DRY BULK WEEKLY WEEK 25 | Monday, 28 June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

China's Merchant Marine

“China’s Merchant Marine” A paper for the China as “Maritime Power” Conference July 28-29, 2015 CNA Conference Facility Arlington, Virginia by Dennis J. Blasko1 Introductory Note: The Central Intelligence Agency’s World Factbook defines “merchant marine” as “all ships engaged in the carriage of goods; or all commercial vessels (as opposed to all nonmilitary ships), which excludes tugs, fishing vessels, offshore oil rigs, etc.”2 At the end of 2014, the world’s merchant ship fleet consisted of over 89,000 ships.3 According to the BBC: Under international law, every merchant ship must be registered with a country, known as its flag state. That country has jurisdiction over the vessel and is responsible for inspecting that it is safe to sail and to check on the crew’s working conditions. Open registries, sometimes referred to pejoratively as flags of convenience, have been contentious from the start.4 1 Dennis J. Blasko, Lieutenant Colonel, U.S. Army (Retired), a Senior Research Fellow with CNA’s China Studies division, is a former U.S. army attaché to Beijing and Hong Kong and author of The Chinese Army Today (Routledge, 2006).The author wishes to express his sincere thanks and appreciation to Rear Admiral Michael McDevitt, U.S. Navy (Ret), for his guidance and patience in the preparation and presentation of this paper. 2 Central Intelligence Agency, “Country Comparison: Merchant Marine,” The World Factbook, https://www.cia.gov/library/publications/the-world-factbook/fields/2108.html. According to the Factbook, “DWT or dead weight tonnage is the total weight of cargo, plus bunkers, stores, etc., that a ship can carry when immersed to the appropriate load line. -

Service Operations Vessel 9020 Standard

1. Click with cursor in the blank space above 2. Drag & Drop Picture (16:9 ratio) 3. Optional: add hyperlink to Damen.com product page to the picture SERVICE OPERATIONS VESSEL 9020 STANDARD PICTURE OF SIMILAR VESSEL GENERAL DECK LAY-OUT Basic functions To provide stepless access onto Lift 2 tonne lift connecting 4 access levels (option: 6) for continuous windfarm assets for technicians, tools access between warehouse, weather deck and WTG via optional and parts by access system, crane and gangway. daughter craft. in both Construction Pedestals - for optional crane Support and Service Operations. - for optional gangway system Classification DNV-GL Maritime, notation: Helicopter winch area on foreship, stepless access to warehouse, hospital. Option: X 1A1, Offshore Service Vessel, helideck D-size 21m COMF(C-3, V-3), DYNPOS(AUTR), CTV landing facilities 1 fixed steel landing at stern. Clean, SF, E0, DK(+), SPS, NAUT(OSV- 1 removable alum. landing SB / PS. A), BWM(T), Recyclable, Crane Flag ACCOMMODATION Owner Crew/ special personnel 15-20x crew, 40-45x SP, all single cabins provided with WiFi, LAN, telephone and audio / video entert. (VOD and sat. TV). DIMENSIONS Other facilities up to 6 Offices and 5 meeting/ conference rooms for Charterer’s Length overall 89.65 m use. Beam moulded 20.00 m 2 Recr.-dayrooms, reception, hospital, drying rooms (M/F), Depth moulded 8.00 m changing rooms (M/F), wellness area (gym and sauna). Draught base (u.s. keel) 4.80 (6.30) m Gross Tonnage 6100 GT NAUTICAL AND COMMUNICATION EQUIPMENT Nautical Radar X-band + S-band, ECDIS, Conning, GMDSS Area 1, 2 and CAPACITIES 3. -

