Annual Report and Accounts 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

May CARG 2020.Pdf

ISSUE 30 – MAY 2020 ISSUE 30 – MAY ISSUE 29 – FEBRUARY 2020 Promoting positive mental health in teenagers and those who support them through the provision of mental health education, resilience strategies and early intervention What we offer Calm Harm is an Clear Fear is an app to Head Ed is a library stem4 offers mental stem4’s website is app to help young help children & young of mental health health conferences a comprehensive people manage the people manage the educational videos for students, parents, and clinically urge to self-harm symptoms of anxiety for use in schools education & health informed resource professionals www.stem4.org.uk Registered Charity No 1144506 Any individuals depicted in our images are models and used solely for illustrative purposes. We all know of young people, whether employees, family or friends, who are struggling in some way with mental health issues; at ARL, we are so very pleased to support the vital work of stem4: early intervention really can make a difference to young lives. Please help in any way that you can. ADVISER RANKINGS – CORPORATE ADVISERS RANKINGS GUIDE MAY 2020 | Q2 | ISSUE 30 All rights reserved. No part of this publication may be reproduced or transmitted The Corporate Advisers Rankings Guide is available to UK subscribers at £180 per in any form or by any means (including photocopying or recording) without the annum for four updated editions, including postage and packaging. A PDF version written permission of the copyright holder except in accordance with the provision is also available at £360 + VAT. of copyright Designs and Patents Act 1988 or under the terms of a licence issued by the Copyright Licensing Agency, Barnard’s Inn, 86 Fetter Lane, London, EC4A To appear in the Rankings Guide or for subscription details, please contact us 1EN. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Crr 412/2002

HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management Prepared by Risk Solutions for the Health and Safety Executive CONTRACT RESEARCH REPORT 412/2002 HSE Health & Safety Executive A survey of UK approaches to sharing good practice in health and safety risk management E Baker Risk Solutions 1st floor, Central House 14 Upper Woburn Place London, WC1H 0JN United Kingdom The concept of good practice is central to HSE’s approach to regulation of health and safety management. There must therefore be a common understanding of what good practice is and where it can be found. A survey was conducted to explore how industry actually identifies good practice in health and safety management, decides how to adopt it, and how this is communicated with others. The findings are based primarily on a segmentation of the survey results by organisation size, due to homogeneity of the returns along other axes of analysis. A key finding is that there is no common understanding of the term good practice or how this is distinguished from best practice. Regulatory interpretation of good practice is perceived to be inconsistent. Three models were identified: A) Large organisations, primarily in privatised industries, have effective Trade Associations where good practice is developed and guidance disseminated industry-wide. B) Large and medium-sized organisations in competitive industries have ineffective trade associations. They develop good practices in-house and may only share these with their competitors when forced to do so. C) Small organisations have little contact with their competitors. -

![J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]](https://docslib.b-cdn.net/cover/2296/j-jarvis-sons-ltd-v-blue-circle-dartford-estates-ltd-2007-322296.webp)

J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]

J Jarvis & Sons Ltd v Blue Circle Dartford Estates Ltd [2007] APP.L.R. 05/14 JUDGMENT : MR JUSTICE JACKSON: TCC. 14th May 2007 1. This judgment is in seven parts, namely, Part 1 "Introduction"; Part 2 "The Facts"; Part 3 "The Present Proceedings"; Part 4 "The Law"; Part 5 "The Application for an Injunction"; Part 6 "Jarvis's Challenges to the Interim Award"; and Part 7 "Conclusion". Part 1: Introduction 2. This is an action brought by a main contractor in order to prevent the continuance of an arbitration. The contractor seeks to achieve that result either by means of an injunction or, alternatively, by challenging an Interim Award of the Arbitrator. This litigation has been infused with some urgency because it was launched just fifteen days before the date fixed for the start of arbitration hearing. 3. J Jarvis & Sons Limited is claimant in these proceedings and defendant in the arbitration. Prior to 18th February 1997, the name of this company was J Jarvis & Sons plc. I shall refer to the company as "Jarvis". Jarvis is the subsidiary company of Jarvis plc. Blue Circle Dartford Estates Limited is defendant in these proceedings and claimant in the arbitration. I shall refer to this party as "Blue Circle". Blue Circle is a subsidiary company of Blue Circle Industries plc. The solicitors for the parties will feature occasionally in the narrative. Squire & Co are solicitors for Jarvis. Howrey LLP are solicitors for Blue Circle. 4. I turn now to other companies which will feature in the narrative of events. GEFCO (UK) Limited are forwarding agents. -

