Annual Report 2018 — Boskalis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PREFERENCE SHARES, NOMINAL VALUE of E2.24 PER SHARE, in the CAPITAL OF

11JUL200716232030 3JUL200720235794 11JUL200603145894 Public Offer by RFS Holdings B.V. FOR ALL OF THE ISSUED AND OUTSTANDING (FORMERLY CONVERTIBLE) PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO Holding N.V. Offer Memorandum and Offer Memorandum for ABN AMRO ordinary shares (incorporated by reference in this Offer Memorandum) 20 July 2007 This Preference Shares Offer expires at 15:00 hours, Amsterdam time, on 5 October 2007, unless extended. OFFER MEMORANDUM dated 20 July 2007 11JUL200716232030 3JUL200720235794 11JUL200603145894 PREFERENCE SHARES OFFER BY RFS HOLDINGS B.V. FOR ALL THE ISSUED AND OUTSTANDING PREFERENCE SHARES, NOMINAL VALUE OF e2.24 PER SHARE, IN THE CAPITAL OF ABN AMRO HOLDING N.V. RFS Holdings B.V. (‘‘RFS Holdings’’), a company formed by an affiliate of Fortis N.V. and Fortis SA/NV (Fortis N.V. and Fortis SA/ NV together ‘‘Fortis’’), The Royal Bank of Scotland Group plc (‘‘RBS’’) and an affiliate of Banco Santander Central Hispano, S.A. (‘‘Santander’’), is offering to acquire all of the issued and outstanding (formerly convertible) preference shares, nominal value e2.24 per share (‘‘ABN AMRO Preference Shares’’), of ABN AMRO Holding N.V. (‘‘ABN AMRO’’) on the terms and conditions set out in this document (the ‘‘Preference Shares Offer’’). In the Preference Shares Offer, RFS Holdings is offering to purchase each ABN AMRO Preference Share validly tendered and not properly withdrawn for e27.65 in cash. Assuming 44,988 issued and outstanding ABN AMRO Preference Shares outstanding as at 31 December 2006, the total value of the consideration being offered by RFS Holdings for the ABN AMRO Preference Shares is e1,243,918.20. -

Prospectus Tomtom Dated 1 July 2009

TomTom N.V. (a public company with limited liability, incorporated under Dutch law, having its corporate seat in Amsterdam, The Netherlands) Offering of 85,264,381 Ordinary Shares in a 5 for 8 rights offering at a price of €4.21 per Ordinary Share We are offering 85,264,381 new Ordinary Shares (as defined below) (the “Offer Shares”). The Offer Shares will initially be offered to eligible holders (“Shareholders”) of ordinary shares in our capital with a nominal value of €0.20 each (“Ordinary Shares”) pro rata to their shareholdings at an offer price of €4.21 each (the “Offer Price”), subject to applicable securities laws and on the terms set out in this document (the “Prospectus”) (the “Rights Offering”). For this purpose, and subject to applicable securities laws and the terms set out in this Prospectus, Shareholders as of the Record Date (as defined below) are being granted transferable subscription entitlements (“SETs”) that will entitle them to subscribe for Offer Shares at the Offer Price, provided that they are Eligible Persons (as defined below). Shareholders as of the Record Date (as defined below) and subsequent transferees of the SETs, in each case which are able to give the representations and warranties set out in “Selling and Transfer Restrictions”, are “Eligible Persons” with respect to the Rights Offering. Application has been made to admit the SETs to trading on Euronext Amsterdam by NYSE Euronext, a regulated market of Euronext Amsterdam N.V., (“Euronext Amsterdam”). Trading of the SETs on Euronext Amsterdam is expected to commence at 09:00 (Central European Time; “CET”) on 3 July 2009 and will continue until 13:00 (CET) on 13 July 2009, barring unforeseen circumstances. -

DSM's Integrated Annual Report 2015

Royal DSM Integrated Annual Report 2015 WorldReginfo - c41a4efa-17eb-497c-8f68-03022dabfb88 WorldReginfo - c41a4efa-17eb-497c-8f68-03022dabfb88 DSM at a glance Nutrition DSM Resins & Functional Materials is a global player in developing, manufacturing and marketing high-quality resins The Nutrition cluster comprises DSM Nutritional Products and solutions for paints, industrial coatings and fiber-optic coatings. DSM Food Specialties.These businesses serve the global Continuous innovation means that customers can meet industries for animal feed, food and beverage, pharmaceutical, regulatory needs and respond better to consumer demands for infant nutrition, dietary supplements and personal care. more sustainable materials. DSM Nutritional Products is one of the world’s leading Innovation Center producers of essential nutrients such as vitamins, carotenoids, nutritional lipids and other ingredients to the feed, food, DSM Innovation Center serves as an enabler and accelerator pharmaceutical and personal care industries. Among its of innovation within DSM as well as providing support to the customers are the world’s largest food and beverage clusters. With its Emerging Business Areas, the Business companies. DSM is uniquely positioned thanks to the Incubator and DSM Venturing & Licensing, the DSM Innovation combination of its broad portfolio of active ingredients, maximum Center has a general business development role, focusing on differentiation through formulation, local presence, a global areas outside the current scope of the business groups. premix network, and a strong focus on innovation. DSM Nutritional Products consists of the following business units: DSM’s Emerging Business Areas provide strong long-term growth platforms based on the company’s core competences Animal Nutrition & Health addresses the nutritional additives in life sciences and materials sciences. -

