1 Potato Frozen French Fries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jinjuu Updated Menu.Pdf

SOHO STARTERS SNACKS RAW PLATES MANDOO / DUMPLINGS JINJUU’S ANJU SHARING BOARD 24 3 PER SERVING (extra maybe ordered by piece) YOOK-HWE STEAK TARTAR 14 FOR 2 VEGETABLE CHIPS & DIPS (v, vg on request) 6 Diced grass fed English beef fillet marinated in soy, ginger, Kong bowl, sae woo prawn lollipops, signature Korean fried chicken, BEEF & PORK MANDOO 7.5 Crispy vegetable chips, served with kimchi soy guacamole. Juicy steamed beef & pork dumplings. Seasoned delicately garlic & sesame. Garnished with Korean pear, toasted steamed beef & pork mandoo, mushroom & true mandoo. pinenuts & topped with raw quail egg. with Korean spices. Soy dipping sauce. KONG BOWL (v) (vg, gf on request) 5 small / large JINJUU’S YA-CHAE SHARING BOARD (v) 20 PHILLY CHEESESTEAK MANDOO 7.5 Steamed soybeans (edamame) topped with our Jinjuu chili SEARED TUNA TATAKI (gf on request) 12 / 18 FOR 2 Crispy fried dumplings stued with bulgogi beef short ribs, panko mix. Seared Atlantic tuna steak in panko crust, topped with kizami Kong bowl, tofu lollipops, signature Korean fried cauliflower, cheddar, mushrooms, spring onion & pickled jalapeno. Spicy wasabi & cucumber salsa, served on a bed of julienne daikon. steamed mushroom & true mandoo. dipping sauce. TACOS SALMON SASHIMI (gf on request) 12 WILD MUSHROOM & TRUFFLE MANDOO (v) 7.5 2 PER SERVING (extra maybe ordered by piece) Raw Scottish salmon sashimi style, avocado, soy & yuja, Steamed dumplings stued with wild mushrooms & black seaweed & wasabi tobiko. K-TOWN MINI SLIDERS trues. True soy dipping sauce. 12 2 PER SERVING (extra maybe ordered by piece) BULGOGI BEEF TACO TUNA TARTAR (gf on request) 12 TRIO MANDOO TASTING PLATE 7.5 Bulgogi UK grass fed beef fillet, avocado, Asian slaw, kimchi, Diced raw Atlantic tuna, dressed with sesame oil, soy, One of each dumpling listed above. -

FRENCH FRIES Are One of the Easiest and Most Cost-Effective Ways to INCREASE SALES and IMPROVE PROFITS and Are the Fastest Growing Item On

FRENCH FRIES Are one of the easiest and most cost-effective ways to INCREASE SALES And IMPROVE PROFITS And are the fastest growing item on PFG # 416250 delivery orders Luigi Coated Fries PFG # 416232 PFG # 416248 PFG # 416234 Luigi Regular Cut Luigi Steak Cut Luigi Crinkle Cut SPICE AND MAKE SURE IT UP THEY’RE ON YOUR ADD MORE • CONSISTENCY VALUE DELIVERY MENU • VERSATILITY • CONVENIENCE • QUALITY • LABOR SAVINGS For Additional Information Contact: Nate Philbrick 207-641-5085 Jake Eastman 207-322-5424 ®® STAY HOT & CRISPY COATED FRIES STAY HOT AND CRISPY LONGER THAN TRADITIONAL FRIES. #1 FOOD COATED ORDERED REGULAR CUT Despite the current state of the restaurant industry, french fries are Cut Size: 3/8” still the #1 food ordered at Skin-off restaurants in North America. USDA Grade: Grade A Cavendish Code: 06795 47090 Source: Source: The NPD Group/CREST® YE May’20 Reorder Number: 416250 Pack Size (LB): 6 x 4.5 Net Wt. (LB): 27 GREAT FOR Ship Wt. (LB): 28.75 Pallet: 10 x 7 CARRY-OUT Cube (FT3): 1.13 Coated fries are perfect for take-out Kosher: or delivery because their coating keeps them crispy in transit. RECOMMENDED PREPARATION METHOD: DEEP FRY TEMP: 350O TIME: 2 3/4 MIN Luigi® is a registered trademark of Performance Food Group. Exclusively distributed by Performance Foodservice. 0 6 7 9 5 5 2 7 6 8 Roma Chips Roma 05 627 7 965 8 January 2019 Roma Chips Product Features Packaging Specifications Cut Size 1/10" Slice, Skin-on GTIN-14 108 06795 52768 8 Serving Size 3 oz / 15 pieces Pack Size 4 x 5 LB Grade Grade A Net Weight 20 LB Shelf Life 24 months Gross Weight 21.5 LB Storage Keep Frozen (0°F or below) Pallet Pattern 10 x 7 = 70 Preparation Deep Fry Case Cube 0.93 ft³ Kosher Yes Case Dimensions 16" x 12" x 8.425" Packaging Paper Bags in Oyster Carton Nutrition Facts Cooking Method(s) Deep Fry 350°F (180°C) for 4 minutes Ingredients Potatoes, Vegetable Oil (Contains one or more of the following: Soybean Oil, Canola Oil), Salt, Dextrose, Disodium Dihydrogen Pyrophosphate (to Promote Color Retention). -

