Private Wealth Machine ESSU Research Report No 6

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Item C1 SW/09/894 – Installation of a Small Scale Biomass Power Plant

SECTION C MINERALS AND WASTE DISPOSAL Background Documents - the deposited documents, views and representations received as referred to in the reports and included in the development proposals dossier for each case and also as might be additionally indicated. Item C1 SW/09/894 – Installation of a small scale biomass power plant within an existing and extended building for the generation of renewable energy from low grade waste wood at Ridham Dock Road, Iwade, Sittingbourne, Kent A report by Head of Planning Applications Group to Planning Applications Committee on 11 May 2010. SW/09/894 – Installation of a small scale biomass power plant within an existing and extended building for the generation of renewable energy from low grade waste wood at Ridham Dock Road, Iwade, Sittingbourne, Kent ME9 8SR (MR. 921 674) Recommendation: Permission BE GRANTED subject to conditions. Local Member: Mr A Willicombe Classification: Unrestricted Background 1. Planning permission was granted in 2006, for a material recovery facility (MRF), in-vessel composting facility and the continuation of secondary aggregate recycling operations at the Countrystyle Recycling site, Ridham Dock, under planning consent reference SW/05/1392. Under its current consent the site is permitted to handle some 31,000 tonnes of compostable waste and 35,000 tonnes per year of recyclable waste through the MRF. Whilst the permission also allows for the continuation of 10,000 tonnes per annum of secondary aggregate recycling, this activity appears to have all but ceased and replaced with shredding of low grade wood waste. Site Description and Proposal 2. The site itself lies some 2km north of Kemsley, 2.1 km to the east of Iwade and 1.2km to the east of the A249. -

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Crr 412/2002

HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management Prepared by Risk Solutions for the Health and Safety Executive CONTRACT RESEARCH REPORT 412/2002 HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management E Baker Risk Solutions 1st floor, Central House 14 Upper Woburn Place London, WC1H 0JN United Kingdom The concept of good practice is central to HSE’s approach to regulation of health and safety management. There must therefore be a common understanding of what good practice is and where it can be found. A survey was conducted to explore how industry actually identifies good practice in health and safety management, decides how to adopt it, and how this is communicated with others. The findings are based primarily on a segmentation of the survey results by organisation size, due to homogeneity of the returns along other axes of analysis. A key finding is that there is no common understanding of the term good practice or how this is distinguished from best practice. Regulatory interpretation of good practice is perceived to be inconsistent. Three models were identified: A) Large organisations, primarily in privatised industries, have effective Trade Associations where good practice is developed and guidance disseminated industry-wide. B) Large and medium-sized organisations in competitive industries have ineffective trade associations. They develop good practices in-house and may only share these with their competitors when forced to do so. C) Small organisations have little contact with their competitors. -

![J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]](https://docslib.b-cdn.net/cover/2296/j-jarvis-sons-ltd-v-blue-circle-dartford-estates-ltd-2007-322296.webp)

J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]

J Jarvis & Sons Ltd v Blue Circle Dartford Estates Ltd [2007] APP.L.R. 05/14 JUDGMENT : MR JUSTICE JACKSON: TCC. 14th May 2007 1. This judgment is in seven parts, namely, Part 1 "Introduction"; Part 2 "The Facts"; Part 3 "The Present Proceedings"; Part 4 "The Law"; Part 5 "The Application for an Injunction"; Part 6 "Jarvis's Challenges to the Interim Award"; and Part 7 "Conclusion". Part 1: Introduction 2. This is an action brought by a main contractor in order to prevent the continuance of an arbitration. The contractor seeks to achieve that result either by means of an injunction or, alternatively, by challenging an Interim Award of the Arbitrator. This litigation has been infused with some urgency because it was launched just fifteen days before the date fixed for the start of arbitration hearing. 3. J Jarvis & Sons Limited is claimant in these proceedings and defendant in the arbitration. Prior to 18th February 1997, the name of this company was J Jarvis & Sons plc. I shall refer to the company as "Jarvis". Jarvis is the subsidiary company of Jarvis plc. Blue Circle Dartford Estates Limited is defendant in these proceedings and claimant in the arbitration. I shall refer to this party as "Blue Circle". Blue Circle is a subsidiary company of Blue Circle Industries plc. The solicitors for the parties will feature occasionally in the narrative. Squire & Co are solicitors for Jarvis. Howrey LLP are solicitors for Blue Circle. 4. I turn now to other companies which will feature in the narrative of events. GEFCO (UK) Limited are forwarding agents. -

