10Bn Sale of PPP Shares

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

Costain Group PLC Scrip Dividend Scheme

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to any aspect of the proposals referred to in this document or as to the action you should take, you should seek your own advice from a stockbroker, solicitor, accountant, or other independent financial adviser authorised under the Financial Services and Markets Act 2000. If you have sold or otherwise transferred all of your shares in Costain Group PLC (the ‘Company’), please pass this document together with the accompanying documents to the purchaser or transferee, or to the person who arranged the sale or transfer so they can pass these documents to the person who now holds the shares. Costain Group PLC (incorporated and registered in England and Wales under number 01393773) Notice of Annual General Meeting and Explanatory Notes to Shareholders Your attention is drawn to the letter from the Chairman of the Company which is set out on page 3 of this document and which recommends you to vote in favour of the resolutions to be proposed at the Annual General Meeting. Notice of the Annual General Meeting of the Company to be held in The More Suite, 2nd Floor, Dexter House, No 2 Royal Mint Court, Tower Hill, London, EC3N 4QN on Wednesday 8 May 2013 at 11.00am is set out on pages 4 to 8 of this document. If you are unable to attend the Annual General Meeting, please complete and submit the form of proxy enclosed with this document in accordance with the instructions printed on the proxy form. -

8347 Interserve AR 2011 Introduction 4 Ifc-P1 Tp.Indd

Interserve Plc 2011 Annual Report and Financial Statements Interserve Plc Every day, we’re planning, creating and managing the world around you. 2011 Annual Report and Financial2011 Statements INTERSERVE ANNUAL REPORT 2011 OVERVIEW HIGHLIGHTS Across the world, people wake to a new day. We help make it a great day. PROUD OF THE Every day people wake to put We help build and look after this their plans, dreams and goals world and we do this through the VALUE WE CREATE IN into action. lasting relationships our people have built with a range of partners PLANNING, CREATING, To make this happen they need the and clients worldwide to ensure we places around them – their schools, AND MANAGING THE create value for everyone involved. their workplace, hospitals, shops WORLD AROUND YOU and infrastructure – to function well, to support, inspire and add value to their lives. FINANCIAL HIGHLIGHTS HEADLINE EPS* PROFIT BEFORE TAX FULL-YEAR DIVIDEND 49.3p £ 67.1m 19.0p + 15% + 5% + 6% VIEW 2011 ANNUAL REPORT ONLINE: HTTP://AR2011.INTERSERVE.COM INTERSERVE ANNUAL REPORT 2011 OVERVIEW HIGHLIGHTS Across the world, people wake to a new day. We help make it a great day. PROUD OF THE Every day people wake to put We help build and look after this their plans, dreams and goals world and we do this through the VALUE WE CREATE IN into action. lasting relationships our people have built with a range of partners PLANNING, CREATING, To make this happen they need the and clients worldwide to ensure we places around them – their schools, AND MANAGING THE create value for everyone involved. -

ITE – a First for Singapore and Bbcap the Transform Grand Prix Spotlight On… Submissions WELCOME & UPDATE

SPRING 2008 THE QUARTERLY MAGAZINE OF BALFOUR BEATTY CAPITAL IN THIS EDITION ITE – a fIRST FOR SiNGAPORE AND BBCAP The Transform Grand Prix Spotlight on… submissions WELCOME & UPDATE Welcome to the Spring edition of capital Q. The year has got off to a good start. In new business bids for Southwark, Derbyshire Schools and Enniskillen Hospital have been submitted and work continues towards achieving financial close on Islington, Fife and CNDR. Decisions are also pending for the M80 and M25 and we hope to hear on these soon. It has been an exciting time internationally with the purchase of GMH Win America, prequalification on the Etoile Project in France, and in Singapore work has started on the ground at ITE. A fantastic effort was made by the “Hard Way Up Club” who tackled the physically and mentally demanding challenge of the Haute Route. Money is still coming in but at the time of going to press, the team had raised over £14,000 for NCH. Well done to all involved. It has been an exciting time internationally SPRING 2008 with the purchase of GMH in America... THE QUARTERLY MAGAZINE OF BALFOUR BEATTY CAPITAL IN THIS EDITION 4-7 News review Learning and development remains a high priority for us all and I ITE – a first for Singapore and BBCap would ask that you make the most of the performance development Elsewhere in the world... reviews that are coming up in May. In addition Capital College is a Six word memoirs fantastic resource and new courses are being added all the time. -

