MARKET REPORT 2021 Samedan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Switzerland 4Th Periodical Report

Strasbourg, 15 December 2009 MIN-LANG/PR (2010) 1 EUROPEAN CHARTER FOR REGIONAL OR MINORITY LANGUAGES Fourth Periodical Report presented to the Secretary General of the Council of Europe in accordance with Article 15 of the Charter SWITZERLAND Periodical report relating to the European Charter for Regional or Minority Languages Fourth report by Switzerland 4 December 2009 SUMMARY OF THE REPORT Switzerland ratified the European Charter for Regional or Minority Languages (Charter) in 1997. The Charter came into force on 1 April 1998. Article 15 of the Charter requires states to present a report to the Secretary General of the Council of Europe on the policy and measures adopted by them to implement its provisions. Switzerland‘s first report was submitted to the Secretary General of the Council of Europe in September 1999. Since then, Switzerland has submitted reports at three-yearly intervals (December 2002 and May 2006) on developments in the implementation of the Charter, with explanations relating to changes in the language situation in the country, new legal instruments and implementation of the recommendations of the Committee of Ministers and the Council of Europe committee of experts. This document is the fourth periodical report by Switzerland. The report is divided into a preliminary section and three main parts. The preliminary section presents the historical, economic, legal, political and demographic context as it affects the language situation in Switzerland. The main changes since the third report include the enactment of the federal law on national languages and understanding between linguistic communities (Languages Law) (FF 2007 6557) and the new model for teaching the national languages at school (—HarmoS“ intercantonal agreement). -

Smv Pilot Briefing

FamiliarisationFamiliarisation BriefingBriefing forfor JetJet andand MultiengineMultiengine AircraftAircraft Crews.Crews ENGADIN AIRPORT AG Plazza Aviatica 2 CH – 7503 Samedan Tel +41 81 851 08 51 www.engadin-airport.ch/[email protected] Fax +41 81 851 08 59 1 Index Version/lang. 1.8 Status: final Date of issue: 2010 – 20. December Author/unit: Tower, MT,BH,CM Owner/unit: Engadin Airport AG File: Pages: 42 Classification: Restricted to Engadin Airport Legal notice: The entire content of this publication is protected by copyright. No part of this publication may be reproduced, stored in a retrievable system or transmitted in any form or by any means such as electronic, mechanical, photocopying and recording systems or otherwise, whithout the prior written approval of Engadin Airport. ENGADIN AIRPORT AG Plazza Aviatica 2 CH – 7503 Samedan Tel +41 81 851 08 51 www.engadin-airport.ch/[email protected] Fax +41 81 851 08 59 2 Foreword The Airport of Samedan is a VFR airport and open to private and commercial operators. It is situated in a particular geographical area. Located in the Engadin Valley, the Airport is surrounded by a mountainous region wherein the flight procedures and aircraft performances are very strongly affected by its natural obstacles. This is particularly true for VFR flights. In fact, the approach to and the departure from LSZS is limited to flight crews holding a special briefing. Flight information contained on this page are not official and shall not be used for navigation purposes. For flight preparation use only the official documentation published in the AIP. -

Engadine St. Moritz

Engadine St. Moritz The mist over the lake gradually clears and the first rays of sunlight break through. The sky is a beautiful blue and snow-covered peaks greet new arrivals from the lowlands. Just a few more steps and you have reached your goal – Allegra in Engadine St. Moritz! A warm welcome to the sunniest mountain valley in Switzerland! At 1800 metres above sea level, enjoying 322 days of sunshine every year and blessed with impress- ive mountain views – this is Engadine St. Moritz. With its dry, healthy climate, snow-sure position, seemingly endless expanse of frozen lakes and unique light conditions, this winter destination has been capturing the hearts of visitors from around the world for more than 150 years. It’s not just the landscape that is unique up here but also the relationship that the people have with their history and culture. Tradition is part of the day-to-day routine – with customs including Chalandamarz (the ancient Engadine New Year) and Schlitteda (Sleigh processions), promotion of the Romansch language in both schools and everyday life or typical Engadine architecture. It doesn’t matter whether you stay in sophisticated St. Moritz or idyllic Bever, the attachment of local people to their history is apparent wherever you go. The residents of Upper Engadine also know quite a lot about a variety of challenging winter sports. This is the largest snow sports region in Switzerland and is home to a vast range of high quality activities - from wide skiing and snowboarding pistes to suit every ability level and extensive cross- country skiing trails through magical winter landscapes, to facilities for new and fashionable sports including snowkiting, freeriding or ice climbing – Engadine St. -

