Milton Friedman's Contributions to Macroeconomics and Teir Influence

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Free to Choose Video Tape Collection

http://oac.cdlib.org/findaid/ark:/13030/kt1n39r38j No online items Inventory to the Free to Choose video tape collection Finding aid prepared by Natasha Porfirenko Hoover Institution Library and Archives © 2008 434 Galvez Mall Stanford University Stanford, CA 94305-6003 [email protected] URL: http://www.hoover.org/library-and-archives Inventory to the Free to Choose 80201 1 video tape collection Title: Free to Choose video tape collection Date (inclusive): 1977-1987 Collection Number: 80201 Contributing Institution: Hoover Institution Library and Archives Language of Material: English Physical Description: 10 manuscript boxes, 10 motion picture film reels, 42 videoreels(26.6 Linear Feet) Abstract: Motion picture film, video tapes, and film strips of the television series Free to Choose, featuring Milton Friedman and relating to laissez-faire economics, produced in 1980 by Penn Communications and television station WQLN in Erie, Pennsylvania. Includes commercial and master film copies, unedited film, and correspondence, memoranda, and legal agreements dated from 1977 to 1987 relating to production of the series. Digitized copies of many of the sound and video recordings in this collection, as well as some of Friedman's writings, are available at http://miltonfriedman.hoover.org . Creator: Friedman, Milton, 1912-2006 Creator: Penn Communications Creator: WQLN (Television station : Erie, Pa.) Hoover Institution Library & Archives Access The collection is open for research; materials must be requested at least two business days in advance of intended use. Publication Rights For copyright status, please contact the Hoover Institution Library & Archives. Acquisition Information Acquired by the Hoover Institution Library & Archives in 1980, with increments received in 1988 and 1989. -

Some Unpleasant Monetarist Arithmetic Thomas Sargent, ,, ^ Neil Wallace (P

Federal Reserve Bank of Minneapolis Quarterly Review Some Unpleasant Monetarist Arithmetic Thomas Sargent, ,, ^ Neil Wallace (p. 1) District Conditions (p.18) Federal Reserve Bank of Minneapolis Quarterly Review vol. 5, no 3 This publication primarily presents economic research aimed at improving policymaking by the Federal Reserve System and other governmental authorities. Produced in the Research Department. Edited by Arthur J. Rolnick, Richard M. Todd, Kathleen S. Rolfe, and Alan Struthers, Jr. Graphic design and charts drawn by Phil Swenson, Graphic Services Department. Address requests for additional copies to the Research Department. Federal Reserve Bank, Minneapolis, Minnesota 55480. Articles may be reprinted if the source is credited and the Research Department is provided with copies of reprints. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Bank of Minneapolis or the Federal Reserve System. Federal Reserve Bank of Minneapolis Quarterly Review/Fall 1981 Some Unpleasant Monetarist Arithmetic Thomas J. Sargent Neil Wallace Advisers Research Department Federal Reserve Bank of Minneapolis and Professors of Economics University of Minnesota In his presidential address to the American Economic in at least two ways. (For simplicity, we will refer to Association (AEA), Milton Friedman (1968) warned publicly held interest-bearing government debt as govern- not to expect too much from monetary policy. In ment bonds.) One way the public's demand for bonds particular, Friedman argued that monetary policy could constrains the government is by setting an upper limit on not permanently influence the levels of real output, the real stock of government bonds relative to the size of unemployment, or real rates of return on securities. -

Forms of Government

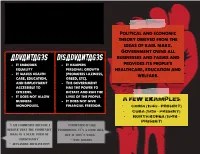

communism An economic ideology Political and economic theory derived from the ideas of karl marx. Government owns all Advantages DISAdvantages businesses and farms and - It embodies - It hampers provides its people's equality personal growth healthcare, education and - It makes health (promotes laziness, welfare. care, education, greed, etc). and employment - The government accessible to has the power to citizens. dictate and run the - It does not allow lives of the people. business - It does not give A Few Examples: monopolies. financial freedom. - China (1949 – Present) - Cuba (1959 – Present) - North Korea (1948 – Present) “I am communist because I “Communism is like believe that the comMunist prohibition. It’s a good idea, ideal is a state form of but it won’t work.” christianity” - will Rogers - Alexander Zhuravlyovv Socialism Government owns many of An Economic Ideology the larger industries and provide education, health and welfare services while Advantages DISAdvantages allowing citizens some - There is a balance - Bureaucracy hampers economic choices between wealth and the delivery of earnings services. - There is equal access - People are to health care and unmotivated to A Few Examples: education develop Vietnam - It breaks down social entrepreneurial skills. Laos barriers - The government has Denmark too much control Finland “The meaning of peace is “Socialism is workable only the absence of opposition to in heaven where it isn’t need socialism” and in where they’ve got it.” - Karl Marx - Cecil Palmer Capitalism Free-market -

