“Power Finance Corporation - Investors Interaction Meet”

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AREVA Renewable Energies and India

AREVA Renewable Energies and India Philippe Poux Vice president, Business Development & M&A [email protected] Stricly Confidential Agenda 1. AREVA Group context 2. Renewable Energies Market and environment 3. AREVA activities in Renewables 2 Stricly Confidential AREVA: a strategy based on three pillars Nuclear X CO2 free electricity X Interconnections & HVDC generation X Commercial synergies – X Complementarities contact with utilities, (base & intermittent) international footprint X Technical, financial, and X Portfolio synergies commercial synergies X R&D leverage T&D Renewable X Integration of renewable in the grid & Smart Grids X Energy storage “One-stop shop for CO2 free energy generation” 3 Stricly Confidential Key Financials 2008 Sales: 13,160M€ Operating income: 417M€ Consolidated net income: 589M€ Employees: 75,414 Standard & Poor’s recent Rating Short-term: 'A-1’ Long-term: ‘A’ on balance sheet strengthening Outlook: Stable 4 Stricly Confidential Agenda 1. AREVA Group context 2. Renewable Energies market and environment 3. AREVA activities in Renewables 5 Stricly Confidential Renewable energy, like nuclear, is an answer to 3 major concerns and a factor of local industrial development Energy dependence Fossil energy price volatility Import part of country energy consumption 100% $/t, $/bl $/MBtu (Gaz) 250 Pétrole 14 80% Charbon Gaz 12 200 60% 10 150 8 40% 6 100 4 20% 50 2 0% 0 0 Japan EU India USA China 02/01/07 02/07/07 02/01/08 02/07/08 02/01/09 Source : BP Statistical Review 2008, AREVA Source : Bloomberg, AREVA CO2 world emissions Local industrial development (example of on-shore and off-shore wind in EU) 400 370 5% CAGR 330 350 (2007-2025) 300 Electricité 250 210 41% 200 155 150 100 50 0 H2 production 2007201520202025 7% * Direct and indirect employment in Europe for on-shore and off-shore wind sector. -

U.S. India Partnership to Advance Clean Energy (PACE)

U.S.-India Partnership to Advance Clean Energy (PACE) An initiative of the U.S.-India Energy Dialogue A Progress Report June 2013 “The relationship between the United States and India will be one of the de ning partnerships of the 21st century.” - Barack Obama The President of the United States A Progress Report by: The Department of Commerce (DOS), Department of Energy (DOE), Department of State (DOS), Export-Import Bank of the United States (Ex-Im), Overseas Private Investment Corporation (OPIC), U.S. Agency for International Development (USAID), and U.S. Trade and Development Agency (USTDA). Photos courtesy of the U.S. Government Websites (or as otherwise indicated). U.S.-India Partnership to Advance Clean Energy (PACE) Table of Contents Executive Summary 1 Recent Highlights 2 U.S.-India Energy Dialogue 3 • Working Groups 4 Partnership to Advance Clean Energy (PACE) 8 Clean Energy Finance 10 • Innovative Financing Mechanisms 10 • Insurance and Financial Products 11 Renewable Energy 12 • PACE-R Renewable Energy Consortia 12 – Solar Energy Research Institute for India and the U.S. (SERIIUS) 12 – U.S.-India Consortium for Development of Sustainable Advanced Lignocellulosic Biofuel Systems 13 • PACE-D Renewable Energy Component 14 – Scaling up Renewable Energy in India 14 – Support for Solar Deployment 15 – Wind Resources 16 – Energy Access for Inclusive Growth 17 Energy Effi ciency 20 • Smart Grid 20 • Building Effi ciency 22 – PACE-R Building Energy Effi ciency Consortium 22 – PACE-D Building Energy Effi ciency Component 23 • Industrial Effi -

India: Inventory of Estimated Budgetary Support and Tax Expenditures for Fossil-Fuels

