Feature Article: Review of 2020; Outlook for 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fossil Fuels………………………………………………

Corso di Laurea magistrale in Relazioni Internazionali Comparate Tesi di Laurea Energy and Environment Between development and sustainability Relatore Ch. Prof. Matteo Legrenzi Correlatore Ch. Prof. Duccio Basosi Laureando Alberto Lora Matricola 987611 Anno Accademico 2013 / 2014 TABLE OF CONTENTS Abstract………………………………………………………………………………………………i Introduction...………………………………………………………….........................................1 PART 1 - ENERGY SECURITY Chapter 1. Energy Security……………………………………………………………………...7 1.1 What is energy security?.......................................................................................................7 1.1.1 Definition of energy security…………………………………………………………………………..7 1.1.2 Elements of energy security………………………………………………………………………….8 1.1.3 Different interpretations of energy security………………………………………………………….9 1.1.4 Theories about energy security……………………………………………………………………..11 1.2 Diversification of the energy mix…………………………………………………………………12 1.2.1 Types of energy sources………………………………..............................................................12 1.2.2 Definition of energy mix……………………………………………………………………………..13 1.3 Growing risks………………………………………………………………………………………16 1.3.1 Energy insecurity……………………………………………………………………………………..16 1.3.2 Geological risk………………………………………………………………………………………..17 1.3.3 Geopolitical risk…………………………………………………………………….........................18 1.3.4 Economic risk…………………………………………………………………………………………22 1.3.5 Environmental risk……………………………………………………………………………………22 1.3.6 Solutions………………………………………………………………………………………………23 -

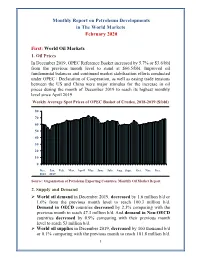

Monthly Report on Petroleum Developments in the World Markets February 2020

Monthly Report on Petroleum Developments in The World Markets February 2020 First: World Oil Markets 1. Oil Prices In December 2019, OPEC Reference Basket increased by 5.7% or $3.6/bbl from the previous month level to stand at $66.5/bbl. Improved oil fundamental balances and continued market stabilization efforts conducted under OPEC+ Declaration of Cooperation, as well as easing trade tensions between the US and China were major stimulus for the increase in oil prices during the month of December 2019 to reach its highest monthly level since April 2019. Weekly Average Spot Prices of OPEC Basket of Crudes, 2018-2019 ($/bbl) 80 70 60 50 40 30 20 10 0 Dec. Jan. Feb. Mar. April May June July Aug. Sept. Oct. Nov. Dec. 2018 2019 Source: Organization of Petroleum Exporting Countries, Monthly Oil Market Report. 2. Supply and Demand World oil demand in December 2019, decreased by 1.6 million b/d or 1.6% from the previous month level to reach 100.3 million b/d. Demand in OECD countries decreased by 2.3% comparing with the previous month to reach 47.3 million b/d. And demand in Non-OECD countries decreased by 0.9% comparing with their previous month level to reach 53 million b/d. World oil supplies in December 2019, decreased by 100 thousand b/d or 0.1% comparing with the previous month to reach 101.8 million b/d. 1 Non-OPEC supplies remained stable at the same previous month level of 67.2 million b/d. Whereas preliminary estimates show that OPEC crude oil and NGLs/condensates total supplies decreased by 0.6% comparing with the previous month to reach 34.5 million b/d. -

