Yoshinoya HD / 9861

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

About HCJ Visitors Information

About HCJ What is HCJ? Visitors information With its history of over 40 years, HCJ is highly recognized by all business Show Information persons in Japanese hospitality industry. 850 exhibitors and 60,000 visitors makes the event most energetic. This is a "must-visit" show for the professionals, especially for those involved Business process is speedy and effective. (expected) Date February 20(Tue.) -23(Fri.), 2018 Scale in newly opening hotels, restaurants and commercial facilities. 10:00 - 17:00 (16:30 on the last day) 850 companies / 2,100 booths / 18,900 sq.m. (HCJ2017 results) ● HOTERES JAPAN: International hotels & restaurant trade show for hotels, "ryokan"s, travel, and facilities. HCJ Brings Powerful Visitors! Number of Visitors (expected) Venue Tokyo Big Sight ● CATEREX JAPAN: Food and catering trade show for catering and food services. (Tokyo International Exhibition Center, Japan) 60,000 professionals ● JAPAN FOOD SERVICE EQUIPMENT SHOW: Equipment for commercial kitchens and food services trade show. By Sector Number of Visitors 56,367 What are the purposes of your visit? Three events are held simultaneously, providing the largest business matching opportunity for hospitality & food service industry in Japan! (multiple answers) Organized by Restaurants, Food Services 11,048 19.6% To gather information on new products/services 49.4% Japan Management Association Japan Hotel Association Manufacturing 10,333 17.8% To gather information for product purchasing 26.3% Japan Ryokan & Hotel Association Japan Restaurant Association Target Exhibits / Zoning To purchase ( or examine ) products 25.6% Japan Tourism Facilities Association Hotels,Inns 9,639 17.1% To ascertain current trends in related markets 22.8% Organized by Renewal Continuation & Expansion Please choose from the four zones. -

Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1St Section 9936 Industry: Food Service, Retail Gold Medalist in Chinese Cuisine

MITA SECURITIES Equity Research June 22, 2021 MITA SECURITIES Co., Ltd. Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1st Section 9936 Industry: Food service, retail Gold medalist in Chinese cuisine. Enjoy Initiation of coverage dumplings in store or at home; initiating coverage with a Buy rating Rating Initiating coverage with a TP of 7,250 yen and a Buy rating We initiate coverage of Ohsho Food Service Corporation (9936, Ohsho Food Service, the Buy company) with a target price of 7,250 yen and a Buy rating. Target price (JPY) 7,250 The company operates “Gyoza no Ohsho,” the largest Chinese restaurant chain, both Stock price (JPY) (Jun 21) 5,610 directly and through franchisees nationwide. The company’s earnings have been robust Market cap (JPYbn) 130.6 since pre-COVID-19 pandemic. Although sales of in-store dining declined as it was forced Key changes to shorten business hours in the wake of the COVID-19, sales of take-out and delivery have Rating New been strong. The company posted an OP of 6.1bn yen (OPM 7.5%) in FY3/21 while many of Target price New its competitors posted losses. With the withdrawal of underperforming restaurants, the Earnings forecast New potential locations for new openings have been increasing. The company appears to be the Stock price (JPY) only major Chinese restaurant chain that can continue to make positive investments. In our 10,000 view, the company’s competitive advantage will continue to strengthen. 9,000 8,000 7,000 The catalysts we envision for an upturn in the stock price include strong monthly same- 6,000 5,000 store sales, recovery in quarterly profits, easing of requests by local governments to 4,000 3,000 shorten business hours, and progress in vaccination against the COVID-19. -

Quarterly Portfolio Disclosure

Schroders 29/05/2020 ASX Limited Schroders Investment Management Australia Limited ASX Market Announcements Office ABN:22 000 443 274 Exchange Centre Australian Financial Services Licence: 226473 20 Bridge Street Sydney NSW 2000 Level 20 Angel Place 123 Pitt Street Sydney NSW 2000 P: 1300 180 103 E: [email protected] W: www.schroders.com.au/GROW Schroder Real Return Fund (Managed Fund) Quarterly holdings disclosure for quarter ending 31 March 2020 Holdings on a full look through basis as at 31 March 2020 Weight Asset Name (%) 1&1 DRILLISCH AG 0.000% 1011778 BC / NEW RED FIN 4.25 15-MAY-2024 144a (SECURED) 0.002% 1011778 BC UNLIMITED LIABILITY CO 3.875 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 4.375 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 5.0 15-OCT-2025 144a (SECURED) 0.004% 1MDB GLOBAL INVESTMENTS LTD 4.4 09-MAR-2023 Reg-S (SENIOR) 0.011% 1ST SOURCE CORP 0.000% 21VIANET GROUP ADR REPRESENTING SI ADR 0.000% 2I RETE GAS SPA 1.608 31-OCT-2027 Reg-S (SENIOR) 0.001% 2I RETE GAS SPA 2.195 11-SEP-2025 Reg-S (SENIOR) 0.001% 2U INC 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 361 DEGREES INTERNATIONAL LTD 0.000% 3D SYSTEMS CORP 0.000% 3I GROUP PLC 0.002% 3M 0.020% 3M CO 1.625 19-SEP-2021 (SENIOR) 0.001% 3M CO 1.75 14-FEB-2023 (SENIOR) 0.001% 3M CO 2.0 14-FEB-2025 (SENIOR) 0.001% 3M CO 2.0 26-JUN-2022 (SENIOR) 0.001% 3M CO 2.25 15-MAR-2023 (SENIOR) 0.001% 3M CO 2.75 01-MAR-2022 (SENIOR) 0.001% 3M CO 3.25 14-FEB-2024 (SENIOR) 0.002% -

