SEC News Digest, 06-30-2000

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

Technology Fast 500

2001 Deloitte & Touche Technology Fast 500 www.fast500.com Leading the Way It’s been a tough year for the technology sector, and the com- Industry segments represented were relatively stable from panies on this year’s Deloitte & Touche Technology Fast 500 last year, with software companies again leading the way are not immune to the effects of the tech correction and the with 221 companies or 44 percent of the list. Notably, given slowing of the U.S. economy. Indeed, some Fast 500 compa- the malaise in the field, communications companies jumped nies have seen their businesses slow significantly in 2001 and from nine percent to 13 percent of the list.While Internet are struggling after five years of dramatic growth (the 2001 companies are prominent at the top of the list, as a group, Fast 500 measures five-year growth through fiscal 2000). they slid from 17 percent to 15 percent. With that said, this year’s Technology Fast 500 companies, as Geographical Shifts a group, found a way to grow even faster than their prede- After a one-year hiatus, the West resumed its position at the cessors.The 2001 Technology Fast 500 averaged a five-year head of the technology class, accounting for 32 percent of percentage revenue growth rate of 6,184 percent, compared the Fast 500, up from 27 percent. California was, by far, the to 3,956 percent for last year’s list.The top five companies biggest contributor to the list with 132 companies, including grew an average of 93,496 percent, compared to 59,367 percent two of the top three companies, calling the Golden State for last year’s top five. -

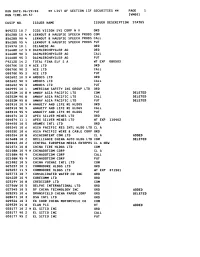

LIST of SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 Ivmool

RUN DATE:06/29/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:09:57 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT 8 HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM DELETED G0352M 90 8 AMWAY ASIA PACIFIC LTD CALL DELETED G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT DELETED GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A ADDED G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM DELETED 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2lO8N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

List of Section 13F Securities, Third Quarter 2001

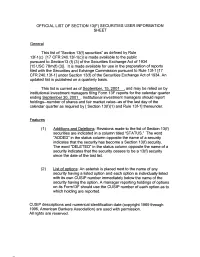

OFFICIAL LIST OF SECTION 13(F) SECURITIES USER INFORMATION SHEET General This list of "Section 13(f) securities" as defined by Rule 13f-I(c) [I7 CFR 240.13f-I (c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [I5 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 117 CFR 240.1 3f-I] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of September, 15, 2001 ,and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending September 30, 2001 . Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by [ Section 13(f)(l) and Rule 13f-I] thereunder. Features (1 ) Additions and Deletions: Revisions made to the list of Section 13(f) securities are indicated in a column titled "STATUS." The word "ADDED" in the status column opposite the name of a security indicates that the security has become a Section 13(f) security. The word "DELE-TED" in the status colurr~nopposite the name of a security indicates that the security ceases to be a 13(f) security since the date of the last list. (2) List of options: An asterisk is placed next to the name of any security having a listed option and each option is individually listed with its own CUSlP nurr~berimmediately below the name of the security having the option. -

3Rd Quarter, 2000

RUN DATE:10/06/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:14:34 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS VISION SYS CORP N V ORD B5628B 10 4 * LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT & HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT & HAUSPIE SPEECH PRODS PUT D1497A 10 1 CELANESE AG ORD D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FINA ELF S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT GO2602 10 3 * AMDOCS LTD ORD GO2602 90 3 AMDOCS LTD CALL GO2602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD GO3910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4074 11 1 APEX SILVER MINES LTD WT EXP 110402 GO4397 10 8 * APW LTD COM ADDED GO4397 90 8 APW LTD CALL ADDED GO4397 95 8 APW LTD PUT ADDED GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE & CABLE CORP ORD GO5354 10 8 ASIACONTENT COM LTD CL A 620045 20 2 CENTRAL EUROPEAN MEDIA ENTRPRS CL A NEW G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 * CHINADOTCOM CORP CL A G2108N 90 9 CHINADOTCOM CORP CALL G2108N 95 9 CHINADOTCOM CORP PUT 621082 10 5 CHINA YUCHAI INTL LTD COM 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 9 COMMODORE HLDGS LTD WT EXP 071501 623773 10 7 CONSOLIDATED WATER CO INC ORD G2422R 10 9 * CORECOMM LTD ORD G2422R 90 9 CORECOMM LTD CALL G2422R 95 9 CORECOMM LTD PUT G2519Y 10 8 CREDICORP LTD COM G2706W 10 5 DELPHI INTERNATIONAL LTD ORD 627545 10 5 DF CHINA TECHNOLOGY INC ORD G2759W 10 1 DIGITAL UNITED HOLDINGS LTD ORD ADDED 628471 10 3 DSG INTL LTD ORD 629526 10 3 EK CHOR CHINA MOTORCYCLE CO COM 629539 14 8 ELAN PLC R T 630177 10 2 * EL SIT10 INC ORD 630177 90 2 EL SIT10 INC CALL RUN DATE:10/06/00 ** LIST OF SECTION 13F SECURITIES ** PAGE 2 RUN TIME:14:34 IVMOOl CUSIP NO. -

