UK CMR Charts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FCC-06-11A1.Pdf

Federal Communications Commission FCC 06-11 Before the FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of ) ) Annual Assessment of the Status of Competition ) MB Docket No. 05-255 in the Market for the Delivery of Video ) Programming ) TWELFTH ANNUAL REPORT Adopted: February 10, 2006 Released: March 3, 2006 Comment Date: April 3, 2006 Reply Comment Date: April 18, 2006 By the Commission: Chairman Martin, Commissioners Copps, Adelstein, and Tate issuing separate statements. TABLE OF CONTENTS Heading Paragraph # I. INTRODUCTION.................................................................................................................................. 1 A. Scope of this Report......................................................................................................................... 2 B. Summary.......................................................................................................................................... 4 1. The Current State of Competition: 2005 ................................................................................... 4 2. General Findings ....................................................................................................................... 6 3. Specific Findings....................................................................................................................... 8 II. COMPETITORS IN THE MARKET FOR THE DELIVERY OF VIDEO PROGRAMMING ......... 27 A. Cable Television Service .............................................................................................................. -

The Marie Curie Hospice, Cardiff and the Vale

Welcome to the Marie Curie Hospice, Cardiff and the Vale We’ve put together this folder with information about our hospice that you might find useful – such as the services we offer, how we can help and what you can expect from us. We want you to have a really comfortable stay with us, and get the most out of what we can offer. So just let us know if there’s anything that you need or something we can do for you, your family and your friends. You can always speak to your nurse if you have any questions or concerns about your care, or have any thoughts or suggestions about our hospice. We’re here to provide you, and those close to you, with our very best care and support. Paula Elson, Hospice Manager Marie Curie Hospice, Cardiff and the Vale Bridgeman Road, Penarth, Vale of Glamorgan CF64 3YR Reception: 02920 426 000 Ground floor ward: 02920 426 017 First floor ward: 02920 426 027 Email: [email protected] mariecurie.org.uk/cardiff Contents Your room 2 Food and drink 5 Medication 6 Information for your visitors 7 Preventing infections and how you can help 9 How to reduce your risk of falling 11 Our services and how we can help 12 Sources of information and other support for you 15 General information 16 How we keep your information safe and confidential 17 Let us know what you think 18 A little about Marie Curie 19 How you can support our work 21 List of TV channels and radio stations 22 Hospice information for in-patient care Page 1 Your room Your bed As your bed is adjustable, our nursing staff will explain to you how the bed’s control buttons work. -

Local Commercial Radio Content

Local commercial radio content Qualitative Research Report Prepared for Ofcom by Kantar Media 1 Contents Contents ................................................................................................................................................. 2 1 Executive summary .................................................................................................................... 5 1.1 Background .............................................................................................................................. 5 1.2 Summary of key findings .......................................................................................................... 5 2 Background and objectives ..................................................................................................... 10 2.1 Background ............................................................................................................................ 10 2.2 Research objectives ............................................................................................................... 10 2.3 Research approach and sample ............................................................................................ 11 2.3.1 Overview ............................................................................................................................. 11 2.3.2 Workshop groups: approach and sample ........................................................................... 11 2.3.3 Research flow summary .................................................................................................... -

A History of Mail Classification and Its Underlying Policies and Purposes

A HISTORY OF MAIL CLASSIFICATION AND ITS UNDERLYING POLICIES AND PURPOSES Richard B. Kielbowicz AssociateProfessor School of Commuoications, Ds-40 University of Washington Seattle, WA 98195 (206) 543-2660 &pared For the Postal Rate Commission’s Mail ReclassificationProceeding, MC95-1. July 17. 1995 -- /- CONTENTS 1. Introduction . ._. ._.__. _. _, __. _. 1 2. Rate Classesin Colonial America and the Early Republic (1690-1840) ............................................... 5 The Colonial Mail ................................................................... 5 The First Postal Services .................................................... 5 Newspapers’ Mail Status .................................................... 7 Postal Policy Under the Articles of Confederation .............................. 8 Postal Policy and Practice in the Early Republic ................................ 9 Letters and Packets .......................................................... 10 Policy Toward Newspapers ................................................ 11 Recognizing Magazines .................................................... 12 Books in the Mail ........................................................... 17 3. Toward a Classitication Scheme(1840-1870) .................................. 19 Postal Reform Act of 1845 ........................................................ 19 Letters and the First Class, l&IO-l&?70 .............................. ............ 19 Periodicals and the Second Class ................................................ 21 Business -