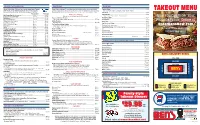

View Take-Out Menu

Overstuffed Sandwiches Side Dishes Beverages Served with pickles. Choice of rye or whole wheat bread. Toasted Some hints on ordering: For most sides, salads and puddings sold by the pound, individual Fountain Sodas .................................................................................................................. $2.29 TAKEOUT MENU garlic bread... $1.29. Add sliced tomato, sweet or hot peppers, servings are generally one half pound. Not sure how to order? We’ll gladly answer your questions. Coke • Diet Coke • Sprite • Diet Sprite • Club • Cream • Cherry potato salad or club bread... $.99. Special requests? Just ask! Please note: We make everything fresh. Not all items are available in all stores. Please inquire. Liter Sodas ......................................................................................................................... $3.29 Per Sandwich Per 1/2 Lb. TRADITIONAL FAVORITES Canned Sodas .................................................................................................................... $2.49 Hot Corned Beef We pickle our own! ................................ $14.49 ........................ $16.98 Prepared in our kitchens the old-fashioned way! Celray • Cream • Black Cherry - Regular or Diet Extra Lean Hot Corned Beef ............................................ $15.49 ........................ $17.98 Now You Can Order Your Hot Pastrami ...................................................................... $14.49 ........................ $16.98 Homemade Mashed Potatoes Bottled Root Beer -

Big Y Seafood Menu Dinners & More Family Size Portions

Big Y Seafood Menu 01/28/19 See Stores for Current Pricing Dinners & More Total Cal Fish & Chips Dinner 1660 Made with Fresh Fried Haddock Fried Jumbo Fresh Clam Strips & Chips Dinner 1840 Fried Clam Strips & Chips Dinner 2560 Fried Shrimp & Chips Dinner (10 Shrimp) 1150 Fried Bay Scallops & Chips Dinner 1620 Fried Sea Scallops & Chips Dinner 1680 Fisherman’s Platter 2670 One Piece of Fried Fresh Haddock, Bay Scallops, Shrimp, Clam Strips and French Fries Fried Fish Sandwich & Chips 1410 Made with Fresh Haddock Fried Fish Sandwich & Cole Slaw 800 Made with Fresh Haddock Fresh Jumbo Fried Clam Strip Roll & Chips 1460 Fresh Jumbo Fried Clam Strip Roll & Cole Slaw 840 Fried Clam Strip Roll & Chips 1810 Fried Clam Strip Roll & Cole Slaw 1190 Store Made Potato Chips 420 Super Size Store Made Potato Chips 1060 Family Size Portions Family Fish Fry 5440 6 Pieces of Fried Fresh Haddock, 1.5 lbs French Fries, Cole Slaw and Condiments, Serves 3 Fresh Jumbo Clam Shack (Fried Fresh Clam Strips) 2110 Clam Shack (Fried Clam Strips) 3540 Fried 40 Piece Large Shrimp 1540 Family Size Fried Calamari 1310 Family Size French Fries with Ketchup 1790 Family Size Beer Battered Onion Rings with Ketchup 1720 Family Size Sweet Potato Fries with Ketchup 1790 Cole Slaw, 1 lb 650 IMPORTANT: Before placing your order, please inform your server (or person in charge) if a person in your party has a food allergy 2,000 calories a day is used for general nutrition advice, but calorie needs vary. Additional nutrition information available upon request. -