Pontresina. Facts and Figures the Village

Pontresina. facts and figures The village The village – fascinating history Languages in Pontresina Guests will be enchanted by the charm of the historical mountain village: lovingly restored Engadin houses from the Languages Population Population Population census 1980 census 1990 census 2000 17th and 18th centuries, palatial belle époque hotels and other architectural gems from earlier times, including the Begräb- Number Amount Number Amount Number Amount niskirche Sta. Maria (Church of the Holy Sepulchre of St Mary, German 990 57,5 % 993 61,9 % 1264 57,7 % dating back to the 11th century) with its impressive frescoes Romansh 250 14,5 % 194 12,1 % 174 7,9 % from the 13th and 15th centuries. Other sights include the pentagonal Spaniola tower (12th/13th century) and the Punt Italian 362 21,0 % 290 18,1 % 353 16,1 % Veglia Roseg and Punt Veglia Bernina bridges. The historical Total citizen 1726 1604 2191 village of Pontresina is divided into four settlements: Laret, San Spiert, Giarsun and Carlihof. Towards Samedan, there is also the more modern part of Muragl. With a total of 2,000 re- sidents, the village welcomes up to 116,000 guests every year. Pontresina Tourismus T +41 81 838 83 00, www.pontresina.ch The sorrounding GERMANY Frankfurt Munich (590 km) (300 km) Friederichshafen Schaffhausen (210 km) Basel St.Gallen (290 km) (190 km) Zurich AUSTRIA (200 km) Innsbruck (190 km) Landquart FRANCE Chur Bern Davos Zernez (330 km) Disentis Thusis Mals Andermatt Filisur Samedan Meran St.Moritz Pontresina Brig Poschiavo Bozen Chiavenna Tirano -

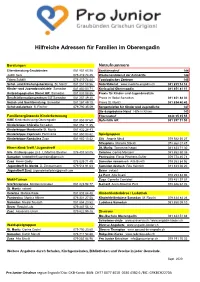

Hilfreiche Adressen Für Familien Im Oberengadin

Hilfreiche Adressen für Familien im Oberengadin Beratungen Notrufnummern Elternberatung Graubünden 081 851 85 58 Sanitätsnotruf 144 Judith Sem 075 419 74 45 Wochenenddienst der Zahnärzte 144 Tabea Schäfli 075 419 74 44 Toxologisches Zentrum 145 Schul- und Erziehungsberatung St. Moritz 081 257 58 56 Notarztdienst www.medinfo-engadin.ch 081 833 14 14 Kinder- und Jugendpsychiatrie Samedan 081 850 03 71 Kreisspital Oberengadin 081 851 81 11 Heilpädagogischer Dienst GR Samedan 081 833 08 85 Praxis für Kinder- und Jugendmedizin Berufsinformationszentrum BIZ Samedan 081 257 49 40 Praxis im Spital Samedan 081 851 88 02 Sozial- und Suchtberatung Samedan 081 257 49 10 Praxis St. Moritz 081 834 40 40 Schulsozialarbeit S. Fischer 079 790 35 09 Sorgentelefon für Kinder und Jugendliche 147 Die dargebotene Hand Hilfe in Krisen 143 Familienergänzende Kinderbetreuung Elternnotruf 0848 35 45 55 KiBE Kinderbetreuung Oberengadin 081 850 07 60 Opferhilfe GR 081 257 31 50 Kinderkrippe Chüralla Samedan 081 852 11 85 Kinderkrippe Muntanella St. Moritz 081 832 28 43 Kinderkrippe Capricorn Pontresina 081 850 03 82 Spielgruppen Kinderkrippe Randulina Zuoz 081 850 13 42 Sils Angela Meuli 079 582 55 27 Silvaplana Mariella Stöckli 078 668 01 47 Eltern-Kind-Treff / Jugendtreff St. Moritz Tomasina Iseppi 081 833 71 30 Sils Krabbelgruppe (0-3 J.) Martina Stecher 076 403 53 05 Celerina Corina Manzoni 081 852 50 35 Samedan [email protected] Pontresina Flavia Pinchera-Gufler 079 774 45 71 Zuoz Helen Godly 078 839 71 49 Samedan romanisch Aita Bivetti 079 253 84 96 Jugendtreff St. Moritz D. Zimmermann 079 514 91 63 Samedan deutsch Rita Heinrich 081 833 06 20 Jugendtreff Zuoz [email protected] Bever vakant La Punt Aita Bivetti 079 253 84 96 Muki-Turnen Zuoz Cornelia Camichel 079 451 97 57 Sils/Silvaplana Marianna Gruber 081 828 98 77 S-chanf Anna Staschia Parli 078 686 64 76 St. -

