Case 3 the US Airline Industry in 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK

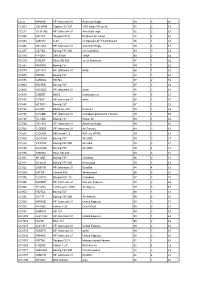

CC22 N848AE HP Jetstream 31 American Eagle 89 5 £1 CC203 OK-HFM Tupolev Tu-134 CSA -large OK on fin 91 2 £3 CC211 G-31-962 HP Jetstream 31 American eagle 92 2 £1 CC368 N4213X Douglas DC-6 Northern Air Cargo 88 4 £2 CC373 G-BFPV C-47 ex Spanish AF T3-45/744-45 78 1 £4 CC446 G31-862 HP Jetstream 31 American Eagle 89 3 £1 CC487 CS-TKC Boeing 737-300 Air Columbus 93 3 £2 CC489 PT-OKF DHC8/300 TABA 93 2 £2 CC510 G-BLRT Short SD-360 ex Air Business 87 1 £2 CC567 N400RG Boeing 727 89 1 £2 CC573 G31-813 HP Jetstream 31 white 88 1 £1 CC574 N5073L Boeing 727 84 1 £2 CC595 G-BEKG HS 748 87 2 £2 CC603 N727KS Boeing 727 87 1 £2 CC608 N331QQ HP Jetstream 31 white 88 2 £1 CC610 D-BERT DHC8 Contactair c/s 88 5 £1 CC636 C-FBIP HP Jetstream 31 white 88 3 £1 CC650 HZ-DG1 Boeing 727 87 1 £2 CC732 D-CDIC SAAB SF-340 Delta Air 89 1 £2 CC735 C-FAMK HP Jetstream 31 Canadian partner/Air Toronto 89 1 £2 CC738 TC-VAB Boeing 737 Sultan Air 93 1 £2 CC760 G31-841 HP Jetstream 31 American Eagle 89 3 £1 CC762 C-GDBR HP Jetstream 31 Air Toronto 89 3 £1 CC821 G-DVON DH Devon C.2 RAF c/s VP955 89 1 £1 CC824 G-OOOH Boeing 757 Air 2000 89 3 £1 CC826 VT-EPW Boeing 747-300 Air India 89 3 £1 CC834 G-OOOA Boeing 757 Air 2000 89 4 £1 CC876 G-BHHU Short SD-330 89 3 £1 CC901 9H-ABE Boeing 737 Air Malta 88 2 £1 CC911 EC-ECR Boeing 737-300 Air Europa 89 3 £1 CC922 G-BKTN HP Jetstream 31 Euroflite 84 4 £1 CC924 I-ATSA Cessna 650 Aerotaxisud 89 3 £1 CC936 C-GCPG Douglas DC-10 Canadian 87 3 £1 CC940 G-BSMY HP Jetstream 31 Pan Am Express 90 2 £2 CC945 7T-VHG Lockheed C-130H Air Algerie -

AWA AR Editoral

AMERICA WEST HOLDINGS CORPORATION Annual Report 2002 AMERICA WEST HOLDINGS CORPORATION America West Holdings Corporation is an aviation and travel services company. Wholly owned subsidiary, America West Airlines, is the nation’s eighth largest carrier serving 93 destinations in the U.S., Canada and Mexico. The Leisure Company, also a wholly owned subsidiary, is one of the nation’s largest tour packagers. TABLE OF CONTENTS Chairman’s Message to Shareholders 3 20 Years of Pride 11 Board of Directors 12 Corporate Officers 13 Financial Review 15 Selected Consolidated Financial Data The selected consolidated data presented below under the captions “Consolidated Statements of Operations Data” and “Consolidated Balance Sheet Data” as of and for the years ended December 31, 2002, 2001, 2000, 1999 and 1998 are derived from the audited consolidated financial statements of Holdings. The selected consolidated data should be read in conjunction with the consolidated financial statements for the respective periods, the related notes and the related reports of independent accountants. Year Ended December 31, (in thousands except per share amounts) 2002 2001(a) 2000 1999 1998 (as restated) Consolidated statements of operations data: Operating revenues $ 2,047,116 $ 2,065,913 $ 2,344,354 $ 2,210,884 $ 2,023,284 Operating expenses (b) 2,207,196 2,483,784 2,356,991 2,006,333 1,814,221 Operating income (loss) (160,080) (417,871) (12,637) 204,551 209,063 Income (loss) before income taxes and cumulative effect of change in accounting principle (c) (214,757) -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

