SECURITIES and EXCHANGE COMMISSION Washington, D.C. 20549

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Elenco Titoli Non Complessi

Codice prodotto/ISIN Denominazione Tipo prodotto IT0004746647 BNL FRN 29/07/2016 Obbligazione FR0010859967 BNP PARIBAS PS 3,75% 26/02/2020 Obbligazione XS0653885961 BMW FINANCE 3,625% 29/01/2018 Obbligazione XS0490567616 BIRS 3,75% 19/05/2017 Obbligazione AN8068571086 SCHLUMBERGER (NEW YORK) Azione ANN963511061 WHN WORLD HEALTH NETWORK Azione AT00000BENE6 BENE Azione AT0000609631 ALLGEMEINE BAUGESELLSCHAFT Azione AT0000617808 AUSTRIA ANTRIEBESTECHNIK G Azione AT0000624739 BSK BANK PRIV Azione IT0004647522 BP FRIULADRIA FRN 29/08/2017 STEP UP Obbligazione AT0000652201 DIE ERSTE IMMOBILIEN AG AOR Azione GB00B2QM7Y61 BARCLAYS SU BRC RMF DIVERS MAG17 (NQ) Warrant AT0000728209 MANNER JOSEF & CO Azione AT0000734835 MIBA AG Azione AT0000741301 KAPITAL & WERT VERM. SVERWALTUNG Azione AT0000746409 OESTERREICHISCHE ELEKTRIZITAETSW Azione AT0000747555 UPDATE COM SOFTWARE Azione AT0000758305 PALFINGER AG Azione AT0000776307 SANOCHEMIA PHARMAZEUTIKA AG AOR Azione AT0000779038 SCHLUMBERGER AG AOR PREFERRED Azione AT0000793658 ADCON TELEMETRY AG AOR Azione AT0000808209 SW UMWELTTECHNIK STOISER & WOLSCH Azione AT0000816301 UNTERNEHMENS INVEST. AG AOR Azione AT0000820659 BRAIN FORCE SOFTWARE AG Azione AT0000834007 WOLFORD AG Azione AT0000837307 ZUMTOBEL Azione AT0000908520 WIENER STAEDTISCHE VERSICHERUNG AG Azione AT0000A02177 BDI BIODIESEL INT Azione AT0000A08968 AUSTRIA 4,35% 15/03/2019 Obbligazione AT0000A0MS25 CA-IMMOBILIEN ANLAGEN Azione IE00B95FFX04 ETF UBS MAP BALANCED 7 UCITS EUR CL. A (XETRA) Fondo AU000000AMP6 AMP LIMITED Azione AU000000ANZ3 -

The Great Telecom Meltdown for a Listing of Recent Titles in the Artech House Telecommunications Library, Turn to the Back of This Book

The Great Telecom Meltdown For a listing of recent titles in the Artech House Telecommunications Library, turn to the back of this book. The Great Telecom Meltdown Fred R. Goldstein a r techhouse. com Library of Congress Cataloging-in-Publication Data A catalog record for this book is available from the U.S. Library of Congress. British Library Cataloguing in Publication Data Goldstein, Fred R. The great telecom meltdown.—(Artech House telecommunications Library) 1. Telecommunication—History 2. Telecommunciation—Technological innovations— History 3. Telecommunication—Finance—History I. Title 384’.09 ISBN 1-58053-939-4 Cover design by Leslie Genser © 2005 ARTECH HOUSE, INC. 685 Canton Street Norwood, MA 02062 All rights reserved. Printed and bound in the United States of America. No part of this book may be reproduced or utilized in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system, without permission in writing from the publisher. All terms mentioned in this book that are known to be trademarks or service marks have been appropriately capitalized. Artech House cannot attest to the accuracy of this information. Use of a term in this book should not be regarded as affecting the validity of any trademark or service mark. International Standard Book Number: 1-58053-939-4 10987654321 Contents ix Hybrid Fiber-Coax (HFC) Gave Cable Providers an Advantage on “Triple Play” 122 RBOCs Took the Threat Seriously 123 Hybrid Fiber-Coax Is Developed 123 Cable Modems -

