Wolters Kluwer Governance Roadshow

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

RSPO Letterhead

EB 02-08 Minutes of Executive Board Meeting Date : 27 May 2008 Venue : Teleconference Start time : 0800 (UK), 0900 (Nl), 1400 (Ina), 1500(My) Attendees: Apologies: 1. Derom Bangun ( GAPKI) 2. Paul Norton (HSBC Malaysia) 1. Johann Zueblin (Migros) 3. Ian McIntosh (AAK) 2. Tim Stephenson ( AAK) 4. Christophe Liebon (Intertek) 3. Simon Lord ( Kulim Malaysia Bhd 5. Don Grubba ( IOI) ) 6. Johan Verburg (Oxfam) 4. Tony Lass ( Cadbury 7. Jan Kees Vis ( Unilever) – Chair Schweppes) 8. Chew Jit Seng (MPOA) 5. Fitrian Adrianshah (WWF- 9. Mamat Salleh (MPOA) Indonesia) 10.MR Chandran (RSPO EB Advisor) 6. Matthias Diemer ( WWF – 11.Thomas Barano ( WWF- Indonesia) Switzerland) 12.Robert Keller ( MIGROS) 7. Mohd Nor Kailany ( Felda) 13.Rudy Lumuru ( Sawit Watch) 8. Samantha Lacey ( CIS) 14.Chong Wei Kwang ( HSBC Malaysia) 9. Darrel Webber ( WWF- Malaysia) 15.Vengeta Rao (VR, Secretariat) 10.Didiek Hajar Gunadi (GAPKI) 16.Desi Kusumadewi ( RILO) AGENDA 1. Introduction and RSPO Antitrust laws 2. Confirmation of minutes of EB 01-08 3. Secretariat 3.1 Accounts & finances 3.1.1 Update on RSPO Accounts to end March 2008 3.1.2 Update on RSPO Sdn Bhd Accounts to end March 2008 3.2 Secretariat updates 3.2.1 Update from Secretary General including RILO matters 4. Membership 4.1 Outstanding/defaulting RSPO Members 4.2 Grievances 4.3 Outstanding Membership applications 4.4 Revised membership application procedures and flowchart 5. Executive Board matters 5.1 Welcome New Members / Alternates / Changes 5.2 EB Retailers seat 5.3 Approval of Ina – NI 5.4 Approval of CBs – PT Mutu Agung (Ina), PT TUV Nord (Ina) 5.5 RT6 theme, delegates fees, exhibition rentals and sponsorships 5.6 RSPO FAQ on C7.3 – cut off date 6. -

Genome Editing with CRISPR/Cas9 in Postnatal Mice Corrects PRKAG2 Cardiac Syndrome

Cell Research (2016) 26:1099-1111. © 2016 IBCB, SIBS, CAS All rights reserved 1001-0602/16 $ 32.00 ORIGINAL ARTICLE www.nature.com/cr Genome editing with CRISPR/Cas9 in postnatal mice corrects PRKAG2 cardiac syndrome Chang Xie1, 2, *, Ya-Ping Zhang3, *, Lu Song2, *, Jie Luo1, Wei Qi2, Jialu Hu3, Danbo Lu3, Zhen Yang3, Jian Zhang2, Jian Xiao1, Bin Zhou4, Jiu-Lin Du5, Naihe Jing2, Yong Liu1, Yan Wang1, Bo-Liang Li2, Bao-Liang Song1, Yan Yan3 1Hubei Key Laboratory of Cell Homeostasis, College of Life Sciences, Wuhan University, Wuhan 430072, China; 2The State Key Laboratory of Molecular Biology, Institute of Biochemistry and Cell Biology, Shanghai Institutes for Biological Sciences, Chinese Academy of Sciences, 320 Yue-Yang Road, Shanghai 200031, China; 3Shanghai Institute of Cardiovascular Diseases, Zhongshan Hospital, Fudan University, Shanghai 200032, China; 4Key Laboratory of Nutrition and Metabolism, Institute for Nutritional Sci- ences, Shanghai Institutes for Biological Sciences, Chinese Academy of Sciences, 320 Yue-Yang Road, Shanghai 200031, China; 5Institute of Neuroscience and State Key Laboratory of Neuroscience, Shanghai Institutes for Biological Sciences, Chinese Acade- my of Sciences, 320 Yue-Yang Road, Shanghai 200031, China PRKAG2 cardiac syndrome is an autosomal dominant inherited disease resulted from mutations in the PRK- AG2 gene that encodes γ2 regulatory subunit of AMP-activated protein kinase. Affected patients usually develop ventricular tachyarrhythmia and experience progressive heart failure that is refractory to medical treatment and requires cardiac transplantation. In this study, we identify a H530R mutation in PRKAG2 from patients with famil- ial Wolff-Parkinson-White syndrome. By generating H530R PRKAG2 transgenic and knock-in mice, we show that both models recapitulate human symptoms including cardiac hypertrophy and glycogen storage, confirming that the H530R mutation is causally related to PRKAG2 cardiac syndrome. -