Royal DSM N.V. Annual Report 2006

Royal DSM N.V. Annual Report 2006 Brighter Wider Better Together DSM Profile DSM is active worldwide in nutritional and pharma ingredients, performance materials and industrial chemicals. The company develops, produces and sells innovative products and services that help improve the quality of life. DSM’s products are used in a wide range of end-markets and applications, such as human and animal nutrition and health, personal care, pharmaceuticals, automotive and transport, coatings and paint, housing and electrics & electronics (E&E). DSM’s strategy, named Vision 2010 – Building on Strengths, focuses on accelerating profitable and innovative growth of the company’s specialties portfolio. The key drivers of this strategy are market-driven growth and innovation plus an increased presence in emerging economies. The group has annual sales of over €8 billion and employs some 22,000 people worldwide. DSM ranks among the global leaders in many of its fields. The company is headquartered in the Netherlands, with locations in Europe, Asia, Africa, Australia and the Americas. More information about DSM can be found at www.dsm.com. Annual Report 2005 www.dsm.com DSM at a glance DSM’s activities have been grouped into business groups representing coherent product / market combinations. The business group directors report directly to the Managing Board. Nutrition Pharma €2,407m €916m DSM Nutritional Products DSM Pharmaceutical Products DSM Nutritional Products is the world’s largest supplier of nutri- DSM Pharmaceutical Products is one of the world’s leading tional ingredients, such as vitamins, carotenoids (anti-oxidants providers of high quality global custom manufacturing services and pigments), other biochemicals and fine chemicals, and to the pharmaceutical, biotech and agrochemical industries. -

Randstad Annual Report 2019

annual report 2019 realizing true potential. contents randstad at a glance management report governance financial statements supplementary information contents. randstad at a glance financial statements 4 key figures 2019 135 contents financial statements 6 message from the CEO 136 consolidated financial statements 8 about randstad 140 main notes to the consolidated financial statements 14 our global presence 170 notes to the consolidated income statement 15 geographic spread 174 notes to the consolidated statement of financial 16 realizing true potential position 189 notes to the consolidated statement of management report cash flows 19 how we create value 193 other notes to the consolidated financial statements 24 integrated reporting framework 200 company financial statements 26 the world around us 202 notes to the company financial statements 31 our strategy and progress 206 other information 36 our value for clients and talent 41 our value for employees supplementary information 47 our value for investors 217 financial calendar 52 our value for society 218 ten years of randstad 58 sustainability basics 220 about this report 71 performance 222 sustainable development goals 88 risk & opportunity management 223 GRI content index 227 global compact index governance 228 sustainability and industry memberships and 102 executive board partnerships 104 supervisory board 229 certifications, rankings, and awards 106 report of the supervisory board 231 highest randstad positions in industry associations 115 remuneration report 232 glossary 128 corporate governance 238 history timeline annual report 2019 2 contents randstad at a glance management report governance financial statements supplementary information randstad at a glance. 4 key figures 2019 6 message from the CEO 8 about randstad 14 our global presence 15 geographic spread 16 realizing true potential annual report 2019 3 contents randstad at a glance management report governance financial statements supplementary information key figures 2019. -

Agenda20 21 Annual General Meeting of Shareholders

Agenda20 21 Annual General Meeting of Shareholders Agenda Agenda for the Virtual Annual General Meeting of Shareholders of Wolters Kluwer N.V., to be held on Thursday, April 22, 2021, at 3.00 PM CET. Formally the meeting will be held at the Corporate Office of Wolters Kluwer, Zuidpoolsingel 2, 2408 ZE in Alphen aan den Rijn, the Netherlands. In accordance with the Temporary Act COVID-19 Justice and Safety, shareholders can only attend the meeting virtually and if desired vote real-time via www.abnamro.com/evoting. 1 Opening 2 2020 Annual Report a Report of the Executive Board for 2020 b Report of the Supervisory Board for 2020 c Advisory vote on the remuneration report as included in the 2020 Annual Report * 3 2020 Financial Statements and dividend a Proposal to adopt the Financial Statements for 2020 as included in the 2020 Annual Report * b Explanation of dividend policy c Proposal to distribute a total dividend of €1.36 per ordinary share, resulting in a final dividend of €0.89 per ordinary share * 4 Release of the members of the Executive Board and the Supervisory Board from liability for the exercise of their respective duties a Proposal to release the members of the Executive Board for the exercise of their duties * b Proposal to release the members of the Supervisory Board for the exercise of their duties * 5 Composition Supervisory Board a Proposal to reappoint Mr. Frans Cremers as member of the Supervisory Board * b Proposal to reappoint Ms. Ann Ziegler as member of the Supervisory Board * 6 Proposal to reappoint Mr. -

