Responses to Improving Network Rail's Renewals Efficiency

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(A) DB Cargo (UK) Limited Whose Registered Office Is at Lakeside Business Park, Carolina Way, Doncaster, South Yorkshire, DN4 5PN (“DBC”) (“The Claimant”); And

1 DETAILS OF PARTIES 1.1 The names and addresses of the parties to the reference are as follows; (a) DB Cargo (UK) Limited whose Registered Office is at Lakeside Business Park, Carolina Way, Doncaster, South Yorkshire, DN4 5PN (“DBC”) (“The Claimant”); and (b) Network Rail Infrastructure Limited whose Registered Office is at 1 Eversholt Street, London NW1 2DN (“Network Rail”) (“The Respondent”). (c) Contact details for DB Cargo: Graham White, Access Manager South, Lakeside Business Park, Carolina Way, Doncaster, South Yorkshire, DN4 5PN. (d) Contact details for Network Rail: Duncan Lovatt & Richard Hooper, Network Rail, Wales Route. 2 DETAILS OF REFERENCE 2.1 This matter is referred to a Timetable Panel (“the Panel”) for determination in accordance with Condition D5 of the Network Code 2.2 This Dispute arises from a decision of Network Rail in respect of Network Rail variations made pursuant to Condition D3.5 of the Network Code 3 CONTENTS OF REFERENCE This Sole Reference includes: - (a) The subject matter of the dispute in Section 4; (b) A detailed explanation of the issues in dispute in Section 5; (c) In Section 6, the decision sought from the panel in respect of legal entitlement. 4 SUBJECT MATTER OF DISPUTE 4.1 This dispute arises from the Late Notice Restrictions of Use between Stoke Gifford No 2/ Caldicot and Leckwith Loop North Jn from 0200 on Saturday 19th October to 0420 on Monday 21st October 2019. Possession Reference P2019/2680990 4.2 Copied and annexed to this Reference are: • Appendix A: DB Cargo (UK) Ltd response to 157-W30-WA19 (original) [Part] • Appendix B: Re-Issued request 157-W30-WA19 1 • Appendix C: DB Cargo (UK) Ltd response to 157-W30-WA19 (subsequent re-issue) [Part] • Appendix D: Decision document for Re-Issued request 157-WA30-WA19 [Part] • Appendix E: Works planned within the restriction of use. -

Network Rail Response with Appendices

Defendant’s Response to Sole Reference Ref: TTP1546 1 of 9 1 DETAILS OF PARTIES 1.1 The names and addresses of the parties to the reference are as follows:- (a) Freightliner Limited whose Registered Office is at 3rd Floor, 90 Whitfield Street, London W1T 4EZ (“Freightliner”) ("the Claimant"); and (b) Network Rail Infrastructure Limited whose Registered Office is at 1 Eversholt Street, London NW1 2DN ("Network Rail") ("the Defendant"). 1.2 Other Train and Freight Operating Companies that could be affected by the outcome of this dispute: (a) Greater Anglia (Abellio East Anglia Ltd), MTR Corporation (Crossrail) Ltd, Arriva Rail London Ltd, GB Railfreight Ltd, DB Cargo (UK) Ltd, c2c (Trenitalia c2c Ltd) 2 CONTENTS OF THIS DOCUMENT This Response to the Claimant’s Sole Reference includes:- (a) Confirmation, or qualification, that the subject matter of the dispute is as set out by the Claimant in its Sole Reference, in the form of a summary schedule cross-referenced to the issues raised by the Claimant in the Sole Reference, identifying which the Defendant agrees with and which it disagrees with. (b) A detailed explanation of the Defendant’s arguments in support of its position on those issues where it disagrees with the Claimant’s Sole Reference, including references to documents or contractual provisions not dealt with in the Claimant’s Sole Reference. (c) Any further related issues not raised by the Claimant but which the Defendant considers fall to be determined as part of the dispute; (d) The decisions of principle sought from the Panel in respect of (i) legal entitlement, and (ii) remedies; (e) Appendices and other supporting material. -

Can Competition for and in the Market Co-Exist in Terms of Delivering Cost Efficient Services? Evidence from Open Access Train O

