Corruption in Procurement: Evidence from Financial Transactions Data∗

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Boris Nemtsov 27 February 2015 Moscow, Russia

Boris Nemtsov 27 February 2015 Moscow, Russia the fight against corruption, embezzlement and fraud, claiming that the whole system built by Putin was akin to a mafia. In 2009, he discovered that one of Putin’s allies, Mayor of Moscow City Yury Luzhkov, BORIS and his wife, Yelena Baturina, were engaged in fraudulent business practices. According to the results of his investigation, Baturina had become a billionaire with the help of her husband’s connections. Her real-estate devel- opment company, Inteco, had invested in the construction of dozens of housing complexes in Moscow. Other investors were keen to part- ner with Baturina because she was able to use NEMTSOV her networks to secure permission from the Moscow government to build apartment build- ings, which were the most problematic and It was nearing midnight on 27 February 2015, and the expensive construction projects for developers. stars atop the Kremlin towers shone with their charac- Nemtsov’s report revealed the success of teristic bright-red light. Boris Nemtsov and his partner, Baturina’s business empire to be related to the Anna Duritskaya, were walking along Bolshoy Moskovo- tax benefits she received directly from Moscow retsky Bridge. It was a cold night, and the view from the City government and from lucrative govern- bridge would have been breathtaking. ment tenders won by Inteco. A snowplough passed slowly by the couple, obscuring the scene and probably muffling the sound of the gunshots fired from a side stairway to the bridge. The 55-year-old Nemtsov, a well-known Russian politician, anti-corrup- tion activist and a fierce critic of Vladimir Putin, fell to the ground with four bullets in his back. -

Organized Crime 1.1 Gaizer’S Criminal Group

INTRODUCTION ......................................................................................................... 4 CHAPTER I. ORGANIZED CRIME 1.1 Gaizer’s Criminal Group ..................................................................................6 1.2 Bandits in St. Petersburg ............................................................................ 10 1.3 The Tsapok Gang .......................................................................................... 14 Chapter II.CThe Corrupt Officials 2.1 «I Fell in Love with a Criminal» ................................................................20 2.2 Female Thief with a Birkin Bag ...............................................................24 2.3 «Moscow Crime Boss».................................................................................29 CONTENTS CHAPTER III. THE BRibE-TAKERS 3.1 Governor Khoroshavin’s medal «THE CRIMINAL RUSSIA PARTY», AN INDEPENDENT EXPERT REPORT «For Merit to the Fatherland» ..................................................................32 PUBLISHED IN MOSCOW, AUGUST 2016 3.2 The Astrakhan Brigade ...............................................................................36 AUTHOR: ILYA YASHIN 3.3 A Character from the 1990s ......................................................................39 MATERiaL COMPILING: VERONIKA SHULGINA HAPTER HE ROOKS TRANSLATION: C 4. T C EVGENia KARA-MURZA 4.1 Governor Nicknamed Hans .......................................................................42 GRAPHICS: PavEL YELIZAROV 4.2 The Party -

The Long Arm of Vladimir Putin: How the Kremlin Uses Mutual Legal Assistance Treaties to Target Its Opposition Abroad

The Long Arm of Vladimir Putin: How the Kremlin Uses Mutual Legal Assistance Treaties to Target its Opposition Abroad Russia Studies Centre Policy Paper No. 5 (2015) Dr Andrew Foxall The Henry Jackson Society June 2015 THE LONG ARM OF VLADIMIR PUTIN Summary Over the past 15 years, there has been – and continues to be – significant interchange between Western and Russian law-enforcement agencies, even in cases where Russia’s requests for legal assistance have been politicaLLy motivated. Though it is the Kremlin’s warfare that garners the West’s attention, its ‘lawfare’ poses just as significant a threat because it undermines the rule of law. One of the chief weapons in Russia’s ‘lawfare’ is the so-called ‘Mutual Legal Assistance Treaty’ (MLAT), a bilateral agreement that defines how countries co-operate on legal matters. TypicaLLy, the Kremlin will fabricate a criminaL case against an individual, and then request, through the MLAT system, the co-operation of Western countries in its attempts to persecute said person. Though Putin’s regime has been mounting, since 2012, an escalating campaign against opposition figures, the Kremlin’s use of ‘lawfare’ is nothing new. Long before then, Russia requested – and received – legal assistance from Western countries on a number of occasions, in its efforts to extradite opposition figures back to Russia. Western countries have complied with Russia’s requests for legal assistance in some of the most brazen and high-profile politicaLLy motivated cases in recent history, incLuding: individuals linked with Mikhail Khodorkovsky and the Yukos affair; Bill Browder and others connecteD to Hermitage Capital Management; and AnDrey Borodin and Bank of Moscow. -