Quarantine Food Stories

Quarantine Food Stories 2020 Gan Hong Li Shuai Yao Shiyu Compiler Gan Hong Li Shuai Yao Shiyu We are Gan Hong, Li Shuai and Yao Shiyu from TU Wien. This collection of stories is the open format for our project 'Daily Food and Everyday Life' which is under the course 'Stoires of life and work: exploring work ethics and diverse economics in and around Vienna and beyond'. The main focus of our project is the food issue, we wonder how resilience of daily food and everyday life performs while all social systems lock down during the quarantine. And our research target group people is the international students who are vulnerable under pandemic. Preface efore you begin this volume of 7 short stories, we would Blike to acknowledge that all of them are based on true cases. All these stories are about the everyday food life of international students in Europe. When the Covid-19 pandemic swept around Europe, the international students here became a group of vulnerable people, for being not familiar with the surrounding especially under such circumstance of pandemic. We are also international students in Europe, we got the inspiration of collecting such stories from our own shifting daily food life. In our quarantine time, everyday we discover funny stories about food which we really want to share with my friends, some are quite ridiculous and some make us proud. When we talked with our friends, we were so moved by the intelligence and strong reflected with the stories of them. The stories happened in quarantine time during their oversea time, but they are not normal due to the lockdown situation outside. -

Easy Fry Recipe Book

C ONTENTS FIRST COURSES T HE SOLU T ION FOR E V E RY D AY LIGH T Beef empanadas AND CRISPY DEEP FRYING Falafel Crispy curried prawns N O N - DIGITAL D IGITAL Vegetable samosas Mummy pizzas DISHES Teriyaki beef kebabs Gourmet hamburger Coriander beef koftas Chicken spring rolls EASY FRY CLASSIC EASY FRY CLASSIC + EASY FRY PRECISION EASY FRY DELUXE Chicken nuggets Chicken wings Sunday roast chicken Lemon lamb chops P I C TOGRAM G UI D E New York hot dogs Masala curried salmon fillets Homemade Fish & Chips Homemade paprika chips Sweet potato fries NUMBER OF NUMBER OF PREPARATION WAITING MARINATING COOKING PEOPLE PORTIONS TIME TIME TIME TIME DESSERTS Chocolate chip muffins Chocolate soufflés FRENCH FRIES PIZZA CHICKEN CUTLET FISH GRILL SHRIMP CAKE (CHOPS) (PRAWNS) FIRST COURSES 15 18 EASY FRY DIGITAL BEEF EMPANADAS 16 min. min. GRILL MODE INGREDIENTS 2 packs (375 g) ready-rolled 1 tbsp paprika shortcrust pastry 1 egg yolk 200 g minced beef 1 tbsp olive oil 3 or 4 fresh spring onions Salt and pepper RECIPE 1 | Finely chop the spring onions. Fry 3 | DIGITAL VERSION : Place 8 empanadas the meat with the olive oil in a pan in your Easy Fry basket and cook on for 8 minutes. Season with salt and GRILL MODE for 10 minutes. Repeat pepper and add the spring onions with the second batch. and paprika. Leave to cool. NON-DIGITAL VERSION: Place 8 2 | Unroll the pastry, cut out 8 rounds of empanadas in your Easy Fry basket approximately 9 cm in diameter, top and cook at 180°C for 10 minutes. -