Annual Report 2017 Talktalk Telecom Group PLC Talktalk Is the UK’S Leading Value for Money Connectivity Provider

TalkTalk Telecom Group PLC Group Telecom TalkTalk Annual Report2017 2017 Annual Report 2017 TalkTalk Telecom Group PLC TalkTalk is the UK’s leading value for money connectivity provider� Our mission is to deliver simple, affordable, reliable and fair connectivity for everyone� Stay up to date at talktalkgroup.com Contents Strategic report Corporate governance Financial statements Highlights ������������������������������������������������������������������������ 01 Board of Directors and PLC Committee ������������� 32 Independent auditor’s report �������������������������������� 66 At a glance ���������������������������������������������������������������������� 02 Corporate governance ���������������������������������������������� 36 Consolidated income statement �������������������������� 73 Chairman’s introduction ������������������������������������������ 04 Audit Committee report ������������������������������������������� 41 Consolidated statement of comprehensive FY17 business review ������������������������������������������������� 05 Directors’ remuneration report ����������������������������� 44 income ���������������������������������������������������������������������������� 74 Business model and strategy ��������������������������������� 08 Directors’ report ���������������������������������������������������������� 63 Consolidated balance sheet ����������������������������������� 75 Measuring our performance ����������������������������������� 12 Directors’ responsibility statement ��������������������� 65 Consolidated -

Section 355 Reviews of Output: U105

Section 355 Reviews of Output: U105 When a local commercial radio licence undergoes a change of control (this includes licence transfer), Ofcom is required, under section 355 of the Communications Act 2003 (the Act), to undertake a review of the effects or likely effects of the change of control in relation to: • the quality and range of programmes included in the service; • the character of the service, and; • the extent to which Ofcom’s duty under section 314 of the Act is performed in relation to the service. Ofcom’s duty under section 314 of the Act relates to securing the inclusion of an appropriate amount of local material, and a suitable proportion of locally-made programmes in the service. Under section 356 of the Act, where it appears to Ofcom from its review that the change of control would be prejudicial to any of the three matters listed above, then it must vary the licence, by including such conditions as it considers appropriate, with a view to ensuring that the relevant change of control is not so prejudicial. In doing so, any new or varied conditions must be such that the licence holder would have satisfied them throughout the three months immediately before the change of control. Ofcom is required to publish a report of its review, setting out its conclusions and any steps it proposes to take under section 356. Where Ofcom proposes to vary the licence, it is required to give the licence holder a reasonable opportunity to make representations about the variation. On 23 November 2016, a change of control took place at the Wireless Group plc, as a result of all of the company’s share capital being acquired by News Corp UK & Ireland Limited. -

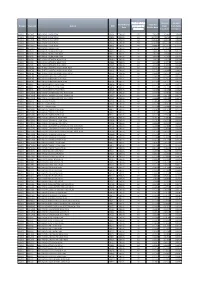

Domain Stationid Station UDC Performance Date

Number of days Amount Amount Performance Total Per Domain StationId Station UDC processed for from from Public Date Minute Rate distribution Broadcast Reception RADIO BR ONE BBC RADIO 1 NON PEAK BRA01 CENSUS 92 7.8347 4.2881 3.5466 RADIO BR ONE BBC RADIO 1 LOW PEAK BRB01 CENSUS 92 10.7078 7.1612 3.5466 RADIO BR ONE BBC RADIO 1 HIGH PEAK BRC01 CENSUS 92 13.5380 9.9913 3.5466 RADIO BR TWO BBC RADIO 2 NON PEAK BRA02 CENSUS 92 17.4596 11.2373 6.2223 RADIO BR TWO BBC RADIO 2 LOW PEAK BRB02 CENSUS 92 24.9887 18.7663 6.2223 RADIO BR TWO BBC RADIO 2 HIGH PEAK BRC02 CENSUS 92 32.4053 26.1830 6.2223 RADIO BR1EXT BBC RADIO 1XTRA NON PEAK BRA10 CENSUS 92 1.4814 1.4075 0.0739 RADIO BR1EXT BBC RADIO 1XTRA LOW PEAK BRB10 CENSUS 92 2.4245 2.3506 0.0739 RADIO BR1EXT BBC RADIO 1XTRA HIGH PEAK BRC10 CENSUS 92 3.3534 3.2795 0.0739 RADIO BRASIA BBC ASIAN NETWORK NON PEAK BRA65 CENSUS 92 1.4691 1.4593 0.0098 RADIO BRASIA BBC ASIAN NETWORK LOW PEAK BRB65 CENSUS 92 2.4468 2.4371 0.0098 RADIO BRASIA BBC ASIAN NETWORK HIGH PEAK BRC65 CENSUS 92 3.4100 3.4003 0.0098 RADIO BRBEDS BBC THREE COUNTIES RADIO NON PEAK BRA62 CENSUS 92 0.1516 0.1104 0.0411 RADIO BRBEDS BBC THREE COUNTIES RADIO LOW PEAK BRB62 CENSUS 92 0.2256 0.1844 0.0411 RADIO BRBEDS BBC THREE COUNTIES RADIO HIGH PEAK BRC62 CENSUS 92 0.2985 0.2573 0.0411 RADIO BRBERK BBC RADIO BERKSHIRE NON PEAK BRA64 CENSUS 92 0.0803 0.0569 0.0233 RADIO BRBERK BBC RADIO BERKSHIRE LOW PEAK BRB64 CENSUS 92 0.1184 0.0951 0.0233 RADIO BRBERK BBC RADIO BERKSHIRE HIGH PEAK BRC64 CENSUS 92 0.1560 0.1327 0.0233 RADIO BRBRIS BBC -