Iraq Delivers Weapons Report

SJMN Operator: NN / Job name: XXXX0523-0001 / Description: Zone:MO Edition: Revised, date and time: 04/26/75, 11:23 Typeset, date and time: 12/08/02, 00:12 1208021MOA0A001 / Typesetter: IIIOUT / TCP: #1 / Queue entry: #0399 CYAN MAGENTA YELLOW BLACK 12/8/2002 MOA1FC SPORTS | GIANTS SIGN TWO, KEEP OPTIONS OPEN ON KENT | PAGE 1C RAY DURHAM, MARQUIS GRISSOM JOIN TEAM SECOND BASEMAN KENT OFFERED SALARY ARBITRATION Sunday ARTS & ENTERTAINMENT L.A. ARTISTS GO BEYOND TRAVEL giving ❤ SPECIAL 16-PAGE SECTION COOL FIVE IDEAS FOR CHRISTMAS, Vision, sincerity on display CALIFORNIA-STYLE Philanthropy in Silicon Valley at San Jose Museum of Art PAGE 1H BEHIND THE BUSINESS SECTION PAGE 1E $1.00 | FINAL EDITION | DECEMBER 8, 2002 | SUNDAY FC . WWW.BAYAREA.COM SERVING NORTHERN CALIFORNIA SINCE 1851 THE NEWSPAPER OF SILICON VALLEY THE INSIDERS Iraq delivers , weapons RICH MAN report 12,000-PAGE DOCUMENT ISSUED WITH A THREAT Mercury News Wire Services BAGHDAD, Iraq — Iraqi President POOR COMPANY Saddam Hussein made a grand ges- ture of cooperation with the United HOW SOME SILICON VALLEY EXECUTIVES MADE FORTUNES Nations on Saturday, turning over a 12,000-page inventory of materials he possesses that could be used for WHILE THE VALUE OF THEIR COMPANIES PLUNGED weapons, but he then turned his open hand into a fist. Iraqi officials said the released doc- (AND IT’S ALL PERFECTLY LEGAL) uments confirmed, in rebuttal of U.S. and British claims, that Saddam Hus- sein’s government had no weapons of FOUR WINNERS mass destruction and no current pro- A Mercury News analysis shows insiders at 40 companies took home AND THEIR LOSERS grams to develop them. -

GAO-03-395R Financial Statement Restatement Database

United States General Accounting Office Washington, DC 20548 January 17, 2003 The Honorable Paul S. Sarbanes Ranking Minority Member Committee on Banking, Housing, and Urban Affairs United States Senate Subject: Financial Statement Restatement Database On October 4, 2002, we issued a report to you entitled Financial Statement Restatements: Trends, Market Impacts, Regulatory Responses, and Remaining Challenges (Washington, D.C.: GAO-03-138). That report included a listing of 919 restatements we identified as having been made because of accounting irregularities between January 1, 1997, and June 30, 2002. Since its release, the report has drawn considerable attention from academics and other researchers, and we have received numerous requests for additional data about these restatements. As a result, and with the agreement of your office, we are releasing our database of information collected from public sources on the 919 restatements. We encourage researchers and the public to consider our objectives, scope, and methodology (enclosure I) and engage in their own analyses of the data contained in our restatements database (enclosure II). In addition to providing the name of each company associated with a restatement announcement, we are including the company’s stock ticker symbol, the market on which the stock was trading at the time of the announcement, the date of the announcement, the entity that prompted the restatement, and the reason(s) for the restatement. We are not releasing stock price or market capitalization data, since we obtained this information from proprietary sources, but we are including the number of shares outstanding for each company. As we stated in our October report, certain of these items, such as the entity that prompted the restatement and the reason for the restatement, are subject to interpretation, and other researchers may categorize certain restatements differently. -

Why Has IPO Underpricing Changed Over Time?

