The Translation and Interpreting Industry in the United States

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ITIA Bulletin 2020/4

ITIA Bulletin 2020 / 04 Irish Translators' and Interpreters' Association Cumann Aistritheoirí agus Ateangairí na hÉireann Contents Editorial • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 02 Member’s Corner • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 04 Interpreting in International Protection • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 06 Translators and MT - Writing an elegy for a doomed profession? • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 08 Managing expectations in relation to eTranslation • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 10 ITIA Translation competition • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 13 English language test for interpreters - not fit for purpose • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 15 Snippets • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 17 CPD • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 18 What’s Hot, What’s Not • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 18 Worth-a-Click • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 18 New Members • • • • • • • • • • • • • • • • • • • • • • • • • • • • • 19 • • • • • • • • • • • • • • • • • • • • • • • • • • • • • Joining the ITIA 19 ITIA Bulletin 2020 / 04 1 Editorial ince the last issue of the Bulletin, and Not stopping at that, ITIA offered two webinars, in despite the times we are in, the ITIA has keeping with our aim to promote the highest of been extremely busy both on and offline. professional standards. The first -

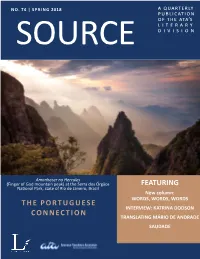

Featuring the Portuguese Connection

NO. 74 | SPRING 2018 a quarterly publication of the ata’s literary SOURCE division Amanhecer no Hercules (Finger of God mountain peak) at the Serra dos Órgãos FEATURING National Park, state of Rio de Janeiro, Brazil New column: WORDS, WORDS, WORDS THE PORTUGUESE INTERVIEW: KATRINA DODSON CONNECTION TRANSLATING MÁRIO DE ANDRADE SAUDADE SPRING 2018 IN THIS ISSUE FROM THE EDITORS.............................................................03 SUBMISSION GUIDELINES ..................................................04 INTRODUCTION OF NEW COLUMN...................................05 LETTER FROM THE LD ADMINISTRATOR .........................06 ASSISTANT LD ADMINISTRATOR PROFILE: AMANDA WILLIAMS .............................................................08 READERS’ CORNER...............................................................09 VÃO / VÒNG A CONVERSATION WITH KATRINA DODSON Interview by Madhu H. Kaza...................................................12 TRANSLATING HUMOR, NATIONALISMS, ETC., IN MÁRIO DE ANDRADE’S MODERNIST WRITINGS (excerpt) By Krista Brune ......................................................................18 SAUDADE by Patrick Saari .....................................................26 WORDS WORDS WORDS COLUMN: “Rule of law” and “L’Assommoir” ............................................35 by Patrick Saari BY THE WAY TOONS by Tony Beckwith...........11, 17, 25, 34 CREDITS................................................................................38 © Copyright 2018 ATA except as noted. SOURCE 2 SPRING 2018 From -

BRIDGING the LANGUAGE GAP at Tedx

The Voice of Interpreters and Translators THE ATA Sept/Oct 2017 Volume XLVI Number 5 BRIDGING THE LANGUAGE GAP AT TEDx A Publication of the American Translators Association to realize that a monolingual approach to American Translators Association business is a competitive disadvantage. 225 Reinekers Lane, Suite 590 Fourteen percent of U.S. and Global Alexandria, VA 22314 USA Fortune 2000 companies—companies like Tel: +1.703.683.6100 Google, Cisco, eBay, Twitter, Microsoft, and Marriott—report a loss of business Fax: +1.703.683.6122 opportunities due to lack of world E-mail: [email protected] FROM THE PRESIDENT language skills.3 Website: www.atanet.org What’s more, counterintuitively, the Editorial Board DAVID RUMSEY public discussion about free online Geoff Koby (chair) [email protected] translation tools has actually increased Twitter handle: @davidcrumsey the market for professional translation Jeff Alfonso and interpreting. Lured by visions of Lois Feuerle technology straight out of Star Trek, Corinne McKay users often discover just how important Michael Wahlster Demand for Translation and challenging translation is—and Publisher/Executive Director realize that they have sophisticated and Interpreting language needs that only human Walter Bacak, CAE Stronger than Ever professionals can meet. [email protected] The global volume of content to be Editor ne of the great things about serving translated is growing exponentially Jeff Sanfacon as ATA President is the ability to each year, and with it comes pressure to [email protected] Omeet, listen to, and learn from produce results faster, cheaper, and more translators and interpreters from around efficiently. But this has been the case Proofreader the U.S. -