Jetblue Honors Public Servants for Inspiring Humanity

www.MetroAirportNews.com Serving the Airport Workforce and Local Communities June 2017 research to create international awareness for INSIDE THIS ISSUE neuroblastoma. Last year’s event raised $123,000. All in attendance received a special treat, a first glimpse at JetBlue’s newest special livery — “Blue Finest” — dedicated to New York City’s more than 36,000 officers. Twenty three teams, consisting of nearly 300 participants, partici- pated in timed trials to pull “Blue Finest,” an Airbus 320 aircraft, 100 feet in the fastest amount of time to raise funds for the J-A-C-K Foundation. Participants were among the first to view this aircraft adorned with the NYPD flag, badge and shield. “Blue Finest” will join JetBlue’s fleet flying FOD Clean Up Event at JFK throughout the airline’s network, currently 101 Page 2 JetBlue Honors Public Servants cities and growing. The aircraft honoring the NYPD joins JetBlue’s exclusive legion of ser- for Inspiring Humanity vice-focused aircraft including “Blue Bravest” JetBlue Debuts ‘Blue Finest’ Aircraft dedicated to the FDNY, “Vets in Blue” honoring veterans past and present and “Bluemanity” - a Dedicated to the New York Police Department tribute to all JetBlue crewmembers who bring JetBlue has a long history of supporting those department competed against teams including the airline’s mission of inspiring humanity to who serve their communities. Today public ser- JetBlue crewmembers and members from local life every day. vants from New York and abroad joined forces authorities including the NYPD and FDNY to “As New York’s Hometown Airline, support- for a good cause. -

Airline Schedules

Airline Schedules This finding aid was produced using ArchivesSpace on January 08, 2019. English (eng) Describing Archives: A Content Standard Special Collections and Archives Division, History of Aviation Archives. 3020 Waterview Pkwy SP2 Suite 11.206 Richardson, Texas 75080 [email protected]. URL: https://www.utdallas.edu/library/special-collections-and-archives/ Airline Schedules Table of Contents Summary Information .................................................................................................................................... 3 Scope and Content ......................................................................................................................................... 3 Series Description .......................................................................................................................................... 4 Administrative Information ............................................................................................................................ 4 Related Materials ........................................................................................................................................... 5 Controlled Access Headings .......................................................................................................................... 5 Collection Inventory ....................................................................................................................................... 6 - Page 2 - Airline Schedules Summary Information Repository: -

New Airlines Are Mailing National Headlines the Civil Aeronautics Board Has Approved 109 Helicopters

f=*i£^am am rotp page two Industry notes New airlines are mailing national headlines The Civil Aeronautics Board has approved 109 helicopters. The helicopter shuttle flights percent below standard fares charged by major the proposed merger of Republic Airlines and will be offered by a company called New York commercial airlines. Hughes Air West. Republic, a recent product of Air which has no connection with the New York Loftliedr bypassed air traffic treaties by the Board’s generally favorable policy toward Air that will start jetliner shuttle flights between staying out of the International Air Traffic mergers, was created by the union of North LaGuardia and Washington National on Decem Association (lATA) and by using Luxembourg Central Airlines and Southern Airways. ber 14. as its European base. The Republic merger with Air West will The latter New York Air is a subsidiary of American students made it their carrier for create the country’s 11th largest carrier in terms Texas Air Corp., the recently formed parent summers abroad, and in Europe Greeks, Italians, of revenue passenger miles. Presidential approval holding company of Texas International Airlines. Germans, Frenchmen and Dutchmen flocked to was not required because there won’t be a formal The CAB has tentatively granted a certificate to Luxembourg to use the airline, which once ran transfer of route certificates. Hughes Air West the Texas Air subsidiary which was founded to as many as 25 flights a week each way. will become a subsidiary airline, named Republic compete in the New York-Washington shuttle The airline made a stopover at Keflavik Air Airlines West. -