Crude Oil Price Movements

OPEC Monthly Oil Market Report 11 July 2018 Feature article: Oil Market Outlook for 2019 Oil market highlights iii Feature article v Crude oil price movements 1 Commodity markets 8 World economy 11 World oil demand 31 World oil supply 44 Product markets and refinery operations 63 Tanker market 71 Oil trade 76 Stock movements 81 Balance of supply and demand 87 Organization of the Petroleum Exporting Countries Helferstorferstrasse 17, A-1010 Vienna, Austria E-mail: prid(at)opec.org Website: www.opec.org Welcome to the Republic of the Congo Welcome to the Republic of the Congo as the 15th OPEC Member The 174th Meeting of the Conference approved the request from the Republic of the Congo to join the Organization of the Petroleum Exporting Countries (OPEC), with immediate effect from 22nd June 2018. In line with this development, data for the Republic of the Congo is now included within the OPEC grouping. As a result, the figures for OPEC crude production, demand for OPEC crude and non-OPEC supply as well as the OPEC Reference Basket have been adjusted to reflect this change. For comparative purposes, related historical data has also been revised. OPEC Monthly Oil Market Report – July 2018 i Welcome the Republic of Congo ii OPEC Monthly Oil Market Report – July 2018 Oil Market Highlights Oil Market Highlights Crude Oil Price Movements The OPEC Reference Basket (ORB) eased by 1.2% month-on-month (m-o-m) in June to average $73.22/b. The ORB ended 1H18 higher at $68.43/b, up more than 36% since the start of the year. -

Asymmetric Impacts of Oil Price on Inflation: an Empirical Study

energies Article Asymmetric Impacts of Oil Price on Inflation: An Empirical Study of African OPEC Member Countries Umar Bala 1,2 and Lee Chin 2,* 1 Department of Economics, Faculty of Management and Social Sciences, Bauchi State University, P.M.B. 65 Gadau, Nigeria; [email protected] 2 Department of Economics, Faculty of Economics and Management, Universiti Putra Malaysia, 43400 UPM Serdang, Selangor Darul Ehsan, Malaysia * Correspondence: [email protected]; Tel.: +60-603-8946-7769 Received: 14 August 2018; Accepted: 26 October 2018; Published: 2 November 2018 Abstract: This study investigates the asymmetric impacts of oil price changes on inflation in Algeria, Angola, Libya, and Nigeria. Three different kinds of oil price data were applied in this study: the actual spot oil price of individual countries, the OPEC reference basket oil price, and an average of the Brent, WTI, and Dubai oil price. Autoregressive distributed lag (ARDL) dynamic panels were used to estimate the short- and long-term impacts. Also, we partitioned the oil price into positive and negative changes to capture asymmetric impacts and found that both the positive and negative oil price changes positively influenced inflation. However, the impact was found to be more significant when the oil prices dropped. We also found that the money supply, the exchange rate, and the gross domestic product (GDP) are positively related to inflation, while food production is negatively related to inflation. Accordingly, policy-makers should be cautious when formulating policies between the positive and negative changes in oil prices, as it was shown that inflation increased when the oil price dropped. -

Dilemmas of Brazilian Grand Strategy

STRATEGIC STUDIES INSTITUTE The Strategic Studies Institute (SSI) is part of the U.S. Army War College and is the strategic level study agent for issues related to national security and military strategy with emphasis on geostrate- gic analysis. The mission of SSI is to use independent analysis to conduct strategic studies that develop policy recommendations on: • Strategy, planning and policy for joint and combined employment of military forces; • Regional strategic appraisals; • The nature of land warfare; • Matters affecting the Army’s future; • The concepts, philosophy, and theory of strategy; and • Other issues of importance to the leadership of the Army. Studies produced by civilian and military analysts concern topics having strategic implications for the Army, the Department of De- fense, and the larger national security community. In addition to its studies, SSI publishes special reports on topics of special or immediate interest. These include edited proceedings of conferences and topically-oriented roundtables, expanded trip re- ports, and quick reaction responses to senior Army leaders. The Institute provides a valuable analytical capability within the Army to address strategic and other issues in support of Army par- ticipation in national security policy formulation. Strategic Studies Institute Monograph DILEMMAS OF BRAZILIAN GRAND STRATEGY Hal Brands August 2010 Visit our website for other free publication downloads http://www.StrategicStudiesInstitute.army.mil/ To rate this publication click here. The views expressed in this report are those of the author and do not necessarily reflect the official policy or position of the Depart- ment of the Army, the Department of Defense, or the U.S. -

