G20 Subsidies to Oil, Gas and Coal Production

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

India: Inventory of Estimated Budgetary Support and Tax Expenditures for Fossil-Fuels

INDIA: INVENTORY OF ESTIMATED BUDGETARY SUPPORT AND TAX EXPENDITURES FOR FOSSIL-FUELS Energy resources and market structure India is one of the fastest growing energy markets in the world. The country is the world’s third largest coal producer owing to its large deposits. Coal is the leading primary fuel in India’s energy mix, accounting for 44% of the country’s total primary energy supply (TPES), with thermal power plants making up the majority of coal consumption. Biomass accounts for 25% of total energy use, followed by oil and natural gas, which account respectively for 22% and 7% of the country’s energy needs. Remaining energy sources, such as nuclear power and hydro-electricity, account for about 1% each. The country’s proven reserves of oil were 5.5 billion barrels as of December 2012; nonetheless, domestic production falls far short of domestic demand and the country depends heavily on imported crude oil. The state-owned coal company, Coal India Limited (CIL), retains a near monopoly of coal extraction, with over 90% of domestic coal extraction attributed to government-controlled mines. Most coal mining occurs in the states of Bihar, Chhattisgarh, Jharkhand, Madhya Pradesh, Orissa, and West Bengal. Market reforms are being implemented to bring competition and transparency to the coal sector. The government has been grappling to get an effective regulatory framework in place, which includes the loosening of regulations for the coal industry, with the objective of moving some grades of coal closer to international market prices, and allocating additional coal blocks through a transparent open bidding process. -

Cairn India Limited

RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated 27 November, 2006 100% Book Built Issue CAIRN INDIA LIMITED (Incorporated as a public limited company under the Companies Act, 1956 on 21 August, 2006) The registered office of the Company was changed from Lentin Chambers, 3rd Floor, Dalal Street, Fort, Mumbai 400 023 to 401 Dalamal Towers, Nariman Point, Mumbai 400 021, India, its current registered office on 12 October, 2006 Tel: +(91) (22) 2287 2001; Fax: +91 (22) 2287 2002 Principal Business Office: 3rd and 4th Floor, Orchid Plaza, Suncity, Sector 54, Gurgaon, 122 002 Tel: +(91) (124) 414 1360; Fax: +(91) (124) 288 9320; Website: www.cairnindia.com Contact Person: Preeti Chheda; E-mail: [email protected] PUBLIC ISSUE OF 328,799,675 EQUITY SHARES OF RS. 10 EACH (‘‘EQUITY SHARES’’) FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE OF CAIRN INDIA LIMITED (THE ‘‘COMPANY’’) AGGREGATING TO RS. [ɀ] (THE ‘‘ISSUE’’). THERE WILL ALSO BE A GREEN SHOE OPTION OF UP TO 49,319,951 EQUITY SHARES FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE AGGREGATING TO RS. [ɀ] (THE ‘‘GREEN SHOE OPTION’’). THE ISSUE AND THE GREEN SHOE OPTION, IF EXERCISED IN FULL, WILL AGGREGATE TO 378,119,626 EQUITY SHARES AMOUNTING TO RS. [ɀ]. THE ISSUE WILL CONSTITUTE 18.63% OF THE FULLY DILUTED POST-ISSUE EQUITY SHARE CAPITAL OF THE COMPANY ASSUMING THAT THE GREEN SHOE OPTION IS NOT EXERCISED AND 20.84% ASSUMING THAT THE GREEN SHOE OPTION IS EXERCISED IN FULL. -

“Power Finance Corporation - Investors Interaction Meet”

