Corporate Social Responsibility Report 2010 Scope of Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

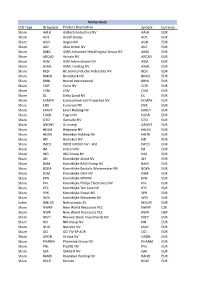

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

Remuneration Report 2017 Report Remuneration 2017

REMUNERATION REMUNERATION REPORT 2017 REPORT 2017 1 TABLE OF CONTENTS REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION 2 3 INTRODUCTION 5 REMUNERATION POLICY FOR THE BOARD OF MANAGEMENT 7 APPLICATION OF REMUNERATION POLICY IN 2017 9 SUPERVISORY BOARD REMUNERATION POLICY REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION 3 INTRODUCTION MEMBERS OF THE REMUNERATION COMMITTEE DUTIES AND RESPONSIBILITIES OF THE REMUNERATION COMMITTEE In 2017 the Remuneration Committee consisted of two members, with Mr. Van Woudenberg as chairman and It is the role of the Remuneration Committee to advise the Mr. Niggebrugge as a member. On 10 May 2017 Supervisory Board on: Mr. Niggebrugge stepped down as member of the the submission of a clear and understandable proposal Remuneration Committee and was succeeded by concerning the remuneration policy to be pursued for Mr. Van der Veer. members of the Board of Management with focus on long-term value creation for the company and the business The Remuneration Committee regularly avails itself of the connected with it and taking into account the internal pay services of an independent remuneration adviser and has ratios within the company. The Remuneration Committee ascertained that this remuneration adviser does not provide shall consider and include all matters required by law and advice to the members of the Board of Management. the Corporate Governance Code 2016 (the “Code”). The Supervisory Board shall present the policy to the General REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION Meeting of Shareholders for adoption; 4 the submission of a proposal concerning the remuneration REVISION OF THE LABOR MARKET REFERENCE of individual members of the Board of Management. -

Integrated Reporting As a Driver for Integrated Thinking?

Integrated Reporting as a driver for Integrated Thinking? Maturity of <IR> in the Netherlands 2015 Contributors Patrick Seinstra Jennifer Muller Royal BAM Group: Barry Oesman Partner Integrated & Sustainability Deloitte Audit Master Student at London School of Economics and Group Controller Political Science Anneke Sipkens DSM: Kimberley Chan Director Sustainability Deloitte Risk Services Michiel van der Valk Sustainability Manager Master Student Sustainable Business & Innovation at Udeke Huiskamp Utrecht University Nutreco: Jose Villalon Senior Manager Sustainability Deloitte Risk Services Corporate Sustainability Director CSR the Netherlands (MVO Nederland) Erica Kostense-Smit Willem Lageweg Nutreco: Sigrid van Amerongen Manager Sustainability Deloitte Risk Services CEO CSR The Netherlands (MVO Nederland) CSR Manager Ashley Myers Vincent van Marle Heineken International: Jan-Willem Vosmeer Manager Sustainability Deloitte Risk Services Manager CSR Manager Frank Geelen Interviewees Delta Lloyd: David Hoppe Partner CFO Services & Finance Transformation NS: Carola Wijdoogen Communications Advisor Deloitte Consulting Director Sustainable Business Ministry of Economic Affairs: Martin Lok Marco van der Vegte KPN: Hans Koeleman Program Manager Natural Capital Managing Partner Audit and Member Executive Board Director Corporate Communications & CSR Deloitte Holding Avans Hogeschool: Marleen Janssen Groesbeek KPN: Brechtje Spoorenberg Professor Sustainable Finance and Accounting Olivier van Thuijl Manager CSR Senior Manager CFO Services Deloitte -