Highways Agency Supplier Recognition Scheme 2011

Highways Agency Supplier Recognition Scheme 2014 Best Practice Report Introduction This report looks to highlight the key aspects of the winning and highly commended entries in each category. Background 2014 was the fourth year of the Highways Agency Supplier Recognition Scheme. The annual recognition scheme highlights the vital contribution made by the Agency’s suppliers who help it operate, maintain and improve England’s network of motorways and A roads. This year entries for the awards increased significantly – as 118 bid for the honour to receive public recognition from the Agency across seven categories. These included joint ventures, the extended supply chain and small and medium enterprises. 2014 Winners and Highly Commended The Highways Agency received 118 entries from 50 entrants which included single suppliers and joint ventures. The following winners and highly commended were chosen: Winners Highly Commended Building and Sustaining Capability Costain Carillion Civil Engineering Customer Experience Carillion Civil Engineering Mouchel (Designer) & Carillion (Delivery Costain Ltd Partner) Delivering Sustainable Value & Solutions Costain Group plc Interserve Construction Limited Sir Robert McAlpine & AW Jenkinson Managing Down Cost/Improving Value Carnell Group Carillion Civil Engineering WSP Skanska Balfour Beatty/Atkins Delivery Simulation Systems Limited Team Promoting Diversity & Inclusion EM Highway Service Limited & BAM/Morgan Sindall JV Recycling Lives Safety, Health & Wellbeing Carnell Group A-One+ Integrated -

Consultees for the Implementation of the Sustainable Drainage

Department for Environment, Food and Rural Affairs December 2011 Consultees list for the consultation on national build standards and automatic adoption arrangements for gravity foul sewers and lateral drains Contents About this document ................................................................................................................. 1 Our consultees ......................................................................................................................... 1 About this document The consultation describes how Government proposes to implement the Flood and Water Management Act 2010 (the Act) for the construction standards and automatic adoption of new- build sewers England. It should be noted that this list of consultees is not exhaustive. We welcome views from anyone expressing an interest in the consultation. Although not specified on the list, some individuals and all the local authorities in England have been contacted. These authorities include borough, district, city and county councils. It should be noted that the Welsh Government is consulting separately on this subject. Our consultees 2B Landscape Consultancy 365 Environmental Services 3e Consulting Engineers Ltd A.L.H. Environmental Services Aberyswyth University ACO Technologies plc Alde and Ore Association Allen Pyke Association Albion Water Allianz Insurance All Internal Drainage Boards All Local Authorities All Parliamentary Group on sewers and sewerage All Parliamentary Group on Water Amey Anglian (Central) Regional Flood Defence Committee Anglian -

Interserve Modern Slavery Statement

Interserve Modern Slavery statement We have a workforce of c 45,000 in the UK, c5,000 in our overseas subsidiaries and c22,000 in our Middle East associate companies, delivering construction, support services, and frontline services covering a range of sectors, worldwide.1 In addition to our directly employed workforce there are many people employed in our supply chain. Our values and our culture guide us to operate ethically and transparently. Consequently, we are committed to ensuring that Modern Slavery2 does not exist in our workforce or our supply chain. This statement should be read in conjunction with our Human Rights policy, http://www.interserve.com/docs/default-source/about/policies/human-rights-policy.pdf and with the policies and the supplier codes of conduct of our operating companies which state our position on human rights and the ethical standards we set for our own business activities and expect of our supply chain. Our whistle blowing policy and procedures http://www.interserve.com/docs/defaultsource/about/policies/whistle-blowing- policy.pdf?sfvrsn=14 provide clear guidance for our own employees and those employed in our supply chain on what to do should they suspect modern slavery is taking place. The main Modern Slavery risk within our subsidiaries’ operations stems from bringing workers employed by other companies on to our own or our customers’ sites, particularly agency workers. There are also potential risks in our supply chain in relation to goods and services at tiers 1 and below. Our suppliers and sub-contractors are required to comply with our business practices and ethical supply policies and our site induction processes extend to sub-contractors’ workers operating on our sites. -

Langdon Innovates in Tight Budget with Procure21 Procure21 Used to Get Medium-Secure Mental Health Build up and Running While Saving on a Tight Budget

Room The design specification Operating development policy process Supplier Literature/ development research review + Repeatable Standardisation ProCure21 provides Post-project 4 Evidence 9 room evaluation matrix design of components and room “open-book” ethos at designs saves money Barrow-in-Furness mental for NHS Trusts health facility Patient Implemen– focus tation group Clinical Previous review scheme designs Peer review FOLLOW US ON TWITTER @DHP21PLUS Langdon innovates in tight budget with ProCure21 ProCure21 used to get medium-secure mental health build up and running while saving on a tight budget April saw the completion of approved by the local Strategic Langdon Hospital’s men-only Health Authority with a budget medium-secure mental health of £45m – but Devon Partnership facility, a 60-bed unit replacing NHS Foundation Trust felt this was a smaller facility that had become unaffordable. Instead, ProCure21 was unfit for purpose. The new facility employed to bring the entire project includes extensive therapy facilities, within budget constraints. with a computer lab, art and music therapy rooms, a gym, shop, café and Although Trust project director Jim library, and is situated on a 110-acre Masters had some experience of the above Main entrance at site with an external sports barn and framework, project manager Craig Langdon Hospital’s men- multi-use games area. The original O’Dwyer was new to it, and the Trust only medium-secure mental project was a PFI new-build, officially health unit right An external courtyard continued on -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Engineering Tomorrow Engineering Tomorrow