Estta1047043 04/04/2020 in the United States Patent And

Trademark Trial and Appeal Board Electronic Filing System. http://estta.uspto.gov ESTTA Tracking number: ESTTA1047043 Filing date: 04/04/2020 IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD Proceeding 91251483 Party Plaintiff Yarnell Ice Cream, LLC Correspondence DANIEL KEGAN Address KEGAN & KEGAN LTD 79 W MONROE ST #1310 CHICAGO, IL 60603-4931 UNITED STATES [email protected] 312-782-6495 Submission Motion to Amend Pleading/Amended Pleading Filer's Name Daniel Kegan Filer's email [email protected] Signature /daniel kegan/ Date 04/04/2020 Attachments 1 SbY-QuickB-mTmoAmend 2Apr2020pdf.pdf(128120 bytes ) 2 SbY-QuickB-TmoAmend 24Mar2020-QB.pdf(180989 bytes ) 3 SbY-QuickB-TmoAmend Exbts.pdf(4810439 bytes ) 4 SbY-QuickB-TmoAmend Red-4Apr2020.pdf(186621 bytes ) IN THE UNITED STATES PATENT AND TRADEMARK OFFICE BEFORE THE TRADEMARK TRIAL AND APPEAL BOARD YARNELL ICE CREAM, LLC ) GUILTLESS FRIES Opposer, ) Serial No. 88-294,467 v ) Filed 8 Feb 2019 QUICK BURGER, INC ) Published 18 Jun 2019 Applicant. ) Opposition 91,251,483 CONSENTED MOTION TO AMEND OPPOSITION NOTICE AND RESET CASE CALENDAR Opposer witH tHe explicit written consent of Applicant moves for leave to file Opposer’s Amended Notice of Opposition, and to reset tHe case calendar as if Discovery were to open as of tHe date of tHe Board’s order to grant leave and resetting tHe calendar. The Board, tHe Federal Rules of Civil Procedure, and tHe US Supreme Court all encourage leave to file an amended complaint Be freely given when justice requires, sucH as underlying facts or circumstances should Be included. -

Bosphorus Menu

BOSPHORUS Restuarant & Cafe MENUZUBZZ.COM BOSPHORUS TURKISH FOOD MEETS ACCRA ZUBZZ.COM sh GH¢ GH¢ Mr Fvurs BREAKFAST BREAKFAST PLATE GH¢ 54 Feta cheese, mozzarella cheese, black olive, green olive, butter, honey, jam, salami, sausage, chocolate plate, pancake, French fries, boiled egg tomato, cucumber, sliced fruit, small glass of French orange juice, unlimited tea. SOUP OF TODAY GH¢ 22 Please ask waiters . CHOICE OF OMELET GH¢ 30 Eggs served with tomato ,cucumber and French fries. ZUBZZ.COM MENEMEN GH¢ 35 A touich of Eastern turkey :Egg , Tomato , Green pepper and special spices Spicy or no spicy GOZLEME GH¢ 29 Turkey Flatbread and minced Meat CONTINENTAL BREAKFAST GH¢ 40 Assorted pastries , condiments fresh fruit in season , fresh juice and beverage ENGLISH BREAKFAST GH¢ 45 Sausage either chicken or beef , mushrooms , baked , bean , egg of your choice , assorted pastries , grilled tomatoes , hash brown , fresh juice , tea or coffee and fresh fruit in season . STARTERS BOSPHORUS SPECIAL GH¢ 45 Lettuce , tomatoes , smoked chicken and avocado CHICKEN AND EGG WHITE SALAD GH¢ 35 Please ask waiters . FRIED /GRILLED CALAMARI GH¢ 40 Eggs served with tomato ,cucumber and French fries. ZUBZZ.COM APPETIZERS CHEESE SPRING ROLLS (7pacs) GH¢ 23 VEGETABLES SPRING ROLLS (7pacs ) GH¢ 23 BEEF BRING ROLLS GH¢ 25 MINI BEEF PITTA GH¢ 18 Turkish pizza and minced meat CRISPY CHICKEN FINGERS GH¢ 45 Turkish pizza and minced meat APPETIZERS CHINEESE CHICKEN SPRING ROLLS (7PACS) GH¢ 41 Two pieces , chicken served with soy sauce and French fries COMBO BASKET -