Transportation Research Part A 113 (2018) 114–124 Contents lists available at ScienceDirect Transportation Research Part A journal homepage: www.elsevier.com/locate/tra Can competition for and in the market co-exist in terms of delivering cost efficient services? Evidence from open access train T operators and their franchised counterparts in Britain ⁎ Phill Wheata, , Andrew S.J. Smitha, Torris Rasmussenb a Institute for Transport Studies, University of Leeds, UK b Norwegian Railway Directorate, Norway ARTICLE INFO ABSTRACT Keywords: This paper aims to inform an important policy debate in Europe on how best to open up pas- Returns to density senger rail markets to increased competition: and specifically, whether to allow open access train Competition-in-the-market operators alongside franchised (tendered) operators. The paper utilises new British data to Competition-for-the-market analyse the cost side of this debate. Our data is unique in that we have cost data by route level for both the incumbent (corresponding to British franchises) and the open access operators, as op- posed to only having cost data on the incumbent at the network level as in other countries. The open access operators are found to have comparable unit costs to franchised operators. This is unexpected considering the significant returns to density that benefit the larger franchised op- erators. This is subsequently found to be due to lower input prices and an ‘open access business model’ effect that outweigh any density disadvantages. Overall we find that there are negligible cost disadvantages of allowing open access operators to compete with franchised intercity op- erators. -

Leeds Thesis Template

Understanding the Relationship Between Capacity Utilisation and Performance and the Implications for the Pricing of Congested Rail Networks John Alexander Haith Submitted in accordance with the requirements for the degree of Doctor of Philosophy The University of Leeds Institute for Transport Studies February, 2015 - ii - The candidate confirms that the work submitted is his own, except where work which has formed part of jointly-authored publications has been included. The contribution of the candidate and the other authors to this work has been explicitly indicated below. The candidate confirms that appropriate credit has been given within the thesis where reference has been made to the work of others. Elements of the work contained in this thesis have previously appeared in the published paper:- Haith, J., Johnson, D. and Nash, C. 2014.The Case for Space: the Measurement of Capacity Utilisation, its Relationship with Reactionary Delay and the Calculation of the Capacity Charge for the British Rail Network. Transportation Planning and Technology 37 (1) February 2014 Special Issue: Universities’ Transport Study Group UK Annual Conference 2013. Where there is specific use of the contents of the above paper in this thesis reference is made to it in the appropriate part of the text. However, general use of the work contained in the paper is particularly made in Chapter 5 (Methodology), Chapter 6 (The Data Set) and Chapter 7 (Results). It should also be noted that all research and analysis contained in this thesis (and the paper) was conducted by the candidate. Secondly, substantial additional analysis was conducted between the finalisation of the paper and the writing of this thesis meaning that the results of the research have expanded significantly. -

Eighth Annual Market Monitoring Working Document March 2020

Eighth Annual Market Monitoring Working Document March 2020 List of contents List of country abbreviations and regulatory bodies .................................................. 6 List of figures ............................................................................................................ 7 1. Introduction .............................................................................................. 9 2. Network characteristics of the railway market ........................................ 11 2.1. Total route length ..................................................................................................... 12 2.2. Electrified route length ............................................................................................. 12 2.3. High-speed route length ........................................................................................... 13 2.4. Main infrastructure manager’s share of route length .............................................. 14 2.5. Network usage intensity ........................................................................................... 15 3. Track access charges paid by railway undertakings for the Minimum Access Package .................................................................................................. 17 4. Railway undertakings and global rail traffic ............................................. 23 4.1. Railway undertakings ................................................................................................ 24 4.2. Total rail traffic ......................................................................................................... -

Sustainability Report 2009 Texts of the Online Report for Downloading

Sustainability Report 2009 Texts of the online report for downloading 1 Note: These are the texts of the Sustainability Report 2009, which are being made available in this file for archival purposes. The Sustainability Report was designed for an Internet presentation. Thus, for example, related links are shown only on the Internet in order to ensure that the report can be kept up-to-date over the next two years until the next report is due. Where appropriate, graphics are offered on the Internet in better quality than in this document in order to reduce the size of the file downloaded. 2 Table of Contents 1 Our company 6 1.1 Preface .................................................................................................................................... 6 1.2 Corporate Culture................................................................................................................... 7 1.2.1 Confidence..................................................................................................................................... 7 1.2.2 Values ............................................................................................................................................ 8 1.2.3 Dialog ........................................................................................................................................... 10 1.2.3.1 Stakeholder dialogs 10 1.2.3.2 Memberships 12 1.2.3.3 Environmental dialog 14 1.3 Strategy ................................................................................................................................ -

