Japan Food Service Industry Has Recovered

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Learning How to Espresso Yourself

WP6 nationalpost.com NATIONAL POST, SATURDAY, JANUARY 27, 2018 KOPI LUWAK IS THE MOST EXPENSIVE COFFEE IN THE WORLD DUE TO ITS UNORTHODOX ORIGINS. IT’S PRODUCED FROM THE COFFEE BEANS DIGESTED AND EXCRETED BY AN INDONESIAN CAT CALLED A CIVET CAT. ITS HEFTY PRICE TAG CAN RUN FROM $100 TO $600 A POUND, ACCORDING TO CNN. rom Tokyo’s classic Press), coffee has been con- spiralling out of the drip. The Café de l’Ambre, where sidered an ordinary, every- pinching of the water kettle Learning how F centenarian master day Japanese beverage since spout so it exudes just the tini- Sekiguchi Ichiro still roasts the early 1900s. Unlike other est stream of water. At a good the beans, to sleek specialty imports – such as the dining shop it’s like a ballet. It’s just coffee shops and retro-cool room table or men’s dress suit beautiful to watch,” she adds. to espresso kissaten (traditional coffee- – that retained their Western Kissaten offer a unique cof- houses), Japan is home to one “scent,” she says that coffee fee experience, says Michie of the world’s most exciting became naturalized quickly. Yamamoto, owner of Tandem yourself coffee cultures. It evolved from being used Coffee in Toronto. Originally This may come as a sur- as a medicine in its early days from Shizuoka (a city between prise to the uninitiated, who (the late 1500s) to “a drink for Tokyo and Nagoya), Yama- Confessions of a coffee-hating assume green tea is the chief pleasure” roughly 70 years moto visits family in Japan caffeinated beverage, but later when the Dutch, Japan’s regularly. -

About HCJ Visitors Information

About HCJ What is HCJ? Visitors information With its history of over 40 years, HCJ is highly recognized by all business Show Information persons in Japanese hospitality industry. 850 exhibitors and 60,000 visitors makes the event most energetic. This is a "must-visit" show for the professionals, especially for those involved Business process is speedy and effective. (expected) Date February 20(Tue.) -23(Fri.), 2018 Scale in newly opening hotels, restaurants and commercial facilities. 10:00 - 17:00 (16:30 on the last day) 850 companies / 2,100 booths / 18,900 sq.m. (HCJ2017 results) ● HOTERES JAPAN: International hotels & restaurant trade show for hotels, "ryokan"s, travel, and facilities. HCJ Brings Powerful Visitors! Number of Visitors (expected) Venue Tokyo Big Sight ● CATEREX JAPAN: Food and catering trade show for catering and food services. (Tokyo International Exhibition Center, Japan) 60,000 professionals ● JAPAN FOOD SERVICE EQUIPMENT SHOW: Equipment for commercial kitchens and food services trade show. By Sector Number of Visitors 56,367 What are the purposes of your visit? Three events are held simultaneously, providing the largest business matching opportunity for hospitality & food service industry in Japan! (multiple answers) Organized by Restaurants, Food Services 11,048 19.6% To gather information on new products/services 49.4% Japan Management Association Japan Hotel Association Manufacturing 10,333 17.8% To gather information for product purchasing 26.3% Japan Ryokan & Hotel Association Japan Restaurant Association Target Exhibits / Zoning To purchase ( or examine ) products 25.6% Japan Tourism Facilities Association Hotels,Inns 9,639 17.1% To ascertain current trends in related markets 22.8% Organized by Renewal Continuation & Expansion Please choose from the four zones. -

Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1St Section 9936 Industry: Food Service, Retail Gold Medalist in Chinese Cuisine

