Abn Amro Bank Nv

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PREFERENCE SHARES, NOMINAL VALUE of E2.24 PER SHARE, in the CAPITAL OF

11JUL200716232030 3JUL200720235794 11JUL200603145894 Public Offer by RFS Holdings B.V. FOR ALL OF THE ISSUED AND OUTSTANDING (FORMERLY CONVERTIBLE) PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO Holding N.V. Offer Memorandum and Offer Memorandum for ABN AMRO ordinary shares (incorporated by reference in this Offer Memorandum) 20 July 2007 This Preference Shares Offer expires at 15:00 hours, Amsterdam time, on 5 October 2007, unless extended. OFFER MEMORANDUM dated 20 July 2007 11JUL200716232030 3JUL200720235794 11JUL200603145894 PREFERENCE SHARES OFFER BY RFS HOLDINGS B.V. FOR ALL THE ISSUED AND OUTSTANDING PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO HOLDING N.V. RFS Holdings B.V. (‘‘RFS Holdings’’), a company formed by an affiliate of Fortis N.V. and Fortis SA/NV (Fortis N.V. and Fortis SA/ NV together ‘‘Fortis’’), The Royal Bank of Scotland Group plc (‘‘RBS’’) and an affiliate of Banco Santander Central Hispano, S.A. (‘‘Santander’’), is offering to acquire all of the issued and outstanding (formerly convertible) preference shares, nominal value e2.24 per share (‘‘ABN AMRO Preference Shares’’), of ABN AMRO Holding N.V. (‘‘ABN AMRO’’) on the terms and conditions set out in this document (the ‘‘Preference Shares Offer’’). In the Preference Shares Offer, RFS Holdings is offering to purchase each ABN AMRO Preference Share validly tendered and not properly withdrawn for e27.65 in cash. Assuming 44,988 issued and outstanding ABN AMRO Preference Shares outstanding as at 31 December 2006, the total value of the consideration being offered by RFS Holdings for the ABN AMRO Preference Shares is e1,243,918.20. -

Premium Thresholds for Equity Options Traded at Euronext Amsterdam Premium Based Tick Size

Premium Based Tick Size Premium thresholds for equity options traded at Euronext Amsterdam Trading Trading Premium Company symbol symbol threshold Underlying American European €0.50 €5.00 1 Aalberts AAI x 2 ABN AMRO Bank ABN x 3 Accell Group ACC x 4 Adidas ADQ x 5 Adyen (contract size 10) ADY x 6 Aegon AGN x 7 Ageas AGA x 8 Ahold Delhaize, koninklijke AH AH9 x 9 Air France-KLM AFA x 10 Akzo Nobel AKZ x 11 Allianz AZQ x 12 Altice Europe ATC x 13 AMG AMG x 14 Aperam AP x 15 Arcadis ARC x 16 ArcelorMittal MT MT9 x 17 ASM International ASM x 18 ASML Holding ASL AS9 x 19 ASR Nederland ASR x 20 BAM Groep, koninklijke BAM x 21 Basf BFQ x 22 Bayer REG BYQ x 23 Bayerische Motoren Werke BWQ x 24 BE Semiconductor Industries BES x 25 BinckBank BCK x 26 Boskalis Westminster, koninklijke BOS x 27 Brunel International BI x 28 Coca-Cola European Partners CCE x 29 CSM CSM x 30 Daimler REGISTERED SHARES DMQ x 31 Deutsche Bank DBQ x 32 Deutsche Lufthansa AG LUQ x 33 Deutsche Post REG DPQ x 34 Deutsche Telekom REG TKQ x 35 DSM, koninklijke DSM x 36 E.ON EOQ x 37 Euronext ENX x 38 Flow Traders FLW x 39 Fresenius SE & CO KGAA FSQ x 40 Fugro FUR x 41 Grandvision GVN x 42 Heijmans HEY x 43 Heineken HEI x 44 IMCD IMD x 45 Infineon Technologies NTQ x 46 ING Groep ING IN9 x 47 Intertrust ITR x 48 K+S KSQ x 49 Kiadis Pharma KDS x 50 Klépierre CIO x 51 KPN, koninklijke KPN x 52 Marel MAR x 53 Muenchener Rueckver REG MRQ x 54 NIBC Holding NIB x 55 NN Group NN x 56 NSI NSI x 57 OCI OCI x 58 Ordina ORD x 59 Pharming Group PHA x 60 Philips Electronics, koninklijke PHI -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