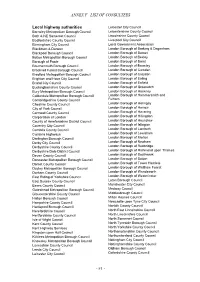

Annex F –List of Consultees

ANNEX F –LIST OF CONSULTEES Local highway authorities Leicester City Council Barnsley Metropolitan Borough Council Leicestershire County Council Bath & NE Somerset Council Lincolnshire County Council Bedfordshire County Council Liverpool City Council Birmingham City Council Local Government Association Blackburn & Darwen London Borough of Barking & Dagenham Blackpool Borough Council London Borough of Barnet Bolton Metropolitan Borough Council London Borough of Bexley Borough of Poole London Borough of Brent Bournemouth Borough Council London Borough of Bromley Bracknell Forest Borough Council London Borough of Camden Bradford Metropolitan Borough Council London Borough of Croydon Brighton and Hove City Council London Borough of Ealing Bristol City Council London Borough of Enfield Buckinghamshire County Council London Borough of Greenwich Bury Metropolitan Borough Council London Borough of Hackney Calderdale Metropolitan Borough Council London Borough of Hammersmith and Cambridgeshire County Council Fulham Cheshire County Council London Borough of Haringey City of York Council London Borough of Harrow Cornwall County Council London Borough of Havering Corporation of London London Borough of Hillingdon County of Herefordshire District Council London Borough of Hounslow Coventry City Council London Borough of Islington Cumbria County Council London Borough of Lambeth Cumbria Highways London Borough of Lewisham Darlington Borough Council London Borough of Merton Derby City Council London Borough of Newham Derbyshire County Council London -

Becoming Collaborative: Enhancing the Understanding of Intra-Organisational Relational Dynamics

BECOMING COLLABORATIVE: ENHANCING THE UNDERSTANDING OF INTRA-ORGANISATIONAL RELATIONAL DYNAMICS by Eloise Grove A Doctoral Thesis submitted in partial fulfilment of the requirements for the award of the Engineering Doctorate (EngD) degree, of Loughborough University July 2018 © by Eloise Grove (2018) Centre for Innovative and Collaborative Engineering (CICE) Department of Architecture, Civil & Building Engineering Loughborough University Loughborough Leics, LE11 3TU Acknowledgements ACKNOWLEDGMENTS I would first like to thank all the people at my Sponsoring organisation who have participated directly and indirectly in this research over the years. Not only have you provided me with the valuable material necessary but you have offered friendship that has made your place of work such an enjoyable place for me to be. Your candid contributions never cease to amaze me and for your trust I am truly grateful. Thanks to my supervisors at Loughborough University for their words of wisdom and encouragement. I’ve been connected to the School of Architecture, Building and Civil Engineering on and off since 2008. Whilst I’ve never been permanently based there I have always felt like I belong. I therefore extend this thanks to the wider team at ACBE – you make it a special place to learn. Thank you to all my industrial supervisors (there have been many) for their guidance, with special thanks to Lisa for, in her words, being the best industrial supervisor in the history of industrial supervisors. She’s kind of a big deal. For the hours upon hours of proof reading, not only throughout the years of this study but for all the homework, assignments, applications and papers that have got me to this stage in my life. -

JOB RECORD 1984 to 2013

TCC-R o.d. 1450, Plumstead, (London, UK), 2013 MICROTUNNELLING HIRE JOB RECORD 1984 to 2013 29 years of experience in Europe, the Middle East, the Americas and elsewhere Over 95 km of microtunnel installed Working with over 90 contractors in 27 countries TCS o.d. 2140, Brighton (England, UK), 2010 TCS o.d. 790, Wolverton (UK), 2005 Distributor for Iseki Poly-Tech, Inc. Sales: Europe, Middle-East, Africa, Indian sub-continent Hire: Worldwide TCP o.d. 1800, West Ham (London, UK), 2010 1984-1989 DATE COUNTRY CONTRACTOR PROJECT m PIPE SYSTEM SOIL DRIVES Oct-84 UK Queghan (SCS) Ltd Irk Vale Sewer 110 1000 ID Concrete TCM1220 Soft clay & sand 1 Jan-85 UK John Mowlem plc Gt. Yarmouth, Central Sewer, stage IV 500 1500 ID Concrete TCM 1800 Loose sand & gravel 3 Feb-86 Germany Dyckerhof & Widman Ingolstatt –multi-service ducts 220 615 ID Steel TCC 660 Clay & marl 2 May-86 UK T. Kilroe & Sons Ltd Dukinfield –sewer 360 1500 ID Concrete TCM 1800 Clay, sand 3 Jun-86 UK Thyssen (GB) Ltd S.W. Interceptor Sewer 360 500 ID Clay & TCC 660 Soft silty clay 5 Concrete Jun-86 UK Thyssen (GB) Ltd S.W. Interceptor Sewer 900 1000 ID Concrete TCC1220 All types 4 Jul-86 UK B.B. Kirk Dalton Sewerage 110 1000 ID Concrete TCC 1220 Loose sand & gravel 1 Jan-87 UK White Cross T.C. Co. (1985) Ltd Osbaldwick Pumping Station 400 500 ID Clay & TCC 660 Soft silty clay & cobbles 4 Concrete Apr-87 UK D Justice Ltd Sewer 25 500 ID GRC TCC 660 Full material 1 Jun-87 UK Miller Construction Ltd Birmingham Business Park 75 500 ID Concrete TCC 660 Gravel & cobbles 1 Oct-87 UK Lilley -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Engineering Tomorrow Engineering Tomorrow

