Completed Acquisition by Interserve Plc of the Facilities Management Business of Rentokil Initial Plc (Initial Facilities)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

View Annual Report

Costain Group PLC PLC Costain Group Costain House Nicholsons Walk Being Number One Maidenhead Costain Group PLC Berkshire SL6 1LN Annual Report 2005 Telephone 01628 842444 www.costain.com Annual Report 2005 Costain is an international Financial calendar engineering and construction Half year results – Announced 31 August 2005 Full year results – Announced 15 March 2006 company, seen as an Report & Accounts – Sent to shareholders 28 March 2006 Annual General Meeting – To be held 27 April 2006 Half year results 2005 – To be announced 30 August 2006 automatic choice for projects Analysis of Shareholders Shares requiring innovation, initiative, Accounts (millions) % Institutions, companies, individuals and nominees: Shareholdings 100,000 and over 156 321.92 90.39 teamwork and high levels of Shareholdings 50,000 – 99,999 93 6.37 1.69 Shareholdings 25,000 – 49,999 186 6.01 1.79 Shareholdings 5,000 – 24,999 1,390 13.78 3.87 technical and managerial skills. Shareholdings 1 – 4,999 12,848 8.06 2.26 14,673 356.14 100.00 Secretary and Registered Office Secretary Registrar and Transfer Office Clive L Franks Lloyds TSB Registrars The Causeway Registered Office Worthing Costain Group PLC West Sussex Costain House BN99 6DA Nicholsons Walk Telephone 0870 600 3984 Maidenhead Berkshire SL6 1LN Telephone 01628 842444 www.costain.com [email protected] Company Number 1393773 Shareholder information The Company’s Registrar is Lloyds TSB Registrars, The Causeway, Worthing, West Sussex BN99 6DA. For enquiries regarding your shareholding, please telephone 0870 600 3984. You can also view up-to-date information abourt your holdings by visiting the shareholder web site at www.shareview.co.uk. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

8347 Interserve AR 2011 Introduction 4 Ifc-P1 Tp.Indd

Interserve Plc 2011 Annual Report and Financial Statements Interserve Plc Every day, we’re planning, creating and managing the world around you. 2011 Annual Report and Financial2011 Statements INTERSERVE ANNUAL REPORT 2011 OVERVIEW HIGHLIGHTS Across the world, people wake to a new day. We help make it a great day. PROUD OF THE Every day people wake to put We help build and look after this their plans, dreams and goals world and we do this through the VALUE WE CREATE IN into action. lasting relationships our people have built with a range of partners PLANNING, CREATING, To make this happen they need the and clients worldwide to ensure we places around them – their schools, AND MANAGING THE create value for everyone involved. their workplace, hospitals, shops WORLD AROUND YOU and infrastructure – to function well, to support, inspire and add value to their lives. FINANCIAL HIGHLIGHTS HEADLINE EPS* PROFIT BEFORE TAX FULL-YEAR DIVIDEND 49.3p £ 67.1m 19.0p + 15% + 5% + 6% VIEW 2011 ANNUAL REPORT ONLINE: HTTP://AR2011.INTERSERVE.COM INTERSERVE ANNUAL REPORT 2011 OVERVIEW HIGHLIGHTS Across the world, people wake to a new day. We help make it a great day. PROUD OF THE Every day people wake to put We help build and look after this their plans, dreams and goals world and we do this through the VALUE WE CREATE IN into action. lasting relationships our people have built with a range of partners PLANNING, CREATING, To make this happen they need the and clients worldwide to ensure we places around them – their schools, AND MANAGING THE create value for everyone involved. -

Annual Report 2007 Download PDF 504.15 KB

Delivering profitable growth Annual Report and Financial Statements 2007 CONTENTS PERFORMANCE “Galliford Try has had an excellent year. We have delivered significant profit growth across all our businesses, Highlights 01 our recent acquisitions are performing The Group 02 ahead of expectations, and we are Chairman’s Statement 03 confident that our strategy will continue Business Review 04 to deliver sustainable growth and Divisional Reviews 06 increased shareholder value.” Financial Results 11 Corporate Responsibility 14 Greg Fitzgerald Corporate and Social Responsibility Report 16 Chief Executive DIRECTORS AND GOVERNANCE Directors and Executive Board 20 Directors’ Report 22 Corporate Governance Report 24 Remuneration Report 28 FINANCIALS Independent Auditors’ Report – Group 34 Consolidated Income Statement 35 Consolidated Statement of Recognised Income and Expense 36 Consolidated Balance Sheet 37 Consolidated Cash Flow Statement 38 Notes to the Consolidated Financial Statements 39 Independent Auditors’ Report – Company 72 Company Balance Sheet 73 Notes to the Company Financial Statements 74 Five-Year Record 82 Contacts 83 Shareholder Information 84 HIGHLIGHTS For the year ended 30 June 2007 • Results ahead of expectations from Morrison Construction and REVENUE Chartdale Homes in the first full year following acquisition. +65% • Good performance from Linden Homes since acquisition; integration going well with synergies exceeding forecast. • Year end net debt of £99 million, representing gearing of 32 per cent, £1,410 m significantly better than expectations. • Current construction order book maintained at £2.1 billion. PROFIT BEFORE TAX • Record housebuilding completions of 1,526 units and landbank +75% of 11,200 plots. Encouraging sales during the summer period with current sales in hand of £323 million. -

