÀ TRONG N Ư Ớ C S Ố T HÀU VÀ N Ấ M – Chicken Oyster Sauce & Tofu rolled in a light potato starch, fried then tossed w/ fresh herbs, Mushrooms $22 chilli & spices (Chicken or Beef or Pork) CURRY & COCONUT CREAM $20 SÚP BẮP GÀ – Chicken Sweet Corn -

Deep Frozen Product

DEEP FROZEN PRODUCT PRODUCT OF COMPANY 1958 1981 1982 1998 2008 NIGEL is a company that specialises in transforming and freezing fish and other fishing products, trading its products in the ccold-storage internal and external market. Founded in 1958, this company is based in capacity Peniche, close to one of Portugal’s main fishing harbours. 18.500 m3; - Currently, NIGEL employs 100 people, part of a qualified, experienced freezing team that works from raw material selection to production. NIGEL’s capacity industrial unit was extended, remodelled and modernised in 2015, by 8 tonnes/hour introducing new manufacture and packaging technologies, therefore improving productivity, quality and service. packaging NIGEL’s cold-storage capacity is 18.500 m3, freezing capacity is 8 capacity tonnes/hour and packaging capacity is 5 tonnes/hour. We use our 5 tonnes/hour experience as the driving factor for constant change with the purpose of producing quality products that meet our client’s needs. Our guiding principles are the respect for commitment, adaptation AANGOLA capacity and a high level of dedication. Export has always been a mission GERMANY SOUTH AFRICA AUSTRALIA of ours, and we are now working for more than 20 countries in 5 BELGIUM BRAZIL continents. Our industrial unit was designed with great flexibility to CANADA CHINA adapt to the demands of completely different markets. In addition to CYPRUS USA SPAIN the ongoing training of our employees, we rely on a highly qualified FRANCA GREECE quality control team that ensures the compliance with all standards HOLLAND ENGLAND established by the HACCP, implemented since JAPAN LUXEMBOURG MOZAMBIQUE 1997. -

The Sea Fisheries of Eastern North America

THE SEA FISHERIES OF EASTERN NORTH AMERICA. INTRODUCTORY. In the present work I propose to give some account, as far as known, of the more important fishes of the Eastern United States north of Delaware Bay, together with an account of the methods by which they are pursued, captured, and utilized, as also of their application, with some statistical tables illustrating the results of the fisheries in the region referred to. For the better elucidation of the subject, I also propose to embrace a reference to corresponding fisheries in Europe and other parts of the • world, so far as these throw light upon the American species. A limitation of the subject to the region north of Delaware Bay is made, partly in view of the fact that the fisheries of that region are much more important in an economical point of view, and can be better monographed at present, and partly because this is the portion of Eastern North America which is embraced in the Washington 'treaty, and of which the information referred to is needed for the proper con- sideration of the international, political, and economical treatment of the subject.* " In confining attention in the present article specially to the subject of the fish- eries of the region covered by the treaty of Washington, it is not to be supposed that there are no productive fisheries on a largo scale further south, the contrary being quite the fact. No portion of the globe exceeds the Southern and Gulf coasts of the United States in the number and variety of excellent food-fish, their waters teeming with them throughout the year and permitting their capture, especially in the cooler seasons, to almost any imaginable extent. -

Preservation of Marine Products by Salting and Drying

PRESERVATION OF MARINE PRODUCTS BY SALTING AND DRYING by NORYATI ISMAIL (M.Sc., University of Nottingham) A thesis submitted in fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY UNIVERSITY OF NEW SOUTH WALES March 1990 UNIVERSITY OF N.S.W. 2 1 MAk 1991 LIBRARY ABSTRACT Dried, salted morwong, shark and sardine salted in saturated brine at 30°C and dried at different temperatures under ambient RH were prepared. Dried squid was prepared without salting. Salt uptake was very rapid and highest in shark followed by morwong and sardine. Moisture loss was highest in sardine followed by shark and morwong. Squid attained the highest drying rates amongst all the species and at 50°C its rate was the highest followed by shark, morwong and sardine. A drying temperature of 50°C gave a compromise between product quality and drying rates. Lightly salted products were significantly (p < 0.01) prefe^ed in all species. Products dried at lower temperatures were significantly more acceptable (p < 0.01) for shark and sardine but not for morwong and squid. Products salted for 8h (morwong and sardine) 4h (shark) and non-salted (squid) and dried at 50°C were used for storage studies. Storage at 5°C was superior to that at 25°C or 37°C in terms of product appearance, browning, rancidity, moisture loss, product texture and rehydration behaviour. The effects of salting, drying and storage on the protein properties were demonstrated by decreased protein solubility in KCl and SDS + B mercoptoethanol, disappearance and lost intensity of some bands in the IEF pattern of water soluble proteins in all the species. -

