Things Wonderful in Tasmanian Single Malt Whisky

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Top Shelf International Holdings Ltd

Top Shelf International Holdings Ltd Principal Place of Business: 16-18 National Boulevard Campbellfield Victoria Australia 3061 22 July 2021 ASX ANNOUNCEMENT (ASX:TSI) Top Shelf International (“TSI”), Australia’s leading premium spirits company, provides an overview of its Maturing Spirit Inventory and Net Sales Value. As at 30 June 2021 • At 30 June 2021, TSI had maturing spirits (Whisky & Agave) with a Net Sales Value of $272 million, an increase of 521% YOY and 154% above Prospectus. • TSI’s total spirit inventory increased to 3.5 million litres in FY21, an increase of 410% on 30 June 2020. • In FY21 2H, TSI achieved an Average Net Sales Value per litre for NED Whisky of $71.40 (an increase of 23% from FY21 1H to FY21 2H). TSI engaged PwC to perform certain procedures on the calculations and methodology to derive the 30 June 2021 whisky Net Sales Value per litre calculation. Forecast • With planned production considered: • By 30 June 2022, TSI forecasts that Net Sales Value of maturing spirits will increase to $418 million. • TSI will have a total of 6.6 million litres of mature spirits (Whisky & Agave) available for sale within the next five years (prior to 30 June 2026) with a Net Sales Value of $500 million. • Net Sales Value over a five year period is an important metric for TSI. It provides an indication of timeframes in which inventory can be expected to be available for sale. The five year period corresponds with: • Two maturation cycles of Whisky, and; • One maturation cycle of Agave. Refer to TSI’s maturing spirit inventory presentation dated 22 July 2021. -

Botanics in a Bottle

Insider THIRST QUENCHER Botanics in a bottle Propelled by dynamic craft spirit makers and cutting-edge mixologists, the Australian gin scene is growing up AUSTRALIA IS IN THE MIDDLE of a gin renaissance. Driven by distilleries, boutique bars and mastermind mixologists, we are becoming more “gintrified” than ever. Our consumption of juniper juice is booming and our craft distilleries are collecting prestigious international awards. Te secret, it seems, is the Indigenous ingredients being used – native myrtle, Tasmanian pepperberry, finger limes and wattle seed – wielded with wizardry in sheds and wineries across the country. Andrew Marks of the Melbourne Gin Company makes gin at his parent’s winery, Gembrook Hill “Tere’s a strong appetite for ‘local’ Four Pillars’ Cameron McKenzie, Vineyard, in the Yarra Valley, 50 in a lot of facets of people’s lives; a winemaker, and others such as minutes from Melbourne. He takes a they’re trying to support farming and Sacha La Forgia of 78 Degrees in winemaking approach, distilling all producers and this is just another the Adelaide Hills have been drawn 11 botanicals separately – including avenue to do so,” says Andrew. to the craft by the opportunity to local grapefruit peel, macadamias Te West Winds Gin from Western experiment with botanicals and and sandalwood – to better gauge Australia and Victorian-based Four flavour. the effect each has on the finished Pillars have put Australian gin on Oddly though, the story of product. Tey’re then blended and the map. Four Pillars, also based in Australia’s craft gin craze actually cut back with filtered rainwater the Yarra Valley, scooped the San begins with whisky. -

Hills Whisky Boost Raises Spirits at Mighty Craft

30/07/2021 Hills whisky boost raises spirits at Mighty Craft Support independent journalism DONATE SUBSCRIBE Hills whisky boost raises spirits at Mighty Craft BUSINESS More than 70,000 litres of mature Adelaide Hills whisky this year will supercharge listed beverage company Mighty Craft’s and fuel its rise to becoming one of Australia’s biggest craft beverage players. Adelaide Hills Distillery founder Sacha La Forgia with Mighty Craft products including his 78 Degrees Australian Whisky. The company that last month announced a $47 million plan to buy SA producers Adelaide Hills Distillery, Mismatch Brewing and Hills Cider yesterday reported sales revenue for the June quarter of $8.9 million, taking its financial year cash receipts to $31 million. https://indaily.com.au/news/business/2021/07/30/hills-whisky-boost-raises-spirits-at-mighty-craft/ 1/4 30/07/2021 Hills whisky boost raises spirits at Mighty Craft They are also expected to be a major boost to Mighty Craft’s whisky acceleration program with figures released in yesterday’s report showing Adelaide Hills Distillery will alone add 78,487 litres of mature whiskey to group inventories this calendar year. A further 63,000 litres of Adelaide Hills Distillery whisky is expected to reach maturity before the end of 2023 adding to the about 45,000 of other Mighty Craft whisky set to reach maturation by 2026. Future whisky stocks increased by 27,556 litres during the June quarter, mainly driven by production of Hidden Lake and the Adelaide Hills Distillery brands. That whisky will not reach maturity until at least 2024. -