Keep Calm and Carillion – the Company’S Pension Schemes Are More Secure Than They Look

Keep Calm and Carillion – The Company’s Pension Schemes Are More Secure than They Look Safeguarding the Carillion pension empire The company we came to know as Carillion was created in July 1999, following a demerger from Tarmac, through which it acquired a number of huge UK employers, including Mowlem and Alfred McAlpine. This gave the new company immediate responsibility for 13 defined benefit pension schemes. Almost two decades later, 27,500 people First Actuarial’s Catherine Lockyer continue to have benefits in schemes reliant on Carillion as sponsor, with close to half of sheds light on the doom and gloom these already receiving their pensions. surrounding Carillion’s pension schemes Commentators were not slow to point to The recent collapse of the construction and public problems with Carillion’s pension schemes. services contractor, Carillion plc, sent shockwaves The Guardian reported that MPs were through the British economy. accusing the company of trying to wriggle out of its pension obligations, for example. When the news broke in January, the future looked And The Economist asked whether pension uncertain for the company’s 20,000 UK employees. protection was still viable, referring to ‘a big And as industrialists took the measure of the hole’. All in all, the future of these schemes consequences for the country, other questions looked deeply uncertain, and this can only quickly emerged. have added to the anxieties of Carillion’s employees and pensioners. How would the Government deal with the huge infrastructure projects that Carillion had failed to The fantastic news, however, is that all of complete? Who would manage the maintenance Carillion’s pension scheme members have and service of hundreds of hospitals, schools and the security of the Pension Protection Fund homes? And as for the thousands of smaller (PPF). -

![J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]](https://docslib.b-cdn.net/cover/2296/j-jarvis-sons-ltd-v-blue-circle-dartford-estates-ltd-2007-322296.webp)

J Jarvis & Sons Ltd V Blue Circle Dartford Estates Ltd [2007]

J Jarvis & Sons Ltd v Blue Circle Dartford Estates Ltd [2007] APP.L.R. 05/14 JUDGMENT : MR JUSTICE JACKSON: TCC. 14th May 2007 1. This judgment is in seven parts, namely, Part 1 "Introduction"; Part 2 "The Facts"; Part 3 "The Present Proceedings"; Part 4 "The Law"; Part 5 "The Application for an Injunction"; Part 6 "Jarvis's Challenges to the Interim Award"; and Part 7 "Conclusion". Part 1: Introduction 2. This is an action brought by a main contractor in order to prevent the continuance of an arbitration. The contractor seeks to achieve that result either by means of an injunction or, alternatively, by challenging an Interim Award of the Arbitrator. This litigation has been infused with some urgency because it was launched just fifteen days before the date fixed for the start of arbitration hearing. 3. J Jarvis & Sons Limited is claimant in these proceedings and defendant in the arbitration. Prior to 18th February 1997, the name of this company was J Jarvis & Sons plc. I shall refer to the company as "Jarvis". Jarvis is the subsidiary company of Jarvis plc. Blue Circle Dartford Estates Limited is defendant in these proceedings and claimant in the arbitration. I shall refer to this party as "Blue Circle". Blue Circle is a subsidiary company of Blue Circle Industries plc. The solicitors for the parties will feature occasionally in the narrative. Squire & Co are solicitors for Jarvis. Howrey LLP are solicitors for Blue Circle. 4. I turn now to other companies which will feature in the narrative of events. GEFCO (UK) Limited are forwarding agents. -

ITE – a First for Singapore and Bbcap the Transform Grand Prix Spotlight On… Submissions WELCOME & UPDATE

SPRING 2008 THE QUARTERLY MAGAZINE OF BALFOUR BEATTY CAPITAL IN THIS EDITION ITE – a fIRST FOR SiNGAPORE AND BBCAP The Transform Grand Prix Spotlight on… submissions WELCOME & UPDATE Welcome to the Spring edition of capital Q. The year has got off to a good start. In new business bids for Southwark, Derbyshire Schools and Enniskillen Hospital have been submitted and work continues towards achieving financial close on Islington, Fife and CNDR. Decisions are also pending for the M80 and M25 and we hope to hear on these soon. It has been an exciting time internationally with the purchase of GMH Win America, prequalification on the Etoile Project in France, and in Singapore work has started on the ground at ITE. A fantastic effort was made by the “Hard Way Up Club” who tackled the physically and mentally demanding challenge of the Haute Route. Money is still coming in but at the time of going to press, the team had raised over £14,000 for NCH. Well done to all involved. It has been an exciting time internationally SPRING 2008 with the purchase of GMH in America... THE QUARTERLY MAGAZINE OF BALFOUR BEATTY CAPITAL IN THIS EDITION 4-7 News review Learning and development remains a high priority for us all and I ITE – a first for Singapore and BBCap would ask that you make the most of the performance development Elsewhere in the world... reviews that are coming up in May. In addition Capital College is a Six word memoirs fantastic resource and new courses are being added all the time. -