HIDAY HIDAKA Corporation

HIDAY HIDAKA Corporation Restaurant chain serving ramen and Chinese dishes to the mass-market: focusing on new business formats despite the impact of COVID-19 TICKER: 7611 | TSE1 | HP: http://hidakaya.hiday.co.jp/english/ | LAST UPDATE: 2021.08.23 Business Strengths and weaknesses Runs Hidakaya restaurant chain near train stations in Greater Tokyo; particular focus Strengths on opening new branches in Kanagawa Cost advantages from area-dominant Business model: Core business is chain of Hidakaya restaurants (94.2% of strategy and central kitchen: GPM above FY02/21 sales) that serve ramen, gyoza (dumplings), and other popular Chinese 70% for over 20 years through FY02/21, dishes. It also offers side dishes that go with alcohol for customers who want a despite relatively low-price menu. One of only quick drink. Customers range from students to businesspeople, late-shift workers, a handful of leading listed restaurant and seniors, all attracted by affordable prices (JPY390 for ramen and JPY230 for operators with a GPM above 70%. gyoza including tax) and late hours (nearly half of stores are open till 2 a.m.; more Directly operated restaurants maintain than 10% are open 24 hours*). Average customer spend is about JPY750 (before quality, boost brand power, and enable tax; FY02/21). Per the company, no other chain operates the same restaurant flexible operations format (serving both ramen and Chinese dishes). From FY02/10 to FY02/19, Low prices and classic dishes keep HIDAY HIDAKA maintained an OPM of over 10%, but in FY02/21 sales fell and the customers coming back: Maintained company posted an operating loss, due in large part to shortened opening hours comparable store sales of at least 100% YoY amid the COVID-19 outbreak. -

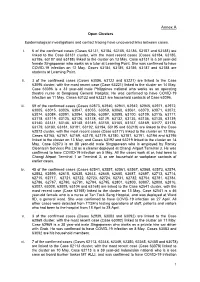

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Hotel Restaurant Institutional Japan

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/26/2013 GAIN Report Number: JA 3526 Japan Food Service - Hotel Restaurant Institutional Japan HRI Food Service Sector Report 2014 Approved By: Steve Shnitzler, Director, ATO Japan Prepared By: Masayuki (Alex) Otsuka, Marketing Specialist, ATO Tokyo Report Highlights: The $361 billion food service industry has finally recovered from the negative impacts affected by the Great Earthquake in 2011. Per capita spending (including company spending) for HRI spending has made a significant contribution to the food service industry’s step by step growth. In addition, increased tourism has also contributed to the re-invigoration of the industry as HRI outlets are offering more international cuisines throughout the market place. Competition remains intense and the sophisticated Japanese consumer continues to demand high quality food products. U.S. suppliers are well positioned to compete in many products categories provided they are willing to adjust to changing market demand. - Table of Contents - I. MARKET SUMMARY A. Market Volume and Trends B. Sectors C. Value of Total Imported Food vs. Domestic Products D. Advantages and Challenges II. ROAD MAP FOR MARKET ENTRY A. Entry Strategy 1. Market Access 2. Competitive Analysis 3. Comparative Advantage of the Products 4. Receptivity of the Distribution Trade 5. Ability of Willingness to Meet Market Requirements B. Market Structure 1. Distribution 2. Segmentation i. Large Increase of Foreign Travelers to Japan ii. Spending More Time at Roadside Rest Areas and Airport Terminals iii. -

