Press Release CRH Continues Share Buyback Programme

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(UK) Plc CRH Funding BV CRH Finance Germany Gmbh CRH

CRH Finance Limited (incorporated with limited liability in Ireland with registered number 50074) CRH Finance (U.K.) plc (incorporated with limited liability in England and Wales with registered number 2153217) CRH Funding B.V. (incorporated with limited liability in The Netherlands with registered number 57502536) CRH Finance Germany GmbH (incorporated with limited liability in the court of Düsseldorf, Germany with registered number HRB 66176) CRH Finance SAS (incorporated with limited liability in France with registered number 519 204 440) CRH Finland Services Oyj (incorporated with limited liability in Finland with Business Identity Code 2553762-1) CRH Finance Switzerland AG (incorporated with limited liability in Switzerland with registered number CH-170.3.037.929-8) €5,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed by CRH plc (incorporated with limited liability in Ireland with registered number 12965) Under this €5,000,000,000 Euro Medium Term Note Programme (the Programme), CRH Finance Limited (an Issuer or CRH Finance), CRH Finance (U.K.) plc (an Issuer or CRH Finance UK),CRH Funding B.V. (an Issuer or CRH Funding B.V.), CRH Finance Germany GmbH (an Issuer or CRH Germany), CRH Finance SAS (an Issuer or CRH Finance SAS), CRH Finland Services Oyj (an Issuer or CRH Finland) and CRH Finance Switzerland AG (an Issuer or CRH Switzerland) (together, the Issuers) may from time to time issue notes (the Notes) denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined below). The payments of all amounts due in respect of the Notes will be unconditionally and irrevocably guaranteed by CRH plc (the Guarantor or CRH). -

IACT | Corporate Treasury & Cash Management Conference

CORPORATE TREASURY & CASH MANAGEMENT CONFERENCE 2013 Wednesday 20th November Gibson Hotel, 02 Point Village, IFSC, Dublin 1, Ireland www.corporatetreasury.ie Gold Sponsor: Premium Silver Sponsor: Silver Sponsors: Asset Management presented by: Irish Association of Corporate Treasurers & Summit Focus tel: + 353 1 524 2375 Irish Association email: [email protected] of www.summitfocus.com Corporate Treasurers EVENT SPONSORS WELCOME NOTE GOLD SPONSOR Irish Association of Corporate Treasurers DANSKE BANK Gold Sponsor Danske Bank Group is one of the strongest, best up with powerful technology platform. The dedicated Contact capitalised and most progressive banking groups in teams in Danske Bank’s Corporates & Institutions team www.treasurers.ie Europe. Operating in Ireland since 2005, Danske Bank work closely with clients to provide bespoke strategies is a specialist bank offering a market-leading product to help achieve their business and financial objectives. and service proposition for corporate clients, backed As President of the Irish Association of Corporate systems and trends (what the treasurer needs to do), Treasurers for 2013, I would like to welcome you all to and they’ll even cover benchmarking and KPIs (or, what this year’s conference. the treasurer needs to tell the Board!). PREMIUM SILVER The year has been a very good one as the Association Garnered with all this knowledge, the treasurers’ SPONSOR goes from strength to strength and builds on last year’s opinion forum will provide you with a chance to ask 25th anniversary. In addition to our recent flagship that question (by text or by the traditional method) that BARCLAYS event, the Annual Dinner, and the ever-popular golf has been on your mind or has cropped up during the Premium Silver Sponsor day, we also held a new event, the very well received conference and hear at first-hand how your peers in the Barclays has been supporting Irish businesses and deliver solutions that work for your business. -

Marketplace Sponsorship Opportunities Information Pack 2017

MarketPlace Sponsorship Opportunities Information Pack 2017 www.airmic.com/marketplace £ Sponsorship 950 plus VAT Annual Conference Website * 1 complimentary delegate pass for Monday www.airmic.com/marketplace only (worth £695)* A designated web page on the MarketPlace Advanced notification of the exhibition floor plan section of the website which will include your logo, contact details and opportunity to upload 20% discount off delegate places any PDF service information documents Advanced notification to book on-site meeting rooms Airmic Dinner Logo on conference banner Advanced notification to buy tickets for the Annual Dinner, 12th December 2017 Logo in conference brochure Access to pre-dinner hospitality tables Opportunity to receive venue branding opportunities Additional Opportunities * This discount is only valid for someone who have never attended an Airmic Conference Airmic can post updates/events for you on before Linked in/Twitter ERM Forum Opportunity to submit articles on technical subjects in Airmic News (subject to editor’s discretion) Opportunity to purchase a table stand at the ERM Forum Opportunity to promote MP content online via @ Airmic Twitter or the Airmic Linked In Group About Airmic Membership Airmic has a membership of about 1200 from about 480 companies. It represents the Insurance buyers for about 70% of the FTSE 100, as well as a very substantial representation in the mid-250 and other smaller companies. Membership continues to grow, and retention remains at 90%. Airmic members’ controls about £5 billion of annual insurance premium spend. A further £2 billion of premium spend is allocated to captive insurance companies within member organisations. Additionally, members are responsible for the payment of insurance claims from their business finances to the value of at least £2 billion per year. -