MITA SECURITIES Equity Research June 22, 2021 MITA SECURITIES Co., Ltd. Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1st Section 9936 Industry: Food service, retail Gold medalist in Chinese cuisine. Enjoy Initiation of coverage dumplings in store or at home; initiating coverage with a Buy rating Rating Initiating coverage with a TP of 7,250 yen and a Buy rating We initiate coverage of Ohsho Food Service Corporation (9936, Ohsho Food Service, the Buy company) with a target price of 7,250 yen and a Buy rating. Target price (JPY) 7,250 The company operates “Gyoza no Ohsho,” the largest Chinese restaurant chain, both Stock price (JPY) (Jun 21) 5,610 directly and through franchisees nationwide. The company’s earnings have been robust Market cap (JPYbn) 130.6 since pre-COVID-19 pandemic. Although sales of in-store dining declined as it was forced Key changes to shorten business hours in the wake of the COVID-19, sales of take-out and delivery have Rating New been strong. The company posted an OP of 6.1bn yen (OPM 7.5%) in FY3/21 while many of Target price New its competitors posted losses. With the withdrawal of underperforming restaurants, the Earnings forecast New potential locations for new openings have been increasing. The company appears to be the Stock price (JPY) only major Chinese restaurant chain that can continue to make positive investments. In our 10,000 view, the company’s competitive advantage will continue to strengthen. 9,000 8,000 7,000 The catalysts we envision for an upturn in the stock price include strong monthly same- 6,000 5,000 store sales, recovery in quarterly profits, easing of requests by local governments to 4,000 3,000 shorten business hours, and progress in vaccination against the COVID-19. -

Demae-Can / 2484

Demae-can / 2484 COVERAGE INITIATED ON: 2017.12.25 LAST UPDATE: 2021.06.25 Shared Research Inc. has produced this report by request from the company discussed herein. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, neutral analysis. To highlight any biases, we clearly attribute our data and findings. We always present opinions from company management as such. The views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. Demae-can / 2484 RCoverage LAST UPDATE: 2021.06.25 Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the Trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the later Business section. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 6 Highlights ------------------------------------------------------------------------------------------------------------------------------------------------------------ -

Quarterly Portfolio Disclosure

Schroders 29/05/2020 ASX Limited Schroders Investment Management Australia Limited ASX Market Announcements Office ABN:22 000 443 274 Exchange Centre Australian Financial Services Licence: 226473 20 Bridge Street Sydney NSW 2000 Level 20 Angel Place 123 Pitt Street Sydney NSW 2000 P: 1300 180 103 E: [email protected] W: www.schroders.com.au/GROW Schroder Real Return Fund (Managed Fund) Quarterly holdings disclosure for quarter ending 31 March 2020 Holdings on a full look through basis as at 31 March 2020 Weight Asset Name (%) 1&1 DRILLISCH AG 0.000% 1011778 BC / NEW RED FIN 4.25 15-MAY-2024 144a (SECURED) 0.002% 1011778 BC UNLIMITED LIABILITY CO 3.875 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 4.375 15-JAN-2028 144a (SECURED) 0.001% 1011778 BC UNLIMITED LIABILITY CO 5.0 15-OCT-2025 144a (SECURED) 0.004% 1MDB GLOBAL INVESTMENTS LTD 4.4 09-MAR-2023 Reg-S (SENIOR) 0.011% 1ST SOURCE CORP 0.000% 21VIANET GROUP ADR REPRESENTING SI ADR 0.000% 2I RETE GAS SPA 1.608 31-OCT-2027 Reg-S (SENIOR) 0.001% 2I RETE GAS SPA 2.195 11-SEP-2025 Reg-S (SENIOR) 0.001% 2U INC 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 360 SECURITY TECHNOLOGY INC A A 0.000% 361 DEGREES INTERNATIONAL LTD 0.000% 3D SYSTEMS CORP 0.000% 3I GROUP PLC 0.002% 3M 0.020% 3M CO 1.625 19-SEP-2021 (SENIOR) 0.001% 3M CO 1.75 14-FEB-2023 (SENIOR) 0.001% 3M CO 2.0 14-FEB-2025 (SENIOR) 0.001% 3M CO 2.0 26-JUN-2022 (SENIOR) 0.001% 3M CO 2.25 15-MAR-2023 (SENIOR) 0.001% 3M CO 2.75 01-MAR-2022 (SENIOR) 0.001% 3M CO 3.25 14-FEB-2024 (SENIOR) 0.002% -

