Feature Article: the Outlook for the Oil Market in 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Brill Typeface User Guide & Complete List of Characters

The Brill Typeface User Guide & Complete List of Characters Version 2.06, October 31, 2014 Pim Rietbroek Preamble Few typefaces – if any – allow the user to access every Latin character, every IPA character, every diacritic, and to have these combine in a typographically satisfactory manner, in a range of styles (roman, italic, and more); even fewer add full support for Greek, both modern and ancient, with specialised characters that papyrologists and epigraphers need; not to mention coverage of the Slavic languages in the Cyrillic range. The Brill typeface aims to do just that, and to be a tool for all scholars in the humanities; for Brill’s authors and editors; for Brill’s staff and service providers; and finally, for anyone in need of this tool, as long as it is not used for any commercial gain.* There are several fonts in different styles, each of which has the same set of characters as all the others. The Unicode Standard is rigorously adhered to: there is no dependence on the Private Use Area (PUA), as it happens frequently in other fonts with regard to characters carrying rare diacritics or combinations of diacritics. Instead, all alphabetic characters can carry any diacritic or combination of diacritics, even stacked, with automatic correct positioning. This is made possible by the inclusion of all of Unicode’s combining characters and by the application of extensive OpenType Glyph Positioning programming. Credits The Brill fonts are an original design by John Hudson of Tiro Typeworks. Alice Savoie contributed to Brill bold and bold italic. The black-letter (‘Fraktur’) range of characters was made by Karsten Lücke. -

Symbol BS HT LF VT FF CR SO SI EM FS GS RS US ! " # $ % & ' ( )

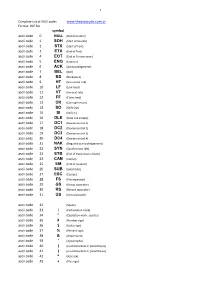

³ Complete List of ASCii codes www.theasciicode.com.ar Format: PDF file symbol ascii code 0 NULL (Null character) ascii code 1 SOH (Start of Header) ascii code 2 STX (Start of Text) ascii code 3 ETX (End of Text) ascii code 4 EOT (End of Transmission) ascii code 5 ENQ (Enquiry) ascii code 6 ACK (Acknowledgement) ascii code 7 BEL (Bell) ascii code 8 BS (Backspace) ascii code 9 HT (Horizontal Tab) ascii code 10 LF (Line feed) ascii code 11 VT (Vertical Tab) ascii code 12 FF (Form feed) ascii code 13 CR (Carriage return) ascii code 14 SO (Shift Out) ascii code 15 SI (Shift In) ascii code 16 DLE (Data link escape) ascii code 17 DC1 (Device control 1) ascii code 18 DC2 (Device control 2) ascii code 19 DC3 (Device control 3) ascii code 20 DC4 (Device control 4) ascii code 21 NAK (Negative acknowledgement) ascii code 22 SYN (Synchronous idle) ascii code 23 ETB (End of transmission block) ascii code 24 CAN (Cancel) ascii code 25 EM (End of medium) ascii code 26 SUB (Substitute) ascii code 27 ESC (Escape) ascii code 28 FS (File separator) ascii code 29 GS (Group separator) ascii code 30 RS (Record separator) ascii code 31 US (Unit separator) ascii code 32 (Space) ascii code 33 ! (Exclamation mark) ascii code 34 " (Quotation mark ; quotes) ascii code 35 # (Number sign) ascii code 36 $ (Dollar sign) ascii code 37 % (Percent sign) ascii code 38 & (Ampersand) ascii code 39 ' (Apostrophe) ascii code 40 ( (round brackets or parentheses) ascii code 41 ) (round brackets or parentheses) ascii code 42 * (Asterisk) ascii code 43 + (Plus sign) ³ ascii code 44 , (Comma) ascii code 45 - (Hyphen) ascii code 46 . -

An Integrated Approach to Assess the Environmental Impacts of Large-Scale Gold Mining: the Nzema-Gold Mines in the Ellembelle District of Ghana As a Case Study