International Whisky Competition®

INTERNATIONAL WHISKY COMPETITION™ ENTRY GUIDE Overview…………….…................................ Page 2 Shipping Instructions…................................. Page 3 Category Class Codes.................................. Page 4 2019 IWC Entry Form…............................... Page 5 Golden Barrel Trophy www.WhiskyCompetition.com - [email protected] - Tel: +1-702-234-3602 OVERVIEW Thank you for entering the 10th edition of the International Whisky Competition! Established in 2010, the International Whisky Competition has grown into the most followed whisky competition with over 30,000 fans, one of the most serious and professional whisky competition in the world. Unlike other spirits competitions we only focus on whisk(e)y and we ensure each winner gets the special attention they deserve. What to expect when entering the International Whisky Competition: • Unique medal for each winner featuring the category in which the whisky won. These medals are coveted among master distillers and are recognized by whisky fans to have a significant meaning. • Each winning whisky also receives a superior quality certificate to showcase in your distillery. • Each entry is rated on a 100 point basis and we offer sticker badges for score of over 85 points. We do not publicly disclose the score of anything below 85. • Proper attention given to your whisky as each judge is presented with one whisky at a time. In-depth notes are taken at every step including various aromas and flavours. • Each distillery and the whiskies entered will be listed in the 2020 International Whisky Guide. The Guide features key information about the distillery, its history, contact information, and full aromas and flavours profile for each whisky entered. Because we only list the whiskies present at the competition there are fewer listed and your distillery gets more attention along with a full color picture for each whisky entered. -

LRK Lark Bar Hobart CBD Brooke Street Pier } Sole Owner of Sepplesfield Exit 07/20 Exit 04/20 Laurent Ly (NED) } 8.7% Holding in LRK } HK Based F&B Investor

LARK : ASX SMALL CAPS PRESENTATION BRAND and BARRELS The Road to Whisky Riches September 2020 ASX SMALL CAPS RECAP ON LARK SINCE WHOLESALE BOARD CHANGE IN 2019/20 EXECUTIVE & BOARD ASSETS & BRANDS David Dearie } Independent Non-Exec Chair } Ex-CEO Treasury Wine Estates Geoff BainbridGe – ManaGinG Director Bothwell Distillery Cambridge Distillery } 10+ Years at Fosters / Ex-MD Spirits } Ex-Founder of Grill’d, Bounce Warren Randall (NED) } 4.4% holding in LRK Lark Bar Hobart CBD Brooke Street Pier } Sole Owner of Sepplesfield Exit 07/20 Exit 04/20 Laurent Ly (NED) } 8.7% Holding in LRK } HK Based F&B Investor Laura McBain (NED) 711,313 Litres } Ex-CEO Bellamy’s Organic $16.7m Cost } Tasmanian Based $99m Mkt Value 2 Lark Bond Stores ASX SMALL CAPS RECAP ON THE STRATEGY ANNOUNCED AT THE NOVEMBER 2019 AGM THE PLAN IS TO MAKE LARK THE “PENFOLDS” OF AUSTRALIAN WHISKY } Premium Brand Position } Embrace 28 Year Lark Heritage } Multi-Tiered Price Point : Lark Rare Cask / Legacy, Lark Classic, Lark Symphony } Innovation Without Compromise to Quality } Strong Asian Consumer & Trade Appeal } Meaningful Scale in Terms of Revenue / Capacity / Maturation } Flexible Sourcing Model – Inhouse & Outsourced } Focused Execution and Superior Returns LARK POINT OF DIFFERENCE } Founder Bill Lark } First Tasmanian Whisky } First Australian Craft Whisky } International Award Winning } Only Australian Peat Bog } Biggest Volume of Tasmanian Whisky Under Maturation “MADE of TASMANIA” 3 ASX SMALL CAPS RECAP ON THE BUSINESS MODEL / THE ECONOMICS Super Premium Whisky -

