Cadmium Telluride Photovoltaics - Wikipedia 1 of 13

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beyond Solyndra: Examining the Department of Energy's Loan Guarantee Program Hilary Kao

William & Mary Environmental Law and Policy Review Volume 37 | Issue 2 Article 4 Beyond Solyndra: Examining the Department of Energy's Loan Guarantee Program Hilary Kao Repository Citation Hilary Kao, Beyond Solyndra: Examining the Department of Energy's Loan Guarantee Program, 37 Wm. & Mary Envtl. L. & Pol'y Rev. 425 (2013), http://scholarship.law.wm.edu/wmelpr/vol37/iss2/4 Copyright c 2013 by the authors. This article is brought to you by the William & Mary Law School Scholarship Repository. http://scholarship.law.wm.edu/wmelpr BEYOND SOLYNDRA: EXAMINING THE DEPARTMENT OF ENERGY’S LOAN GUARANTEE PROGRAM HILARY KAO* ABSTRACT In the year following the Fukushima nuclear disaster in March 2011, the renewable and clean energy industries faced significant turmoil— from natural disasters, to political maelstroms, from the Great Recession, to U.S. debt ceiling debates. The Department of Energy’s Loan Guarantee Program (“DOE LGP”), often a target since before it ever received a dollar of appropriations, has been both blamed and defended in the wake of the bankruptcy filing of Solyndra, a California-based solar panel manufac- turer, in September 2011, because of the $535 million loan guarantee made to it by the Department of Energy (“DOE”) in 2009.1 Critics have suggested political favoritism in loan guarantee awards and have questioned the government’s proper role in supporting renewable energy companies and the renewable energy industry generally.2 This Article looks beyond the Solyndra controversy to examine the origin, structure and purpose of the DOE LGP. It asserts that loan guaran- tees can serve as viable policy tools, but require careful crafting to have the potential to be effective programs. -

AS You Sow on Creating Greener Solar PV Panels

AS You Sow on Creating Greener Solar PV Panels Andrew Burger. March 28, 2012 Advocating solar PV manufacturers adopt a set of industry best practices, a new survey and report highlights the environmental benefits of using solar photovoltaic (PV) energy as compared to fossil fuels, while at the same time criticizing ongoing, outsized government support for fossil fuel production. “Even though there are toxic compounds used in the manufacturing of many solar panels, the generation of electricity from solar energy is much safer to both the environment and workers than production of electricity from coal, natural gas, or nuclear,” stated Amy Galland, PhD and research director at non-profit group As You Sow. “For example, once a solar panel is installed, it generates electricity with no emissions of any kind for decades, whereas coal-fired power plants in the U.S. emitted nearly two billion tons of carbon dioxide and millions of tons of toxic compounds in 2010 alone.” Based on an international survey of more than 100 solar PV manufac- turers, the best practices in As You Sow’s report, “Clean & Green: Best Practices in Photovoltaics” aim to protect the employee and community health and safety, as well as the broader environment. Also analyzed are investor considerations regarding environmental, social and govern- ance for responsible management of solar PV manufacturing business- es. The best practices listed were determined in consultation with sci- entists, engineers, academics, government labs and industry consult- ants. Solar PV CSR survey and report card “We have been working with solar companies to study and minimize the environmental health and safety risks in the production of solar panels and the industry has embraced the opportunities,” Vasilis Fthenakis, PhD and director of the National PV Environmen- tal Health and Safety Research Center at Brookhaven National Laboratory and director of the Center for Life Cycle Analysis at Columbia University, explained. -

Laying the Foundation for a Bright Future: Assessing Progress

Laying the Foundation for a Bright Future Assessing Progress Under Phase 1 of India’s National Solar Mission Interim Report: April 2012 Prepared by Council on Energy, Environment and Water Natural Resources Defense Council Supported in part by: ABOUT THIS REPORT About Council on Energy, Environment and Water The Council on Energy, Environment and Water (CEEW) is an independent nonprofit policy research institution that works to promote dialogue and common understanding on energy, environment, and water issues in India and elsewhere through high-quality research, partnerships with public and private institutions and engagement with and outreach to the wider public. (http://ceew.in). About Natural Resources Defense Council The Natural Resources Defense Council (NRDC) is an international nonprofit environmental organization with more than 1.3 million members and online activists. Since 1970, our lawyers, scientists, and other environmental specialists have worked to protect the world’s natural resources, public health, and the environment. NRDC has offices in New York City; Washington, D.C.; Los Angeles; San Francisco; Chicago; Livingston and Beijing. (www.nrdc.org). Authors and Investigators CEEW team: Arunabha Ghosh, Rajeev Palakshappa, Sanyukta Raje, Ankita Lamboria NRDC team: Anjali Jaiswal, Vignesh Gowrishankar, Meredith Connolly, Bhaskar Deol, Sameer Kwatra, Amrita Batra, Neha Mathew Neither CEEW nor NRDC has commercial interests in India’s National Solar Mission, nor has either organization received any funding from any commercial or governmental institution for this project. Acknowledgments The authors of this report thank government officials from India’s Ministry of New and Renewable Energy (MNRE), NTPC Vidyut Vyapar Nigam (NVVN), and other Government of India agencies, as well as United States government officials. -