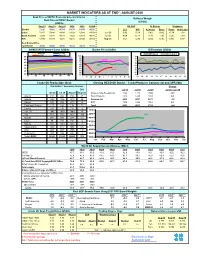

Market Indicators As at End*: August-2020

MARKET INDICATORS AS AT END*: AUGUST-2020 Spot Price of OPEC Basket & Selected Crudes Refiners' Margin Real Price of OPEC Basket (US$/b) (US$/b) Aug-18 Aug-19 Aug-20 2018 2019 2020# US Gulf N. Europe Singapore Basket 72.26 59.62 45.19 69.78 64.04 40.50 LLS WTI A. Heavy Brent Oman Arab Light Dubai 72.47 58.88 43.89 69.68 63.48 41.54 Jun-20 3.92 5.19 0.42 0.42 -0.74 1.02 North Sea Dtd 72.64 58.83 44.79 71.22 64.19 40.88 Jul-20 4.64 6.13 -1.86 1.30 1.26 1.99 WTI 67.99 54.84 42.36 65.16 57.02 38.15 Aug-20 3.67 5.30 -2.05 0.16 0.86 0.87 Real Basket Price Jun01=100 46.86 39.02 28.30 35.22 44.73 26.19 NYMEX WTI Forward Curve (US$/b) Basket Price (US$/b) Differentials (US$/b) May-20 Jun-20 WTI-Brent Brent-Dubai Jul-20 Aug-20 50 100 3 90 2 45 2018 80 1 70 40 0 60 35 2019 -1 50 30 40 -2 2020 -3 25 30 20 -4 20 10 -5 1M 3M 5M 7M 9M 11M J F M A M J J A S O N D 03 05 07 11 13 17 19 21 25 27 31 Crude Oil Production (tb/d) Closing OECD Oil Stocks - Crude/Products Commercial and SPR (Mb) Crude Oil Production (Tb/d) Production: Secondary Sources Change Diff. -

Oil and Security Policies

Oil and Security Policies <UN> International Comparative Social Studies Editor-in-Chief Mehdi P. Amineh (Amsterdam Institute for Social Science Research, University of Amsterdam, International Institute for Asian Studies, University of Leiden) Editorial Board Sjoerd Beugelsdijk (Radboud University, Nijmegen, The Netherlands) Simon Bromley (Open University, uk) Harald Fuhr (University of Potsdam, Germany) Gerd Junne (University of Amsterdam, The Netherlands) Kurt W. Radtke (International Institute for Asian Studies, The Netherlands) Ngo Tak-Wing (University of Leiden, The Netherlands) Mario Rutten (University of Amsterdam, The Netherlands) Advisory Board W.A. Arts (University College Utrecht, The Netherlands) G.C.M. Lieten (University of Amsterdam, The Netherlands) H.W. van Schendel (University of Amsterdam/International Institute of Social History, Amsterdam) L.A. Visano (York University, Canada) VOLUME 32 The titles published in this series are listed at brill.com/icss <UN> Oil and Security Policies Saudi Arabia, 1950–2012 By Islam Y. Qasem LEIDEN | BOSTON <UN> Cover illustration: © Ruletkka|Dreamstime.com. Library of Congress Cataloging-in-Publication Data Qasem, Islam Y., author. Oil and security policies : Saudi Arabia, 1950-2012 / by Islam Y. Qasem. pages cm. -- (International comparative social studies, ISSN 1568-4474 ; volume 32) Includes bibliographical references and index. ISBN 978-90-04-27774-8 (hardback : alk. paper) 1. Petroleum industry and trade--Political aspects--Saudi Arabia. 2. Energy consumption--Political aspects--Saudi Arabia. 3. Internal security--Saudi Arabia. 4. National security--Saudi Arabia. 5. Security, International--Saudi Arabia. 6. Saudi Arabia--Foreign relations. I. Title. HD9576.S32Q26 2015 338.2’72820953809045--dc23 2015028649 This publication has been typeset in the multilingual “Brill” typeface. -