Remuneration Policy Supervisory Board

Signify N.V. Remuneration Policy Supervisory Board 1 Introduction The total remuneration of members of the Supervisory Board is targeted around the median The objective of the remuneration policy of the level of a representative labor market peer group and Supervisory Board is to support long-term value benchmarked periodically. This peer group is the same creation of the company. The following principles apply as used for benchmarking the remuneration of the for this remuneration policy: Board of Management. The peer group consists of 50% • The remuneration policy aims to attract, reward and Dutch headquartered cross-industry companies that are retain qualified Supervisory Board members, together included in the AEX or AMX, and 50% European sector forming a diverse and balanced Supervisory Board specific companies. For use for the remuneration of the with the appropriate level of skills, competences and Chairman of Supervisory Board, peer group companies experience for overseeing the (execution of the) having a one-tier board structure are excluded. Company’s strategy and performance, whilst taking the interest of all the company’s stakeholders into As of January 2020, the labor market peer group account. consists of the following 14 companies: • Given the nature of the responsibilities of the Supervisory Board as an independent body, the Signify labor market peer group remuneration is not dependent on the performance Aalberts DSM Prysmian Group of the company and therefore consists of fixed AkzoNobel KPN Rexel components only. ASML Legrand Rheinmetall Group • The remuneration reflects the time spent and BAM Nexans Siemens Gamesa responsibilities of each individual member of the Boskalis Osram Supervisory Board. -

Arcadis N.V. Remuneration Policy Supervisory Board

ARCADIS N.V. REMUNERATION POLICY SUPERVISORY BOARD Objectives The remuneration policy for members of the Supervisory Board of Arcadis N.V. (‘Arcadis’ or the ‘Company’) should serve to attract, motivate and retain diverse Supervisory Board members of the highest caliber in order to support and oversee the execution of our ambitious business strategy. Remuneration elements The remuneration of the members of the Supervisory Board consists of a fixed fee and an attendance fee. Given the nature of the responsibilities of the Supervisory Board, the remuneration is not tied to the performance of the Company and therefore includes fixed compensation only. In line with the Dutch corporate governance code, the members of the Supervisory Board will not be rewarded in equity-based compensation. Labor market reference The annual remuneration levels for the Supervisory Board are based on a benchmark analysis against the median of the following 16 Dutch headquartered companies with significant international activities. Dutch headquartered companies with significant international activities1 Randstad (NL) SBM Offshore (NL) AkzoNobel (NL) Aalberts Industries (NL) DSM (NL) Fugro (NL) BAM (NL) Refresco (NL) KPN (NL) Vopak (NL) Wolters Kluwer (NL) TKH Group (NL) PostNL (NL) Brunel (NL) Boskalis (NL) TomTom (NL) Total compensation The following fixed annual fees are applicable: ASC/RemCo Supervisory (combined Board AARC membership) Chairperson € 85,000 € 12,000 € 10,0002 Member € 58,000 € 8,000 € 7,000 AARC = Arcadis Audit and Risk Committee ASC = Arcadis Selection Committee RemCo = Remuneration Committee Attendance fee The following attendance fees are applicable for members of the Supervisory Board: • € 2,500 for every visit for meetings that take place outside of the Supervisory Board member’s country of domicile and does not involve intercontinental travel; or • € 4,000 for every visit for meetings that involve intercontinental travel; and • No attendance fee is paid if the meeting takes place in the Supervisory Board’s member’s country of domicile. -

Remuneration Report 2016 Remuneration 016 2 Report

REMUNERATION REPORT REMUNERATION REPORT 2016 2 016 1 TABLE OF CONTENTS REMUNERATION REPORT 2016 — BOSKALIS REMUNERATION 2 3 INTRODUCTION 5 REMUNERATION POLICY FOR THE BOARD OF MANAGEMENT 7 APPLICATION OF REMUNERATION POLICY IN 2016 9 SUPERVISORY BOARD REMUNERATION POLICY REMUNERATION REPORT 2016 — BOSKALIS REMUNERATION 3 INTRODUCTION MEMBERS OF THE REMUNERATION COMMITTEE DUTIES AND RESPONSIBILITIES OF THE REMUNERATION COMMITTEE The Remuneration Committee consists of two members, with Mr. Van Woudenberg as chairman and Mr. Niggebrugge as The Remuneration Committee performs the following duties: a member. Putting forward a proposal to the Supervisory Board with regard to the remuneration policy to be pursued for the The Remuneration Committee regularly avails itself of the Board of Management. The policy is submitted for services of an independent remuneration adviser and has approval to the General Meeting of Shareholders. ascertained that this remuneration adviser does not provide Investigating whether the adopted remuneration policy is advice to the members of the Board of Management. still up-to-date and proposing policy adjustments where necessary. Putting forward proposals to the Supervisory Board with regard to the remuneration of individual members of the Board of Management (this in accordance with the remuneration policy adopted by the General Meeting of Shareholders). Compiling the remuneration report on the remuneration policy pursued, subject to adoption by the Supervisory REMUNERATION REPORT 2016 — BOSKALIS REMUNERATION Board. 4 ACTIVITIES DURING 2016 financial position of PGB. Future indexation will be The Remuneration Committee met twice during 2016, financed by PGB pension fund only. with both members having attended each of the meetings. The Committee also held regular consultations outside these To compensate for the change from unconditional to meetings. -