Beverages Chicken Family Special to Go $49.95 Kids Menu

ExTrAs & A La CaRtE ChIcKeN FaMiLy SpEcIaL To Go $49.95 Serves 4 to 6 ppl. Served Only for Take-Out Garlic Sauce Chicken Tawook Please allow 30 min. for preparation (4 oz.) $1.5 (12 oz.) $4.5 Skewer Eight Chicken Kebab Skewers (8), Breast Kebab $6 Tahini Sauce Rice, Hummus or Baba Ganouj, Salad, FRESH MEDITERRANEAN Sesame Sauce Kaa Skewer Pita Bread & Garlic Sauce (4 oz.) $1.5 (12 oz.) $4.5 Angus Ground Beef $6 (Substitutions are Extra) Tzatziki Sauce Steak Skewer Cucumber Yogurt Beef Sirloin Kebab $7 (4 oz.) $1.5 (12 oz.) $4.5 Side Chicken Side Olives $4 Shawarma Dark & White Chicken $7 Side Pickles & Turnips $3.5 Side Tri-Tip Shawarma $8 Side of Rice $2.75 Veggie Skewer Bag of Pita (6) $3.50 Tomato, Onion, Bellpepper $3 BeVeRaGeS To order call (562) 592-0001 KiDs MeNu Sodas Mint Lemonade Coke, Diet Coke, Sprite Home-Made $3 or visit us online at 12 Years & Under Only $1.99 www.SkewersGrillUSA.com Served with Rice or Fries Jallab Moroccan Mint Iced Grape Molasses, Dates & Tea Rose Water Drink w Pine Nuts Kids Chicken Nuggets $5.99 $3.5 Breaded Breast Nuggets Unsweetened $2.25 Kids Chicken Kebab $6.50 Honest Tea $2.50 Bottled Water $2 Grilled Chicken Breast Kebab Pellegrino Sparkling Espresso Kids Kaa Kebab $6.50 Regular or Orange $3 Single $3 Double $4 Grilled Ground Beef Skewer Kids Steak Kebab $7.50 16552 Bolsa Chica St. Huntington Beach, CA 92649 Kids Drink $1.25 Lemonade, Apple Juice, Soda Bolsa Chica & Heil, at The Albertsons Shopping Center - Vegan - Vegetarian ApPeTiZeRs KeBaB PlAtEs PiTa WrApS Served with Rice, Hummus or Baba Ganouj, Salad & Pita . -

Starters Sandwiches Side Items Burgers

An 18% gratuity is added to checks for parties of five or more. Starters Chicken Tenders 5.30 Mozzarella Sticks 5.00 Five golden brown chicken tenders served with Six breaded mozzarella sticks served with marinara honey mustard, BBQ, ranch, or sweet-n-sour sauce. sauce or ranch dressing. Onion Rings sm. 2.50/ lg. 4.00 Soups 3.00 Our rings are freshly-prepared and are battered Ask your server for the soup of the day and fried until crisp and golden. Cup of Brunswick Stew 3.00 Available after 11 a.m. Chili Cheese Fries 4.55 Tossed Salad 3.30 A plate of our golden fries smothered with (with an entrée or sandwich only 2.80) homemade meat chili and your choice of cheese. Burgers The beef for our burgers is ground daily at Cliff’s Meat Market from 100% chuck, char-grilled, and served with lettuce, tomato, and mayo on a sesame seed bun with chips and a pickle spear. Raw and grilled onions are available for no extra charge. Substitute French Fries—1.00, onion rings — 1.50 or available veggies— 1.50 Hamburger 4.30 The Mixed Grill Burger 5.60 Our cheese burger served with a slice of Cheeseburger 5.10 sugar cured ham. Our burger with the choice of cheddar, Swiss Blue Cheese Burger 5.60 provolone, or American cheese. Our hamburger served with our special Bacon Cheeseburger 5.60 blue cheese mix on the side. Two strips of bacon served atop our Chili Cheese Burger 5.80 cheeseburger with your choice of cheese. -