“Power Finance Corporation - Investors Interaction Meet” May 31, 2018 MANAGEMENT: TEAM OF POWER FINANCE CORPORATION:- - Mr. Rajeev Sharma - Chairman and Managing Director - Mr. D. Ravi - Director (Commercial) - Mr. C. Gangopadhyay - Director (Project) - Shri Sitaram Pareek - Independent Director Page 1 of 23 Power Finance Corporation May 31, 2018 Speaker: Good Afternoon, Ladies and Gentlemen. On behalf of Power Finance Corporation, we feel honored and privileged to welcome you all to this Investors Interaction Meet. The company recently announced its financial results for the year 2017-18 and has been successful in maintaining its growth trajectory. PFC is always aiming to connect with its investor and build a strong and enduring positive relationship with the investment community. With this objective, today’s event has been organized to discuss PFC’s current performance and future outlook with the current and prospective investors. On the desk in the center is Chairman and Managing Director -- Shri Rajeev Sharma along with the other directors. To my immediate left is Shri DRavi – Director, Commercial. Next to him is Shri C Gangopadhyay – Director, Projects. To my extreme left is Shri Sitaram Pareek – Independent Director and beside him is Shri N.B. Gupta – Director, Finance. They are all in front of you to give a brief insight of PFC’s performance during the financial year 2017-18. They will also present to you a roadmap for the forthcoming year. I request Shri Rajeev Sharma -- Chairman and Managing Director to address the gathering. Rajeev Sharma: Thank you very much for sparing your valuable time to be present here during this interaction. -

Shri Saurabh Tripathy Informant and Great Eastern Energy Corporation

COMPETITION COMMISSION OF INDIA Case No. 63 of 2014 In Re: Shri Saurabh Tripathy Informant And Great Eastern Energy Corporation Ltd. Opposite Party CORAM Mr. Devender Kumar Sikri Chairperson Mr. S. L. Bunker Member Mr. Sudhir Mital Member Mr. U.C. Nahta Member Mr. Justice G. P. Mittal Member Appearances: Shri Sharad Gupta and Shri Vinayak Gupta, Advocates for the Informant alongwith Shri Saurabh Tripathy, Informant- in-Person. Shri Ramji Srinivasan, Senior Advocate with Shri P. Ram Kumar, Shri Avinash Amarnath and Shri Tushar Bhardwaj, Advocates; Shri Amit Sharma, Head (Legal) & Company Secretary and Shri Amit Kumar, Deputy Manager (Legal & Secretarial) for Great Eastern Energy Corporation Ltd. (‘GEECL’/ ‘OP’). C. No. 63 of 2014 Page 1 of 39 ORDER 1. The present information has been filed by Shri Saurabh Tripathy (‘the Informant’) under Section 19(1) (a) of the Competition Act, 2002 (‘the Act’) against Great Eastern Energy Corporation Ltd. (‘the Opposite Party’/ OP/ ‘GEECL’) alleging inter alia contravention of the provisions of Section 4 of the Act. Facts 2. Facts, as stated in the information, may be briefly noticed. 3. GEECL is a company incorporated under the provisions of the Companies Act, 1956, having its registered office at M-10, ADDA Industrial Estate, Asansol- 713305, West Bengal. Founded in 1993, it is stated to be the first commercial producer of Coal Bed Methane (CBM) gas in India and is engaged in exploration, development, production, distribution and sale of CBM gas. It currently owns 100% stake in two CBM gas blocks in Raniganj (South), West Bengal and Mannargudi, Tamil Nadu. -

Vedanta Limited and Cairn India Revise Terms for Merger

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION 22 July 2016 VEDANTA LIMITED AND CAIRN INDIA REVISE TERMS FOR MERGER Vedanta Limited, Cairn India Limited (“Cairn India”) and Vedanta Resources plc (“Vedanta plc” together with its subsidiaries, the “Group”), today announce revised and final terms to the recommended merger between Vedanta Limited and Cairn India (the “Transaction”), that was announced on 14 June 2015. Key Highlights o The Boards of Vedanta Limited and Cairn India have today approved revised and final terms for the Transaction, taking into account prevailing market conditions and having regard to underlying commercial factors. o Pursuant to the revised and final terms, each Cairn India minority shareholder will receive for each equity share held: - 1 equity share in Vedanta Limited; and - 4 Redeemable Preference Shares with a face value of INR 10 in Vedanta Limited, with a coupon of 7.5% and tenure of 18 months from issuance. - Implied premium of 20% to one month VWAP of Cairn India share price. o The recent commodity price environment has further strengthened the strategic rationale of the Transaction outlined at the announcement: - Diversified Tier-I portfolio de-risks earnings volatility and drives stable cash flows through the cycle. - Strong historical evidence over the last 10 years, of diversified resources companies generating total shareholder returns superior to single-commodity companies. - Improved ability to allocate capital to the highest return projects across the portfolio. -