Why Has IPO Underpricing Changed Over Time? Tim Loughran and Jay Ritter* In the 1980s, the average first-day return on initial public offerings (IPOs) was 7%. The average first-day return doubled to almost 15% during 1990-1998, before jumping to 65% during the internet bubble years of 1999-2000 and then reverting to 12% during 2001-2003. We attribute much of the higher underpricing during the bubble period to a changing issuer objective function. We argue that in the later periods there was less focus on maximizing IPO proceeds due to an increased emphasis on research coverage. Furthermore, allocations of hot IPOs to the personal brokerage accounts of issuing firm executives created an incentive to seek rather than avoid underwriters with a reputation for severe underpricing. What explains the severe underpricing of initial public offerings in 1999-2000, when the average first-day return of 65% exceeded any level previously seen before? In this article, we address this and the related question of why IPO underpricing doubled from 7% during 1980-1989 to almost 15% during 1990-1998 before reverting to 12% during the post-bubble period of 2001- 2003. Our goal is to explain low-frequency movements in underpricing (or first-day returns) that occur less often than hot and cold issue markets. We examine three hypotheses for the change in underpricing: 1) the changing risk composition hypothesis, 2) the realignment of incentives hypothesis, and 3) a new hypothesis, the changing issuer objective function hypothesis. The changing issuer objective function hypothesis has two components, the spinning hypothesis and the analyst lust hypothesis. -

Robert M. Karr Collection of IPO S-1 Registration Documents Inventory, 1980-2001

Robert M. Karr collection of IPO S-1 registration documents X8760.2019 Robert M. Karr collection of IPO S-1 registration documents inventory, 1980-2001 The following inventory was provided by the donor. Box 1: 3D Labs – CardioGenesis Box 2: Cardiometrics – Farallon Communications Box 3: Faroudja – Larscom Box 4: Laserscope – Pacific Gateway Exchange Box 5: Packeteer – Somnus Medical Technologies Box 6: SonicWALL – WJ Communications Box 7: Women.com Networks – Zycon Name Issue date Year 3D Labs 11/18/96 1996 3DFX 6/25/97 1997 8x8 7/2/97 1997 Abaxis 1/22/92 1992 Abgenix 7/2/98 1998 Abovenet Communications 12/10/98 1998 AccelGraphics 4/11/97 1997 Accom 9/26/95 1995 Accrue Software 7/30/99 1999 Aclara 3/20/00 2000 Actel 8/2/93 1993 ActivCard 3/15/00 2000 Active Software 8/12/99 1999 Actuate 7/17/98 1998 Adept 12/15/95 1995 Adeza 1996 Adforce 5/7/99 1999 Adobe Systems 8/13/86 1986 Advanced Fibre Communications 9/30/96 1996 Computer History Museum 1 Robert M. Karr collection of IPO S-1 registration documents X8760.2019 Advanced Polymer Systems 8/26/87 1987 Advent Software 11/15/95 1995 Aehr Test Systems 8/14/97 1997 AeroGen 11/10/00 2000 Affymax N.V 12/17/91 1991 Affymetrix 6/6/96 1996 AG Associates 5/15/95 1995 Agile Software 12/15/95 1995 Agilent Technologies 11/17/99 1999 Alantec 2/4/94 1994 Alliance Fibre Optic Products 11/20/00 2000 Alliance Semiconductor 11/30/93 1993 Alteon Web Systems 9/23/99 1999 Altera 3/30/88 1988 AltiGen Communications 10/4/99 1999 AMB Property 11/21/97 1997 American Champion Entertainment 7/30/97 1997 American Xtal -