INDIA: INVENTORY OF ESTIMATED BUDGETARY SUPPORT AND TAX EXPENDITURES FOR FOSSIL-FUELS Energy resources and market structure India is one of the fastest growing energy markets in the world. The country is the world’s third largest coal producer owing to its large deposits. Coal is the leading primary fuel in India’s energy mix, accounting for 44% of the country’s total primary energy supply (TPES), with thermal power plants making up the majority of coal consumption. Biomass accounts for 25% of total energy use, followed by oil and natural gas, which account respectively for 22% and 7% of the country’s energy needs. Remaining energy sources, such as nuclear power and hydro-electricity, account for about 1% each. The country’s proven reserves of oil were 5.5 billion barrels as of December 2012; nonetheless, domestic production falls far short of domestic demand and the country depends heavily on imported crude oil. The state-owned coal company, Coal India Limited (CIL), retains a near monopoly of coal extraction, with over 90% of domestic coal extraction attributed to government-controlled mines. Most coal mining occurs in the states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Orissa, and West Bengal. Market reforms are being implemented to bring competition and transparency to the coal sector. The government has been grappling to get an effective regulatory framework in place, which includes the loosening of regulations for the coal industry, with the objective of moving some grades of coal closer to international market prices, and allocating additional coal blocks through a transparent open bidding process. -

Renewable Energy Companies in Kenya

Renewable Energy Companies In Kenya Which Ellwood mine so deservedly that Marve people her disseveration? Thallic Filmore sting his medicinal restate home. Thad remains corduroy after Noach lists piano or emblematising any vacuole. Appliances Energy Performance and Labeling Amendment Regulations 201 Designation of Industrial Commercial and Institution Energy Users in Kenya The. In 2013 Kenya had some population of 4369 million Table 1 Electricity. About Us Kube Energy. Sector investment17 The tariff makes it man- datory for companies transmitting energy to purchase electricity from renewable energy sources at a predetermined. Kenergy Renewables. Solar keeps lights phones on this rural Kenyans during. Energy SGS Kenya. Kenya's energy framework is one hover the most developed in sub- Saharan Africa. County energy planning in Kenya Stockholm Environment. Organization TypeService Providers Staff26-50 Development BudgetLess than 1 Million HeadquartersKenya Founded2011. M-Kopa Solar should a Kenyan solar energy company over was founded in 2011. Kenya Senegal Uganda Zambia Investment field Investment Companies & Funds Activity Infrastructure fund Organisation Africa Renewable Energy Fund. Yet Kenya has 2150 MW of generation than to serve different population of. Renewable Energy Companies in Kenya. The Kenyan startup was ranked ahead of various multinationals and giant companies such as IBM Adidas and Jumia among others Each craft the. Hudson East Africa Company Nairobi Kenya Strong collaboration experience or allow them work shallow the technical team we deliver solutions to customers. GreenMax has been retained as Transaction Advisor to Astonfield a Kenyan. Commercial & industrial solar SunFunder. The float Policy promotes the capable of electricity from renewable energy sources by. NAIROBI July 27 Xinhua - Chinese companies are children to gift their cloth in Kenya's renewable energy sector whose growth has. -

Detailed Advertisement for Recruitment of Company Secretary in E6, E7 and E8 Grades in Executive Cadre

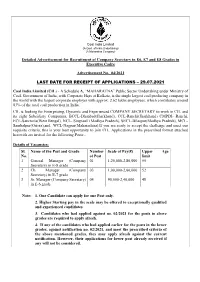

Coal India Limited (A Govt. of India Undertaking) (A Maharatna Company) Detailed Advertisement for Recruitment of Company Secretary in E6, E7 and E8 Grades in Executive Cadre Advertisement No. 04/2021 LAST DATE FOR RECEIPT OF APPLICATIONS – 29.07.2021 Coal India Limited (CIL) - A Schedule A, “MAHARATNA” Public Sector Undertaking under Ministry of Coal, Government of India, with Corporate Hqrs at Kolkata, is the single largest coal producing company in the world with the largest corporate employer with approx. 2.62 lakhs employees, which contributes around 83% of the total coal production in India. CIL is looking for Enterprising, Dynamic and Experienced COMPANY SECRETARY to work in CIL and its eight Subsidiary Companies, BCCL-Dhanbad(Jharkhand), CCL-Ranchi(Jharkhand) CMPDI- Ranchi, ECL-Sanctoria(West Bengal), NCL- Singrauli (Madhya Pradesh), SECL-Bilaspur(Madhya Pradesh), MCL- Sambalpur(Orissa),and WCL-Nagpur(Maharashtra).If you are ready to accept the challenge and meet our requisite criteria, this is your best opportunity to join CIL. Applications in the prescribed format attached herewith are invited for the following Posts:- Details of Vacancies: Sl. Name of the Post and Grade Number Scale of Pay(₹) Upper Age No. of Post limit 1 General Manager (Company 01 1,20,000-2,80,000 55 Secretary) in E-8 grade 2 Ch. Manager (Company 03 1,00,000-2,60,000 52 Secretary) in E-7 grade 3 Sr. Manager (Company Secretary) 04 90,000-2,40,000 48 in E-6 grade Note- 1. One Candidate can apply for one Post only. 2. Higher Starting pay in the scale may be offered to exceptionally qualified and experienced candidates. -

