Marketplace Sponsorship Opportunities Information Pack 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

MI Downing Monthly Income Fund Market Commentary July 2017 in June, the MSCI UK All Cap Total Return Index Fell 2.57% While the Fund Fell 2.34%

MI Downing Monthly Income Fund Market commentary July 2017 In June, the MSCI UK All Cap Total Return Index fell 2.57% while the Fund fell 2.34%. Key contributors to the portfolio throughout the month were Sprue Aegis (up 16.47%), Polar Capital Holdings (up 9.87%) and Caretech Holdings (up 7.79%). Key detractors included Crest Nicholson (down 17.10%) and Conviviality (down 9.94%). Sprue Aegis, one of Europe’s leading developers and suppliers of home safety products, announced a positive start to the year in their June AGM statement. They expect a strong return to profitability in the first half of 2017 and with manufacturing and distribution arrangements progressing well, they believe they are well positioned to deliver a full-year adjusted operating profit in line with market expectations. Polar Capital released good group results for the period ended 31 March 2017 with assets under management increasing 27% from £7.3 billion to £9.3 billion. The results highlighted that co-founder of the business, Tim Woolley, will be standing down from his CEO role in July, although he will remain with the company as a non-executive member of the board. Gavin Rochussen will join the board as new CEO, bringing his experience as a CEO in asset management and track record in developing an institutional business and building a significant presence in North America. Caretech, a provider of specialist social care services in the UK, announced positive interim results in June for the six months ending 31 March 2017. Highlights included their acquisitions of Beacon Reach (a centre offering residential care and education to children) and Selborne Care (a centre providing support for adults with learning disabilities) after raising £37 million from a share placing in March. -

City-REDI Policy Briefing Series

City-REDI Policy Briefing Series March Image Image 2018 Part B Carillion’s Collapse: Consequences Dr Amir Qamar & Professor Simon Collinson Carillion, the second-largest construction firm in the UK, were proud of their commitment to support regional growth and small-scale suppliers. As part of this commitment they directed 60% of project expenditure to local economies. Following the collapse of the firm, this positive multiplier effect became a significant, negative multiplier effect, particularly damaging to small-scale suppliers in the construction industry. The aim of this policy brief is to examine the consequences of Carillion’s demise, many of which are only now surfacing. One of the fundamental lessons that we can learn from Carillion’s collapse is about these ‘contagion’ effects. As we saw in the 2008 financial crisis, the businesses that underpin the economic health of the country are connected and strongly co-dependent. When a large flagship firm falls it brings down others. This does not mean we need more state intervention. But it does mean we need more intelligent state intervention. One of the fundamental lessons that the Government can learn from the Carillion episode is that it has a significant responsibility as a key customer, using public sector funds for public sector projects, to monitor the health of firms and assess the risks prior to issuing PPI and other contracts. 1 Introduction The collapse of Carillion, the second-largest construction firm in the UK, has had a significant, negative knock-on effect, particularly on small-scale suppliers in the industry. In total, Carillion was comprised of 326 subsidiaries, of which 199 were in the UK. -

Full Portfolio Holdings

Hartford Multifactor International Fund Full Portfolio Holdings* as of August 31, 2021 % of Security Coupon Maturity Shares/Par Market Value Net Assets Merck KGaA 0.000 152 36,115 0.982 Kuehne + Nagel International AG 0.000 96 35,085 0.954 Novo Nordisk A/S 0.000 333 33,337 0.906 Koninklijke Ahold Delhaize N.V. 0.000 938 31,646 0.860 Investor AB 0.000 1,268 30,329 0.824 Roche Holding AG 0.000 74 29,715 0.808 WM Morrison Supermarkets plc 0.000 6,781 26,972 0.733 Wesfarmers Ltd. 0.000 577 25,201 0.685 Bouygues S.A. 0.000 595 24,915 0.677 Swisscom AG 0.000 42 24,651 0.670 Loblaw Cos., Ltd. 0.000 347 24,448 0.665 Mineral Resources Ltd. 0.000 596 23,709 0.644 Royal Bank of Canada 0.000 228 23,421 0.637 Bridgestone Corp. 0.000 500 23,017 0.626 BlueScope Steel Ltd. 0.000 1,255 22,944 0.624 Yangzijiang Shipbuilding Holdings Ltd. 0.000 18,600 22,650 0.616 BCE, Inc. 0.000 427 22,270 0.605 Fortescue Metals Group Ltd. 0.000 1,440 21,953 0.597 NN Group N.V. 0.000 411 21,320 0.579 Electricite de France S.A. 0.000 1,560 21,157 0.575 Royal Mail plc 0.000 3,051 20,780 0.565 Sonic Healthcare Ltd. 0.000 643 20,357 0.553 Rio Tinto plc 0.000 271 20,050 0.545 Coloplast A/S 0.000 113 19,578 0.532 Admiral Group plc 0.000 394 19,576 0.532 Swiss Life Holding AG 0.000 37 19,285 0.524 Dexus 0.000 2,432 18,926 0.514 Kesko Oyj 0.000 457 18,910 0.514 Woolworths Group Ltd. -

