Spar Nord Changes It-Platform from Sdc to Bec

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

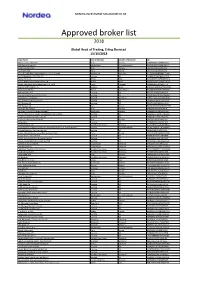

External Borkers List

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2018 Global Head of Trading, Erling Skorstad 15/10/2018 Legal Name City of Domicile Country of Domicile LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABN Amro Group NV Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BCS Prime Brokerage Limited London UK 213800UU8AHE2B6QUI26 BGC Brokers LP London UK ZWNFQ48RUL8VJZ2AIC12 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Carnegie AS Norway Oslo Norway 5967007LIEEXZX57BC18 Carnegie Investment Bank AB (publ) Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities AS Oslo Norway 5967007LIEEXZXA40G44 CLSA (UK) London UK 213800VZMAGVIU2IJA72 Commerzbank AG Frankfurt -

Danmarks Nationalbank 2 Thedanmarks Response of Householdnationalbank Customers to Negative Deposit Rates Analyses

ANALYSIS DANMARKS NATIONALBANK 27 APRIL 2021 — NO. 9 The response of house- hold customers to negative deposit rates Negative deposit Reduction in Announcement rates more deposits following increases demand widespread announcements for investments Negative deposit rates There are indications Household customers for household custom that household cus appear to increase their ers are now being tomers reduce their de demand for investment applied by most banks posits when their bank fund shares and switch in Denmark. Further announces negative their deposits to pool more, the banks have interest rates. However, schemes when faced gradually reduced the household customers’ with prospects of nega thresholds for when total deposits have tive deposit rates. negative interest rates increased during the are imposed. period of negative deposit rates. Read more Read more Read more ANALYSIS — DANMARKS NATIONALBANK 2 THEDANMARKS RESPONSE OF HOUSEHOLDNATIONALBANK CUSTOMERS TO NEGATIVE DEPOSIT RATES ANALYSES Low for long Denmark was the first country to introduce negative ABOUT THIS ANALYSIS monetary policy rates in 2012. Since then, Switzer- land, Sweden, Japan and the euro area have followed Most banks in Denmark have now in suit. troduced negative deposit rates for household customers. Furthermore, Very low and in some cases negative interest rates the banks have gradually reduced the thresholds for when negative have characterised the past decade across the ad- interest rates are payable. vanced economies. There are several reasons why interest rates have fallen to the current low levels. Low There are indications that household interest rates reflect the fact that inflation has been customers reduce their deposits subdued in many countries, but structural changes when their bank announces negative in household and corporate savings and investment interest rates. -

Quarterly Report for Q1 2008 for Spar Nord Bank DKK 183 Million in Pre-Tax Profits - Forecast for Core Earnings for the Year Repeated

To Stock Exchange Announcement OMX The Nordic Exchange Copenhagen No. 5, 2008 and the press For further information, contact: Lasse Nyby Chief Executive Officer Tel. +45 9634 4011 30 April 2008 Ole Madsen, Communications Manager Tel. +45 9634 4010 Quarterly report for Q1 2008 for Spar Nord Bank DKK 183 million in pre-tax profits - forecast for core earnings for the year repeated • Annualized 18% return on equity before tax • Net interest income up 15% to DKK 313 million • Net income from fees, charges and commissions down 20% to DKK 104 million • Market-value adjustments reduced to DKK 8 million • Costs grew 11% • DKK 8 million recognized as net income due to reversed impairment of loans and advances and related items • Earnings from the trading portfolio and an extra payment regarding Totalkredit amount to DKK 37 million in total • Lending up 15%, and a 26% hike in deposits • Forecast for core earnings for the year repeated Spar Nord Bank A/S • Moody’s rating: C, A1, P-1 (unchanged, outlook stable) Skelagervej 15 Developments in Q1 2008 P. O. Box 162 • 13 consecutive quarterly periods with net growth in customers DK-9100 Aalborg • Net interest income DKK 13 million up on Q4 2007 • Net income from fees, charges and commissions in line with Q3 and Q4 2007 results Reg. No. 9380 • Sustained strong credit quality level – reporting recognition of net income from Telephone +45 96 34 40 00 impairment of loans, advances, etc. for the 10th consecutive quarterly period Telefax + 45 96 34 45 60 • Business volume at same level as at end-2007 Swift spno dk 22 • Leasing activities continue to develop on a very satisfactory note • Interest margin widening at a moderate pace www.sparnord.dk • Wider yield spread between Danish mortgage-credit bonds and government bonds means distinctively lower market-value adjustments and loss on earnings from invest- [email protected] ment portfolios • Improved excess coverage relative to strategic liquidity target CVR-nr. -

