HIDAY HIDAKA Corporation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HIDAY HIDAKA Corporation

HIDAY HIDAKA Corporation Restaurant chain serving ramen and Chinese dishes to the mass-market: steady growth in sales and OP since FY02/04 TICKER: 7611| TSE1 | website: http://hidakaya.hiday.co.jp/english/ | LAST UPDATE: 2017.04.27 Business Strengths and weaknesses Runs Hidakaya restaurant chain near train stations in Greater Tokyo; particular focus on opening new branches in Kanagawa Strengths Cost advantages from area-dominant Business model: Core business is chain of Hidakaya restaurants (95.4% of sales in FY02/17) that serve ramen, gyoza (dumplings), and other popular Chinese dishes. strategy and central kitchen: pushes up It also offers side dishes that go with alcohol for customers who want a quick OPM to above 10% since FY02/12 despite relatively low-price menu drink. Customers range from students to businesspeople, late-shift workers, and seniors, all attracted by affordable prices (JPY390 for ramen and JPY210 for gyoza Directly operated restaurants maintain including tax; FY02/16) and late hours (open till 4 a.m.: more than 10% opened quality, boost brand power, and enable 24 hours). Average spend per customer is JPY690 (before tax; FY02/17). Per the flexible operations company, no other chain operates the same restaurant format (serving both Low prices and classic dishes keep ramen and Chinese dishes). Since FY02/10 HIDAY HIDAKA has maintained an OPM customers coming back: Maintained of over 10% (11.9% in FY02/17). comparable store sales of at least 100% YoY Dominant strategy: The company’s chain restaurants are almost all directly for past six years (FY02/12-FY02/17) operated. -

4.1 Potential Facilities List FY 17-18

FY 2017-2018 Annual Report Permittee Name: City of San José Appendix 4.1 FAC # SIC Code Facility Name St Num Dir St Name St Type St Sub Type St Sub Num 820 7513 Ryder Truck Rental A 2481 O'Toole Ave 825 3471 Du All Anodizing Company A 730 Chestnut St 831 2835 BD Biosciences A 2350 Qume Dr 840 4111 Santa Clara Valley Transportation Authority Chaboya Division A 2240 S 7th St 841 5093 Santa Clara Valley Transportation Authority - Cerone Division A 3990 Zanker Rd 849 5531 B & A Friction Materials, Inc. A 1164 Old Bayshore Hwy 853 3674 Universal Semiconductor A 1925 Zanker Rd 871 5511 Mercedes- Benz of Stevens Creek A 4500 Stevens Creek Blvd 877 7542 A.J. Auto Detailing, Inc. A 702 Coleman Ave 912 2038 Eggo Company A 475 Eggo Way 914 3672 Sanmina Corp Plant I A 2101 O'Toole Ave 924 2084 J. Lohr Winery A 1000 Lenzen Ave 926 3471 Applied Anodize, Inc. A 622 Charcot Ave Suite 933 3471 University Plating A 650 University Ave 945 3679 M-Pulse Microwave, Inc. A 576 Charcot Ave 959 3672 Sanmina Corp Plant II A 2068 Bering Dr 972 7549 San Jose Auto Steam Cleaning A 32 Stockton Ave 977 2819 Hill Bros. Chemical Co. A 410 Charcot Ave 991 3471 Quality Plating, Inc. A 1680 Almaden Expy Suite 1029 4231 Specialty Truck Parts Inc. A 1605 Industrial Ave 1044 2082 Gordon Biersch Brewing Company, Inc. A 357 E Taylor St 1065 2013 Mohawk Packing, Div. of John Morrell A 1660 Old Bayshore Hwy 1067 5093 GreenWaste Recovery, Inc. -

Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1St Section 9936 Industry: Food Service, Retail Gold Medalist in Chinese Cuisine