Langkah Membuka Bisnis Restoran Di Jepang

VOLUME NO.1//2020 MARKET INTELLIGENT LANGKAH MEMBUKA BISNIS RESTORAN DI JEPANG INDONESIAN TRADE PROMOTION CENTER (ITPC) OSAKA DAFTAR ISI 03 Gambaran Umum Bisnis Restoran di Jepang 04 Pasar Jasa Makanan di Jepang 07 Tren Pasar Restoran di Jepang 09 Tahapan Mendirikan Restoran bagi WNA di Jepang 10 Tahapan Umum Mendirikan Restoran di Jepang 11 Pendaftaran Perusahaan 14 Mendapatkan Visa Manajer Bisnis 17 Mendapatkan Izin Bisnis Restoran 21 Ketentuan Lain dalam Bisnis Restoran 22 Ketentuan Operasional 25 Ketentuan Tenaga Kerja 28 Ketentuan Pajak 34 Peluang Pasar Bisnis Restoran di Jepang 35 Gambaran Tren Kuliner 41 Masakan Asing di Jepang 45 Potensi Makanan Indonesia 49 Tips Menjalankan Bisnis Restoran di Jepang 50 Sertifikasi Halal 54 Suplai Bahan Baku 60 Tips Lainnya MARKET INTELLIGENT VOL.1/2020 | 2 GAMBARAN UMUM PASAR JASA MAKANAN DI JEPANG MARKET INTELLIGENT VOL.1/2020 | 3 PASAR JASA MAKANAN DI JEPANG Gambaran Umum kerja (USD 15,8 miliar). Semua sub sektor tumbuh sedikit dari 2015 hingga 2018. Dengan jumlah penduduk sekitar 127 juta dan produk domestik bruto (PDB) sebesar USD 5 Perkembangan Outlet triliun pada tahun 2018, Jepang merupakan salah satu pasar konsumen terbesar di dunia, Restoran memberikan peluang bagi para eksportir Di Jepang, sub sektor restoran memiliki Indonesia, terutama bagi mereka yang berminat penjualan terbesar di sektor jasa makanan laba pada pasar jasa makanan. Jepang, menyumbang 50,9% dari total pendapatan jasa makanan pada tahun 2018. Di Industri jasa makanan konsumen Jepang dalam sub sektor restoran, gerai makan kasual penting, mencapai penjualan sebesar USD mencatat penjualan tertinggi sebesar USD 91,5 274,6 miliar pada tahun 2018. -

Resolving Labour Shortage? the Digital Transformation of Working Practices in the Japanese Service Sector

This is an open source publication by LeidenAsiaCentre, July 2019. LEIDENASIACENTRE Resolving Labour Shortage? The Digital Transformation of Working Practices in the Japanese Service Sector Saori Shibata LeidenAsiaCentre is an independent research centre affiliated with Leiden University and made possible by a grant from the Vaes Elias Fund. The centre focuses on academic research with direct application to society. All research projects are conducted in close cooperation with a wide variety of partners from Dutch society. More information can be found on our website : www.leidenasiacentre.nl For contact or orders: [email protected] M. de Vrieshof 3, 2311 BZ Leiden, The Netherlands 0 1. Introduction Many advanced democracies, including Japan, face a shift toward an ageing society and a labour shortage. The Japanese Ministry of Labour, Health and Welfare (MHLW) reports in its Labour Economy Survey that on average roughly 55 % of firms in the hospitality industry (hotels, restaurants and cafes) face a labour shortage of part-time workers in 2018 (MHLW 2018:7). Many restaurants in Japan were already forced to end 24-hour opening due to labour shortages (Harding 2017). It has progressed automation in restaurants. For instance, an increasing number of restaurants and cafes started introducing automation and robotisation, increasing labour productivity, improving advertisement, requiring a smaller number of workers and reducing labour costs. Some restaurants integrated registered customers’ smartphones and send advertising messages to their smartphones when they are near to restaurants. This can contribute to the reduction of advertisement costs and effectively increase customers. IBM Japan invented a system named “Chef Watson”, which creates a large number of menus for restaurants with just a little input of some food ingredients (Nakata 2014). -

Exhibition for Hospitality, Food Service and Catering Industries!

Exhibition for Hospitality, Food Service and Catering Industries! 44th Japan Management Association Japan Hotel Association Japan Ryokan & Hotel Association Japan Restaurant Association Japan Tourism Facilities Association 37th Japan Contract Food Service Association Japan Lunch Food Service Association Japan Food Service for Patients Association Japan Management Association Japan Food Service Equipment Association Japan Japan ManagementManagement AssociAssociationation Date February 16(Tue.) ~ 19(Fri.), 2016 10:00~17:00(Last day 10:00~16:30) Venue Tokyo Big Sight (Tokyo International Exhibition Center, Ariake) 811 companies / 1,947 booths / 17,523sq.m. scale Japan’s largest trade show for hospitality, food service and catering! HCJ represents the three trade shows: ● HOTERES JAPAN: International hotels & restaurant trade show for hotels, "ryokan"s, travel, and facilities. ● CATEREX JAPAN: Food and catering trade show for catering and food services. ● JAPAN FOOD SERVICE EQUIPMENT SHOW: Equipment for commercial kitchens and food services trade show. Three events are held simultaneously, H for HOTERES JAPAN, providing the largest business matching for CATEREX JAPAN, and opportunity for hospitality & food C service industry in Japan! J for JAPAN FOOD SERVICE EQUIPMENT SHOW. (The 44th International Hotel & Restaurant Show) * & ' ( ! ) $)% "# $"% (The 37th Exhibition for the Catering Industries) + * ! -(* ! * ! &, * & ' ( & ('-/ & &" '+ '* * ( ! ( -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Intellectual Property Center, 28 Upper Mckinley Rd. Mckinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel

Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date < July 1, 2019 > 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION .................................................................................................... 2 1.1 ALLOWED NATIONAL MARKS .............................................................................................................................................. 2 Intellectual Property Center, 28 Upper McKinley Rd. McKinley Hill Town Center, Fort Bonifacio, Taguig City 1634, Philippines Tel. No. 238-6300 Website: http://www.ipophil.gov.ph e-mail: [email protected] Publication Date < July 1, 2019 > 1 ALLOWED MARKS PUBLISHED FOR OPPOSITION 1.1 Allowed national marks Application No. Filing Date Mark Applicant Nice class(es) Number 16 THE ICON CLINIC-PLASTIC 1 4/2016/00013984 November VBOOST SURGERY AND 44 2016 DERMATOLOGY INC. [PH] 28 2 4/2016/00506771 December YETI Yeti Coolers, LLC [US] 18 2016 Nissan Jidosha Kabushiki 6 March NISSAN INTELLIGENT 9; 12; 35; 38; 39 3 4/2017/00003226 Kaisha (also trading as Nissan 2017 MOBILITY and42 Motor Co., Ltd.) [JP] 27 April 4 4/2017/00006475 WISDOM Tianjin Lin [PH] 6; 9 and16 2017 30 August 2; 4; 6; 7; 8; 9; 11; 5 4/2017/00013996 SINGA Charlie Pua [PH] 2017 19 and25 6 6 4/2017/00017947 November CORE ML Apple Inc. [US] 9 2017 17 SPT-SPERM Plaridel Products & Services, 7 4/2017/00018507 November PRECISION 5 and44 Inc [PH] 2017 TECHNOLOGIES 20 8 4/2017/00020526 December BEAUTY WORKS Taft Property Group, Inc., [PH] 3 2017 Miguel Pocholo Morales, doing 5 January 9 4/2018/00000278 SEÑOR business under the name Blitz 5 2018 Krieg Marketing [PH] 22 10 4/2018/00003367 February THINK DIFFERENT Apple Inc. -

FTSE Publications

2 FTSE Russell Publications 19 November 2019 FTSE Global Small Cap ex US Indicative Index Weight Data as at Closing on 30 September 2019 Index Index Index Constituent weight Country Constituent weight Country Constituent weight Country (%) (%) (%) 21Vianet Group (ADS) (N Shares) 0.03 CHINA Agrana Beteiligungs AG 0.01 AUSTRIA Allreal Hld N 0.12 SWITZERLAND 361 Degrees International (P Chip) 0.01 CHINA Agritrade Resources 0.01 HONG KONG Alm Brand 0.02 DENMARK 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Agung Podomoro Land Tbk PT 0.01 INDONESIA Alpen 0.01 JAPAN 888 Holdings 0.02 UNITED Ahlstrom-Munksjo Oyl 0.03 FINLAND Alpha Networks 0.01 TAIWAN KINGDOM Ahnlab 0.01 KOREA Alpha Systems 0.01 JAPAN A.G.V. Products <0.005 TAIWAN Ai Holdings 0.03 JAPAN Alpiq Holding AG 0.01 SWITZERLAND AA 0.02 UNITED AIA Engineering 0.04 INDIA ALSO Holding AG 0.02 SWITZERLAND KINGDOM Aichi Bank Ltd 0.01 JAPAN Alstria Office 0.12 GERMANY AAK 0.15 SWEDEN Aichi Corp 0.01 JAPAN AltaGas. 0.18 CANADA Aareal Bank AG 0.08 GERMANY Aichi Steel 0.01 JAPAN Altarea 0.04 FRANCE Aarti Industries 0.02 INDIA Aida Engineering 0.02 JAPAN Altek Corp 0.01 TAIWAN Aavas Financiers 0.02 INDIA Aiful 0.03 JAPAN Alten 0.14 FRANCE Abacus Property Group 0.04 AUSTRALIA AIMS APAC REIT 0.02 SINGAPORE Altice Europe NV A 0.13 NETHERLANDS Abdulmohsen Al Hokair Group for Tourism <0.005 SAUDI ARABIA Ainsworth Game Technology Ltd <0.005 AUSTRALIA Altice Europe NV B 0.01 NETHERLANDS and Development Co C Aiphone 0.01 JAPAN Altran Techn.