Boskalis September 2015

BoskalisEQUITY September RESEARCH 2015 . Change in recommendation 11 September 2015 Boskalis Hold (previously Buy) Strong, but not immune Price (10/09/15) We downgrade our recommendation for Boskalis from Buy to HOLD and cut €44.70 our target price from €49.0 to €45.0. The key reason is that we believe too Target price (12-mth) €45.00 (previously €49.00) many people are taking the one-off positives for granted. We believe chances Forecast total return are high for the Dredging unit to soon start showing the underlying indicated 4.3% EBIT margins of 10-12%. In addition, the Offshore Energy unit has visibility until roughly 3Q16 but, with the current weak oil price, few new projects are Construction & Materials being started, while the stable order backlog represents new work from Netherlands Europe’s offshore wind market, which has a lower margin profile compared Bloomberg: BOKA NA Reuters: BOSN.AS with oil & gas work. Given the persistently low oil price, we believe Boskalis will be able to acquire cheap assets in the next few quarters but do not expect Share data any change in the Fugro situation. We do not materially change our 2015-16F Avg daily volume (3-mth) 436,503 operating income forecasts but slightly lower our target valuation metrics on Free float (%) 67.0 the core business units to 7.5x 2016F EV/EBITDA, or €34.39 per share, plus Market cap (€m) 5,466.6 Net debt (1F, €m) 300 €7.68 per share for tugboats and €2.84 per share for the Fugro stake. -

About France and Retirees

About France and retirees vol. 2 nr. 4 February 2021 vol. 2 nr. 1 February 2020 3: Change at Concarneau A matter of heritage TugeZine A new tug operator and a new is published every even month tug on order. It’s evident that tugs have long lives. The reason being simple in that tugs in digital format only. have strength and durability into their design. Even so, an active life of a 5, 25: Regional hundred years or more is quite something. Editor Some recent transports. Job van Eijk There is an obvious difference between a vessel with historic Co-editor 7: Toulonnais V significance and ‘just being old’. Even so it is true to say that many Cock Peterse A technical description. of these old tugs may have led interesting and colourful lives earning over the years good money for their owners. Many are Advertising 9: 100+ Tugs being preserved in one way or the other, probably because their Frank van Gils A search for 100-year olds. size in general is manageable in terms of maintenance and costs. DTP 13: New for Following the story on the preservation of the Canadian steam Dtpplus - Spijkenisse Hadera and Shanghai tug Master out of interest we dug into our files to see if there Some recent shiphandlers. were many more like her. Age-wise, we found many, but we also Branding & Webdesign found huge gaps in documentation about the period after a tug Studio DBLY - Rotterdam 19: Tug News – New Tugs had been taken out of (towage) service. The information silence News from within the towage is such that serious doubt now exists about the whereabouts of Publisher industry and its suppliers. -

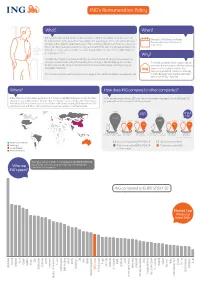

2015 Remuneration Fact Sheet

ING’s Remuneration Policy What? When? ING needs to attract and retain excellent leaders so that it can deliver on its promise to its Changes to ING’s Executive Board 34 million clients in the more than 40 countries it is operating in. At the same time, ING has Remuneration are eective as of to balance the interests of all stakeholders. The Supervisory Board reconfirms its support of 1 Jan 2016. ING´s Executive Board Remuneration Policy aimed at further reducing the gap between the total direct compensation of ING’s Executive Board and the median of the EURO STOXX 50 peer group over time. Why? For 2016, the Supervisory Board decided to increase the total (at target) remuneration of Executive Board members by 2%. Including these changes, ING will still pay its Executive To remain competitive, ING needs to attract Board well below the median for national and international companies in its peer group and retain the best leaders with international (the EURO STOXX 50). experience for its global activities. The Supervisory Board will continue to annually For more information see the remuneration page or the full Annual Report on www.ing.com. monitor developments and the applicable benchmark (EURO STOXX 50). Where? How does ING compare to other companies? ING is a European bank with a global presence. It has over 54,000 employees serving 34 million ING’s total remuneration for its CEO is far below the median (see graph). Also, its CFO and CRO customers across 40 countries. At least 70% of employees work outside of the Netherlands. -

