OPEC Petroleum

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Algeria Upstream OG Report.Pub

ALGERIA UPSTREAM OIL & GAS REPORT Completed by: M. Smith, Sr. Commercial Officer, K. Achab, Sr. Commercial Specialist, and B. Olinger, Research Assistant Introduction Regulatory Environment Current Market Trends Technical Barriers to Trade and More Competitive Landscape Upcoming Events Best Prospects for U.S. Exporters Industry Resources Introduction Oil and gas have long been the backbone of the Algerian economy thanks to its vast oil and gas reserves, favorable geology, and new opportunities for both conventional and unconventional discovery/production. Unfortunately, the collapse in oil prices beginning in 2014 and the transition to spot market pricing for natural gas over the last three years revealed the weaknesses of this economic model. Because Algeria has not meaningfully diversified its economy since 2014, oil and gas production is even more essential than ever before to the government’s revenue base and political stability. Today’s conjoined global health and economic crises, coupled with persistent declining production levels, have therefore placed Algeria’s oil and gas industry, and the country, at a critical juncture where it requires ample foreign investment and effective technology transfer. One path to the future includes undertaking new oil and gas projects in partnership with international companies (large and small) to revitalize production. The other path, marked by inertia and institutional resistance to change, leads to oil and gas production levels in ten years that will be half of today's production levels. After two decades of autocracy, Algeria’s recent passage of a New Hydrocarbons Law seems to indicate that the country may choose the path of partnership by profoundly changing its tax and investment laws in the hydrocarbons sector to re-attract international oil companies. -

Unconventional Gas and Oil in North America Page 1 of 24

Unconventional gas and oil in North America This publication aims to provide insight into the impacts of the North American 'shale revolution' on US energy markets and global energy flows. The main economic, environmental and climate impacts are highlighted. Although the North American experience can serve as a model for shale gas and tight oil development elsewhere, the document does not explicitly address the potential of other regions. Manuscript completed in June 2014. Disclaimer and copyright This publication does not necessarily represent the views of the author or the European Parliament. Reproduction and translation of this document for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2014. Photo credits: © Trueffelpix / Fotolia (cover page), © bilderzwerg / Fotolia (figure 2) [email protected] http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog) Unconventional gas and oil in North America Page 1 of 24 EXECUTIVE SUMMARY The 'shale revolution' Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking). Economic impacts This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals. The production of tight oil is costly, so that a high oil price is required to make it economically viable. -

23Rd WPC Announces Innovation Zone Special Feature Invites Innovators to Share Their Transformative Ideas That Will Impact the Future of Energy

FOR IMMEDIATE RELEASE 23rd WPC Announces Innovation Zone Special feature invites innovators to share their transformative ideas that will impact the future of energy HOUSTON, TX (August 4, 2021) — The 23rd World Petroleum Congress Organizing Committee has announced the launch of the Innovation Zone, a captivating new feature on the exhibition floor of the Congress, which will take place in-person in Houston from December 5-9, 2021 at the George R. Brown Convention Center. The Innovation Zone, presented by ConocoPhillips, will provide startup companies an international platform to showcase cutting-edge practices and solutions to combat the current challenges of the energy industry and bring awareness to progressive energy solutions available on the market today. “For more than a century, innovation has enabled our industry to keep pace with the growing demand for safe and reliable energy,” said W. L. (Bill) Bullock, Jr., EVP and CFO, ConocoPhillips. “ConocoPhillips is pleased to be the Innovation Zone presenting sponsor, where companies will showcase innovations that can propel our industry’s purposeful journey through the energy transition and into the future.” Thirty-two selected startup companies and individuals will have the opportunity to pitch their innovative energy tools, technologies and practices on stage to Congress delegates and participants, who will then pick one to receive the Energy Innovator Award. The Innovation Zone is open to all for-profit energy companies, private entities and individuals operating as independent -

Fossil Fuels………………………………………………

Corso di Laurea magistrale in Relazioni Internazionali Comparate Tesi di Laurea Energy and Environment Between development and sustainability Relatore Ch. Prof. Matteo Legrenzi Correlatore Ch. Prof. Duccio Basosi Laureando Alberto Lora Matricola 987611 Anno Accademico 2013 / 2014 TABLE OF CONTENTS Abstract………………………………………………………………………………………………i Introduction...………………………………………………………….........................................1 PART 1 - ENERGY SECURITY Chapter 1. Energy Security……………………………………………………………………...7 1.1 What is energy security?.......................................................................................................7 1.1.1 Definition of energy security…………………………………………………………………………..7 1.1.2 Elements of energy security………………………………………………………………………….8 1.1.3 Different interpretations of energy security………………………………………………………….9 1.1.4 Theories about energy security……………………………………………………………………..11 1.2 Diversification of the energy mix…………………………………………………………………12 1.2.1 Types of energy sources………………………………..............................................................12 1.2.2 Definition of energy mix……………………………………………………………………………..13 1.3 Growing risks………………………………………………………………………………………16 1.3.1 Energy insecurity……………………………………………………………………………………..16 1.3.2 Geological risk………………………………………………………………………………………..17 1.3.3 Geopolitical risk…………………………………………………………………….........................18 1.3.4 Economic risk…………………………………………………………………………………………22 1.3.5 Environmental risk……………………………………………………………………………………22 1.3.6 Solutions………………………………………………………………………………………………23 -

