Financial Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Unsupervised Crop Classification Method Based on Principal

International Journal of Geo-Information Article An Unsupervised Crop Classification Method Based on Principal Components Isometric Binning Zhe Ma 1, Zhe Liu 1,2,3 , Yuanyuan Zhao 1,2,3, Lin Zhang 1, Diyou Liu 1 , Tianwei Ren 1, Xiaodong Zhang 1,2,3 and Shaoming Li 1,2,3,* 1 College of Land Science and Technology, China Agricultural University, Beijing 100083, China; [email protected] (Z.M.); [email protected] (Z.L.); [email protected] (Y.Z.); [email protected] (L.Z.); [email protected] (D.L.); [email protected] (T.R.); [email protected] (X.Z.) 2 Key Laboratory of Remote Sensing for Agri-Hazards, Ministry of Agriculture and Rural Affairs, Beijing 100083, China 3 Key Laboratory for Agricultural Land Quality, Ministry of Natural Resources of the People’s Republic of China, Beijing 100083, China * Correspondence: [email protected]; Tel.: +86-010-627-37554 Received: 24 September 2020; Accepted: 26 October 2020; Published: 29 October 2020 Abstract: The accurate and timely access to the spatial distribution information of crops is of great importance for agricultural production management. Although widely used, supervised classification mapping requires a large number of field samples, and is consequently costly in terms of time and money. In order to reduce the need for sample size, this paper proposes an unsupervised classification method based on principal components isometric binning (PCIB). In particular, principal component analysis (PCA) dimensionality reduction is applied to the classification features, followed by the division of the top k principal components into equidistant bins. -

Annual Report 2014 年度報告 Annual 2014 Report CONTENTS

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2014 年度報告 Annual 2014 Report CONTENTS Chairman’s Statement 3 Section I Definition and Important Risk Warnings 4 Section II Company Profile 7 Section III Summary of Accounting Data and Financial Indicators 18 Section IV Report of The Board of The Directors 24 Section V Significant Events 79 Section VI Changes in Share and Particulars about Shareholders 85 Section VII Preferred Shares 98 Section VIII Particulars about Directors, Supervisors, Senior Management and Employees 99 Section IX Corporate Governance 145 Section X Internal Control 169 Section XI Financial and Accounting Reports 176 Section XII Documents Available for Inspection 177 Section XIII Information Disclosure of Securities Company 178 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company represent and warrant that this annual report is true, accurate and complete and does not contain any false records, misleading statements or material omission and jointly and severally take full legal responsibility. This Report was reviewed and passed at the second meeting (the “Board Meeting”) of the sixth session of the Board. The number of Directors to attend the Board Meeting should be 13 and the number of Directors having actually attended the Board Meeting was 12. Director He Jianyong, was unable to attend the Board Meeting in person due to business engagement, and had appointed Chairman Wang Kaiguo to vote on his behalf. None of the Directors or Supervisors has made any objection to this Report. The Company’s annual financial reports, prepared in accordance with the PRC GAAP and IFRS, were audited by BDO China Shu Lun Pan Certified Public Accountants LLP (Special General Partnership) and Deloitte Touche Tohmatsu respectively, whom then issued a standard unqualified audit report thereon. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated. -

Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 6138)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Harbin Bank Co., Ltd. 哈爾濱銀行股份有限公司* (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 6138) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of Harbin Bank Co., Ltd. (the “Bank”) is pleased to announce the audited annual results of the Bank and its subsidiaries (the “Group”) for the year ended 31 December 2019. This results announcement, containing the full text of the 2019 Annual Report of the Bank, complies with the relevant content requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to preliminary announcements of annual results. The annual financial statements of the Group for the year ended 31 December 2019 have been audited by Ernst & Young in accordance with International Standard on Review Engagements. Such annual results have also been reviewed by the Board and the Audit Committee of the Bank. Unless otherwise stated, financial data of the Group are presented in Renminbi. This results announcement is published on the websites of the Bank (www.hrbb.com.cn) and HKExnews (www.hkexnews.hk). The printed version of the 2019 Annual Report of the Bank will be dispatched to the holders of H shares of the Bank and available for viewing on the above websites in April 2020. -