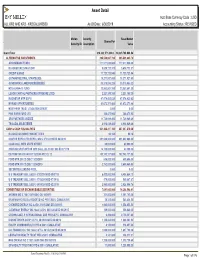

Asset Detail Acct Base Currency Code : USD ALL KR2 and KR3 - KR2GALLKRS00 As of Date : 6/30/2019 Accounting Status : REVISED

Asset Detail Acct Base Currency Code : USD ALL KR2 AND KR3 - KR2GALLKRS00 As Of Date : 6/30/2019 Accounting Status : REVISED Mellon Security Base Market . Shares/Par Security ID Description Value Grand Total 214,322,571,803.0.. 18,225,768,088.54 ALTERNATIVE INVESTMENTS 395,539,667.780 395,539,665.78 ARROWMARK FUND I 177,577,920.000 177,577,920.00 BLACKSTONE STRAT OPP 5,629,722.370 5,629,722.37 CREDIT SUISSE 11,723,723.940 11,723,723.94 GOTHAM NEUTRAL STRATEGIES 18,271,927.600 18,271,927.60 GOVERNORS LANE FUNDÉÉÉÉÉÉÉÉ 30,370,085.220 30,370,085.22 H2O ALPHA-10 FUND 23,983,801.350 23,983,801.35 LUXOR CAPITAL PARTNERS OFFSHORE LTDD 2,221,195.350 2,221,195.35 MAGNETAR MTP EOF II 47,074,425.620 47,074,425.62 MYRIAD OPPORTUNITIES 61,672,371.480 61,672,371.48 NORTHERN TRUST LITIGATION CREDIT 2.000 0.00 PINE RIVER FUND LTD 366,473.900 366,473.90 SRS PARTNERS USÉÉÉÉ 11,729,989.490 11,729,989.49 TRICADIA SELECTÉÉÉÉ 4,918,029.460 4,918,029.46 CASH & CASH EQUIVALENTS 901,268,217.160 887,047,810.08 BLACKROCK MONEY MARKET FD B 90.160 90.16 CANTOR REPO A TRI REPO 2.450% 07/01/2019 DD 06/28/19 691,600,000.000 691,600,000.00 CASH COLL WITH STATE STREET 60,000.000 60,000.00 CNH/USD SPOT OPTION 2019 CALL JUL 19 007.000 ED 071119 14,130,000.000 42,390.00 EB TEMP IVN FD VAR RT 12/31/49 FEE CL 12 182,143,127.000 182,143,127.00 FORD MTR CR CO DISC 11/25/2019 636,000.000 609,606.00 FORD MTR CR CO DISC 12/04/2019 2,762,000.000 2,685,469.58 SECURITIES LENDING POOL 0.000 0.00 U S TREASURY BILL 0.000% 07/02/2019 DD 05/07/19 6,422,000.000 6,408,684.73 U S TREASURY -