Approved Broker List 2016

NORDEA INVESTMENT MANAGEMENT AB Approved broker list 2016 Head of Trading, Miles Kumaresan 07/04/2016 NORDEA INVESTMENT MANAGEMENT AB Legal Name City name Country name LEI ABG Sundal Collier ASA Oslo Norway 2138005DRCU66B8BNY04 ABNAMRO Bank N.V Amsterdam The Netherlands BFXS5XCH7N0Y05NIXW11 Ak Yatirim Menkul Degerler A.S Istanbul Turkey 789000ZSYXQD4Y7YRG72 Arctic Securities AS Oslo Norway 5967007LIEEXZX4RVS72 Aurel BGC SAS Paris France 5RJTDGZG4559ESIYLD31 Australia and New Zealand Banking Group Limited Melbourne Australia JHE42UYNWWTJB8YTTU19 AUTONOMOUS RESEARCH LLP London UK 213800LBM6PT85IGM996 Banca IMI S.p.A Milan Italy QV4Q8OGJ7OA6PA8SCM14 Banco Bilbao Vizcaya Argentaria S.A Bilbao Spain K8MS7FD7N5Z2WQ51AZ71 Banco Português de Investimento, S.A. (BPI) Porto Portugal 213800NGLJLXOSRPK774 BANCO SANTANDER S.A Madrid Spain 5493006QMFDDMYWIAM13 Bank Vontobel AG Zurich Switzerland 549300L7V4MGECYRM576 Barclays Bank PLC London UK G5GSEF7VJP5I7OUK5573 Barclays Capital Securities Limited London UK K9WDOH4D2PYBSLSOB484 Bayerische Landesbank Munich Germany VDYMYTQGZZ6DU0912C88 BMO Capital Markets Limited London UK L64HM9LHPDOS1B9HJC68 BNP Paribas SA Paris France R0MUWSFPU8MPRO8K5P83 Canaccord Genuity Limited London UK ZBU7VFV5NIMN4ILRFC23 Carnegie Holding AB Stockholm Sweden 529900BR5NZNQZEVQ417 China International Capital Corporation (UK) Limited London UK 213800STG3UV87MDGA96 Citigroup Global Markets Europe Limited London UK 5493004FUULDQTMX0W20 Citigroup Global Markets Limited London UK XKZZ2JZF41MRHTR1V493 Clarksons Platou Securities -

Governmental Assistance to the Financial Sector: an Overview of the Global Responses (V9)

Economic Stabilization Advisory Group | October 2, 2009 Governmental Assistance to the Financial Sector: an Overview of the Global Responses (v9) The measures that Governments have taken to protect the financial sector have settled down to a large extent. We have, however, decided to publish a further update on the measures following a renewed interest in developments and the recent G20 Summit. This memorandum summarizes the measures Governments across the world have taken to protect the financial sector and prevent a recession. The measures fall into the following categories: guarantees of bank liabilities; retail deposit guarantees; central bank assistance measures; bank recapitalization through equity investments by private investors and Governments; and open-market or negotiated acquisitions of illiquid or otherwise undesirable assets from weakened financial institutions. The purpose of this publication is to provide an overview of the principal measures that have been taken in the major financial jurisdictions to support the financial system. The first version of this note was published on November 12, 2008. Since then, Governments in some jurisdictions have adopted further measures or amended measures previously adopted. The current version of the note takes into account those measures and is based on information available to us on September 30, 2009. Table of Contents Page AUSTRALIA.......................................................................................................................................................................................................................... -