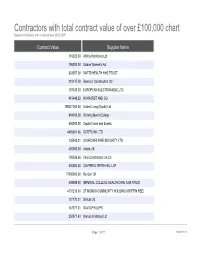

Contractors with Total Contract Value of Over £100,000 Chart Based on Contracts with a Value of Over 5000 GBP

Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP Contract Value Supplier Name 116325.00 Affinity Workforce Ltd 796000.00 Solace Women's Aid 323557.00 BARTS HEALTH NHS TRUST 210147.00 Boxmoor Construction Ltd 107420.30 EUROPEAN ELECTRONIQUE LTD 415448.22 HAYHURST AND CO 198221000.00 United Living (South) Ltd 894000.00 Working Men's College 450000.00 Capita Travel and Events 4405561.66 CATERLINK LTD 135545.21 CHURCHES FIRE SECURITY LTD 400000.00 Artelia UK 105036.66 Vinci Construction Uk Ltd 500000.00 CAMPBELL REITH HILL LLP 17000000.00 Re-Gen UK 408098.00 IMPERIAL COLLEGE HEALTHCARE NHS TRUST 4707213.00 ST MUNGO COMMUNITY HOUSING (GRIFFIN HSE) 131176.21 Softcat Ltd 147371.31 DAVID PHILLIPS 250971.43 Marcus & Marcus Ltd Page 1 of 22 10/02/2021 Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP 136044.00 CENTRAL & CECIL 198667.55 GODWIN & CROWNDALE TMC LTD 288142.90 PRICEWATERHOUSECOOPERS 494918.96 APEX HOUSING SOLUTIONS 425000.00 Rick Mather Architects LLP 148855.40 Alderwood LLA Ltd - Irchester 2 821312.26 Falcon Structural Repairs 1169203.00 Ark Build PLC 103675.37 MANOR HOSTELS (LONDON) LTD 319608347.72 VEOLIA ENVIRONMENTAL SERVICES (UK) PLC 299532.76 CASTLEHAVEN COMMUNITY ASSOC. 207757.50 PERSONALISATION SUPPORT IN CAMDEN 12000000.00 AD Construction Group 678874.77 St Johns Wood - Lifestyle Care (2011) PLC 424893.63 INSIGHT DIRECT (UK) LTD 150366.19 HOLLY LODGE ESTATE COMMITTEE 114136.63 SPECIALIST COMPUTER CENTRES 943735.13 Mihomecare 4800000.00 Turner & Townsend Project Management Ltd 140000000.00 Volkerhighways 233048.00 KPMG 1150000.00 LONDON DIOCESAN BOARD FOR SCHOOLS Page 2 of 22 10/02/2021 Contractors with total contract value of over £100,000 chart Based on Contracts with a value of over 5000 GBP 302480.00 DAISY DATA CENTRE SOLUTIONS LTD 30000000.00 Eurovia Infrastructure 140126.15 DAWSONRENTALS BUS & COACH LTD 261847.08 ST MARTIN OF TOURS HOUSING ASSOC. -

Costain Group PLC Scrip Dividend Scheme

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should seek your own advice from a stockbroker, solicitor, accountant, or other independent financial adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares in Costain Group PLC (the ‘Company’), please pass this document together with the accompanying documents to the purchaser or transferee, or to the person who arranged the sale or transfer so they can pass these documents to the person who now holds the shares. Costain Group PLC (incorporated and registered in England and Wales under number 01393773) Notice of Annual General Meeting and Explanatory Notes to Shareholders Your attention is drawn to the letter from the Chairman of the Company which is set out on page 3 of this document and which recommends you to vote in favour of the resolutions to be proposed at the Annual General Meeting. Notice of the Annual General Meeting of the Company to be held in The More Suite, 2nd Floor, Dexter House, No 2 Royal Mint Court, Tower Hill, London, EC3N 4QN on Wednesday 8 May 2013 at 11.00am is set out on pages 4 to 8 of this document. If you are unable to attend the Annual General Meeting, please complete and submit the form of proxy enclosed with this document in accordance with the instructions printed on the proxy form. -