MITA SECURITIES Equity Research June 22, 2021 MITA SECURITIES Co., Ltd. Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1st Section 9936 Industry: Food service, retail Gold medalist in Chinese cuisine. Enjoy Initiation of coverage dumplings in store or at home; initiating coverage with a Buy rating Rating Initiating coverage with a TP of 7,250 yen and a Buy rating We initiate coverage of Ohsho Food Service Corporation (9936, Ohsho Food Service, the Buy company) with a target price of 7,250 yen and a Buy rating. Target price (JPY) 7,250 The company operates “Gyoza no Ohsho,” the largest Chinese restaurant chain, both Stock price (JPY) (Jun 21) 5,610 directly and through franchisees nationwide. The company’s earnings have been robust Market cap (JPYbn) 130.6 since pre-COVID-19 pandemic. Although sales of in-store dining declined as it was forced Key changes to shorten business hours in the wake of the COVID-19, sales of take-out and delivery have Rating New been strong. The company posted an OP of 6.1bn yen (OPM 7.5%) in FY3/21 while many of Target price New its competitors posted losses. With the withdrawal of underperforming restaurants, the Earnings forecast New potential locations for new openings have been increasing. The company appears to be the Stock price (JPY) only major Chinese restaurant chain that can continue to make positive investments. In our 10,000 view, the company’s competitive advantage will continue to strengthen. 9,000 8,000 7,000 The catalysts we envision for an upturn in the stock price include strong monthly same- 6,000 5,000 store sales, recovery in quarterly profits, easing of requests by local governments to 4,000 3,000 shorten business hours, and progress in vaccination against the COVID-19. -

HIDAY HIDAKA Corporation

HIDAY HIDAKA Corporation Restaurant chain serving ramen and Chinese dishes to the mass-market: focusing on new business formats despite the impact of COVID-19 TICKER: 7611 | TSE1 | HP: http://hidakaya.hiday.co.jp/english/ | LAST UPDATE: 2021.08.23 Business Strengths and weaknesses Runs Hidakaya restaurant chain near train stations in Greater Tokyo; particular focus Strengths on opening new branches in Kanagawa Cost advantages from area-dominant Business model: Core business is chain of Hidakaya restaurants (94.2% of strategy and central kitchen: GPM above FY02/21 sales) that serve ramen, gyoza (dumplings), and other popular Chinese 70% for over 20 years through FY02/21, dishes. It also offers side dishes that go with alcohol for customers who want a despite relatively low-price menu. One of only quick drink. Customers range from students to businesspeople, late-shift workers, a handful of leading listed restaurant and seniors, all attracted by affordable prices (JPY390 for ramen and JPY230 for operators with a GPM above 70%. gyoza including tax) and late hours (nearly half of stores are open till 2 a.m.; more Directly operated restaurants maintain than 10% are open 24 hours*). Average customer spend is about JPY750 (before quality, boost brand power, and enable tax; FY02/21). Per the company, no other chain operates the same restaurant flexible operations format (serving both ramen and Chinese dishes). From FY02/10 to FY02/19, Low prices and classic dishes keep HIDAY HIDAKA maintained an OPM of over 10%, but in FY02/21 sales fell and the customers coming back: Maintained company posted an operating loss, due in large part to shortened opening hours comparable store sales of at least 100% YoY amid the COVID-19 outbreak. -

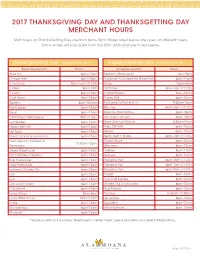

2017 Thanksgiving Day and Thanksgetting Day Merchant Hours

2017 THANKSGIVING DAY AND THANKSGETTING DAY MERCHANT HOURS Mall hours on ThanksGetting Day are from 6am−9pm. Stores listed below are open at different hours. Some stores will stay open from the 23th−24th and are noted below. THANKSGIVING DAY NOVEMBER 23, 2017 THANKSGIVING DAY NOVEMBER 23, 2017 Store/Restaurant Hours Store/Restaurant Hours Aldo etc. 6pm–12am Morton’s Steakhouse 1pm–9pm Chapel Hats 6pm–10pm Nagasaki Champon by Ringer Hut 6pm–11pm Cho Dang 8am–1am (11/24) Nijiya 10am–6pm Claire’s 5pm–1am Old Navy 3pm–1am (11/24) Coach 6pm–12am Panda Express 6pm–12am Cole Haan 9pm–12am Panini Grill 6pm–12am Express 6pm–12amw Patisserie La Palme D’Or 9:30am–2pm Foot Locker 6pm–12am Rip Curl 6pm–2am (11/24) Fossil 6pm–12am Rokkaku Hamakatsu 6pm–10pm GEN Korean BBQ House 10am–11pm Ross Dress For Less 6pm–12am Gymboree 6pm–12am Saint Germain Bakery 8:30am–2pm Happy Wahine 6pm–12am Saks OFF 5TH 6pm–12am Hot Topic 6pm–12am Sbarro 6pm–12am Island Crepes & Lemonade 6pm–12am Sera’s Surf ’n Shore 8pm–1am (11/24) Jade Dynasty Seafood & Shoe Palace 6pm–12am 10:30am–10pm Restaurant Skechers 6pm–12am Jeans Warehouse 6pm–12am Sobaya 6pm–11pm John Masters Organics 6pm–12am Subway 6pm–12am Kids FootLocker 6pm–12am Sunglass Hut 6pm–2am (11/24) Lady FootLocker 6pm–12am Sunglass Hut 6pm–2am (11/24) Lahaina Chicken Co. 6pm–12am Sunglass Hut 6pm–2am (11/24) Lids 6pm–12am Target 6pm–12am Lids 6pm–12am Toys R US Express 6pm–12am Lids Locker Room 6pm–12am Tricked Out Accessories 6pm–12am L’Occitane 6pm–12am True Friends 6pm–12am Longs Drugs 5am–5pm Truffaux 5:30pm–12:30am Lucky Strike Social 10am–12am VR Junkies 6pm–12am malie 6pm–12am Sugarfina 6pm–12am Michael Kors 6pm–12am Wind Spinners 6pm–12am Microsoft 6pm–12am *Sunglass Hut has 3 locations: Street Level 1, Center Court, Level 3, Ewa Wing and Level 3, Mauka Wing. -

