Costain Group PLC Scrip Dividend Scheme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

Highways Agency Supplier Recognition Scheme 2011

Highways Agency Supplier Recognition Scheme 2014 Best Practice Report Introduction This report looks to highlight the key aspects of the winning and highly commended entries in each category. Background 2014 was the fourth year of the Highways Agency Supplier Recognition Scheme. The annual recognition scheme highlights the vital contribution made by the Agency’s suppliers who help it operate, maintain and improve England’s network of motorways and A roads. This year entries for the awards increased significantly – as 118 bid for the honour to receive public recognition from the Agency across seven categories. These included joint ventures, the extended supply chain and small and medium enterprises. 2014 Winners and Highly Commended The Highways Agency received 118 entries from 50 entrants which included single suppliers and joint ventures. The following winners and highly commended were chosen: Winners Highly Commended Building and Sustaining Capability Costain Carillion Civil Engineering Customer Experience Carillion Civil Engineering Mouchel (Designer) & Carillion (Delivery Costain Ltd Partner) Delivering Sustainable Value & Solutions Costain Group plc Interserve Construction Limited Sir Robert McAlpine & AW Jenkinson Managing Down Cost/Improving Value Carnell Group Carillion Civil Engineering WSP Skanska Balfour Beatty/Atkins Delivery Simulation Systems Limited Team Promoting Diversity & Inclusion EM Highway Service Limited & BAM/Morgan Sindall JV Recycling Lives Safety, Health & Wellbeing Carnell Group A-One+ Integrated -

Consultees for the Implementation of the Sustainable Drainage

Department for Environment, Food and Rural Affairs December 2011 Consultees list for the consultation on national build standards and automatic adoption arrangements for gravity foul sewers and lateral drains Contents About this document ................................................................................................................. 1 Our consultees ......................................................................................................................... 1 About this document The consultation describes how Government proposes to implement the Flood and Water Management Act 2010 (the Act) for the construction standards and automatic adoption of new- build sewers England. It should be noted that this list of consultees is not exhaustive. We welcome views from anyone expressing an interest in the consultation. Although not specified on the list, some individuals and all the local authorities in England have been contacted. These authorities include borough, district, city and county councils. It should be noted that the Welsh Government is consulting separately on this subject. Our consultees 2B Landscape Consultancy 365 Environmental Services 3e Consulting Engineers Ltd A.L.H. Environmental Services Aberyswyth University ACO Technologies plc Alde and Ore Association Allen Pyke Association Albion Water Allianz Insurance All Internal Drainage Boards All Local Authorities All Parliamentary Group on sewers and sewerage All Parliamentary Group on Water Amey Anglian (Central) Regional Flood Defence Committee Anglian -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Engineering Tomorrow Engineering Tomorrow

COSTAIN GROUP PLC | ANNUAL REPORT 2016 ENGINEERING TOMORROW ENGINEERING TOMORROW Costain helps to improve people’s lives by deploying technology-based engineering solutions to meet urgent national needs across the UK’s energy, water and transportation infrastructures. We have been shaping the world in which we live for the past 150 years. Our people are committed to delivery, performance and reliability. UNIQUE BUSINESS MODEL STRONG MARKET FOCUS CLEAR SET OF PRIORITIES PROVEN TRACK RECORD We offer a broad range Our focus is on meeting urgent Our ‘Engineering Tomorrow’ We have a proven history of of innovative services across national needs in three major strategy outlines the core areas delivering results for all our the whole life-cycle of our areas to improve the quality that we are focusing on in order stakeholders – and continue to customers’ assets, through the of key assets and bring benefits to create a sustainable business. create value for customers, society, delivery of integrated consultancy, to end users. our people and shareholders. asset optimisation, technology Our three business areas: and complex delivery services. 1 Order book 2 Our services: 7 Water Consultancy (advisory, design, programme management) 3 £3.9bn Energy 6 Complex delivery 2016 £3.9bn 4 Technology 5 Transportation 2015 £3.9bn Asset optimisation Our customer-centric approach We are focused on the UK 1. Unique customer focus 2014 £3.5bn enables us to become a trusted market which offers a significant 2. Skills and experience 2013 £3.0bn partner to our customers. opportunity for Costain. of the team Central to this is our people and the expertise and professionalism Our ‘Engineering Tomorrow’ 3. -