United States of America Before the Board of Governors of the Federal Reserve System Washington, D.C

DE NEDERLANDSCHE BANK N.V. AMSTERDAM, THE NETHERLANDS UNITED STATES OF AMERICA BEFORE THE BOARD OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM WASHINGTON, D.C. STATE OF ILLINOIS DEPARTMENT OF FINANCIAL AND PROFESSIONAL REGULATION NEW YORK STATE BANKING DEPARTMENT NEW YORK, NEW YORK ____________________________________ In the Matter of ) ) FRB Dkt. No. 05-035-B-FB ABN AMRO BANK N.V. ) Amsterdam, The Netherlands ) Order to issue a Direction ) (in Dutch, “Besluit tot het geven van ABN AMRO BANK N.V. ) een aanwijzing”); NEW YORK BRANCH ) Order to Cease and Desist New York, New York ) Issued Upon Consent ) ABN AMRO BANK N.V. ) CHICAGO BRANCH, ) Chicago, Illinois ) ____________________________________) WHEREAS, De Nederlandsche Bank (“DNB”) is the home country supervisor of ABN AMRO Bank N.V., Amsterdam, The Netherlands (“ABN AMRO”), a Netherlands bank; WHEREAS, the Board of Governors of the Federal Reserve System (the “Board of Governors”) is the host country supervisor in the United States of ABN AMRO, which is both a foreign bank as defined in section 3101(7) of the International Banking Act (12 U.S.C. § 3101(7)), including its New York Branch and its Chicago Branch (collectively, the “Branches”), and a registered bank holding company; WHEREAS, the Illinois Department of Financial and Professional Regulation, Division of Banking (the “IDFPR”), pursuant to the authority provided under Section 3 of the Foreign Banking Office Act, (205 ILCS 645/1 et seq.) supervises and has examination authority over the foreign banking office maintained by ABN AMRO in the state of Illinois; WHEREAS, the New York State Banking Department (the “NYSBD”) is the licensing agency of the New York Branch of ABN AMRO, pursuant to Article II of the New York Banking Law (“NYBL”), and is responsible for the supervision and regulation thereof pursuant to the NYBL; WHEREAS, the Board of Governors, the NYSBD, the IDFPR (collectively, the “U.S. -

ABN AMRO Annual Report 2003

Annual Report 2003 ABN AMRO Holding N.V. Profile ABN AMRO • is a prominent international bank with origins going back to 1824 • ranks eleventh in Europe and twenty-third in the world based on tier 1 capital • has more than 3,700 branches in over 60 countries and territories, a staff of about 110,000 full-time equivalents and total assets of EUR 560 billion as of year-end 2003 • is listed on the Euronext Amsterdam, London and New York Stock Exchanges, among others. Our business strategy is built on five key elements: 1. Creating value for our clients by offering high-quality financial solutions which best meet their current needs and long-term goals 2. Focusing on: • consumer and commercial clients in our home markets of the Netherlands, the United States Midwest, Brazil and in selected growth markets around the world • selected wholesale clients with an emphasis on Europe, and financial institutions • private clients 3. Leveraging our advantages in products and people to benefit all our clients 4. Sharing expertise and operational excellence across the group 5. Creating ‘fuel for growth’ by allocating capital and talent according to the principles of Managing for Value, our value-based management model. The goal is sustainable growth which will benefit all our stakeholders: clients, shareholders, employees and society at large. ABN AMRO’s Corporate Values and Business Principles guide everything we do as an organisation and as individuals. We basically implement the strategy through three Strategic Business Units: • Consumer & Commercial Clients (C&CC) – for individual and corporate clients requiring day-to-day banking. -

