163 Chapter 6 Effects of Globalisation on The

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Latest Rate Card

Connecting brands with Malaysia’s most valuable audience TV Advertising Rate Card • Effective 15 April 2021 Introduction Hi! We appreciate your interest in partnering with us. As the only growing local media platform in Malaysia, you can count on our dedication in delivering customised advertising and marketing solutions for your brand. Together, let’s take your business to the next level across TV, Radio and Digital Platforms, with the added impact of influencers, event activations and marketplaces. We’ve grouped the available TV advertising channels by target audience or interest – Malay, Chinese, Indian, English, GenNext, News and Sports. The advertising rates are priced according to channel value propositions and timebelt viewerships. Enjoy a base rate that starts from RM1,000 for a 30-sec TVC (category x1), with specific pricing ratios for respective durations, as outlined in the following rate table. TV ADVERTISING RATE TABLE (RM GROSS) Category 10 sec 15 sec 20 sec 25 sec 30 sec 35 sec 40 sec 45 sec 50 sec 60 sec x1 500.00 660.00 800.00 900.00 1,000.00 1,180.00 1,300.00 1,500.00 1,700.00 2,000.00 x1.5 750.00 990.00 1,200.00 1,350.00 1,500.00 1,770.00 1,950.00 2,250.00 2,550.00 3,000.00 x2 1,000.00 1,320.00 1,600.00 1,800.00 2,000.00 2,360.00 2,600.00 3,000.00 3,400.00 4,000.00 x2.5 1,250.00 1,650.00 2,000.00 2,250.00 2,500.00 2,950.00 3,250.00 3,750.00 4,250.00 5,000.00 x3 1,500.00 1,980.00 2,400.00 2,700.00 3,000.00 3,540.00 3,900.00 4,500.00 5,100.00 6,000.00 x3.5 1,750.00 2,310.00 2,800.00 3,150.00 3,500.00 4,130.00 4,550.00 -

Brunei Darussalam Household ICT Survey 2013

BRUNEI DARUSSALAM HOUSEHOLD ICT SURVEY REPORT 2013 disclaimer This publication is protected by copyright and save where otherwise stated may only be reproduced for non-commercial use provided it is reproduced accurately and not used in a misleading context. Where material in this publication is reproduced, the source of the material must be identified and the copyright status acknowledged. All rights to brand names, registered trademarks, logos and images remain with their legal owners. The use of any image, trade name and trademark in this publication shall not be construed as an endorsement of the same. Whilst every effort has been made to ensure that results reported in this document are complete, accurate and true, AITI does not provide any warranty that the information provided is complete, accurate or true, and will not be responsible for any damage or loss suffered as a result of its use. 02 Brunei Household ICT Survey Report 2013 contents Message from the Chief Executive 04 1 Introduction 05 2 Methodology 06 2.1 Overview 06 2.2 Geographical Diagram 07 2.3 Structure (Demographic Information) 07 3 Findings of the Household ICT Survey 10 3.1 Household Section 10 3.1.1 Available Services And Devices In Households 10 3.1.2 Number of Devices in Households 12 3.1.3 Internet Access In Households 13 3.1.4 Amount of Household Members Using The Internet 14 3.1.5 Type of Internet Access 14 3.1.6 Monthly Household Spend On ICT Devices 15 3.1.7 Computer Protection 15 3.1.8 Reasons For No Internet Access In Household 16 3.1.9 Media Usage 17 3.1.10 -