Pdf Tribune Des Lecteurs Du 2020-03-07

C M Pages 01-24 C M C M C M J N J N J N J N POUR LA PREMIÈRE FOIS DEPUIS 2017 COOPÉRATION LE BRENT SOUS LES 50 DOLLARS TEBBOUNE REÇOIT MÉTÉO Le baril londonien a terminé jeudi à son plus bas niveau en deux ans et LA MINISTRE demi, les investisseurs se demandant si la Russie allait accepter la proposition de l'Opep de réduire encore plus sa production pour enrayer la ESPAGNOLE DES AE REVOILÀ chute des cours liée au coronavirus. Le baril de Brent de la mer du Nord TRIBUNE TRIBUNE pour livraison en mai a perdu 2,2% ou 1,14 dollar à 49,99 dollars, un niveau Page 2 plus vu depuis juillet 2017. A New York, le baril américain de WTI pour Des Lecteurs Des Lecteurs LA PLUIE avril a lui perdu 1,9% ou 88 cents à 45,90 dollars. Réunis à Vienne, les 13 REVUE EL-DJEICH : membres de l'Organisation des pays exportateurs de pétrole (Opep) ont Quotidien national d’information Quotidien national d’information Page 24 proposé jeudi une coupe drastique de 1,5 million de barils par jour jusque fin " L'ALGÉRIE EST ÈME juin 2020 pour faire face à la forte baisse de la demande, affectée par 12 ANNÉE - N° 3350 - VEN 6 - SAM 7 MARS 2020 - PRIX 15 DA. ÈME l'épidémie de pneumonie virale. ENTRÉE DANS UNE 12 ANNÉE - N° 3350 - VEN 6 - SAM 7 MARS 2020 - PRIX 15 DA. www.tribunelecteurs.com ÈRE NOUVELLE " ATTENTAT-SUICIDE PRÈS DE L'AMBASSADE AMÉRICAINE À TUNIS Page 3 GLISSEMENT DE TERRAIN PROCÈS DE KARIM DANS UN CHANTIER À SIDI ABDALLAH TABBOU LE VERDICT SERA UN POLICIER DÉCÉDÉ RENDU LE 11 MARS DEUX MORTS Un policier, touché lors de l'attentat suicide survenu, vendredi, aux alentours de l'ambassade américaine à Tunis, Page 3 ET DEUX BLESSÉS a succombé à ses blessures, a indiqué une source du département tunisien de l'Intérieur. -

Monthly Report on Petroleum Developments in the World Markets February 2020

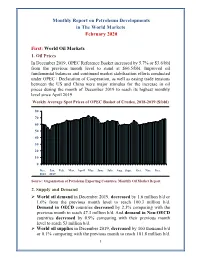

Monthly Report on Petroleum Developments in The World Markets February 2020 First: World Oil Markets 1. Oil Prices In December 2019, OPEC Reference Basket increased by 5.7% or $3.6/bbl from the previous month level to stand at $66.5/bbl. Improved oil fundamental balances and continued market stabilization efforts conducted under OPEC+ Declaration of Cooperation, as well as easing trade tensions between the US and China were major stimulus for the increase in oil prices during the month of December 2019 to reach its highest monthly level since April 2019. Weekly Average Spot Prices of OPEC Basket of Crudes, 2018-2019 ($/bbl) 80 70 60 50 40 30 20 10 0 Dec. Jan. Feb. Mar. April May June July Aug. Sept. Oct. Nov. Dec. 2018 2019 Source: Organization of Petroleum Exporting Countries, Monthly Oil Market Report. 2. Supply and Demand World oil demand in December 2019, decreased by 1.6 million b/d or 1.6% from the previous month level to reach 100.3 million b/d. Demand in OECD countries decreased by 2.3% comparing with the previous month to reach 47.3 million b/d. And demand in Non-OECD countries decreased by 0.9% comparing with their previous month level to reach 53 million b/d. World oil supplies in December 2019, decreased by 100 thousand b/d or 0.1% comparing with the previous month to reach 101.8 million b/d. 1 Non-OPEC supplies remained stable at the same previous month level of 67.2 million b/d. Whereas preliminary estimates show that OPEC crude oil and NGLs/condensates total supplies decreased by 0.6% comparing with the previous month to reach 34.5 million b/d. -