Property Useful Links

PROPERTY - USEFUL LINKS Property - Useful Links 1300 Home Loan 1810 Malvern Road 1Casa 1st Action 1st Choice Property 1st Property Lawyers 247 Property Letting 27 Little Collins 47 Park Street 5rise 7th Heaven Properties A Place In The Sun A Plus New Homes a2dominion AACS Abacus Abbotsley Country Homes AboutProperty ABSA Access Plastics AccessIQ Accor Accord Mortgages Achieve Adair Paxton LLP Adams & Remrs Adept PROPERTY - USEFUL LINKS ADIT Brasil ADIT Nordeste Adriatic Luxury Hotels Advanced Solutions International (ASI) Affinity Sutton Affordable Millionaire Agence 107 Promenade Agency Express Ajay Ajuha Alcazaba Hills Resort Alexander Hall Alitex All Over GEO Allan Jack + Cottier Allied Pickfords Allied Surveyors AlmaVerde Amazing Retreats American Property Agent Amsprop Andalucia Country Houses Andermatt Swiss Alps Andrew and Ashwell Anglo Pacific World Movers Aphrodite Hills Apmasphere Apparent Properties Ltd Appledore Developments Ltd Archant Life Archant Life France PROPERTY - USEFUL LINKS Architectural Association School Of Architecture AREC Aristo Developers ARUP asbec Askon Estates UK Limited Aspasia Aspect International Aspinall Group Asprey Homes Asset Agents Asset Property Brokers Assetz Assoc of Home Information Pack Providers (AHIPP) Association of Residential Letting Agents (ARLA) Assoufid Aston Lloyd Astute ATHOC Atisreal Atlas International Atum Cove Australand Australian Dream Homes Awesome Villas AXA Azure Investment Property Baan Mandala Villas And Condominiums Badge Balcony Systems PROPERTY - USEFUL LINKS Ballymore -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Tussell Clients Receive Bespoke Research on Companies of Interest - Sign up for a Free Trial to find out More

Strategic Suppliers 2018 in Review Want to receive more market updates on the most important suppliers to government? Tussell clients receive bespoke research on companies of interest - sign up for a free trial to find out more: Data as at: 05 February 2019 Strategic Suppliers are defined by the Cabinet O!ce as: "Those suppliers with contracts across a number of Departments whose revenue from Government according to Government data exceeds £100m per annum and/or who are deemed significant suppliers to Government in their sector." For more information, see this information from the Crown Commerical Service and the Cabinet O!ce: https://www.gov.uk/government/publications/strategic-suppliers This analysis includes any subsidiaries, a!lliates and joint ventures of the companies mentioned. A list of these entitites is available on request. This data is derived from public sector information (a) licensed for use by the UK Government under the Open Government Licence v3.0 and/or (b) from the EU Tenders Electronic Daily website licenced for re-use by the European Commission. This information remains the copyright of the UK Government and European Commission respectively. Strategic Suppliers - Overview The Cabinet O!ce designates 30 companies as 'Strategic Suppliers' to Government. These firms are deemed so important to the delivery of essential public services that the Government's relationship with them is managed centrally by 'Crown Representatives'. 2018 was a turbulent year for some Strategic Suppliers. Starting with the collapse of Carillion in the beginning of the year and continuing with mounting stock market pressure on several others. This culminated with the re-capitalisation of Interserve on February 5th 2019. -

Investment Stewardship 2020 Annual Report

Investment Stewardship 2020 Annual Report For institutional and sophisticated investors only. Not for public distribution. 2020 Annual Report An introduction from our chairman and CEO 1 Resilience and growth in a turbulent year 2 Our four principles 4 Our program 5 Investment Stewardship at a glance 6 Regional roundup 10 Engagement case studies Board composition 14 Oversight of strategy and risk 18 Proposals seek greater climate-change disclosure 22 Attention on diversity as social issues gain the spotlight 26 Executive compensation 30 Shareholder rights 34 Key votes 36 Proxy voting history 44 Company engagements 52 For institutional and sophisticated investors only. Not for public distribution. b An introduction from our chairman and CEO Tim Buckley Vanguard Chairman and Chief Executive Officer Investors come to Vanguard for many reasons. Some are drawn to our client-ownership structure. Others are attracted to our long-term, low-cost investment philosophy. And still others are looking for an investment firm with a strong track record of stability and outperformance. Regardless of your reason for selecting Vanguard, we deeply appreciate your trust and are committed to helping you achieve your financial goals. One of the clearest expressions of how we advocate on your behalf is our engagement with the companies in which we invest. Our Investment Stewardship team speaks with thousands of executives and board members each year to understand how they intend to deliver enduring value to investors. Our conversations delve into the strategic risks facing a portfolio company and how its leadership plans to manage those risks. Many of the issues we discuss are reflected in proxy ballot items, and Vanguard votes each fund’s shares in accordance with what will serve its investors best over a long time horizon. -