Filem Lakonan Izzue Islam

Filem Lakonan Izzue Islam. Izzue IslamKelahiranMuhammad Izzul Islam bin Mazlan (1990-06-02) 2 Jun 1990 (umur 29)Kota Bharu, Kelantan, MalaysiaKediamanKuala LumpurPendidikanSijil Pelajaran Malaysia (SPM)PekerjaanPelakon, model, penyanyiTahun aktif2010–kiniKetinggian1.75 m (5 ka 8+7⁄8 in)Berat55 kg (121 lb; 8.7 st)PasanganAwin Nurin (k. 2013)Kerjaya muzikGenrePopPekerjaanPenyanyiInstrumenVokalTahun aktif2011–kiniSyarikat rakamanKRU StudiosKegiatan berkaitanForteen (2011-18) Muhammad Izzul Islam bin Mazlan (lahir 2 Jun 1990)[a] ialah seorang penyanyi, pemuzik dan pelakon Malaysia. Memulakan kerjaya seninya dengan berlakon dan seterusnya nyanyian dengan menyertai sebuah kumpulan di bawah naungan KRU Studios iaitu kumpulan Forteen.[1] Beliau mula dikenali selepas memenangi anugerah "Pelakon Terbaik[2] Festival Filem Malaysia ke-25" dan "Hero Baru Terhebat Anugerah Blokbuster 2". Namanya kian meningkat apabila diberikan tanggungjawab menggalas watak utama di dalam drama Sebenarnya, Saya Isteri Dia!.[3] Kehidupan awal Beliau dilahirkan pada 2 Jun 1990 sebagai Muhammad Izzul Islam bin Mazlan di Kota Bharu, Kelantan dan berkelulusan Sijil Pelajaran Malaysia (SPM). Forteen Rencana utama: Kumpulan Forteen Izzue Islam menyertai kumpulan Forteen sewaktu kumpulan ini ditubuhkan pada 2011. Kumpulan ini turut dianggotai Muhammad Ridzuan Sharifuddin (One), Saiful Ridzuan Abdul Hamid (Ariz) dan Mohd Arif Ameerais Azhar (Ameerais). Forteen mula dikenali umum setelah muncul bersama single "Berdua Bersatu" yang dkeluarkan pada 27 Ogos 2011.[4] Album EP sulung mereka, Kita dikeluarkan pada 19 Disember 2013 diterbitkan oleh KRU Records,[5] mengandungi 6 lagu. Pada 2014, KRU Music mengumumkan bahawa Forteen bakal menganjurkan konsert buat pertama kalinya pada 29 Mac 2014 bagi menghargai peminat mereka[6][7] Namun, pihak menganjur telah menunda konsert tersebut kepada tarikh baharu iaitu 26 April 2014 bagi menghormati kejadian pesawat MH370 yang hilang pada 8 Mac 2014.[8][9] Pada Disember 2016, Izzue menafikan khabar angin mengatakan beliau keluar dari Forteen. -

PDF ATF Dec12

> 2 < PRENSARIO INTERNATIONAL Commentary THE NEW DIMENSIONS OF ASIA We are really pleased about this ATF issue of world with the dynamics they have for Asian local Prensario, as this is the first time we include so projects. More collaboration deals, co-productions many (and so interesting) local reports and main and win-win business relationships are needed, with broadcaster interviews to show the new stages that companies from the West… buying and selling. With content business is taking in Asia. Our feedback in this, plus the strength and the capabilities of the the region is going upper and upper, and we are region, the future will be brilliant for sure. pleased about that, too. Please read (if you can) our central report. There THE BASICS you have new and different twists of business devel- For those reading Prensario International opments in Asia, within the region and below the for the first time… we are a print publication with interaction with the world. We stress that Asia is more than 20 years in the media industry, covering Prensario today one of the best regions of the world to proceed the whole international market. We’ve been focused International with content business today, considering the size of on Asian matters for at least 15 years, and we’ve been ©2012 EDITORIAL PRENSARIO SRL PAYMENTS TO THE ORDER OF the market and the vanguard media ventures we see attending ATF in Singapore for the last 5 years. EDITORIAL PRENSARIO SRL in its main territories; the problems of the U.S. and As well, we’ve strongly developed our online OR BY CREDIT CARD. -

Go Beyond™ MULTITAINMENT 360˚

Go Beyond™ MULTITAINMENT 360˚ Financial Year Ended 31 January 2015 Astro is more than just bringing joy into the living rooms of millions of Malaysians. We strive to touch all facets of their lives – from empowering our customers with the most 2015 current and relevant information to championing SHARE OF 33% education by creating quality learning content and giving our children better opportunities. TV ADEX 2014 31% To our customers, we are a reflection of their diversity and aspirations. Going beyond TV and radio into content creation, e-commerce and digital media, we offer them unlimited ways to ‘Watch, Listen, Read and Shop’ with exceptional quality content on the tv, tablet and mobile – not just in every corner of their homes, but on the go ADVERTISING INCOME too. 2015 2014 To our very own eclectic mix of talent, we are a RM RM believer in their dreams, providing them with the platform to not only fulfill their potential but also add colour to the lives of others. We nurture the 589MILLION 582MILLION growth of Malaysia’s singing sensations, actors, sporting heroes and comedy kings – turning them into stars and even propelling them onto the world stage. 2 0 1 5 2 0 1 4 At Astro, it is about embracing a multimedia, multidimensional and multicultural approach to enrich the lives of all Malaysians. 49% 47% All this takes us beyond entertainment to a whole new level – Multitainment 360˚. SHARE OF VIEWERSHIP household SHARE OF ARPU RADEX PENETraTION 2 0 1 5 2 0 1 4 2015 2 0 1 5 2 0 1 4 2015 % 60 RM99.0 2014 6360% 5652% 2014 54% % % RM96.0 -

