ABN AMRO Annual Report Group 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PREFERENCE SHARES, NOMINAL VALUE of E2.24 PER SHARE, in the CAPITAL OF

11JUL200716232030 3JUL200720235794 11JUL200603145894 Public Offer by RFS Holdings B.V. FOR ALL OF THE ISSUED AND OUTSTANDING (FORMERLY CONVERTIBLE) PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO Holding N.V. Offer Memorandum and Offer Memorandum for ABN AMRO ordinary shares (incorporated by reference in this Offer Memorandum) 20 July 2007 This Preference Shares Offer expires at 15:00 hours, Amsterdam time, on 5 October 2007, unless extended. OFFER MEMORANDUM dated 20 July 2007 11JUL200716232030 3JUL200720235794 11JUL200603145894 PREFERENCE SHARES OFFER BY RFS HOLDINGS B.V. FOR ALL THE ISSUED AND OUTSTANDING PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO HOLDING N.V. RFS Holdings B.V. (‘‘RFS Holdings’’), a company formed by an affiliate of Fortis N.V. and Fortis SA/NV (Fortis N.V. and Fortis SA/ NV together ‘‘Fortis’’), The Royal Bank of Scotland Group plc (‘‘RBS’’) and an affiliate of Banco Santander Central Hispano, S.A. (‘‘Santander’’), is offering to acquire all of the issued and outstanding (formerly convertible) preference shares, nominal value e2.24 per share (‘‘ABN AMRO Preference Shares’’), of ABN AMRO Holding N.V. (‘‘ABN AMRO’’) on the terms and conditions set out in this document (the ‘‘Preference Shares Offer’’). In the Preference Shares Offer, RFS Holdings is offering to purchase each ABN AMRO Preference Share validly tendered and not properly withdrawn for e27.65 in cash. Assuming 44,988 issued and outstanding ABN AMRO Preference Shares outstanding as at 31 December 2006, the total value of the consideration being offered by RFS Holdings for the ABN AMRO Preference Shares is e1,243,918.20. -

De Volksbank N.V. Annual Report 2020

2020 Annual Report REPORT OF THE BOARD GOVERNANCE RISK FINANCIAL STATEMENTS OTHER INFORMATION ADDITIONAL 2 de Volksbank N.V. Annual Report 2020 BETTER FOR EACH OTHER 4 OTHER INFORMATION 192 Key figures 6 Provisions regarding profit or loss appropriation 192 Foreword of the CEO 8 Independent auditor's report 194 1 STRATEGY AND PROGRESS 10 ADDITIONAL INFORMATION 204 1.1 Economic developments 11 Definitions and abbreviations 204 1.2 Our Strategy 13 Disclaimer 210 1.3 Developments in our shared value ambition 15 1.4 Options for the future 18 1.5 Commercial developments 19 1.6 Financial results 20 1.7 Compliance and de Volksbank 24 1.8 Responsible tax policy 26 2 GOVERNANCE 28 2.1 Supervisory Board and Board of Directors 29 2.2 Report of the Supervisory Board 33 2.3 Banking Code 37 2.4 Dutch Corporate Governance Code 37 2.5 Legal structure of de Volksbank 38 2.6 Remuneration Report 38 3 RISK MANAGEMENT 44 3.1 Risk management structure 45 3.2 Strategic risks 52 3.3 Credit risk 54 3.4 Market risk 86 3.5 Non-financial risks 90 3.6 Liquidity management and funding strategy 94 3.7 Credit ratings 103 3.8 Capital management 104 3.9 Sustainability risk 115 3.10 Management statement 123 FINANCIAL STATEMENTS 126 Consolidated financial statements 128 Notes to the consolidated financial statements 132 Company financial statements 178 Notes to the company financial statements 181 REPORT OF THE BOARD GOVERNANCE RISK FINANCIAL STATEMENTS OTHER INFORMATION ADDITIONAL de Volksbank N.V. Annual Report 2020 3 Presentation of information This 2020 Annual Report consists of: • The Report of the Board of Directors, comprising: This is our 2020 Annual Report. -

Does Ownership Have an Effect on Accounting Quality?