Internal Balance of Power in Russia and the Survival of Lukashenko’S Regime

81 FROM RUSSIA WITH LOVE: INTERNAL BALANCE OF POWER IN RUSSIA AND THE SURVIVAL OF LUKASHENKO’S REGIME Laurynas Jonavičius* Abstract This article analyses the relationship between the stability of Alexander Lukashenko’s authoritarian rule and the power balance of different factions competing for power in Russia. The article aims to demonstrate that Lukashenko’s survival not only depends on his ability to trade on Belarus’s geopolitical position between Russia and the West but is also is a function of the existing composition of the ruling elite in Moscow. Being increasingly dependent on Russia’s political and economic support as well as on its energy, Lukashenko manages to use Russia’s internal situation of informal political competition by supporting one or another side. Historically, Lukashenko relied on the support and cooperation of groups that were associated with soviet nostalgia, interests in increasing the state’s role in political and economic life as well as representatives of military and military-industrial complex in Russia. Changes to the balance of power within Russia, the withdrawal of older factions and the entrenchment of new ones, has significantly decreased Lukashenko’s ability to manoeuvre in Russian political life and has minimised his ability to manipulate the competition among the Russian power elite. While retaining some leverages and sporadic contacts with the siloviki faction in Russia, Lukashenko faces more and more difficulties in defending his country’s sovereignty and his own autonomy. Introduction Lukashenko does not love Russia; he loves power. The paradox is that Lukashen- ko needs Russia to remain in power, yet Russia is also the only player capable of removing him from power. -

Dissertation Final Aug 31 Formatted

Identity Gerrymandering: How the Armenian State Constructs and Controls “Its” Diaspora by Kristin Talinn Rebecca Cavoukian A thesis submitted in conformity with the requirements for the degree of Doctor of Philosophy Department of Political Science University of Toronto © Copyright by Kristin Cavoukian 2016 Identity Gerrymandering: How the Armenian State Constructs and Controls “Its” Diaspora Kristin Talinn Rebecca Cavoukian Doctor of Philosophy Department of Political Science University of Toronto 2016 Abstract This dissertation examines the Republic of Armenia (RA) and its elites’ attempts to reframe state-diaspora relations in ways that served state interests. After 17 years of relatively rocky relations, in 2008, a new Ministry of Diaspora was created that offered little in the way of policy output. Instead, it engaged in “identity gerrymandering,” broadening the category of diaspora from its accepted reference to post-1915 genocide refugees and their descendants, to include Armenians living throughout the post-Soviet region who had never identified as such. This diluted the pool of critical, oppositional diasporans with culturally closer and more compliant emigrants. The new ministry also favoured geographically based, hierarchical diaspora organizations, and “quiet” strategies of dissent. Since these were ultimately attempts to define membership in the nation, and informal, affective ties to the state, the Ministry of Diaspora acted as a “discursive power ministry,” with boundary-defining and maintenance functions reminiscent of the physical border policing functions of traditional power ministries. These efforts were directed at three different “diasporas:” the Armenians of Russia, whom RA elites wished to mold into the new “model” diaspora, the Armenians of Georgia, whose indigeneity claims they sought to discourage, and the “established” western diaspora, whose contentious public ii critique they sought to disarm. -

An Integrated Irish Aviation Policy

An Integrated Irish Aviation Policy Submission to the Department of Transport, Tourism and Sport Consultation Chambers Ireland|Air Transport User’s Council|Submission to the Irish Aviation Authority|June 2013 Contents Introduction ............................................................................................................................... 2 Airports ...................................................................................................................................... 3 Access to Infrastructure ......................................................................................................... 3 Future Airport Capacity Needs .............................................................................................. 3 Regional Airports ................................................................................................................... 4 Pricing of Air services ................................................................................................................. 5 Irish Airlines............................................................................................................................ 5 Connectivity ........................................................................................................................... 6 Air Travel Tax.......................................................................................................................... 7 Cargo Services ........................................................................................................................... -