Langkah Membuka Bisnis Restoran Di Jepang

VOLUME NO.1//2020 MARKET INTELLIGENT LANGKAH MEMBUKA BISNIS RESTORAN DI JEPANG INDONESIAN TRADE PROMOTION CENTER (ITPC) OSAKA DAFTAR ISI 03 Gambaran Umum Bisnis Restoran di Jepang 04 Pasar Jasa Makanan di Jepang 07 Tren Pasar Restoran di Jepang 09 Tahapan Mendirikan Restoran bagi WNA di Jepang 10 Tahapan Umum Mendirikan Restoran di Jepang 11 Pendaftaran Perusahaan 14 Mendapatkan Visa Manajer Bisnis 17 Mendapatkan Izin Bisnis Restoran 21 Ketentuan Lain dalam Bisnis Restoran 22 Ketentuan Operasional 25 Ketentuan Tenaga Kerja 28 Ketentuan Pajak 34 Peluang Pasar Bisnis Restoran di Jepang 35 Gambaran Tren Kuliner 41 Masakan Asing di Jepang 45 Potensi Makanan Indonesia 49 Tips Menjalankan Bisnis Restoran di Jepang 50 Sertifikasi Halal 54 Suplai Bahan Baku 60 Tips Lainnya MARKET INTELLIGENT VOL.1/2020 | 2 GAMBARAN UMUM PASAR JASA MAKANAN DI JEPANG MARKET INTELLIGENT VOL.1/2020 | 3 PASAR JASA MAKANAN DI JEPANG Gambaran Umum kerja (USD 15,8 miliar). Semua sub sektor tumbuh sedikit dari 2015 hingga 2018. Dengan jumlah penduduk sekitar 127 juta dan produk domestik bruto (PDB) sebesar USD 5 Perkembangan Outlet triliun pada tahun 2018, Jepang merupakan salah satu pasar konsumen terbesar di dunia, Restoran memberikan peluang bagi para eksportir Di Jepang, sub sektor restoran memiliki Indonesia, terutama bagi mereka yang berminat penjualan terbesar di sektor jasa makanan laba pada pasar jasa makanan. Jepang, menyumbang 50,9% dari total pendapatan jasa makanan pada tahun 2018. Di Industri jasa makanan konsumen Jepang dalam sub sektor restoran, gerai makan kasual penting, mencapai penjualan sebesar USD mencatat penjualan tertinggi sebesar USD 91,5 274,6 miliar pada tahun 2018. -