International Journal of Environmental Research and Public Health Article An Integrated Approach to Assess the Environmental Impacts of Large-Scale Gold Mining: The Nzema-Gold Mines in the Ellembelle District of Ghana as a Case Study Dawuda Usman Kaku 1 , Yonghong Cao 1,2,*, Yousef Ahmed Al-Masnay 1 and Jean Claude Nizeyimana 1 1 School of Environment, Northeast Normal University, Changchun 130117, China; [email protected] (D.U.K.); [email protected] (Y.A.A.-M.); [email protected] (J.C.N.) 2 State Environmental Protection Key Laboratory of Wetland Ecology and Vegetation Restoration, School of Environment, Northeast Normal University, Changchun 130117, China * Correspondence: [email protected] Abstract: The mining industry is a significant asset to the development of countries. Ghana, Africa’s second-largest gold producer, has benefited from gold mining as the sector generates about 90% of the country’s total exports. Just like all industries, mining is associated with benefits and risks to indigenes and the host environment. Small-scale miners are mostly accused in Ghana of being environmentally disruptive, due to their modes of operations. As a result, this paper seeks to assess the environmental impacts of large-scale gold mining with the Nzema Mines in Ellembelle as a case study. The study employs a double-phase mixed-method approach—a case study approach, consisting of site visitation, key informant interviews, questionnaires, and literature reviews, and the Normalized Difference Vegetation Index (NDVI) analysis method. The NDVI analysis shows that Citation: Usman Kaku, D.; Cao, Y.; agricultural land reduced by −0.98%, while the bare area increases by 5.21% between the 2008 and Al-Masnay, Y.A.; Nizeyimana, J.C. -

071810101081.Pdf

Digital Repository Universitas Jember PENGKODEAN PLAINTEKS MENGGUNAKAN GABUNGAN SHIFT CHIPER DAN TRANSPOSISI DIAGONAL SKRIPSI diajukan guna melengkapi tugas akhir dan memenuhi salah satu syarat untuk menyelesaikan Program Studi Matematika (S1) dan mencapai gelar Sarjana Sains Oleh Tri Lindawati NIM 071810101081 JURUSAN MATEMATIKA FAKULTAS MATEMATIKA DAN ILMU PENGETAHUAN ALAM UNIVERSITAS JEMBER 2015 i Digital Repository Universitas Jember PERSEMBAHAN Skripsi ini saya persembahkan untuk: 1. Orangtuaku Bapak Sudarto dan Ibu Aspiyah yang selalu memberikan doa, restu dan motivasi dalam perjalanan hidupku; 2. Suamiku kakanda Nurlatiful Wahid yang selalu mendampingiku, memberikan support dan semangat; 3. Guru-guruku sejak taman kanak-kanak sampai dengan perguruan tinggi yang telah mendidik, membimbing dan mengajariku tentang pentingnya ilmu; 4. Sahabat-sahabatku Umi Kholila, Hilyatul A, Fatihatul Ayatillah, Mike Ardila, Silvia Anggraeni, Janter Sinaga, Wika Anggani, Yulan Isa Puspita, Prastowo Sandi Asmoro, Dimas yang selalu membantu dan memberiku semangat; 5. Almamater Fakultas Matematika dan Ilmu Pengetahuan Alam Universitas Jember. ii Digital Repository Universitas Jember MOTTO Sesungguhnya bersama kesulitan ada kemudahan. Maka, apabila kamu telah selesai (dari suatu urusan) tetaplah bekerja keras (untuk urusan yang lain) dan hanya kepada Tuhanmulah hendaknya engkau berharap. (terjemahan Surat Al-Insyiroh Ayat 6-8)*) Orang terkuat bukan mereka yang selalu menang, melainkan mereka yang tetap tegar ketika mereka jatuh. (Khalil Gibran) *) Departemen -