Motivational Factors That Drive Russian Women Towards Entrepreneurship

Master Thesis Motivational Factors That Drive Russian Women Towards Entrepreneurship Author: Iana Sibiriakova & Nikita Lutokhin Supervisor: Frederic Bill Examiner: Åsa Gustafsson Term: VT19 Subject: Degree Project in Business Administration Level: Master Course code: 4FE25E Abstract Purpose – The purpose of this master thesis is to offer a number of illustrations of Russian female entrepreneurs in order to identify potential motivational factors that make Russian women launch their own business start-ups. Design/methodology/approach – The qualitative research method is applied within the master thesis based on information received from secondary (case studies) and primary (semi-structured interviews) data collection methods. The actor view and combination of directed and summative approaches of the qualitative content analysis update the information gathered within the theoretical studies of peer-reviewed articles on female entrepreneurship in general and particularly in Russia. Findings – Female entrepreneurs are not a homogenous group. Motivational factors can be divided in two groups: both applicable to male and female entrepreneurship; exclusively female motivations. “The glass ceiling effect” is a common problem that pushes women into self-employment. “Internal-stable reasons” encourage women entrepreneurship as an opportunity to achieve work-life balance and be one’s own boss. The desire of social contribution is a driver of female entrepreneurship, too. Marriage and birth of children make females think about starting their own businesses as well. Female entrepreneurship discrimination in Russia still exists up to now, in particular: sexism and dalliance. The principle motivational factors for women entrepreneurs in Russia are: wholesome family relationship and family support. One can behold a developing positive trend inside the boundaries of various discrimination problems that used to frustrate the majority of females determined to embark on entrepreneurial activity. -

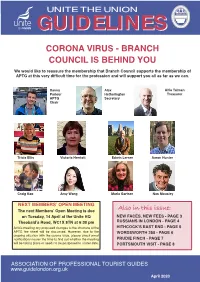

Branch Council Is Behind

CORONA VIRUS - BRANCH COUNCIL IS BEHIND YOU We would like to reassure the membership that Branch Council supports the membership of APTG at this very difficult time for the profession and will support you all as far as we can. Danny Alex Alfie Talman Parlour Hetherington Treasurer APTG Secretary Chair Tricia Ellis Victoria Herriott Edwin Lerner Aaron Hunter Craig Kao Amy Wang Maria Gartner Nan Mousley NEXT MEMBERS’ OPEN MEETING The next Members’ Open Meeting is due Also in this issue: on Tuesday, 14 April at the Unite HQ NEW FACES, NEW FEES - PAGE 3 Theobald’s Road, WC1X 8TN at 6:30 pm RUSSIANS IN LONDON - PAGE 4 At this meeting any proposed changes to the structure of the HITHCOCK’S EAST END - PAGE 5 APTG fee sheet will be discussed. However, due to the WORDSWORTH 250 - PAGE 6 ongoing situation with the corona virus, please check email notifications nearer the time to find out whether the meeting PRUDIE FINCH - PAGE 7 will be taking place or needs to be postponed to a later date. PORTSMOUTH VISIT - PAGE 8 ASSOCIATION OFASSOCIATION PROFESSIONAL OF PROFESSIONALTOURIST GUIDES TOURIST GUIDES www.guidelondon.org.ukwww.guidelondon.org.uk September 2019 April 2020 Union news THE CORONA VIRUS: FACTS AND FEARS Co-ordinated Action by Guiding Organisations What is being done for blue badge guides Advice on fighting the corona virus APTG, the Institute of Tourist Guiding, the Guild, and the Frequent and thorough hand-washing: twenty seconds with Driver Guides Association have all agreed to come together soap and hot water or sanitiser gel (if you can access it) is for the benefit of their members at this exceptional time to: recommended. -

A Introduction

University of Groningen The Soft Side of Dark Power Roslycky, L.L. IMPORTANT NOTE: You are advised to consult the publisher's version (publisher's PDF) if you wish to cite from it. Please check the document version below. Document Version Publisher's PDF, also known as Version of record Publication date: 2011 Link to publication in University of Groningen/UMCG research database Citation for published version (APA): Roslycky, L. L. (2011). The Soft Side of Dark Power: A Study in Soft Power, National Security and the Political-Criminal Nexus with a special focus on the post-Soviet Political-Criminal Nexus, the Russian Black Sea Fleet and Separatism in the Autonomous Republic of Crimea. University of Groningen. Copyright Other than for strictly personal use, it is not permitted to download or to forward/distribute the text or part of it without the consent of the author(s) and/or copyright holder(s), unless the work is under an open content license (like Creative Commons). The publication may also be distributed here under the terms of Article 25fa of the Dutch Copyright Act, indicated by the “Taverne” license. More information can be found on the University of Groningen website: https://www.rug.nl/library/open-access/self-archiving-pure/taverne- amendment. Take-down policy If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Downloaded from the University of Groningen/UMCG research database (Pure): http://www.rug.nl/research/portal. For technical reasons the number of authors shown on this cover page is limited to 10 maximum. -