HICL Infrastructure PLC Annual Report 2020 Delivering Real Value

HICL Infrastructure PLC Annual Report 2020 Delivering Real Value. Bangor and Nendrum Schools, UK Contents 2020 Highlights 2 Overview 01 1.1 Chairman’s Statement 6 Strategic Report 02 2.1 The Infrastructure Market 12 2.2 Investment Proposition 17 2.3 HICL’s Business Model & Strategy 18 2.4 Key Performance & Quality Indicators 20 2.5 Investment Manager’s Report 22 Strategic Report: Performance & Risk 03 3.1 Operating Review 30 3.2 Sustainability Report 34 3.3 Financial Review 50 3.4 Valuation of the Portfolio 55 3.5 The Investment Portfolio 68 3.6 Portfolio Analysis 70 3.7 Risk & Risk Management 72 3.8 Viability Statement 84 3.9 Risk Committee Report 85 3.10 Strategic Report Disclosures 89 Directors’ Report 04 4.1 Board and Governance 94 4.2 Board of Directors 96 4.3 The Investment Manager 98 4.4 Corporate Governance Statement 99 4.5 Audit Committee Report 113 4.6 Directors’ Remuneration Report 118 4.7 Report of the Directors 122 4.8 Statement of Directors’ Responsibilities 126 Financial Statements 05 5.1 Independent Auditor’s Report 130 5.2 Financial Statements 136 5.3 Notes to the Financial Statements 140 Glossary 180 Directors & Advisers 182 Front cover image: Salford Hospital, UK HICL Infrastructure Company Limited (or “HICL Guernsey”) announced on 21 November 2018 that, following consultation with investors, the Board was of the view that it would be in the best interests of shareholders as a whole to move the domicile of the investment business from Guernsey to the United Kingdom. -

Tackling High Risk Regional Roads Safer Roads Fund Full

Mobility • Safety • Economy • Environment Tackling High-Risk Regional Roads Safer Roads Fund 2017/2018 FO UND Dr Suzy Charman Road Safety Foundation October 2018 AT ION The Royal Automobile Club Foundation for Motoring Ltd is a transport policy and research organisation which explores the economic, mobility, safety and environmental issues relating to roads and their users. The Foundation publishes independent and authoritative research with which it promotes informed debate and advocates policy in the interest of the responsible motorist. RAC Foundation 89–91 Pall Mall London SW1Y 5HS Tel no: 020 7747 3445 www.racfoundation.org Registered Charity No. 1002705 October 2018 © Copyright Royal Automobile Club Foundation for Motoring Ltd Mobility • Safety • Economy • Environment Tackling High-Risk Regional Roads Safer Roads Fund 2017/2018 FO UND Dr Suzy Charman Road Safety Foundation October 2018 AT ION About the Road Safety Foundation The Road Safety Foundation is a UK charity advocating road casualty reduction through simultaneous action on all three components of the safe road system: roads, vehicles and behaviour. The charity has enabled work across each of these components and has published several reports which have provided the basis of new legislation, government policy or practice. For the last decade, the charity has focused on developing the Safe Systems approach, and in particular leading the establishment of the European Road Assessment Programme (EuroRAP) in the UK and, through EuroRAP, the global UK-based charity International Road Assessment Programme (iRAP). Since the inception of EuroRAP in 1999, the Foundation has been the UK member responsible for managing the programme in the UK (and, more recently, Ireland), ensuring that these countries provide a global model of what can be achieved. -

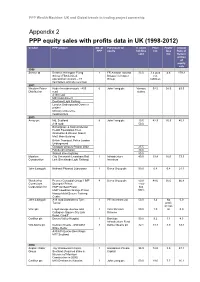

Appendix 2 PPP Equity Sales with Profits Data in UK (1998-2012)

PPP Wealth Machine: UK and Global trends in trading project ownership Appendix 2 PPP equity sales with profits data in UK (1998-2012) Vendor PPP project No. of Purchaser of % share Price Profit/ Annual PPP equity holding £m loss Rate of sold £m Return at time of equity sale 1998 Serco Ltd Defence Helicopter Flying 1 FR Aviation Ltd and 33.0 3.4 plus 4.6 179.3 School (FBS Limited, Bristow Helicopter net operational contract – 47 Group liabilities helicopters and site services) 2001 Western Power Hyder Investments plc - A55 6 John Laing plc Various 92.5 58.5 63.3 Distribution road stakes A130 road M40 road project Dockland Light Railway London Underground Connect project Ministry of Defence headquarters 2003 Amey plc M6, Scotland 8 John Laing plc 19.5 42.9 25.9 45.2 A19 road 50.0 Birmingham & Solihull Mental Health Foundation Trust (Erdington & Winson Green) MoD Main Building British Transport Police London Underground Glasgow schools-Project 2002 25.5 Edinburgh schools 30.0 Walsall street lighting 50.0 Mowlem City Greenwich Lewisham Rail 1 Infrastructure 40.0 19.4 16.0 73.3 Construction Link (Docklands Light Railway) Investors John Laing plc National Physical Laboratory 1 Serco Group plc 50.0 0.8 0.4 21.1 Wackenhut Premier Custodial Group: HMP 4 Serco Group plc 50.0 48.6 35.0 66.8 Corrections Dovegate Prison - now Corporation Inc HMP Ashfield Prison has HMP Lowdham Grange Prison 100% Hassockfield Secure Training Centre John Laing plc A19 road Dishforth to Tyne 1 PFI Investors Ltd 50.0 3.4 No 0.0 Tunnel profit or loss Vinci plc Lloyd George -