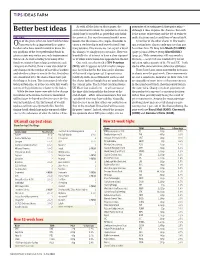

Better Best Ideas Extra Information About the Popularity of Stocks Although It Does Improve the Chances

TIPS IDEAS FARM As with all the data on these pages, the guarantee of securing good share price gains – Better best ideas extra information about the popularity of stocks although it does improve the chances. But such should not be regarded as providing any defini- is the nature of investing and the job of trying to ALGY HALL tive pointers. It is easy for normal market move- make decisions under conditions of uncertainty. ne of the plans when we launched the Ideas ments over the course of a couple of months to A number of the other shares in this week’s OFarm was to keep improving these pages. cause a stock to slip in and out of a fund’s top tips section have also recently appeared on our Readers who have found it useful to know the few positions. This means we can expect a lot of best ideas lists: US drug firmMerck (US:MRK) top positions of the best-performing funds in the changes to simply represent noise. However, (page 32) and defence group QinetiQ (QQ.) given sectors may notice one such improvement hopefully it is of interest to have a clear signpost (page 31). With coronavirus still very much a this week. As well as listing how many of the as to when a new name has appeared on the list. live issue – as we’ve been reminded by recent funds we monitor have a large position in each One such case this week is XPS Pensions infection spikes in parts of the US and UK – both company on the list, there is now also detail of (XPS), which appears as a UK smaller compa- stocks offer some welcome defensive attributes. -

Business Briefing

Business Briefing 05 June 2015 Business Briefing 05 June 2015 Tony Bickerstaff, Group Finance Director Agenda Meeting National Needs Andrew Wyllie Meeting the National Need for Energy John Pettigrew HS2: A Catalyst for Growth across Britain Simon Kirby BREAK Upgrading the highways infrastructure Graham Dalton Being a partner of choice Costain Business Briefing 05 June 2015 Andrew Wyllie CBE, Chief Executive Business Briefing 05 June 2015 Meeting the National Need for Energy John Pettigrew National Grid Executive Director, UK Change in Energy Landscape Electricity Market Reform A package of measures to………….. Incentivise low carbon investment - Contracts For Difference Manage emissions - Emissions Performance Standard - Carbon floor price support Security of supply - Capacity market Our 2015 Future Energy Scenarios Consumer Gone Green Power More More prosperity Prosperity Less Prosperity No Slow Progression Progression Less Ambition Green Ambition More ambition Changes in Generation landscape Currently New Applicants Plant Type Connected (MW) (MW) Coal / Biomass 20296 280 Hydro 3775 3029 Interconnector 4364 8205 Nuclear 9937 17737 Oil & AGT 800 0 Wind Offshore 4328 32791 Wind Onshore 2953 7144 Gas 28060 21044 Total 74513 90230 Key Investments Our major infrastructure projects (I/C’s in orange) NSN Link – UK / Norway North West Coast - Interconnector Nuclear connection HVDC Eastern Link - Inter connection with Scotland HVDC Western Link - King’s Lynn - Gas- Inter connection fired power station with Scotland connection North Wales - East Anglia -