Sihvonenjaakko.Pdf

Jaakko Sihvonen TALOUDELLISEN VÄÄRINKÄYTÖSKOLMION JA TALOUDELLISTEN VÄÄRINKÄYTÖSTEN VÄLINEN YHTEYS Havainnot Yhdysvalloista ajanjaksolta 2006−2016 Johtamisen ja talouden tiedekunta Pro gradu -tutkielma Marraskuu 2020 TIIVISTELMÄ Jaakko Sihvonen: Taloudellisen väärinkäytöskolmion ja taloudellisten väärinkäytösten välinen yhteys Pro gradu -tutkielma Tampereen yliopisto Kauppatieteiden tutkinto-ohjelma, yrityksen laskentatoimi Marraskuu 2020 Globaalien markkinoiden kiihtyvä kasvu ja yhdysvaltalaisten julkisten osakeyhtiöiden hallintorakenteiden monimuotoisuus ovat tarjonneet mahdollisuuksia petolliselle liiketoiminnalle. Vaikka lainsäädäntöä on pyritty uudistamaan ja hallintorakenteita implementoimaan kohti läpinäkyvämpää toimintaa, taloudelliset väärinkäytökset ovat kasvaneet finanssikriisin aikana ja sen jälkeen uusiin mittakaavoihin. Tämän tutkimuksen tavoitteena on selvittää taloudellisen väärinkäytöskolmion elementtien yhteys taloudellisiin väärinkäytöksiin sekä päivittää aikaisemmin 2000- luvulla tehtyjä tutkimuksia. Tässä tutkimuksessa selvitetään, voidaanko Cresseyn 1950- luvulla luoman taloudellisen väärinkäytöskolmion avulla havaita ja ennustaa taloudellisia väärinkäytöksiä. Tutkimusasetelma luotiin siten, että Yhdysvaltojen arvopaperimarkkinoita valvovan elimen, Securities and Exchange Commissionin, verkkosivuilta etsittiin vuosina 2015−2019 julkaistut mediatiedotteet taloudellisista väärinkäytöksistä ja niitä tehneistä yhtiöistä. Havaituille väärinkäytösyhtiöille etsittiin satunaisesti vertailuyhtiö yhtiön kokoon perustuen. Tutkimus -

Telecommunications Provider Locator

Telecommunications Provider Locator Industry Analysis & Technology Division Wireline Competition Bureau March 2009 This report is available for reference in the FCC’s Information Center at 445 12th Street, S.W., Courtyard Level. Copies may be purchased by contacting Best Copy and Printing, Inc., Portals II, 445 12th Street S.W., Room CY-B402, Washington, D.C. 20554, telephone 800-378-3160, facsimile 202-488-5563, or via e-mail at [email protected]. This report can be downloaded and interactively searched on the Wireline Competition Bureau Statistical Reports Internet site located at www.fcc.gov/wcb/iatd/locator.html. Telecommunications Provider Locator This report lists the contact information, primary telecommunications business and service(s) offered by 6,252 telecommunications providers. The last report was released September 7, 2007.1 The information in this report is drawn from providers’ Telecommunications Reporting Worksheets (FCC Form 499-A). It can be used by customers to identify and locate telecommunications providers, by telecommunications providers to identify and locate others in the industry, and by equipment vendors to identify potential customers. Virtually all providers of telecommunications must file FCC Form 499-A each year.2 These forms are not filed with the FCC but rather with the Universal Service Administrative Company (USAC), which serves as the data collection agent. The pool of filers contained in this edition consists of companies that operated and collected revenue during 2006, as well as new companies that file the form to fulfill the Commission’s registration requirement.3 Information from filings received by USAC after October 16, 2007, and from filings that were incomplete has been excluded from this report. -

THE HISTORY of ONLINE SEARCHING by Matt Hannigan

AT A LONG STRANGE TRIP IT'S BEEN: THE HISTORY OF ONLINE SEARCHING by Matt Hannigan, lndianapolis-Mmion Cotm[Y Public Library N THE BEGINNING You can't miss the timeline that runs through this article. What I find remarkable is how fast all of this When the editor asked me to write this stuff occurred. I sometimes feel like one of those history of the last twenty years of cartoon characters who is left standing in his union suit searching it wasn't because I'm the senior statesperson after being whirled about in the dust of the Road of online in Indiana. That title rightly belongs to Ann Runner or Speedy Gonzalez. Van Camp (formerly of the IU Medical Library, now an independent searcher). Nor am I the intellectual When I first started my career in libraries back in backbone of Indiana's online community. That honor 1978, a young scholar would drive to the library, find a goes to Becki Whitaker of the Indiana Cooperative parking space, locate the proper division, find a Library Services Authority (INCOLSA) . Becki is online's periodical index, guess at a subject and finally identify nearest approximation to Star Trek's Mr. Speck. My and locate an article on the history of the Punic War. role has been more like that of Forrest Gump or Jar Jar These days the same young student jumps out of bed, Binks - I just happened to be along for the ride. Arid logs onto the Net, types some keywords into an EBSCO what a ride it has been! One can picture future Carl database - and in a few moments is reading an article Sagans and Jacob Bronowskis speaking of this era and on the history of MTV. -