GAO-03-138 Financial Statement Restatements

United States General Accounting Office Report to the Chairman, Committee on GAO Banking, Housing, and Urban Affairs, U.S. Senate October 2002 FINANCIAL STATEMENT RESTATEMENTS Trends, Market Impacts, Regulatory Responses, and Remaining Challenges a GAO-03-138 Contents Letter 1 Results in Brief 4 Background 9 The Number of Restatements Has Grown Significantly and Trends Emerge 14 Restating Publicly Traded Companies Lost Billions of Dollars in Market Capitalization in the Days and Months Surrounding a Restatement Announcement 24 Restatements and Accounting Issues Appear to Have Negatively Impacted Investor Confidence 32 SEC Has Been Investigating an Increasing Number of Cases Involving Accounting-Related Issues 42 The Growing Number of Accounting Problems in the Corporate Financial Reporting System Have Spurred Reforms 55 Observations 72 Agency Comments and Our Evaluation 73 Appendixes Appendix I: Objectives, Scope, and Methodology 75 Identifying the Number of and Reasons for Financial Statement Restatements 75 Determining the Impact of Financial Statement Restatements on Market Values of Restating Companies 77 Determining the Impact of Financial Statement Restatements on Investor Confidence 84 Analysis of SEC’s Accounting-Related Enforcement Activities 84 Collecting Information on Current and Proposed Accounting and Financial Reporting Oversight Structures 85 Appendix II: Comments from the Securities and Exchange Commission 86 Appendix III: Listing of Financial Statement Restatement Announcements, 1997-June 2002 88 Appendix IV: Case Study -

List of Section 13F Securities, 3Rd Quarter 1999

RUN DATE:09/22/99 3% LIST OF SECTION 13F SECURITIES ** PAGE 1 RUN TIME:12:35 IVMOOl CUSIP NO. ISSUER NAME ISSUER DESCRIPTION STATUS B49233 10 7 ICOS-VISION SYS CORP N V ORD B5628B 10 4 3 LERNOUT & HAUSPIE SPEECH PRODS COM B5628B 90 4 LERNOUT 8 HAUSPIE SPEECH PRODS CALL B5628B 95 4 LERNOUT & HAUSPIE SPEECH PRODS PUT D1668R 12 3 * DAIMLERCHRYSLER AG ORD D1668R 90 3 DAIMLERCHRYSLER AG CALL D1668R 95 3 DAIMLERCHRYSLER AG PUT F9212D 14 2 TOTAL FlNA S A WT EXP 080503 G0070K 10 3 * ACE LTD ORD G0070K 90 3 ACE LTD CALL G0070K 95 3 ACE LTD PUT 602602 10 3 * AMDOCS LTD ORD 602602 90 3 AMDOCS LTD CALL 602602 95 3 AMDOCS LTD PUT GO2995 10 1 AMERICAN SAFETY INS GROUP LTD ORD G0352M 10 8 * AMWAY ASIA PACIFIC LTD COM 60352M 90 8 AMWAY ASIA PACIFIC LTD CALL G0352M 95 8 AMWAY ASIA PACIFIC LTD PUT GO3910 10 9 * ANNUITY AND LIFE RE HLDGS ORD 603910 90 9 ANNUITY AND LIFE RE HLDGS CALL GO3910 95 9 ANNUITY AND LIFE RE HLDGS PUT GO4074 10 3 APEX SILVER MINES LTD ORD GO4450 10 5 ARAMEX INTL LTD ORD GO5345 10 6 ASIA PACIFIC RES INTL HLDG LTD CL A G0535E 10 6 ASIA PACIFIC WIRE 8 CABLE CORP ORD G0690R 10 8 AXOGEN LTD COM G1368B 10 2 BRILLIANCE CHINA AUTO HLDG LTD COM 620045 10 3 CENTRAL EUROPEAN MEDIA ENTRPRS CL A G2107X 10 8 CHINA TIRE HLDGS LTD COM G2108N 10 9 CHINA COM CORP CL A ADDED 621082 10 5 CHINA YUCHAI INTL LTD COM G2109A 10 6 CHINA ENERGY RES CORP ORD 623257 10 1 COMMODORE HLDGS LTD ORD 623257 11 9 COMMODORE HLDGS LTD WT EXP 071501 623773 10 7 CONSOLIDATED WATER CO INC ORD G2422R 10 9 CORECOMM LTD ORD G2519Y 10 8 CREDICORP LTD COM G2706W 10 5 DELPHI INTERNATIONAL