2019 Global Stewardship Report Schlumberger Limited Contents

2019 Global Stewardship Report Schlumberger Limited Contents Governance and Ethics 4 Environment and Climate 11 Social and Community 21 Index and Data 47 Corporate Governance 4 Managing Environmental Risk 12 Education 22 Frameworks 48 Ethics and Compliance 7 Environmental Performance Data 16 Health and Safety 24 Global Reporting Initiative Standards (GRI) 48 Key Environmental Issues 17 Human Rights 38 Sustainability Accounting Standards Board (SASB) 50 Technology Advantage 19 Stakeholder Engagement 41 Task Force on Climate-Related Schlumberger New Energy 20 Employment and Human Capital 43 Financial Disclosures (TCFD) 52 United Nations Sustainable Development Goals Mapping (UN SDGs) 53 Performance Data 56 Our Sustainability Focus The energy industry is changing, and Schlumberger’s vision is to define and drive high performance, sustainably. Our core competence is to enable our customers to operate safely, efficiently, effectively, and in an environmentally responsible manner. Our Global Stewardship program addresses: .» identifying and managing opportunities and risks associated with the energy transition and climate change .» protecting the environment .» investing in and engaging with the communities where we and our customers live and work .» respecting human rights and promoting diversity 1 GOVERNANCE ENVIRONMENT SOCIAL INDEX Introduction 2019 Global Stewardship Report Message from the CEO Schlumberger’s vision is to define and drive high performance, sustainably. We are focused on our purpose: creating amazing technology that unlocks -

A Comparative History of Oil and Gas Markets and Prices: Is 2020 Just an Extreme Cyclical Event Or an Acceleration of the Energy Transition?

April 2020 A Comparative History of Oil and Gas Markets and Prices: is 2020 just an extreme cyclical event or an acceleration of the energy transition? Introduction Natural gas markets have gone through an unprecedented transformation. Demand growth for this relatively clean, plentiful, versatile and now relatively cheap fuel has been increasing faster than for other fossil fuels.1 Historically a `poor relation’ of oil, gas is now taking centre stage. New markets, pricing mechanisms and benchmarks are being developed, and it is only natural to be curious about the direction these developments are taking. The oil industry has had a particularly rich and well recorded history, making it potentially useful for comparison. However, oil and gas are very different fuels and compete in different markets. Their paths of evolution will very much depend on what happens in the markets for energy sources with which they compete. Their history is rich with dominant companies, government intervention and cycles of boom and bust. A common denominator of virtually all energy industries is a tendency towards natural monopoly because they have characteristics that make such monopolies common. 2 Energy projects tend to require multibillion – often tens of billions of - investments with long gestation periods, with assets that can only be used for very specific purposes and usually, for very long-time periods. Natural monopolies are generally resolved either by new entrants breaking their integrated market structures or by government regulation. Historically, both have occurred in oil and gas markets.3 As we shall show, new entrants into the oil market in the 1960s led to increased supply at lower prices, and higher royalties, resulting in the collapse of control by the major oil companies. -

Secure Fuels from Domestic Resources ______Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development

5th Edition Secure Fuels from Domestic Resources ______________________________________________________________________________ Profiles of Companies Engaged in Domestic Oil Shale and Tar Sands Resource and Technology Development Prepared by INTEK, Inc. For the U.S. Department of Energy • Office of Petroleum Reserves Naval Petroleum and Oil Shale Reserves Fifth Edition: September 2011 Note to Readers Regarding the Revised Edition (September 2011) This report was originally prepared for the U.S. Department of Energy in June 2007. The report and its contents have since been revised and updated to reflect changes and progress that have occurred in the domestic oil shale and tar sands industries since the first release and to include profiles of additional companies engaged in oil shale and tar sands resource and technology development. Each of the companies profiled in the original report has been extended the opportunity to update its profile to reflect progress, current activities and future plans. Acknowledgements This report was prepared by INTEK, Inc. for the U.S. Department of Energy, Office of Petroleum Reserves, Naval Petroleum and Oil Shale Reserves (DOE/NPOSR) as a part of the AOC Petroleum Support Services, LLC (AOC- PSS) Contract Number DE-FE0000175 (Task 30). Mr. Khosrow Biglarbigi of INTEK, Inc. served as the Project Manager. AOC-PSS and INTEK, Inc. wish to acknowledge the efforts of representatives of the companies that provided information, drafted revised or reviewed company profiles, or addressed technical issues associated with their companies, technologies, and project efforts. Special recognition is also due to those who directly performed the work on this report. Mr. Peter M. Crawford, Director at INTEK, Inc., served as the principal author of the report. -