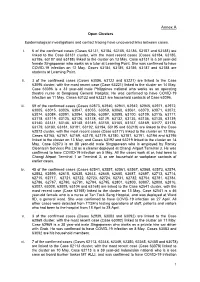

Annex a Open Clusters

Annex A Open Clusters Epidemiological investigations and contact tracing have uncovered links between cases. i. 6 of the confirmed cases (Cases 63131, 63184, 63185, 63186, 63187 and 63188) are linked to the Case 63131 cluster, with the most recent cases (Cases 63184, 63185, 63186, 63187 and 63188) linked to the cluster on 13 May. Case 63131 is a 50 year-old female Singaporean who works as a tutor at Learning Point. She was confirmed to have COVID-19 infection on 12 May. Cases 63184, 63185, 63186, 63187 and 63188 are students at Learning Point. ii. 3 of the confirmed cases (Cases 63096, 63122 and 63221) are linked to the Case 63096 cluster, with the most recent case (Case 63221) linked to the cluster on 14 May. Case 63096 is a 33 year-old male Philippines national who works as an operating theatre nurse at Sengkang General Hospital. He was confirmed to have COVID-19 infection on 11 May. Cases 63122 and 63221 are household contacts of Case 63096. iii. 59 of the confirmed cases (Cases 62873, 62940, 62941, 62942, 62945, 62971, 62972, 63005, 63015, 63026, 63047, 63055, 63059, 63060, 63061, 63070, 63071, 63072, 63074, 63084, 63091, 63094, 63095, 63097, 63098, 63100, 63109, 63115, 63117, 63118, 63119, 63125, 63126, 63128, 63129, 63132, 63135, 63136, 63138, 63139, 63140, 63141, 63146, 63148, 63149, 63150, 63165, 63167, 63169, 63177, 63178, 63179, 63180, 63181, 63191, 63192, 63194, 63195 and 63219) are linked to the Case 62873 cluster, with the most recent cases (Case 63177) linked to the cluster on 12 May, Cases 63165, 63167, 63169, 63178, 63179, 63180, 63181, 63191, 63194 and 63195 linked to the cluster on 13 May, and Cases 63192 and 63219 linked to the cluster on 14 May. -

Izakaya Sushi Noodle Cafe Karaoke Otaku Play Spot Bakery Ramen

japanese sweets 01 天ぷらきよし Tenpura Kiyoshi ★ 01 31Ice cream Baskin Robbins Tenpura restaurant *run by family ice cream 370yen~ 10:30-22:00 Tenpura set menu 850yen~ for lunch fast food ★ izakaya 02/06 不二家 fujiya 12:00-14:30, 17:00-21:00(tue-sun) 01 Freshness Burger Japanese style drinking place. Normally, cake take out 300yen~10:00-21:00 ★ there is a table charge for small dish. 02 /11 松屋 Matsuya Japanese Burger shop, Burgers 350yen~ 03 梅家 Umeya Traditional sweets Gyudon(Beef bowl) many kind dishes Vegie burger,Hot dogs 8:00-23:00 At first, order drink & otsumami from many kind of dishes and enjoy drinking! Many typeJapanese sweets 400yen~ Beef bowl 280yen(M), 24hrs open Season Lunch set 800yen 9:30-20:00 03 Subway Sandwich300yen~ 8:00-21:00 01 ビール工房 Beer Koubou ★ 03 かもん&あっこ kamon&Akko Craft Beer, Food, All 500yen 04 コージーコーナー cozy corner 04/12 モスバーガー Mos Burger cake take out 330yen~ 10:00-22:00 Okonomiyaki/Monjayaki 840yen~ Japaese Burger shop has Rice burgers 18:00-23:00, 15:00-21:00(weekend) 17:00-23:00(mon-sat)16:00-22:00(sun) Mos burger 320yen 9:00-23:00 05 おやき処 れふ亭 Refutei 03 秋吉 Akiyoshi Cheap Yakitori Japanese pancake 120yen~9:00-21:00 04 名代 宇奈とと Unatoto 05/10 McDonalds 24hrs open Negima(Chicken&Green onion) Cheap Unagi(Eel) restaurant ★ 400yen/5sticks 17:00-23:00 07 いさわ Isawa japanese sweets 500yen~ for Unadon 11:00-23:00 06 コロッケ西郷亭 Korokke Saigou Tei Dango110yen take out 11:00-20:30 Croquette 120yen~ Bento boxes 04 馬肉食堂さくら Horsemeat Sakura 05 かつや Katsuya 10:00-21:00,-20:00(sat,sun) Raw horse450yen Grilled horse150yen S ★ Beer 400yen 18:00-23:00 closed sun supermarket Cheap pork cutlet restaurant 07 健康食卓 わしや Washiya Enjoy Japanese supermarket! They have Katsudon 490yen~ 7:00-25:30 Try many Japanese dishes selling by 05 加賀屋 Kagaya old-fashioned Place discount daily food before their closing. -