Rate Card 01Jun20 FA

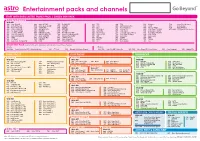

Entertainment packs and channels START WITH BASIC ASTRO FAMILY PACK / CHUEN MIN PACK Astro Family Pack With HD 104 Astro Ria HD* 306 Astro AEC HD* 703 FOXlife HD* 101 TV1 149 TV9 502 Bernama 729 Asian Food Network 105 Astro Prima HD 308 Astro Quan Jia HD* 704 FOX HD* 102 TV2 200 Self Service Portal 503 CGTN 801 Astro Arena 106 Astro OASIS HD 335 CCTV4 HD* 705 KIX HD* 103 TV3 202 Astro Vellithirai 570 Nat Geo Wild 837 FOX SPORTS 3 116 Colors Hindi HD* 392 KBS World HD* 706 HITS HD* 114 TV AlHijrah 203 Makkal TV 601 Astro Tutor TV UPSR 852 – 882 27 Digital Radio Stations 118 Go Shop RUUMA 393 ONE HD* 707 TLC HD* 124 Astro Ria 305 TVB Classic 602 Astro Tutor TV PT3 120 Go Shop GAAYA 401 HITS Movies HD 708 Food Network HD* 125 Astro Prima 321 Celestial Classic Movies 603 Astro Tutor TV SPM 201 Astro Vaanavil HD 550 Nat Geo Wild HD* 709 Asian Food Network HD* 126 Astro OASIS 344 Astro Xiao Tai Yang 610 Astro TVIQ 231 Astro Vinmeen HD* 611 Astro Ceria HD* 710 Nat Geo People HD* 129 ART 346 Astro AEC 631 Astro Ceria 300 iQIYI 612 Disney XD HD* 800 eGG Network* 146 TV Okey 375 CCTV4 721 AXN 303 Go Shop 2 701 AXN HD* 802 Astro Arena HD* 147 NTV7 391 KBS World 723 FOXlife 304 Astro Xiao Tai Yang HD* 702 Hello 817 FOX SPORTS 3 HD* 148 8TV 501 Astro Awani 727 TLC Chuen Min Pack A variant of the Astro Family Pack which includes more Chinese channels Includes Excludes 309 | 349 Celestial Movies HD* / Celestial Movies 316 CTI Asia 323 Phoenix InfoNews Channel 104 | 124 Astro Ria HD* / Astro Ria 105 | 125 Astro Prima HD / Astro Prima 201 Astro Vaanavil -