Financial Statements

FINANCIAL STATEMENTS 62 STATEMENT OF INCOME 65 NOTES TO THE FINANCIAL 76 LIST OF SHAREHOLDINGS STATEMENTS 62 BALANCE SHEET 86 AUDITOR’S REPORT > 67 Notes to the balance sheet > 62 Assets > 71 Notes to the statement > 86 Report on the financial > 62 Equity and liabilities of income statements > 86 Report on the management 63 STATEMENT OF CASH FLOWS > 72 Notes to the statement of cash flows report 64 FIXED AssETS SCHEDULE > 72 Other disclosures 62 DEUTSCHE BAHN AG 2014 MANAGEMENT REPORT AND FINANCIAL STATEMENTS STATEMENT OF INCOME JAN 1 THROUGH DEC 31 [€ mILLION] Note 2014 2013 Inventory changes 0 0 Other internally produced and capitalized assets 0 – Overall performance 0 0 Other operating income (16) 1,179 1,087 Cost of materials (17) –95 –91 Personnel expenses (18) –324 –303 Depreciation –10 –12 Other operating expenses (19) –970 –850 –220 –169 Net investment income (20) 794 583 Net interest income (21) –67 –37 Result from ordinary activities 507 377 Taxes on income (22) 37 –10 Net profit for the year 544 367 Profit carried forward 4,531 4,364 Net retained profit 5,075 4,731 BALANCE SHEET AssETS [€ MILLION] Note Dec 31, 2014 Dec 31, 2013 A. FIXED ASSETS Property, plant and equipment (2) 29 33 Financial assets (2) 26,836 27,298 26,865 27,331 B. CUrrENT ASSETS Inventories (3) 1 1 Receivables and other assets (4) 4,412 3,690 Cash and cash equivalents 3,083 2,021 7,496 5,712 C. PREpaYMENTS anD AccrUED IncoME (5) 0 1 34,361 33,044 EQUITY AND LIABILITIES [€ MILLION] Note Dec 31, 2014 Dec 31, 2013 A. -

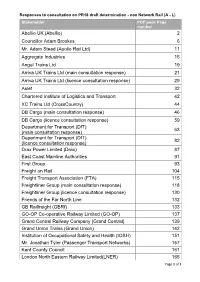

Responses to Consultation on PR18 Draft Determination - Non Network Rail (A - L) Stakeholder PDF Pack Page Number Abellio UK (Abellio) 2 Councillor Adam Brookes 6 Mr

Responses to consultation on PR18 draft determination - non Network Rail (A - L) Stakeholder PDF pack Page number Abellio UK (Abellio) 2 Councillor Adam Brookes 6 Mr. Adam Stead (Apollo Rail Ltd) 11 Aggregate Industries 15 Angel Trains Ltd 19 Arriva UK Trains Ltd (main consultation response) 21 Arriva UK Trains Ltd (licence consultation response) 29 Aslef 32 Chartered Institute of Logistics and Transport 42 XC Trains Ltd (CrossCountry) 44 DB Cargo (main consultation response) 46 DB Cargo (licence consultation response) 59 Department for Transport (DfT) 63 (main consultation response) Department for Transport (DfT) 82 (licence consultation response) Drax Power Limited (Drax) 87 East Coast Mainline Authorities 91 First Group 93 Freight on Rail 104 Freight Transport Association (FTA) 115 Freightliner Group (main consultation response) 118 Freightliner Group (licence consultation response) 130 Friends of the Far North Line 132 GB Railfreight (GBRf) 133 GO-OP Co-operative Railway Limited (GO-OP) 137 Grand Central Railway Company (Grand Central) 139 Grand Union Trains (Grand Union) 142 Institution of Occupational Safety and Health (IOSH) 151 Mr. Jonathan Tyler (Passenger Transport Networks) 157 Kent County Council 161 London North Eastern Railway Limited(LNER) 165 Page 1 of 1 PR18 draft determination consultation: pro forma This pro forma is available to those that wish to use it to respond to our draft determination consultation, structured around the main areas of the draft determination. Other forms of response (e.g. letter format) are equally welcome, though we would be grateful if these could be structured broadly in line with the areas listed below (where you wish to comment), to aid our review of responses. -

Acquisition by Arriva Rail North Limited of the Northern Rail Franchise

Acquisition by Arriva Rail North Limited of the Northern rail franchise Summary of final report 2 November 2016 Background 1. On 20 May 2016, the Competition and Markets Authority (CMA), in the exercise of its duty under section 22(1) of the Enterprise Act 2002 (the Act), referred the completed acquisition by Arriva Rail North Limited (ARN), a wholly-owned subsidiary of Arriva plc (Arriva), of the Northern rail franchise (the Northern Franchise) (altogether the Merger) for further investigation and report by a group of CMA panel members (inquiry group). Throughout this document, where appropriate, we refer to Arriva, ARN and the Northern Franchise collectively as ‘the Parties’. 2. In exercise of its duty under section 35(1) of the Act, the CMA must decide: (a) whether a relevant merger situation has been created; and (b) if so, whether the creation of that situation has resulted or may be expected to result in a substantial lessening of competition (SLC) within any market or markets in the United Kingdom (UK) for goods or services. The rail and bus sectors in Great Britain 3. Franchised train operating companies (franchised TOCs) operate passenger rail franchises and are awarded the right to run specific services within a specified area for a specific period of time, in return for the right to charge fares. Where appropriate, franchised TOCs receive financial support from the franchising authority, which is currently the Rail Group in the Department for Transport (DfT).1 There are currently 16 franchises operating in England and Wales and two in Scotland. 1 Transport Scotland is the franchising authority for the ScotRail and Caledonian Sleeper franchises. -