Enginuity 2017 Competition TEAM IMPROVEMENT TABLE

Enginuity 2017 Competition TEAM IMPROVEMENT TABLE During period 10 (Early Years) Position Name Sponsor Location Imp rovement 1 The Transatlantic Trade Union Steer Davies Gleave Colombia 21 % 2 Mouchel Scousers WSP UK 19 % 3 Geotopia WSP UK 18 % 4 Prestige Worldwide WSP United States 14 % 5 Taken For Granite Arcadis UK 12 % 6 Le Nain Rouge WSP United States 12 % 7 JaCUB's Builders Jacobs Ireland 11 % 8 Make New Zealand Great Again OPUS International Consultants New Zealand 11 % 9 Global Construction WSP Qatar 11 % 10 The Business Campaigner WSP Qatar 11 % 11 GDL Rail WSP UK 11 % 12 Build Everything Create Anything Beca New Zealand 10 % 13 Making Work Holistic, now part of Enginuity MWH now part of Stantec UK 10 % 14 Creepy Crawleys UK Power Networks UK 10 % 15 Southerners WSP UK 10 % 16 JuMEngi WSP UK 10 % 17 The Brummies WSP UK 10 % 18 TheBestBecaTeamSoFar Beca New Zealand 9 % 19 Bechtel-ligence Bechtel UK 9 % 20 Green is the New Black Cundall UK 9 % 21 FNGenius Mott Macdonald UK 9 % 22 FMAC Construction Mott Macdonald UK 9 % 23 Never Tell Me The Odds WSP United States 9 % 24 Exe-Men WSP UK 9 % 25 CH2Much CH2M UK 8 % 26 #Hatchtag_winning Hatch Canada 8 % 27 Pa-shock Independent UK 8 % 28 Motts Water Warriors Mott Macdonald UK 8 % 29 Magnitude Management OPUS International Consultants New Zealand 8 % 30 Robert's Lucky Birds Robert Bird Group UK 8 % 31 Synergy WSP United States 8 % 32 Unleash the CampbellReith Campbell Reith Hill LLP UK 7 % 33 Cundallicious Cundall UK 7 % 34 JAPK MWH now part of Stantec Taiwan 7 % 35 IJC Ltd MWH now part -

Suppliers Recognised at Agency Awards

14 HIGHWAYS AGENCY JAN/FEB 2015 www.highways.gov.uk Suppliers recognised at Agency awards The Highways Agency has saluted the suppliers making a difference on national roads – and calls for more as it moves towards being a government-owned company Small and medium-sized enterprises, partnership with Recycling Lives which innovation, and customer and led to two homeless people securing worker care all emerged as employment placements. But there was winners as the Highways Agency still room for the first tier suppliers as Costain won three awards – including announced the results of its Supplier one in ‘Customer experience’ for its Recognition Scheme. work on the M1 junction 28-31 smart The awards for 2014, which were motorway scheme. The company announced in Birmingham in January, had implemented measures including saw small and medium-sized enterprises an ANPR system to give drivers live (SMEs) make their mark by picking up a journey time information as they travel quarter of the honours. through roadworks. The Agency was already celebrating Interserve Construction won the a record number of entries across the ‘Delivering sustainable value and seven categories – with 118 flooding in solutions’ category for its beyond from 50 companies. 2020 sustainability framework; while The annual recognition scheme Carillion impressed judges for its highlights the vital contribution made customer service solutions on the A23 by the Agency’s suppliers who help Handcross to Warninglid scheme. There it operate, maintain and improve the company not only made public England’s network of motorways and liaison available 24/7 for any complaints A roads. In fact more than 90 per cent or queries, it also visited schools for of the work delivered on Agency roads educational talks, raised funds for local is down to the supply chain. -