Soho Alc 2017 Front Website

SOHO ANJU / SMALL PLATES VEGETABLE CHIPS & DIPS 6.5 K-TOWN MINI SLIDERS TWO PER SERVING MANDOO / DUMPLINGS FOUR PER SERVING TACOS TWO PER SERVING Crispy vegetable crisps, served with tomato soy salsa EXTRA SLIDER(S) MAY BE ORDERED BY PIECE EXTRA DUMPLING(S) MAY BE ORDRED BY PIECE EXTRA TACO(S) MAY BE ORDERED BY PIECE & kimchi guacamole. KOREAN FRIED CHICKEN SLIDERS 8 MANDOO (Beef & Pork) 8 SHORT RIB BEEF TACOS 9 KONG BOWL (v) 5 Golden fried chicken thighs, our signature sauces, mayo, Juicy steamed beef & pork dumplings. Seasoned delicately with Korean spices. Chipotle short rib tacos, avocado, gem lettuce, red onion, kimchi, Steamed soybeans (edamame) topped with our Jinjuu chili panko mix. crispy iceberg lettuce, tossed in a brioche bun. Soy dipping sauce. sour cream & topped with coriander. PORK & KIMCHI SOUP 6.5 BULGOGI SLIDERS 8 PHILLY CHEESESTEAK 8 PORK BELLY TACOS 9 Artisan English pork stewed with homemade kimchi, tofu & spring onions. House ground beef burger jazzed up with Korean spices. Thinly sliced English artisanal pork belly marinated in Korean spices, Cooked pink & topped with homemade pickle, cheddar & bacon. shitake, spring onion & pickled jalapeno. Spicy dipping sauce. apple, kimchi & Asian slaw. 9 JINJUU’S SIGNATURE KOREAN FRIED CHICKEN (v) 7 (v) 8 Chicken thighs (boneless) crispy fried in our famous batter. KOREAN FRIED TOFU SLIDERS YA-CHAE MANDOO (Vegetable) (v) 7.5 MUSHROOM TACOS Pickled white radish on the side & paired with our signature sauces: Golden fried crispy tofu, our signature sauces, mayo & crispy Miso sauteed portobello mushroom, kale & black beans, feta cheese, Gochujang Red & Jinjuu Black Soy. -

Fish Fry Guide

FISH FRY GUIDE Gordon Food Service® A Fish Fry Destination The popularity of fried fish remains strong, so don’t underestimate the value of featuring it on your menu. Unique fried fish items on your menu can bring you recognition and loyalty. After all, consumers desire dishes that they can’t or don’t want to make at home. Try your hand at the techniques in this guide and satisfy customers searching for delicious fried fish dinners. With the tips, procedures, and products in this guide, Gordon Food Service® is here to equip you with everything you need to make you well-known for fish! 2 Batter Frying Battered coatings yield a more consistent appearance and can be more forgiving than breading during rush periods. The batter itself causes fillets to rise to the surface almost immediately when placed in the fryer, an eventuality that is not a reliable indicator of doneness. Use small portions of four ounces or less to ensure that fish is cooked thoroughly without overcooking the batter. Slice children’s menu portions into strips. Crunchy, battered whitefish is great served with condiments of malt vinegar or tartar sauce and crisp french fries. The standard approach is outlined below: 1 2 3 Dust moist fish with flour or dry Plunge fish into wet batter, taking With baskets removed from the batter mix and tap gently to care to thoroughly coat it. Lift fillet preheated fryer to prevent sticking, remove excess. out to allow excess batter to drip gently lay battered fillets down into off. Batter is made from one part the oil.