Wolters Kluwer Governance Roadshow

Wolters Kluwer Governance Roadshow Selection & Remuneration Committee of the Supervisory Board of Wolters Kluwer November 2020 Governance Roadshow, November 2020 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. Governance Roadshow, November 2020 2 Agenda Wolters Kluwer NV - Selection & Remuneration Committee Current remuneration policy and how it links to strategy Remuneration consultation Proposed changes Proposed ESG measures in STIP Current policy versus proposed changes Next steps Appendix Governance Roadshow, November 2020 3 Selection & Remuneration Committee The Selection & Remuneration Committee is responsible for Executive Board succession planning and remuneration policy Frans Cremers Jeanette Horan Ann Ziegler . -

Starters Economic Outlook Recent Research Current Research

1997/4 CCPPR BB E P O R T STARTERS CURRENT RESEARCH When in doubt, deregulate? How efficient is Dutch electricity generation? 45 Eric Bartelsman 3 Maurice Dykstra ACTIVITIES ECONOMIC OUTLOOK Workshops The world economy: short-term developments 5 • Assessing infrastructure projects 48 The Dutch economy: short-term developments 7 Ernst van Koesveld and Pim van Santen • Challenging Neighbours 50 The world economy: medium-term prospects 13 Hans Timmer The Dutch economy: medium-term prospects 14 • Regulating Dutch tele-competition 52 Sectoral developments in the Dutch economy: Paul Arnoldus medium-term prospects 17 Seminar series 54 Note on unemployment definitions 19 FORUM RECENT RESEARCH Challenging partners 56 Detecting relevant policy issues on Bart van Ark competition and regulation 20 Harold Creusen Scanning CPB: A view from the outside 57 Anton Barten Economic effects of liberalizing shop opening hours in the Netherlands 24 Yvonne Bernardt How competitive is the Dutch coffee market? 27 RECENT PUBLICATIONS Leon Bettendorf and Frank Verboven Working papers 59 Competition in communication and Research memoranda 59 information services 30 Publications about forecasting activities 59 Marcel Canoy Special publication 59 Competition in health care: Ordering information 60 A Dutch experiment 34 Eric Bartelsman and Philip ten Cate Assessing the economy-wide effects of deregulation 39 ECONOMIC INDICATORS Ate Nieuwenhuis Basic statistics of the Netherlands 61 Competition and welfare 42 Tables 62 Jan Boone Explanations to Tables 68 _CPRB B E P O R T 97/4 2 S eason’s greetings and best wishes for 1998 STARTERS _CPR B B E P O R T 97/4 When in doubt, deregulate? “As an advice-giving profession we are in way over our heads.” Robert E. -

2009 Annual Report

Annual Report 2009 Ambitious, committed, independent and professional. Four core values that are embodied by our bank and our employees. In 2009, a turbulent year, we continued to steer our own course. We took an independent line and proved we are a stable bank that is committed to our clients, and uses all the knowledge and professional expertise at our disposal to provide them with the best possible service. The high standards we set ourselves reflect our ambition. Essentially, little has changed at our bank, where we have continued as we have done for nearly 275 years. Ambitious, committed, independent and professional: these values are part of our DNA. Annual report 2009 20 Ambitious Tom de Swaan 34 Committed Jessica Biermans 44 Professional Anna Bouman 54 Independent Hans Jacobs Contents Profile Supplementary notes 5 184 Acquisitions in 2009 186 Consolidated balance sheet by accounting policy at Strategy 31 December 2009 6 187 Consolidated balance sheet by accounting policy at 31 December 2008 Key data 188 Remuneration of the Board of Managing Directors and 8 Supervisory Board 192 Related parties Information for shareholders 194 Non-current liabilities 10 196 Segment information 201 Events after the balance sheet date Message from the Chairman of the Board of Managing Directors Company financial statements 14 203 Company balance sheet at 31 December 2009 204 Company income statement for 2009 Report of the Supervisory Board 205 Accounting policies for the company financial statements 16 206 Notes to the company financial statements Financial -