Preparing for the Challenge

MAY 2011 Preparing for the Challenge CONFERENCE DEVELOPS CHANGE AGENDA Spectrum May 2011 Spectrum 16/05/2011 12:26 Page 2 infra: red SHORTCUTS SHORTCUTS Seán Óg free at last • RBS faces EU inquiry • Complaints against banks Bank directors sought • • Bank deposits fall by Ex-President of failed US E16.7 billion in March • bank jailed • Union NEWSANALYSIS NEWSANALYSIS End of an error 1 • End rights theme for Luther An Agenda for A Change ‘Debt depression’ • US of an error 2 • Regling • King memorial events in banks to face law suits? Mixed blessings US • UK banks ringfenced? 4-6 7-9 10-13 14-15 NEWSANALYSIS IBOANEWS E:UNION After Nyberg, IBOA urges Different class: Union IBOA TV News goes Dáil inquiry • Anglo launches new training online investigation nears end? initiative • IBOA’s Equalisers PENSIONSNEWS Protecting your future income 16-17 18-19 20-21 22-23 SAFETYFEATURE SPORTSSOCIAL New health and safety IBOA Family Zoo Days • structure in Ulster Bank IBOA Golfer of the Year • Play safe – work safe 2011 • Brodie’s law in CONFERENCECALL CULTURESURVEY Australia A Vision for A Change • Union in High Level Talks • Survey of Workplace IBOA’s New President • New Executive Committee Culture – Special 24-25 26-33 34-35 Pull-Out The Magazine FOR MeMBeRS OF iBOa – The Finance UniOn 2 may 2011 Spectrum May 2011 Spectrum 16/05/2011 12:26 Page 3 infra: red WORKPLACE WORKPLACE LIFESTYLE NEWS NEWS Eat chocolate and live an Breakthrough in Ulster? • Union secures benefits for extra year! WORKPLACE NEWS Northern Bank pay deal • Irish Nationwidemembers -

Cuaderno De Documentacion

SECRETARIA DE ESTADO DE ECONOMIA Y APOYO A LA EMPRESA MINISTERIO DE ECONOMÍA Y DIRECCION GENERAL DE POLÍTICA ECONOMICA COMPETITIVIDAD '$' UNIDAD DE APOYO CUADERNO DE DOCUMENTACION Número 99 ANEXO II Alvaro Espina 25 de Octubre de 2013 ENTRE 11 Y EL 24 DE OCTUBRE DE 2013 Legal/Regulatory October 24, 2013, 5:10 pm 24 Comments Fed Proposes a Rule to Help Big Banks Stay Liquid in Times of Crisis By PETER EAVIS Jim Lo Scalzo/European Pressphoto Agency The Fed’s Board of Governors discussed a plan to make banks hold a set amount of liquid assets. During the financial crisis of 2008, the big banks fell dangerously short of cash, forcing them to take out enormous government loans to survive the tumult. To help prevent another giant cash squeeze, federal regulators proposed a rule on Thursday that requires big banks to hold a set amount of assets that they can quickly turn into cash. The hope is that, in times of turbulence, banks will have adequate funds to replace the cash that might be leaving them at a rapid clip. The new rule, known as the liquidity coverage ratio, is the first to systematically require banks to be in a position to cover a set amount of cash outflows. The rule is intended to complement new rules on capital that focus more on making banks resilient to losses on loans and securities. “The proposed rule would, for the first time in the United States, put in place a quantitative liquidity requirement,” Ben S. Bernanke, chairman of the Federal Reserve, said in a statement. -

Putin Wants Russia to Cut Inflation To

WEDNESDAY NOVEMBER 16, 2011 Politics and economy 2 Mining and Metals 22 agro commodities 35 finance and Insurance 6 engineering and construction 24 Pulp and Paper 37 oil & Gas 13 transport and automobile 26 focus 38 chemicals 16 consumer Goods and retail 30 Power and coal 18 telecoms 31 Putin wants Russia to cut inflation to 3.0–3.5% in short, mid term Russia has to decrease its consumer price inflation to 3.0%–3.5% per year in the short- or mid-term, Russian Prime Minister Vladimir Putin said at a meeting with representatives of German businesses Wednesday, as cited by RIA Novosti. The growth in consumer prices is slowing down, Putin said, adding that this year inflation could amount to about 7%. “This is still high, we will continue to work to cut it. We want to reach a level of 3.0%–3.5% in the short- or mid-term,” Putin said. Russia’s consumer price inflation was at 0.3% from November 1 through Monday, and amounted to 5.5% from January 1 through Monday, the Federal State Statistics service said earlier Wednesday. Under a draft of the federal budget for 2012–2014, the country’s inflation is expected to amount to 6.0% in 2012; 5.5% in 2013; and 5.0% in 2014. Consumer prices in Russia rose 8.8% in 2010, the statistics service said earlier. Ministry sees inflation at 0.6%–0.7% in November, up on month Russia’s Economic Development Ministry expects the country’s consumer price inflation to amount to 0.6%–0.7% in November, compared to 0.5% in October, Deputy Economic Development Minister Andrei Klepach said Wednesday.