Master Degree Project in Accounting Does Ownership have an Effect on Accounting Quality? Andreas Danielsson and Jochem Groenenboom Supervisor: Jan Marton Master Degree Project No. 2013:14 Graduate School Abstract Research on accounting quality in banks has evolved around the manipulation of the Loan Loss Provision and has been discussed in terms of earnings management and income smoothing. Key variables used to explain the manipulation of Loan Loss Provisions have been investor protection, legal enforcement, financial structure and regulations. This study will extend previous research by investigating the effect of state, private, savings and cooperative ownership on accounting quality. In this study data from more than 600 major banks were collected in the European Economic Area, covering annual reports between 2005 and 2011. Similar to prevalent research, the Loan Loss Provision is used as a central indicator of accounting quality. In contrast to existent literature, accounting quality is not explained by the manipulation of the Loan Loss Provision in terms of income smoothing or earnings management. Instead, accounting quality is addressed in terms of validity and argued to be an outcome of the predictive power of the Loan Loss Provision in forecasting the actual outcome of credit losses. The findings of this study confirm that ownership has an effect on accounting quality. All but one form of ownership investigated showed significant differences. State ownership was found to have a positive effect on accounting quality, both in comparison to private banks and all other banks. On the other hand, savings ownership was shown to have a negative impact on accounting quality compared to private and other banks. -

ABN AMRO Annual Report 2003

Annual Report 2003 ABN AMRO Holding N.V. Profile ABN AMRO • is a prominent international bank with origins going back to 1824 • ranks eleventh in Europe and twenty-third in the world based on tier 1 capital • has more than 3,700 branches in over 60 countries and territories, a staff of about 110,000 full-time equivalents and total assets of EUR 560 billion as of year-end 2003 • is listed on the Euronext Amsterdam, London and New York Stock Exchanges, among others. Our business strategy is built on five key elements: 1. Creating value for our clients by offering high-quality financial solutions which best meet their current needs and long-term goals 2. Focusing on: • consumer and commercial clients in our home markets of the Netherlands, the United States Midwest, Brazil and in selected growth markets around the world • selected wholesale clients with an emphasis on Europe, and financial institutions • private clients 3. Leveraging our advantages in products and people to benefit all our clients 4. Sharing expertise and operational excellence across the group 5. Creating ‘fuel for growth’ by allocating capital and talent according to the principles of Managing for Value, our value-based management model. The goal is sustainable growth which will benefit all our stakeholders: clients, shareholders, employees and society at large. ABN AMRO’s Corporate Values and Business Principles guide everything we do as an organisation and as individuals. We basically implement the strategy through three Strategic Business Units: • Consumer & Commercial Clients (C&CC) – for individual and corporate clients requiring day-to-day banking. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

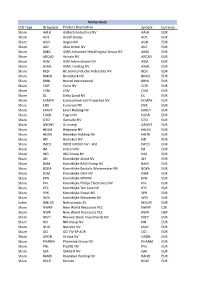

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

Abn Amro Group N.V

PRICING STATEMENT ABN AMRO GROUP N.V. (a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands, with its corporate seat in Amsterdam, the Netherlands) 2 Initial public offering of 188,000,000 depositary receipts representing 188,000,000 Ordinary Shares at a price of €17.75 per Offer DR This pricing statement (the “Pricing Statement”) relates to the Offering as referred to in the prospectus of ABN AMRO Group N.V. (the “Company”) dated 10 November 2015 (the “Prospectus”). The Offering consists of: (i) a public offering in the Netherlands to institutional and retail investors and (ii) a private placement to certain institutional and other investors that qualify under available offering exemptions in various other jurisdictions. The Offer DRs are being offered: (i) by private placement within the United States of America (the “US”), to persons reasonably believed to be “qualified institutional buyers” as defined in, and in reliance on, Rule 144A under the US Securities Act of 1933, as amended (the “US Securities Act”), and (ii) outside the US, where all offers and sales of the Offer DRs will be made in compliance with Regulation S under the US Securities Act. This Pricing Statement has been prepared in accordance with section 5:18(2) of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht; the “FMSA”) and has been filed with the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten, the “AFM”). This Pricing Statement is being made generally available in the Netherlands in accordance with section 5:21(3) of the FMSA. -