ASR1304876 Astro Channel Renumbering PDF RGB FA R5

YOUR NEW CHANNEL LISTING Here is your complete and latest channel listing for your reference. MEASAT Broadcast Network Systems Sdn Bhd 199201008561 (240064-A) Click on your desired channels MALAY VARIETY 101 – 149 INDIAN VARIETY 200 – 251 CHINESE VARIETY 300 – 375 KOREAN & JAPANESE 391 – 398 MOVIES 401 – 433 NEWS 501 – 533 LEARNING 550 – 576 KIDS 601 – 636 ENGLISH VARIETY 701 – 736 SPORTS 800 – 841 FAQ CHANNELS MALAY VARIETY TV1 101 TV2 102 TV3 103 104 (HD) Astro Ria 124 (SD) 105 (HD) Astro Prima 125 (SD) 106 (HD) Astro OASIS 126 (SD) 107 (HD) Astro Warna 127 (SD) 108 (HD) Astro Citra 128 (SD) Naura 109 (HD) TV AlHijrah 114 ABO Movies 115 (HD) Tayangan Hebat MALAY Back to directory MALAY VARIETY Colors Hindi 116 (HD) Go Shop RUUMA 118 (HD) Go Shop GAAYA 120 (HD) ART 129 NJOI TV 140 Bintang 141 Pelangi 142 TV Okey 146 NTV7 147 8TV 148 TV9 149 MALAY Back to directory INDIAN VARIETY* Self Service Portal 200 Astro Vaanavil 201 Astro Vellithirai 202 Makkal TV 203 SUN Music 212 Chutti TV 213 Adithya 214 Jaya TV 221 Raj TV 222 Kalaignar TV 223 Astro Vinmeen 231 (HD) INDIAN *Channel numbers remain unchanged. Back to directory INDIAN VARIETY* 232 (HD) Star Vijay 224 (SD) Colors Tamil 233 (HD) SUN TV 234 (HD) 211 (SD) ABO Movies 241 (HD) Thangathirai BollyOne 251 (HD) INDIAN *Channel numbers remain unchanged. Back to directory CHINESE VARIETY iQIYI 300 (HD) Go Shop 303 (HD) Astro 304 (HD) Xiao Tai Yang 344 (SD) TVB Classic 305 306 (HD) Astro AEC 346 (SD) Astro 307 (HD) Shuang Xing 347 (SD) Astro Quan Jia 308 (HD) 309 (HD) Celestial Movies 349 (SD) -

Landing Page List

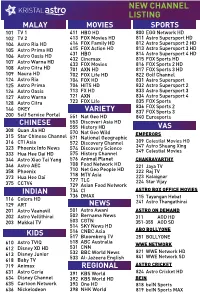

NEW CHANNEL LISTING MALAY MOVIES SPORTS 101 TV 1 411 HBO HD 800 EGG Network HD 102 TV 2 413 FOX Movies HD 811 Astro Supersport HD 104 Astro Ria HD 414 FOX Family HD 812 Astro Supersport 2 HD 105 Astro Prima HD 415 FOX Action HD 813 Astro Supersport 3 HD 814 106 Astro Oasis HD 431 HBO Astro Supersport 4 HD 432 Cinemax 815 FOX Sports HD 107 Astro Warna HD 433 FOX Movies 816 FOX Sports 2 HD 108 Astro Citra HD 701 AXN HD 817 FOX Sports 3 HD 109 Naura HD 702 FOX Life HD 822 Golf Channel 124 Astro Ria 704 FOX HD 831 Astro Supersport 125 Astro Prima 706 HITS HD 832 Astro Supersport 2 126 Astro Oasis 713 FX HD 833 Astro Supersport 3 127 Astro Warna 721 AXN 834 Astro Supersport 4 128 Astro Citra 723 FOX Life 835 FOX Sports 836 FOX Sports 2 146 OKEY VARIETY 837 FOX Sports 3 200 Self Service Portal 551 Nat Geo HD 840 Eurosports CHINESE 553 Discoveri Asia HD 555 History HD VAS 308 Quan Jia HD 570 Nat Geo Wild EMPERORS 315 Star Chinese Channel 571 National Geographic 316 CTI Asia 572 Discovery Channel 309 Celestial Movies HD 323 Phoenix Info News 574 Discovery Science 347 Astro Shuang Xing 349 Celestial Movies 333 Hua Hee Dai HD 575 History Channel 344 Astro Xiao Tai Yang 576 Animal Planet CHAKRAVARTHY 346 Astro AEC 708 Food Network HD 221 Jaya TV 358 Phoenix 710 Net Geo People HD 222 Raj TV 718 MTV Asia 373 Hua Hee Dai 223 Kalaignar 727 TLC 224 Star Vijay 375 CCTV4 729 Asian Food Network INDIAN 734 CI ASTRO BOX OFFICE MOVIES 736 DMAX 116 Colors HD 115 Tayangan Hebat 241 Astro Thangathirai 129 ART NEWS 201 Astro Vaanavil 501 Astro Awani ASTRO ON DEMAND -