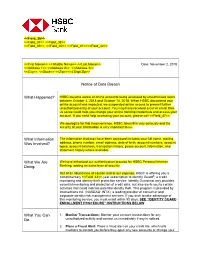

HSBC Became Aware of Online Accounts Being Accessed by Unauthorized Users Between October 4, 2018 and October 14, 2018

<<Field_36>> <<Field_37>> <<Field_38>> <<Field_39>>, <<Field_40>> <<Field_41>><<Field_42>> <<First Name>> << Middle Name>> <<Last Name>> Date: November 2, 2018 <<Address 1>> <<Address 2>> <<Address 3>> <<City>>, <<State>> <<Zip>><<4 Digit Zip>> Notice of Data Breach What Happened? HSBC became aware of online accounts being accessed by unauthorized users between October 4, 2018 and October 14, 2018. When HSBC discovered your online account was impacted, we suspended online access to prevent further unauthorized entry of your account. You may have received a call or email from us so we could help you change your online banking credentials and access your account. If you need help accessing your account, please call <<Field_47>>. We apologize for this inconvenience. HSBC takes this very seriously and the security of your information is very important to us. What Information The information that may have been accessed includes your full name, mailing Was Involved? address, phone number, email address, date of birth, account numbers, account types, account balances, transaction history, payee account information, and statement history where available. What We Are We have enhanced our authentication process for HSBC Personal Internet Doing. Banking, adding an extra layer of security. Out of an abundance of caution and at our expense, HSBC is offering you a complimentary <<Field_43>>-year subscription to Identity Guard®, a credit monitoring and identity theft protection service. Identity Guard not only provides essential monitoring and protection of credit data, but also alerts you to certain activities that could indicate potential identity theft. This program is provided by Intersections Inc. (NASDAQ: INTX), a leading provider of consumer and corporate identity risk management services. -

Introduction to the Sage Group Plc

Introduction to The Sage Group plc December 2013 An introduction to The Sage Group plc 1 Our vision Our vision is to be recognised as the most valuable supporter of small and medium sized companies by creating greater freedom for them to succeed. An introduction to The Sage Group plc 2 What we do We provide small and medium sized Businesses come in all shapes and sizes organisations with a range of easy-to-use and while every one of our customers is unique they have common technology business management software and needs - for simple, secure and smart services - from accounting and payroll, to solutions that reduce complexity and risk. enterprise resource planning, customer When they have problems that need relationship management and payments. resolving, they want to speak to a real person – someone they can trust. So we make sure we’re always there to listen and help. Our customers receive continuous advice and support through our global network of local experts to help them solve their business problems, giving them the confidence to achieve their business ambitions. An introduction to The Sage Group plc 3 Key facts about our organisation Market Finances Customers ‒ Global company with over ‒ Revenue of £1,376.1m** ‒ Provide advice to 12,700 employees* million for FY2013* customers through 1.9 ‒ Over 6 million customers ‒ Organic revenue growth of million support contracts* worldwide* 4% for 2013 (2012: 2%)* ‒ Manage around 36,000 ‒ One of the market ‒ EBITA £375.8m* customer calls each day* leaders in the UK, North ‒ Market capitalisation of ‒ Work with 22,600 reseller America, Europe, South approximately £4 billion* partners and more than Africa, Asia and Brazil 40,000* accountants ‒ More than 40 acquisitions since 1991 worldwide An introduction to The Sage Group plc *Data for financial year ending September 2013 4 ** Statutory revenue How we started An introduction to The Sage Group plc 5 How we work Our business is guided by our five principles which shape everything we do and how we do it. -

Top Trends Shaping Identity Verification (IDV) in 2018

NOT LICENSED FOR DISTRIBUTION Top Trends Shaping Identity Verification (IDV) In 2018 Post-Equifax Breach, IDV Aggregators Will Cater To Multifaceted IDV Requirements by Andras Cser and Merritt Maxim March 29, 2018 Why Read This Report Key Takeaways In the face of increasing identity theft, stricter IDV Based On Credit Header Data Will Become compliance regulations, and the push for online Weaker — Get Ready To Fight Back customer acquisition, reliable, accurate, cost- After the 2017 Equifax breach, we entered a new effective, and easy-to-use identity verification era in which credit header data for IDV solutions (IDV) is becoming a core building block of any and knowledge-based authentication (KBA) customer or employee identity and access are inadequate for reliable identity verification. management (IAM) system. This document Firms will have to adopt new lower cost and less highlights the key trends shaping the IDV market intrusive IDV technologies, such as those based in 2018 and beyond and helps security and risk on device reputation or phone number. pros adapt their strategies, vendor selection, and Social And Behavioral IDV Will Lower Costs implementation. And Improve Accuracy Social IDV, based on comparing identity attributes to profiles on social media, and behavioral biometrics, verifying identities based on how a user moves the mouse or touches the screen, will lower the cost and improve the accuracy of day- to-day IDV across all verticals. FORRESTER.COM FOR SECURITY & RISK PROFESSIONALS Top Trends Shaping Identity Verification -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Ascential Secure