AGENDA DA SEGL Silser Veranstaltungen Und Aktuelles «Bainvgnieu a Segl»

25. September – 24. Oktober 2021 AGENDA DA SEGL Silser Veranstaltungen und Aktuelles «Bainvgnieu a Segl» Stimos giasts da Segl Geschätzte Silser Gäste und Einheimische Jolanda Picenoni Der faszinierende Herbst ist da und wir wünschen Ihnen eine farbenfrohe Auszeit in Sils. Geniessen Sie ihn in vollen Zügen und lassen Sie sich von unserer «Agenda da Segl» inspirieren. Es gibt viel zu entdecken. Seit dem 13. September gilt an vielen Orten die Covid-Zertifikationspflicht. NUR MIT COVID-ZERTIFIKAT Sie als Besucher oder Besucherin von Restaurants, Sport- anlagen, Kulturinstitutionen, Veranstaltungen in Innen- COVID-CertCOVID-Cert räumen etc. benötigen ein gültiges Covid-Zertifikat: geimpft, genesen oder getestet. GEIMPFT, GENESEN ODER GETESTET. V 1.10.2021 Kanton Graubünden Chantun Grischun www.gr.ch/corona DieCantone dei Grigioni hemmende, aber nützliche Vorschrift sorgt für das notwendige Vertrauen, dass alle Anwesenden Corona ernst nehmen und sich und die anderen schützen. Die Gemeinde Sils i.E./Segl bietet Covid-Testmöglichkeiten vor Ort an. Mehr dazu auf Seite 4. Gut zu wissen: - Das Restaurant «Grond Burger» ist bereits geschlossen. Ab Dezember 2021 erwartet Sie im «Restorant Plazzet» beim Sportzentrum Muot Marias Daniel Rodrigues und sein Team. Er führt bereits den «Beach Club» am Silvaplaner- see. - Die Post in Sils Maria hat neue Öffnungszeiten, ab 1.10. bis 30.11.2021: Montag bis Freitag 8.30 Uhr bis 11.30 Uhr. Chers salüds Ihre Jolanda Picenoni Geschäftsführerin Sils Tourismus 2 INHALTSVERZEICHNIS Veranstaltungshighlights 5 Veranstaltungsübersicht -

Liste Der Bestände Des Kulturarchivs Oberengadin Archiv Culturel D'engiadin'ota, Samedan