COSTAIN GROUP PLC | ANNUAL REPORT 2016 ENGINEERING TOMORROW ENGINEERING TOMORROW Costain helps to improve people’s lives by deploying technology-based engineering solutions to meet urgent national needs across the UK’s energy, water and transportation infrastructures. We have been shaping the world in which we live for the past 150 years. Our people are committed to delivery, performance and reliability. UNIQUE BUSINESS MODEL STRONG MARKET FOCUS CLEAR SET OF PRIORITIES PROVEN TRACK RECORD We offer a broad range Our focus is on meeting urgent Our ‘Engineering Tomorrow’ We have a proven history of of innovative services across national needs in three major strategy outlines the core areas delivering results for all our the whole life-cycle of our areas to improve the quality that we are focusing on in order stakeholders – and continue to customers’ assets, through the of key assets and bring benefits to create a sustainable business. create value for customers, society, delivery of integrated consultancy, to end users. our people and shareholders. asset optimisation, technology Our three business areas: and complex delivery services. 1 Order book 2 Our services: 7 Water Consultancy (advisory, design, programme management) 3 £3.9bn Energy 6 Complex delivery 2016 £3.9bn 4 Technology 5 Transportation 2015 £3.9bn Asset optimisation Our customer-centric approach We are focused on the UK 1. Unique customer focus 2014 £3.5bn enables us to become a trusted market which offers a significant 2. Skills and experience 2013 £3.0bn partner to our customers. opportunity for Costain. of the team Central to this is our people and the expertise and professionalism Our ‘Engineering Tomorrow’ 3. -

A Vision Shared the Movement for Innovation Second Anniversary Report

A Vision Shared The Movement for Innovation Second Anniversary Report November 2000 Board & Team Members M4I Board Alan Crane* Chairman Rab Bennetts* Bennetts Associates Ltd. Bill Bolsover Aggregate Industries UK Ltd. Mike Burt European Career Systems Clive Cain Defence Estates Organisation John Connaughton Davis Langdon Consultancy Martin Davis Drake & Scull Eng. Ltd. Deryk Eke OGC Construction Team John Emery Hammerson Plc David Fison* Skanksa Construction Colin Harding George & Harding Ltd. Shonagh Hay* Amey Plc John Hobson DETR Tony Ingle-Finch Railtrack Plc John Kerman The Highways Agency Zara Lamont Construction Best Practice Programme Peter Lobban* Construction Industry Training Board Roderick Macdonald Buro Happold Allan McDougall Shepherd Engineering Services Ltd. Robin Nicholson Edward Cullinan Architects Abena Nsia National Housing Forum Richard Ogden McDonald’s Restaurants Kate Priestley* NHS Estates Robert Shed Bovis Lend Lease Stef Stefanou* John Doyle Group Plc Martin Sykes DETR Brian Thompson Babtie Electrical and Mechanical David Trapnell Etex Group Bob White* Mace Ltd. Andrew Wolstenholme* BAA The M4I Team David Crewe* Executive Director Ian Pannell Deputy Director Adrian Blumenthal Crown House Engineering Wayne Callender Drake & Scull Eng. Ltd. Charles Gjertsen Wates Construction Ali Mafi M4I Team Member John Mead Construction Industry Council Tim Penrose Mace Ltd. Neil Rennison Taylor Woodrow Peter Runacres M4I Team Member Charles Stirling BRE Scotlab Adrian Terry CITB Tim Warren Buro Happold Jane Mitchell Administrator * Members of the Executive Management Group (EMG) Contents Chairman’s Review. 2 Demonstration Projects . 9 • Purpose . 9 • Process . 10 • Regional Clusters . 11 • Performance Measurement . 13 • Statistical Review . 15 A Structured Review of Demonstration Projects (University of Reading Interim Report) . -

Completed Acquisition by Interserve Plc of the Facilities Management Business of Rentokil Initial Plc (Initial Facilities)

Completed acquisition by Interserve plc of the facilities management business of Rentokil Initial plc (Initial Facilities) ME/6432-14 The CMA’s decision on clearance under section 33(1) given on 29 May 2014. Full text of the decision published on 11 June 2014. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. Summary 1. On 18 March 2014, Interserve plc (Interserve) acquired the facilities management (FM) business (Initial Facilities) of Rentokil Initial plc (Rentokil) through the purchase of a combination of shares and assets. The Competition and Markets Authority (CMA) considers that the parties have ceased to be distinct and that the turnover test in section 23(1)(b) of the Enterprise Act 2002 (the Act) is met. The CMA therefore believes that it is or may be the case that a relevant merger situation has been created. 2. The parties notified the completed merger to the Office of Fair Trading (OFT)1 on 31 March 2014. The administrative deadline for the CMA to make a decision on whether or not to refer the merger to a phase II investigation is 29 May 2014. 3. The parties overlapped in the provision of FM services in the UK. The CMA analysed the effects of the merger on the provision of FM services in the UK as a whole, and also taking into account the information received by it on how competition varies across certain segments and geographies. 1 The Competition and Markets Authority (CMA) was established on 1 October 2013.