Tri-Service General Hospital Outpatient Department Physician

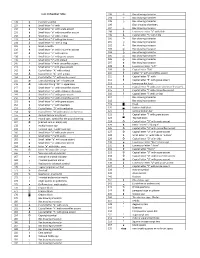

DNZL Voice registration : (02) 8792-7111 ɏ! Manual registration : (02) 8792-7222 Tri-Service General Hospital Outpatient Department Physician Schedule ɂ Neihu Main Facility Ƀ Information counter : (02) 8792-3311 ext. 88125 March-2018 Weekday Monday Tuesday Wednesday Thursday Friday Saturday (Monday to Saturday) Morning Afternoon Evening Morning Afternoon Evening Morning Afternoon Evening Morning Afternoon Evening Morning Afternoon Evening Morning Clinic Room Room Room Room Room Room Room Room Room Room Room Room Room Room Room Room Department 0830-1200 1400-1700 1800-2100 0830-1200 1400-1700 1800-2100 0830-1200 1400-1700 1800-2100 0830-1200 1400-1700 1800-2100 0830-1200 1400-1700 1800-2100 0830-1200 Wang, Ni-Chiz 10235 129 �Shih, Yu-Lueng 10343 147 Line, Yueng-Chueng 10300 127 Wang, Ni-Chiz 10235 129 General Internal Medicine )3/5. 19. 26.* �Chang, Ping-Ying 10432 149 Hsieh, Chia-Chuan 10588 183 Hung, Yung-Hsing 10299 139 Kao, Tung-Wei 10385 183 Chang, Yaw-Wen 10433 183 Chih-Chia, Wang 10443 183 Hsieh, Chia-Chuan 10588 183 Hsu, Yu-Juei 10375 139 Chu, Shi-Jye 10105 096 Rheumatology, Chen, Hsiang-Cheng 10372 100 Kuo, San-Yuan 10063 100 Lu, Chun-Chi 10561 100 Chu, Shi-Jye 10105 100 Chen, Hsiang-Cheng 10372 099 Chang, Deh-Ming 10075 097 Lin, Feng-Cheng 10399 100 Lu, Chun-Chi 10561 100 Chen, Hsiang-Cheng 10372 099 Chu, Shi-Jye 10105 100 Kuo, San-Yuan 10063 100 Immunology and Allergy Liu, Feng-Cheng 10399 100 �Chen, Hsiang-Cheng 10372 148 Kuo, San-Yuan 10063 100 )3/22.*! Perng, Chung-Kan 10357 122 Perng, Wann-Cherng 10071 123 Chen, Ying-Gieh -

Feature Article: Review of 2020; Outlook for 2021

Organization of the Petroleum Exporting Countries 14 December 2020 Feature article: Review of 2020; outlook for 2021 Oil market highlights i Feature article iii Crude oil price movements 1 Commodity markets 7 World economy 10 World oil demand 26 World oil supply 36 Product markets and refinery operations 51 Tanker market 57 Crude and refined products trade 60 Commercial stock movements 65 Balance of supply and demand 70 Publishing schedule for 2021 Thursday, 14 January Thursday, 11 February Thursday, 11 March Tuesday, 13 April Tuesday, 11 May Thursday, 10 June Thursday, 15 July Thursday, 12 August Monday, 13 September Wednesday, 13 October Thursday, 11 November Monday, 13 December OPEC Monthly Oil Market Report – December 2020 i Chairman of the Editorial Board HE Mohammad Sanusi Barkindo Secretary General Editor-in-Chief Dr. Ayed S. Al-Qahtani Director, Research Division email: aalqahtani(at)opec.org Editor Behrooz Baikalizadeh Head, Petroleum Studies Department email: bbaikalizadeh(at)opec.org Contributors Crude Oil Price Movements Yacine Sariahmed Senior Oil Price Analyst, PSD email: ysariahmed(at)opec.org Commodity Markets Hector Hurtado Chief Financial Analyst, PSD email: hhurtado(at)opec.org World Economy Imad Al-Khayyat Chief Economic Analyst, PSD email: ial-khayyat(at)opec.org Hector Hurtado Chief Financial Analyst, PSD email: hhurtado(at)opec.org Dr. Asmaa Yaseen Modelling & Forecasting Analyst, PSD email: ayaseen(at)opec.org Dr. Joerg Spitzy Senior Research Analyst, PSD email: jspitzy(at)opec.org World Oil Demand Hassan Balfakeih Chief Oil Demand Analyst, PSD email: hbalfakeih(at)opec.org World Oil Supply Mohammad Ali Danesh Chief Oil Supply Analyst, PSD email: mdanesh(at)opec.org Product Markets and Refinery Operations Tona Ndamba Senior Refinery & Products Analyst, PSD email: tndamba(at)opec.org Tanker Markets Douglas Linton Senior Research Specialist, PSD email: dlinton(at)opec.org Crude and Refined Products Trade Douglas Linton Senior Research Specialist, PSD email: dlinton(at)opec.org Stock Movements Dr. -