Raya 2020 Is Unlike Any We've Celebrated Before

Once Upon A Special Raya Aidilfitri Raya 2020 is unlike any we’ve celebrated before. What remains the same is that families gather in front of the TV, bonding closer together over comedies, dramas, horrors and other entertaining stories. Now even as social distance is observed, brands can still continue marketing as they work with Astro to foster a closer bond among Malaysians in this new normal. All through a variety of content that is sure to make Raya even more special for everyone. Astro is the entertainment hub of choice during any major festive seasons. This Raya, a massive 93% of Malays are projected to engage with our media ecosystem. In 2019, Astro dominated 3 most important family times during Raya which is 10am, 6pm and 10pm. Plus in just over a mere 9 days, Astro gained a 70% platform share. With such high coverage of your consumers in mind, let’s take a look at what we have in store for you this Raya Aidilfitri. Source: Astro Q3FY20 Report Source: Kantar Media DTAM | Astro Malay 4+ (Base: 9.8mil) 3 We know our Malay friends love films! All because our highest-grossing films were the most-watched genre last Raya. HANTU KAK LIMAH Hantu Kak Limah haunts the villagers who just can’t seem to get rid of her. This horror comedy is a favourite among Malay households, garnering RM36 million box office and becoming the 2nd highest-grossing film of all times locally. ABANG LONG FADIL 2 A spin-off from 2011 KL Gangster, this story is about Abang Long Fadil whose dreams of a gangster life becomes real after his best friend is jailed. -

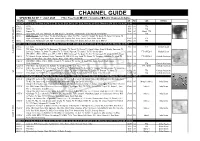

D:\Channel Change & Guide\Chann

CHANNEL GUIDE UPDATED AS OF 1ST JULY 2020 FTA = Free To Air SCR = Scrambled Radio Channels in Italics FREQ/POL CHANNEL SR FEC CAS NOTES ARABSAT 5C at 20.0 deg E: Bom Az 256 El 27, Blr Az 262 El 24, Del Az 253 El 20, Chen Az 263 El 21, Bhopal Az 256 El 21, Cal Az 261 El 11 S 3796 LSRTV 1850 3/4 FTA A 3809 RSSBC TV 1600 2/3 FTA T E 3853 L Espace TV 1388 3/5 Mpeg4 FTA L L 3884 R Iqraa Arabic, ERI TV1, Ekhbariya TV, KSA Sports 2, 2M Monde, El Mauritania. Canal Algeria, Al Maghribia 27500 5/6 FTA I T 3934 L ASBU Bouquet: South Sudan TV, Abu Dhabi Europe, Oman TV, KTV 1, Saudi TV, Sharjah TV, Quran TV, Sudan TV, Sunna TV, E Libya Al Watanya; Holy Quran Radio, Emarat FM, Program One, Radio Quran, Qatar Radio, Radio Oman 27500 7/8 FTA & 3964 L Al Masriyah, Al Masriyah USA, Nile Tv International, Nile News, Nile Drama, Nile Life, Nile Sport, ERTU 1 27500 3/4 FTA C A BADR 5 at 26 deg East: Bom Az 253 El 33.02, Blr Az 259.91 El 29.71, Del 248.93 El 25.47, Chennai Az 260.76 El 26.88, Bhopal Az 252 El 27 B L 4087 L Tele Sahel 3330 3/4 FTA Medium Beam E T 4102 L TNT Niger: Télé Sahel, Tal TV, Espérance TV, Liptako TV, Ténéré TV, Dounia TV, Canal 3 Niger, Canal 3 Monde, Saraounia TV, V Bonferey, Tambara TV, Anfani TV, Labari TV, TV Fidelité, Niger 24, Télé Sahel, Tal TV, Voix du Sahel 20000 2/3 FTA MPEG-4 Medium Beam IRIB: IRIB 1, IRIB 2, IRIB 3 (scr), IRIB 4, IRIB 5, IRINN, Amouzesh TV, Quran TV, Doc TV, Namayesh TV, Ofogh TV, Ifilm, Press 11881 H TV, Varzesh, Pooya, Salamat, Nasim, Tamasha HD, IRIB 3 HD (scr), Omid TV, Shoma TV, Tamasha, Alkhatwar TV, Irkala TV, 27500 5/6 FTA MPEG-4 Central Asia beam Sepehr TV HD; Radio Iran, Radio Payam, Radio Jawan, Radio Maaref etc 11900 V IRIB: IRIB 1, IRIB 2, IRIB 3, IRINN, Amouzesh TV, Salamat TV, Sepehr HD; Radio Iran, Radio Payam, Radio Jawan, Radio Maaref etc. -