Hotel Restaurant Institutional Japan

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/26/2013 GAIN Report Number: JA 3526 Japan Food Service - Hotel Restaurant Institutional Japan HRI Food Service Sector Report 2014 Approved By: Steve Shnitzler, Director, ATO Japan Prepared By: Masayuki (Alex) Otsuka, Marketing Specialist, ATO Tokyo Report Highlights: The $361 billion food service industry has finally recovered from the negative impacts affected by the Great Earthquake in 2011. Per capita spending (including company spending) for HRI spending has made a significant contribution to the food service industry’s step by step growth. In addition, increased tourism has also contributed to the re-invigoration of the industry as HRI outlets are offering more international cuisines throughout the market place. Competition remains intense and the sophisticated Japanese consumer continues to demand high quality food products. U.S. suppliers are well positioned to compete in many products categories provided they are willing to adjust to changing market demand. - Table of Contents - I. MARKET SUMMARY A. Market Volume and Trends B. Sectors C. Value of Total Imported Food vs. Domestic Products D. Advantages and Challenges II. ROAD MAP FOR MARKET ENTRY A. Entry Strategy 1. Market Access 2. Competitive Analysis 3. Comparative Advantage of the Products 4. Receptivity of the Distribution Trade 5. Ability of Willingness to Meet Market Requirements B. Market Structure 1. Distribution 2. Segmentation i. Large Increase of Foreign Travelers to Japan ii. Spending More Time at Roadside Rest Areas and Airport Terminals iii. -

Vocelli Pizza

MY VOCELLI PIZZA Franchise Brochure (800) Vocelli Franchise Report Table of Contents Page Our Philosophy .....................................................................................................................................3 What is Vocelli Pizza? ..........................................................................................................................4-5 The 25 Year Vocelli Story .....................................................................................................................6-7 Our “Quality” Focus .............................................................................................................................7-8 Your Perfect Dough ..............................................................................................................................8 Your Perfect Sauce ................................................................................................................................8 Your Perfect Cheese ..............................................................................................................................9 Our Top Rankings and Award .............................................................................................................10 Our Franchise .......................................................................................................................................10-11 The Vocelli Pizza Menu ........................................................................................................................12-13 -

Rising Cheese Prices Can Be Challenge for Pizza Business

Volume 31 February 25, 2011 Number 5 INSIDE Rising cheese prices can be ✦ Total butter, cheese stocks up from December. challenge for pizza business For details, see page 3. By Alyssa Sowerwine of foodservice at FCStone/ would take the first half of the past years,” Cropp says. “The ✦ Guest column: Downes-O’Neill. “Prices aren’t year to slow down the growth net result is that it appears ‘Taking policy changes MADISON, Wis. — To the exactly where we expected in milk production as dairy pro- that buyers are anticipating to Capitol Hill without surprise of many, cheese prices them to be, especially for this ducers slowly adjust cow num- considerably tighter supplies consensus is unacceptable.’ have seen steady increases over time of year.” bers and milk per cow slows in of milk and dairy products for For details, see page 4. the past several weeks at the USDA’s Dairy Market News response to much higher feed the immediate months ahead Chicago Mercantile Exchange notes that cheese inventories prices,” he says. “But it now and have been aggressive in ✦ Study finds actual sodium (CME). While this is welcome remain above historic levels. looks like the opposite will bidding up prices.” may vary from what is on news to some in the dairy indus- Cheddar block prices at occur with prices averaging Dairy Market News notes manufacturers’ labels. try, it presents some challenges the CME have increased from higher for the first half of the that Mozzarella interest re- For details, see page 12. for pizza makers. $1.3425 per pound at the begin- year than the second half, and mains solid, as pizza makers re- “Coming into the year, I ning of January to $1.9550 as of with averages for the year much supply for the typically stronger ✦ January milk production up think it’s safe to say that the Feb. -