1995 Annual Report

Southwest Airlines Co. 1995 Annual Report OUR 6 SECRETS OF SUCCESS Table of Contents Consolidated Highlights ..................................................................2 Introduction .....................................................................................3 Letter to Shareholders.....................................................................4 1. Stick To What You’re Good At ....................................................4 2. Keep It Simple .............................................................................8 3. Keep Fares Low, Costs Lower ..................................................10 4. Treat Customers Like Guests....................................................12 5. Never Stand Still .......................................................................14 6. Hire Great People .....................................................................16 Looking Ahead ..............................................................................18 Destinations ..................................................................................20 Financial Review ...........................................................................21 Management’s Discussion and Analysis .......................................21 Consolidated Financial Statements...............................................27 Report of Independent Auditors ....................................................39 Quarterly Financial Data ...............................................................40 Common Stock Price Ranges -

Overview and Trends

9310-01 Chapter 1 10/12/99 14:48 Page 15 1 M Overview and Trends The Transportation Research Board (TRB) study committee that pro- duced Winds of Change held its final meeting in the spring of 1991. The committee had reviewed the general experience of the U.S. airline in- dustry during the more than a dozen years since legislation ended gov- ernment economic regulation of entry, pricing, and ticket distribution in the domestic market.1 The committee examined issues ranging from passenger fares and service in small communities to aviation safety and the federal government’s performance in accommodating the escalating demands on air traffic control. At the time, it was still being debated whether airline deregulation was favorable to consumers. Once viewed as contrary to the public interest,2 the vigorous airline competition 1 The Airline Deregulation Act of 1978 was preceded by market-oriented administra- tive reforms adopted by the Civil Aeronautics Board (CAB) beginning in 1975. 2 Congress adopted the public utility form of regulation for the airline industry when it created CAB, partly out of concern that the small scale of the industry and number of willing entrants would lead to excessive competition and capacity, ultimately having neg- ative effects on service and perhaps leading to monopolies and having adverse effects on consumers in the end (Levine 1965; Meyer et al. 1959). 15 9310-01 Chapter 1 10/12/99 14:48 Page 16 16 ENTRY AND COMPETITION IN THE U.S. AIRLINE INDUSTRY spurred by deregulation now is commonly credited with generating large and lasting public benefits. -

Speaker Bios

Aircraft Builders Council 2018 Annual Conference Speaker Biographies Matt Barton, Partner Flightpath Economics, LLC Matt Barton is an aviation economist with twenty years of experience at the intersection of airline finance, labor dynamics, and strategy. His career to date has covered key portions of the industry, including: labor negotiations, fleet and network planning, and regulatory advocacy. During the bankruptcies of American Airlines, United Airlines, and Sun Country Airlines, Matt served as a financial advisor to creditors, labor groups, and other stakeholders. In 2010, Matt helped to facilitate the successful merger of two large US network airlines by leading an external analysis of synergies and financial performance. Outside the United States, Matt has led restructuring projects at China Southern, Shenzhen Air, Cebu Pacific, and Fiji Airways. At the negotiating table, Matt has modeled contract costs and represented pilots and flight attendants at United Airlines, American Airlines, US Airways, Frontier, AirTran, NetJets, Horizon Air, Atlas Air Worldwide, and others. He was part of the startup team for a new airline that operated small regional jets in Hawaii, and has participated directly in the planning and establishment of five other startup airlines worldwide. Prior to these consulting roles, Matt worked in corporate planning functions at US Airways. Matt earned an MBA from London Business School and a BA from the University of California. Itash Samani Global Head of FSTD Regulatory Affairs, CAE Training Strategy Itash has worked in flight simulation for over 35 years, in design and manufacturing as well training operations. He has extensive experience in aerodynamics and avionics systems simulation, and through his career held various managerial positions including Manager of Engineering, Manager of Acquisitions, Manager of Regulatory Compliance, Head of Regulatory for FAA Part 142, and currently holds the position of Global Head of Regulatory Affairs (FSTD). -