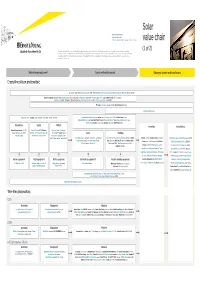

Lsoar Value Chain Value Chain

Solar Private companies in black Public companies in blue Followed by the founding date of companies less than 15 years old value chain (1 of 2) This value chain publication contains information gathered and summarized mainly from Lux Research and a variety of other public sources that we believe to be accurate at the time of ppggyublication. The information is for general guidance only and not intended to be a substitute for detailed research or the exercise of professional judgment. Neither EYGM Limited nor any other member of the global Ernst & Young organization nor Lux Research can accept responsibility for loss to any person relying on this publication. Materials and equipment Components and products Balance of system and installations Crystalline silicon photovoltaic GCL Silicon, China (2006); LDK Solar, China (2005); MEMC, US; Renewable Energy Corporation ASA, Norway; SolarWorld AG, Germany (1998) Bosch Solar Energy, Germany (2000); Canadian Solar, Canada/China (2001); Jinko Solar, China (2006); Kyocera, Japan; Sanyo, Japan; SCHOTT Solar, Germany (2002); Solarfun, China (2004); Tianwei New Energy Holdings Co., China; Trina Solar, China (1997); Yingli Green Energy, China (1998); BP Solar, US; Conergy, Germany (1998); Eging Photovoltaic, China SOLON, Germany (1997) Daqo Group, China; M. Setek, Japan; ReneSola, China (2003); Wacker, Germany Hyundai Heavy Industries,,; Korea; Isofoton,,p Spain ; JA Solar, China (();2005); LG Solar Power,,; Korea; Mitsubishi Electric, Japan; Moser Baer Photo Voltaic, India (2005); Motech, Taiwan; Samsung -

Bankrupt Companies

The List of Fallen Solar Companies: 2015 to 2009: S.No Year/Status Company Name and Details 118 2015 Enecsys (microinverters) bankrupt -- Enecsys raised more than $55 million in VC from investors including Wellington Partners, NES Partners, Good Energies and Climate Change Capital Private Equity for its microinverter technology. 117 2015 QBotix (trackers) closed -- QBotix had a two-axis solar tracker system where the motors, instead of being installed two per tracker, were moved around by a rail-mounted robot that adjusted each tracker every 40 minutes. But while QBotix was trying to gain traction, single-axis solar trackers were also evolving and driving down cost. QBotix raised more than $19.5 million from Firelake, NEA, DFJ JAIC, Siemens Ventures, E.ON and Iberdrola. 116 2015 Solar-Fabrik (c-Si) bankrupt -- German module builder 115 2015 Soitec (CPV) closed -- France's Soitec, one of the last companies with a hope of commercializing concentrating photovoltaic technology, abandoned its solar business. Soitec had approximately 75 megawatts' worth of CPV projects in the ground. 114 2015 TSMC (CIGS) closed -- TSMC Solar ceased manufacturing operations, as "TSMC believes that its solar business is no longer economically sustainable." Last year, TSMC Solar posted a champion module efficiency of 15.7 percent with its Stion- licensed technology. 113 2015 Abengoa -- Seeking bankruptcy protection 112 2014 Bankrupt, Areva's solar business (CSP) closed -- Suffering through a closed Fukushima-inspired slowdown in reactor sales, Ausra 111 2014 Bankrupt, -

Mintz Levin Project Finance Greenpaper

whitepaper Renewable Energy Project Finance in the U.S.: An Overview and Midterm Outlook Renewable Energy Project Finance in the U.S.: An Overview and Midterm Outlook I EXECUTIVE SUMMARY Wind, solar and geothermal energy projects in the United States are typically paid for using an approach known as “project finance.” This is a structure employed to finance capital-intensive projects that are either difficult to support on a corporate balance sheet or that become more attractive when financed on their own. Project financing structures will vary on a project-by-project basis, but renewable energy projects in the U.S. utilizing project financing generally rely upon a mix of direct equity investors, tax equity investors and project-level loans provided by a syndicate of banks. Turbulence in the financial markets began disrupting the flow of project financing (both equity and debt) into renewable energy projects in the U.S. in the fourth quarter of 2008. Nearly two years later, the availability of project financing has improved considerably due to the thawing of the lending markets, with a return to longer tenors on term-debt, and legislative support mechanisms introduced as part of the American Recovery and Reinvestment Act (ARRA)—particularly the ITC cash grant. In this report, we provide an update on the current terms and availability of project financing for large-scale wind, solar and geothermal projects in the U.S. and forecast the amount of project financing we expect to be sought by the sector through 2012. In analyzing where this financing is likely to come from, we address the potential impacts of the upcoming expiration of the cash grant and changes to the tax equity supply—two main themes in the renewable energy project financing arena at present. -