Guide to Translation of Legal Materials

Guide to Translation of Legal Materials Prepared by the Professional Issues Committee April 2011 Consortium for Language Access in the Courts Equal Justice: Bridging the Language Divide Consortium for Language Access in the Courts, April 2011 1 | P a g e This document has been prepared by the Consortium for Language Access in the Courts, Professional Issues Committee. Thank you to those individuals who volunteered their time, resources, expertise and effort in the spirit of sharing information for the betterment of interpreter programs and to further ensure equal access in the courts. Special acknowledgement goes to Carmel Capati, WI; Brenda Carrasquillo, NJ; Katrin Johnson, WA; Andrea Krlickova, NV; Kelly Mills, OR; and Mara Simmons, AR. DISCLAIMER: This translation guide was compiled and edited by the Consortium for Language Access in the Courts’ Professional Issues Committee, a committee of volunteers dedicated to advancing the work of the state courts’ language access programs. Nothing in this document should be viewed as an “industry standard,” or required of the state courts. Instead, it is meant to compile some lessons learned by program managers over the years and serve as a guide to help other program managers move forward with translation projects within their own court system. Copyright © 2011 by the National Center for State Courts, on behalf and for the use of the Consortium for Language Access in the Courts. All rights reserved. The National Center for State Courts is an independent, nonprofit, tax-exempt organization in accordance with Section 501 © (3) of the Internal Revenue Code. Except as permitted under the Copyright Act of 1976 and as otherwise expressly provided herein, no part of this publication may reproduced in any form of by any means, electronic or mechanical, including the use of information storage and retrieval systems, without permission in writing form the copyright holder. -

Translation: an Exploration of Stylistic Patterns in the Translations of Margaret Jull Costa and Peter Bush

Style ¿»/Translation: An exploration of stylistic patterns in the translations of Margaret Jull Costa and Peter Bush Gabriela Saldanha Thesis submitted for the Degree of Doctor of Philosophy School of Applied Language and Intercultural Studies Dublin City University Supervisor: Dr. Dorothy Kenny September 2005 I hereby certify that this material, which I now submit for assessment on the programme of study leading to the award of Doctor of Philosophy, is entirely my own work and has iiot been taken from the work of others save and to die extent that such work, has been cited and acknowledged within the text of my work. ID No.: 51169983 Date: 16lh September, 2005 ACKNOWLEDGMENTS Working with Dorothy Kenny, my supervisor, has been a great privilege. I would like to thank her for her unfailing enthusiasm, her constant support, and her -invariably wise - advice. I would also like to thank the two translators whose work is investigated here, Margaret Jull Costa and Peter Bush, for their trust, their answers to my many questions and their valuable comments about my work. During my research I consulted with a number of colleagues at DCU and elsewhere, who also provided invaluable advice, among them: Christine Appel, Mona Baker, Eithne O’Connell, Minako O’Hagan and Carl Vogel. The help of Marion Winters, as a short and long distance office mate, and as a friend, has also been priceless. I would like to acknowledge the financial support of the School of Applied Language and Intercultural Studies, and I would like to thank the School and the Centre for Translation and Textual Studies for providing such a great environment for conducting research. -

Ata's First Advocacy Day in Washington, Dc

The Voice of Interpreters and Translators THE ATA Jan/Feb 2018 Volume XLVII Number 1 STEPPING OUT ON CAPITOL HILL: ATA’S FIRST ADVOCACY DAY IN WASHINGTON, DC A Publication of the American Translators Association afternoon for all languages into English. American Translators Association The success of our pre-conference 225 Reinekers Lane, Suite 590 Advanced Skills and Training Day has Alexandria, VA 22314 USA shown us that ATA members want Tel: +1.703.683.6100 hands-on, advanced level training, and Fax: +1.703.683.6122 we’re excited to expand our offerings in that area. E-mail: [email protected] FROM THE PRESIDENT During David Rumsey’s term as Website: www.atanet.org president, ATA became much more CORINNE MCKAY Editorial Board involved in lobbying and advocacy Geoff Koby (chair) [email protected] efforts, creating our Government Jeff Alfonso Twitter handle: @corinnemckay Relations Committee and holding our rst (sold-out!) Advocacy Day at the Lois Feuerle 2017 Annual Conference. (For more Corinne McKay on Advocacy Day, see page 8.) I’d like Mary McKee us to continue and even expand those Michael Wahlster efforts so that the voice of the language Ted Wozniak professions is heard by government Priorities! agencies and lawmakers. Publisher/Executive Director Walter Bacak, CAE often tell people that my main In some areas, we simply need to keep [email protected] problem in life is wanting to do doing what we’re doing. Our Public Relations program has been revitalized I everything. During my term as ATA Editor in recent years, and I will support the president, it will surely be impossible Jeff Sanfacon continuation and expansion of our PR to do everything I’d would like to do, [email protected] so I’ve set some priorities—the most efforts during my term. -