Delta April 2003 Worldwide Timetable

Airline Listing 3M Silver Airways Corporation KE Korean Air Lines Co. Ltd. 6G Sun Air Express, LLC KL KLM Royal Dutch Airlines AA American Airlines LH Deutsche Lufthansa AG AC Air Canada LW Pacific Wings, L.L.C AF Air France NH All Nippon Airways AM Aeromexico Aerovias OS Austrian Airlines AG dba Austrian de Mexico S.A. de C.V. PD Porter Airlines Inc. AS Alaska Airlines QR Qatar Airways (Q.C.S.C.) AV Aerovias del Continente Americano SA South African Airways S.A. AVIANCA SK Scandinavian Airlines System B6 Jetblue Airways Corporation SN Brussels Airlines N.V. BA British Airways SU JSC Aeroflot Russian Airlines CA Air China Limited SV Saudi Arabian Airlines CM Compania Panamena SY MN Airlines LLC de Aviacion, S.A. (COPA) TK Turkish Airlines, Inc. DL Delta Air Lines, Inc. UA United Airlines, Inc. EK Emirates US US Airways ET Ethiopian Airlines Enterprise VS Virgin Atlantic Airways Limited EY Etihad Airways VX Virgin America Inc. F9 Frontier Airlines, Inc. WN Southwest Airlines FI Icelandair DOMESTIC DOMESTIC Stops/ Stops/ Stops/ Stops/ Depart/Arrive Flight Equip Via Freq Depart/Arrive Flight Equip Via Freq Depart/Arrive Flight Equip Via Freq Depart/Arrive Flight Equip Via Freq AKRON/CANTON, OH (CAK) To AKRON/CANTON, OH (CAK) From AKRON/CANTON, OH (CAK) To ALBUQUERQUE, NM (cont) From ALBUQUERQUE, NM (cont) From National To National From Dulles (cont) To Dulles (cont) 2 00p 3 20p US5151* CRJ 0 6 6 30a 7 42a US5226* CRJ 0 7 12 31p 4 56p UA1090/UA4914* DEN 125 1 10p 9 02p UA3655*/UA652 DEN 6 Operated By US Airways Express - PSA Airlines Operated -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

March 2018 REFLECTIONS the Newsletter of the Northwest Airlines History Center Dedicated to Preserving the History of a Great Airline and Its People

Vol.16, no.1 nwahistory.org facebook.com/NorthwestAirlinesHistoryCenter March 2018 REFLECTIONS The Newsletter of the Northwest Airlines History Center Dedicated to preserving the history of a great airline and its people. NORTHWEST AIRLINES 1926-2010 ______________________________________________________________________________________________________ THE QUEEN OF THE SKIES Personal Retrospectives by Robert DuBert It's hard to believe that they are gone. Can it be possible that it was 50 years ago this September that this aircraft made its first public appearance? Are we really all so, ahem, elderly that we Photo: True Brand, courtesy Vincent Carrà remember 1968 as if it were yesterday? This plane had its origins in 1964, when Boeing began work on a proposal for the C-5A large military airlifter contract, and after Lockheed won that contest, Boeing considered a commercial passenger version as a means of salvaging the program. Urged on by Pan Am president Juan Trippe, Boeing in 1965 assigned a team headed by Chief Engineer Joe Sutter to design a large new airliner, although Boeing at the time was really more focused on its supersonic transport (SST) program. A launch customer order from Pan Am on April 13, 1966 for twenty five aircraft pushed Sutter's program into high gear, and in a truly herculian effort, Joe Sutter and his Boeing team, dubbed “The Incredibles,” brought the program from inception on paper to the public unveiling of a finished aircraft in the then unheard of time of 29 months. We're talking, of course, about the legendary and incomparable Boeing 747. THE ROLLOUT It was a bright, sunny morning on Monday, Sept.