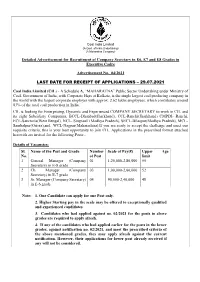

Detailed Advertisement for Recruitment of Company Secretary in E6, E7 and E8 Grades in Executive Cadre

Coal India Limited (A Govt. of India Undertaking) (A Maharatna Company) Detailed Advertisement for Recruitment of Company Secretary in E6, E7 and E8 Grades in Executive Cadre Advertisement No. 04/2021 LAST DATE FOR RECEIPT OF APPLICATIONS – 29.07.2021 Coal India Limited (CIL) - A Schedule A, “MAHARATNA” Public Sector Undertaking under Ministry of Coal, Government of India, with Corporate Hqrs at Kolkata, is the single largest coal producing company in the world with the largest corporate employer with approx. 2.62 lakhs employees, which contributes around 83% of the total coal production in India. CIL is looking for Enterprising, Dynamic and Experienced COMPANY SECRETARY to work in CIL and its eight Subsidiary Companies, BCCL-Dhanbad(Jharkhand), CCL-Ranchi(Jharkhand) CMPDI- Ranchi, ECL-Sanctoria(West Bengal), NCL- Singrauli (Madhya Pradesh), SECL-Bilaspur(Madhya Pradesh), MCL- Sambalpur(Orissa),and WCL-Nagpur(Maharashtra).If you are ready to accept the challenge and meet our requisite criteria, this is your best opportunity to join CIL. Applications in the prescribed format attached herewith are invited for the following Posts:- Details of Vacancies: Sl. Name of the Post and Grade Number Scale of Pay(₹) Upper Age No. of Post limit 1 General Manager (Company 01 1,20,000-2,80,000 55 Secretary) in E-8 grade 2 Ch. Manager (Company 03 1,00,000-2,60,000 52 Secretary) in E-7 grade 3 Sr. Manager (Company Secretary) 04 90,000-2,40,000 48 in E-6 grade Note- 1. One Candidate can apply for one Post only. 2. Higher Starting pay in the scale may be offered to exceptionally qualified and experienced candidates. -

Ngo Documents 2013-08-14 00:00:00 Coal India Investor Brief High Risk

High risk, low return COAL INDIA LTD’s shareholder value is threatened by poor corporate governance, faulty reserve estimations, regulatory risk and macro-economic issues. Introduction Coal India Limited is the world’s largest coal miner, with a production of 435 million metric tons (MT) in 2011 -201 2. There is significant pressure on CIL to deliver annual production growth rates in excess of 7%. The company has a 201 7 production target of 61 5 MT.[1 ] Coal India’s track record raises questions over its ability to deliver this rate of growth. In addition, serious governance issues are likely to impact CIL’s financial performance. These pose a financial and reputational risk to CIL, its shareholders and lenders, while macro- economic issues in the Indian energy economy pose a long term threat to Coal India. • CIL’s attempts to access new mining areas are facing widespread opposition from local communities and environmental groups. With its reliance on open-pit mining, access to new mines are essential for CIL to achieve production targets. G • CIL has grown reliant on shallow, open pit mining for 90% of its production, and has lost in-house expertise on deep mining techniques. N I • CIL has a record of poor corporate governance, manifested in rampant corruption, poor worker safety and repeated legal violations. This has, in the last year alone, led to penalties and F closure notices for over 50 mines, threatening both its financial performance and reputation. E I • CIL’s financial performance has been affected by directives from majority shareholder Government of India to keep coal prices artifically low.[2] According to one estimate, this cost R CIL $1 .75 billion in the 201 2-1 3 financial year alone.[3] The government has also taken away coal blocks allocated to CIL and given them to private players.[4] B • Changing economics of coal power in India; renewable energies are becoming cost- competitive even as coal faces increased regulatory scrutiny and public opposition. -