COSTAIN GROUP PLC | ANNUAL REPORT 2016 ENGINEERING TOMORROW ENGINEERING TOMORROW Costain helps to improve people’s lives by deploying technology-based engineering solutions to meet urgent national needs across the UK’s energy, water and transportation infrastructures. We have been shaping the world in which we live for the past 150 years. Our people are committed to delivery, performance and reliability. UNIQUE BUSINESS MODEL STRONG MARKET FOCUS CLEAR SET OF PRIORITIES PROVEN TRACK RECORD We offer a broad range Our focus is on meeting urgent Our ‘Engineering Tomorrow’ We have a proven history of of innovative services across national needs in three major strategy outlines the core areas delivering results for all our the whole life-cycle of our areas to improve the quality that we are focusing on in order stakeholders – and continue to customers’ assets, through the of key assets and bring benefits to create a sustainable business. create value for customers, society, delivery of integrated consultancy, to end users. our people and shareholders. asset optimisation, technology Our three business areas: and complex delivery services. 1 Order book 2 Our services: 7 Water Consultancy (advisory, design, programme management) 3 £3.9bn Energy 6 Complex delivery 2016 £3.9bn 4 Technology 5 Transportation 2015 £3.9bn Asset optimisation Our customer-centric approach We are focused on the UK 1. Unique customer focus 2014 £3.5bn enables us to become a trusted market which offers a significant 2. Skills and experience 2013 £3.0bn partner to our customers. opportunity for Costain. of the team Central to this is our people and the expertise and professionalism Our ‘Engineering Tomorrow’ 3. -

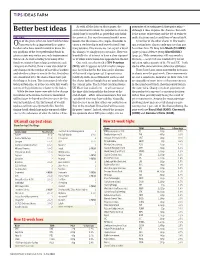

Better Best Ideas Extra Information About the Popularity of Stocks Although It Does Improve the Chances

TIPS IDEAS FARM As with all the data on these pages, the guarantee of securing good share price gains – Better best ideas extra information about the popularity of stocks although it does improve the chances. But such should not be regarded as providing any defini- is the nature of investing and the job of trying to ALGY HALL tive pointers. It is easy for normal market move- make decisions under conditions of uncertainty. ne of the plans when we launched the Ideas ments over the course of a couple of months to A number of the other shares in this week’s OFarm was to keep improving these pages. cause a stock to slip in and out of a fund’s top tips section have also recently appeared on our Readers who have found it useful to know the few positions. This means we can expect a lot of best ideas lists: US drug firmMerck (US:MRK) top positions of the best-performing funds in the changes to simply represent noise. However, (page 32) and defence group QinetiQ (QQ.) given sectors may notice one such improvement hopefully it is of interest to have a clear signpost (page 31). With coronavirus still very much a this week. As well as listing how many of the as to when a new name has appeared on the list. live issue – as we’ve been reminded by recent funds we monitor have a large position in each One such case this week is XPS Pensions infection spikes in parts of the US and UK – both company on the list, there is now also detail of (XPS), which appears as a UK smaller compa- stocks offer some welcome defensive attributes. -

Completed Acquisition by Interserve Plc of the Facilities Management Business of Rentokil Initial Plc (Initial Facilities)

Completed acquisition by Interserve plc of the facilities management business of Rentokil Initial plc (Initial Facilities) ME/6432-14 The CMA’s decision on clearance under section 33(1) given on 29 May 2014. Full text of the decision published on 11 June 2014. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. Summary 1. On 18 March 2014, Interserve plc (Interserve) acquired the facilities management (FM) business (Initial Facilities) of Rentokil Initial plc (Rentokil) through the purchase of a combination of shares and assets. The Competition and Markets Authority (CMA) considers that the parties have ceased to be distinct and that the turnover test in section 23(1)(b) of the Enterprise Act 2002 (the Act) is met. The CMA therefore believes that it is or may be the case that a relevant merger situation has been created. 2. The parties notified the completed merger to the Office of Fair Trading (OFT)1 on 31 March 2014. The administrative deadline for the CMA to make a decision on whether or not to refer the merger to a phase II investigation is 29 May 2014. 3. The parties overlapped in the provision of FM services in the UK. The CMA analysed the effects of the merger on the provision of FM services in the UK as a whole, and also taking into account the information received by it on how competition varies across certain segments and geographies. 1 The Competition and Markets Authority (CMA) was established on 1 October 2013.