Quarterly Portfolio Disclosure

Schroders 29/05/2020 ASX Limited Schroders Investment Management Australia Limited ASX Market Announcements Office ABN:22 000 443 274 Exchange Centre Australian Financial Services Licence: 226473 20 Bridge Street Sydney NSW 2000 Level 20 Angel Place 123 Pitt Street Sydney NSW 2000 P: 1300 180 103 E: [email protected] W: www.schroders.com.au/GROW Schroder Real Return Fund (Managed Fund) Quarterly holdings disclosure for quarter ending 31 March 2020 Holdings on a full look through basis as at 31 March 2020 Weight Asset Name (%) 1&1 DRILLISCH AG 0.000% 1011778 BC / NEW RED FIN 4.25 15-MAY-2024 144a (SECURED) 0.002% 1011778 BC UNLIMITED LIABILITY CO 3.875 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 4.375 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 5.0 15-OCT-2025 144a (SECURED) 0.004% 1MDB GLOBAL INVESTMENTS LTD 4.4 09-MAR-2023 Reg-S (SENIOR) 0.011% 1ST SOURCE CORP 0.000% 21VIANET GROUP ADR REPRESENTING SI ADR 0.000% 2I RETE GAS SPA 1.608 31-OCT-2027 Reg-S (SENIOR) 0.001% 2I RETE GAS SPA 2.195 11-SEP-2025 Reg-S (SENIOR) 0.001% 2U INC 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 361 DEGREES INTERNATIONAL LTD 0.000% 3D SYSTEMS CORP 0.000% 3I GROUP PLC 0.002% 3M 0.020% 3M CO 1.625 19-SEP-2021 (SENIOR) 0.001% 3M CO 1.75 14-FEB-2023 (SENIOR) 0.001% 3M CO 2.0 14-FEB-2025 (SENIOR) 0.001% 3M CO 2.0 26-JUN-2022 (SENIOR) 0.001% 3M CO 2.25 15-MAR-2023 (SENIOR) 0.001% 3M CO 2.75 01-MAR-2022 (SENIOR) 0.001% 3M CO 3.25 14-FEB-2024 (SENIOR) 0.002% -

Press Release CRH Continues Share Buyback Programme

CRH plc T +353 (1) 404 1000 Stonemason’s Way E [email protected] Rathfarnham W www.crh.com Dublin 16 D16 KH51 Ireland 30 June 2021 Press Release CRH Continues Share Buyback Programme CRH plc, the leading building materials business in the world, is pleased to announce the continuation of its share buyback programme. The Group has entered into arrangements with Societe Generale to repurchase ordinary shares on CRH’s behalf for a consideration of up to $300 million (the “Buyback”). The Buyback will commence today, 30 June 2021, and will end no later than 1 October 2021. Under the terms of the Buyback, ordinary shares will be repurchased on Euronext Dublin. CRH has entered into non-discretionary instructions with Societe Generale, acting as principal, to conduct the Buyback on CRH’s behalf and to make trading decisions under the Buyback independently of CRH in accordance with certain pre-set parameters. The purpose of the Buyback is to reduce the share capital of CRH and it will be conducted within the limitations of the authority granted at CRH’s AGM on 29 April 2021 to repurchase up to 10% of the Company’s ordinary shares in issue (being 66,634,105 ordinary shares following the completion of the latest phase of the buyback programme). The Buyback will also be conducted within the parameters prescribed by the Market Abuse Regulation 596/2014 and the Commission Delegated Regulation (EU) 2016/1052 (also as in force in the UK, from time to time, including, where relevant, pursuant to the UK’s Market Abuse (Amendment) (EU Exit) Regulations 2019) and Chapter 12 of the UK Financial Conduct Authority’s Listing Rules.