1 Objectives, Functions, Schemes and Organizational Structure

1 Objectives, Functions, Schemes and Organizational Structure The core objectives of MoC are linked to its vision of securing the availability of coal to meet the demand of different sectors of the economy in an eco-friendly and sustainable manner and the overall mission of augmenting production through Government companies as well as the captive mining route by adopting state-of-the-art, clean-coal technologies; enhancing exploration efforts with thrust on increasing proven resources and developing the necessary infrastructure for prompt evacuation of coal. 1.1 Objectives Ensuring achievement of Annual Action Plan targets for coal production and off-take, OBR removal, lignite production and lignite based power generation. Infrastructure development to augment coal and washed coal production. Leveraging technology to minimize environmental externalities. Cutting edge research and development initiatives. Enhancing exploration to augment resource base. Quality and reliability in customer services. Expeditious and joint solutions to inter-ministerial issues. Improving efficiency of Coal India Attracting private investments Allocating new coal blocks in a transparent manner. 1.2 Functions Facilitating exploration, development and exploitation of coking and non-coking coal and lignite reserves in India. All matters related to production, supply, distribution and prices of coal. 3 Development and operation of coal washeries other than those for which Department of Steel is responsible. Administration of the Coal Mines (Nationalisation) -

PPAC's Snapshot of India's Oil & Gas Data

PPAC's Snapshot of India’s Oil & Gas data Abridged Ready Reckoner May, 2021 Petroleum Planning & Analysis Cell (Ministry of Petroleum & Natural Gas) As on 18.06.2021 Petroleum Planning & Analysis Cell (PPAC), an attached office of the Ministry of Petroleum & Natural Gas (MoPNG), Government of India, collects and analyses data on the Oil and Gas sector. It disseminates many reports on the Oil & Gas sector to the various stakeholders. The data is obtained from the Public Sector companies, Government agencies as well as the Private companies. Given the ever-increasing demand for energy and transition of energy demand to renewables and Biofuels, Policy makers and Analysts need to be well informed about the updated trends in the Oil & Gas industry. The PPAC’s Snapshot of India’s Oil & Gas data (Abridged Ready Reckoner) provides a comprehensive compilation of the latest data/information in a single volume for the latest month and historical time series. The Snapshot of India’s Oil & Gas data is also published on PPAC’s website (www.ppac.gov.in) and is accessible on mobile app-PPACE. This publication is a concerted effort by all divisions of PPAC. The cooperation of the oil and gas industry is acknowledged for their timely inputs. Table of contents Table Description Page No. Highlights for the month 2-3 ECONOMIC INDICATORS 1 Selected indicators of the Indian economy 5 2 Crude oil, LNG and petroleum products at a glance; Graph 6-7 CRUDE OIL, REFINING & PRODUCTION 3 Indigenous crude oil production 9 4 Domestic oil & gas production vis-à-vis overseas -

Running an Oil Company in India by Sastry Karra

RUNNING AN OIL COMPANY IN INDIA BY SASTRY KARRA FROM 1999 – 2009 INTRO 1 INDIA BACKGROUND • POPULATION 1.3 BN • AREA - 3.3 MM SQ KM, A THIRD OF CANADA • 5,000 YEARS (OR MORE) OF HISTORY • YOUNG POPULATION - AVERAGE 24 YEARS OLD • SIZEABLE ILLITERACY AND POVERTY STILL REMAINS • PROBLEMS ARE MYRIAD • MANY CHALLENGES 2 INDIA AND CHINA ACCOUNTED FOR 75% OF WORLD GDP IN THE 15TH CENTURY UNLIKELY THEY WILL REACH BUT ROBUST GROWTH WILL AND INDIA, FOURTH TODAY THIS FIGURE AGAIN PUSH CHINA AS THE NO 1 WILL REACH 3RD POSITION ECONOMY SOON TECHNOLGY BILLION CELL PHONESPACE MOST NUMBER OF CELL PHONES ACHIEVEMENTS IN SPACE MANY FIRSTS JUST LAUNCHED A VESSEL TO MARS 3 FROM OUT-SOURCING AND BACKOFFICE TO INTERNET AND CORPORATE POWER • FINANCIAL ANALYSIS FOR MOST USA, CANADIAN AND EUROPEAN BANKS • A YOUTH FROM HYDERABAD NOW CEO OF MICROSOFT • ANOTHER YOUNG MAN FROM CHENNAI CEO OF GOOGLE • SEVERAL CEOS OF WESTERN BANKS • CEO OF PEPSI • MAJORITY ON THE DIAMOND COUNCIL IN ANTWERP 4 OIL AND GAS SITUATION • ONLY 4% OF WORLD’S SEDIMENTARY BASINS IN INDIA SERVING 18% OF POPULATION • STILL MANY AREAS REMAIN TO BE EXPLORED • YEAR 2002 WAS A GREAT YEAR WITH RELIANCE MAKING BIOGENIC GAS DISCOVERIES IN THE KRISHNA GODAVARI (KG) BASIN DEEP WATER • CAIRN MADE MEGA DISCOVERIES IN RAJASTHAN • CURRENT IMPORTS 4 MMSTB OF OIL PER DAY AND 15 MMT/YR OF LNG • DEMAND SOARING AND DOMESTIC PRODUCTION ON DECLINE 5 FOREIGN OIL COMPANIES IN INDIA • FEW EXPLORATION WELLS DRILLED PRIOR TO THE EIGHTIES WITH NO SUCCESS • EARLY NINETIES SAW THE ENTRY OF CAIRN ENERGY, HARDY OIL, NIKO -