39Th Annual Conference American Literary Translators Association

39th Annual Conference American Literary Translators Association October 6–9, 2016 Oakland, CA Join AmazonCrossing editors and translators for a discussion on crime fiction in translation. Translators will share favorite passages from recent translations, discuss their approach, and give away copies of their works. Date: Friday, October 7 Time: 11-12:15pm Location: OCC 210-211 AmazonCrossing is a proud sponsor of The American Literary Translators Association Conference. For more information on AmazonCrossing, please visit www.amazon.com/crossing A powerful novel by one of the most important The first English translation of Muhammad Zafzaf’s novel twentieth-century writers of the Armenian diaspora. of a coastal Moroccan city and its gritty underbelly. “An indelible portrait of a man in transit and a country in transition. “An incandescent translation by Zafzaf writes without indulgence, yet Manoukian and Jinbashian and with sympathy and humor, about life an indispensable afterword by in the coastal town Essaouira, where Nichanian, foremost reader and locals and tourists mingle, mutually critic of modern Armenian litera- exposing their hypocrisies. A gritty, ture, make the publication of The powerful novel by one of Morocco’s Candidate an indisputable event, greatest writers.” as readers of English can finally pay close attention to the words —Laila Lalami, author of The Moor’s Account of Zareh Vorpouni.” “A welcome addition to the canon — Gil Anidjar, Columbia University of works of Moroccan literature in translation.” —William Hutchins, -

The American Literary Translators Association

American Literary Translators Association ALTA42 | Rochester, NY Thursday, November 7 – Sunday, November 10, 2019 Joseph A. Floreano Riverside Convention Center ALTA43 | Tucson, AZ November 2020 More information at www.literarytranslators.org welcome Dear Friends and Colleagues: elcome to Bloomington for our annual gathering. ALTA41 promises to be another outstanding conference, with an almost around-the-clock series of panels, readings, and special events that underscore this year’s themes: Performance, Props, and Platforms. This year’s conference features 67 panels, 229 presenters, and 91 bilingual readers, not to mention the yet-to be- Wdiscovered talent among us that will shine at the always-amazing Declamación! Let me draw special attention to the theater events we have planned, and to the cross-disciplinary nature of the conference. We welcome renowned playwright, translator, and educator Caridad Svich, recipient of an Obie Award for Lifetime Achievement, as our keynote speaker. Two staged readings are planned, one cosponsored by IU’s renowned Department of Theatre, Drama, and Contemporary Dance, and another in collaboration with Cardinal Stage. Of particular note as well are the sessions “Translanguaging in ASL Embodied Poetry Performance: A Marriage of Words and Hands” (featuring the Flying Words Project, Deaf American Sign Language poet Peter Cook and collaborator Kenny Lerner), and the Translation Centre Stage Workshop. Endless thanks are due to this year’s conference planning committee. 2018 has been another busy year for our organization. Earlier in the spring, we signed an affiliation agreement with the University of Arizona, and effective January 1, 2019, ALTA will have its central office on the UA campus in Tucson. -

Advanced Translation Advanced Translation

Dwi Astuti Wahyu N. ADVANCED TRANSLATION ADVANCED TRANSLATION Copyright ©, Dwi Astuti Wahyu N., 2017 Hak cipta dilindungi undang-undang All right reserved Layout: Saiful Mustofa Desain cover: Diky Mohamad Fauzi viii+ 139 hlm: 14 x 20,3 cm ISBN: 978-602-6706-17-1 Cetakan Pertama, Februari 2018 Diterbitkan oleh: Akademia Pustaka Perum. BMW Madani Kavling 16, Tulungagung Telp: 081216178398 Email: [email protected] Sanksi Pelanggaran Pasal 113 Undang-Undang Nomor 28 Tahun 2014 tentang Hak Cipta (1) Setiap Orang yang dengan tanpa hak melakukan pelanggaran hak ekonomi seba- gaimana dimaksud dalam Pasal 9 ayat (1) huruf i untuk Penggunaan Secara Komersial dipidana dengan pidana penjara paling lama 1 (satu) tahun dan/atau pidana denda paling banyak Rp.100.000.000,00 (seratus juta rupiah). (2) Setiap Orang yang dengan tanpa hak dan/atau tanpa izin Pencipta atau pemeg- ang Hak Cipta melakukan pelanggaran hak ekonomi Pencipta sebagaimana dimaksud dalam Pasal 9 ayat (1) huruf c, huruf d, huruf f, dan/atau huruf h untuk Penggunaan Secara Komersial dipidana dengan pidana penjara paling lama 3 (tiga) tahun dan/atau pidana denda paling banyak Rp.500.000.000,00 (lima ratus juta rupiah). (3) Setiap Orang yang dengan tanpa hak dan/atau tanpa izin Pencipta atau pemeg- ang Hak Cipta melakukan pelanggaran hak ekonomi Pencipta sebagaimana dimaksud dalam Pasal 9 ayat (1) huruf a, huruf b, huruf e, dan/atau huruf g untuk Penggunaan Secara Komersial dipidana dengan pidana penjara paling lama 4 (empat) tahun dan/ atau pidana denda paling banyak Rp.1.000.000.000,00 (satu miliar rupiah). -