Wolters Kluwer Governance Roadshow

Wolters Kluwer Governance Roadshow Selection & Remuneration Committee of the Supervisory Board of Wolters Kluwer September, 2020 Governance Roadshow, September 2020 1 Forward-looking statements This presentation contains forward-looking statements. These statements may be identified by words such as "expect", "should", "could", "shall", and similar expressions. Wolters Kluwer cautions that such forward-looking statements are qualified by certain risks and uncertainties that could cause actual results and events to differ materially from what is contemplated by the forward-looking statements. Factors which could cause actual results to differ from these forward-looking statements may include, without limitation, general economic conditions, conditions in the markets in which Wolters Kluwer is engaged, behavior of customers, suppliers and competitors, technological developments, the implementation and execution of new ICT systems or outsourcing, legal, tax, and regulatory rules affecting Wolters Kluwer's businesses, as well as risks related to mergers, acquisitions and divestments. In addition, financial risks, such as currency movements, interest rate fluctuations, liquidity and credit risks could influence future results. The foregoing list of factors should not be construed as exhaustive. Wolters Kluwer disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Growth rates are cited in constant currencies unless otherwise noted. -

Abn Amro Bank Nv

7 MAY 2020 ABN AMRO ABN AMRO BANK N.V. REGISTRATION DOCUMENT constituting part of any base prospectus of the Issuer consisting of separate documents within the meaning of Article 8(6) of Regulation (EU) 2017/1129 (the "Prospectus Regulation") 250249-4-270-v18.0 55-40738204 CONTENTS Page 1. RISK FACTORS ...................................................................................................................................... 1 2. INTRODUCTION .................................................................................................................................. 26 3. DOCUMENTS INCORPORATED BY REFERENCE ......................................................................... 28 4. SELECTED DEFINITIONS AND ABBREVIATIONS ........................................................................ 30 5. PRESENTATION OF FINANCIAL INFORMATION ......................................................................... 35 6. THE ISSUER ......................................................................................................................................... 36 1.1 History and recent developments ............................................................................................. 36 1.2 Business description ................................................................................................................ 37 1.3 Regulation ............................................................................................................................... 40 1.4 Legal and arbitration proceedings .......................................................................................... -

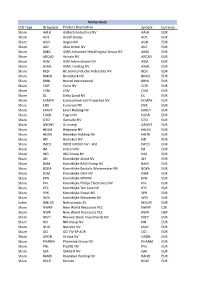

CFD Type IB Symbol Product Description Symbol Currency Share

Netherlands CFD Type IB Symbol Product Description Symbol Currency Share AALB Aalberts Industries NV AALB EUR Share AO1 Accell Group AO1 EUR Share AGN Aegon NV AGN EUR Share AKZ Akzo Nobel NV AKZ EUR Share AMG AMG Advanced Metallurgical Group NV AMG EUR Share ARCAD Arcadis NV ARCAD EUR Share ASM ASM International NV ASM EUR Share ASML ASML Holding NV ASML EUR Share BESI BE Semiconductor Industries NV BESI EUR Share BINCK BinckBank NV BINCK EUR Share BRNL Brunel International BRNL EUR Share COR Corio NV COR EUR Share CSM CSM CSM EUR Share DL Delta Lloyd NV DL EUR Share ECMPA Eurocommercial Properties NV ECMPA EUR Share ENX Euronext NV ENX EUR Share EXACT Exact Holding NV EXACT EUR Share FUGR Fugro NV FUGR EUR Share GTO Gemalto NV GTO EUR Share GRONT Grontmij GRONT EUR Share HEIJM Heijmans NV HEIJM EUR Share HEHN Heineken Holding NV HEHN EUR Share HEI Heineken NV HEI EUR Share IMCD IMCD GROUP NV - W/I IMCD EUR Share IM Imtech NV IM EUR Share ING ING Groep NV ING EUR Share AH Koninklijke Ahold NV AH EUR Share BAM Koninklijke BAM Groep NV BAM EUR Share BOKA Koninklijke Boskalis Westminster NV BOKA EUR Share DSM Koninklijke DSM NV DSM EUR Share KPN Koninklijke KPN NV KPN EUR Share PHI Koninklijke Philips Electronics NV PHI EUR Share KTC Koninklijke Ten Cate NV KTC EUR Share VPK Koninklijke Vopak NV VPK EUR Share WES Koninklijke Wessanen NV WES EUR Index IBNL25 Netherlands 25 IBNL25 EUR Share NWRP New World Resources PLC NWRP CZK Share NWR New World Resources PLC NWR GBP Share NISTI Nieuwe Steen Investments NV NISTI EUR Share NN NN Group NV