12Thjune 2014 Helsinki Eba Clearing Shareholders

REPORT OF THE BOARD EBA CLEARING SHAREHOLDERS MEETING 12TH JUNE 2014 HELSINKI Contents 1. Introduction 3 2. The Company’s activities in 2013 5 2.1 EURO1/STEP1 Services 5 2.2 STEP2 Services 8 2.3 Operations 15 2.4 Legal, Regulatory & Compliance 18 2.5 Risk Management 20 2.6 Other corporate developments 21 2.7 The MyBank initiative 23 2.8 Activities of Board Committees 23 2.9 Corporate matters 26 2.10. Financial situation 29 3. The Company’s activities in 2014 32 3.1 EURO1/STEP1 Services 32 3.2 STEP2 Services 33 3.3 PRETA S.A.S. 35 3.4 Other relevant matters of interest 36 Appendix 1: Changes in EURO1/STEP1 participation 37 Appendix 2: List of participants in EURO1/STEP1 40 Appendix 3: List of direct participants in STEP2 45 Appendix 4: Annual accounts for 2013 53 2 EBA CLEARING SHAREHOLDERS MEETING // 12th June 2014 // Report of the Board 1. Introduction 2013 was marked by the major changeover that the SEPA migration end-date for euro retail payments of 1st February 2014 represented for payment service providers in the Eurozone and their customers. SEPA migration-related activities were also the top priority for EBA CLEARING throughout 2013. The Company continued to strengthen and enhance the STEP2 platform and intensified its customer support activities to assist its users across Europe in ensuring a disruption-free changeover to the SEPA instruments for their customers. SEPA migration affirmed the position of the STEP2 platform among the leading retail payment systems in Europe. The timely delivery of its SEPA Services as well as the processing capacity, operational robustness and rich functionality of the system made STEP2 the platform of first choice of many European communities in preparation of and during this migration. -

Target2 List of Participants

Participants BIC Participant's company name Participation type AABAFI22XXX Bank of Aland Plc 1 AACSDE33XXX Sparkasse Aachen 1 AARBDE5WXXX Aareal Bank AG 1 ABANSI2XXXX NOVA KREDITNA BANKA MARIBOR D. D. 1 ABCADEFFXXX Arab Banking Corporation SA Zweigniederlassung Frankfurt 1 ABCOFRPPXXX ARAB BANKING CORPORATION 2 ABCOITMMXXX ABC INTERNATIONAL BANK PLC MILAN MILANO 2 ABGRDEFFXXX PIRAEUS BANK A.E., Athen Zweigniederlassung Frankfurt am Main 1 ABKBDEB1XXX ABK Allgemeine Beamten Bank AG 2 ABKBDEBBXXX ABK Allgemeine Beamten Bank AG 1 ABKLCY2NXXX ALPHA BANK CYPRUS LIMITED 1 ABNABE2AIDJ ABN AMRO II N.V. 2 ABNABE2AIPC ABN AMRO II N.V. 2 ABNANL2AXXX ABN AMRO BANK NV 1 ABNCNL2AISA ABN AMRO CLEARING BANK N.V. 1 ABNCNL2AXXX ABN AMRO CLEARING BANK N.V. 1 ABOCDEFFXXX Agricultural Bank of China Limited Frankfurt Branch 1 ACTVPTPLXXX BANCO ACTIVOBANK, S.A. 2 ADYBNL2AXXX ADYEN B.V. 1 AEBAGRAAXXX Aegean Baltic Bank S.A.. 1 AEGONL2U100 AEGON BANK 1 AEGONL2UXXX AEGON BANK NV 1 AFFAATWWXXX Oesterreichische Bundes- finanzierungsagentur 2 AFRIFRPPXXX BOA-FRANCE 1 AGBACZPPXXX MONETA Money Bank, a.s. 1 AGBLLT2XXXX LUMINOR BANK AS LITHUANIAN BRANCH 1 AGBMDEMMTGT Airbus Bank GmbH 1 AGBMDEMMXXX Airbus Bank GmbH 2 AGFBFRCCXXX ALLIANZ BANQUE S.A 2 AGFBFRPPXXX ALLIANZ BANQUE SA 1 AGFOFR21XXX AGENCE FRANCE LOCALE 1 AGRIFRP1ACF CA CONSUMER FINANCE 2 AGRIFRP1EFG CREDIT AGRICOLE LEASING ET FACTORING 2 AGRIFRPP802 CRCAM NORD EST 2 AGRIFRPP810 CRCAM CHAMPAGNE BOURGOGNE 2 AGRIFRPP812 CRCAM NORD MIDI PYRENEES 2 AGRIFRPP813 CRCAM ALPES PROVENCE 2 AGRIFRPP817 CRCAM CHARENTE MARITIME -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