Connecting Brands with Malaysia's Most Valuable Audience

Media Sales Connecting brands with Malaysia’s most valuable audience Advertising Rate Card • Effective 16 June 2018 Introduction Congratulations, you’ve chosen Astro, the only growing local media platform in Malaysia. Thank you for your interest. Here’s to years of fruitful collaborations between us. We have grouped our channels into 7 segments – Malay, Chinese, English, Indian, Sports, News, and GenNext. Our advertising rates are categorized from CPS 100 to CPS 3000 for English segment, and from A15 to G for all other segments, the pricing category for each channel and its time belt is rated according to channel proposition, target audience, and market value. Check out our rate cards on the next page comprising both Gross and GST inclusive versions. Media Sales TV ADVERTISING RATE CARD (GROSS BOOKING RATES) Category 10 sec 15 sec 20 sec 25 sec 30 sec 35 sec 40 sec 45 sec 50 sec 60 sec A15 10,000.00 13,200.00 16,000.00 18,000.00 20,000.00 23,600.00 26,000.00 30,000.00 34,000.00 40,000.00 A14 9,500.00 12,540.00 15,200.00 17,100.00 19,000.00 22,420.00 24,700.00 28,500.00 32,300.00 38,000.00 A13 9,000.00 11,880.00 14,400.00 16,200.00 18,000.00 21,240.00 23,400.00 27,000.00 30,600.00 36,000.00 A12 8,500.00 11,220.00 13,600.00 15,300.00 17,000.00 20,060.00 22,100.00 25,500.00 28,900.00 34,000.00 A11 8,000.00 10,560.00 12,800.00 14,400.00 16,000.00 18,880.00 20,800.00 24,000.00 27,200.00 32,000.00 A10 7,500.00 9,900.00 12,000.00 13,500.00 15,000.00 17,700.00 19,500.00 22,500.00 25,500.00 30,000.00 A9 7,000.00 9,240.00 11,200.00 12,600.00 14,000.00 -

CHANNEL PROFILE Malay Segment

CHANNEL PROFILE Malay segment Period: January - June 2018 30 200 25 150 Channel 123 & 104 (HD) 20 15 100 10 50 5 Gender 0 0 Location Home of Malay signature Group Age 52% 4-9 10-19 20-29 30-39 40-49 50-59 60+ 79% entertainment that offers a Female Astro Ria Index vs Total TV variety of local programmes Urban ranging from reality shows Skewed age 10-19 [Index: 119] to fun game shows to drama series. Key Signature Programmes: RM10K + 19% 10% GenF, AME, AF Teens, Gegar 18% RM8K-RM10K < RM2K Vaganza & MegaDrama belt. 4% 24% PMEBs Blue Collars RM6K-RM8K 7% Monthly Net Reach (Ave. Past 6 Months) 27% 36% RM4K-RM6K 20% HH Income 9.586 mil Occupation RM2K-RM4K Housewives/ 35% Students Unemployed Source: Kantar Media DTAM, Skewed HHI Below RM2K [Index: 113] Individual (Total Universe: 14,964K), Jan-Jun 2018 Skewed Students [Index: 115] 25 200 20 150 Channel 105 15 100 10 50 Wholesome Family Channel 5 that offers a variety of local Gender 0 0 Location programmes such as long 53% Group Age 4-9 10-19 20-29 30-39 40-49 50-59 60+ 76% series drama's, Female Astro Prima Index vs Total TV Urban documentaries and classic Skewed age 20-29 [Index: 118] movies as well reality shows. Key Signature Programme: My Mother is the Best Cook, RM10K + 19% 19% RM8K-RM10K 7% Irama Malaysia and TIARA 4% < RM2K Drama belt. 29% RM6K-RM8K PMEBs Blue Collars 6% Monthly Net Reach RM4K-RM6K (Ave. Past 6 Months) 15% 32% 30% HH Income 8.261 mil Occupation RM2K-RM4K Housewives/ 39% Students Unemployed Skewed HHI Below RM2K [Index: 133], Source: Kantar Media DTAM, Slight skewed housewives [Index: 106] Individual (Total Universe: 14,964K), Jan-Jun 2018 RM2K-4K [Index: 110] 30 200 25 Channel 132 & 124 (HD) 150 20 15 100 Stress Free, No Tension 10 50 Channel - Unwind after a 5 Gender Location long day with Warna.