Successful NLII Business Loan Fund Continues to Grow

Successful NLII business loan fund continues to grow Another € 480 million available for Dutch SMEs through institutional investors Amsterdam/Rotterdam, 8 March 2017 – Dutch investment institution Nederlandse Investeringsinstelling N.V. (NLII) and Robeco today announce that the SME corporate lending fund Bedrijfsleningenfonds (BLF), created by NLII with Robeco acting as fund manager, has raised € 480 million in the second funding round, bringing the fund total to € 960 million. This will make extra funding from institutional investors available to larger Dutch SMEs. An amount of € 195 million has already been lent to Dutch SMEs since the fund was established. The parties participating in this second round of funding are NN Group, Pensioenfonds Metaal & Techniek (PMT), Pensioenfonds van de Metalektro (PME), a.s.r. and the European Investment Fund (EIF). Most of these parties also participated in the first funding round. NLII CEO Loek Sibbing: “The success of the BLF is clearly highlighted by this second round of funding. Our objective is to enable institutional investors such as pension funds and insurers to invest directly in the Dutch economy and that is exactly what the BLF offers investors. The fund has already enabled a number of Dutch companies to continue to grow. Expanding the fund increases the lending opportunities for SMEs significantly.” Robeco BLF fund manager Erik Hylarides: “The BLF was established to bring about a change in the funding landscape by offering companies access to multiple sources of finance. The current expansion of the fund and the pipeline of transactions we are working on prove that this has been a success. -

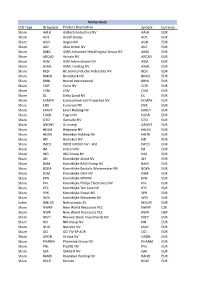

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV -

Aegon Fixed Income

Executing our strategy April 2014 Fixed income presentation aegon.com Key messages . Focus on executing our strategy is delivering clear results ► Strategic transformation to become a truly customer-centric company is well underway ► Solid business growth is driving increase in profitability ► Risk profile significantly improved . Executing on balanced capital deployment strategy, supporting a sustainable dividend . Making progress towards 2015 targets . Intention to remain on track to be within leverage target ranges by the end of 2014 2 Over 150 Life insurance, pensions years of & asset management history AA- financial Present in more than 25 strength rating markets throughout the Americas, Europe and Asia Underlying earnings before tax Revenue-generating investments Paid out in claims and benefits in 2013 in 2013 Over EUR 1.9 EUR 20 26,500 billion billion EMPLOYEES1 EUR 475 billion1 Aegon at a glance 1) As per December 31, 2013 3 Building on leading market positions United States United Kingdom The Netherlands China of America # 7 Individual pensions # 1 Group pensions # 11 of foreign-owned life # 5 Individual life # 3 Group pensions # 6 Individual life insurers in China # 8 Variable Annuities # 10 Individual protection # 6 Accident & health # 12 Pensions # 10 Annuities # 10 Property & casualty Japan Canada Central & Spain # 1 Variable annuities # 5 Universal life Eastern Europe Historic positions do not reflect # 6 Term life # 1 Household in Hungary current business India # 6 Life in Hungary Start up # 3 Pensions Romania1 Brazil # -

Controversial Arms Trade

Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Case study: Controversial Arms Trade A case study prepared for the Fair Insurance Guide Anniek Herder Alex van der Meulen Michel Riemersma Barbara Kuepper 18 June 2015, embargoed until 18 June 2015, 00:00 CET Naritaweg 10 1043 BX Amsterdam The Netherlands Tel: +31-20-8208320 E-mail: [email protected] Website: www.profundo.nl Contents Summary ..................................................................................................................... i Samenvatting .......................................................................................................... viii Introduction ................................................................................................................ 1 Chapter 1 Background ...................................................................................... 2 1.1 What is at stake? ....................................................................................... 2 1.2 Trends in international arms trade .......................................................... 3 1.3 International standards............................................................................. 4 1.3.1 Arms embargoes ......................................................................................... 4 1.3.2 EU arms export policy ................................................................................. 4 1.3.3 Arms Trade Treaty ..................................................................................... -