Lessons from Enron Thomas G

Pepperdine Law Review Volume 32 Issue 2 Symposium: Can the Ordinary Practice of Law Article 15 Be a Religious Calling? 1-20-2005 The Lawyer as Truth-Teller: Lessons from Enron Thomas G. Bost Follow this and additional works at: http://digitalcommons.pepperdine.edu/plr Part of the Corporation and Enterprise Law Commons, Ethics and Professional Responsibility Commons, and the Legal Profession Commons Recommended Citation Thomas G. Bost The Lawyer as Truth-Teller: Lessons from Enron, 32 Pepp. L. Rev. 2 (2005) Available at: http://digitalcommons.pepperdine.edu/plr/vol32/iss2/15 This Symposium is brought to you for free and open access by the School of Law at Pepperdine Digital Commons. It has been accepted for inclusion in Pepperdine Law Review by an authorized administrator of Pepperdine Digital Commons. For more information, please contact [email protected]. The Lawyer as Truth-Teller: Lessons From Enron Thomas G. Bost* I. THE "CODE" The teaching and practice of law assume and are shaped by, in Joseph Allegretti's words, the "standard vision" of lawyer conduct and ethical responsibility.' Under the standard vision, which is reflected in the various codes of professional responsibility governing lawyers, the lawyer is a "neutral partisan" for his or her client: "neutral" in that he does not let his moral values affect his actions on behalf of his client; "partisan" in that she does whatever she can within the limits of the law to advance her client's stated interests. Because the standard vision is readily understood by most lawyers as imposing a code of conduct upon them in their practice of law, Allegretti calls the standard vision the "Code.",2 Although the Code is not codified per se, it is reflected in the Constitution, with its guarantees of trial by jury and assistance of legal counsel, in our judicial system, which is primarily adversarial rather than inquisitorial, and in the various codes of ethics governing lawyer behavior. -

Liquid Assets: Enron's Dip Into Water Business Highlights Pitfalls of Privatization

Liquid Assets: Enron's Dip into Water Business Highlights Pitfalls of Privatization A special report by Public Citizen’s Critical Mass Energy and Environment Program Washington, D.C. March 2002 Liquid Assets: Enron's Dip into Water Business Highlights Pitfalls of Privatization A special report by Public Citizen’s Critical Mass Energy and Environment Program Washington, D.C. March 2002 This document can be viewed or downloaded at www.citizen.org/cmep. Public Citizen 215 Pennsylvania Ave., S.E. Washington, D.C. 20003 202-546-4996 fax: 202-547-7392 [email protected] www.citizen.org/cmep © 2002 Public Citizen. All rights reserved. Public Citizen, founded by Ralph Nader in 1971, is a non-profit research, lobbying and litigation organization based in Washington, D.C. Public Citizen advocates for consumer protection and for government and corporate accountability, and is supported by over 150,000 members throughout the United States. Liquid Assets: Enron's Dip into Water Business Highlights Pitfalls of Privatization Executive Summary The story of Enron Corp.’s failed venture into the water business serves as a cautionary tale for consumers and policymakers about the dangers of turning publicly operated water systems and resources over to private corporations and creating a private “market” system in which water can be traded as a commodity, as Enron did with electricity and tried to do with water. Enron’s water investments, which contributed to the company’s spectacular collapse, would not have been permitted had the Public Utility Holding Company Act (PUHCA) been properly enforced and not continually weakened by the deregulation initiatives advocated by Enron and other energy companies. -