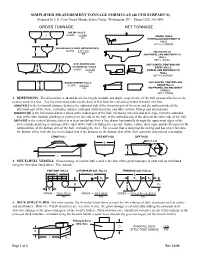

SIMPLIFIED MEASUREMENT TONNAGE FORMULAS (46 CFR SUBPART E) Prepared by U.S

SIMPLIFIED MEASUREMENT TONNAGE FORMULAS (46 CFR SUBPART E) Prepared by U.S. Coast Guard Marine Safety Center, Washington, DC Phone (202) 366-6441 GROSS TONNAGE NET TONNAGE SAILING HULLS D GROSS = 0.5 LBD SAILING HULLS 100 (PROPELLING MACHINERY IN HULL) NET = 0.9 GROSS SAILING HULLS (KEEL INCLUDED IN D) D GROSS = 0.375 LBD SAILING HULLS 100 (NO PROPELLING MACHINERY IN HULL) NET = GROSS SHIP-SHAPED AND SHIP-SHAPED, PONTOON AND CYLINDRICAL HULLS D D BARGE HULLS GROSS = 0.67 LBD (PROPELLING MACHINERY IN 100 HULL) NET = 0.8 GROSS BARGE-SHAPED HULLS SHIP-SHAPED, PONTOON AND D GROSS = 0.84 LBD BARGE HULLS 100 (NO PROPELLING MACHINERY IN HULL) NET = GROSS 1. DIMENSIONS. The dimensions, L, B and D, are the length, breadth and depth, respectively, of the hull measured in feet to the nearest tenth of a foot. See the conversion table on the back of this form for converting inches to tenths of a foot. LENGTH (L) is the horizontal distance between the outboard side of the foremost part of the stem and the outboard side of the aftermost part of the stern, excluding rudders, outboard motor brackets, and other similar fittings and attachments. BREADTH (B) is the horizontal distance taken at the widest part of the hull, excluding rub rails and deck caps, from the outboard side of the skin (outside planking or plating) on one side of the hull, to the outboard side of the skin on the other side of the hull. DEPTH (D) is the vertical distance taken at or near amidships from a line drawn horizontally through the uppermost edges of the skin (outside planking or plating) at the sides of the hull (excluding the cap rail, trunks, cabins, deck caps, and deckhouses) to the outboard face of the bottom skin of the hull, excluding the keel. -

A Study of the Size of Nuclear Fuel Carriers, the Most Required Ships for Safety : How Large Can Ship's Tonnage Be? Azusa Fukasawa World Maritime University

World Maritime University The Maritime Commons: Digital Repository of the World Maritime University World Maritime University Dissertations Dissertations 2013 A study of the size of nuclear fuel carriers, the most required ships for safety : how large can ship's tonnage be? Azusa Fukasawa World Maritime University Follow this and additional works at: http://commons.wmu.se/all_dissertations Part of the Risk Analysis Commons Recommended Citation Fukasawa, Azusa, "A study of the size of nuclear fuel carriers, the most required ships for safety : how large can ship's tonnage be?" (2013). World Maritime University Dissertations. 228. http://commons.wmu.se/all_dissertations/228 This Dissertation is brought to you courtesy of Maritime Commons. Open Access items may be downloaded for non-commercial, fair use academic purposes. No items may be hosted on another server or web site without express written permission from the World Maritime University. For more information, please contact [email protected]. WORLD MARITIME UNIVERSITY Malmö, Sweden A STUDY OF THE SIZE OF NUCLEAR FUEL CARRIERS, THE MOST REQUIRED SHIP FOR SAFETY How large can ship’s tonnage be? By AZUSA FUKASAWA Japan A dissertation submitted to the World Maritime University in partial fulfilment of the requirements for the award of the degree of MASTER OF SCIENCE In MARITIME AFFAIRS (MARITIME SAFETY AND ENVIRONMENTAL ADMINISTRATION) 2013 Copyright Azusa Fukasawa, 2013 DECLARATION I certify that all the material in this dissertation that is not my own work has been identified, and that no material is included for which a degree has previously been conferred on me. The contents of this dissertation reflect my own personal views, and are not necessarily endorsed by the University. -