Liste der Bestände des Kulturarchivs Oberengadin Archiv culturel d’Engiadin’Ota, Samedan Eingänge von 1985 bis 2020 nach Alphabet Stand: 1.3.2020 www.kulturarchiv.ch Tel 081 852 35 31 1 Titelblatt, St. Moritz, Fotografie von Albert Steiner, Schenkung Hans Nater, um 1930 2 Liste der Bestände des Kulturarchivs Oberengadin, Samedan Eingänge von 1985 bis 2020 nach Alphabet Stand: 1.3.2020 Die Liste der Bestände soll eine Übersicht über die Nachlässe, Schenkungen und Ankäufe des Kulturarchivs Oberengadin geben. Die Liste wird laufend ergänzt und korrigiert. Die Bestände sind alphabetisch nach Provenienz aufgeführt. Die Signatur entspricht dem ersten Ersteingangsdatum des Bestandes. Die ID-Nummer ist jene des Bestandes im Online-Inventar (www.kulturarchiv.ch, Suche im Archiv). Darin sind die einzelnen Archivalien detailliert zu finden. A Acatos-Bazzighèr, Bern, Nachlass Signatur: 2.8.1999 ID-200229 Übergeben von Giuliano Pedretti, Celerina Zirka 20 Postkarten: St. Moritz, Maloja, Köln, Smyrna, Griechenland, Deutschland usw. Depot 1, 1g, Schachtel Diverse Schenkungen 4 Adank-Viletta, Lina, Samedan, Schenkung 20.6.2013 ID-2005777 Gerahmtes Foto „Eidgenössisches Musikfest 1948 in St. Gallen“ der Musikgesellschaft „Harmonie“ Samedan, 1948 Depot 2, 23a Albertin, Ursula und Robert, Samedan, Schenkung 14.3.2019 ID-4206974 Bild von Roman Faoro „Chalandamarz“, 1971 Depot 11 Albrecht, Lydia, Bever, Schenkung 12.3.2019 ID-4206975 Fotografien Bergbesteigung Trais Fluors, Inn Überschwemmung bei Samedan und Bever (, Susch vor und nach dem Brand 1925 Büro 7d 3 Alesch, Henri, Samedan/Rorschach, Schenkung 5.8.1992 ID-200002 Ingenieurzeichnungen seines Vaters H. Alesch, Pläne und Schriften, 1885 bis 1933 Hotel Bernina: Statuen, Aktiengesellschaft etc., 1896-1950 Depot 2, 12d Allemann, Anita, Samedan, Schenkung 29.3.2018 ID-4201531 Heiratsschein/Copulationsschein und Taufschein, 1864 Alioth, Max, St. -

La Padella Infurmaziuns Da Samedan Settember Nr

padella la padella Infurmaziuns da Samedan Settember nr. 9/2013 Anneda XVII tuot las lavuors publichedas ad impressa- Rahmen des Gebäudeprogramms (www. ris da Samedan e Schlarigna. Las lavuors dasgebaudeprogramm.ch), einen nam- haun düro dals 1. lügl fin la mited avuost. haften Subventionsbeitrag zu. Nachdem A tuot ils partecipos pertuocha ün cordiel Anfang März 2012 die Projekt- und Bau- grazcha fich per las bunas prestaziuns. leitungsarbeiten für die Dachsanierung Seit einigen Jahren zerfallen die asbest- ausgeschrieben wurden, vergab der Ge- losen Eternitplatten auf dem Dach des meindevorstand im April 2013 die Projek- Dachsanierung Puoz Mehrzweckgebäudes Puoz. Sie lösten sich tierungs- und Bauleitungsarbeiten dem Las plattas d’eternit (sainza asbest) sülla Schicht um Schicht, bis Wasser eindrang. Architekturbüro H. Hirschi AG, Samedan. sela Puoz d’eiran defettusas e stuva- Die Platten stammten aus der ersten Pro- Ende Mai 2013 konnte der Gemeindevor- ivan gnir rimplazzedas. La ditta Eternit duktion der Firma Eternit AG, welche sich stand alle ausgeschriebenen Arbeiten an SA surpiglia generusamaing üna part dals kulanter weise bereit erklärt hat, einen die Unternehmer Duttweiler AG von Same- cuosts da producziun, uschè cha la san- Teil der Produktionskosten zu überneh- dan und Kast AG Celerina vergeben. aziun cuosta auncha var CHF 410 000. Per men. Somit belaufen sich die Sanierungs- Dank der guten Vorbereitung des Archi- l’isolaziun termica supplementera garan- kosten noch auf ca. CHF 410 000.–. Das tekten und der Unternehmer konnten die tescha il Chantun üna subvenziun con- Stimmvolk stimmte diesem Betrag, an- Arbeiten am 1. Juli 2013 aufgenommen und siderabla i’l ram dal program d’edifizis. -