Ascential Secure Enhanced Health & Safety Standards at Ascential’s Events in a Post-COVID-19 World 1 About Ascential Secure Ascential Secure is our approach to enhanced health and safety standards at our events following COVID-19. From exhibitors to sponsors, speakers, visitors and journalists, those who come to our events do so to gain the information, insights, connections, data and digital tools that they need, effectively and safely. The standards and practices that make up Ascential Secure are designed to provide confidence that at every Ascential event, we are striving to provide the highest standards of safety, hygiene, cleanliness and quality. Whether they are exhibitors, attendees, visitors, speakers or sponsors, people come to events to connect, learn, know more and do more business, effectively, safely and with confidence. Ascential Secure is based on a set of event industry standards, called AllSecure. The AllSecure industry standards were developed collaboratively by a group including industry associations UFI, AEO and SISO, event organisers Informa, Reed Exhibitions and Clarion, a range of event venues, suppliers and with input from health, government and local authorities. Ascential Secure is the way these industry-wide AllSecure standards are being applied to Ascential live events. You can expect to see that health and safety continues to be a priority, and that a range of measures are in place to ensure everyone involved is able to enjoy a safe, hygienic, productive and high-quality organised event experience. As a starting point, Ascential Secure events will be run according to the guidance of the government or official local authority for that location, and according to any venue-specific regulations. -

![[ "Pearson F-1 Rights Offering" ]](https://docslib.b-cdn.net/cover/2251/pearson-f-1-rights-offering-212251.webp)

[ "Pearson F-1 Rights Offering" ]

As filed with the Securities and Exchange Commission on August 8, 2000 Registration No. 333-43198 SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 Amendment No. 1 to FORM F-1 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 PEARSON plc (Exact name of registrant as specified in its charter) England and Wales 2731 Not Required (State or other jurisdiction (Primary Standard Industrial (I.R.S. Employer of incorporation or organization) Classification Code Number) Identification Number) 3 Burlington Gardens Pearson Inc. London, England W1X 1LE 1330 Avenue of the Americas 44-20-7411-2000 New York, New York 10019 (Address, including zip code, and telephone number, (212) 641-2400 including area code, of registrant's principal executive (Name, address, including zip code, and telephone number, offices) including area code, of agent for service) Copies to: Charles E. Engros Robert M. Thomas, Jr. Morgan, Lewis & Bockius LLP Sullivan & Cromwell 101 Park Avenue 125 Broad Street New York, New York 10178 New York, New York 10004 (212) 309-6000 (212) 558-4000 Fax: (212) 309-6273 Fax: (212) 558-3588 Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement. If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ፤ If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. -

Annual Report 2020

In pursuit of progress since Annual report 2020 report Annual Annual report 2020 In pursuit of progress since Annual report 2020 report Annual Annual report 2020 CONTENTS ANNUAL REPORT STRATEGIC REPORT 2 Five-year summary 3 Group overview 4 From the chairman 6 From the chief executive 8 From the editor 9 Business review: the year in detail 13 The Economist Educational Foundation 15 The Economist Group and environmental sustainability 17 Corporate governance: the Wates Principles, our Section 172(1) statement and our guiding principles REPORT AND ACCOUNTS GOVERNANCE 22 Directors 23 Executive team 24 Trustees, board committees 25 Directors’ report 28 Directors’ report on remuneration 31 Financial review CONSOLIDATED FINANCIAL STATEMENTS 35 Independent auditor’s report to the members of The Economist Newspaper Limited 38 Consolidated income statement 39 Consolidated statement of comprehensive income 40 Consolidated balance sheet 41 Consolidated statement of changes in equity 42 Consolidated cashflow statement 44 Notes to the consolidated financial statements COMPANY FINANCIAL STATEMENTS 94 Company balance sheet 95 Company statement of changes in equity 96 Notes to the company financial statements NOTICES 108 Notice of annual general meeting 1 STRATEGIC REPORT Five-year summary 2020 2019 2018 2017 2016 £m £m £m £m £m Income statement—continuing business* Revenue 326 333 329 303 282 Operating profit 31 31 38 43 47 Profit after taxation 21 25 28 39 37 Profit on sale of CQ-Roll Call, Inc - 43 - - - Profit on sale of Economist Complex - - - - -