Fakultas Sains Dan Teknologi Universitas Pvnbangunan Panca Budi Medait

APLIKASI ENKRIPSI DAh{ DEKRIPSI BENGAN TEKNIK XOR MENGGT]NAKAN METODE VERNAM CIPHER Disusun dan Diajrrkan Sebagai Satah Satu Persyaratan Untuk Memenghi Ujian Alfiir Memperoleh Gelar sarjana Komputer PadaFakultas sains Dan Teknologi Universitas Pvnbangunan Panca Budi Medait sK&.{p$x {}{,Et{ NAMA MHD. FIRMANSYAH N.P.M t5l4s10629 PROGRAM STUDI SISTEM KOMPUTER FAKULTAS SAINS DAN TEKNOLOGI UNIYERSITAS PEMBANGUNAN PANCA BUDI MEDAN 2028 IF ABSTRAK MHD. FIRMANSYAH APLIKASI ENKRIPSI DAN DEKRIPSI DENGAN TEKNIK XOR MENGGUNAKAN METODE VERNAM CIPHER Perkembangan teknologi terutama pada sistem pengamanan data dalam menjaga keamanan data informasi telah berkembang pesat. Dalam menjaga keamanan data informasi terdapat cabang ilmu dalam pengembangannya seperti kriptografi. Pada penerapannya dilakukan tidak hanya pada satu teknik keamanan saja, melainkan bisa dilakukan dengan kombinasi dalam keamanan data informasi. Penelitian ini bertujuan untuk membuat sebuah sistem keamanan data dengan mengimplementasikan kriptografi pada pesan teks, isi file dokumen, dan file dokumen dengan melakukan perhitungan algoritma Vernam Cipher. Metode Vernam Cipher merupakan algoritma berjenis symmetric key kunci yang digunakan untuk melakukan enkripsi dan dekripsi yang menggunakan kunci yang sama. Dalam proses enkripsi, algoritma Vernam Cipher menggunakan cara stream cipher dimana cipher berasal dari hasil XOR antara bit plaintext dan bit key, sedangkan permutasi biner dilakukan dengan membalikan kode biner pada setiap karakter Dalam makalah ini akan dibahas, program aplikasi -

Grade 10-12 NSC IT Cram Notes

Grade 10-12 NSC IT Cram Notes Key Grade 10 – Blue Grade 11 – Green Grade 12 – Red INPUTBOX MATHEMATICAL FUNCTIONS & PROCEDURES Allows user to enter data StringResult := InputBox StrToInt DELPHI BASICS CONCEPTS AND TOOLS (‘Windows caption’, ‘Prompt’, Default value’); Converts string value to integer iN := StrToInt(sNumber); Procedure TForm1.Button1Click(Sender: TObject); DELPHI FILES Var IntToStr Eight files when you save and run the program, main files; sName : string; Converts integer value to string begin sNumber := IntToStr(iN); Project file (.dpr / .dproj) sName := InputBox (‘Name’, ‘Enter your name’, ‘’); Form file (.dfm) lblName.Caption := sName; StrToFloat Unit file (.pas) end; Converts string value to real rN := StrToFloat(sNumber); BASIC RULES Assignment operator := CALCULATIONS USING VARIABLES FloatToStr left side gets, right side gives Converts real value to string A := B sNumber := FloatToStr(rN); VARIABLES String Text must be place between single quotes ‘ ‘ FloatToStrF Values that are text (Numbers and letters) sText := ‘Hello World’ Converts real value to string with formatting (1 number Abbreviation: s (sName) after the decimal for example) Strings are joined by a + sign sN := FloatToStrF(rN, ffFixed, 15, 1); Integer sText := 'Hello' + 'World' Whole numbers (Numbers with no digits after the decimal Trunc point Input, Processing, Output (IPO) Truncates (cuts) the decimal point Abbreviation: i (iNumber) Trunc(4.5); Real Val Whole and fractions (Numbers with digits after the decimal Converts string value to integer or real. Also checks for point) errors. Abbreviation: r (rAmount) Val(sOriginal, iNum, iError); ERRORS Val(sOriginal, rNum, iError); Syntax Errors: Common mistakes: no semi-colon at the end Char of a line; : = instead of := (no space between : and =) spelling Any single characters (Text, Symbol or Number) Round errors Abbreviation: c (cInitial) Rounds real number to the nearest integer Round(4.8); Logical Errors: Errors created by the programmer in Boolean specifying the wrong steps in the program. -