Smurfit Kappa Annual Report 2014

Annual Report 2014 OPEN OPPORTUNITIES From the production line through to the consumer, packaging can make a difference: through new ideas it has the potential to shape the way you do business. The images in this report are from video case studies on our company microsite. For more information visit openthefuture.info OPEN POTENTIAL The Smurfit Kappa Group strives to be a customer-orientated, market-led company where the satisfaction of customers, the personal development of employees, and respect for local communities and the environment are seen as being inseparable from the aim of creating value for the shareholders. CONTENTS 2 Group Profile 62 Statement of Directors’ 3 2014 Financial Responsibilities Performance Overview 63 Independent Auditors’ Report 4 Group Operations 68 Consolidated Income Statement 6 Chairman’s Statement 69 Consolidated Statement of 10 Chief Executive’s Review Comprehensive Income 12 Business Model 70 Consolidated Balance Sheet 13 Strategy 71 Company Balance Sheet 16 Operations Review 72 Consolidated Statement of Changes in Equity 22 Finance Review 73 Company Statement of 32 Sustainability Changes in Equity 34 Board of Directors 74 Consolidated Statement 38 Corporate Governance of Cash Flows Statement 75 Company Statement 43 Directors’ Report of Cash Flows 45 Audit Committee Report 76 Notes to the Consolidated 48 Remuneration Report Financial Statements 61 Nomination Committee Report 131 Shareholder Information Group Profile Group Profile Smurfit Kappa Group plc (‘SKG plc’ or ‘the Given the high degree of integration Company’) and its subsidiaries (together between the mills and its conversion plants, 42,000 ‘SKG’ or ‘the Group’) is one of the world’s particularly in terms of containerboard, the people employed worldwide largest integrated manufacturers of Group’s end customers are primarily in the paper-based packaging products, with corrugated packaging market, which uses operations in Europe, Latin America, the the packaging for product protection and We operate in United States and Canada. -

International Value Fund Q3 Portfolio Holdings

Putnam International Value Fund The fund's portfolio 3/31/21 (Unaudited) COMMON STOCKS (96.1%)(a) Shares Value Aerospace and defense (0.7%) BAE Systems PLC (United Kingdom) 137,249 $955,517 955,517 Airlines (1.2%) Qantas Airways, Ltd. (voting rights) (Australia)(NON) 437,675 1,698,172 1,698,172 Auto components (1.5%) Magna International, Inc. (Canada) 23,813 2,097,257 2,097,257 Automobiles (1.2%) Yamaha Motor Co., Ltd. (Japan) 70,500 1,742,181 1,742,181 Banks (14.7%) AIB Group PLC (Ireland)(NON) 708,124 1,861,795 Australia & New Zealand Banking Group, Ltd. (Australia) 165,820 3,561,114 BNP Paribas SA (France)(NON) 28,336 1,723,953 CaixaBank SA (Spain) 295,756 915,292 DBS Group Holdings, Ltd. (Singapore) 60,800 1,311,573 DNB ASA (Norway) 71,016 1,511,129 Hana Financial Group, Inc. (South Korea) 38,370 1,447,668 ING Groep NV (Netherlands) 362,345 4,432,786 Lloyds Banking Group PLC (United Kingdom)(NON) 1,014,265 594,752 Mizuho Financial Group, Inc. (Japan) 73,920 1,066,055 Skandinaviska Enskilda Banken AB (Sweden)(NON) 30,210 368,223 Sumitomo Mitsui Financial Group, Inc. (Japan) 67,400 2,450,864 21,245,204 Beverages (1.0%) Asahi Group Holdings, Ltd. (Japan) 33,700 1,426,966 1,426,966 Building products (1.1%) Compagnie De Saint-Gobain (France)(NON) 27,404 1,617,117 1,617,117 Capital markets (3.6%) Partners Group Holding AG (Switzerland) 1,115 1,423,906 Quilter PLC (United Kingdom) 798,526 1,759,704 UBS Group AG (Switzerland)(NON) 132,852 2,057,122 5,240,732 Chemicals (1.1%) LANXESS AG (Germany) 21,951 1,618,138 1,618,138 Construction and engineering (2.5%) Vinci SA (France) 35,382 3,624,782 3,624,782 Construction materials (1.2%) CRH PLC (Ireland) 38,290 1,794,760 1,794,760 Containers and packaging (0.8%) SIG Combibloc Group AG (Switzerland) 51,554 1,192,372 1,192,372 Diversified financial services (2.1%) Eurazeo SA (France)(NON) 20,542 1,563,415 ORIX Corp. -