Talktalk Telecom Group Limited Annual Report 2021 1 STRATEGIC REPORT Our Business Model

TalkTalk Telecom Group Limited 2021 Annual Report 2021 Annual Limited Group Telecom TalkTalk 2021 ANNUAL REPORT TalkTalk Telecom Group Limited (formerly TalkTalk Telecom Group PLC) At a glance Contents Strategic report IFC At a glance 2 Our business model 4 Our strategy 6 Key performance indicators 8 Business and financial review 13 Principal risks and uncertainties HQ 18 Section 172 Salford, Greater 24 Regulatory environment Manchester 26 Corporate social responsibility Corporate governance 30 Corporate governance 35 Audit Committee report 38 Directors’ remuneration report 53 Directors’ report 55 Directors’ responsibility statement 47,300 Financial statements Over 3,000 high-speed unbundled 56 Independent auditor’s report Ethernet 66 Consolidated income statement exchanges 67 Consolidated balance sheet connections 68 Consolidated cash flow statement 69 Consolidated statement of changes in equity 70 Notes to the consolidated financial statements 108 Company balance sheet 109 Company cash flow statement 110 Company statement of changes in equity 111 Notes to the Company financial statements Other information UK’s 116 Five year record (unaudited) 96% largest 117 Alternative performance measures population wholesale 118 Glossary coverage broadband 120 Registered office 120 Advisers provider Over 957 million GB average 4 million customer broadband downloads per customers month Stay up to date at www.talktalkgroup.com 2,019 2.8 million employees FTTC and FTTP (as at 28 customers February 2021) WHO WE ARE TalkTalk is the UK’s leading value for money connectivity provider. We believe that simple, affordable, reliable and fair connectivity should be available to everyone. Since entering the market in the early 2000s, we have a proud history as an innovative challenger brand ensuring customers benefit from more choice, affordable prices and better services. -

BBC Four Programme Information

SOUND OF CINEMA: THE MUSIC THAT MADE THE MOVIES BBC Four Programme Information Neil Brand presenter and composer said, “It's so fantastic that the BBC, the biggest producer of music content, is showing how music works for films this autumn with Sound of Cinema. Film scores demand an extraordinary degree of both musicianship and dramatic understanding on the part of their composers. Whilst creating potent, original music to synchronise exactly with the images, composers are also making that music as discreet, accessible and communicative as possible, so that it can speak to each and every one of us. Film music demands the highest standards of its composers, the insight to 'see' what is needed and come up with something new and original. With my series and the other content across the BBC’s Sound of Cinema season I hope that people will hear more in their movies than they ever thought possible.” Part 1: The Big Score In the first episode of a new series celebrating film music for BBC Four as part of a wider Sound of Cinema Season on the BBC, Neil Brand explores how the classic orchestral film score emerged and why it’s still going strong today. Neil begins by analysing John Barry's title music for the 1965 thriller The Ipcress File. Demonstrating how Barry incorporated the sounds of east European instruments and even a coffee grinder to capture a down at heel Cold War feel, Neil highlights how a great composer can add a whole new dimension to film. Music has been inextricably linked with cinema even since the days of the "silent era", when movie houses employed accompanists ranging from pianists to small orchestras. -