Safestyle UK Plc Annual Report & Accounts 2019 Safestyle UK Plc

safestyleukplc.co.uk Safestyle UK plc Annual Report & Accounts 2019 Safestyle UK plc Financial Overview Contents Revenue (£m) 2017 158.6 Safestyle UK plc 2018 116.4 -27% Annual Report 2019 2019 126.2 8% The UK’s No.1 for replacement Underlying profit / (loss) before taxation¹ (£m) 2017 15.1 windows and doors³ 2018 (8.7) -158% 01 Welcome page and Financial Overview 2019 (1.5) 83% Strategic Report Reported profit / (loss) before taxation (£m) 06 What we do 2017 13.8 20 Chairman’s Statement 22 CEO’s Statement 2018 (16.3) -218% 24 Financial Review 2019 (3.8) 76% 30 Risk Management 36 Corporate Social Responsibility 38 Our People Net cash² (£m) Governance 2017 11.0 2018 0.3 -98% 46 Board of Directors 48 Audit Committee Report 2019 0.4 71% 50 Directors’ Remuneration Report 58 Directors’ Report Average installed order value (£) 61 Independent Auditor’s Report 2017 3,232 Financials 2018 3,319 3% 68 Consolidated Income Statement 2019 3,337 1% 69 Consolidated Statement of Financial Position 70 Consolidated Statement of Changes in Equity 71 Consolidated Statement of Cash Flows Average frame price (£) 72 Notes to the Consolidated Financial Statements 2017 608 2018 646 6% 2019 678 5% Frames installed 2017 265,716 2018 184,184 -31% 2019 190,252 3% ¹ See the Financial Review for definition of underlying profit / (loss) before taxation ² See the Financial Review for definition of net cash Annual Report & Accounts 2019 01 ³ Based on Fensa data Safestyle UK plc Highly Recommended All figures from February 2020 Safestyle UK leading the way in customer reviews -

Annual Report and Accounts 2006

ANNUAL REPORT AND ACCOUNTS 2006 MAKING TOMORROW A BETTER PLACE Report Section 01 Our Mission, Vision, Values and Strategy Section 02 A Year of Good Progress 02 Financial Highlights 03 Chairman’s Statement Section 03 What We Do 04 At a glance Section 04 Operating and Financial Review 06 Chief Executive’s Review 10 Markets and Outlook Defence/Education/Health Facilities Management and Services/Building Roads and Civil Engineering/Rail Middle East/Canada and the Caribbean 18 Financial Review 22 Corporate Social Responsibility Section 05 A Strong Team 24 Board of Directors Section 06 Accountability 26 Corporate Governance Report 31 Remuneration Report 39 Report of the Directors 42 Statement of Directors’ Responsibilities in Respect of the Annual Report and Financial Statements 43 Independent Auditors’ Report to the Members of Carillion plc Section 07 Financial Statements 44 Consolidated Income Statement 45 Consolidated Statement of Recognised Income and Expense 46 Consolidated Balance Sheet 47 Consolidated Statement of Cash Flows 48 Notes to the Consolidated Financial Statements 82 Company Balance Sheet 83 Notes to the Company Our mission Financial Statements Making tomorrow a better place. Section 08 Further Information Our vision 89 Five Year Review To be the leader in delivering integrated 91 Principal Subsidiary Undertakings, Jointly Controlled Entities and solutions for infrastructure, buildings Jointly Controlled Operations and services. 92 Shareholder Information IBC Advisers For the latest information, including Investor Relations and Sustainability, visit our website any time. www.carillionplc.com Cover – Restoration art The Ikon Gallery, Birmingham is now housed in a former neo-gothic school restored by Carillion to its former architec- tural glory. -