Our Governance Our Governance

OUR GOVERNANCE OUR GOVERNANCE PEOPLE Recruit and retain employees who are empowered to deliver the growing business we aspire to be. Board of Directors 62 Senior Management and Company Secretary 68 Chairman’s Introduction 70 Corporate Governance Report: 72 – Division and responsibilities 72 – Board leadership and 75 Company purpose – Composition, success 84 and evaluation: – Nomination Committee Report 88 – Audit and Risk Committee Report 94 – Audit, risk and internal control: 96 – Corporate Governance Statement 99 – Remuneration: 100 – Directors’ Remuneration Report 100 Directors’ Report 112 Statement of Directors’ Responsibilities 117 Henry Boot PLC Annual Report and Financial Statements for the year ended 31 December 2019 63 OUR GOVERNANCE Board of Directors 2 1 3 4 5 1 TIM ROBERTS Chief Executive Officer 2 JOHN SUTCLIFFE Executive Director 3 AMY STANBRIDGE Company Secretary 4 DARREN LITTLEWOOD Group Finance Director 5 JOANNE LAKE Deputy Chairman 64 Henry Boot PLC Annual Report and AccountsFinancial Statements for the year for ended the year31 December ended 31 2019December 2019 OUR GOVERNANCE 6 7 Replace Jamie 9 8 6 GERALD JENNINGS Non-executive Director 7 PETER MAWSON Non-executive Director 8 JAMIE BOOT Chairman 9 JAMES SYKES Non-executive Director Henry BootHenry PLC AnnualBoot PLC Report Annual and ReportFinancial and Statements Accounts for the year ended 31 December 2019 65 OUR GOVERNANCE Board of Directors JAMIE BOOT TIM ROBERTS JOHN SUTCLIFFE DARREN LITTLEWOOD Chairman Chief Executive Officer Executive Director Group Finance Director N A R Date of appointment Date of appointment Date of appointment Date of appointment June 1985. January 2020. October 2006. January 2016. Independent Independent Independent Independent No. -

Build to Last Annual Report and Accounts 2017 Contents

Build to Last Annual Report and Accounts 2017 Contents Strategic Report Chairman’s introduction 02 The transformation of Group Chief Executive’s review 04 Group at a glance 06 Balfour Beatty is Market review 08 well underway Business model 10 Our priorities 12 What we have been doing in 2017 16 Group Chief Directors’ valuation of the Executive’s review Investments portfolio 26 p04 Building a sustainable business 29 Measuring our performance 38 Chief Financial Officer’s review 44 Risk management framework 48 Performance review Principal risks 51 by segment Viability statement 57 Governance Chairman’s introduction 58 What we have been Leadership 60 doing in 2017 Effectiveness 63 p16 Accountability 67 Directors’ report – other disclosures 72 Remuneration report 76 Acting responsibly to protect Financial Statements and enhance the Independent auditor’s report 88 Financial statements 94 environment and support Notes to the financial statements 102 local communities Other Information Building a sustainable business Unaudited Group five-year summary 174 p29 Shareholder information 175 Front cover images (clockwise): Dorenell wind farm: this £20 million overhead line will connect a key Scottish wind farm to the national grid. Cooper’s Hill retirement development: this luxury facility includes 78 retirement properties, a health club, swimming pool, restaurant and library. The Dallas Horseshoe: following a distinctive U-shaped path, this design-build project upgraded 73 miles of road and 37 bridges to reduce congestion in Dallas, Texas. Balfour Beatty Annual Report and Accounts 2017 Strategic Report Governance Financial Statements Other Information 01 2017 progress Build to Last Lean Today, Balfour Beatty is well placed to drive £335m 2016: £173m sustainable profitable growth, underpinned Net cash excluding by a strong balance sheet. -

(A) Costain Group

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to the action you should take, you are recommended to seek your own personal financial advice immediately from your stockbroker, bank, solicitor, accountant, fund manager or other appropriate independent financial adviser who is authorised under FSMA if you are resident in the United Kingdom, or, if you are not, from another appropriately authorised independent financial adviser. This document has been approved by the FCA as competent authority under Regulation (EU) 2017/1129 (the “Prospectus Regulation”). The FCA only approves this prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation and such approval shall not be considered as an endorsement of the issuer that is the subject of this prospectus or of the quality of the securities that are the subject of this prospectus. Investors should make their own assessment as to the suitability of investing in the New Ordinary Shares. This document has been drawn up as part of a simplified prospectus in accordance with Article 14 of the Prospectus Regulation. If you sell or have sold or otherwise transferred all of your Existing Ordinary Shares before 8.00 a.m. on 11 May 2020 being the date upon which the Existing Ordinary shares will be marked “ex” the entitlement to the Open Offer, please forward this document together with the accompanying Form of Proxy and, if relevant, Application Form, if and when received, as soon as possible to the purchaser or transferee or to the stockbroker, bank or other agent through whom the sale or transfer is/was effected for delivery to the purchaser or the transferee.