The Sell: Australian Advertising, 1790S to 1990S

The Sell: Australian Advertising, 1790s to 1990s Checklist Section 1: 1790s to 1851 George Hughes (Government Printer) Playbill for a performance of Jane Shore, The Wapping landlady and The miraculous cure at the Theatre, Sydney, Saturday 30 July 1796 typeset ink on handmade paper; 20 x 12 cm AUSTRALIAN PRINTED COLLECTION, nla.cat-vn4200235 GIFT FROM THE GOVERNMENT OF CANADA TO THE PEOPLE OF AUSTRALIA, 2007 Inscribed on the UNESCO Australian Memory of the World Register, 2011 Thomas Bock (artist and engraver, 1790–1855) Ship Inn & Family Hotel, Elizabeth Street, Hobart c. 1828 engraving; 6.2 x 8.7 cm PETHERICK COLLECTION (PICTURES), nla.cat-vn534027 Thomas Bock (artist and engraver, 1790–1855) H. Baynton, carcass & retail butcher, corn factor & general dealer, Elizabeth Street, Hobart c. 1828 engraving; 4.1 x 7.8 cm PETHERICK COLLECTION (PICTURES), nla.cat-vn2056336 John Armstrong (surveyor, d. 1870) Baker’s Lithography (printer) Sales plan: The Great Broughton Ground estate, in York and Clarence streets: for sale by Mr Stubbs ... on Wednesday the 3rd Novr 1841 at 12 o'clock precisely 1841 hand-coloured lithograph; 38.2 x 51.3 cm RARE MAPS COLLECTION, nla.cat-vn1705270 Front page of The Moreton Bay courier, volume II, no. 85, Brisbane 29 January 1848 letterpress; 50.2 x 38 cm AUSTRALIAN PRINTED COLLECTION, nla.cat-vn177429 James Barnard (Government Printer) Reward! One hundred pounds and conditional pardon: poster for the apprehension of runaway convicts Daniel Priest and John Smith 19 May 1845 wood and metal type letterpress; 56.8 x 75.5 cm REX NAN KIVELL COLLECTION, nla.cat-vn974640 Emigration poster Westminster, London: Colonial Land and Emigration Office, 15 May 1851 wood and metal type letterpress; 57.5 x 51.2 cm FERGUSON COLLECTION, nla.cat-vn1628093 1 Section 2: 1851 to 1901 Penny token: T. -

Single Malt Scotch

TABLE OF CONTENTS: Kentucky ...................................... 1, 2, 3, 4, 5, 6, 7,8, 9, 10 Alabama, Arizona & Arkansas ............................................. 10 California .................................................. 10, 11, 12, 13 Colorado, Delaware & Florida ........................................ 13, 14 Georgia, Hawaii, Idaho, Illinois &Indiana ............................... 15 Iowa, Kansas, Maine, Maryland, Massachusetts & Michigan ................. 16 Michigan & Minnesota ................................................ 17, 18 Missouri, Montana, Nevada, New Jersey & New Mexico ...................... 18 New York ........................................................ 18, 19, 20 North Carolina, North Dakota, Ohio, Oklahoma & Oregon ................... 20 Oregon & Pensylvania .................................................... 21 Rhode Island & South Carolina ........................................... 22 Tennessee ....................................................... 22, 23, 24 Texas ................................................................... 24 Utah, Vermont & Virginia ................................................ 25 Virginia, Washington & Washington DC .................................... 26 West Virginia Wisconsin, Wyoming & NGO ................................. 27 Blended Scotch .................................................. 28, 29, 30 Highland Single Malt Scotch ................................. 30, 31, 32, 33 Speyside Single Malt Scotch ............................. 34, 35, 36, 37, 38 Islay -