(UK) Plc CRH Funding BV CRH Finance Germany Gmbh CRH

CRH Finance DAC (incorporated with limited liability in Ireland with registered number 50074) CRH Finance (U.K.) plc (incorporated with limited liability in England and Wales with registered number 2153217) CRH Funding B.V. (incorporated with limited liability in The Netherlands with registered number 57502536) CRH Finance Germany GmbH (incorporated with limited liability in the court of Düsseldorf, Germany with registered number HRB 66176) CRH Finance SAS (incorporated with limited liability in France with registered number 519 204 440) CRH Finland Services Oyj (incorporated with limited liability in Finland with Business Identity Code 2553762-1) CRH Finance Switzerland AG (incorporated with limited liability in Switzerland with registered number CHE-230.454.128) CRH Canada Finance, Inc. (a corporation incorporated under the Business Corporations Act (New Brunswick) with corporation number 677784) €8,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed by CRH plc (incorporated with limited liability in Ireland with registered number 12965) Under this €8,000,000,000 Euro Medium Term Note Programme (the Programme), CRH Finance DAC (an Issuer or CRH Finance), CRH Finance (U.K.) plc (an Issuer or CRH Finance UK), CRH Funding B.V. (an Issuer or CRH Funding B.V.), CRH Finance Germany GmbH (an Issuer or CRH Germany), CRH Finance SAS (an Issuer or CRH Finance SAS), CRH Finland Services Oyj (an Issuer or CRH Finland), CRH Finance Switzerland AG (an Issuer or CRH Switzerland) and CRH Canada Finance, Inc. (an Issuer or CRH Canada) (together, the Issuers) may from time to time issue notes (the Notes) denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined below). -

Agenda Item 4B-02 Attachment 2

Attachment 2, Page 1 of 5 CalPERS 2013 Northern Ireland Report CalPERS Holdings of Non-US Companies with Operations in Northern Ireland as of December 31, 2013 Equity Exposure Fixed Income Exposure Company Name Country Number of shares Market Value Par Value Market Value Total Market Value 3I GROUP PLC United Kingdom 2,574,784 $ 16,422,524.30 $ 16,422,524.30 Abertis Infraestructuras, S.A. Spain 1,593,291 $ 35,456,913.79 $ 35,456,913.79 Adecco S.A. Switzerland 496,749 $ 39,433,833.03 $ 39,433,833.03 Aer Lingus Group PLC Ireland 690,822 $ 1,220,358.65 $ 1,220,358.65 AGF Management Limited Canada 473,502 $ 5,913,761.45 $ 5,913,761.45 Akzo Nobel N.V. Netherlands 913,438 $ 70,913,548.72 $ 70,913,548.72 Allianz SE Germany 1,688,214 $ 303,229,768.85 $ 303,229,768.85 Anglo American PLC United Kingdom 7,998,118 $ 174,864,659.74 $ 174,864,659.74 AON PLC United Kingdom 884,243 $ 74,179,145.27 $ 74,179,145.27 ASSOCIATED BRITISH FOODS PLC United Kingdom 942,014 $ 38,147,125.08 $ 38,147,125.08 AstraZeneca PLC United Kingdom 4,953,597 $ 293,321,909.59 $ 293,321,909.59 ATOS S.A. France 268,961 $ 24,382,739.52 $ 24,382,739.52 AVIVA PLC United Kingdom 10,790,113 $ 80,366,392.33 $ 80,366,392.33 Axa SA France 7,018,874 $ 195,464,125.84 28,000,000 $ 28,389,999.68 $ 223,854,125.52 AYALA CORPORATION Philippines 609,480 $ 7,113,403.71 $ 7,113,403.71 BABCOCK INTERNATIONAL GROUP PLC United Kingdom 1,071,215 $ 24,040,391.35 $ 24,040,391.35 Banco Santander, S.A. -