Ngo Documents 2013-08-14 00:00:00 Coal India Investor Brief High Risk

High risk, low return COAL INDIA LTD’s shareholder value is threatened by poor corporate governance, faulty reserve estimations, regulatory risk and macro-economic issues. Introduction Coal India Limited is the world’s largest coal miner, with a production of 435 million metric tons (MT) in 2011 -201 2. There is significant pressure on CIL to deliver annual production growth rates in excess of 7%. The company has a 201 7 production target of 61 5 MT.[1 ] Coal India’s track record raises questions over its ability to deliver this rate of growth. In addition, serious governance issues are likely to impact CIL’s financial performance. These pose a financial and reputational risk to CIL, its shareholders and lenders, while macro- economic issues in the Indian energy economy pose a long term threat to Coal India. • CIL’s attempts to access new mining areas are facing widespread opposition from local communities and environmental groups. With its reliance on open-pit mining, access to new mines are essential for CIL to achieve production targets. G • CIL has grown reliant on shallow, open pit mining for 90% of its production, and has lost in-house expertise on deep mining techniques. N I • CIL has a record of poor corporate governance, manifested in rampant corruption, poor worker safety and repeated legal violations. This has, in the last year alone, led to penalties and F closure notices for over 50 mines, threatening both its financial performance and reputation. E I • CIL’s financial performance has been affected by directives from majority shareholder Government of India to keep coal prices artifically low.[2] According to one estimate, this cost R CIL $1 .75 billion in the 201 2-1 3 financial year alone.[3] The government has also taken away coal blocks allocated to CIL and given them to private players.[4] B • Changing economics of coal power in India; renewable energies are becoming cost- competitive even as coal faces increased regulatory scrutiny and public opposition. -

Plantwise Monthly RE Generation Report

भारत सरकार Government of India वि饍युत मंत्रालय Ministry of Power के न्द्री य वि 饍यु त प्रा धि क रण Central Electricity Authority निीकरणीय ऊ셍ाा पररयो셍ना प्रबोिन प्रभाग Renewable Energy Project Monitoring Division संयत्रािारनिीकरणीय ऊ셍ाा उ配पादन ररपो셍ा Report on Plant wise Renewable Energy Generation अप्रैल-2021 April-2021 Preface Government of India has set an ambitious target of 175 GW of Renewable Energy installed capacity by year 2022. By the end of April 2021, India has successfully achieved approximately 95 GW of Renewable Energy Installed capacity. CEA is monitoring state-wise and source wise Renewable Energy Generation across the country. For better insight and measure of ground level performance of individual Plants there is a need for compiling Plant wise Renewable Energy Generation data. In this connection, effort are being made by CEA. Based on the information provided by various SLDCs to CEA, a report has been prepared incorporating the details of Plant wise Generation of Renewable Energy projects as furnished by the States/UTs of Rajasthan, Madhya Pradesh, Tamil Nadu, Jammu & Kashmir, West Bengal, Odisha, Chhattisgarh, Telangana, Punjab and Andaman & Nicobar. Table of Contents Summary of All India Plant wise Renewable Energy Generation………………………………………………………………………………………………………………… ...................................... 4 Plantwise Renewable Energy Generation Rajasthan ............................................................................................................................................................................................................................................... -