FIRST QUARTER RESULTS January – March 2020

FIRST QUARTER RESULTS January – March 2020 CONTENTS: 1. Highlights 2. Backlog 3. Consolidated Income Statement 4. Consolidated Balance Sheet Appendix: Alternative Performance Metrics First Quarter Results January – March 2020 1. MAIN HIGHLIGHTS ▪ Backlog of €10.9 billion ▪ Q1 2020 Order intake of €1.9 billion ▪ Sales at €1,181 million ▪ Operating profit (EBIT) at €23.7 million, with a 2.0% EBIT margin ▪ Net profit at €8.7 million ▪ Net cash position of €419 million Backlog at the end of March stood at €10.9 billion. In Q1 2020, the main award added to the backlog was the important refining project for Sonatrach at Haoud el-Hamra, Hassi Messaoud (Algeria), with a value of $2 billion for Técnicas Reunidas. Total sales reached €1,181 million in Q1 2020, growing 29% versus Q1 2019. Sales in the last month of the quarter were slightly affected by Covid-19 disruptions. Q1 2020 EBIT was €23.7 million, that compares to the Q1 2019 EBIT of €10.6 million, with an increase of 124% year on year. Growth in operating profit was favoured by the contribution of newer projects with healthier margins and despite the slowdown of project execution due to Covid in the last month of the quarter. Net profit in Q1 2020 reached €8.7 million, a 134% higher than in the same period of last year. Net cash position at the end of March stood at €419 million. The healthy cash position reflects the maintenance of a good progress in working capital, with no cash downpayments being received in the quarter. -

XI KAZENERGY EURASIAN FORUM: Securing the Future of Energy

XI KAZENERGY EURASIAN FORUM: Securing the future of energy Opening Address Tor Fjaeran, President, World Petroleum Council Astana, 7th September 2017 Good morning your Excellencies, Ladies and Gentlemen and thank you to our hosts of the KazEnergy Eurasian Forum. During the last three months Astana has been the nexus of the energy world and has showcased the best approaches and solutions for Future Energy. The EXPO 2017 couldn’t have chosen a more important topic to focus on. Together with food and water, they form the basic building blocks for sustainable development. Sustainable development of the world requires access to safe, affordable, reliable, sustainable and modern energy sources. Long before the term “climate change” was even introduced, the World Petroleum Council has been dedicated to promoting the sustainable management and use of the world’s petroleum resources for the benefit for all. Since 1933 our mandate has been to provide a neutral platform to bring together the best minds in the industry with key decision makers to discuss the best way forward for all involved in oil and gas. We face a very different world today, but our original mandate still applies. In the last half-century, the global population has more than doubled. Life expectancy has risen from 50 to 70. GDP is more than 30 times what it was. And extreme poverty has been halved. It is an extraordinary transformation. And it is one in which energy has been vital, more than trebling in consumption since the 1960s. And this trend will continue. Over the next quarter of century, we are going to see: • A world economy that will double again in size. -

AC Vol 40 No 10

23 July 1999 Vol 40 No 15 AFRICA CONFIDENTIAL ALGERIA 3 ORGANISATION OF AFRICAN UNITY Alger l'Africaine President Bouteflika reestablished Tougher talk Algeria's anti-colonial credentials when he hosted the OAU summit Africa's big three - Algeria, Nigeria and South Africa - focused the and marketed his country as a summit on peace talks and ending military rule dynamic economy at the junction of Africa, Europe and the Middle For once, the Organisation of African Unity caught the mood of the continent, balanced uneasily East. He wanted to show visitors between hope and despair. Hope that, after shaky ceasefire agreements in Congo-Kinshasa and that national reconciliation was Sierra Leone, the Algiers OAU summit (12-16 July) might progress towards resolving the conflicts working and convinced many. ripping through over one-fifth of Africa’s 53 states. Despair that good intentions are far from realisation, as economic weakness persists and old conflicts linger on in Angola and Sudan. Yet by FRANCE/OIL 4 the standards of summits in general and OAU summits in particular, it was constructive. Zambia’s President Frederick Chiluba flew off to Congo-K to persuade the quarrelling rebel Totally elfin factions to sign the 10 July Lusaka peace accord; Nigeria’s President Olusegun Obasanjo flew to For decades the oil company Elf meet embattled President José Eduardo dos Santos in Luanda; United Nations Secretary General Aquitaine has played a key role for Kofi Annan flew back to New York (via Slovakia) with proposals for UN help in peacemaking in French policy in Africa. After its Congo, Sierra Leone and Eritrea-Ethiopia.