Wilmington Funds Holdings Template DRAFT

Wilmington International Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD 2.82% ISHARES MSCI CANADA ETF 2.43% SAMSUNG ELECTRONICS CO LTD 1.97% TENCENT HOLDINGS LTD 1.82% DREYFUS GOVT CASH MGMT-I 1.76% MSCI INDIA FUTURE JUN21 1.68% AIA GROUP LTD 1.05% HDFC BANK LTD 1.05% ASML HOLDING NV 1.03% ISHARES MSCI EUROPE FINANCIALS ETF 1.02% USD/EUR SPOT 20210601 BNYM 1.00% ALIBABA GROUP HOLDING LTD 0.95% DSV PANALPINA A/S 0.90% TECHTRONIC INDUSTRIES CO LTD 0.88% JAMES HARDIE INDUSTRIES PLC 0.83% INFINEON TECHNOLOGIES AG 0.73% BHP GROUP LTD 0.67% SIKA AG 0.64% MEDIATEK INC 0.60% NOVO NORDISK A/S 0.56% OVERSEA-CHINESE BANKING CORP LTD 0.55% CSL LTD 0.55% LVMH MOET HENNESSY LOUIS VUITTON SE 0.54% RIO TINTO LTD 0.53% DREYFUS GOVT CASH MGMT-I 0.53% MIDEA GROUP CO LTD 0.53% TOYOTA MOTOR CORP 0.52% PARTNERS GROUP HOLDING AG 0.52% SAP SE 0.51% ADIDAS AG 0.49% NAVER CORP 0.49% HITACHI LTD 0.49% MERIDA INDUSTRY CO LTD 0.47% ZALANDO SE 0.47% SK MATERIALS CO LTD 0.47% CHINA PACIFIC INSURANCE GROUP CO LTD 0.45% HEXAGON AB 0.45% LVMH MOET HENNESSY LOUIS VUITTON SE 0.44% JD.COM INC 0.44% TOMRA SYSTEMS ASA 0.44% DREYFUS GOVT CASH MGMT-I 0.44% SONY GROUP CORP 0.43% L'OREAL SA 0.43% EDENRED 0.43% AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 0.43% NEW ORIENTAL EDUCATION & TECHNOLOGY GROUP INC 0.42% HUAZHU GROUP LTD 0.41% CRODA INTERNATIONAL PLC 0.40% ATLAS COPCO AB 0.40% ASSA ABLOY AB 0.40% IMCD NV 0.40% HUTCHMED CHINA LTD 0.40% JARDINE MATHESON HOLDINGS LTD 0.40% HONG KONG EXCHANGES -

This Is the Message

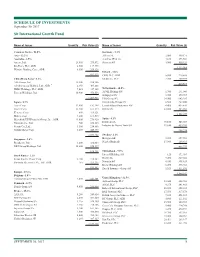

SCHEDULE OF INVESTMENTS September 30, 2017 Sit International Growth Fund Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 96.0% Germany - 5.3% Asia - 22.2% Allianz SE 2,000 449,171 Australia - 2.5% Aurelius SE & Co. 4,160 273,564 Amcor, Ltd. 23,400 279,872 Siemens AG 3,900 550,324 Rio Tinto, PLC, ADR 2,500 117,975 1,273,059 Westpac Banking Corp., ADR 8,300 209,326 Ireland - 1.8% 607,173 CRH, PLC, ADR 5,800 219,588 China/Hong Kong - 6.2% Medtronic, PLC 2,700 209,979 AIA Group, Ltd. 32,200 238,386 429,567 Alibaba Group Holding, Ltd., ADR * 2,350 405,868 HSBC Holdings, PLC, ADR 7,025 347,105 Netherlands - 10.5% Tencent Holdings, Ltd. 10,900 476,556 ASML Holding NV 1,700 291,040 Galapagos NV * 3,725 379,717 1,467,915 ING Groep NV 34,900 643,285 Japan - 8.7% Koninklijke Philips NV 6,500 267,800 Asics Corp. 12,900 192,398 LyondellBasell Industries NV 4,400 435,820 Daicel Corp. 13,400 161,574 RELX NV 22,800 485,033 Keyence Corp. 600 319,121 2,502,695 Makita Corp. 4,200 169,515 Mitsubishi UFJ Financial Group, Inc., ADR 43,000 276,920 Spain - 4.1% Nintendo Co., Ltd. 700 258,113 Iberdrola SA 70,100 545,069 Secom Co., Ltd. 3,500 254,886 Industria de Diseno Textil SA 11,650 439,205 Suzuki Motor Corp. 8,400 440,875 984,274 2,073,402 Sweden - 2.1% Singapore - 2.6% Hexagon AB 5,200 257,962 Broadcom, Ltd. -