Coal India Signs Mou with GAIL

Monthly Magazine on CPSE happenings March, 2020 | www.psuconnect.in The Prime Minister, Shri Narendra Modi interacting with the Heads of Indian Missions abroad through video conferencing to discuss responses to the global COVID-19 pandemic www.psuconnect.in March, 2020 1 EVENTS Monthly Magazine of CPSE happenings WINGS INDIA 2020 takes off hri K.T Rama Rao, Minister for Industries &Commerce,Telangana inaugurated Wings India 2020,at Begumpet Airport, Hyderabad in presence of Shri M K Rao, Minister of Civil Aviation, Puducherry, Shri Arvind Singh, Chairman, AAI and Smt Usha SPadhee, Joint Secretary, Minister of Civil Aviation, GoI. The international event is jointly organized by Ministry of Civil Aviation, Govt. of India, AAI and FICCI. www.psuconnect.in March, 2020 2 EVENTS Monthly Magazine of CPSE happenings Shri Rajnath Singh Inaugurates Shri R.K Singh inaugurates NTPC PFCSetupFirstWomens The Light Combat Helicopter O&M-IPS 2020 Conference ConvenienceLoungeAt nion Defence Minister, Shri Rajnath Singh inaugurates the Light Combat DelhiMetrosBlueLine UHelicopter Final Assembly Hangar at the hri S N Sahai, Secretary, Power in Hindustan Aeronautics Limited (HAL) Complex the presence of CMD/PFC Shri in Bengaluru. SRajeev Sharma and MD/DMRC Dr HAL is actively engaged and is contributing to Mangu Singh and inaugurated the the space programmes of the country. HAL is Women's Convenience Lounge at also setting up dedicated facility for Barakhamba Road station with a dedicated manufacture of cryogenic engines. diaper changing centre, breastfeeding kiosk & free napkin vending machine. hri R K Singh, Union Minister of State with Independent Charge for Power and New & SRenewable Energy, Inaugurated the 9th edition of NTPC O&M-India Power Station (IPS) 2020 conference at Pandit Deen Dayal Upadhyay auditorium in Raipur. -

Ifrss) As Issued by International Accounting Standards Board (‘IASB’)

INDEPENDENT AUDITOR’S REPORT To the Board of Directors of Great Eastern Energy Corporation Limited Report on the Audit of the Financial Statements Opinion We have audited the financial statements of Great Eastern Energy Corporation Limited (“the Company”), which comprise the statement of financial position as at March 31, 2020, and the income statement, the statement of profit and loss and other comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies. In our opinion, the accompanying financial statements give a true and fair view of the financial position of the Company as at March 31, 2020, and of its financial performance and its cash flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs) as issued by International Accounting Standards Board (‘IASB’). Basis for Opinion We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the International Ethics Standards Board for Accountants’ Code of Ethics for Professional Accountants (IESBA Code) together with the ethical requirements that are relevant to our audit of the financial statements in India, and we have fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.