Annual Report 2011

AnnualReport2011 135 2011 年度报告 AnnualReport 2 0 1 1 年 度 报 告 Directory MessagefromtheChairmanoftheBoard 136 Important Note138 SummaryofFinancialDataandBusiness Data139 Company Profile143 Changesinshare capital144 Top10shareholdersandtheir shareholdings145 Major shareholders146 InformationonDirectors,Supervisors,SeniorExecutivesand Employees147 LongjiangBankOrganization Structure153 IntroductiontoGeneralMeetingof Shareholders154 2011ReportonWorkofBoardofDirectorsofLongjiangBank Corporation155 2011ReportonWorkofBoardofSupervisorsofLongjiangBank Corporation160 FinancialStatementandAudit Report166 MemorabiliaofLongjiangBankin 2011267 ListofLongjiangBank Institutions269 MessagefromtheChairmanoftheBoard Theyear2011isthefirstyearofthe"12thFive-YearPlan"period,alsotheyearduringwhichChina's economyhasachievedastableandhealthydevelopmentinthesevereandcomplexinternationalenvi- 2 0 1 ronment.UnderthecorrectleadershipoftheCPCCentralCommitteeandStateCouncil,thewhole 1 A n n countryisguidedbythescientificdevelopment-topulleffortstogetherandovercomedifficulties, u a l R e andhasachieveagoodstartinthe"12thFive-YearPlan"period.Duringtheyear,theHeilongjiang p o r ProvincialPartyCommitteeandProvincialGovernmentfirmlygraspedthescientificdevelopment t theme,andeffectivelyprotectedandimprovedpeople'slivelihood.Theprovince'seconomicandsocial growthisaccelerated,structureisimproved,qualityisupgradedandpeople'slivelihoodisturningbet- ter. ThisyearisalsoofgreatsignificancetothedevelopmenthistoryoftheLongjiangBank.Withthe meticulousmanagementasthetheme,wehaveenhancedthemanagementlevel,andcontinuedtoad- -

Annual Results Announcement for the Year Ended 31 December 2019

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 06881) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2019 The board of directors of China Galaxy Securities Co., Ltd. (the “Company”) hereby announces the audited annual results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 annual report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) in relation to information to accompany preliminary announcements of annual results. The printed version of the Company’s 2019 annual report will be dispatched to the shareholders of the Company and available for viewing on the website of Hong Kong Exchanges and Clearing Limited at www.hkexnews.hk and the website of the Company at www.chinastock.com.cn by the end of April 2020. By Order of the Board China Galaxy Securities Co., Ltd. Chen Gongyan Chairman and Executive Director Beijing, the PRC 27 March 2020 As at the date of this announcement, the executive directors of the Company are Mr. CHEN Gongyan (Chairman) and Mr. -

Heilongjiang Road Development II Project (Yichun-Nenjiang)

Technical Assistance Consultant’s Report Project Number: TA 7117 – PRC October 2009 People’s Republic of China: Heilongjiang Road Development II Project (Yichun-Nenjiang) FINAL REPORT (Volume II of IV) Submitted by: H & J, INC. Beijing International Center, Tower 3, Suite 1707, Beijing 100026 US Headquarters: 6265 Sheridan Drive, Suite 212, Buffalo, NY 14221 In association with WINLOT No 11 An Wai Avenue, Huafu Garden B-503, Beijing 100011 This consultant’s report does not necessarily reflect the views of ADB or the Government concerned, ADB and the Government cannot be held liable for its contents. All views expressed herein may not be incorporated into the proposed project’s design. Asian Development Bank Heilongjiang Road Development II (TA 7117 – PRC) Final Report Supplementary Appendix A Financial Analysis and Projections_SF1 S App A - 1 Heilongjiang Road Development II (TA 7117 – PRC) Final Report SUPPLEMENTARY APPENDIX SF1 FINANCIAL ANALYSIS AND PROJECTIONS A. Introduction 1. Financial projections and analysis have been prepared in accordance with the 2005 edition of the Guidelines for the Financial Governance and Management of Investment Projects Financed by the Asian Development Bank. The Guidelines cover both revenue earning and non revenue earning projects. Project roads include expressways, Class I and Class II roads. All will be built by the Heilongjiang Provincial Communications Department (HPCD). When the project started it was assumed that all project roads would be revenue earning. It was then discovered that national guidance was that Class 2 roads should be toll free. The ADB agreed that the DFR should concentrate on the revenue earning Expressway and Class I roads, 2. -

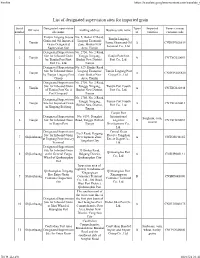

List of Designated Supervision Sites for Imported Grain

Firefox https://translate.googleusercontent.com/translate_f List of designated supervision sites for imported grain Serial Designated supervision Types Imported Venue (venue) Off zone mailing address Business unit name number site name of varieties customs code Tianjin Lingang Jiayue No. 5, Bohai 37 Road, Tianjin Lingang Grain and Oil Imported Lingang Economic 1 Tianjin Jiayue Grain and Oil A CNDGN02S619 Grain Designated Zone, Binhai New Terminal Co., Ltd. Supervision Site Area, Tianjin Designated Supervision No. 2750, No. 2 Road, Site for Inbound Grain Tanggu Xingang, Tianjin Port First 2 Tianjin A CNTXG020051 by Tianjin Port First Binhai New District, Port Co., Ltd. Port Co., Ltd. Tianjin Designated Supervision No. 529, Hunhe Road, Site for Inbound Grain Lingang Economic Tianjin Lingang Port 3 Tianjin A CNDGN02S620 by Tianjin Lingang Port Zone, Binhai New Group Co., Ltd. Group Area, Tianjin Designated Supervision No. 2750, No. 2 Road, Site for Inbound Grain Tanggu Xingang, Tianjin Port Fourth 4 Tianjin A CNTXG020448 of Tianjin Port No. 4 Binhai New District, Port Co., Ltd. Port Company Tianjin No. 2750, No. 2 Road, Designated Supervision Tanggu Xingang, Tianjin Port Fourth 5 Tianjin Site for Imported Grain A CNTXG020413 Binhai New District, Port Co., Ltd. in Xingang Beijiang Tianjin Tianjin Port Designated Supervision No. 6199, Donghai International Sorghum, corn, 6 Tianjin Site for Inbound Grain Road, Tanggu District, Logistics B CNTXG020051 sesame in Tianjin Port Tianjin Development Co., Ltd. Designated Supervision Central Grain No.9 Road, Haigang Site for Inbound Grain Reserve Tangshan 7 Shijiazhuang Development Zone, A CNTGS040165 at Jingtang Port Grocery Direct Depot Co., Tangshan City Terminal Ltd. -