Scorpio Tankers Inc. Company Presentation June 2018

Scorpio Tankers Inc. Company Presentation June 2018 1 1 Company Overview Key Facts Fleet Profile Scorpio Tankers Inc. is the world’s largest and Owned TC/BB Chartered-In youngest product tanker company 60 • Pure product tanker play offering all asset classes • 109 owned ECO product tankers on the 50 water with an average age of 2.8 years 8 • 17 time/bareboat charters-in vessels 40 • NYSE-compliant governance and transparency, 2 listed under the ticker “STNG” • Headquartered in Monaco, incorporated in the 30 Marshall Islands and is not subject to US income tax 45 20 38 • Vessels employed in well-established Scorpio 7 pools with a track record of outperforming the market 10 14 • Merged with Navig8 Product Tankers, acquiring 27 12 ECO-spec product tankers 0 Handymax MR LR1 LR2 2 2 Company Profile Shareholders # Holder Ownership 1 Dimensional Fund Advisors 6.6% 2 Wellington Management Company 5.9% 3 Scorpio Services Holding Limited 4.5% 4 Magallanes Value Investor 4.1% 5 Bestinver Gestión 4.0% 6 BlackRock Fund Advisors 3.3% 7 Fidelity Management & Research Company 3.0% 8 Hosking Partners 3.0% 9 BNY Mellon Asset Management 3.0% 10 Monarch Alternative Capital 2.8% Market Cap ($m) Liquidity Per Day ($m pd) $1,500 $12 $10 $1,000 $8 $6 $500 $4 $2 $0 $0 Euronav Frontline Scorpio DHT Gener8 NAT Ardmore Scorpio Frontline Euronav NAT DHT Gener8 Ardmore Tankers Tankers Source: Fearnleys June 8th, 2018 3 3 Product Tankers in the Oil Supply Chain • Crude Tankers provide the marine transportation of the crude oil to the refineries. -

Branch's Elements of Shipping/Alan E

‘I would strongly recommend this book to anyone who is interested in shipping or taking a course where shipping is an important element, for example, chartering and broking, maritime transport, exporting and importing, ship management, and international trade. Using an approach of simple analysis and pragmatism, the book provides clear explanations of the basic elements of ship operations and commercial, legal, economic, technical, managerial, logistical, and financial aspects of shipping.’ Dr Jiangang Fei, National Centre for Ports & Shipping, Australian Maritime College, University of Tasmania, Australia ‘Branch’s Elements of Shipping provides the reader with the best all-round examination of the many elements of the international shipping industry. This edition serves as a fitting tribute to Alan Branch and is an essential text for anyone with an interest in global shipping.’ David Adkins, Lecturer in International Procurement and Supply Chain Management, Plymouth Graduate School of Management, Plymouth University ‘Combining the traditional with the modern is as much a challenge as illuminating operations without getting lost in the fascination of the technical detail. This is particularly true for the world of shipping! Branch’s Elements of Shipping is an ongoing example for mastering these challenges. With its clear maritime focus it provides a very comprehensive knowledge base for relevant terms and details and it is a useful source of expertise for students and practitioners in the field.’ Günter Prockl, Associate Professor, Copenhagen Business School, Denmark This page intentionally left blank Branch’s Elements of Shipping Since it was first published in 1964, Elements of Shipping has become established as a market leader. -

Weekly Market Report

GLENPOINTE CENTRE WEST, FIRST FLOOR, 500 FRANK W. BURR BOULEVARD TEANECK, NJ 07666 (201) 907-0009 September 24th 2021 / Week 38 THE VIEW FROM THE BRIDGE The Capesize chartering market is still moving up and leading the way for increased dry cargo rates across all segments. The Baltic Exchange Capesize 5TC opened the week at $53,240/day and closed out the week up $8,069 settling today at $61,309/day. The Fronthaul C9 to the Far East reached $81,775/day! Kamsarmaxes are also obtaining excellent numbers, reports of an 81,000 DWT unit obtaining $36,500/day for a trip via east coast South America with delivery in Singapore. Coal voyages from Indonesia and Australia to India are seeing $38,250/day levels and an 81,000 DWT vessel achieved $34,000/day for 4-6 months T/C. A 63,000 DWT Ultramax open Southeast Asia fixed 5-7 months in the low $40,000/day levels while a 56,000 DWT supramax fixed a trip from Turkey to West Africa at $52,000/day. An Ultramax fixed from the US Gulf to the far east in the low $50,000/day. The Handysize index BHSI rose all week and finished at a new yearly high of 1925 points. A 37,000 DWT handy fixed a trip from East coast South America with alumina to Norway for $37,000/day plus a 28,000 DWT handy fixed from Santos to Morocco with sugar at $34,000/day. A 35,000 DWT handy was fixed from Morocco to Bangladesh at $45,250/day and in the Mediterranean a 37,000 DWT handy booked a trip from Turkey to the US Gulf with an intended cargo of steels at $41,000/day. -