2020 Full Year Results

2020 Full Year Results Key Highlights • Robust performance in a challenging environment • Further EBITDA and margin improvement despite lower activity levels • Continued strong cash generation underpinning financial strength and flexibility • Net debt/EBITDA of 1.3x, lowest level in over 10 years • Strong acquisition pipeline; significant opportunities for future value creation • Full-year dividend per share up 25% to 115.0c; 37 years of dividend delivery • Recommencing share buyback programme with further tranche of $0.3bn Summary Financials 2020 LFL Sales Revenue $27.6bn -2% EBITDA $4.6bn +5% EBITDA Margin 16.8% +120bps Operating Cash Flow $3.9bn +1% Albert Manifold, Chief Executive, said today: “Our 2020 performance is testament to the commitment of our people and the strength and resilience of our business model. Through the repositioning of our business in recent years and our relentless focus on continuous business improvement, we have delivered record levels of profitability, margins and cash generation. Although the near-term outlook remains uncertain, our unique portfolio of businesses together with the strength of our balance sheet leaves us well positioned to capitalise on the growth opportunities that lie ahead.” Announced Thursday, 4 March 2021 2020 Full Year Results Health & Safety As many of our markets continue to be affected by the spread of COVID-19, the health and safety of our people remains our number one priority. In this regard, our primary focus is to ensure that we provide a safe working environment for our employees, contractors and customers, enabling them to carry out their activities in accordance with the various health and safety protocols currently in place across our markets. -

Press Release CRH Completes Latest Phase of Share Buyback Programme

CRH plc T +353 (1) 404 1000 Stonemason’s Way E [email protected] Rathfarnham W www.crh.com Dublin 16 D16 KH51 Ireland 28 June 2021 Press Release CRH completes latest phase of Share Buyback Programme CRH plc, the leading building materials business in the world, is pleased to announce that it has completed the latest phase of its share buyback programme, returning a further $0.3 billion of cash to shareholders. Between 8 March and 24 June 2021, 5.8 million ordinary shares were repurchased on Euronext Dublin at an average discount of 1.03% to the volume weighted average price over the period. This brings total cash returned to shareholders under our ongoing share buyback programme to $2.3 billion since its commencement in May 2018. Further share buybacks are under active consideration. **** Contact CRH at Dublin 404 1000 (+353 1 404 1000) Albert Manifold Chief Executive Jim Mintern Finance Director Frank Heisterkamp Director of Capital Markets & ESG Tom Holmes Head of Investor Relations About CRH CRH (LSE: CRH, ISE: CRG, NYSE: CRH) is the leading building materials business in the world, employing c.77,000 people at c.3,100 operating locations in 29 countries. It is the largest building materials business in North America and Europe and also has regional positions in Asia. CRH manufactures and supplies a range of integrated building materials, products and innovative solutions which can be found throughout the built environment, from major public infrastructure projects to commercial buildings and residential structures. A Fortune 500 company, CRH is a constituent member of the FTSE 100 Index, the EURO STOXX 50 Index, the ISEQ 20 and the Dow Jones Sustainability Index (DJSI) Europe. -

Boardeurope V20n03.Pdf

Board EuropeA newsletter for members of The Conference Board in Europe Volume 20 • Number 3/4 • March/April 2005 BuildingBuilding SustainableSustainable EnterprisesEnterprises 1 ompanies are increasingly being assessed on their environmental, social and In this Issue corporate governance performance. Failure to live up to stakeholder C expectations can threaten corporate brands, reputations, and long-term 1 Building Sustainable shareholder value. Enterprises At The Conference Board’s “Building Sustainable Enterprises” forum, hosted by 3 New Research TOTAL in Brussels on 26-27 January, executives from Europe-based businesses • EU Productivity Growth explained how they are integrating environmental, social and corporate governance • Human Capital Measurement reporting into their mainstream activities. The forum was linked to four European Councils: Corporate Governance and Board Effectiveness, Environmental Interview with Barbara Reno 4 Management, Sustainability Reporting and Corporate Citizenship. 5 China Centre for Business and Economics CRH focuses on Sustainable Performance and Growth Keynote speaker Liam 0’Mahony, Global Counsellor for The Conference Board, 6 Council News and Group Chief Executive of CRH, the international building materials group, said • Innovation that his company has grown steadily and profitably for the past 15 years. Building a • Sustainability Reporting sustainable enterprise “the CRH way” is fuelled, said O’Mahony, by relentless • Investor Relations operational best practice throughout the organisation, supplemented by dynamic yet • Corporate Communications prudent acquisitive growth, with rigorous corporate governance throughout. • Strategic Risk Management (NEW) CRH balances local autonomy and entrepreneurial drive with prudent operating 8 Good Practice in practices that require sharing of best practice in every area of the business including Workplace Diversity environmental and people management.