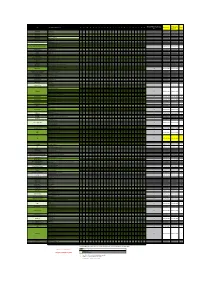

Updated As of 01/06/2017 Changes Highlighted in Yellow

NEW QUARTER TOTAL PDship per Previous Quarter Firm Legal Entity Holding Dealership AT BE BG CZ DE DK ES FI FR GR HU IE IT LV LT NL PL PT RO SE SI SK UK Current Quarter Changes Bank March 2016) ABLV Bank ABLV Bank, AS 1 bank customer bank customer 0 Abanka Vipa Abanka Vipa d.d. 1 bank customer bank customer 0 ABN Amro ABN Amro Bank N.V. 3 bank inter dealer bank inter dealer 0 Alpha Bank Alpha Bank S.A. 1 bank customer bank customer 0 Allianz Group Allianz Bank Bulgaria AD 1 bank customer bank customer 0 Banca IMI Banca IMI S.p.A. 3 bank inter dealer bank inter dealer 0 Banca Transilvania Banca Transilvania 1 bank customer bank customer 0 Banco BPI Banco BPI + 1 bank customer bank customer 0 Banco Comercial Português Millenniumbcp + 1 bank customer bank customer 0 Banco Cooperativo Español Banco Cooperativo Español S.A. + 1 bank customer bank customer 0 Banco Santander S.A. + Banco Santander / Santander Group Santander Global Banking & Markets UK 6 bank inter dealer bank inter dealer 0 Bank Zachodni WBK S.A. Bank Millennium Bank Millennium S.A. 1 bank customer bank customer 0 Bankhaus Lampe Bankhaus Lampe KG 1 bank customer bank customer 0 Bankia Bankia S.A.U. 1 bank customer bank customer 0 Bankinter Bankinter S.A. 1 bank customer bank customer 0 Bank of America Merrill Lynch Merrill Lynch International 9 bank inter dealer bank inter dealer 0 Barclays Barclays Bank PLC + 17 bank inter dealer bank inter dealer 0 Bayerische Landesbank Bayerische Landesbank 1 bank customer bank customer 0 BAWAG P.S.K. -

Private Information Trading and Enhanced Accounting Disclosure of Bank Stocks

PRIVATE INFORMATION TRADING AND ENHANCED ACCOUNTING DISCLOSURE OF BANK STOCKS Rocco Huang1 The World Bank, and the University of Amsterdam Abstract In this study, price-volume patterns of traded bank stocks in 47 countries around the world are examined, to study whether enhanced accounting information disclosure is associated with lower information asymmetry between informed and uninformed investors in the trading of bank stocks, as measured by Llorente et al. (2002)’s private information trading (PIT) indicator. The study finds that, the second pillar of Basel II, stronger supervisory power, is surprisingly associated with more private information trading (although we do not argue for causality in either direction). In contrast, the third pillar (information disclosure) of Basel II is found to be quite effective in reducing private information trading in bank stocks. We find that bank- level enhanced disclosures of accounting information (such as classification of loans or deposits by maturity), as defined by a composite index proposed by Nier (2005), is associated with significantly less PIT, and the magnitude of the effect is large enough to counteract the influence of existing national policies. Finally, we also find that level of PIT is not higher in bank than in their size-matched nonfinancial stocks, which suggests that banks may not be special when it comes to information asymmetry. 1 I especially want to thank Stijn Claessens for his numerous comments, suggestions, and encouragement, which help substantially improve this paper. I appreciate valuable comments from Vidhi Chhaochharia, Luc Laeven, and participants at a seminar in the World Bank. This paper’s findings, interpretations and conclusions are entirely those of the author and do not necessarily represent the views of the World Bank, its Executive Directors or the countries they represent. -