Interserve Modern Slavery Statement

Interserve Modern Slavery statement We have a workforce of c 45,000 in the UK, c5,000 in our overseas subsidiaries and c22,000 in our Middle East associate companies, delivering construction, support services, and frontline services covering a range of sectors, worldwide.1 In addition to our directly employed workforce there are many people employed in our supply chain. Our values and our culture guide us to operate ethically and transparently. Consequently, we are committed to ensuring that Modern Slavery2 does not exist in our workforce or our supply chain. This statement should be read in conjunction with our Human Rights policy, http://www.interserve.com/docs/default-source/about/policies/human-rights-policy.pdf and with the policies and the supplier codes of conduct of our operating companies which state our position on human rights and the ethical standards we set for our own business activities and expect of our supply chain. Our whistle blowing policy and procedures http://www.interserve.com/docs/defaultsource/about/policies/whistle-blowing- policy.pdf?sfvrsn=14 provide clear guidance for our own employees and those employed in our supply chain on what to do should they suspect modern slavery is taking place. The main Modern Slavery risk within our subsidiaries’ operations stems from bringing workers employed by other companies on to our own or our customers’ sites, particularly agency workers. There are also potential risks in our supply chain in relation to goods and services at tiers 1 and below. Our suppliers and sub-contractors are required to comply with our business practices and ethical supply policies and our site induction processes extend to sub-contractors’ workers operating on our sites. -

Langdon Innovates in Tight Budget with Procure21 Procure21 Used to Get Medium-Secure Mental Health Build up and Running While Saving on a Tight Budget

Room The design specification Operating development policy process Supplier Literature/ development research review + Repeatable Standardisation ProCure21 provides Post-project 4 Evidence 9 room evaluation matrix design of components and room “open-book” ethos at designs saves money Barrow-in-Furness mental for NHS Trusts health facility Patient Implemen– focus tation group Clinical Previous review scheme designs Peer review FOLLOW US ON TWITTER @DHP21PLUS Langdon innovates in tight budget with ProCure21 ProCure21 used to get medium-secure mental health build up and running while saving on a tight budget April saw the completion of approved by the local Strategic Langdon Hospital’s men-only Health Authority with a budget medium-secure mental health of £45m – but Devon Partnership facility, a 60-bed unit replacing NHS Foundation Trust felt this was a smaller facility that had become unaffordable. Instead, ProCure21 was unfit for purpose. The new facility employed to bring the entire project includes extensive therapy facilities, within budget constraints. with a computer lab, art and music therapy rooms, a gym, shop, café and Although Trust project director Jim library, and is situated on a 110-acre Masters had some experience of the above Main entrance at site with an external sports barn and framework, project manager Craig Langdon Hospital’s men- multi-use games area. The original O’Dwyer was new to it, and the Trust only medium-secure mental project was a PFI new-build, officially health unit right An external courtyard continued on -

JOB RECORD 1984 to 2013

TCC-R o.d. 1450, Plumstead, (London, UK), 2013 MICROTUNNELLING HIRE JOB RECORD 1984 to 2013 29 years of experience in Europe, the Middle East, the Americas and elsewhere Over 95 km of microtunnel installed Working with over 90 contractors in 27 countries TCS o.d. 2140, Brighton (England, UK), 2010 TCS o.d. 790, Wolverton (UK), 2005 Distributor for Iseki Poly-Tech, Inc. Sales: Europe, Middle-East, Africa, Indian sub-continent Hire: Worldwide TCP o.d. 1800, West Ham (London, UK), 2010 1984-1989 DATE COUNTRY CONTRACTOR PROJECT m PIPE SYSTEM SOIL DRIVES Oct-84 UK Queghan (SCS) Ltd Irk Vale Sewer 110 1000 ID Concrete TCM1220 Soft clay & sand 1 Jan-85 UK John Mowlem plc Gt. Yarmouth, Central Sewer, stage IV 500 1500 ID Concrete TCM 1800 Loose sand & gravel 3 Feb-86 Germany Dyckerhof & Widman Ingolstatt –multi-service ducts 220 615 ID Steel TCC 660 Clay & marl 2 May-86 UK T. Kilroe & Sons Ltd Dukinfield –sewer 360 1500 ID Concrete TCM 1800 Clay, sand 3 Jun-86 UK Thyssen (GB) Ltd S.W. Interceptor Sewer 360 500 ID Clay & TCC 660 Soft silty clay 5 Concrete Jun-86 UK Thyssen (GB) Ltd S.W. Interceptor Sewer 900 1000 ID Concrete TCC1220 All types 4 Jul-86 UK B.B. Kirk Dalton Sewerage 110 1000 ID Concrete TCC 1220 Loose sand & gravel 1 Jan-87 UK White Cross T.C. Co. (1985) Ltd Osbaldwick Pumping Station 400 500 ID Clay & TCC 660 Soft silty clay & cobbles 4 Concrete Apr-87 UK D Justice Ltd Sewer 25 500 ID GRC TCC 660 Full material 1 Jun-87 UK Miller Construction Ltd Birmingham Business Park 75 500 ID Concrete TCC 660 Gravel & cobbles 1 Oct-87 UK Lilley -