Monthly Oil Market Report

Organization of the Petroleum Exporting Countries OMonthlyP Oil MEarket CReport March 2005 Feature Article: Relationship between commercial crude inventories and oil prices Oil Market Highlights 1 Feature Article 3 Outcome of the 135th Meeting of the Conference 5 Highlights of the world economy 7 Crude oil price movements 11 Product markets and refinery operations 15 The oil futures market 19 The tanker market 21 World oil demand 23 World oil supply 28 Rig count 31 Stock movements 32 Balance of supply and demand 34 Obere Donaustrasse 93, A-1020 Vienna, Austria Tel: +43 1 21112 Fax: +43 1 2164320 E-mail: [email protected] Web site: www.opec.org ____________________________________________________________________Monthly Oil Market Report Oil Market Highlights For the first time since the summer of 2004, Japan and Europe appear to have begun to share in the growth of the world economy. The outlook for Japan is particularly encouraging as both domestic and corporate demand look to have made a good start to 2005. The indications for Europe are more modest but early data for Germany, at least, suggest that improving investment demand and consumer spending should produce meaningful GDP growth in the first quarter. Nevertheless the main growth engines of the world economy remain the USA and China. US consumer and investment spending continued to grow strongly in February and the first quarter may see growth of about 4%. Data for China confirms a slight slowdown in the growth rates for retail sales in January and February but industrial production growth accelerated, rising to 16.9% year-on-year. There are risks on the sustainability of world economic growth in 2005. -

Porosity Permeability Volume and Lifespan Gabriel Wimmerth

POROSITY PERMEABILITY VOLUME AND LIFESPAN GABRIEL WIMMERTH 1 THE POROSITY OF A RESERVOIR DETERMINES THE QUANTITY OF OIL AND GAS. THE MORE PORES A RESERVOIR CONTAINS THE MORE QUANTITY, VOLUME OF OIL AND GAS IS PRESENT IN A RESERVOIR. BY GABRIEL KEAFAS KUKU PLAYER WIMMERTH DISSERTATION PRESENTED FOR THE DEGREE OF DOCTORATE IN PETROLEUM ENGINEERING In the Department of Engineering and Science at the Atlantic International University, Hawaii, Honolulu, UNITED STATES OF AMERICA Promoter: Dr. Franklin Valcin President/Academic Dean at Atlantic International University October 2015 2 DECLARATION I declare by submitting this thesis, dissertation electronically that that the comprehensive, detailed and the entire piece of work is my own, original work that I am the sole owner of the copyright thereof(unless to the extent otherwise stated) and that I have not previously submitted any part of the work in obtaining any other qualification. Signature: Date: 10 October 2015 Copyright@2015 Atlantic International University All rights reserved 3 DEDICATION This work is dedicated to my wife Edla Kaiyo Wimmerth for assisting, encouraging, motivating and being a strong pillar over the years as I was completing this dissertation. It has been quite a tremendous journey, hard work and commitment for me and I would not have completed this enormous work, dissertation without her weighty, profound assistance. 4 ABSTRACT The oil and gas industry, petroleum engineering, exploration, drilling, reservoir and production engineering have taken an enormous toll since the early forties and sixties and it has predominantly reached the peak in the early eighties and nineties. The number of oil and gas companies have been using the vertical drilling approach and successfully managed to pinch the reservoir with productive oil or gas. -

Brazil's Oil Discoveries Bring New

Brazil’s Oil Discoveries Brazil’s discovery of large offshore oil reserves holds the possibility of raising the country’s profile in the international Bring New energy market and bringing an influx of wealth to the country. Safeguard- ing the nation’s economy against the Challenges downside of newfound resource wealth is among its leaders’ concerns. 22 EconSouth First Quarter 2011 While deepwater drilling permits in the United States were Brazil: Oil Production and Consumption, 1995–2012 being withheld because of concerns about safety and the envi- ronment, Brazil is moving at full speed to develop its massive Production deepwater reserves. In fact, Petrobras, the country’s state-run Forecast Consumption oil company, has already committed to investing $224 billion 3 through 2014 in its plan to develop deepwater fields off the country’s coast. day per The Brazilians have much to be optimistic about. The dis- 2 covery of the Tupi oil field in October 2006—the largest oil field barrels found in the Western Hemisphere in 30 years—signified Brazil’s of emergence as a global oil power. During the inaugural extrac- Millions 1 tion from the Tupi super-field, former president Luis Inacio Lula da Silva described the country’s newfound oil riches as a “second independence for Brazil.” (In December 2010, the Tupi 0 field was renamed “Lula.”) Although the oil finds present an 1995 1997 1999 2001 2003 2005 2007 2009 2011 enormous opportunity for Brazil, the logistical and political Source: EIA Short-term Energy Outlook, January 2011 challenges involved in developing the fields leave much of the future unmapped, however. -