1152/8/3/10 (IR) British Sky Broadcasting Limited

Neutral citation [2014] CAT 17 IN THE COMPETITION Case Number: 1152/8/3/10 APPEAL TRIBUNAL (IR) Victoria House Bloomsbury Place 5 November 2014 London WC1A 2EB Before: THE HONOURABLE MR JUSTICE ROTH (President) Sitting as a Tribunal in England and Wales B E T W E E N : BRITISH SKY BROADCASTING LIMITED Applicant -v- OFFICE OF COMMUNICATIONS Respondent - and - BRITISH TELECOMMUNICATIONS PLC VIRGIN MEDIA, INC. THE FOOTBALL ASSOCIATION PREMIER LEAGUE LIMITED TOP-UP TV EUROPE LIMITED EE LIMITED Interveners Heard in Victoria House on 23rd July 2014 _____________________________________________________________________ JUDGMENT (Application to Vary Interim Order) _____________________________________________________________________ APPEARANCES Mr. James Flynn QC, Mr. Meredith Pickford and Mr. David Scannell (instructed by Herbert Smith Freehills LLP) appeared for British Sky Broadcasting Limited. Mr. Mark Howard QC, Mr. Gerry Facenna and Miss Sarah Ford (instructed by BT Legal) appeared for British Telecommunications PLC. Mr. Josh Holmes (instructed by the Office of Communications) appeared for the Respondent. EE Limited made written submissions by letter dated 9 May 2014 but did not seek to make oral representations at the hearing. Note: Excisions in this judgment (marked “[…][ ]”) relate to commercially confidential information: Schedule 4, paragraph 1 to the Enterprise Act 2002. 2 INTRODUCTION 1. On 31 March 2010, the Office of Communications (“Ofcom”) published its “Pay TV Statement.” By the Pay TV Statement, Ofcom decided to vary, pursuant to s. 316 of the Communications Act 2003 (“the 2003 Act”), the conditions in the broadcasting licences of British Sky Broadcasting Ltd (“Sky”) for what have been referred to as its “core premium sports channels” (or “CPSCs”), Sky Sports 1 and Sky Sports 2 (“SS1&2”). -

10 June 2011 Page 1 of 15

Radio 4 Listings for 4 – 10 June 2011 Page 1 of 15 SATURDAY 04 JUNE 2011 SAT 07:00 Today (b011msk2) Series 74 Morning news and current affairs with John Humphrys and SAT 00:00 Midnight News (b011jx96) Evan Davis. Episode 8 The latest national and international news from BBC Radio 4. 08:10 How effective are plans to curb provocative images seen Followed by Weather. by children? A satirical review of the week's news, chaired by Sandi 08:30 Lord Lamont and Alistair Darling on the economy. Toksvig. With Rory Bremner, Jeremy Hardy, Mark Steel and 08:44 The man who inspired the classic film The Battle of Fred Macaulay. SAT 00:30 Book of the Week (b011mt39) Algiers. Ox Travels 08:49 Does London need its new Playboy club? SAT 12:57 Weather (b011jx9v) The Wrestler The latest weather forecast. SAT 09:00 Saturday Live (b011msk4) Ox Travels features original stories from twenty-five top travel Richard Coles with actor and director Richard Wilson, poet writers; this week we'll be featuring five of these stories. Susan Richardson, a woman who discovered her outwardly SAT 13:00 News (b011jx9x) respectable father was in fact a criminal gangster, and a man The latest national and international news from BBC Radio 4. Each of the stories takes as its theme a meeting life-changing, who kept a lion as a pet. There's an I Was There feature from a affecting, amusing by turn and together they transport readers man who worked on the world's first international satellite TV into a brilliant, vivid atlas of encounters. -

Annual Report on the BBC 2019/20

Ofcom’s Annual Report on the BBC 2019/20 Published 25 November 2020 Raising awarenessWelsh translation available: Adroddiad Blynyddol Ofcom ar y BBC of online harms Contents Overview .................................................................................................................................... 2 The ongoing impact of Covid-19 ............................................................................................... 6 Looking ahead .......................................................................................................................... 11 Performance assessment ......................................................................................................... 16 Public Purpose 1: News and current affairs ........................................................................ 24 Public Purpose 2: Supporting learning for people of all ages ............................................ 37 Public Purpose 3: Creative, high quality and distinctive output and services .................... 47 Public Purpose 4: Reflecting, representing and serving the UK’s diverse communities .... 60 The BBC’s impact on competition ............................................................................................ 83 The BBC’s content standards ................................................................................................... 89 Overview of our duties ............................................................................................................ 96 1 Overview This is our third