ITV Plc Q1 Trading Update – 3 Months to 31 March 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CP-ITV3-D300 3-Axis ITV Control Panel

CP-ITV3-D300 3-Axis ITV Control Panel Telemetrics Control Panel for the Sony EVI-D30, EVI-D70, EVI-D100, EVI-HD3V, BRC-300, BRC-700 and Elmo PTC-100 Pan/Tilt Video Cameras enhances function and value for Teleconferencing, Educational, and Security Applications. P/N 92 55418 002 – 11 REV. - Page 1 6 Leighton Place Mahwah, New Jersey 07430 P: 201•848•9818 F: 201•848•9819 CP-ITV3-D300 OPERATING INSTRUCTIONS System with Daisy Chain Wiring Interconnect Cable Interconnect Cable Interconnect Cable 15’ CA-ITV-S15 15’ CA-ITV-S15 15’ CA-ITV-S15 25’ CA-ITV-S25 25’ CA-ITV-S25 25’ CA-ITV-S25 50’ CA-ITV-S50 50’ CA-ITV-S50 50’ CA-ITV-S50 Control Cable 6’ CA-ITV-DIN-6 25’ CA-ITV-DIN-25 *Extension Cable (Optional) 25’ CA-ITV-D-25 300’ CA-ITV-D-300 50’ CA-ITV-D-50 400’ CA-ITV-D-400 100’ CA-ITV-D-100 500’ CA-ITV-D-500 Video Switcher 200’ CA-ITV-D-200 Cables > 500’ use Rs422 kit Comprehensive CVG-SW61CS Control Cable Remote Panel POR T 1 PORT 3 Remote Control 10’ CA-ITV-V10 CAMERA CAMERA Cable * Remote Panel only PRES ET 25’ CA-ITV-P25 PR ES E T available with daisy PO R T 4 PORT 4 chain configuration CP-ITV3-EVI/BRC CP-ITV3-EVI/BRC * For Plenum cables, use part number CA-ITV-DP-XXX (where XXX=feet). PORT DESCRIPTION 1 SONY EVI-D100 CAMERA 2 NOT USED 3 VIDEO SWITCHER (CVG-SW61CS) 4 REMOTE PORT • Connect power, camera data, and video switcher cables to rear panel. -

Download Catch up Content

Creating change for good ITV Responsibility Corporate Responsibility Summary Report 2017 Contents About us As an integrated producer broadcaster, we create, own and distribute high quality entertainment on multiple platforms globally. Since our first broadcast in 1955, we’ve grown into an integrated About us 1 producer broadcaster with an increasingly global and diversified How we do business 2 operating footprint. We run the largest commercial family of channels in the UK, as well as deliver programmes on demand through numerous Our Corporate Responsibility Strategy 3 platforms directly and on the ITV Hub. 2017 highlights and achievements 4 Our global production business, ITV Studios, creates and sells Did you programmes and formats from offices in the UK, US, Australia, France, People Germany, the Netherlands, the Nordics and Italy. It’s the largest and most successful commercial production company in the UK, and a know… Our commitments 6 leading unscripted independent producer in the US and Europe. In 2017, 54% of ITV Studios revenue was from outside the UK. ITV Studios Global Our website Case studies 7 Entertainment is a leading international distribution business, offering a Find out more on what we do at catalogue of over 45,000 hours of world-class television and film. In 2017, our itvresponsibility.com, including: Planet We reach 80% of the UK’s TV-watching population each week. group external Our commitments 8 Internationally, we’ve continued to grow with operations in 11 countries Reports and more than 6,300 colleagues based across the globe. revenue was over Policies Case studies 9 Toolkits In 2017, we continued to build significant scale in key creative markets £3.1 billion Latest news around the world, creating and producing programmes and formats Partnerships that return and travel, namely drama, entertainment and factual Our commitments 10 entertainment. -