Abn Amro Group N.V

PRICING STATEMENT ABN AMRO GROUP N.V. (a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands, with its corporate seat in Amsterdam, the Netherlands) 2 Initial public offering of 188,000,000 depositary receipts representing 188,000,000 Ordinary Shares at a price of €17.75 per Offer DR This pricing statement (the “Pricing Statement”) relates to the Offering as referred to in the prospectus of ABN AMRO Group N.V. (the “Company”) dated 10 November 2015 (the “Prospectus”). The Offering consists of: (i) a public offering in the Netherlands to institutional and retail investors and (ii) a private placement to certain institutional and other investors that qualify under available offering exemptions in various other jurisdictions. The Offer DRs are being offered: (i) by private placement within the United States of America (the “US”), to persons reasonably believed to be “qualified institutional buyers” as defined in, and in reliance on, Rule 144A under the US Securities Act of 1933, as amended (the “US Securities Act”), and (ii) outside the US, where all offers and sales of the Offer DRs will be made in compliance with Regulation S under the US Securities Act. This Pricing Statement has been prepared in accordance with section 5:18(2) of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht; the “FMSA”) and has been filed with the Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten, the “AFM”). This Pricing Statement is being made generally available in the Netherlands in accordance with section 5:21(3) of the FMSA. -

1 23 April 2007 for Immediate Release ABN AMRO and BARCLAYS ANNOUNCE AGREEMENT on TERMS of MERGER the Managing Board and Supervi

This document shall not constitute an offer to sell or buy or the solicitation of an offer to buy or sell any securities, nor shall there be any sale or purchase of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The availability of the Offer to persons not resident in the United States, the Netherlands and the United Kingdom may be affected by the laws of the relevant jurisdictions. Such persons should inform themselves about and observe any applicable requirements. 23 April 2007 For immediate release ABN AMRO AND BARCLAYS ANNOUNCE AGREEMENT ON TERMS OF MERGER The Managing Board and Supervisory Board of ABN AMRO Holding N.V. (“ABN AMRO”) and the Board of Directors of Barclays PLC (“Barclays”) jointly announce that agreement has been reached on the combination of ABN AMRO and Barclays. Each of the Boards has unanimously resolved to recommend the transaction to its respective shareholders. The holding company of the combined group will be called Barclays PLC. The proposed merger of ABN AMRO and Barclays will create a strong and competitive combination for its clients with superior products and extensive distribution. The merged group is expected to generate significant and sustained future incremental earnings growth for shareholders. The combination of ABN AMRO and Barclays will benefit from a diversified customer base and geographic mix. The proposed merger will create: • A leading force in global retail and commercial banking, with world class products: o 47 million customers, approximately 90 per cent. -

1 Modern Slavery Statement May 2021 About ABN AMRO ABN

Modern Slavery Statement May 2021 About ABN AMRO ABN AMRO Bank N.V. is one of the Netherlands’ leading banks, with over 19,000 ABN AMRO employees worldwide. We create value for our stakeholders by providing individuals and businesses with banking services such as loans, mortgages, payments, savings, advice and asset management. Our focus is on Northwest Europe. Outside the Netherlands, ABN AMRO has offices in 13 countries, among which in the United Kingdom and Australia. We fund our loans through savings and capital markets, and actively manage the risks associated with them. In return for our services, we receive interest, fees and commissions. We use our income to pay for our operating costs, reinvest in our business and distribute dividend to our investors. This Modern Slavery Statement has been issued to comply with ABN AMRO’s obligations under the UK Modern Slavery Act and the Australian Modern Slavery Act. It has been prepared in cooperation with all the bank’s relevant business lines and support departments, including ABN AMRO’s branches and subsidiaries in the United Kingdom and Australia. Under this legislation, companies are obliged to provide information on the steps they have taken to address modern slavery risks in their own business operations and value chains. ABN AMRO may be exposed to modern slavery risks through the services it offers retail and business clients, through companies in its investment universe, through its employment practices and through suppliers of goods and services it procures. Of the different forms of modern slavery, ABN AMRO is predominantly exposed to risks of labour exploitation.