2021 Application for New Members Thank You for Your Interest in the American Translators Association

2021 Application for New Members Thank you for your interest in the American Translators Association. ATA membership is open to anyone with an interest in translation and interpreting as a profession or as a scholarly pursuit. All individual applicants are first accepted as Associate or Student members before gaining eligibility for Active or Corresponding membership. If you join online, you may select the option to pay your dues in two installments at www.atanet.org/join. ATA Membership for Individuals Associate Membership Student Membership Open to individuals interested in the goals and objectives of ATA. Open to graduate and undergraduate college or university students enrolled • Associate members receive the benefit of listing their services in the full-time in any program or part-time in a translation- or interpreting-related Directory of Translators and Interpreters. program, including foreign language study. • Military Discount is available • Student members cannot list their services in the Directory of Translators - Open to US active duty military, reserves, and National Guard. and Interpreters. - Requires name and email of commanding officer or unit training • Requires proof of current student enrollment (in English). manager, and name and location of unit. • Membership is limited to 4 years. - Discount is limited to 2 years. ATA Membership for Organizations Corporate Membership Institutional Membership Membership is in the name of the corporation, not of an individual. Membership is in the name of the institution, not of an individual. • Corporate members receive the benefit of listing their services in the • Institutional members cannot list their services in the Directory of Directory of Language Companies. -

The ATA CHRONICLE

April 2015 Volume XLIV Number 4 A Publication of the American The Voice of Interpreters and Translators Translators Association The ATA CHRONICLE The Copyright Thicket Translations for Legal Evidence Finding Balance Medical Marketing Translation American Translators From the President Association 225 Reinekers Lane Caitilin Walsh Suite 590 [email protected] Alexandria, VA 22314 USA Tel: +1-703-683-6100 Fax: +1-703-683-6122 E-mail: [email protected] Better Together Website: www.atanet.org Editor As my husband and I just marked a Jeff Sanfaçon milestone wedding anniversary, I feel a certain [email protected] degree of wisdom when I meet newlyweds (tempered by a certain amount of humility Proofreader when I meet those who have celebrated a more Sandra Burns Thomson noble metal anniversary). Likewise, my role as Art Directors your president has taught me a few things, and Ellen Banker I actively seek the counsel of people who have done this more extensively and bring a longer- Amy Peloff term perspective. Advertising I recently had an exchange with a member Lauren Mendell about the role of machine translation (MT) [email protected] researchers and developers in our Association. In +1-703-683-6100, ext. 3001 it, I characterized the debate about the inclusive Fax: +1-703-683-6122 nature of our membership policies as a perennial debate, as the subject has popped up repeatedly Membership and over the course of our Association’s history—and indeed, even as it was being born. General Information In all long-term relationships, there are what marriage researcher John Gottmann Lauren Mendell terms perpetual problems. -

Interpreters'

TheT.I.V•VOLUME 4•ISSUE 2•SUMMER 2001 PAGE 1 Interpreters’ Volume 4 Issue 2 Voice Summer 2001 Inside this issue: The Right to An Interpreter, Who Decides? An Australian Perspective The Right to An Interpreter by Penny Patterson 1 Administrator’s Perspective ustralian judges presently have the position of deciding who is capable 2 Aof speaking English sufficiently, enabling or disqualifying a person from access to an interpreter during court proceedings. A judge’s decision Humor to allow an interpreter into their courtroom directly effects over ten percent 3 of the seventeen million plus people presently residing in Australia. Dan’s Picks : Websites for Interpreters The capacity of judges, who are extensively trained in legal matters but not 4 usually so in linguistic ones, to make informed decisions about language Interpreters Division - proficiency is highly questionable and exposes a serious weakness in the Election 2001 Australian legal system. Lack of recognition of this problem undermines 6 international convention and obstructs the course of natural justice. The Provide Over-the-Phone right to an interpreter is a human rights issue that should be treated with the Interpretation professionalism and seriousness it deserves. Qualified professionals should 7 be responsible for determining the necessity for an interpreter, to allow natural justice to occur in the fairest circumstances possible, as according to Training Opportunities: the constitution of any democratic state. 8 Adventures in Interpreting Language is the key to employment and access to health, education and 10 welfare services. Everything from applying for unemployment benefits or a The Interpreters Division home loan, to buying a car or applying for a visa is almost impossible Website without the work of competent interpreters.