Cave-76-03-Fullr.Pdf

R. Putisˇka, D. Kusˇnira´k, I. Dosta´l, A. Lacˇny´, A. Mojzesˇ, J. Ho´k, R. Pasˇteka, M. Krajnˇa´k, and M. Bosˇansky´– Integrated geophysical and geological investigations of karst structures in Komberek, Slovakia. Journal of Cave and Karst Studies, v. 76, no. 3, p. 155–163. DOI: 10.4311/2013ES0112 INTEGRATED GEOPHYSICAL AND GEOLOGICAL INVESTIGATIONS OF KARST STRUCTURES IN KOMBEREK, SLOVAKIA RENE´ PUTISˇKA1*,DAVID KUSˇNIRA´ K1,IVAN DOSTA´ L1,ALEXANDER LACˇ NY´ 2,ANDREJ MOJZESˇ 1,JOZEF HO´ K2, ROMAN PASˇTEKA1,MARTIN KRAJNˇ A´ K1, AND MARIA´ N BOSˇANSKY´ 1 Abstract: A complex of geophysical methods were used to investigate a small karst area aimed at the production of detailed geological mapping, to confirm geological localization of known sinkholes, and to find possible continuations of caves and voids below the surface. The dipole electromagnetic profiling and radiometric mapping (the gamma-ray spectrometry method) were applied to determine the spatial distribution of hard carbonate rocks and weathered valley-fill sediments. Detailed high-definition magnetometry was carried out at selected sites in the studied region with the aim of distinguishing between sinkholes and man-made lime-kilns, pits where limestone was heated and transformed into lime. The microgravity and the electrical-resistivity tomography (ERT) methods were used to create high-resolution images of the underground cave. The results of ERT and the geological survey were used as an initial model for gravity modeling. Subsurface cavities of various sizes are contrasting geophysical objects, and the electrical resistivity can range from very conductive to relatively resistive depending on the composition of the filling materials. -

Font 13 Number Table 128 ╟А Capital C

Font 13 Number Table 193 ┴ Box drawing character 194 ┬ Box drawing character 128 Ç Capital C‐cedilla) 195 ├ Box drawing character 129 ü Small letter "u" with 196 ─ (Box drawing character) 130 é Small letter "e" with acute accent 197 ┼ Box drawing character 131 â Small letter "a" with circumflex accent 198 ã Lowercase letter "a" with tilde 132 ä Small letter "a" with umlaut 199 Ã Capital letter "A" with tilde 133 à Small letter "a" with grave accent 200 ╚ Box drawing character 134 å Small letter "a" with a ring 201 ╔ Box drawing character 135 ç Small c‐cedilla 202 ╩ Box drawing character 136 ê Small letter "e" with circumflex accent 203 ╦ Box drawing character 137 ë Small letter "e" with umlaut 204 ╠ Box drawing character 138 è Small letter "e" with grave accent 205 ═ Box drawing character 139 ï Small letter "i" with umlaut 206 ╬ Box drawing character 140 î Small letter "i" with circumflex accent 207 ¤ Box drawing character 141 ì Small letter "i" with grave accent 208 ð Lowercase letter "eth" 142 Ä Capital letter "A" with umlaut 209 Ð Capital letter "Eth" 143 Å Capital letter "A" with a ring) 210 Ê (letter "E" with circumflex accent 144 É Capital letter "E" with acute accent 211 Ë Capital letter "E" with 145 æ Latin diphthong "ae" in lowercase 212 È Capital letter "E" with grave accent 146 Æ Latin diphthong "AE" in uppercase 213 ı lowercase dot less i 147 ô Small letter "o" with circumflex accent 214 Í Capital letter "I" with acute accent or "I‐acute") 148 ö Small letter "o" with umlaut or diaeresis 215 Î Capital letter "I" with circumflex -