Published on 7 October 2016 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2016) Published on 7 October 2016 1. Constituents Change Addition( 70 ) Deletion( 60 ) Code Issue Code Issue 1810 MATSUI CONSTRUCTION CO.,LTD. 1868 Mitsui Home Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2196 ESCRIT INC. 2117 Nissin Sugar Co.,Ltd. 2198 IKK Inc. 2124 JAC Recruitment Co.,Ltd. 2418 TSUKADA GLOBAL HOLDINGS Inc. 2170 Link and Motivation Inc. 3079 DVx Inc. 2337 Ichigo Inc. 3093 Treasure Factory Co.,LTD. 2359 CORE CORPORATION 3194 KIRINDO HOLDINGS CO.,LTD. 2429 WORLD HOLDINGS CO.,LTD. 3205 DAIDOH LIMITED 2462 J-COM Holdings Co.,Ltd. 3667 enish,inc. 2485 TEAR Corporation 3834 ASAHI Net,Inc. 2492 Infomart Corporation 3946 TOMOKU CO.,LTD. 2915 KENKO Mayonnaise Co.,Ltd. 4221 Okura Industrial Co.,Ltd. 3179 Syuppin Co.,Ltd. 4238 Miraial Co.,Ltd. 3193 Torikizoku co.,ltd. 4331 TAKE AND GIVE. NEEDS Co.,Ltd. 3196 HOTLAND Co.,Ltd. 4406 New Japan Chemical Co.,Ltd. 3199 Watahan & Co.,Ltd. 4538 Fuso Pharmaceutical Industries,Ltd. 3244 Samty Co.,Ltd. 4550 Nissui Pharmaceutical Co.,Ltd. 3250 A.D.Works Co.,Ltd. 4636 T&K TOKA CO.,LTD. 3543 KOMEDA Holdings Co.,Ltd. 4651 SANIX INCORPORATED 3636 Mitsubishi Research Institute,Inc. 4809 Paraca Inc. 3654 HITO-Communications,Inc. 5204 ISHIZUKA GLASS CO.,LTD. 3666 TECNOS JAPAN INCORPORATED 5998 Advanex Inc. 3678 MEDIA DO Co.,Ltd. 6203 Howa Machinery,Ltd. 3688 VOYAGE GROUP,INC. 6319 SNT CORPORATION 3694 OPTiM CORPORATION 6362 Ishii Iron Works Co.,Ltd. 3724 VeriServe Corporation 6373 DAIDO KOGYO CO.,LTD. 3765 GungHo Online Entertainment,Inc. -

Resolving Labour Shortage? the Digital Transformation of Working Practices in the Japanese Service Sector

This is an open source publication by LeidenAsiaCentre, July 2019. LEIDENASIACENTRE Resolving Labour Shortage? The Digital Transformation of Working Practices in the Japanese Service Sector Saori Shibata LeidenAsiaCentre is an independent research centre affiliated with Leiden University and made possible by a grant from the Vaes Elias Fund. The centre focuses on academic research with direct application to society. All research projects are conducted in close cooperation with a wide variety of partners from Dutch society. More information can be found on our website : www.leidenasiacentre.nl For contact or orders: [email protected] M. de Vrieshof 3, 2311 BZ Leiden, The Netherlands 0 1. Introduction Many advanced democracies, including Japan, face a shift toward an ageing society and a labour shortage. The Japanese Ministry of Labour, Health and Welfare (MHLW) reports in its Labour Economy Survey that on average roughly 55 % of firms in the hospitality industry (hotels, restaurants and cafes) face a labour shortage of part-time workers in 2018 (MHLW 2018:7). Many restaurants in Japan were already forced to end 24-hour opening due to labour shortages (Harding 2017). It has progressed automation in restaurants. For instance, an increasing number of restaurants and cafes started introducing automation and robotisation, increasing labour productivity, improving advertisement, requiring a smaller number of workers and reducing labour costs. Some restaurants integrated registered customers’ smartphones and send advertising messages to their smartphones when they are near to restaurants. This can contribute to the reduction of advertisement costs and effectively increase customers. IBM Japan invented a system named “Chef Watson”, which creates a large number of menus for restaurants with just a little input of some food ingredients (Nakata 2014). -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Zhou Hei Ya International Holdings Focus on Potential Demand and Attempts at Extending Brand