The Poetry and Humor of the Scottish Language

in" :^)\EUN'i\TPr/> ^ c^ < ^ •-TilJD^ =o o ir.t' ( qm-^ I| POETRY AND HUMOUR OF THE SCOTTISH LANGUAGE. THE POETRY AND HUMOUR OF THE SCOTTISH LANGUAGE. BY CHARLES MACKAY, LL.D, " Autlior of The Gaelic Etymology of the Languages of Westerti Europe, tuore particularly of the English and Lowland Scotch;" " Recreations Gauloises, or Sources Celtigues de la " " Langue Fratifaise ; and The Obscure Words and Phrases in Shakspeare and his Con- temporaries" is'c. ALEXANDER GARDNER, PAISLEY; LONDON : 12 PATERNOSTER ROW. 1882. :•: J ^ PREFACE. a I/) c The nucleus of this volume was contributed in three " papers to Blackwood's Magazine," at the end of the year 1869 and beginning of 1870. They are here of Messrs. r--. reprinted, by the kind permission Blackwood, CO ^ with many corrections and great extensions, amounting "^ to more than two-thirds of the volume. The original :> intention of the work was to present to the admirers of ^o Scottish literature, where it differs from that of England, only such words as were more poetical and humorous in the Scottish language than in the English, or were \ altogether wanting in the latter. The design gradually extended itself as the with his ^ compiler proceeded task, ^^11 it came to include large numbers of words derived from the Gaelic or Keltic, with which Dr. Jamieson, the 4 author of the best and most copious Scottish Dictionary ^ hitherto published, was very imperfectly or scarcely at all acquainted, and which he very often wofuUy or ludi- crously misunderstood. " Broad Scotch," says Dr. Adolphus Wagner, the eru- and editor of the Poems of Robert dite sympathetic Burns,— pubUshed in Leipzig, in 1835, "is literally broadened, i.e.^ a language ot dialect very worn off, and blotted, whose VL PREFACE. -

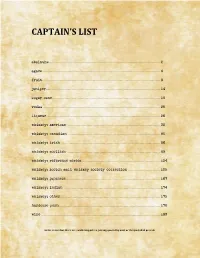

Captain's List

CAPTAIN’S LIST absinthe ............................................................................................................. 2 agave .................................................................................................................... 4 fruit .................................................................................................................... 9 juniper ................................................................................................................ 14 sugar cane .......................................................................................................... 19 vodka ................................................................................................................... 25 liqueur................................................................................................................ 26 whiskey: american ............................................................................................ 32 whiskey: canadian ........................................................................................... 85 whiskey: irish .................................................................................................. 86 whiskey: scottish ............................................................................................ 89 whiskey: reference series ............................................................................. 124 whiskey: scotch malt whiskey society collection ................................ 125 whiskey: japanese............................................................................................ -

Á LA CARTE Fresh from Scotland’S Larder

Á LA CARTE Fresh from Scotland’s larder STARTERS Soup of the Day freshly made and served with crusty sourdough (v) 4.75 Grilled North Uist landed Langoustines with garlic and chive butter, rocket and lemon (gf) 9.95 Ardnamurchan’s Own Haggis, Neeps and Tatties with Auchentoshan 12yr old whisky sauce 6.95 (also available with vegetarian haggis/vegan option) Rope Grown Shetland Mussels in an Arbikie chilli vodka bloody mary sauce with garlic bread 7.95 Smoked Mackerel Pate with tonic pickled cucumber, horseradish pesto and toasted wholemeal 5.95 Whipped Goats Cheese with almond thyme granola, smoked beetroot, mint & lime dressed peashoots (v) 5.95 Vegetarian Haggis Falafel with kohlrabi, shallot, pickled carrot and scotch bonnet jam (v) 6.95 Crispy Isle Of Barra Squid with lime and honey aioli, shaved fennel, red chilli and samphire 7.95 Venison Bresaola Carpaccio with confit cherry tomato, Hebridean blue cheese, pumpkin seeds, rocket and a lavender & lemon vinaigrette (gf) 8.95 Tobermory Fish Co. Smoked Trout and Salmon with fig chutney, pink grapefruit, capers, shallots and toasted wholemeal bread 7.95 Stornoway Black Pudding Fritters with whisky marmalade and a preserved carrot, rocket and sybie salad 6.95 Isle of Mull Scallops with black pudding puree, apple, radish, peashoots and peas 9.95 MAINS Ardnamurchan’s Own Haggis, Neeps and Tatties with Auchentoshan 12yr old whisky sauce 14.95 (also available with vegetarian haggis/vegan option) Breast of Free Range Chicken with a truffle and honey mustard cream, mash and tender stem broccoli -