Engineering Tomorrow Engineering Tomorrow

COSTAIN GROUP PLC | ANNUAL REPORT 2016 ENGINEERING TOMORROW ENGINEERING TOMORROW Costain helps to improve people’s lives by deploying technology-based engineering solutions to meet urgent national needs across the UK’s energy, water and transportation infrastructures. We have been shaping the world in which we live for the past 150 years. Our people are committed to delivery, performance and reliability. UNIQUE BUSINESS MODEL STRONG MARKET FOCUS CLEAR SET OF PRIORITIES PROVEN TRACK RECORD We offer a broad range Our focus is on meeting urgent Our ‘Engineering Tomorrow’ We have a proven history of of innovative services across national needs in three major strategy outlines the core areas delivering results for all our the whole life-cycle of our areas to improve the quality that we are focusing on in order stakeholders – and continue to customers’ assets, through the of key assets and bring benefits to create a sustainable business. create value for customers, society, delivery of integrated consultancy, to end users. our people and shareholders. asset optimisation, technology Our three business areas: and complex delivery services. 1 Order book 2 Our services: 7 Water Consultancy (advisory, design, programme management) 3 £3.9bn Energy 6 Complex delivery 2016 £3.9bn 4 Technology 5 Transportation 2015 £3.9bn Asset optimisation Our customer-centric approach We are focused on the UK 1. Unique customer focus 2014 £3.5bn enables us to become a trusted market which offers a significant 2. Skills and experience 2013 £3.0bn partner to our customers. opportunity for Costain. of the team Central to this is our people and the expertise and professionalism Our ‘Engineering Tomorrow’ 3. -

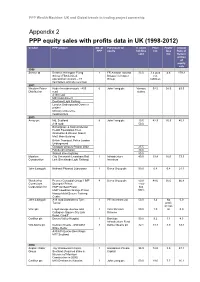

Appendix 2 PPP Equity Sales with Profits Data in UK (1998-2012)

PPP Wealth Machine: UK and Global trends in trading project ownership Appendix 2 PPP equity sales with profits data in UK (1998-2012) Vendor PPP project No. of Purchaser of % share Price Profit/ Annual PPP equity holding £m loss Rate of sold £m Return at time of equity sale 1998 Serco Ltd Defence Helicopter Flying 1 FR Aviation Ltd and 33.0 3.4 plus 4.6 179.3 School (FBS Limited, Bristow Helicopter net operational contract – 47 Group liabilities helicopters and site services) 2001 Western Power Hyder Investments plc - A55 6 John Laing plc Various 92.5 58.5 63.3 Distribution road stakes A130 road M40 road project Dockland Light Railway London Underground Connect project Ministry of Defence headquarters 2003 Amey plc M6, Scotland 8 John Laing plc 19.5 42.9 25.9 45.2 A19 road 50.0 Birmingham & Solihull Mental Health Foundation Trust (Erdington & Winson Green) MoD Main Building British Transport Police London Underground Glasgow schools-Project 2002 25.5 Edinburgh schools 30.0 Walsall street lighting 50.0 Mowlem City Greenwich Lewisham Rail 1 Infrastructure 40.0 19.4 16.0 73.3 Construction Link (Docklands Light Railway) Investors John Laing plc National Physical Laboratory 1 Serco Group plc 50.0 0.8 0.4 21.1 Wackenhut Premier Custodial Group: HMP 4 Serco Group plc 50.0 48.6 35.0 66.8 Corrections Dovegate Prison - now Corporation Inc HMP Ashfield Prison has HMP Lowdham Grange Prison 100% Hassockfield Secure Training Centre John Laing plc A19 road Dishforth to Tyne 1 PFI Investors Ltd 50.0 3.4 No 0.0 Tunnel profit or loss Vinci plc Lloyd George