Solar Photovoltaic Manufacturing: Industry Trends, Global Competition, Federal Support

U.S. Solar Photovoltaic Manufacturing: Industry Trends, Global Competition, Federal Support Michaela D. Platzer Specialist in Industrial Organization and Business January 27, 2015 Congressional Research Service 7-5700 www.crs.gov R42509 U.S. Solar PV Manufacturing: Industry Trends, Global Competition, Federal Support Summary Every President since Richard Nixon has sought to increase U.S. energy supply diversity. Job creation and the development of a domestic renewable energy manufacturing base have joined national security and environmental concerns as reasons for promoting the manufacturing of solar power equipment in the United States. The federal government maintains a variety of tax credits and targeted research and development programs to encourage the solar manufacturing sector, and state-level mandates that utilities obtain specified percentages of their electricity from renewable sources have bolstered demand for large solar projects. The most widely used solar technology involves photovoltaic (PV) solar modules, which draw on semiconducting materials to convert sunlight into electricity. By year-end 2013, the total number of grid-connected PV systems nationwide reached more than 445,000. Domestic demand is met both by imports and by about 75 U.S. manufacturing facilities employing upwards of 30,000 U.S. workers in 2014. Production is clustered in a few states including California, Ohio, Oregon, Texas, and Washington. Domestic PV manufacturers operate in a dynamic, volatile, and highly competitive global market now dominated by Chinese and Taiwanese companies. China alone accounted for nearly 70% of total solar module production in 2013. Some PV manufacturers have expanded their operations beyond China to places like Malaysia, the Philippines, and Mexico. -

Current Loan Guarantee Commitments

Department of Energy Loan Guarantee Program: Current Loan Guarantee Commitments Passed as part of the Energy Policy Act of 2005, the Department of Energy’s (DOE) Title XVII Loan Guarantee Program has $34 billion in authority to give loan guarantees to innovative technologies. 1 The 1705 program also had about $2.4 billion in Recovery Act funds to pay for the credit subsidy cost for renewable and energy efficiency projects, but those funds expired on September 30, 2011. So far, the DOE has finalized $16.13 billion worth of loans and committed $10.65 billion. Below is a list of applicants that have a committed or finalized loan; there are other companies that are in the process of applying for a loan and at least one company that has rejected the loan terms offered by the DOE. Nuclear Power Facilities Current DOE loan guarantee authority for the financing of nuclear projects is set at $18.5 billion with an additional $4 billion now identified for uranium enrichment (see see front-end nuclear cycle below).1 President Obama is requesting more. In both his FY2011 and FY2012 budgets, he included an additional $36 billion in loan guarantee authority for nuclear reactors. If his FY2012 budget is approved, loan guarantee authority for nuclear reactors would total roughly $50 billion. This authority is under the 1703 program. So far, only one nuclear company, Southern Company, has been offered a conditional commitment. Constellation Energy was in extensive negotiations with the DOE over a loan guarantee but backed out after citing the “unreasonably burdensome” cost associated with the loan guarantee the DOE offered and claimed that it would “create unacceptable risks and costs for our company.”2 Other nuclear companies are currently under review for a loan guarantee and rely on reactor designs that are currently in use in Japan. -

The Seeds of Solar Innovation: How a Nation Can Grow a Competitive Advantage by Donny Holaschutz

The Seeds of Solar Innovation: How a Nation can Grow a Competitive Advantage by Donny Holaschutz B.A. Hispanic Studies (2004), University of Texas at Austin B.S. Aerospace Engineering (2004), University of Texas at Austin M.S.E Aerospace Engineering (2007), University of Texas at Austin Submitted to the System Design and Management Program In Partial Fulfillment of the Requirements for the Degree of Master of Science in Engineering and Management ARCHIVES MASSACHUSETTS INSTITUTE at the OF TECHNOLOGY Massachusetts Institute of Technology February 2012 © 2012 Donny Holaschutz. All rights reserved The author hereby grants to MIT permission to reproduce and to distribute publicly paper and electronic copies of this thesis document in whole or in part in any medium now known or hereqfter reated. Signed by Author: Donny Holaschutz Engineering Systems Division and Sloan School of Management January 20, 2012 Certified by: James M. Utterback, Thesis Supervisor David . McGrath jr (1959) Professor of Management and Innovation and Professor of neering SysemsIT oan School of Management Accepted by: Patrick C.Hale Director otS ystem Design and Management Program THIS PAGE INTENTIONALLY LEFT BLANK Table of Contents Fig u re List ...................................................................................................................................................... 5 T ab le List........................................................................................................................................................7 Executive -