Here Possible

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to the action you should take you should immediately seek advice from your stockbroker, bank manager, solicitor, accountant or other independent professional advisor duly authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares in SIG plc, please forward this document and the Form of Proxy as soon as possible to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer was effected, for transmission to the purchaser or transferee. SIG plc (Registered in England No. 998314) Chairman’s Letter to Shareholders and Notice of Annual General Meeting The Annual General Meeting is to be held at the offices of SIG Plc, 10 Eastbourne Terrace, London, W2 6LG on Tuesday 30 June 2020 at 11am The Notice of Annual General Meeting is set out on pages 7 to 9 of this Document. A Form of Proxy for use at the Annual General Meeting is enclosed. SIG plc Notice of Annual General Meeting 2020 01 SIG Notice of Meeting-2020.indd 1 29/05/2020 16:37:24 26982 29 May 2020 4:37 pm Proof 10 SIG plc (Registered in England No. 998314) DIRECTORS: REGISTERED OFFICE A.J. Allner 10 Eastbourne Terrace S.R Francis London K.H.M Kearney-Croft W2 6LG H.C Allum I.B. Duncan G.D.C Kent A.C. Lovell 5 June 2020 Dear Shareholder, ANNUAL GENERAL MEETING 2020 NOTICE OF MEETING I am writing to explain in detail the items of business contained in the Notice of Annual General Meeting (the “AGM”) of SIG plc (the “Company”), to be held at 11am on Tuesday 30 June 2020 at the offices of SIG Plc, 10 Eastbourne Terrace, London, W2 6LG. -

A26 Cycle Route Business Case

Transport Business Case Report A26 Cycle Route, Tunbridge Wells CO04300618/002 Revision 02 July 2017 Document Control Sheet Project Name: A26 Cycle Route, Tunbridge Wells Project Number: CO04300618 Report Title: Transport Business Case Report Report Number: 002 Issue Prepared Reviewed Approved Status/Amendment 00 (Draft for Name: Various County & Name: Comment) Paul Beecham Borough Council Jeff Webb officers Signature: Signature: Date: 14/06/2017 Date: 19/06/2017 01 (Issue for Gate 1 Name: Various County & Name: submission to SELEP) Paul Beecham Borough Council Jeff Webb officers Signature: Signature: Signature: Date: 22/06/2017 Date: Date: 22/06/2017 02 (Issue for Gate 2 Name: Various County & Name: submission to SELEP) Paul Beecham Borough Council Steve Whittaker officers Signature: Signature: Signature: Date: 22/07/2017 Date: 24/07/17 Date: 25/07/17 Name: Name: Name: Signature: Signature: Signature: Date: Date: Date: Project Name A26 Cycle Route, Tunbridge Wells Document Title Transport Business Case Report Contents 1 Introduction ....................................................................................................... 4 1.1 SELEP Schemes – Business Case Preparation ....................................................... 4 1.2 Purpose of Report ............................................................................................. 4 1.3 Specific Scheme ................................................................................................ 4 2 Scheme Summary ............................................................................................. -

Report of the Directors 21

735427 pp21-pp22 6/4/04 12:58 pm Page 21 Alfred McAlpine plc | Annual Report & Accounts 2003 Report of the Directors 21 Report of the Directors The Directors present their Annual Report and the audited accounts for the year ended 31st December, 2003. Principal Activities The Group provides infrastructure, construction and business services, principally in the UK. The operations of the Group are reviewed on pages 6 to 17 of this report. Profits and Dividends The Group profit for the year attributable to shareholders amounted to £22.8m (2002: £14.4m) after tax and goodwill. The Directors recommend the payment of a final dividend of 6.5p per ordinary share which, together with the interim dividend of 4.5p already paid, makes a total of 11p per ordinary share for the financial year. If approved at the Annual General Meeting (‘AGM’) to be held on 20th May, 2004, the final dividend will be paid on 28th May, 2004 to those shareholders on the register at close of business on 7th May, 2004. After provision for these ordinary dividends and dividends of £0.4m paid to preference shareholders, the retained profit of £11.5m (2002: £3.6m) has been transferred to reserves. Post Balance Sheet Event On 6th February, 2004, the Group acquired the entire issued share capital of UK Power Construction Limited for a total cash consideration of £5.2m. Substantial Interests At 22nd March, 2004, the following interests in 3% or more of the Company’s ordinary share capital had been notified to the Company: Number of shares Percentage held % Fidelity International Limited 5,262,986 5.13 Zurich Financial Services 5,105,000 4.98 Aviva plc 4,185,713 4.08 Legal & General Group Plc 3,538,268 3.45 Standard Life Investments 3,159,675 3.08 Directors Present members of the Board are shown on pages 18 and 19.