Ztráta Soběstačnosti ČR V Oblasti Černého Uhlí: Ohrožení Energetické Bezpečnosti? Bc. Ivo Vojáček

MASARYKOVA UNIVERZITA FAKULTA SOCIÁLNÍCH STUDIÍ Katedra mezinárodních vztahů a evropských studií Obor Mezinárodní vztahy a energetická bezpečnost Ztráta soběstačnosti ČR v oblasti černého uhlí: ohrožení energetické bezpečnosti? Diplomová práce Bc. Ivo Vojáček Vedoucí práce: PhDr. Tomáš Vlček, Ph.D. UČO: 363783 Obor: MVEB Imatrikulační ročník: 2014 Petrovice u Karviné 2016 Prohlášení o autorství práce Čestně prohlašuji, že jsem diplomovou práci na téma Ztráta soběstačnosti ČR v oblasti černého uhlí: ohrožení energetické bezpečnosti? vypracoval samostatně a výhradně s využitím zdrojů uvedených v seznamu použité literatury. V Petrovicích u Karviné, dne 22. 5. 2016 ……………………. Bc. Ivo Vojáček 2 Poděkování Na tomto místě bych rád poděkoval svému vedoucímu PhDr. Tomáši Vlčkovi, Ph.D. za ochotu, se kterou mi po celou dobu příprav práce poskytoval cenné rady a konstruktivní kritiku. Dále chci poděkovat své rodině za podporu, a zejména svým rodičům za nadlidskou trpělivost, jež se mnou měli po celou dobu studia. V neposlední řadě patří můj dík i všem mým přátelům, kteří mé studium obohatili o řadu nezapomenutelných zážitků, škoda jen, že si jich nepamatuju víc. 3 Láska zahřeje, ale uhlí je uhlí. (Autor neznámý) 4 Obsah 1 Úvod .................................................................................................................................... 7 2 Vědecká východiska práce ................................................................................................ 10 2.2 Metodologie .............................................................................................................. -

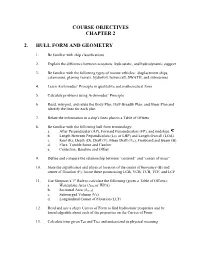

Course Objectives Chapter 2 2. Hull Form and Geometry

COURSE OBJECTIVES CHAPTER 2 2. HULL FORM AND GEOMETRY 1. Be familiar with ship classifications 2. Explain the difference between aerostatic, hydrostatic, and hydrodynamic support 3. Be familiar with the following types of marine vehicles: displacement ships, catamarans, planing vessels, hydrofoil, hovercraft, SWATH, and submarines 4. Learn Archimedes’ Principle in qualitative and mathematical form 5. Calculate problems using Archimedes’ Principle 6. Read, interpret, and relate the Body Plan, Half-Breadth Plan, and Sheer Plan and identify the lines for each plan 7. Relate the information in a ship's lines plan to a Table of Offsets 8. Be familiar with the following hull form terminology: a. After Perpendicular (AP), Forward Perpendiculars (FP), and midships, b. Length Between Perpendiculars (LPP or LBP) and Length Overall (LOA) c. Keel (K), Depth (D), Draft (T), Mean Draft (Tm), Freeboard and Beam (B) d. Flare, Tumble home and Camber e. Centerline, Baseline and Offset 9. Define and compare the relationship between “centroid” and “center of mass” 10. State the significance and physical location of the center of buoyancy (B) and center of flotation (F); locate these points using LCB, VCB, TCB, TCF, and LCF st 11. Use Simpson’s 1 Rule to calculate the following (given a Table of Offsets): a. Waterplane Area (Awp or WPA) b. Sectional Area (Asect) c. Submerged Volume (∇S) d. Longitudinal Center of Flotation (LCF) 12. Read and use a ship's Curves of Form to find hydrostatic properties and be knowledgeable about each of the properties on the Curves of Form 13. Calculate trim given Taft and Tfwd and understand its physical meaning i 2.1 Introduction to Ships and Naval Engineering Ships are the single most expensive product a nation produces for defense, commerce, research, or nearly any other function. -