Annual Report 2018 — Boskalis

ANNUAL REPORT 2018 — BOSKALIS ANNUAL REPORT 2018 ANNUAL ANNUAL REPORT 2018 REPORT 2018 KEY FIGURES (in EUR million, unless stated otherwise) 2018 2017 Revenue 2,570 2,343 Order book 4,292 3,495 EBITDA 353.6* 436.6 Net result from joint ventures and associates 28.4* 31.0 Depreciation and amortization 234.6 251.6 Operating result 119.0* 185.0 Extraordinary charges 519.5 0.0 EBIT -400.5 185.0 Net profit adjusted for extraordinary charges after tax 82.8 150.5 Net profit (loss) -435.9 150.5 Net group profit (loss) -433.7 150.4 Cash flow 319.5* 402.0 Shareholders’ equity 2,544 3,023 RATIOS (IN PERCENTAGES) EBIT as % of revenue 4.6* 7.9 Return on capital employed 2.9* 4.8 Return on equity 3.0* 4.9 Solvency 56.1 62.6 S S RE FIGURES PER SHARE (IN EUR) RE U U G Profit 0.63* 1.15 I G I F F Dividend 0.50 1.00 Y Y E E Cash flow 2.41* 3.07 K NON-FINANCIAL INDICATORS Employees including associated companies 11,345 10,732 Employees in Boskalis majority owned entities 5,912 5,772 Ratio women/men within Boskalis’ majority owned entities 12/88 10/90 Number of nationalities within Boskalis’ majority owned entities 68 64 Lost Time Injuries (LTI) 10 9 Lost Time Injury Frequency (LTIF) 0.05 0.06 Total Recordable Injury Rate (TRIR) 0.40 0.55 Strategic suppliers: percentage spend covered by Supplier Code of Conduct 70 81 CO2 emissions scope 1+2 (MT (‘000)) 1,180 1,223 Please refer to the glossary for definitions of the terms used S I * Excluding extraordinary charges L A SK BO – 8 1 0 7 RT 2 O EP LAG 201 R S VER UAL R NN JAA A REVENUE (in EUR million) NET PROFIT (in -

ABN AMRO Bank N.V

ABN AMRO Bank N.V. Annual Report 2019 Introduction Table of contents Introduction Strategy and performance Strategy and performance 2 5 39 137 Risk, funding & capital Introduction Strategy and Risk, funding & Leadership & performance capital governance Risk, funding & capital About this report 2 Economic environment 6 Introduction to Risk, Introduction to Leadership Key figures and profile 3 Regulatory environment 9 funding & & governance 138 ABN AMRO shares 4 Strategy 11 capital management 40 Executive Board and Bank performance 15 Risk, funding & Executive Committee 138 Business performance 23 capital management 41 Supervisory Board 142 Responsibility statement 38 Risk, funding & Report of the capital review 72 Supervisory Board 146 Additional risk, funding General Meeting and Leadership & capital disclosures 129 shareholder structure 154 Codes and regulations 157 Leadership & governance Legal structure 159 Remuneration report 160 Governance 171 281 Annual Financial Statements 2019 Annual Financial Statements 2019 Other Consolidated Annual Financial Statements 2019 172 Independent Annual Financial Statements Notes to the Consolidated Annual Financial Statements 179 auditor’s report 282 Company Financial Statements of ABN AMRO Bank N.V. 263 Other information 290 Notes to the Company Financial Statements Cautionary statements 292 of ABN AMRO Bank N.V. 267 Enquiries 293 Other Other ABN AMRO Bank Annual Report 2019 Introduction About this report Introduction / About this report 2 Introduction About this report Introduction Value- creating Welcome to ABN AMRO’s 2019 Annual Report topics Strategy and performance Strategy and performance ABN AMRO takes a ‘core and more’ approach to Impact Annual reporting. The Integrated Annual Review (IAR) is Report Report the ‘core’ report that explains how, over time, Overview Integrated Non- of total Annual financial data & our bank creates value for its stakeholders.