Environmental Issues in China's Northeast

Environmental Issues in China’s Northeast By Sian Eiles, July 2014 Chinese environmental issues tend to centre around three particular issues: air pollution, water resources and desertification/ soil erosion. Air and water pollution are the most serious environmental problems in NE China Air pollution Air pollution is largely a result of China’s rapid period of industrialisation since the death of Mao and the economic reform era ushered in by his successor Deng Xiaoping. This has led to a growth in demand for power and in China this has been provided largely by coal, which has been the mainstay of electrical power generation as well as household energy for many years. Chinese domestic coal production is covered in another paper, but it is important to note the peculiarities of Chinese coal: which is that it is unusually ‘dirty’, particularly in the level of particulates it is likely to produce, along with a high sulphur content. Although the north east has seen a loss of industry since the beginning of the reform era the pollution problem still remains. In the south and the eastern coastal areas there been, over the past two decades, a movement away from ‘heavy’ industries such as steel smelting and car production. These are less energy intensive and have helped reduce pollution levels to some degree (although these areas now produce a lot of pollution via cars due to the increased wealth and increased demand for electricity, which is largely still coal fired). There is also a clear argument that pollution is an inevitable component of the development process, and that pollution levels reduce as economic wealth is more established. -

China - Provisions of Administration on Border Trade of Small Amount and Foreign Economic and Technical Cooperation of Border Regions, 1996

China - Provisions of Administration on Border Trade of Small Amount and Foreign Economic and Technical Cooperation of Border Regions, 1996 MOFTEC copy @ lexmercatoria.org Copyright © 1996 MOFTEC SiSU lexmercatoria.org ii Contents Contents Provisions of Administration on Border Trade of Small Amount and Foreign Eco- nomic and Technical Cooperation of Border Regions (Promulgated by the Ministry of Foreign Trade Economic Cooperation and the Customs General Administration on March 29, 1996) 1 Chapter 1 - General Provisions 1 Article 1 ......................................... 1 Article 2 ......................................... 1 Article 3 ......................................... 1 Chapter 2 - Border Trade of Small Amount 1 Article 4 ......................................... 1 Article 5 ......................................... 2 Article 6 ......................................... 2 Article 7 ......................................... 2 Article 8 ......................................... 3 Article 9 ......................................... 3 Article 10 ........................................ 3 Article 11 ........................................ 3 Article 12 ........................................ 4 Article 13 ........................................ 4 Article 14 ........................................ 4 Article 15 ........................................ 4 Article 16 ........................................ 5 Article 17 ........................................ 5 Chapter 3 - Foreign Economic and Technical Cooperation in Border Regions -

Annual Report 2019 Annual Report

Annual Report 2019 Annual Report 2019 For more information, please refer to : CONTENTS DEFINITIONS 2 Section I Important Notes 5 Section II Company Profile and Major Financial Information 6 Section III Company Business Overview 18 Section IV Discussion and Analysis on Operation 22 Section V Directors’ Report 61 Section VI Other Significant Events 76 Section VII Changes in Shares and Information on Shareholders 93 Section VIII Directors, Supervisors, Senior Management and Staff 99 Section IX Corporate Governance Report 119 Section X Independent Auditor’s Report 145 Section XI Consolidated Financial Statements 151 Appendix I Information on Securities Branches 276 Appendix II Information on Branch Offices 306 China Galaxy Securities Co., Ltd. Annual Report 2019 1 DEFINITIONS “A Share(s)” domestic shares in the share capital of the Company with a nominal value of RMB1.00 each, which is (are) listed on the SSE, subscribed for and traded in Renminbi “Articles of Association” the articles of association of the Company (as amended from time to time) “Board” or “Board of Directors” the board of Directors of the Company “CG Code” Corporate Governance Code and Corporate Governance Report set out in Appendix 14 to the Stock Exchange Listing Rules “Company”, “we” or “us” China Galaxy Securities Co., Ltd.(中國銀河證券股份有限公司), a joint stock limited company incorporated in the PRC on 26 January 2007, whose H Shares are listed on the Hong Kong Stock Exchange (Stock Code: 06881), the A Shares of which are listed on the SSE (Stock Code: 601881) “Company Law”