The Marathon with a Difference

Engadin. 42 Tips The marathon with a difference. The Engadin has so much to offer. Here are 42 tips for the 42 kilometres from Maloja to S-chanf. www.engadin.ch km Resort Tips 1 Maloja Catch the fish of a lifetime: ice fishing on Lake Sils 2 Maloja Surprise adventure for children: snowtubing at the Aela ski li 3 Sils World of a great philosopher: ponder life's big questions at the Nietzsche House in Sils 4 Sils Discover an idyllic side valley: cross-country skiing in the picturesque Val Fex 5 Sils Head high into pristine nature: snowshoeing up on Furtschellas 6 Silvaplana Powered by the wind: snowkiting on Lake Silvaplana 7 Silvaplana Switzerland's longest floodlit ski piste: night skiing on the Corvatsch 8 Silvaplana Endless views: a stroll on frozen Lake Silvaplana 9 St.Moritz Start preparing for next year's race: train on the floodlit cross-country ski trail 10 St.Moritz Hone your technique: get expert cross-country ski tuition at the Ovaverva sports centre 11 St.Moritz Historic Winter Olympics mountain: spring skiing on the local Corviglia 12 St.Moritz Improve your ball skills: play tennis or squash at the St.Moritz Tennis Centre 13 St.Moritz Tourism is history, too: visit the 3,400-year-old therapeutic springs 14 St.Moritz World-famous painter from the Engadin: admire his works at the Segantini Museum 15 St.Moritz Olympic ice: skating on the frozen lake or on the ice rink of the Kulm Hotel 16 St.Moritz The largest Whisky Bar in the world: sip a wee dram at the Hotel Waldhaus am See 17 St.Moritz Coffee and cakes with a view: enjoy upli -

Camping Im Engadin Die Schönheit Der

Anfahrt mit dem Auto Anfahrt mit öffentlichen Verkehrsmitteln Glacier Express 5. CAMPING MORTERATSCH, PONTRESINA Mit dem Wohnwagen ins Engadin / Con roulotte / With caravan Anfahrt mit dem Auto Zeltplätze / Tent pitches / Posteggi per tende Frankfurt DEUTSCHLAND Anfahrt mit öffentlichen VerkehrsmittelnMünchen (280 km) Mai - Oktober / May - October / Maggio - Ottobre Bernina Express Glacier Express Malojapass 1815 m ü.M. Wohn– Maloja 1815 m s.l.m., strada con Maloja Pass 1,815 metres above Frankfurt DEUTSCHLAND München (280 km) Wohnwagenplätze / Caravans / Posteggi per camper Bernina Express Dezember - April / December - April / Dicembre - Aprile UNESCOwagentauglich. Welterbe SteigungAlbula/Ber max. ninmoltia tornanti, adatta al transito sea level, pass road full of bends, UNESCO Welterbe Albula/Bernina Venedig–St. Moritz Tour Friedrichshafen (210 km) Plätze / Pitches / Posteggi: 250 / 150 11%, Klasse 2 (mittel). Im Sommer con la roulotte. Pendenza max. 11%, Friedrichshafen Schaffhausen Spielplatz / Playground / Parco giochi per bambini suitable for caravans. Max. gra- Palm Express (Postauto(210) kmBasel) (280 km) Venedig–St. Moritz Tour Autoverlad Vereina und Winter geöffnet. classe: 2, aperta estate e inverno dient 11%, class 2, open summer St. Gallen WC @ Schaffhausen Zürich (200 km) ÖSTERREICH Laden klein / Small shop / Negozio con piccola scelta alimentare Palm Express (Postauto) Basel (280 km) + winter Julierpass 2284 mü.M. Wohn– Julier 2284 m s.l.m., strada ben Innsbruck (190 km) 6. CAMPING GRAVATSCHA, SAMEDAN Autoverlad Vereina Landeck Restaurant (max. 1 km) / Restaurant (max. 1 km) / Ristorante (max. 1 km) wagentauglich. Steigung max. disegnata e adatta al transito con Julier Pass 2,284 m.a.s.l., very FRANCE Januar - Dezember / January - December / St. Gallen Landquart 13%, Klasse 1 (leicht). -