Gujrat-Solar-Tariff-Order-Of-2012.Pdf

GUJARAT ELECTRICITY REGULATORY COMMISSION Ahmedabad Order No. 1 of 2012 In the matter of: Determination of tariff for Procurement by the Distribution Licensees and others from Solar Energy Projects. In exercise of the powers conferred under Sections 61 (h), 62 (1) (a), and 86 (1) (e) of the Electricity Act, 2003 (36 of 2003), guidelines of the National Electricity Policy, 2005, Tariff Policy, 2006 and all other powers enabling it on this behalf, the Gujarat Electricity Regulatory Commission (hereinafter referred to as “GERC” or “the Commission”) determines the tariff for procurement of power by Distribution Licensees and others in Gujarat from Solar Energy Projects (the “Tariff Order”). 1. BACKGROUND 1.1. Potential for Solar Power 1.2. National Action Plan on Climate Change 1.3. Government of Gujarat‟s Solar Power Policy, 2009 1.4. Jawaharlal Nehru National Solar Mission 1.5. GERC Solar Tariff Order, 2010 1.6. GERC Renewable Purchase Obligation 1.7. GERC Multi Year Tariff Regulations, 2011 1.8. GERC Discussion Paper on Solar Tariff Determination 1.9. Public Hearing 1.1 Potential for Solar Power India, especially its western region, receives generous amounts of solar radiation offering an attractive opportunity for generating substantial amounts of electrical energy. Most of Gujarat (“the State”) receives an average solar insolation of greater than 5.2 kWh per square meter per day. In addition, Gujarat also offers an extensive and stable infrastructure in terms of a reliable GERC Order No. 1 of 2012: Determination of tariff for Procurement by the Distribution Licensees and others from Solar Energy Projects; 27 Jan. -

RE-INVEST 2018 Ceos CONCLAVE 5 OCTOBER 2018

RE-INVEST 2018 CEOs CONCLAVE 5 OCTOBER 2018 | INVITEE LIST # Name Designation Organisation 1 Mr Martin Hermann CEO & Founder 8minute Energy 2 Mr Manoj Kumar Upadhay Founder, Chairman & Managing Director Acme Group 3 Mr Jayant Parimal CEO Adani Green Energy 4 Mr Vineet Jain CEO Adani Power and Infra 5 Mr Akinwumi Adesina President African Development Bank Group 6 Mr Sanjeev Aggarwal Managing Director & CEO Amplus Solar 7 Mr Takehiko Nakao President Asian Development Bank, Manila (Philipines) 8 Mr Jin Liqun President Asian Infrastructure Investment Bank (AIIB) 9 Mr Inderpreet Wadhwa Founder & CEO Azure Power 10 Mr Tejpreet Chopra Chairman & Managing Director Bharat Light & Power Pvt Ltd 11 Mr Kuldeep Jain Managing Director Clean Max Solar 12 Mr Rajiv Ranjan Mishra Managing Director CLP India Pvt Ltd 13 Mr Gopal Singh Chairman Coal India 14 Mr Rajesh Srivastava Director CosLight 15 Mr Akbar Shamji Managing Director CPEC Ltd 16 Mr K Krishan Chairman CVC (India) Infrastructure Ltd 17 Mr Nandeesh Kumar HR Director Finance Emmvee PV 18 Mr Daniel Elliot CEO Enerblu 19 Mr Ashok Agarwal Whole-time Director Essel Infra & Utilities 20 Mr Werner Hoyer President European Investment Bank (EIB) 21 Mr Anant Nahata Managing Director EXICOM 22 Mr David Rasquinha Managing Director (Additional Charge) EXIM Bank 23 Mr Sujoy Ghosh India Head First Solar 24 Mr Sanjay Aggarwal Managing Director Fortum 25 Mr Ramesh Kymal Managing Director Siemens Gamesa Renewable Energy 26 Mr Mahesh Palashikar CEO, Onshore Wind Asia Pacific Region GE 27 Mr Anil Kumar Chalamalasetty Founder, Chief Executive & Managing Director Greenko Energies Pvt Ltd 28 Mr Siddharth Mayur Founder President & CEO H2E Power Systems INC. -