Questions and Answers

Intermediate Microeconomics 2nd Year Dr. Eman Gamal El-Din M. Chapter 4 Part 1 Questions and Answers Chapter4 Q1: MCQ Explaining Macroeconomic Trends and Fluctuations 1) The AS/AD model studies the relationship between A) the price level and unemployment. B) the price level and real GDP. C) unemployment and real GDP. D) nominal GDP and inflation. Answer: B 2) By using only the aggregate demand curve, we can determine A) only the price level. B) only the quantity of real GDP. C) both the price level and quantity of real GDP. D) neither the price level nor the quantity of real GDP. Answer: D 3) In short-run macroeconomic equilibrium A) real GDP equals potential GDP and aggregate demand determines the price level. B) the price level is fixed and short-run aggregate supply determines real GDP. C) real GDP and the price level are determined by short-run aggregate supply and aggregate demand. D) real GDP is less than potential GDP. Answer: C 4) The economy is in its short run equilibrium at the point where the A) price level is stable. B) SAS curve intersects the LAS curve. C) AD curve intersects the LAS curve. D) AD curve intersects the SAS curve. Answer: D 9) In the short run, the equilibrium level of real GDP A) is necessarily less than potential GDP. B) is necessarily equal to potential GDP. C) is necessarily greater than potential GDP. D) could be less than, equal to, or greater than potential GDP. Answer: D 10) In the short run, the intersection of the aggregate demand and the short-run aggregate supply curves, A) determines the equilibrium price level. -

Liberty, Property and Rationality

Liberty, Property and Rationality Concept of Freedom in Murray Rothbard’s Anarcho-capitalism Master’s Thesis Hannu Hästbacka 13.11.2018 University of Helsinki Faculty of Arts General History Tiedekunta/Osasto – Fakultet/Sektion – Faculty Laitos – Institution – Department Humanistinen tiedekunta Filosofian, historian, kulttuurin ja taiteiden tutkimuksen laitos Tekijä – Författare – Author Hannu Hästbacka Työn nimi – Arbetets titel – Title Liberty, Property and Rationality. Concept of Freedom in Murray Rothbard’s Anarcho-capitalism Oppiaine – Läroämne – Subject Yleinen historia Työn laji – Arbetets art – Level Aika – Datum – Month and Sivumäärä– Sidoantal – Number of pages Pro gradu -tutkielma year 100 13.11.2018 Tiivistelmä – Referat – Abstract Murray Rothbard (1926–1995) on yksi keskeisimmistä modernin libertarismin taustalla olevista ajattelijoista. Rothbard pitää yksilöllistä vapautta keskeisimpänä periaatteenaan, ja yhdistää filosofiassaan klassisen liberalismin perinnettä itävaltalaiseen taloustieteeseen, teleologiseen luonnonoikeusajatteluun sekä individualistiseen anarkismiin. Hänen tavoitteenaan on kehittää puhtaaseen järkeen pohjautuva oikeusoppi, jonka pohjalta voidaan perustaa vapaiden markkinoiden ihanneyhteiskunta. Valtiota ei täten Rothbardin ihanneyhteiskunnassa ole, vaan vastuu yksilöllisten luonnonoikeuksien toteutumisesta on kokonaan yksilöllä itsellään. Tutkin työssäni vapauden käsitettä Rothbardin anarko-kapitalistisessa filosofiassa. Selvitän ja analysoin Rothbardin ajattelun keskeisimpiä elementtejä niiden filosofisissa, -

Free to Choose

June 9, 2005 COMMENTARY Free to Choose By MILTON FRIEDMAN June 9, 2005; Page A16 Little did I know when I published an article in 1955 on "The Role of Government in Education" that it would lead to my becoming an activist for a major reform in the organization of schooling, and indeed that my wife and I would be led to establish a foundation to promote parental choice. The original article was not a reaction to a perceived deficiency in schooling. The quality of schooling in the United States then was far better than it is now, and both my wife and I were satisfied with the public schools we had attended. My interest was in the philosophy of a free society. Education was the area that I happened to write on early. I then went on to consider other areas as well. The end result was "Capitalism and Freedom," published seven years later with the education article as one chapter. With respect to education, I pointed out that government was playing three major roles: (1) legislating compulsory schooling, (2) financing schooling, (3) administering schools. I concluded that there was some justification for compulsory schooling and the financing of schooling, but "the actual administration of educational institutions by the government, the 'nationalization,' as it were, of the bulk of the 'education industry' is much more difficult to justify on [free market] or, so far as I can see, on any other grounds." Yet finance and administration "could readily be separated. Governments could require a minimum of schooling financed by giving the parents vouchers redeemable for a given sum per child per year to be spent on purely educational services. -