Cafe, Sweets Cafe Sweet Sales

Cafe, Sweets The sales of cafe are going well with their strategy of store remodeling, and many of them earn high profit due to the low cost. The companies operating cafes mainly compete in suburb area, Sweet Cafe while companies operating sweets are opening restaurants at Shopping malls. Duskin Co., Ltd. Komeda’s Coffee Doutor Coffee Co., Ltd. Starbucks Coffee Japan, Ltd. Mister Donut Dotour, Execior The main business of Duskin Starbucks Coffee It has been operating food division. Most shops The leading company Komeda Coffee shop franchise café in Japan are franchise. It frequently of cafe industry. It has Originated in Nagoya and it is opening for long time. It releases new menu. been merged into franchise shops, including in Kyushu and proceeds remodeling Starbucks U.S. in 2015. Chain Tohoku area. restaurants. 102 Billion yen Sales Chain Sales of Cafe 47.9 Billion yen Sales of business 75.2 Billion yen Sales 137.8 Billion yen 48.2 Billion yen Sales business Profit of Cafe Sales 19.4 Billion yen Profit Profit of business 4.5 Billion yen 13.4 Billion yen -0.2 Billion yen business Profit 3.9 Billion yen Stores 1,359 stores Stores 588 stores 1,170 stores Stores Store 614 stores Pronto Corporation Saintmarc Holdings Co., Ltd. B-R 31 Ice Cream Co., Ltd. Tully’s Coffee Japan Co., Ltd. St. Marc Cafe Tully ‘s Coffee Originated in Okayama. Seatle styled cafe. Thirty-one Ice cream It serves freshly baked It has been merged The leading company of ice cream shops. bakery. It has good in Ito En Ltd. -

SBA Franchise Directory Effective March 31, 2020

SBA Franchise Directory Effective March 31, 2020 SBA SBA FRANCHISE FRANCHISE IS AN SBA IDENTIFIER IDENTIFIER MEETS FTC ADDENDUM SBA ADDENDUM ‐ NEGOTIATED CODE Start CODE BRAND DEFINITION? NEEDED? Form 2462 ADDENDUM Date NOTES When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Collateral Assignment of Lease and Lease S3606 #The Cheat Meal Headquarters by Brothers Bruno Pizza Y Y Y N 10/23/2018 Addendum may not be executed. S2860 (ART) Art Recovery Technologies Y Y Y N 04/04/2018 S0001 1‐800 Dryclean Y Y Y N 10/01/2017 S2022 1‐800 Packouts Y Y Y N 10/01/2017 S0002 1‐800 Water Damage Y Y Y N 10/01/2017 S0003 1‐800‐DRYCARPET Y Y Y N 10/01/2017 S0004 1‐800‐Flowers.com Y Y Y 10/01/2017 S0005 1‐800‐GOT‐JUNK? Y Y Y 10/01/2017 Lender/CDC must ensure they secure the appropriate lien position on all S3493 1‐800‐JUNKPRO Y Y Y N 09/10/2018 collateral in accordance with SOP 50 10. S0006 1‐800‐PACK‐RAT Y Y Y N 10/01/2017 S3651 1‐800‐PLUMBER Y Y Y N 11/06/2018 S0007 1‐800‐Radiator & A/C Y Y Y 10/01/2017 1.800.Vending Purchase Agreement N N 06/11/2019 S0008 10/MINUTE MANICURE/10 MINUTE MANICURE Y Y Y N 10/01/2017 1. When the real estate where the franchise business is located will secure the SBA‐guaranteed loan, the Addendum to Lease may not be executed.