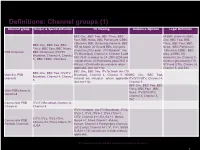

PSB Report Definitions

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

ITV Partners with Viewability Company Meetrics

PRESS RELEASE ITV partners with viewability company Meetrics First measurements across all channels show viewability rates above industry-wide benchmarks ITV, the UK’s biggest commercial broadcaster, announces that it has partnered with Meetrics, a leading European software company for advertising measurement and analytics, to provide enhanced advertising campaign delivery validation for VOD advertising across ITV Hub platforms. As part of the partnership, Meetrics provides video viewability data and reporting for ITV Hub on connected TV platforms and In-App (Android and iOS) as well as desktop and mobile web campaigns. This enriches the reporting capabilities for VOD campaigns run on ITV Hub and demonstrates the high quality of ITV’s ad inventory on metrics that are important to agencies and advertisers. With the partnership, ITV underlines its commitment to very high transparency standards and quality controls for the benefit of its advertising customers. Meetrics is an independent vendor accredited for various services by the Media Rating Council and committed to strict privacy rules in full accordance with GDPR. With Meetrics as a partner ITV is breaking new ground by being the first broadcaster in the world to make use of the IAB Open Measurement SDK, which is considered the most rigorous standard for In-App viewability measurement. To date, average measurement for campaigns running across ITV Hub showed a viewability rate (according to the MRC definition) of 98%, which is far beyond average, compared to industry viewability benchmarks. The new viewability measurement and reporting will give advertisers huge confidence that ITV can deliver standards on human and viewability measures that outperform the VOD market. -

INDUSTRY REPORT (AN ARTICLE of ITV ) After My Graduation, My

INDUSTRY REPORT (AN ARTICLE OF ITV ) After my graduation, my ambition is to work in ITV channel, for creating movies for children and applying 3d graphics in news channels is my passion in my life. In this report I would like to study about Itv’s News channel functions and nature of works in ITV’s graphics hub etc. ITV is a 24-hour television news channel in the United Kingdom which Launched in 1955 as Independent Television. It started broadcasting from 1 August 2000 to 23 December 2005. Latterly only between 6:00 am and 6:00 pm when ITV4 cut its hours to half day in 2005 and analogue cable, presenting national and international news plus regular business, sport, entertainment and weather summaries. Priority was usually given to breaking news stories. There was also an added focus on British stories, drawing on the resources of the ITV network's regional newsrooms. As a public service broadcaster, the ITV network is obliged to broadcast programming of public importance, including news, current affairs, children's and religious programming as well as party election broadcasts on behalf of the major political parties and political events. Current ITV Channels: • 1.1ITV • 1.2ITV2 • 1.3ITV3 • 1.4ITV4 • 1.5ITVBe • 1.6ITV Box Office • 1.7ITV Encore • 1.8ITV HD • 1.9CITV Uses of Graphics : 3D Graphics have been used to greatest effect in within news. In what can be a chaotic world where footage isn’t always the best quality news graphics play an important role in striping stories down to the bare essentials. -

Quick Reference Guide To: How to Deliver Content to ITV Your Programme Has Been Commissioned and You Have Been Asked by ITV to Deliver a Piece of Content

July 2020 Quick Reference Guide To: How to Deliver Content to ITV Your programme has been commissioned and you have been asked by ITV to deliver a piece of content. What do you need to do and who are the contacts along the journey?..... Firstly, you will need to know who your Compliance Advisor is. If you’ve not been provided with a contact then email [email protected]. Your Advisor will be able to provide you with legal advice along the journey and will be able to provide you with lots of key information such as your unique Production Number. Another key contact is your Commissioner. They may require some deliverables from you so it’s best to have that discussion directly with them. Within this guide you will find a list of frequently asked questions with links to more detailed documents. 1. My programme will be transmitted live. Does this make a difference? 2. My programme isn’t live; so what exactly am I delivering? 3. Where do I get my Production/Clock Numbers from? 4. Where can I get my tech spec to file deliver? 5. Where do I deliver my DPP AS-11 file to? 6. I need to ensure that my programme has the ITV ‘Look & Feel’. How do I make this happen? 7. Can I make amendments to my programme after I’ve delivered it to Content Delivery? 8. Where do I send my Post Productions Scripts to? 9. What do I do if I have queries around part durations and the total runtime of my programme? 10. -

ITV2 Limited

ITV2 Limited Strategic Report for the Year Ended 31 December 2019 The Directors present their strategic report for the year ended 31 December 2019. Principal activity ITV2 Limited (the "Company") is licensed by Ofcom to broadcast digital programme services in the United Kingdom. The company holds the broadcast licences for the ITV2, ITV4 and ITVBe channels. Fair review of the business The results for the Company show a profit for the year of £86,523,000 (2018: profit of £86,395,000) against sales of £323,513,000 (2018: sales of £322,096,000). KPIs The Directors of the ITV plc Group manage the Group’s operations on a divisional basis with this Company being included within the Broadcast & Online division. For this reason, the Company’s Directors use the ITV plc Group Broadcast & Online division’s operating and performance review in managing and understanding the development, performance and position of the Company. The operating and performance review is included on pages 37 to 43 of ITV plc’s 2019 annual report. Further to the divisional key performance indicators, the Directors would consider the key financial performance indicators of the Company during the year to include: • Revenues, which were up 0.4%, with an increase of 1.2% in Total advertising revenue (TAR). This is ahead of overall ITV Family TAR (down 1.5%) driven by good performance around Love Island. The strong performance relating to TAR offset declines in the Company across Direct to consumer and other revenues. • Share of viewing (SOV) ITV2 SOV was down slightly in the year. -