A New Energy Economy

A BLUEPRINT FOR A New Energy Economy Report authored by Todd Hartman Photo, Above Mike Stewart looks over an array of solar panels at the Greater Sandhill Solar Project being constructed by SunPower Corporation outside of Alamosa. Photography by Matt McClain unless otherwise indicated Design by Communication Infrastructure Group, LLC No taxpayer dollars were used in the production of this report. On the Cover The light of the setting sun reflects off solar panels at SunEdison’s 8.2-megawatt solar photovoltaic plant outside of Alamosa. A LETTER FROM GOVERNOR RITTER A Letter From Governor Ritter Dear Reader, In four years as Governor of Colorado, I have made it a top priority to position Colorado as an economic and energy leader by creating sustainable jobs for our residents, encouraging economic growth for our businesses, and fostering new innovations and new technologies from our public, non-profit and private institutions. We call it the New Energy Economy, and it is built on the recognition that the world is changing the way it produces and consumes energy. By harnessing the creative forces of advancing the diversified energy resources In Colorado, we’ve elected to join that race, world, and give them the knowledge that we entrepreneurs, researchers, educators, that we turn to today, and will increasingly and together, we believe America can win worked with their futures in mind in hopes foundations, business leaders and policy do so in the future: solar, wind, geothermal, it. Colorado is proof positive that we can that they will do the same. makers, we have in Colorado created biomass, small hydro, Smart Grid and other create new opportunities for new forms of Sincerely, an ecosystem that is supporting private elements of the emerging new energy world. -

US Solar Photovoltaic Manufacturing

U.S. Solar Photovoltaic Manufacturing: Industry Trends, Global Competition, Federal Support Michaela D. Platzer Specialist in Industrial Organization and Business May 30, 2012 Congressional Research Service 7-5700 www.crs.gov R42509 CRS Report for Congress Prepared for Members and Committees of Congress U.S. Solar PV Manufacturing: Industry Trends, Global Competition, Federal Support Summary Every President since Richard Nixon has sought to increase U.S. energy supply diversity. In recent years, job creation and the development of a domestic renewable energy manufacturing base have joined national security and environmental concerns as rationales for promoting the manufacturing of solar power equipment in the United States. The federal government maintains a variety of tax credits, loan guarantees, and targeted research and development programs to encourage the solar manufacturing sector, and state-level mandates that utilities obtain specified percentages of their electricity from renewable sources have bolstered demand for large solar projects. The most widely used solar technology involves photovoltaic (PV) solar modules, which draw on semiconducting materials to convert sunlight into electricity. By year-end 2011, the total number of grid-connected PV systems nationwide reached almost 215,000. Domestic demand is met both by imports and by about 100 U.S. manufacturing facilities employing an estimated 25,000 U.S. workers in 2011. Production is clustered in a few states, including California, Oregon, Texas, and Ohio. Domestic PV manufacturers operate in a dynamic and highly competitive global market now dominated by Chinese and Taiwanese companies. All major PV solar manufacturers maintain global sourcing strategies; the only U.S.-based manufacturer ranked among the top 10 global cell producers in 2010 sourced the majority of its panels from its factory in Malaysia. -

About to Explode

PHOTOVOLTAICS USA/MANUFACTURERS About to explode Projects in the non- Similar to other PV markets, the development in the United States is residential market segment, such as this characterized by excess capacities in manufacturing and a rapid price rooftop PV system in decline for component of solar power plants. Nevertheless, the US industry California, have been the driving force behind representatives are less pessimistic about the future than their colleagues the US solar market. Photo: Europressedienst in Europe. It shows that the markets are quite different from each other. ata by the Solar Energy Industries Association range of 31.14 % for companies found to benefit from (SEIA) suggests that the newly installed PV ca unfair subsidies and price dumping as well as Dpacity on the US market had reached 1,855 MW 249.96 % for companies that did not collaborate with in 2011, exceeding the previous record year 2010 the US customs service or failed to provide the infor (887 MW) by nearly 110 %. Generally, the solar indus mation needed. “The decision by the US Department try has therefore reason to be pleased with the devel of Commerce encourages us to believe that we can re opment in the last year. The newly installed capacities turn to fair competition,” explains Frank Asbeck, CEO had been equivalent to a market share of 7 % (2010: of SolarWorld. The path on the US market seems now 5 %) in the global new installa tions. The trend is ex open for a positive trend that could be comparable to pected to continue over the next few years – not least the last year.