Seafood Pizza Pasta Risotto

TASMANIAN NATURAL BEEF gf GRILLED PORTERHOUSE STEAK 250g 26.00 GRILLED SCOTCH FILLET 250g 26.00 GRILLED T-BONE 400g 26.00 “ Food - taken to support life. CHICKEN gf Wine - taken to enrich life. Food and wine - taken to fulfil life. ” PAN OVEN ROASTED chicken breast in butter and thyme 26.00 THIS IS WHERE THE FUN STARTS You get to create your own delicious beef or chicken meal by choosing your BREADS AND STARTERS favourite sauce and accompaniment. SAUCES Whether passing the time over a drink or filling that hunger gap while waiting for a meal or whiskey cream sauce 4.00 rich jus 4.00 creamy peppercorn 4.00 simply to mop up that delicious pasta sauce...whatever the occasion...it will be mouth-watering mushroom sauce 4.00 garlic parsley butter 4.00 garlic cream reduction 4.00 enjoyment ACCOMPANIMENTS GARLIC COB (4 SLICES) crusty on the outside | soft, garlicky & morish v 12.00 citrus steamed seasonal vegetables 4.00 chips 4.00 GRILLED BREAD (1 SLICE) | extra virgin olive oil | balsamic v 2.70 green beans 4.00 chunky greek salad 4.00 GRILLED BREAD (3 SLICES) | extra virgin olive oil | balsamic v 9.30 caramelised onions 4.00 tempura squid & prawn 4.00 HOUSE PIZZA napoli | garlic | mozzarella | parmesan v 21.00 golden roasted potatoes 4.00 wild roquette salad 4.00 GARLIC PIZZA garlic butter | parsley | parmesan | mozzarella v 21.00 FISH | SEAFOOD a selection of dips and flatbread with olives and fetta MEZZE PLATTER 15.50 MARKET FISH SEE SPECIALS BOARD full of the goodness of tomatoes ELAIA HOUSE BRUSCHETTA (2 SLICES) SQUID N CHIPS lightly battered -

Traditionally Preserved Fish Products Are Largely Confined to East And

Traditionally preserved fish products are largely confined to east and south-east Asia which are still produced principally on a cottage i,ndustry or domestic scale (Adams, 1998). As commonly applied, the term 'fermented fish' covers two categories of product (Adams et a/., 1985): (i) fish-salt formulations, e.g. fish sauce products such as the fish ' . pastes and sauces tend to contain relatively high levels of salt, typically in the range 15-25% and are used mainly as a condiment; and (ii) fish salt-carbohydrate mixtures, e.g. pla-ra in Thailand and burong-isda in the Philippines. In hot countries, particulady in rural areas, fermented fish products continue to play a vital role in adding protein, flavour and varietY to rice-based diets (Campbell-Platt, 1987). Table (A) summarises some of the corrimon traditionally processed fish ,~Jroducts of Asia. Among the fermented fish products, the more widely used are fish sauces and pastes (van Veen, 1965; Orejana, 1983). In the fish-salt carbohydrate product, lactic fermentation occurs and contributes to the ex.tended shelf life (Adams et a/., 1985; Owens and Mendoza, 1985). Lactic acid fermented products can be prepared in a shorter time than the fish-salt products, which depend primarily on autolytic processes I , and offer greater scope for low-cost fish preservation in South East Asia than the simply, low water activity products (Adams et a/., 1985). The pri~cipal carbohydrate source used in these traditional lactic fermented products is cooked rice, although in some products partially s~ccharified rice (mouldy rice: ang-kak, or pre-fermented rice) is used or, on occasion, sniall amounts of cassava flour, or cooked millet, e.g; sikhae in Korea (Lee, 1984).