List of Realdania's Commercial Investments in Listed Equites

List of Realdania's commercial investments in listed equites 31st December 2018 ISIN or Sedol Security name FR0000120644 Danone US3703341046 General Mills US4943681035 Kimberly-Clark NL0011794037 Ahold Delhaize US58933Y1055 Merck & Co FR0000130577 Publicis Groupe CH0038863350 Nestle CH0012032048 Roche US1890541097 Clorox FR0000120073 Air Liquide JP3422950000 Seven & I Holdings US7170811035 Pfizer JP3496400007 KDDI Corp US4404521001 Hormel Foods DK0060534915 Novo Nordisk FR0000133308 Orange SE0000163594 Securitas US2058871029 ConAgra Brands GB00B01FLG62 G4S FR0000121220 Sodexo CH0012255151 Swatch JP3862400003 Makita GB0032089863 Next JP3982100004 Lawson US5132721045 Lamb Weston US94106L1098 Waste Management IE0004906560 Kerry Group US6092071058 Mondelez International JP3116000005 Asahi Group GB0009252882 GlaxoSmithKline JP3205800000 Kao JP3421800008 Secom JP3469000008 Mitsubishi Tanabe DE000A1EWWW0 Adidas IT0005252207 Campari JP3258000003 Kirin GB00B03MLX29 Royal Dutch Shell Plc-A shs (GB) US8923561067 Tractor Supply Co CH0012005267 Novartis AG US92939U1060 WEC Energy Group Inc US91324P1021 United Health Group Inc. NL0011540547 ABN AMRO Group NV GB00B0744B38 Bunzl PLC US2333311072 DTE Energy Co US58933Y1055 Merck & Co Inc US0367521038 Anthem Inc US0028241000 Abbott Laboratories US7185461040 Phillips 66 US30231G1022 Exxon Mobil Corporation CH0012032048 Roche Holdings CA7751092007 Rogers Communications Inc CA7800871021 Royal Bank of Canada US4824801009 KLA-Tencor Corp US92343V1044 Verizon Communications Inc US89417E1091 Travelers Cos Inc/The -

Philanthropy Services by Dutch Banks: Creating Impact for Colleagues, Clients and Charities

Philanthropy services by Dutch banks: Creating impact for colleagues, clients and charities Philanthropy services by Dutch banks: Creating Impact for Colleagues, Clients and Charities Jacqueline Detiger (www.betergeven.nl) Joining forces for more impact In October 2015 four Dutch Charity Desks at banks offering philanthropy services to wealthy clients set up the FAFI network (the name derives from Philanthropy Advice by Financial Institutions). The aim of this cooperation is to meet regularly to share best practices, new perspectives and research results so as to improve knowledge and insights in philanthropy and to be able to expand the number of clients making use of philanthropy advice. Jacqueline Detiger ecent research in the Netherlands shows Banks provide this service because customers that wealthy individuals are looking for show a keen interest in it and it is part of these ways to give more strategically. Charity banks’ DNA. Guus Loomans of Rabobank states: desks of banks provide this service. In the “We have a long tradition of giving through our Rend, it is all about helping clients with their giving foundation and through our employee giving plan and to increase the number of clients investing in fund. Giving is in the DNA of our Cooperative charities: making the pie bigger for everyone! Bank. To be able to support our clients with philanthropy we started our Charity Management We even have a verb for joining forces so as to get Services eight years ago.” Andrew Mackay of positive results that are beneficial for everybody. Van Lanschot Charity Service remarks: “The client is asking us about giving and social investing. -