Friedman's Monetary Framework

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Research Papers in Economics Friedman’s Monetary Framework: Some Lessons Ben S. Bernanke t is an honor and a pleasure to have this opportunity, on the anniversary of Milton and Rose Friedman’s popular classic, Free to Choose, to speak on I Milton Friedman’s monetary framework and his contributions to the theory and practice of monetary policy. About a year ago, I also had the honor, at a conference at the University of Chicago in honor of Milton’s ninetieth birthday, to discuss the contribution of Friedman’s classic 1963 work with Anna Schwartz, A Monetary History of the United States.1 I mention this earlier talk not only to indicate that I am ready and willing to praise Friedman’s contributions wherever and whenever anyone will give me a venue but also because of the critical influ- ence of A Monetary History on both Friedman’s own thought and on the views of a generation of monetary policymakers. In their Monetary History, Friedman and Schwartz reviewed nearly a cen- tury of American monetary experience in painstaking detail, providing an his- torical analysis that demonstrated the importance of monetary forces in the economy far more convincingly than any purely theoretical or even economet- ric analysis could ever do. Friedman’s close attention to the lessons of history for economic policy is an aspect of his approach to economics that I greatly admire. Milton has never been a big fan of government licensing of profession- als, but maybe he would make an exception in the case of monetary policy- makers. -

2012-2 Milton Friedman's Contributions to Macroeconomics and Their Nfluei Nce David Laidler

Western University Scholarship@Western Economic Policy Research Institute. EPRI Working Economics Working Papers Archive Papers 2012 2012-2 Milton Friedman's Contributions to Macroeconomics and Their nflueI nce David Laidler Follow this and additional works at: https://ir.lib.uwo.ca/economicsepri_wp Part of the Economics Commons Citation of this paper: Laidler, David. "2012-2 Milton Friedman's Contributions to Macroeconomics and Their nflueI nce." Economic Policy Research Institute. EPRI Working Papers, 2012-2. London, ON: Department of Economics, University of Western Ontario (2012). Milton Friedman's Contributions to Macroeconomics and Their Influence by David Laidler Working Paper # 2012-2 February 2012 Economic Policy Research Institute EPRI Working Paper Series Department of Economics Department of Political Science Social Science Centre The University of Western Ontario London, Ontario, N6A 5C2 Canada This working paper is available as a downloadable pdf file on our website http://economics.uwo.ca/centres/epri/ Milton Friedman's Contributions to Macroeconomics and their Influence* by David Laidler JEL Classifications: B22, E20, E30, E40, E50 Keywords: Friedman, macroeconomics, Keynes, Keynesianism. monetarism, money, inflation, cycle, depression, monetary policy, consumption. Abstract. Milton Friedman's contributions to and influence on macroeconomics are discussed, beginning with his work on the consumption function and the demand for money, not to mention monetary history, which helped to undermine the post World War II "Keynesian" consensus in the area. His inter-related analyses of the dynamics of monetary policy's transmission mechanism, the case for a money growth rule, and the expectations augmented Phillips curve are then taken up, followed by a discussion of his influence not only directly on the monetarist policy experiments of the early 1980s, but also less directly on the regimes that underlay the "great moderation" that broke down in the crisis of 2007-2008. -

Is Neoliberalism Consistent with Individual Liberty? Friedman, Hayek and Rand on Education Employment and Equality

International Journal of Teaching and Education Vol. IV, No. 4 / 2016 DOI: 10.20472/TE.2016.4.4.003 IS NEOLIBERALISM CONSISTENT WITH INDIVIDUAL LIBERTY? FRIEDMAN, HAYEK AND RAND ON EDUCATION EMPLOYMENT AND EQUALITY IRIT KEYNAN Abstract: In their writings, Milton Friedman, Friedrich August von Hayek and Ayn Rand have been instrumental in shaping and influencing neoliberalism through their academic and literary abilities. Their opinions on education, employment and inequality have stirred up considerable controversy and have been the focus of many debates. This paper adds to the debate by suggesting that there is an internal inconsistency in the views of neoliberalism as reflected by Friedman, Hayek and Rand. The paper contends that whereas their neoliberal theories promote liberty, the manner in which they conceptualize this term promotes policies that would actually deny the individual freedom of the majority while securing liberty and financial success for the privileged few. The paper focuses on the consequences of neoliberalism on education, and also discusses how it affects employment, inequality and democracy. Keywords: Neoliberalism; liberty; free market; equality; democracy; social justice; education; equal opportunities; Conservativism JEL Classification: B20, B31, P16 Authors: IRIT KEYNAN, College for Academic Studies, Israel, Email: [email protected] Citation: IRIT KEYNAN (2016). Is neoliberalism consistent with individual liberty? Friedman, Hayek and Rand on education employment and equality. International Journal of Teaching and Education, Vol. IV(4), pp. 30-47., 10.20472/TE.2016.4.4.003 Copyright © 2016, IRIT KEYNAN, [email protected] 30 International Journal of Teaching and Education Vol. IV, No. 4 / 2016 I. Introduction Neoliberalism gradually emerged as a significant ideology during the twentieth century, in response to the liberal crisis of the 1930s. -