The Sage Group Plc an Introduction

The Sage Group plc An introduction February 2016 What we do Sage is the market leader for integrated accounting, payroll and payment systems, supporting the ambition of the world’s entrepreneurs. Sage began as a small business in the UK 35 years ago and over 13000 colleagues now support millions of entrepreneurs across 23 countries as they power the global economy. We reinvent and simplify business accounting through brilliant technology, working with a thriving community of entrepreneurs, business owners, tradespeople, accountants, partners and developers. And as a FTSE 100 business, we are active in supporting our local communities and invest in making a real difference through the philanthropy of the Sage Foundation. The Sage Group plc - an introduction 2 Key facts about our organization Market Finances Customers Global company with over Revenue of 13,000 £1.4bn 3m employees • One of the market leaders • Organic revenue growth of • Supporting customers, in the UK, North America, 6% for 2015 (2014: 5%)* managing over 30,000 calls Europe, South Africa, Asia • Organic operating profit each day and Brazil £380m* • Ecosystem including 100,000 • Local presence in 23 • Market capitalization of c. accountants globally countries globally £6bn The Sage Group plc - an introduction * Data for financial year ending 30 September 2015 3 How we started 1981 2005 2015 Entered the Polish market Sage founded in Newcastle Launch of upon Tyne by David Goldman, 1989 Sage Live Paul Muller and Graham Wylie 1999 2008 Listed on the London Stock and Sage Became -

Annual Report 2012

BRINGING How we have performed KNOWLEDGE FIN ANCIAL HIGHLIGHTS • Record adjusted diluted EPS up 7.7% to 40.7p (2011: 37.8p), ahead of market expectations TO LIFE • Full year dividend increased by 10.1% – second interim dividend of 12.5p giving a total 2012 dividend of 18.5p (2011: 16.8p) Businesses, professionals and • Revenue broadly flat despite Robbins Gioia and European academics worldwide turn to Informa Conference disposals – £1.23bn (2011: £1.28bn) for unparalleled knowledge, up-to- • Adjusted operating profit up 4.0% to £349.7m the minute information and highly (2011: £336.2m); organic growth of 2.8% specialist skills and services. • Record adjusted operating margin of 28.4% (2011: 26.4%) Our ability to deliver high quality • Adjusted profit before tax of £317.4m up 7.3% (2011: £295.9m) knowledge and services through • Statutory profit after tax of £90.7m (2011: £74.3m) multiple channels, in dynamic and rapidly changing environments, • Strong cash generation – operating cash flow up 5.7% to £329.0m (2011: £311.2m) makes our offer unique and • Balance sheet strength maintained – net debt/EBITDA extremely valuable to individuals ratio of 2.1 times (2011: 2.1 times) and organisations. OPEAI R T ONAL HIGHLIGHTS • Proactive portfolio management drives significant Annual Report & Financial Statements for the year ended December 31 2012 improvement in the quality of Group earnings • Total product rationalisation reduced Group revenue by 2% • Investment in new products, geo-cloning and platform development • Acquisition of MMPI and Zephyr -

Intertek Annual Report 2008

FC1 Intertek Group plc Annual Report 2008 Report Annual Bringing competitive advantage to business Annual Report 2008 IFC2 Contents 01 Financial Highlights 02 At a Glance 04 Chairman’s Statement Directors’ Report – Business Review 06 Chief Executive Officer’s Review 09 Operating Review 23 Chief Operating Officer’s Review 24 Financial Review 28 Risks and Uncertainties Directors’ Report – Governance 32 Board of Directors 34 Intertek Operations Committee 36 Corporate Governance Report 42 Remuneration Report 56 Other Statutory Information 58 Statement of Directors’ Responsibilities 59 Corporate Social Responsibility Report Financial Statements 66 Independent Auditors’ Report 68 Consolidated Income Statement 69 Consolidated Balance Sheet 70 Consolidated Statement of Cash Flows 71 Consolidated Statement of Recognised Income and Expense 72 Notes to the Financial Statements 112 Intertek Group plc Company Balance Sheet 113 Notes to the Company Financial Statements Shareholder Information 116 Corporate and Shareholder Information 117 Financial Calendar and Contact Information Cautionary statement This Annual Report contains certain forward- looking statements with respect to the financial condition, results, operations and business of Intertek Group plc. These statements and forecasts involve risk and uncertainty because they relate to events and depend upon circumstances that will occur in the future. There are a number of factors that could cause actual results or developments to differ materially from those expressed or implied by these forward-looking