Triodos Bank Produces a Printed Version of the Annual Report

T¬B Annual Report 2016 Triodos Bank produces a printed version of the Annual Report. We do this because some of our stakeholders want to read the report in this format and because we are legally required to provide the Annual Report as a discrete, single document. However, we have chosen to put more energy into producing the Annual Report online. The online Annual Report includes content that is not in this document; from films highlighting the extraordinary work of the sustainable enterprises we finance and an interview with our CEO, to an extended chapter about Triodos Bank’s impact. We believe the online Annual Report provides a more complete picture of our performance and our aspirations for the future, and many more people choose to view it than read the report in print. It has also allowed us to reduce the number of printed copies of the report we produce each year. However you choose to read or view the Annual Report, we hope it provides you with a rich picture of Triodos Bank’s values-based mission, strategy and impact in the wider world. We appreciate your feedback, so please contact us via the ‘tell us what you think’ button on the homepage of the website. www.annual-report-triodos.com T¬B Triodos Bank is a co-founder of the Global Alliance for Banking on Values, a network of leading sustainable banks – visit www.gabv.org Important data for Triodos Bank’s shareholders and depository receipt holders. Annual general meeting 19 May 2017 Ex-dividend date 23 May 2017 Dividend payment date 26 May 2017 Annual Report 2016 Triodos Bank -

Remuneration Report 2017 Report Remuneration 2017

REMUNERATION REMUNERATION REPORT 2017 REPORT 2017 1 TABLE OF CONTENTS REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION 2 3 INTRODUCTION 5 REMUNERATION POLICY FOR THE BOARD OF MANAGEMENT 7 APPLICATION OF REMUNERATION POLICY IN 2017 9 SUPERVISORY BOARD REMUNERATION POLICY REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION 3 INTRODUCTION MEMBERS OF THE REMUNERATION COMMITTEE DUTIES AND RESPONSIBILITIES OF THE REMUNERATION COMMITTEE In 2017 the Remuneration Committee consisted of two members, with Mr. Van Woudenberg as chairman and It is the role of the Remuneration Committee to advise the Mr. Niggebrugge as a member. On 10 May 2017 Supervisory Board on: Mr. Niggebrugge stepped down as member of the the submission of a clear and understandable proposal Remuneration Committee and was succeeded by concerning the remuneration policy to be pursued for Mr. Van der Veer. members of the Board of Management with focus on long-term value creation for the company and the business The Remuneration Committee regularly avails itself of the connected with it and taking into account the internal pay services of an independent remuneration adviser and has ratios within the company. The Remuneration Committee ascertained that this remuneration adviser does not provide shall consider and include all matters required by law and advice to the members of the Board of Management. the Corporate Governance Code 2016 (the “Code”). The Supervisory Board shall present the policy to the General REMUNERATION REPORT 2017 — BOSKALIS REPORT 2017 REMUNERATION Meeting of Shareholders for adoption; 4 the submission of a proposal concerning the remuneration REVISION OF THE LABOR MARKET REFERENCE of individual members of the Board of Management. -

Integrated Reporting As a Driver for Integrated Thinking?

Integrated Reporting as a driver for Integrated Thinking? Maturity of <IR> in the Netherlands 2015 Contributors Patrick Seinstra Jennifer Muller Royal BAM Group: Barry Oesman Partner Integrated & Sustainability Deloitte Audit Master Student at London School of Economics and Group Controller Political Science Anneke Sipkens DSM: Kimberley Chan Director Sustainability Deloitte Risk Services Michiel van der Valk Sustainability Manager Master Student Sustainable Business & Innovation at Udeke Huiskamp Utrecht University Nutreco: Jose Villalon Senior Manager Sustainability Deloitte Risk Services Corporate Sustainability Director CSR the Netherlands (MVO Nederland) Erica Kostense-Smit Willem Lageweg Nutreco: Sigrid van Amerongen Manager Sustainability Deloitte Risk Services CEO CSR The Netherlands (MVO Nederland) CSR Manager Ashley Myers Vincent van Marle Heineken International: Jan-Willem Vosmeer Manager Sustainability Deloitte Risk Services Manager CSR Manager Frank Geelen Interviewees Delta Lloyd: David Hoppe Partner CFO Services & Finance Transformation NS: Carola Wijdoogen Communications Advisor Deloitte Consulting Director Sustainable Business Ministry of Economic Affairs: Martin Lok Marco van der Vegte KPN: Hans Koeleman Program Manager Natural Capital Managing Partner Audit and Member Executive Board Director Corporate Communications & CSR Deloitte Holding Avans Hogeschool: Marleen Janssen Groesbeek KPN: Brechtje Spoorenberg Professor Sustainable Finance and Accounting Olivier van Thuijl Manager CSR Senior Manager CFO Services Deloitte