Members' Directory

ROYAL WARRANT HOLDERS ASSOCIATION MEMBERS’ DIRECTORY 2019–2020 SECRETARY’S FOREWORD 3 WELCOME Dear Reader, The Royal Warrant Holders Association represents one of the most diverse groups of companies in the world in terms of size and sector, from traditional craftspeople to global multinationals operating at the cutting edge of technology. The Members’ Directory lists companies by broad categories that further underline the range of skills, products and services that exist within the membership. Also included is a section dedicated to our principal charitable arm, the Queen Elizabeth Scholarship Trust (QEST), of which HRH The Prince of Wales is Patron. The section profiles the most recent alumni of scholars and apprentices to have benefited from funding, who have each developed their skills and promoted excellence in British craftsmanship. As ever, Royal Warrant holders and QEST are united in our dedication to service, quality and excellence as symbolised by the Royal Warrant of Appointment. We hope you find this printed directory of use when thinking of manufacturers and suppliers of products and services. An online version – which is regularly updated with company information and has enhanced search facilities – can be viewed on our website, www.royalwarrant.org “UNITED IN OUR DEDICATION TO Richard Peck SERVICE, QUALITY CEO & Secretary AND EXCELLENCE” The Royal Warrant Holders Association CONTENTS Directory of members Agriculture & Animal Welfare ...............................................................................................5 -

Retail Market Review Consultation on the Potential Impacts of Regulation and Industry Arrangements and Practices for Ticket Selling

Retail market review Consultation on the potential impacts of regulation and industry arrangements and practices for ticket selling September 2014 Contents Executive Summary 4 1. Introduction 10 Purpose of the document 10 Why we are reviewing the regulations and industry arrangements and practices for ticket selling 11 Scope of the Review 12 Approach to the Review 13 Structure of the document 14 Questions for Chapter 1 15 2. Rail ticket buying and selling practices 16 Introduction 16 Ticket buying trends in rail 16 Ticket selling behaviour in rail 18 Questions for Chapter 2 22 3. The regulation and industry arrangements and practices for selling tickets 24 Introduction 24 Retailers’ incentives to sell tickets 25 Obligations on retailers to facilitate an integrated, national network 26 Governance arrangements in retailing 29 Industry rules 32 Industry processes and systems 34 Question for Chapter 3 37 4. The impact of retailers’ incentives and of retailers’ obligations to facilitate an integrated, national network 38 Introduction 38 The impact of retailers’ incentives in selling tickets 38 The impact of obligations on retailers to facilitate an integrated, national network 40 Questions for Chapter 4 44 5. The impact of industry governance, rules, processes, and systems 45 Introduction 45 The impact of industry governance arrangements 45 Office of Rail Regulation | September 2014 | Retail market review consultation 2 10866832 The impact of industry rules 47 The impact of industry processes and systems 52 Questions for Chapter 5 58 6. Emerging -

East Midlands Rail Franchise

East Midlands Rail Franchise EMC Workshop 21st MARCH 2017 AGENDA Welcome Cllr Roger Blaney – Leader Newark and Sherwood District Council Setting the context for the day Andrew Pritchard - EMC Where has the process got to Andrew MacDonald - DfT What does the Passenger want Martin Clarke - Transport Focus Consultation and workshop process David Young - SCP Break out sessions – everyone involved Cllr Roger Blaney LEADER NEWARK AND SHERWOOD DISTRICT COUNCIL Welcome Welcome 2nd Workshop Strategic Statement Today: Develop the detail of our ask Inform EMC’s consultation response to DfT Help partners respond to the consultation Mobilise public and private sector awareness of the consultation Andrew Pritchard EAST MIDLANDS COUNCILS EMC & the EM Franchise Competition East Midlands Councils the collective body for Local Government across the East Midlands Strong interest in rail issues: improved services and supporting our world class rail engineering sector EMC closely working with DfT to facilitate stakeholder input on the EM Franchise – including seconding resource to work with DfT Franchise Team in London Chance to influence things for the next 10 years www.emcouncils.gov.uk EMC Strategic Statement Strong private sector job Connecting people to jobs growth and training 20% of GVA Exported Connecting businesses to Strong academic network customers EM population likely to rise by half a million to 5.1 million Access to London by 2030 Connectivity to regional Hubs Biggest growth in university towns & cities - and Corby! Connecting local services 400,000 new homes planned into the Hub towns and cities over next 20 years Growth: Rail Patronage MML carries over 13 Ensure sufficient capacity million passenger p.a.