Media: Industry Overview

MEDIA: INDUSTRY OVERVIEW 7 This document is published by Practical Law and can be found at: uk.practicallaw.com/w-022-5168 Get more information on Practical Law and request a free trial at: www.practicallaw.com This note provides an overview of the sub-sectors within the UK media industry. RESOURCE INFORMATION by Lisbeth Savill, Clare Hardwick, Rachael Astin and Emma Pianta, Latham & Watkins, LLP RESOURCE ID w-022-5168 CONTENTS RESOURCE TYPE • Scope of this note • Publishing and the press Sector note • Film • Podcasts and digital audiobooks CREATED ON – Production • Advertising 13 November 2019 – Financing and distribution • Recorded music JURISDICTION • Television • Video games United Kingdom – Production • Radio – Linear and catch-up television • Social media – Video on-demand and video-sharing services • Media sector litigation SCOPE OF THIS NOTE This note provides an overview of the sub-sectors within the UK media industry. Although the note is broken down by sub-sector, in practice, many of these areas overlap in the converged media landscape. For more detailed notes on media industry sub-sectors, see: • Sector note, Recorded music industry overview. • Sector note, TV and fi lm industry overview. • Practice note, Video games industry overview. FILM Production Total UK spend on feature fi lms in 2017 was £2 billion (up 17% on 2016) (see British Film Institute (BFI): Statistical Yearbook 2018). Film production activity in the UK is driven by various factors, including infrastructure, facilities, availability of skills and creative talent and the incentive of fi lm tax relief (for further information, see Practice note, Film tax relief). UK-produced fi lms can broadly be sub-divided into independent fi lms, UK studio-backed fi lms and non-UK fi lms made in the UK. -

Tv Uk Freesat

Tv uk freesat loading Skip to content Freesat Logo TV Guide Menu. What is Freesat · Channels · Get Freesat · THE APP · WHAT'S ON · Help. Login / Register. My Freesat ID. With over channels - and 13 in high definition - it's not hard to find unbelievably good TV. With Freesat's smart TV Recorders you can watch BBC iPlayer, ITV Hub*, All 4, Demand 5 and YouTube on your TV. Tune into our stellar line-up of digital radio channels and get up to date Get Freesat · What's on · Sport. If you're getting a new TV, choose one with Freesat built in and you can connect directly to your satellite dish with no need for a separate box. You can now even. With a Freesat Smart TV Recorder you can enjoy the UK's favourite Catch Up services: BBC iPlayer, ITV Hub*, All 4 & Demand 5, plus videos on YouTube. Freesat TV Listings. What's on TV now and next. Full grid view can be viewed at Freesat is a free-to-air digital satellite television joint venture between the BBC and ITV plc, . 4oD launched on Freesat's Freetime receivers on 27 June , making Freesat the first UK TV platform to host the HTML5 version of 4oD. Demand Owner: BBC and ITV plc. Freesat, the satellite TV service from the BBC and ITV, offers hundreds of TV and radio channels to watch Lifestyle: Food Network UK, Showcase TV, FilmOn. FREESAT CHANNEL LIST - TV. The UK IPTV receiver now works on both wired internet and WiFi which , BET Black Entertainment TV, Entertainment. -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

Case Study ITV

Case Study ITV Case Study ITV “The main benefit of moving to Fujitsu and their VME services is risk mitigation. In moving to Fujitsu from our incumbent provider we get access to a very rare resource base for VME development and support. This provides us with a path enabling us to keep our critical Artist Payments System application running and allows us to keep our options open when VME as a product is end dated in 2020.” Anthony Chin, Head of Technology - Finance Systems, ITV The customer ITV is an integrated producer broadcaster and the largest commercial television network in the UK. It is the home of popular television from the biggest entertainment events, to original drama, major sport, landmark factual series and independent news. It operates a family of channels including ITV, ITVBe, ITV2, ITV3 and ITV4 and CITV, which are broadcast free-to-air, as well as the pay channel ITV Encore. ITV is also focused on delivering its programming across multiple platforms including itv.com, mobile devices, video on demand and third party platforms. ITV Studios is a global production business, creating and selling programmes and formats from offices in the UK, US, Australia, France, Germany, the Nordics and the Netherlands. It is the largest and most successful commercial production company in the UK, the largest independent non-scripted indie in the US and ITV Studios Global Entertainment is a leading international distribution The customer businesses. The challenge Country: United Kingdom ITV receives revenue from advertising, its online, pay and interactive Industry: Broadcasting business as well as from the production and sales of the programmes Founded: 1955 it creates and holds rights to.