Some Issues in Monetary Economics January 1970

Some Issues in Monetary Economies* By DAVID I. FAND Public policies are continuously sought which will assist in guiding the economy between the perils of inflation and the dangers of unemployment and under-production. During the last five years the perils of inflation have become increasingly apparent, and during the past year stabilization actions have been taken to reduce the rate of advance of the price level. At the present time there is growing concern that these actions may lead the economy into a recession, What are the vehicles and avenues of stabilization policy which can best restore the econ- oniy to a satisfactory course, that is, a high and rising level of output and employment with a reasonably stable price level? Unfortunately, students of this problem are not in ~ubstan- tial agreement on an answer. Economists have tended to fall into two conflicting schools of thought regarding economic stabilization — the income-expenditure approach and the modern quantity theory of money approach. Until recently, the dominant school has been the modern version of the income-expendi- ture theory which has evolved from the work of John Maynard Keynes in the 1930’s. Policy- makers in the 1950’s and 1960’s generally adopted the theoretical framework of this school for the formulation of economic stabilization actions. Primary emphasis was given to fiscal actions — Federal government spending and taxing programs — in guiding the economy be- tween inflation and unemployment. During the last two decades, proponents of the modern quantity theory of money have increasingly challenged the basic propositions of the income- expenditure school. -

100 Years Since the Birth of Milton Friedman Marek Loužek 1

REVIEW OF ECONOMIC PERSPECTIVES – NÁRODOHOSPODÁ ŘSKÝ OBZOR, VOL. 12, ISSUE 3, 2012, pp. 185–203 , DOI: 10.2478/v10135-012-0008-4 100 Years since the Birth of Milton Friedman Marek Loužek 1 Abstract: The paper deals with the economic theory of Milton Friedman. Its first part outlines the life of Milton Friedman. The second part examines his economic theories – “Essays in Positive Economics” (1953), “Studies in the Quantity Theory of Money“ (1956), “A Theory of the Consumption Function” (1957), “A Program for Monetary Stability” (1959), “A Monetary History of the United States 1897 to 1960” (1963), and “Price Theory” (1976). His Nobel Prize lecture and American Economic Association lecture in 1967 are discussed, too. The third part analyzes Friedman’s methodology. Milton Friedman was the most influential economist of the second half of the 20th century. He is best known for his theoretical and empirical research, especially consumption analysis, monetary history and theory, and for his demonstration of the complexity of stabilization policy. Key words: Chicago School of Economics, Milton Friedman, monetarism, quantitative theory of money, theory of consumption function JEL Classification: B212, B31, E40, N10, 011 Milton Friedman was born one hundred years ago, which gives us an opportunity to commemorate this famous economist who has become a legend of economic theory indeed, and with his permanent income hypothesis, foundation of monetarism and the methodology of positive economics will forever be an inseparable part of economic theory. Why was Friedman’s economics such a revolutionary one, and why can we still learn much from him? Milton Friedman’s work is vivid and encompasses a broad scale, from highly expert and technical essays, to popular articles published in Newsweek, and to political- philosophical books. -

Aggregate Or Targeted Demand?

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Tcherneva, Pavlina R. Working Paper Keynes's approach to full employment: aggregate or targeted demand? Working Paper, No. 542 Provided in Cooperation with: Levy Economics Institute of Bard College Suggested Citation: Tcherneva, Pavlina R. (2008) : Keynes's approach to full employment: aggregate or targeted demand?, Working Paper, No. 542, Levy Economics Institute of Bard College, Annandale-on-Hudson, NY This Version is available at: http://hdl.handle.net/10419/31663 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Working Paper No. 542 Keynes’s Approach to Full Employment: Aggregate or Targeted Demand? by Pavlina R. Tcherneva The Levy Economics Institute of Bard College August 2008 The Levy Economics Institute Working Paper Collection presents research in progress by Levy Institute scholars and conference participants.