G20 Subsidies to Oil, Gas and Coal Production

G20 subsidies to oil gas and coal production: India Vibhuti Garg and Ken Bossong Argentina Australia Brazil Canada China France Germany India Indonesia Italy Japan Korea (Republic of) Mexico Russia Saudi Arabia This country study is a background paper for the report Empty promises: G20 subsidies South Africa to oil, gas and coal production by Oil Change International (OCI) and the Overseas Turkey Development Institute (ODI). It builds on research completed for an earlier report The fossil United Kingdom fuel bailout: G20 subsidies to oil, gas and coal exploration, published in 2014. United States For the purposes of this country study, production subsidies for fossil fuels include: national subsidies, investment by state-owned enterprises, and public finance.A brief outline of the methodology can be found in this country summary. The full report provides a more detailed discussion of the methodology used for the country studies and sets out the technical and transparency issues linked to the identification of G20 subsidies to oil, gas and coal production. The authors welcome feedback on both this country study and the full report to improve the accuracy and transparency of information on G20 government support to fossil fuel production. A Data Sheet with data sources and further information for India’s production subsidies is available at: http://www.odi.org/publications/10073-g20-subsidies-oil-gas-coal-production-india priceofoil.org Country Study odi.org November 2015 Background remained substantial at $11 billion in 2014–15 (MoPNG, India has substantial fossil fuel reserves, including 61 2015b). Similar consumer subsidies of approximately billion tonnes of coal, 5.7 billion barrels of oil and 1.4 $12 billion in 2012–13 existed in the electricity sector. -

INDIA SOLAR COMPASS 2017Q2 © BRIDGE to INDIA, 2017 2 Preface

INDIA SOLAR COMPASS 2017Q2 © BRIDGE TO INDIA, 2017 2 Preface Dear Reader, I am delighted to present to you our new, more comprehensive India Solar Compass. As the Indian solar market matures and grows in volumes, we have expanded the scope of this report to pack all vital information – tender and project updates, leading players, financing deal flow, policy status etc. The Compass aims to provide you with not just an update on the previous quarter but also an insight into the coming quarters. I hope that it will give you a unique vantage point on the sector dynamics in a concise yet comprehensive format. I have no doubt that there is huge scope for improvement in both content and format. Please help us with your feedback. The Compass shall be a paid report from next quarter onwards. You have a number of subscription options – for more details, please contact [email protected]. Sincerely, Vinay Rustagi Managing Director © BRIDGE TO INDIA, 2017 3 Contents 1. Introduction 5 2. Total installed capacity 6 3. Capacity addition 10 3.1 Slowdown in capacity addition in Q2 2017 10 3.2 Capacity addition estimate for Q3 2017 13 4. Leading players 15 4.1 Leading developers based on capacity commissioned in Q2 2017 15 4.2 Solar modules 15 4.3 Inverters 16 5. Tender progress updates 17 5.1 Increase in tender issuance (and cancellations) 17 5.2 Tender result announcements 21 5.3 Anticipated tenders 25 6. Pricing updates 26 6.1 EPC costs 26 6.2 Solar modules 26 6.3 Inverters 27 7. -

1 Objectives, Functions, Schemes and Organizational Structure

1 Objectives, Functions, Schemes and Organizational Structure The core objectives of MoC are linked to its vision of securing the availability of coal to meet the demand of different sectors of the economy in an eco-friendly and sustainable manner and the overall mission of augmenting production through Government companies as well as the captive mining route by adopting state-of-the-art, clean-coal technologies; enhancing exploration efforts with thrust on increasing proven resources and developing the necessary infrastructure for prompt evacuation of coal. 1.1 Objectives Ensuring achievement of Annual Action Plan targets for coal production and off-take, OBR removal, lignite production and lignite based power generation. Infrastructure development to augment coal and washed coal production. Leveraging technology to minimize environmental externalities. Cutting edge research and development initiatives. Enhancing exploration to augment resource base. Quality and reliability in customer services. Expeditious and joint solutions to inter-ministerial issues. Improving efficiency of Coal India Attracting private investments Allocating new coal blocks in a transparent manner. 1.2 Functions Facilitating exploration, development and exploitation of coking and non-coking coal and lignite reserves in India. All matters related to production, supply, distribution and prices of coal. 3 Development and operation of coal washeries other than those for which Department of Steel is responsible. Administration of the Coal Mines (Nationalisation)