Starters Mains Sides Salads and Platters Cranachan Fish Tea

starters Soup of the Day (v) • £4.95 Crab Gratin (gf) • £6.50 Mackerel Pate • £6.50 Served with rustic bread and butter Scottish crab mixed with crème fraiche, herbs and lemon. Rustic smoked mackerel with cream cheese, Baked with a parmesan crumb. Served with dressed Cullen Skink • £6.95 spring onions and chive. Choice of bread or oatcakes. leaves and brown toast. Smoked Haddock, leeks and corn simmered in a creamy broth. Served with rustic bread and butter Bruschetta (v) vegan option available • £5.95 Highland Smoked Salmon • £7.95 Toasted sourdough bread topped with vine tomatoes, Haggis Bonbons • £5.95 Scottish smoked salmon with lemon, warm halloumi cheese, chili jam and balsamic glaze. Haggis, neeps and tatties coated in panko breadcrumbs baby capers and brown toast. and lightly fried. Served with a peppercorn dipping sauce. Halloumi (v) • £6.50 Chicken Liver Pate • £5.95 Ham Hock Terrine • £6.50 Smooth chicken liver pate, homemade red onion A Cranachan classic! Ham hock set with capers, gherkins and Lightly fried sticks of Halloumi cheese, served with Cranachan marmalade with choice of rustic bread or oatcakes. parsley. Served with homemade piccalilli and rustic bread. dressed leaves and our homemade chili jam. Desserts Cranachan £6.95 Our signature dessert! Salads and Platters Scottish raspberries, toasted oats, heather honey and Whisky spiked chantilly cream served with Black Pudding Salad • £9.95 Scottish Platter • £11.95pp buttery shortbread. Cranachan Fish Tea Warm black pudding, crispy bacon, baby spinach Our chicken liver pate, Mull of Kintyre cheddar cheese Add a scoop of vanilla ice cream £7.95 and croutons, topped with a soft poached egg and mackerel pate, and miniature Cullen Skink soup. -

What Is Single Malt Whisky? Single Malt Whisky Is Whisky Produced from Only Water and Malted Barley at a Single Distillery by Batch Distillation in Pot Stills

ALL THINGS WONDERFUL IN TASMANIAN SINGLE MALT WHISKY Business Update 2017 1 DISCLAIMER This presentation (“Presentation”) has been prepared by Australian Whisky Holdings Ltd (“AWH” or “Company”). You must read and accept the conditions in this notice of disclaimer (“Disclaimer”) before considering the information set out in or referred to in this Presentation. If you do not agree, accept or understand the terms on which this Presentation is supplied as per this Disclaimer, or if you are subject to the laws of any jurisdiction in which it would be unlawful to receive this Presentation or which requires compliance with obligations that have not been complied with in respect of it, you must immediately return or destroy this Presentation and any other confidential information supplied to you by AWH. Upon receiving this document, you acknowledge and agree to the conditions in this Disclaimer and agree that you irrevocably release AWH from any claims you may have (presently or in the future) in connection with the provision or content of this Presentation. No Offer This Presentation is not a prospectus, product disclosure statement or other offering document under Australian law (and will not be, and is not required to be, lodged with Australian Securities & Investments Commission.) or any other law. This Presentation is for information purposes only and is not (and nothing in it should be construed as) an invitation, offer, solicitation or recommendation with respect to the subscription for, purchase or sale of any security in any jurisdiction . Neither this document nor anything in it shall form the basis of any contract or commitment.