Scuol-Tarasp St. Moritz - Samedan Stand: 5

FAHRPLANJAHR 2021 960 Pontresina - Samedan - Scuol-Tarasp St. Moritz - Samedan Stand: 5. Oktober 2020 RE R R R R R R R R 1310 1110 1912 1114 1914 1116 1916 1916 3914 4213 1920 Landquart Pontresina 05 42 05 58 07 02 Punt Muragl 05 45 06 01 07 04 Samedan 05 48 06 05 07 08 St. Moritz 04 45 05 41 05 58 Celerina 04 48 05 45 06 01 Samedan 04 53 05 11 05 13 05 50 05 53 06 07 06 08 06 08 07 13 Bever 04 55 05 13 05 16 05 52 05 56 06 09 06 11 06 11 07 16 La Punt Chamues-ch 05 01 05 21 06 01 06 17 06 17 07 21 Madulain 05 03 05 23 06 04 06 19 06 19 07 23 Zuoz 05 06 05 26 06 07 06 22 06 22 07 27 S-chanf 05 09 05 30 06 10 06 26 06 26 07 30 Cinuos-chel-Brail 05 14 05 35 06 31 06 31 07 35 Zernez 05 25 05 46 06 45 06 45 07 46 Zernez 05 26 05 46 06 46 06 46 07 46 Susch 05 32 05 53 06 53 06 53 06 55 07 53 Sagliains 05 56 06 56 06 56 07 56 Sagliains 06 01 06 57 Lavin 06 03 06 59 06 59 Guarda 06 07 07 04 Ardez 06 12 07 09 07 09 Ftan Baraigla 06 18 07 15 Scuol-Tarasp 06 23 07 17 07 18 Landquart Chur Chur Chur Klosters Platz R R RE R R RE RE R 1120 1322 1217 1124 1221 1924 1926 1326 1128 1225 1928 Ilanz Disentis/ Disentis/ Mustér Mustér Pontresina 08 02 09 02 Punt Muragl 08 04 09 04 Samedan 08 09 09 09 St. -

Zernez Abfahrt Partenza Departure Départ Live-Anzeige 13

Zernez Abfahrt Partenza Departure Départ Live-Anzeige 13. Dezember 2020 - 11. Dezember 2021 05:00 09:00 12:00 15:00 Zeit Linie Zielort Gleis Zeit Linie Zielort Gleis Zeit Linie Zielort Gleis Zeit Linie Zielort Gleis R 05:26 RE Landquart 1 09:07 R Pontresina 1 12:07 R Pontresina 1 15:07 R Pontresina 1 Susch 05:32 - Klosters 05:51 - Saas 06:06 - Cinuos-chel-B. 09:18 - S-chanf 09:23 - Cinuos-chel-B. 12:18 - S-chanf 12:23 - Cinuos-chel-B. 15:18 - S-chanf 15:23 - Küblis 06:12 - Jenaz 06:19 - Schiers 06:25 - Zuoz 09:26 - Madulain 09:30 - La Punt C. 09:32 - Zuoz 12:26 - Madulain 12:30 - La Punt C. 12:32 - Zuoz 15:26 - Madulain 15:30 - La Punt C. 15:32 - Grüsch 06:32 - Seewis-P. 06:34 - Bever 09:38 - Samedan 09:42 - Bever 12:38 - Samedan 12:42 - Bever 15:38 - Samedan 15:42 - Malans GR 06:39 - Landquart 06:43 Punt Muragl 09:51 - Pontresina 09:57 Punt Muragl 12:51 - Pontresina 12:57 Punt Muragl 15:51 - Pontresina 15:57 U 05:46 R Scuol-Tarasp 1 09:30 RE Landquart 1 12:26 RE St.Moritz 1 15:30 RE Landquart 1 Susch 05:53 - Sagliains 05:56 - Lavin 06:02 - Susch 09:36 - Klosters 09:56 - Küblis 10:15 - S-chanf 12:41 - Zuoz 12:45 - Bever 12:54 - Susch 15:36 - Klosters 15:56 - Küblis 16:15 - Guarda 06:06 - Ardez 06:11 - Ftan Baraigla 06:17 - Schiers 10:25 - Landquart 10:37 Samedan 12:57 - Celerina 13:03 - St.Moritz 13:09 Schiers 16:25 - Landquart 16:37 Scuol-T.