List of Market Makers and Authorised Primary Dealers Who Are Using the Exemption Under the Regulation on Short Selling and Credit Default Swaps

Last update 11 August 2021 List of market makers and authorised primary dealers who are using the exemption under the Regulation on short selling and credit default swaps According to Article 17(13) of Regulation (EU) No 236/2012 of the European Parliament and of the Council of 14 March 2012 on short selling and certain aspects of credit default swaps (the SSR), ESMA shall publish and keep up to date on its website a list of market makers and authorised primary dealers who are using the exemption under the Short Selling Regulation (SSR). The data provided in this list have been compiled from notifications of Member States’ competent authorities to ESMA under Article 17(12) of the SSR. Among the EEA countries, the SSR is applicable in Norway as of 1 January 2017. It will be applicable in the other EEA countries (Iceland and Liechtenstein) upon implementation of the Regulation under the EEA agreement. Austria Italy Belgium Latvia Bulgaria Lithuania Croatia Luxembourg Cyprus Malta Czech Republic The Netherlands Denmark Norway Estonia Poland Finland Portugal France Romania Germany Slovakia Greece Slovenia Hungary Spain Ireland Sweden Last update 11 August 2021 Austria Market makers Name of the notifying Name of the informing CA: ID code* (e.g. BIC): person: FMA ERSTE GROUP BANK AG GIBAATWW FMA OBERBANK AG OBKLAT2L FMA RAIFFEISEN CENTROBANK AG CENBATWW Authorised primary dealers Name of the informing CA: Name of the notifying person: ID code* (e.g. BIC): FMA BARCLAYS BANK PLC BARCGB22 BAWAG P.S.K. BANK FÜR ARBEIT UND WIRTSCHAFT FMA BAWAATWW UND ÖSTERREICHISCHE POSTSPARKASSE AG FMA BNP PARIBAS S.A. -

Samarbejdspartnere Og Handelssteder

Vestjysk Banks samarbejdspartnere og handelssteder Danske aktier Valuta Ved eksekvering af ordrer i danske aktier Ved eksekvering af ordrer i valuta samarbejder samarbejder Vestjysk Bank med Arbejdernes Vestjysk Bank med Danske Bank, Jyske Bank, Landsbank, Maj Invest, Danske Bank, Nordea, Sydbank, Arbejdernes Landsbank, Nordea og Sydbank, Jyske Bank og ABG Sundal, der alle er Nykredit. medlem af NASDAQ OMX Copenhagen A/S. Investeringsforeninger Udenlandske aktier Ved udførelse af ordrer i investeringsforenings- Ved eksekvering af ordrer i udenlandske aktier beviser samarbejder Vestjysk Bank med samarbejder Vestjysk Bank med Arbejdernes Arbejdernes Landsbank, Spar Nord, Bankinvest, Landsbank, Danske Bank og Nordea, der er Sydbank, Danske Bank, Nordea, Jyske Bank og medlem af handelssteder i de relevante lande eller Maj Invest. handler via en mægler, der er medlem af det relevante marked. Vestjysk Bank modtager provision fra Bankinvest, Sparinvest, Valueinvest, Sydinvest, Danske obligationer Maj Invest, Falcon Invest, Skagen Fondene, Ved eksekvering af ordrer i danske obligationer C Worldwide, SEBInvest, Storebrand og Nykredit samarbejder Vestjysk Bank med Spar Nord, Invest. En samlet oversigt over Sydbank, Nykredit, Danske Bank, Jyske Bank, provisionssatserne fremgår af Nordea og Arbejdernes Landsbank. www.vestjyskbank.dk/provision Udenlandske obligationer Pensionspuljer Ved eksekvering af ordrer i udenlandske Investering af bankens pensionspuljer varetages af obligationer samarbejder Vestjysk Bank med Lokal Puljeinvest. Sydbank, Nordea,