Inside This Issue

www.thedialogue.org August 4-8, 2008 FEATURED Q&A BOARD OF ADVISORS What is the Outlook for Wind Energy in Latin America? Jeffrey Davidow James R. Jones President, Co-chair, With oil prices forecasted to and the resulting increase in energy needs, Institute of the Manatt Jones remain at or above historic which have brought the region to look at Americas Global Strategies LLC highs, wind energy may be renewable energy and wind in particular becoming more viable as an as a viable option to diversify their energy Ramon Espinasa Doris Rodriguez Q alternative energy source, as indicated by matrices and help satisfy their growing Consultant, Partner, the announcement last week by Spain’s Inter-American Andrews Kurth LLP electricity needs. Several countries, like Development Bank Grupo Enhol and Chile's Haciendas Brazil, Chile, the Dominican Republic, Talinay of a billion-dollar joint venture Everett Santos and Peru, are already taking steps in terms Luis Giusti President, that would have a capacity to produce 500 of regulation, and the rest [of the coun- Senior Adviser, DALEC LLC megawatts of electricity for Chile. What tries] should follow the same road to make Center for Strategic & is the outlook for wind energy in Latin way for this energy source, which every International Studies R. Kirk Sherr America? Should governments in the day is more profitable, although it still CEO, region be doing more to encourage wind needs a push by governments to hasten its David Goldwyn Arrakis Geodynamics energy generation, and if so, what? President, Ltd. Q&A continued on page 4 Goldwyn International Guest Comment: Mauricio Strategies LLC Roger Stark Partner, Trujillo: "We are definitely seeing Jonathan C. -

MAY 2014 VOLUME 41, ISSUE 05 Canadian Publication Mail Contract – 40070050 MORE THAN MAPPING WANT to LIFT YOUR PETREL® WORKFLOWS to NEW HEIGHTS?

20 Fossils Hunting for Provinces 28 Go Take a Hike 34 GeoConvention 2014: Focus 36 Bringing the Cretaceous Sea to Mount Royal University: A Proposal to Fund the East Gate Entrance Fossil Display $10.00 MAY 2014 VOLUME 41, ISSUE 05 Canadian Publication Mail Contract – 40070050 MORE THAN MAPPING WANT TO LIFT YOUR PETREL® WORKFLOWS TO NEW HEIGHTS? Seamlessly bring more data into the fold. Dynamically present your insight like never before. SOFTWARE SERVICES CONNECTIVITY DATA MANAGEMENT The Petrosys Plug-in for Petrel® gives you access to powerful Petrosys mapping, surface modeling and data exchange from right where you need it – inside Petrel. Now you have the power to effortlessly and meticulously bring your critical knowledge together on one potent mapping canvas. Work intuitively with your Petrel knowledge and, should you so require, simultaneously aggregate, map and model data direct from multiple other sources – OpenWorks®, ArcSDE®, IHS™ Kingdom®, PPDM™ and more. Refine, enhance and then present your results in beautiful, compelling detail. The result? Decision-making is accelerated through consistent mapping and surface modeling as focus moves from regional overview through to the field and reservoir scale. To learn more go to www.petrosys.com.au/petrel. Petrel is a registered trademark of Schlumberger Limited and/or its affiliates. OpenWorks is a registered trademark of Halliburton. ESRI trademarks provided under license from ESRI. IHS and Kingdom are trademarks or registered trademarks of IHS, Inc. PPDM is a trademark of the Professional Petroleum Data Management (PPDM) Association. MAY 2014 – VOLUME 41, ISSUE 05 ARTICLES Fossils Hunting for Provinces ..................................................................................................... 20 CSPG OFFICE Tools to Tackle the Riddle of the Sands ...............................................................................