Unibook Document

Title: Additional repertoire for ISO/IEC 10646:2017 (5th ed.) Amendment 1.3 Date: 2017-06-05 L2/17-190 WG2 N4824 Source: Michel Suignard, project editor Status: Project Editor's summary of the character repertoire addition as of June 2017 Action: For review by WG2 and UTC experts Distribution: WG2 and UTC Replaces: Status This document presents a summary of all characters that constitute the tentative new repertoire for ISO/IEC 10646 5th edition Amd1, with code positions, representative glyphs and character names. Manner of Presentation The character names and code points shown are the same for Unicode and ISO/IEC 10646, including annotations. Note to Reviewers UTC reviewers, please use this document as a summary of UTC review of pending ballots and proposals. WG2 Reviewers, please use this document as an aid during disposition of ballot comments. Contents This document lists 1392 characters. The following list shows all 41 blocks (existing or new) to which characters are proposed to be added, or which have been affected by other changes documented here. 0530-058F Armenian See document: L2/17-032 0590-05FF Hebrew See document: L2/16-305 07C0-07FF NKo See document L2/15-338 08A0-08FF Arabic Extended-A See document L2/16-056 0980-09FF Bengali See document L2/16-322 0A00-0A7F Gurmukhi See document L2/16-209 0C00-0C7F Telugu See document: L2/16-285 0C80-0CFF Kannada See document L2/16-031 1800-18AF Mongolian See document: L2/17-007 2B00-2BFF Miscellaneous Symbols and Arrows See document L2/16-064 L2/16-067 L2/16-173R L2/16-174R L2/17-033R -

Steganografi Teks Menggunakan Pemetaan Digit Biner Pada Karakter Ascii Untuk Keamanan Plain Text

TESIS – TE142599 STEGANOGRAFI TEKS MENGGUNAKAN PEMETAAN DIGIT BINER PADA KARAKTER ASCII UNTUK KEAMANAN PLAIN TEXT ALFIN NAHARUDDIN NRP 07111650067006 DOSEN PEMBIMBING Dr. Surya Sumpeno, S.T., M.Sc. Dr. Adhi Dharma Wibawa, S.T., M.T. PROGRAM MAGISTER BIDANG KEAHLIAN TELEMATIKA DEPARTEMEN TEKNIK ELEKTRO FAKULTAS TEKNOLOGI ELEKTRO INSTITUT TEKNOLOGI SEPULUH NOPEMBER SURABAYA 2018 TESIS – TE142599 STEGANOGRAFI TEKS MENGGUNAKAN PEMETAAN DIGIT BINER PADA KARAKTER ASCII UNTUK KEAMANAN PLAIN TEXT ALFIN NAHARUDDIN NRP 07111650067006 DOSEN PEMBIMBING Dr. Surya Sumpeno, S.T., M.Sc. Dr. Adhi Dharma Wibawa, S.T., M.T. PROGRAM MAGISTER BIDANG KEAHLIAN TELEMATIKA DEPARTEMEN TEKNIK ELEKTRO FAKULTAS TEKNOLOGI ELEKTRO INSTITUT TEKNOLOGI SEPULUH NOPEMBER SURABAYA 2018 LEMBAR PENGESAHAN Tesis disusun untuk memenuhi salah satu syarat memperoleh gelar Magister Teknik (M.T) di Institut Teknologi Sepuluh Nopember oleh: Alfin N ahamddin NRP. 07111650067006 Tanggal Ujian : 6 Juli 2018 Periode Wisuda: September 2018 Disetujui oleh: 1. Dr. Surya Sumpeno, S.T., M.Sc. (Pembimbing I) NIP 196906131997021003 2. Dr. Adhi Dharma~ Wibawa, S.T., M.T. (Pembimbing II) NIP 197605052008121003 3. Prof. Dr. Ir. Ma f~iHery Pumomo, M.Eng. (Penguji) NIP 195809161~~ 1001 4. Dr. I Ketut E~ Purnama, S.T., M.T. (Penguji) NIP 196907 io¥J~ 12 1 (Penguji) as Teknologi Elektro iii Halaman ini sengaja dikosongkan iv PERNYATAAN KEASLIAN TESIS Dengan ini saya menyatakan bahwa isi keseluruhan Tesis saya dengan judul "STEGANOGRAFI TEKS 1\tiENGGi.JNAKAN PEMETAAN DIGIT BINER PADA KARAKTER ASCII UNTUK KEAMANAN PLAIN TEXT" adaiah benar-benar hasii karya inteiektuai mandiri, diseiesaikan tanpa menggunakan bahan-bahan yang tidak diijinkan dan bukan merupakan karya pihak iain yang saya akui sebagai karya sendiri.