Equity Research December 13, 2017 Zhou Hei Ya International Holdings Focus on potential demand and attempts at extending brand Initial Coverage Initiate with BUY Investment positives We initiate coverage with a BUY rating and a target price of HK$9.72 Ticker 01458.HK based on 23.4x 2018e P/E—lower than the average for Hong Kong CICC investment rating * BUY Last close HK$7.08 staples and global peers using chain store business models. Given the CICC target HK$9.72 long-term growth visibility, the current 16.5x 2018e P/E presents a good buying opportunity, in our view. 52wk price range HK$9.80–6.38 Market cap (bn) HK$17 Why a BUY rating? Daily value (mn) HK$21.46 Abundant demand potential. We expect potential demand for Shares outstanding (mn) 2,383 existing products at 4.3x of 2017e sales in self-operated stores Free float (%) 100 (Rmb2.78bn). Assuming the company meets all potential demand in Daily volume (mn sh) 2.97 Business sector Food & Beverages 10 years, we expect the sales CAGR of self-operated stores to reach 15.6% over 2017–2027 in our base case. 01458.HK HSCEI Margin correction does not reflect weakening consumption. The 130 margin correction is more a result of the company's attempts to expand membership, foster robust growth of online demand and a 120 mismatch between the growth pattern of rental cost and average sales per store. Excluding member discounts, ASP and gross margin 110 should remain stable. We also expect the ratios of online expenses Relative Value (%) Value Relative 100 and rentals to sales to fall after peaking in 2020 and 2022. -

Meet 65,000 Buyers in Hotel, Restaurant and Food Service Industry

Japan’s Largest Exhibition for Hospitality Standard Booth (Space ONLY) Special Trade show for Food-service, Accommodation & Leisure industries 1 booth=9㎡ (W2,970mm× D2,970mm× H2,700mm) Early bird 2700㎜ Early bird discount discount 47 [Until Jul. 31] 378,000 JPY (tax incl.) 75,600 Final application JPY No carpet [Until Sep. 28] 453,600 JPY (tax incl.) 2970㎜ 2970㎜ Option: Package Plan Trade show for Food-service & Home delivery 40 1 booth with Package W2,970×D2,970×H2,700 unit/ mm Company name Outlet 507,600 JPY (Early bird) Price Fascia board 583,200 JPY (Final Application) (incl. Construction fee & 8% consumption tax) 1. Fascia board + Company name 5-3 Rental equipment (Choose 3 items) Trade show for Kitchen equipment 2. Outlet (100V, Single phase) J. Rectangle table (Choose 1 item) 3. Carpet (Choose your own color) K. Wall shelf (x 1 unit) 4. Meeting set L. White cloth (2200x1000mm x 3 units) 5. Rental equipments (Choose your own)※ M. Brochure stand (A4 size, 6 rows) 5-1 Electrical equipment (Choose 3 items) N. Panel stand (Choose 1 item) 2700 A. Fluorescent light (40W) O. Fire extinguisher B. Spotlight (100W) P. Table-top brochure stand & Business card box C. Arm spotlight (100W) Q. Hanger stand (x 1 unit) & Hangers (x 10 units) 5-2 Rental equipment (Choose 1 item) ※Check the official website or contact the Secretariat Carpet D. Reception counter 6. Electricity (Choose your own color) E. Square table (Choose 1 item) Electric wiring work (Up to 1kW/ 100V) Date Venue F. Counter table (φ600xH1000mm) Electricity usage (1kW/ For set up & show period ) 2970 Tue Fri G. -

Ohsho Food Service (9936): August Sales, Industry Update

MITA SECURITIES Equity Research September 2, 2021 MITA SECURITIES Co., Ltd. Ohsho Food Service Junichi Shimizu Chief Analyst, Head of Research TSE 1st Section 9936 Industry: Food service, retail [email protected] August sales, industry update Update Monthly data for August: affected by the expansion of shortened hours areas Rating Ohsho Food Service (9936, the company) disclosed monthly data for its directly-owned Buy stores for August (on a preliminary basis). Same-store sales were 91.4% YoY (same month last yar = 100%; 104.6% for July). The number of holidays (weekends and national holidays) Target price (JPY) 7,250 was one less than in August 2020. The breakdown is as follows: number of customers 88.8% Stock price (JPY) (Sep 2) 5,930 (99.1% for July); average spend per customer 102.9% (105.5% for July). Market cap (JPYbn) 138.1 Same-store sales were 87.6% of August 2019 figure (our estimate; 98.2% for July). The Key changes number of holidays was the same as in August 2019. Rating No Target price No The weakness of the August numbers compared to July appears to be a trend similar to Earnings forecast No that of restaurant operators in general. In August, the areas subject to emergency Stock price (JPY) measures and priority measures to prevent the spread of the disease were expanded, and 8,000 restaurants in these areas were requested to shorten their hours and stop serving alcohol. 7,500 7,000 (the company operated normally in August 2020). According to the company, sales 6,500 between 5:00 am and 8:00 pm (the hours not subject to the request for shorter hours) 6,000 5,500 were 107.9% of the same month last year, a significantly strong figure.