1 UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

1 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: September 30, 2000 Check here if Amendment [ ]; Amendment Number: This Amendment (Check only one.): [ ] is a restatement. [ ] adds new holdings entries Institutional Investment Manager Filing this Report: Name: AMERICAN INTERNATIONAL GROUP, INC. Address: 70 Pine Street New York, New York 10270 Form 13F File Number: 28-219 The Institutional Investment Manager filing this report and the person by whom it is signed represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Edward E. Matthews Title: Vice Chairman -- Investments and Financial Services Phone: (212) 770-7000 Signature, Place, and Date of Signing: /s/ Edward E. Matthews New York, New York November 14, 2000 - ------------------------------- ------------------------ ----------------- (Signature) (City, State) (Date) Report Type (Check only one.): [X] 13F HOLDINGS REPORT. (Check if all holdings of this reporting manager are reported in this report.) [ ] 13F NOTICE. (Check if no holdings reported are in this report, and all holdings are reported in this report and a portion are reported by other reporting manager(s).) [ ] 13F COMBINATION REPORT. (Check -

Lehman Brothers Holdings

SECURITIES AND EXCHANGE COMMISSION FORM 13F-HR/A Initial quarterly Form 13F holdings report filed by institutional managers [amend] Filing Date: 2004-12-01 | Period of Report: 2004-09-30 SEC Accession No. 0000806085-04-000212 (HTML Version on secdatabase.com) FILER LEHMAN BROTHERS HOLDINGS INC Mailing Address Business Address LEHMAN BROTHERS LEHMAN BROTHERS CIK:806085| IRS No.: 133216325 | State of Incorp.:DE | Fiscal Year End: 1130 745 SEVENTH AVENUE 745 SEVENTH AVENUE Type: 13F-HR/A | Act: 34 | File No.: 028-03182 | Film No.: 041177215 NEW YORK NY 10019 NEW YORK NY 10019 SIC: 6211 Security brokers, dealers & flotation companies 2125267000 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document NON-CONFIDENTIAL <TABLE> <CAPTION> TITLE OF VALUE SHRS OR SH/ PUT/ INVESTMENT OTHER VOTING AUTHORITY NAME OF ISSUER CLASS CUSIP (X$1000) PRN AMT PRN CALL DISCRETION MANAGERS SOLE SHARED NONE <S> <C> <C> <C> <C> <C> <C> -------------------------------- -------- --------- -------- ------- --- ---- ---------- -------- -------- -------- -------- ***DAIMLERCHRYSLER A.G. COMMON D1668R123 9514 227843 SH DEFINED 01 227843 0 0 ***SANOFI AVENTIS COMMON F5548N101 34013 491666 SH DEFINED 01 491666 0 0 PNM RESOURCES COMMON GKD49H100 0 50000 SH DEFINED 01 0 0 50000 PNM RESOURCES COMMON GKD49H100 0 200000 SH DEFINED 01 200000 0 0 ***ACE LTD-ORD COMMON G0070K103 9964 248616 SH DEFINED 01 0 0 248616 ***ASPEN INSURANCE HOLDINGS COMMON G05384105 3950 171680 SH DEFINED 01 171680 0 0 ***ASSURED GUARANTY -

The Great Telecom Meltdown

4 The Internet Boom and the Limits to Growth Nothing says “meltdown” quite like “Internet.” For although the boom and crash cycle had many things feeding it, the Internet was at its heart. The Internet created demand for telecommunications; along the way, it helped create an expectation of demand that did not materialize. The Internet’s commercializa- tion and rapid growth led to a supply of “dotcom” vendors; that led to an expec- tation of customers that did not materialize. But the Internet itself was not at fault. The Internet, after all, was not one thing at all; as its name implies, it was a concatenation [1] of networks, under separate ownership, connected by an understanding that each was more valuable because it was able to connect to the others. That value was not reduced by the mere fact that many people overesti- mated it. The ARPAnet Was a Seminal Research Network The origins of the Internet are usually traced to the ARPAnet, an experimental network created by the Advanced Research Projects Agency, a unit of the U.S. Department of Defense, in conjunction with academic and commercial contrac- tors. The ARPAnet began as a small research project in the 1960s. It was pio- neering packet-switching technology, the sending of blocks of data between computers. The telephone network was well established and improving rapidly, though by today’s standards it was rather primitive—digital transmission and switching were yet to come. But the telephone network was not well suited to the bursty nature of data. 57 58 The Great Telecom Meltdown A number of individuals and companies played a crucial role in the ARPAnet’s early days [2].