Shipping Market Review – May 2021

SHIPPING MARKET REVIEW – MAY 2021 DISCLAIMER The persons named as the authors of this report hereby certify that: (i) all of the views expressed in the research report accurately reflect the personal views of the authors on the subjects; and (ii) no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the research report. This report has been prepared by Danish Ship Finance A/S (“DSF”). This report is provided to you for information purposes only. Whilst every effort has been taken to make the information contained herein as reliable as possible, DSF does not represent the information as accurate or complete, and it should not be relied upon as such. Any opinions expressed reflect DSF’s judgment at the time this report was prepared and are subject to change without notice. DSF will not be responsible for the consequences of reliance upon any opinion or statement contained in this report. This report is based on information obtained from sources which DSF believes to be reliable, but DSF does not represent or warrant such information’s accuracy, completeness, timeliness, merchantability or fitness for a particular purpose. The information in this report is not intended to predict actual results, and actual results may differ substantially from forecasts and estimates provided in this report. This report may not be reproduced, in whole or in part, without the prior written permission of DSF. To Non-Danish residents: The contents hereof are intended for the use of non-private customers and may not be issued or passed on to any person and/or institution without the prior written consent of DSF. -

NOAA Form 57-19-01 Annual Small Boat Evaluation/Small Boat

NOAA Form 57-19-01 U.S. DEPARTMENT OF COMMERCE (1-13) Page 1 of 9 NATIONAL OCEANIC AND ATMOSPHERIC ADMINISTRATION ANNUAL SMALL BOAT EVALUATION/SMALL BOAT EXAMINATION Instructions Annual Small Boat Evaluation (ASBE) is an inspection conducted by Vessel Operations Coordinator (VOC), Commanding Officer (CO), or designee(s). All boats shall be inspected annually. • The ASBE checklist has been condensed from the detailed ASBE outline for use in the field. Evaluators shall use the checklists during the inspection, and shall refer to the outline for additional details as needed. Evaluators are responsible for all information contained within the ASBE outline. • The ASBE outline and checklist are based on NAO 209-125, The NOAA Small Boat Standards and Procedures Manual (SBSPM), 46 CFR, 33 CFR, NFPA 302, MARPOL, ABYC standards and recommendations, United States Coast Guard (USCG) inspection criteria, and standard marine survey practices. Small Boat Examination (SBEX) is an examination conducted by the Small Boat Program or a certified Marine Surveyor. Class I boats shall be examined every three (3) years and Class II boats shall be examined every two (2) years. • Some items may not apply to all boats. Evaluators are responsible for determining applicability. Consult the SBSPM for equipment carriage requirements. Installed equipment in excess of requirements must be maintained to inspection standards. • Completed evaluation checklists, reports, records of findings, and recommendations shall be signed by the evaluator or surveyor; signed and retained by the VOC with a copy forwarded to and signed by the Line Office Small Boat Officer (LOSBO). Completed evaluations shall be submitted to the NOAA Small Boat Program (SBP) Coordinator. -

The IMO Number Explained

A fact sheet from May 2017 Adam Baske The IMO Number Explained What is an IMO number? The International Maritime Organization (IMO) introduced its Ship Identification Number Scheme in 1987 to help prevent maritime fraud and enhance the security of merchant vessels. It is recognized by regional fisheries organizations and most governments and is considered the best available global identification system for ships. IHS Maritime & Trade, a company based in the U.K., administers the scheme on behalf of the IMO. The unique seven-digit vessel number the company issues to each vessel, preceded by the letters IMO, stays with it until it is scrapped and never changes, regardless of the ship’s owner, country of registration or name. The records based on the IMO number provide an independent audit trail for each vessel. The scheme was applied to fishing vessels in 2013, and the eligibility criteria were amended in 2016 to cover smaller and non-steel hull vessels. Why do fishing vessels need an IMO number? Illegal, unreported, and unregulated fishing worldwide accounts for up to 26 million metric tons of fish annually, worth up to $23.5 billion. IMO numbers are an essential tool in the fight against illegal fishing because they help to improve monitoring, control, surveillance and enforcement of fishing operations. They: • Allow flag States to accurately manage vessels under their authority. • Give national authorities information to help them police their waters more effectively. • Bring clarity and consistency to Regional Fisheries Management Organization (RFMO) records, helping governments determine whether vessels are authorized to fish in their waters.